Category: Uncategorized

September 11th, 2020 by Admin

The chargeback process was introduced more than four decades ago as a consumer-protection mechanism. It was meant to inspire consumer confidence in payment cards, which were still a novel concept at the time. Fast-forward to today, though, and these forced payment reversals have evolved into a significant problem for online merchants.

Chargeback abuse—commonly known as friendly fraud—is a major source of loss. In fact, chargeback issuances resulting from friendly fraud were expected to reach $50 billion annually in 2020, according to Mercator Advisory Group.

Even then, this figure is a low estimate. It doesn’t account for current trends in a post-Covid environment, where we’ve seen a dramatic increase in friendly fraud. These attacks were already up by the end of March, and there’s no sign that they’re going to slow down.

Covid-19 might look like the source of the problem on a superficial level. If we dig deeper, though, we see four underlying factors behind the preexisting upward trend in chargeback filings:

- More fraudsters view the CNP environment as the “channel of least resistance;”

- Inconsistency in technologies and regulations across different markets;

- The rise of mobile banking;

- The response by card networks like Visa and Mastercard.

These four factors carry diverse ramifications for the market. For instance, roughly $118 billion in e-commerce transactions are declined each year, according to Javelin Strategy & Research. Most of these rejected purchases are false positives, meaning the merchant unnecessarily rejected the purchase in hopes of avoiding a chargeback.

Clearly, there’s a growing disconnect between merchants, financial institutions, and card networks regarding how best to address this situation. We can see this reflected in the fact that the rate of chargeback issuances in North America is expected to significantly outpace those in the European market. This is attributed to factors like strong customer authentication protocols required by the Revised Payment Services Directive (PSD2), and more widespread use of 3-D Secure technology.

The pressure is on for industry players to find more comprehensive solutions for chargebacks. These solutions must be data-driven and adaptable, though. Otherwise, the growing disconnect between cardholders, merchants, financial institutions, and card networks will exacerbate existing problems in the market, leading to further losses.

The good news is that, in the meantime, there are strategies merchants can employ to address these concerns. For instance, even though friendly fraud operates by concealing itself behind false chargeback reason codes, it’s still helpful to have a clear understanding of what each reason code means in context.

Merchants can’t avoid friendly fraud in the same way they can detect criminal attacks or eliminate merchant errors. However, they can minimize friendly fraud risk by adopting key best practices, including:

- Notifying customers to remind them about recurring payments;

- Keeping organized and well-documented transaction records;

- Using delivery confirmation when shipping physical goods;

- Providing easy access to round-the-clock, live customer service;

- Providing a quick response to any refund or cancellation requests.

Also, if a merchant identifies a chargeback as friendly fraud, it’s important to engage that dispute through the representment process. This is a complex, time-consuming process, which is why many merchants opt to outsource their chargeback management. It’s still possible to conduct the process with in-house management. However, it will require strong evidence to support the merchant’s case, such as:

- A legible sales receipt

- A tracking number

- Any emails or transcripts of communications you’ve had with the customer

- Delivery confirmation information

- A record of in-store pickup

- Photographic evidence (when available)

This evidence needs to be contextualized with a chargeback rebuttal letter, explaining why the original transaction was valid. Also, merchants are on a tight schedule. In most cases, they have only a few days to provide a response to their acquirer.

Chargeback management can be a difficult and confusing process. But, with the problem of chargeback abuse only set to grow over time, it’s something merchants can’t afford to take for granted.

—Monica Eaton Cardone is the chief operating office and cofounder of Chargebacks911, Clearwater, Fla.

COMMENTARY: What Will the Future Hold for Chargebacks in Digital Payments?

Monica Eaton-Cardone September 11, 2020 Competitive Strategies, E-Commerce, Fraud & Security, Issuing/Originating, Mobile Commerce, Point-of-sale, Transaction Processing

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Uncategorized, Visa MasterCard American Express Tagged with: chargeback, chargebacks, ecommerce, ecommerce merchant, ecommerce merchants, ecommerce sites, electronic payment, electronic transactions, fraud protection, mobile payment security, strategies, transaction security

September 10th, 2020 by Admin

There are few moments like now where American consumers are collectively open to the idea of new payment methods – especially contactless ones such as mobile wallets. This is good news for businesses since mobile wallets offer a safer payment alternative to credit cards and drastically reduce customer wait times at checkout.

