Category: Point of Sale

October 18th, 2013 by Elma Jane

Cash registers were the only game in town not too long ago, but these days companies have many more choices. Replacing antiquated cash registers with modern POS (point of sale devices carries a number of important benefits, including:

1. Can cut down on user errors. Hitting a wrong key is always a risk when ringing a sale, but point of sale devices have built in checks to ensure that the information is entered accurately.

2. Customers receive more informative itemized receipts with a point of sale devices. Many cash registers can only print the date and the amount of the sale, but since point of sale devices are tied into the inventory control system they can provide much more detailed information, including a description of the item, the list price and the sale price.

3. Easy to look up past transactions. If you need to know how much you sold last Tuesday a point of sale system can give you that information in a snap. It would take many hours of laborious work to find the same answer using a cash register.

4. Maintenance and repair costs are often much lower on a point of sale device than a cash register. The number of companies that repair cash registers is dwindling, and that means that repair costs can be rather high. There are many vendors who repair point of sale devices, and that can keep repair costs low.

5. Provide faster service than old fashioned cash registers. Every part of the process, from authorizing a credit card transaction to printing a customer receipt, is faster on a point of sale device.

6. Simplify the accounting process. Old fashioned cash registers force accountants to sort through hundreds of receipts, but with a point of sale system financial personnel can simply use the built in reports or create their own.

7. Unlike a cash register, a point of sale system often includes an overall inventory management system. Store owners can use a point of sale system to track their biggest sellers and reorder those products when stock gets low.

8. Workers now a days are often more comfortable with point of sale devices than old fashioned cash registers. Generation now entering the workforce never knew a time without computers, and as a result they are very comfortable working with computerized technology like point of sale devices.

9. You can use a point of sale system to create your own purchase orders, eliminating an extra step in the ordering process. You can even automate the ordering process to make sure you never run out of your hottest selling products.

10. You can see real time inventory with a point of sale device, something that even the best cash registers simply cannot do. In fact, many companies have found that implementing a point of sale system virtually eliminates the need for a costly hand count.

There are many reasons why your company should consider state of the art point of sale device and ditching the old fashioned cash register. These devices can lower the cost of doing business while increasing productivity, and that can be good for the bottom line.

Ready to make the switch from a cash register to a point of sale system? National Transaction can provide the software, hardware and support for any POS need. NTC integrate your payment processing into many accounting software titles such as Intuit Quickbooks or Peachtree Accounting. NTC can also provide integation for any restaurant cash register system and all industry specific solutions. NTC provide credit card readers for Android, Apple and Blackberry smartphones and tablet devices. National Transaction can make the World your Point Of Sale.

Posted in Credit card Processing, Mobile Point of Sale, Point of Sale, Visa MasterCard American Express Tagged with: accounting, amount, Android, Apple, authorizing, benefits, blackberry, cash register, computerized, control, costs, credit-card, date, devices, hardware, inventory, itemized, low, maintenance, point of sale, POS, price, print, process, readers, receipts, reorder, repair, sale, sale price, Smartphones, software, stock, system, transactions, vendors, virtually

October 18th, 2013 by Elma Jane

Verifone Ruby 2 POS

VeriFone Systems, announced today the availability of Commander Site Controller, the company’s next generation site management solution, and Ruby2 a touch-screen point of sale (POS) solution, both designed to provide greater efficiency, faster payment acceptance and new management capabilities that maximize profit potential for convenience store retailers.

Commander Site Controller is purpose-built for rugged c-store environments and combines site, payment and forecourt control in one device, creating additional flexibility in store configuration. Its future-proof system architecture includes expansion slots and ports for additional capacity and functionality. Additionally, Commander Site Controller features 100 percent IP communication for increased speed of EMV transactions.

Ruby2 is the next evolution of VeriFone’s Ruby POS platform, a 20-year leader in the petroleum industry. It features a fully-touchscreen console that increases checkout speed by providing fast and efficient order and payment processing, and a smaller footprint for increased counter space. Ruby2 is compatible with the latest VeriFone product offerings, including customer engagement media solutions, site management software to efficiently manage multiple locations seamlessly, and the latest in fuel control management.

