May 31st, 2017 by Elma Jane

If you’re a retail business you’re going to need a credit card terminal to accept credit cards, and if you have multiple locations; you might need more than one terminal.

Obtaining terminals for your business with multiple locations can be expensive. Because of this, some merchants used leasing arrangements which they think that monthly leasing fee might seem like a bargain compared to the cost of buying a terminal.

One provision of the lease is: Non-Cancelable Lease

Leases commonly have a 48-month (four-year) term, and a clause that makes the lease completely non-cancelable.

They also have a purchase option at the end of the lease. You must exercise your option to end the lease.

In a non-cancelable provision, they’ll keep deducting monthly leasing fees from your account regardless of anything, or an immediate payment of all remaining months of your contract if you break your lease.

In addition to monthly leasing fee, you’ll also pay sales tax and a monthly equipment insurance fee; while you can purchase it for as low as $150-$200.

Beware of free terminal offers, other providers will offer a free terminal, but they also charge higher monthly fees if you elect the free terminal. So the terminal isn’t really FREE.

For Electronic Payment Set Up Call now 888-996-2273 or go to NationalTransaction.Com

Posted in Best Practices for Merchants, Electronic Payments Tagged with: credit card, electronic payment, merchants, payment, terminal

May 10th, 2017 by Elma Jane

Mobile Wallet Technology have flooded the market in the last few years with offerings such as Apple Pay, Android pay, Samsung Pay and more. And so far, they seem to be succeeding.

To understand how contactless payments work, here is an example.

A smart phone like Android or iPhone allows you to take advantage of mobile wallets like Android Pay, Apple Pay or Samsung Pay. You input your credit card information onto your phone, which stores it for later use.

If you’re shopping at a store that has mobile payment readers at the register, rather than reach for your wallet and get your credit card; you take out your phone to make a payment.

The point-of-sale (POS) terminal will automatically reads the payment information stored by holding your mobile phone a few inches away from the POS, and then processes the transaction. When the mobile device is in range, a wireless communication protocol links the terminal and the phone, which exchange information and conduct a secure transaction in a fraction of a second.

Near-field communication or NFC technology, works by bringing together two electronic devices. In terms of payments technology, a mobile device such as a smartphone and a reader. The reader would be the initiator and the smartphone would be the target, which contains the stored credit card information.

The market potential for NFC payment technology is huge, as more merchants adopt the EMV. EMV compliant terminals accept NFC payments through mobile wallets.

For Electronic Payment set up call now 888-996-2273!

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Mobile Payments, Near Field Communication, Smartphone Tagged with: contactless payments, credit card, electronic payment, merchants, mobile wallets, Near Field Communication, nfc, point of sale, POS, smart phone, terminal

May 8th, 2017 by Elma Jane

Tips for preventing funding delays!

If you’re running an unusual transaction and know of it beforehand, let your merchant provider know; sending an invoice in advance can cut processing time.

Make sure to give your most up to date information. Keeping provider in the loop on the fluctuations in your processing volumes will help tremendously, especially as your business grows.

Funding delays are an inconvenience, but being prepared can keep the delay to a minimum. If you keep these tips in mind, you’ll be processing without ever having to worry about delays again.

Flagged, Security and Review Process

Why some merchant accounts hold funds and others do not?

There are a number of reasons:

Underwriting merchant account is ongoing. Imagine a small business convenience store was set up and accidentally enters $1,000.000 should we transfer that or hold it?

One reason is something has gone with that particular business account.

Another reason could be that particular institution’s practices are more efficient than others.

Financial institutions use different payment processing systems, and they are not uniform in their practices. For this reason, some transactions are significantly faster than others.

Though there are other reasons funds get held, the main reason for this occurrence is when a payment is out of the ordinary patterns.

Unusual transactions are any transaction that vary from your typical processing patterns.

If It’s for security, an account will be flag as a way to reduce fraud as well as ensuring no one is using your account.

How do I know if I’m flagged?

Security checks are carried out by processing banks or processor. You’ll be contacted by a loss prevention officer. They’ll provide all details of the hold, including the review process as well as the next steps.

What’s the review process?

The review is simply to verify your transaction before delivering your funds. A typical review is confirming the transaction with yourself as well as your customer’s credit card company. You’ll speak briefly with a loss prevention officer to discuss the transaction. If further review is required, the loss prevention officer may ask you for a copy of the transaction’s invoice.

