Recent high-profile cyberattacks at retail giants like Target and Neiman Marcus have highlighted the importance of protecting your business against point-of-sale (POS) security breaches. Often, the smallest merchants are the most vulnerable to these types of cyberthreats. The latest of these POS attacks is known as Backoff, a malware with such brute force that the U.S. Department of Homeland Security (DHS) has gotten involved. The DHS recently released a 10-page advisory that warns retailers about the dangers of Backoff and tells them how they can protect their systems. Backoff and its variants are virtually undetectable low to zero percent by most antivirus software, thus making it more critical for retailers to make sure their networks and POS systems are secure.

How Backoff works

Backoff infiltrates merchant computer systems by exploiting remote desktop applications, such as Microsoft’s Remote Desktop, Apple Remote Desktop, Chrome Remote Desktop, Splashtop 2 and LogMeIn, among others. Attackers then use these vulnerabilities to gain administrator and privileged access to retailer networks. Using these compromised accounts, attackers are able to launch and execute the Backoff malware on POS systems. The malware then makes its way into computer and network systems, gathers information and then sends the stolen data to cybercriminals. The advisory warns that Backoff has four capabilities that enable it to steal consumer credit card information and other sensitive data: scraping POS and computer memory, logging keystrokes, Command & Control (C2) communication, and injecting the malware into explorer.exe. Although Backoff is a newly detected malware, forensic investigations show that Backoff and its variants have already struck retailers three times since 2013, the advisory revealed. Its known variants include goo, MAY, net and LAST.

Prevent a Backoff attack

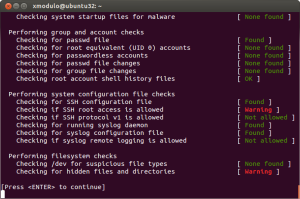

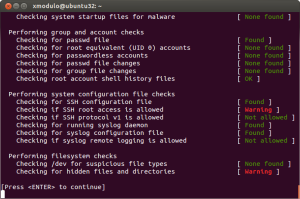

To mitigate and prevent Backoff malware attacks, the DHS’ recommendations include the following:

Configure network security. Reevaluate IP restrictions and allowances, isolate payment networks from other networks, use data leakage and compromised account detection tools, and review unauthorized traffic rules.

Control remote desktop access. Limit the number of users and administrative privileges, require complex passwords and two-factor authentication, and automatically lock out users after inactivity and failed login attempts.

Implement an incident response system. Use a Security Information and Event Management (SIEM) system to aggregate and analyze events and have an established incident response team. All logged events should also be stored in a secure, dedicated server that cannot be accessed or altered by unauthorized users.

Manage cash register and POS security. Use hardware-based point-to-point encryption, use only compliant applications and systems, stay up-to-date with the latest security patches, log all events and require two-factor authentication.