VeriFone is taking petroleum retail and c-store operations to new heights of efficiency and manageability. These next-generation systems build on the success of Sapphire site controller and original Ruby POS systems with the ability to expand in order to meet customers’ future needs.

Commander Site Controller’s cloud based management software platform – Commander Console—enables owners to remotely and simultaneously complete PLU price changes, tax rate adjustments, fuel price changes and promotional updates in real time for multiple site locations from any web enabled device or mobile app for iOS and Android tablets and smartphones.

Ruby2 will be available this fall on certain networks while Commander Site Controller is available today on certain networks.

Posted in Credit card Processing, Electronic Payments, Mobile Point of Sale, Point of Sale Tagged with: acceptance, app, architecture, capabilities, capacity, command site controller, convenience, EMV, engagement, expansion, forecourt, iOS, management, mobile, networks, payment, plu, point of sale, POS, retailers, ruby 2, rugged, seemlessly, site, Smartphones, store, systems, touch-screen, touchscreen, transactions, verifone

October 17th, 2013 by Elma Jane

National Transaction Corporation’s services will work with any existing (Non Proprietary) Terminal. NTC can reprogram an existing terminal as well as service and provide supplies for any terminal.

Below are the following Terminals and Model Type:

1. Hypercom – They produce electronic payment processing hardware and software for a wide range of industries. In 2009 Hypercom co-founded founding the Secure POS (Point Of Sale) Vendor Alliance, a non profit organization created by Hypercom, Ingenico and VeriFone to increase awareness of and improve payment industry security. Hypercom entered into a merger agreement with VeriFone, which closed August 4th, 2011.

Hypercom Machines: T7P – T7Plus – T4100 – T4210 – T4220 IP Terminal. For Precise Detail of the machines please check our website. www.nationaltransaction.com

2. Ingenico – is a leading provider of payment solutions, with over 20 million terminals deployed in more than 125 countries. Ingenico is a worldwide company, whose business is to provide the technology involved in secure electronic transactions. Its traditional business is based around the manufacture of point of sale payment terminals, but it now also includes complete payment solutions and related services. In 2008, after the merging with SAGEM Sécurité, Ingenico decided to close its historical R&D centre in Barcelona. This centre has developed Ingenico’s most successful family of EFTPOS (Electronic funds transfer point of sale). More than three million units sold worldwide in 2007. Ingenico acquired German payment processor Easycash in 2009. In 2011, Ingenico integrated Pennies, The electronic charity box, into one of their market leading mobile Chip and PIN payment terminals, allowing retailers to ‘switch on’ the Pennies solution so their customers can add a micro-donation to their bill when paying by card. As of 2012, over 15 million Ingenico terminals are deployed across 125 countries, with the Ingenico Aqua 50 being their best selling POS (Point Of Sale) terminal.

Ingenico Terminals: iPP220 – iPP320USB – iCT220 PIN Pad – iCT250 CounterTop – Agua PCI – i5100 Dial – i7780 HandHeld i778oM – i7780 Versatile Base – 7770 Intel Base. For Precise Detail of the terminal please check our website. www.nationaltransaction.com

3. VeriFone – is a global provider of technology for electronic payment transactions an international producer and designer of electronic payment solutions and value-added services at the POS (Point Of Sale). VeriFone provides merchant-operated, consumer-facing and self-service payment systems for the financial, retail, travel & hospitality, petroleum, government and healthcare industries. The company’s solutions are utilized by merchants, processors and acquirers in developed and emerging economies worldwide.