Mobile wallets (such as Apple Pay and PayPal) use authentication, monitoring and data encryption to secure and transmit personal information, and the level of security associated with them has payment card issuers backing their use. This is certainly helping drive consumer adoption, as does convenience.

In fact, global mobile wallet transaction value is estimated to reach nearly $14 trillion by 20201 – and that is a pre-COVID-19 estimate. New estimates are higher and point to further rapid adoption given the current need for touch-free payment options. According to a recently published Visa Back to Business report,* 70 percent of consumers surveyed in June 2020 have used a new shopping or payment method for the first time this year.

A rapid shift has begun and the numbers tell the storySo what is holding back business adoption of mobile wallets? Until recently, it just wasn’t a priority for many small- and medium-size businesses to enable it or educate their employees on its use. The lack of preferential demand didn’t make it a pressing topic. But that is changing. Consider this:

- According to Forbes,2 by 2026, digital natives will be 59 percent of the consumers in the U.S. market.

- Of this, 45 percent will be specifically Millennials and Gen Z, representing the largest purchasing power.

- As Gen Z move into becoming the largest generation cohort, their purchasing power will be $143 billion.

But it’s not just what lies ahead that SMBs should be focused on now.

According to Visa’s Back to Business report, shoppers are now putting COVID-19 safety measures at the top of their shopping lists and they will reward stores that do the same. In fact, if all other factors were equal (price, selection, location), nearly 63 percent of consumers surveyed would switch to a new store that installed contactless payment options, such as mobile wallets.3

What does this mean for you? Now is the time to connect with customers to make sure they are fully contactless capable and have the technology in place to accept many of the most popular mobile wallets.

1Payments Industry Intelligence, “The rise of digital and mobile wallet: Global usage statistics from 2018,” November 25, 2018.

2Forbes, January 2020

3Visa Back to Business report 2020

Posted in Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Uncategorized Tagged with: business, digital payment, digital payments, Digital Wallet, Digital wallets, mobile, mobile commerce, Mobile Devices, mobile payment, Mobile Payments, mobile wallet, mobile wallets, payment, payments

September 9th, 2020 by Admin

It started off as a favor, “Can I bring my puppy, Baxter to work today?” And in the days that followed, everyone kept asking, where is Baxter? So he started making an appearance at the office a few days a week. Now, I can’t leave home without him. He knows the morning routine and as soon as he hears the car keys, he is waiting at the door. When we get to the office, he makes a bee line into every office to see who is here. He greets you as if he has never seen you before, so excited and happy, it can’t help but put a smile on your face. I mean seriously, do you get greeted by anyone in your office with such positive energy? The difference in the office atmosphere when Baxter is here, is incredible. The moral is much higher, the motivation of the sales team has increased and the boss is much calmer. But beware when you enter, he we might look cute and sweet but he will surely greet you at the door with a loud excited vocal bark and crazy twitching tail. And be cautious of where you step as the office floor is now covered in toys and treats. We are not sure who has more fun, the employees playing catch on breaks, or Baxter chasing the balls or toy squirrels up and down the halls. When things are busy, he knows to lay low, but when it’s time for Lunch, you better watch out, he will be glued by your side. When tension in the office gets high, Baxter will zero in on you and demand your attention, as if he knows petting him, will soothe the mood and ease the tension. It is a win win for us all. He might not be a “Certified Therapy Pet”, but in our office, he most certainly deserves the title of “Therapy Pet”.

Posted in Daily Inspiration, Uncategorized Tagged with: business, motivation, therapy pet, work environment

November 21st, 2018 by Admin

We care about our clients and are happy to hear from them, we were able to sit down with one of them and hear their story. Let’s get some Monday motivation and meet Kash Patel from Baryia Travel.

Thank you so much for taking the time to do this interview, it is an honor. Since we know you are taking time away from your busy schedule let’s get started. Tell us about yourself and your business.