How can I speed up the process?

For an easy review, make sure to provide detailed documents. When an invoice is asked for, make sure it clearly shows the following:

- Product Description of Items Sold

- Your Customer’s Name

- Address

- Phone Number

For Electronic Payment set up call now 888-996-2273 or go to NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: credit card, electronic payment, funds, merchant provider, processor, Security, transaction

May 5th, 2017 by Elma Jane

Tokenization is a powerful security feature that allows a merchant to support all of their existing business processes that require card data without the risk of holding card data and without any security implications, because tokens are useless to criminals, they can be saved by the merchant as they do not represent any threat.

The liability and costs associated with PCI compliance is substantially reduced and the risk of storing sensitive data is eliminated.

Tokenization applies to credit card and gift card.

Merchants set up for the tokenization service receive responses that include a token.

The token generated is not linked to a specific transaction but to a specific card number and the token generated for that transaction will be identical for every use of that card number and merchant.

Furthermore, you can generate a token and save the token with associated information in the Card Manager.

For Electronic Payments with Tokenization call now 888-996-2273

or click here NationalTransaction.Com

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, Payment Card Industry PCI Security Tagged with: card, credit card, data, electronic payments, merchant, PCI, Security, token, tokenization, transaction

May 1st, 2017 by Elma Jane

3D Secure Authentication

One of the biggest frustration for e-Commerce businesses has been the risk of chargebacks. If a shopper were to tell their issuers that they did not authorize an Internet purchase with their credit card, the merchant can lose the chargeback and the product.

By using 3D Secure capabilities, merchants get detailed evidence of authorized purchases “authentication data”.

The authentication data, together with an authorization approval gives you a transaction that is guaranteed against the most common types of chargebacks: Cardholder not authorized and cardholder not recognized chargebacks.

3D Secure is a security tool that enables cardholders to authenticate their identity to their card issuer through the use of Visa’s Verified by Visa and MasterCard’s SecureCode services.

3D Secure adds another layer of security to cardholders by preventing fraudulent purchases in an e-Commerce environment and reducing the number of unauthorized transactions.

NTC’s Virtual Merchant users processing transactions in an integrated e-Commerce environment are able to take advantage of this functionality.

3D Secure processing is supported with MasterCard and Visa transactions only. Other card types will process as normal and will not trigger 3D secure processing.

For e-Commerce Electronic Payments set up with 3D Secure

call now 888-996-2273! or click here NationalTransaction.Com

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Visa MasterCard American Express Tagged with: chargebacks, credit card, data, e-commerce, electronic payments, MasterCard, merchant, Security, transaction, visa

April 24th, 2017 by Elma Jane

Recurring Payments through VirtualMerchant

Providing recurring payments is an easy way to increase retention, grow loyalty, and improve customer satisfaction.

Recurring Payments are automatic payments where a customer authorize a merchant to collect the total charges from a customer’s credit card or bank account every month. It is a useful feature with multiple applications: Donations, Memberships, subscriptions and utility payments.

Handle your recurring and installment payments with our single solution.

To set up a recurring payment, the merchant simply enters the specified charge, chooses the frequency of payment (weekly, monthly, annually) and the customer’s card is billed.

Automated recurring billing is an efficient, convenient and hassle-free service that can help merchants build and manage their business growth.

To set up recurring payment through VirtualMerchant call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: bank, credit card, merchant, payments, recurring

April 7th, 2017 by Elma Jane

Merchant Cash Advance Or Loans

Merchant Cash Advance – is a funding product providing working capital to businesses. When it comes to securing a merchant cash advance, businesses are far more likely to be approved and secure the amount of funding you actually need because cash advance is not a loan.

Loans generally are lower rates than MCA? Monthly payments not daily and many of these loans may also be lines of credit. Lines of credit sometimes have collateral, real estate or other guarantees. These options can be uncovered through consultation service at NTC.

MCA companies provide funds to businesses in exchange for a percentage of the businesses daily credit card income directly from the processor that clears and settles the credit card payment. A company’s remittances are drawn from customers’ debit-and credit-card purchases on a daily basis until the obligation has been met. Most providers form partnerships with payment processors and then take a fixed percentage of a merchant’s future credit card sales.

The Term Merchant Cash Advance – may be used to describe purchases of future credit card sales receivables, revenue and receivables factoring short-term business loans, and it has a different set of rules and rates.