VeriFone Models: OMNI 3730LE/VX510LE N – OMNI 3750 4MEG DUAL COM – VX 510 6 MB DUAL COM 12MB – VX570 DUAL COM 6MB WITH SMART CARD – VX610 CDMA (AVAILABLE FOR SPRINT AND VERIZONE). For Precise Detail of the models please check our website. www.nationaltransaction.com

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Electronic Payments, Near Field Communication, Point of Sale Tagged with: 15100 Dial, 7770 Intel Base, acquirers, aqua 50, Aqua PCI, Chip and PIN, eftpos, electronic, electronic funds transfer point of sale, financial, healthcare, hospitality, hypercom, i7780, iCT220 PIN Pad, IP, iPP220, iPP320USB, mobile, Omni 3730LE, Omni 3750, paying, payment, point of sale, processor, retailers, Security, T4100, T4210, T4220, T7P, T7Plus, travel, VX 510, VX510LE, VX570, VX610

October 17th, 2013 by Elma Jane

VeriFone and National Payment Card Association (NPCA) debuted a mobile payment and rewards solution that enables convenience store and petroleum retailers to provide customers with smartphone-based payment options at the pump.

Utilizing VeriFone’s Smart Fuel Controller and NPCA’s mobile payment solution, c-store and gas station operators with VeriFone payment acceptance systems can quickly implement a fixed low-cost mobile payment and rewards program built on existing infrastructure used for merchant branded debit cards.

Consumers are increasingly drawn to rewards-based fuel purchase programs and they expect to be able to use their mobile phone to complete transactions at the pump. NPCA and VeriFone are showing how easy it is for CSPs to offer mobile payment and reward options to customers that increase loyalty and sales.

VeriFone Smart Fuel solutions make it easy for CSPs to offer forecourt pump POS payment without incurring the cost of installing new dispensers. The Smart Fuel Controller combines pump and pay-point support into a single unit, simplifying installation and maintenance, and eliminating the need for third-party interface devices to integrate pay-point management with in-store POS systems.

Merchants can develop their own mobile app, or apply their brand to a mobile app supplied by NPCA, to enable customers to pay for purchases and receive loyalty incentives using their smartphones.

Consumers today would rather utilize the capabilities of their smartphones versus pulling out their wallets. Using this solution, retailers can easily and cost-effectively create mobile loyalty programs that attract and reward high-value customers – without having to replace their existing payment infrastructure.

NPCA’s debit-based payment programs provide retailers with the ability to drive customer loyalty and reduce the cost of payments. Fuel discounts are funded from interchange savings that retailers would otherwise pay to banks. Payment processing is done by NPCA using the automated clearing house (ACH) system to clear debits to cardholder checking accounts and net settle with retailers each day. The company holds five patents related to the processing and methods for ACH-based decoupled debit and mobile payments.

Come November VeriFone and NPCA mobile payments solution will be available for beta testing.

Posted in Electronic Payments, Mobile Payments, Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: acceptance, ach, app, apply, cardholder, consumers, cost, debit cards, devices, infrastructure, interchange, interface, loyalty, merchant, mobile, pay-point, payment, payments, phone, POS, Processing, rewards, sales, smart, Smartphones, solution, transactions, verifone, wallets

October 3rd, 2013 by Admin

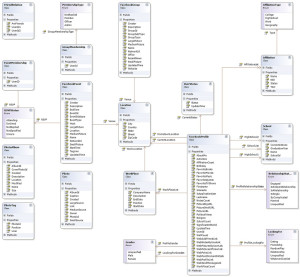

When managing a business nothing helps more than raw data. Storing that data in a database makes it infinitely more flexible and accessible. A database is an application that efficiently and effectively stores and retrieves data as well as ties that data to other data. Many large scale accounting applications like QuickBooks, PeachTree and many other titles store all their information in some form of a database.

Tables are like spreadsheets. Rows and columns group together data in an organized manner. Databases can have many tables with many columns or just a few. Relational databases like SQL database engines link tables together using what are known as primary and foreign keys. So in the example of an invoice the Customer table has a Primary key uniquely identifying a specific customer from the rest of all of the customers. The Invoice table stores a foreign key in its table so the match between customer id’s links the two tables. The invoices themselves also have a primary key so that there can be many invoices for the same customer. These concepts are actually born of a mathematics branch known as Algebra.

Data at its most basic level is a specific bit of information. Like the number 19 or a specific date and/or time. A database holds these bits of data and an application built to interact with a database is used to generate information from the data. A clearer example is the invoice. An invoice has quantities, part numbers, serial numbers, account numbers, dates and even totals which are not stored in the database but are calculated each time the invoice is accessed. Invoices bring many bits of data to a single entity most commonly referred to as a report. Looking at a common invoice explains a transaction with the details stored in many tables all tying back to a single transaction.