I founded Baryia Travel in 1991 and have been designing luxury travel packages for individuals to small groups! We specialize in South Pacific (Australia, New Zealand, Tahiti, Fiji, Cook Island and Hawaii), Africa (Kenya, Tanzania, Uganda, South Africa, Botswana, Namibia, and the Indian Ocean Islands), and Luxury Cruises (ocean and River). I am a Premium Aussie, Kiwi, Kenya and Fundi (South Africa) Specialist and certified by respective countries Tourism Commissions! I have also completed certification offered by Silver Seas, Uniworld River Cruises, among the major cruise lines. Our expertise include romance (honeymoons, destination weddings, etc.) adventure, and sports (golf, tennis, etc.) travel.

Thank you so much for sharing. Tell us, has the journey been smooth or have there been some bumps along the way?

The journey has been anything but smooth, but we are still going strong now for about 27 years! Couple years after starting the business, airlines stopped paying commissions to travel agencies, but we survived and since then have learned various lessons as we march forward! Although many bumps in the road, it has been a very pleasant and enjoyable journey!

Please tell us more about Baryia Travel.

Our motto is “Making your dream vacations a reality”. We accomplice this by making sure we understand what they want and design to meet their needs and desire and paying attention to every detail! By working with local tour operators in various countries we make sure they get the best experience!

Wow, that is very interesting, thanks for sharing. What made you decide to open up this business? What are you most passionate about it?

I have been passionate about travel and born and raised in Africa I wanted people to experience this very different continent! One of my first trip after starting my business was Australia and I fell in love with the island continent and since then I have visited South Pacific about 25 times to learn what they have to offer!

Thank you so much for answering all of our questions, before we let you go, is there any tips of advice you would give to other entrepreneurs like yourself?

Listening to customers’ needs and providing superior customer service with attention to details! Provide them off the beaten path experiences!

Share with us how customers can find you.

kash@baryiatravel.com

617-527-4799

We work by appointment only but have flexible hours and can also come to you for a meeting!

It was a wonderful opportunity to meet and talk with Kash Patel, be sure to contact them for your luxury travel needs!

Posted in Uncategorized Tagged with: business, business cards, business travel, entrepreneur, entrepreneur blog, feature, interview, luxury, online travel, travel agency, traveling

November 18th, 2018 by Admin

We got the chance to speak with Jan Aragon from Roadway Motors; they want to provide you with the best automotive experience possible and we wanted to learn how their company has grown to be the great one it is. Let’s learn more about them, shall we?

Thank you so much for taking the time to do this interview, it is an honor. We know you are taking time away from your busy schedule let’s get started. Tell us about yourself and your business.

We are a Car Dealership that sells Pre-Owned and New Cars

Picture available at Roadway Motors LLC’s Facebook.

Thank you so much for sharing. Tell us, has the journey been smooth or have there been some bumps along the way?

Everything was perfect from start to finish.

Please tell us more about Roadway Motors LLC: We are a Car Dealership that sells Pre-Owned & New Cars

Thank you so much for answering all of our questions, before we let you go, is there any tips of advice you would give to other entrepreneurs like yourself?

Start small and grow big and strong.

Thank you and finally, share with us how customers can find you.

www.roadwaymotorsllc.com

I was such a pleasure to get the opportunity to speak with Roadway Motors. If you are looking for your next set of wheels, they are happy to help from researching the vehicle you want to test drive the ones you like. Roadway Motors is there to help you with a selection of cars, trucks, and SUVs.

Posted in Uncategorized Tagged with: blog, blogger, business owner, Car, dealership, entrepreneur, entrepreneur blog, entrepreneurship, feature, Florida, interview, SUVs, west park

November 15th, 2018 by Admin

When you think of starting a business, you often think of making a huge investment: Office, marketing materials, furniture, inventory, etc. The reality is that not all companies need that and not all need an office to start. Here are ten businesses you can start from home now.

1. Web Design: If you have experience building websites or do it as a hobby, do it this one is for you. Website design is in high demand, and although there are Do-It-Yourself sites available, not everyone wants to spend the time doing it. This is where you come in, create a fantastic website, a portfolio with your best work and get started.

2. Virtual Assistant: If you have experience as an Administrative Assistant, Executive Assistant or you are just good at the computer this one is perfect for you. With many people working and managing the business online, it is only fit that many entrepreneurs look for virtual admins to help them with everyday tasks. Some might hire you for a short-term/one task kind of project, while others might want to hire you for the long term. Be sure you outline a plan to figure out which type of projects you want and which industries you would want to focus on.

3. eBay Seller: If you have been online, we are sure you or someone you know have heard of Gary Vaynerchuk and his flip challenge. Essentially, you would buy items at a garage sale that you know you can sell for more online. You can try this approach or start by selling books and other things you have already at home, and you don’t use. It is an easy and not complicated way start a side business. Just be sure to abide by their terms of service.

4. Accountant: Do you work as an accountant? Those online businesses and even brick and mortar businesses are always in need of an accountant. Find out competitive rates in your area and reach out to companies that might be in need of your services. Do a good job and good luck!

5. Copywriter: Marketing is significant for any business, writing good copy is essential for this part of the business, and you might be the person who makes a difference in the company’s advertising efforts.

6. Driver: With companies like Uber and Lyft offering ride services, it is easy to start your own ride service business. You can join either of them and get started. Do keep in mind that they do have guidelines when it comes to the vehicles. After all, they are the brand.

7. Consultant: If you are highly knowledgeable about a specific topic and you know there is a demand for this kind of information, you can sell your services as a consultant. Set up a rate and know who your customer will be and get started.

8. Coach: This is another one that pays off when you are good at a specific skill. People can coach in a variety of subjects like Business, Life, work, spirituality and more. For this one, we recommend you get the tools needed by becoming a certified coach, although it is not necessary.

9. Meal Delivery Service: Similar to the ride services, you can deliver food by joining companies like GrubHub, Uber Eats DoorDash. Many companies offer this service, and you can get started as soon as your application is accepted. The benefit, like Uber or Lyft, is that you make your schedule.

10. Social Media: If you are creative like to write and enjoy social media, this might be a good business to start. This is the kind of business that is needed and can compliment a good marketing strategy. Remember to stay on top of trends, news and be willing to learn as this industry changes quickly but can be a rewarding experience.

There are many more businesses you can start home that requires minimal to no investment; we hope this list gives you an idea to get started.

Posted in Uncategorized Tagged with: business, coach, consultant, copywriter, customer, data, driver, ebay, entrepreneur blog, entrepreneurship, lyft, mobile, social media, tips, uber, uber eats, virtual assistant, web design, work from home, writing

October 28th, 2018 by Admin

In the age where technology is practically king, and your business needs to run. We have decided to share with you, apps that can help your business today.

1. OfficeSuite : Free Office + PDF Editor. OfficeSuite lets you view, edit and create in Word, Excel, and PowerPoint documents, and perform advanced PDF operations. Many find the app easy to use while on the go; however, do keep in mind that many found a need to purchase the paid version to get the best out of it. As of this post, the app rated 4.3 stars out of 5 in GooglePlay.

1. OfficeSuite : Free Office + PDF Editor. OfficeSuite lets you view, edit and create in Word, Excel, and PowerPoint documents, and perform advanced PDF operations. Many find the app easy to use while on the go; however, do keep in mind that many found a need to purchase the paid version to get the best out of it. As of this post, the app rated 4.3 stars out of 5 in GooglePlay.

2. Slack: This app brings your team together and maintains communication a breeze. This app helps you check off your to-do list and move your projects forward by bringing your team, conversations, tools, and information you need together. The app is great for big and small business and as of right now it rated 4.4 stars out of 5.

2. Slack: This app brings your team together and maintains communication a breeze. This app helps you check off your to-do list and move your projects forward by bringing your team, conversations, tools, and information you need together. The app is great for big and small business and as of right now it rated 4.4 stars out of 5.

3. Google Drive: This app can help you manage your projects, documents, and photos with ease. Better yet, you can start working on a document from your computer and continue on the go if needed. Google Drive is a safe place for all your files and puts them within reach from any smartphone, tablet, or computer. Currently, is rated 4.4 stars out of 5.

3. Google Drive: This app can help you manage your projects, documents, and photos with ease. Better yet, you can start working on a document from your computer and continue on the go if needed. Google Drive is a safe place for all your files and puts them within reach from any smartphone, tablet, or computer. Currently, is rated 4.4 stars out of 5.

4. Evernote: This is another note app but with more features! This app can help you jot down a few notes, create to-do lists, scan your hand-written notes, add images, web links and even audio. And best yet, this app can be accessed from your computer or on the phone making it extremely versatile. Rated 4.5 out of 5.