Database servers run a service that can be connected over connections on a local area network or over the internet to allow applications on different computers access to data simultaneously. Many websites like Facebook, NASA and even Google make extended use of databases to supply services to millions of users concurrently. Whether it’s over the internet or across a physical office space, a database can be the heart of a businesses information technology.

SQL databases conform to an industry standardized set of functionality so that complex queries can be performed without knowing the underlying technical architecture.

Open Source

Open Source is usually associated with applications that are free to download, distribute and modify. Many times open source applications are developed by a community of developers over the internet that take feature suggestions from the user community and build them into the application. Open source applications tend to follow one of several ‘licenses’ like the GPL or General Public License to make sure the program is unmolested or incorporated into a proprietary software trying to take credit for the programming code.

There are many examples of open source titles here.

http://directory.fsf.org/wiki/All

https://en.wikipedia.org/wiki/List_of_free_and_open-source_software_packages

Open Source Databases

One aspect of open source known as LAMP has become wildly popular as the internet has matured. Lamp stands for Linux, the operating system, Apache, the web server component, MySQL, a wildly popular free and open database engine and the P stands for Perl, Python or PHP the three most popular languages of backend programming. Combining these components provides a very fertile ground for developing Web Applications that can be served across an office or the world. Many sites like Google and WordPress take full advantage of these technology to create feature rich applications that run in a web browser but work like a traditional desktop application like Microsoft Word. Being open source allows anyone to build on top of or out of the offering. This means you can customize the programming of any of these applications to best fit your particular style or way of doing business. This is a huge time saver for any small business.

Some common examples of open source applications that utilize Lamp architecture are listed below:

SugarCRM – A contact and lead management system to manage a sales force.

WordPress – The most popular blogging application on the internet.

OpenCart – An extremely flexible shopping cart software.

GNUCash – A full fledged accounting program.

Mobile Devices

Today we have smartphones and tablets that have web browsers built in and available for each platform. Using new techniques known as adaptive or responsive web layouts, information on a page automatically transform a web page to smaller displays. So any page can be designed once and displayed on a desktop browser, a tablet browser or a mobile phone browser. This allows web designers to best optimize the content for smaller displays while leaving the pages viewed on a desktop for a larger view. Using responsive design techniques your business data can even extend to mobile devices like iPhones and Android or Blackberry phones and tablets. The potential is huge for your business.

Posted in Best Practices for Merchants, Point of Sale Tagged with: Android, bits, blackberry, data, database, e-commerce, information technology, Iphone, MySQL, open source, relational, shopping cart, smartphone, SQL, tablet

October 1st, 2013 by Elma Jane

PayPal announces updated app, device for hands-free, in store payment.

A busy few days at PayPal. Late last week, the global payments giant announced a major update to its app for Android and iOS. The new features have a strong mobile payments bent. And now, the company has announced the planned roll-out of “Beacon,” which uses Bluetooth Low Energy Technology to let customers check into retail stores and pay by verbal consent.

Paypal’s President calls the solution PayPal’s “most significant contribution to date in reinventing the in-store shopping experience.”

Beacon is a new add-on technology that merchants plug into an A/C outlet. When a PayPal customer walks into a participating store and agrees to check-in, Beacon triggers a quick vibration or sound to confirm a check-in; customer’s photo then appears on a point-of-sale screen. To pay, the customer simply gives a verbal confirmation. “No wallet and no card. Nothing to do. Not even touching your phone.

BLE was chosen to resolve some problems posed by traditional geo-location, including power consumption. It will look for any store running a PayPal compatible POS system, and will only transmit information to PayPal or to the merchant if the customer agrees to check in.

The solution aims to improve on the credit-card-swiping experience. PayPal figured the only better way to pay would be to do nothing.

The company will be piloting Beacon in the fourth quarter.

New App

PayPal’s vastly redesigned app for creating a more seamless in-store shopping experience is getting a lot of kudos across the web.

A New tab called “Shop” the first thing that appears when the app is opened, it displays nearby stores or restaurants that accept PayPal payments. Users can check in and open a tab, then select various payment methods from the check-in screen. Upon payment, the app generates a confirmation alert and sends an email receipt.

You’ve really got access to your entire wallet in the app.

The app also lets you order food ahead of your arrival bypassing the line. The feature works through PayPal’s partnership with Eat24 . Dinners can pay at the table, and at some locations, order more drinks.

For the first time, the app includes a Bill Me Later tab that lets users apply to finance PayPal purchases, and it integrates coupons and offers.

The company wanted the new app to help solve problem, and that payment isn’t something they typically complain about. So they focused on other potentially problematic experiences in the retail environment, waiting in line, waiting to pay the bill at their table and keeping track of coupons.

Posted in Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, Mobile Payments, Near Field Communication, Point of Sale, Smartphone Tagged with: Android, app, Apple, card, credit-card-swiping, geo-location, iOS, payment, PayPal, POS, retail, system, wallet

September 10th, 2013 by Admin

Verizon annually releases it’s Data Breach Investigation Reports which probes data breaches in various industries and studies the nature of fraud reported by merchants and other agencies. In the past Verizon has worked with the U.S. Secret Service, now the information gathered on the electronic payment breaches have expanded to Police Central e-Crime Unit, Australian Federal Police, the Dutch National High Tech Crime Unit, and the Irish Reporting & Information Security Service in addition to the United States Secret Service.

One area that Verizon broke out and performed independent studies on was the healthcare industry. In 2010 the Health Information Technology for Economic and Clinical Health (HI TECH) Act included a provision to report healthcare and medical data breaches to a variety of outlets including the Secretary of Health and Human Services. Medical record protections keep the casual cyber criminal at bay but the majority of security data breaches are in large part targeted at information attackers can profit from. The data cybercriminals target most often includes health insurance data, personal and electronic payment transaction data. Hardware is another assett that is targeted both because of the data on the hardware and the cost of the hardware itself.

Remote data breaches on health care providers were typically carried out through some form of hacking or malware. That is consistent with other industries in the report and is considered the favorites among cybercriminal organizations. Exploiting of default or guessable credentials rang in at the top of the chart. Of those, point of sale payment systems and desktop computers were the highest targeted areas of the health care industry. Although electronic medical records and transcriptions stored on file and database servers were a target, those criminals were more likely interested in indentity theft and fraudulent loans than what was actually in any individuals medical records.

Point of sale payment terminals are the most targeted assett with POS servers and gateways as the second most targeted. Like all other sectors, professional criminals tend to follow the money trail and that ends up being at POS payment systems. So much so that even desktop computers and emails try to get malware onto medical systems to render security policies inneffective. To find out how to better protect medical and healthcare records from cybercriminals and data breaches read the reports here and here.

Posted in Best Practices for Merchants, Credit Card Security, Point of Sale Tagged with: Breach, breaches, electronic payment, gateways, healthcare, medical, point of sale, POS, Security, transactions, transcription

August 30th, 2013 by Admin

According to a poll by OnePoll on behalf of I Love Velvet titled “Consumer Mobile Point-of-Sale (MPOS) Attitudes Report” over half of retail customers think cash registers are outdated. The poll found that 51% of Americans think the cash register could soon be gone altogether as retailers opt for mobile point of sale systems. Consumers seem to favor MPOS systems allowing the shoppers to check out from anywhere in the store and that they return more often to stores with modern electronic payment technologies. Thirty five percent cited they would shop more often at stores with mobile point of sale payment systems. An additional 17% said they would share their shopping experience via social networking sites and 35% report they likely would tell a friend or recommend stores with these technologies. Forty six percent say that stores that have mobile payment systems seem to be more tech savvy and even more (56%) praise the store for making the experience more convenient and secure. Retailers are struggling to modernize their payment platforms to cut down long lines at registers, and place staff on the floor for better customer access. “It’s a great opportunity for retail store owners to dip into the mobile point of sale arena” said Richard Delos Santos of National Transaction Corporation.