4. Evernote: This is another note app but with more features! This app can help you jot down a few notes, create to-do lists, scan your hand-written notes, add images, web links and even audio. And best yet, this app can be accessed from your computer or on the phone making it extremely versatile. Rated 4.5 out of 5.

5. DocuSign: Save time, money and the environment with this app. Docusign allows you to send contracts to your clients while on the go. This app also complies with the e-sign act, the documents are encrypted and is ISO 27001 SSAE16 compliant. Rated 4.5 out of 5.

5. DocuSign: Save time, money and the environment with this app. Docusign allows you to send contracts to your clients while on the go. This app also complies with the e-sign act, the documents are encrypted and is ISO 27001 SSAE16 compliant. Rated 4.5 out of 5.

6. aCalendar: We love Google calendars but this app takes it to a new level of organization. It syncs your phone and Google calendar, has agenda and widget view, 48 colors per calendar, moon phases, mini month or graphical week overview in a day and week view. Currently rated 4.4 out of 5.

6. aCalendar: We love Google calendars but this app takes it to a new level of organization. It syncs your phone and Google calendar, has agenda and widget view, 48 colors per calendar, moon phases, mini month or graphical week overview in a day and week view. Currently rated 4.4 out of 5.

7. Google Ads: With a business, you got to market. Google is usually a good way to get started a managing your Google Ads from your phone is even easier. You can view your campaign’s performance when you are not near your computer and it’s free. Rated 4.3 out of 5.

7. Google Ads: With a business, you got to market. Google is usually a good way to get started a managing your Google Ads from your phone is even easier. You can view your campaign’s performance when you are not near your computer and it’s free. Rated 4.3 out of 5.

8. Google Analytics: Google tools can be your friend and Google Analytics can help you learn how your website is performing. While on the go, this is a good app to have. It helps you see how your ad campaign is doing and what you can do to improve, for free. Rated 4.5 out of 5.

8. Google Analytics: Google tools can be your friend and Google Analytics can help you learn how your website is performing. While on the go, this is a good app to have. It helps you see how your ad campaign is doing and what you can do to improve, for free. Rated 4.5 out of 5.

9. ZOOM Cloud Meetings: Growing your business can mean lots of meetings in your future. When you are not able to meet in person, ZOOM Cloud can help. This app brings video conferencing, online meetings and group messaging into one easy-to-use application. People can connect through the app or via computer. Rated 4.4 out of 5.

9. ZOOM Cloud Meetings: Growing your business can mean lots of meetings in your future. When you are not able to meet in person, ZOOM Cloud can help. This app brings video conferencing, online meetings and group messaging into one easy-to-use application. People can connect through the app or via computer. Rated 4.4 out of 5.

10. Mailchimp: Chances are, if you have a business you are doing e-mail marketing. Up your game with Mailchimp and manage your e-mail marketing efforts on the go. Rated 4.1 out of 5.

10. Mailchimp: Chances are, if you have a business you are doing e-mail marketing. Up your game with Mailchimp and manage your e-mail marketing efforts on the go. Rated 4.1 out of 5.

App images via Google Play

Posted in Uncategorized Tagged with: Android, Android app, apps, b2b business, boost productivity, business, calendar, evernote, google, Google Apps, google drive, google play, mailchimp, productivity, slack, zoom

September 13th, 2017 by Elma Jane

NTC GIVES will be collecting donations for the Florida Keys:

No donation is small

• Water

• Non-perishable Food Items

• Cleaning Supplies (bleach, bleach wipes, mops, gloves,

clean rags)

• Clean Clothes (All styles and sizes. Used items are okay,

as long as they are washed and clean.)

• Personal Hygiene Products (soap, shampoo, toothbrushes,

etc.)

Drop off location:

National Transaction Corp. 888.996.2273

11951 NW 37th Street, Coral Springs FL, 33065

Between 9AM to 5PM Mondays thru Fridays

Please make donations by Friday, September 15th

www.NationalTransaction.Com

www.NTCGives.Com

Posted in Uncategorized

September 5th, 2017 by Elma Jane

It’s true that the travel agencies are high risk. This is because of the high chargebacks by travelers who fail to complete their trips or stays due to a variety of reasons. But, using the right merchant solutions can make a difference.