Mobile point-of-sale equipment and software manufacturers are stepping up to the security plate as they seek to pass PCI DSS and other security related issues. As new mobile kiosks and point of sale hardware and software evolve so do the security challenges used to thwart credit card fraud and identity theft. The challenge for point of sale system providers is to create an increasingly secure and convenient way for customers to make electronic payments in-store or on their mobile devices. iPads, iPhones and Android tablets are often used by curious shoppers to compare and contrast features, prices and availability, why not let digital wallets be used to close the transaction? The use and connectivity of these new devices mean more complex security measures are needed to thwart attackers, crackers, and hackers.

In the coming years everything from NFC, to fingerprint readers in smartphones and tablets and even QR codes will change the landscape of mobile payment transaction processing and things are beginning to heat up. An estimated $17 Trillion of mobile transactions are predicted by 2020 and security and adoption will reign king on the streets. It might be time to look into the security and features that a mobile point-of-sale system can add over any existing point of sale systems and cash registers. Mobility is a great tool for a sales force, but security and convenience for the customer is a necessity that will only grow in the future.

Posted in Credit Card Reader Terminal, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: Android, ipad, Iphone, mobile, MPOS, payments, point of sale, Processing, smartphone, tablet, transaction

August 16th, 2013 by Admin

Today the PCI Security Standards Council (PCI SSC), an open, global forum for the development of electronic transaction security standards published PCI Data Security Standard (PCI DSS) and Payment Application Data Security Standard (PA-DSS) 3.0 Change Highlights as a preview of the new version of the standards coming in November 2013. The changes will help companies make PCI DSS part of their business-as-usual activities by introducing more flexibility, and an increased focus on education, awareness and transaction security as a shared responsibility with merchant account holders.

The seven-page document is part of the Council’s commitment to provide as much information as possible during the development process and eliminate any perceived surprises for organizations in their PCI credit card security planning. Specifically, the summary will help PCI Participating Organizations and the assessment community as they prepare to review and discuss draft versions of the standards at the 2013 Community Meetings in September and October.

Changes to the standards are made based on feedback from the Council’s global constituents per the PCI DSS and PA-DSS development lifecycle and in response to market needs. Key drivers for version 3.0 updates include: lack of education and awareness; weak passwords, authorization, verification and authentication challenges; third party payment security challenges; slow self-detection in response to malware and other threats; inconsistency in assessments.

“Today, most organizations have a good understanding of PCI DSS and its importance in securing credit card data during transactions, but implementation and maintenance remains a struggle – especially in light of increasingly complex business and payment technology environments,” said Bob Russo, PCI SSC general manager. “The challenge for us now is providing the right balance of flexibility, rigor and consistency within the standards to help organizations make payment security business-as-usual. And that’s the focus of the changes we’re making with version 3.0.”

Based on feedback from the industry, in 2010 the Council moved from a two-year to a three-year standards development lifecycle. The additional year provides a longer period to gather feedback and more time for organizations to implement changes before a new version is released. Version 3.0 will introduce more changes than version 2.0, with several new sub-requirements. Proposed updates include:

- Recommendations on making PCI DSS business-as-usual and best practices for maintaining ongoing PCI DSS credit card compliance

- Security policy and operational procedures built into each requirement

- Guidance for all requirements with content from Navigating PCI DSS Guide

- Increased flexibility and education around password strength and complexity

- New requirements for point-of-sale terminal security

- More robust requirements for penetration testing and validating segmentation

- Considerations for credit card data in memory

- Enhanced testing procedures to clarify the level of validation expected for each requirement

- Expanded software development lifecycle security requirements for PA-DSS application vendors, including threat modeling

Note that these updates are still under review by the PCI community. Final changes will be determined after the PCI Community Meetings and incorporated into the final versions of the PCI DSS and PA-DSS published in November.

The change highlights document with tables outlining anticipated updates is available on the PCI SSC website:https://www.pcisecuritystandards.org/security_standards/documents.php

The Council will host a webinar series for the PCI community and the general public to outline the proposed changes. To register, visit: https://www.pcisecuritystandards.org/training/webinars.php

“PCI DSS and PA-DSS 3.0 will provide organizations the framework for assessing the risk involved with technologies and platforms and the flexibility to apply these principles to their unique payment and business environments, such as e-commerce, m-commerce, mobile acceptance or cloud computing,” added Troy Leach, PCI SSC chief technology officer.