You want merchant solutions that help you to manage chargebacks, errant transactions, and terminal messages. Additionally, you should be able to integrate your software with services such as Sabre Red, Sabre, Trams or other accounting programs such as QuickBooks and Peachtree.

With NTC ePay, simply create a pay button for any dollar amount. Then send this digital link to your customers via email. The customer reviews the invoice details and enters their payment information to complete payment.

With this service, you avoid the complexities of integrating the software with your shopping cart, the point of sale, or accounting system.

For Electronic Payment Set Up Call Now! 888-996-227

Posted in Uncategorized Tagged with: chargebacks, high risk, merchant, payment, point of sale, terminal, transactions, travel

March 1st, 2017 by Elma Jane

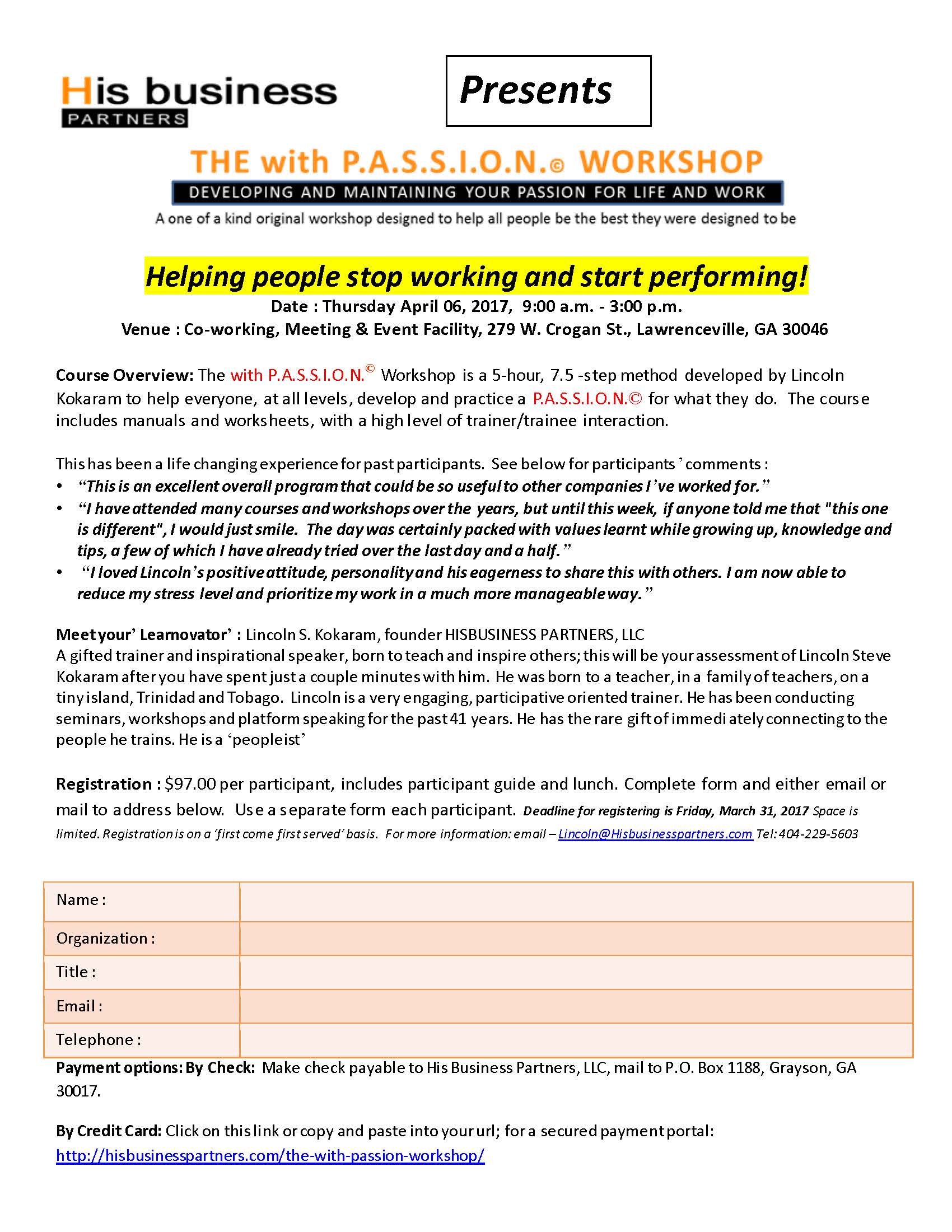

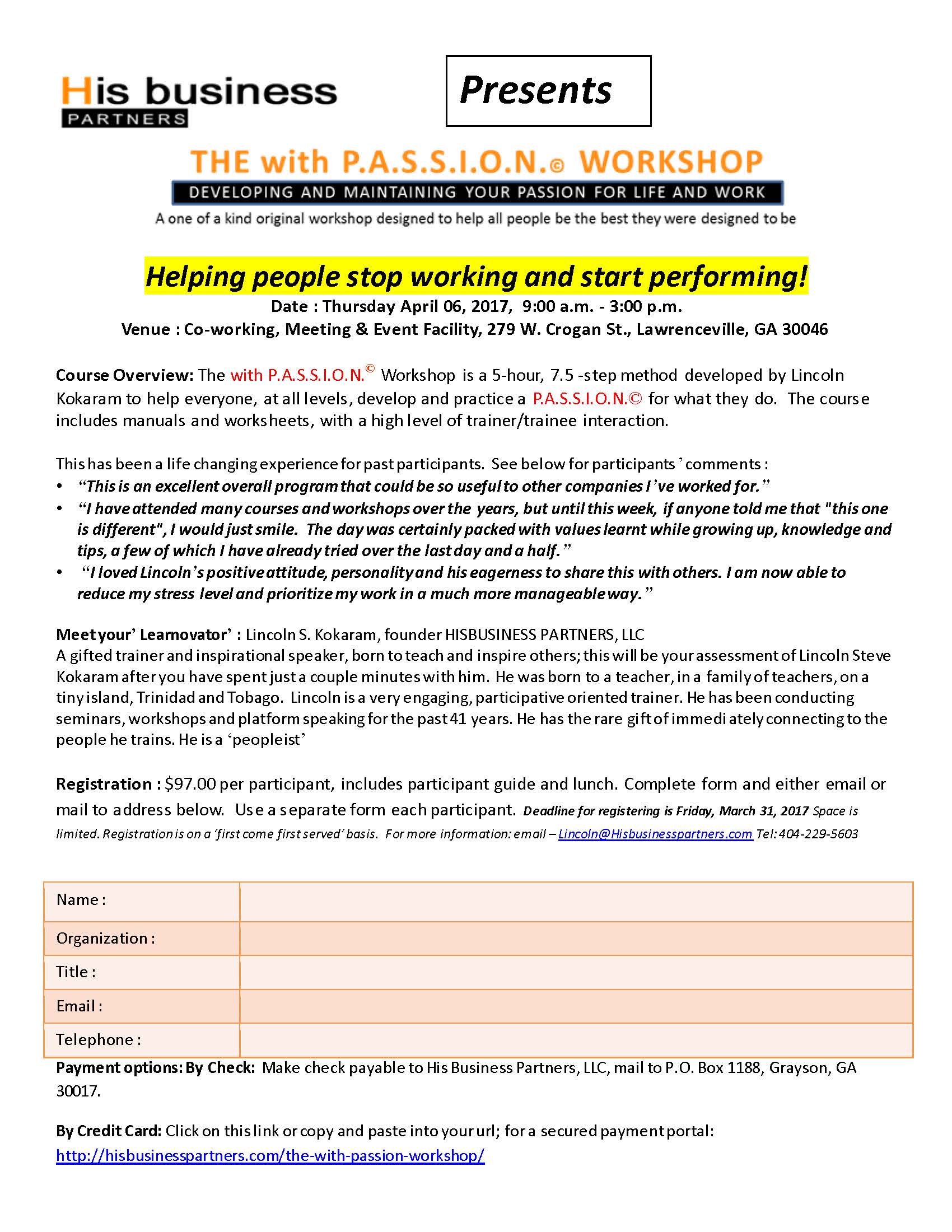

Click the image below to fill up and download the form!

Posted in Uncategorized

1.

1.  2.

2.  3.

3.  4.

4.  5.

5.  6.

6.  7.

7.  8.

8.  9.

9.  10.

10.