PCI DSS and PA-DSS 3.0 will be published on 7 November 2013. The standards become effective 1 January 2014, but to ensure adequate time for the transition, version 2.0 will remain active until 31 December 2014.

For more information and to register for the 2013 Community Meetings, please visit:https://www.pcisecuritystandards.org/communitymeeting/2013/

About the PCI Security Standards Council

The PCI Security Standards Council is an open global forum that is responsible for the development, management, education, and awareness of the PCI Data Security Standard (PCI DSS) and other standards that increase payment data security. Founded in 2006 by the major payment card brands American Express, Discover Financial Services, JCB International, MasterCard Worldwide and Visa Inc., the Council has more than 650 Participating Organizations representing merchants, banks, processors and vendors worldwide. To learn more about playing a part in securing payment card data globally, please visit: pcisecuritystandards.org.

Connect with the PCI Council on LinkedIn: http://www.linkedin.com/company/pci-security-standards-council

Join the conversation on Twitter: http://twitter.com/#!/PCISSC

Posted in Credit Card Security, Digital Wallet Privacy, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: credit card, DSS, e-commerce, m-commerce, mobile, PA-DSS, PCI Compliance, Security, transaction

August 13th, 2013 by Admin

MasterCard who has endorsed Google Wallet on the Sprint network will now endorse the ISIS network for mobile wallet solutions. Both Google and Sprint have not joined ISIS and it is interesting to see card issuers invest in both platforms. With Verizon, AT&T and T-Mobile in alliance with ISIS, could Sprint be next? Google? Well count Visa and MasterCard as Isis partners. After securing American Express both Visa and MasterCard will now have their credit cards available in Isis’ Wallet. What will be in your mobile wallet?

Many mobile wallet providers are looking at the various options for electronic transaction processing. Will NFC beat out all the others? It’s hard to say but with Apple having yet to release an iPhone model with the chip on board, it could be a yet unseen technology that wins out. QR Codes and Carrier billing are gaining traction for devices without NFC installed and SmartSD cards are coming equipped with NFC to extend devices that have a card slot available.

With device limitations, mobile wallets are still in flux. There are approximately 5 different types of mobile wallets today. There are digital bank accounts similar to prepaid credit cards offered by banks and mostly used for person to person or P2P payments. Mobile payment apps that link payment accounts like those offered by Starbucks or PayPal. Card containers like Apple Passbook store credit cards and loyalty rewards card information and can even fill in forms requesting that information. Similarly, Credential and Card containers store credit card and loyalty rewards but also store identity credentials.

True mobile wallets directly mimic a physical wallet and allow the customer to chose between various credit cards, debit cards even electronic benefits transfer or EBT cards at the point of sale. These wallets are typically app based for both iPhone and Android smartphones and tablets. These wallets can link account information to a point of sale terminal via NFC or other methods for a secure electronic transaction.

Branding and Banks

In recent times Visa, MasterCard and American Express signs at the point-of-sale was a branding element designed to instill confidence for the consumer. With digital wallets becoming the interface for payments, this branding may fade into the background. Yet payment card issuers find themselves in a precarious position. The big three are participating in multiple digital wallet programs in order to not be excluded. This early in the game there are multiple movers and shakers like Square, PayPal, Lemon, Google and now banks and cellular carriers getting into the game, no one knows who consumers and merchants will eventually prefer over the others. It’s like a wait and see game that forces them to play. As banks enter the arena they are favored to win because of the solid loyalty they enjoy from their customers. Though they may not be fair in other categories, they win the security of their customers.

Posted in Credit card Processing, Digital Wallet Privacy, Electronic Payments, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, smartSD Cards, Visa MasterCard American Express Tagged with: American Express, Android, Apple, AT&T, google, Iphone, ISIS, MasterCard, PayPal, Square, Starbucks, T-Mobile, Verizon, Visa MasterCard American Express