Cash advance has some advantage over a conventional loan structure. Payments to the merchant cash advance company fluctuate directly with the merchant’s sales volumes, giving the merchant greater flexibility with which to manage their cash flow, particularly during a slow season. Advances are processed quicker than a typical type loan, giving borrowers quicker access to capital.

Merchant Cash Advances are often used by businesses that do not qualify for regular bank loans.

Ask our loan consultant if you were told you do not qualify for a loan.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, loan, merchant cash advance, payments

April 6th, 2017 by Elma Jane

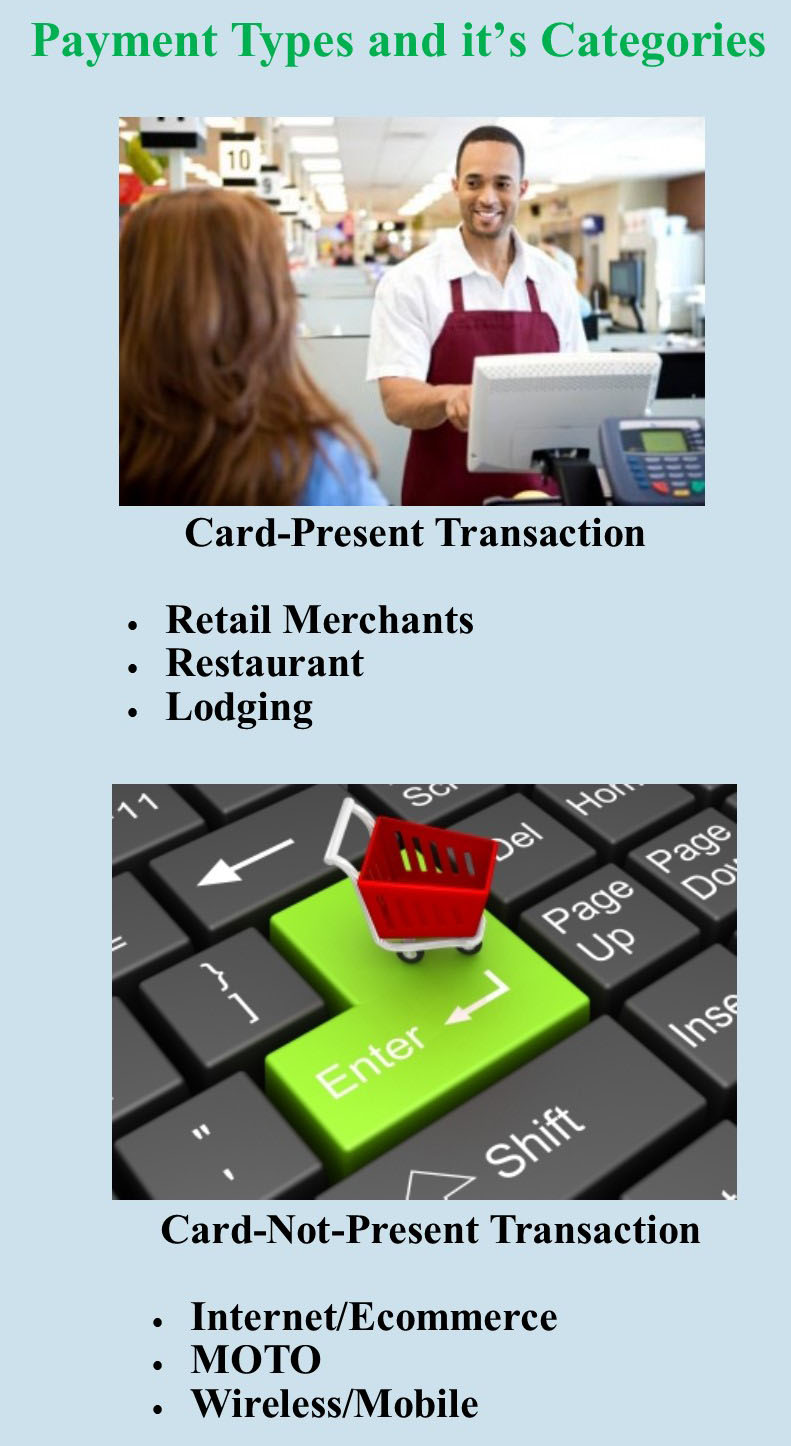

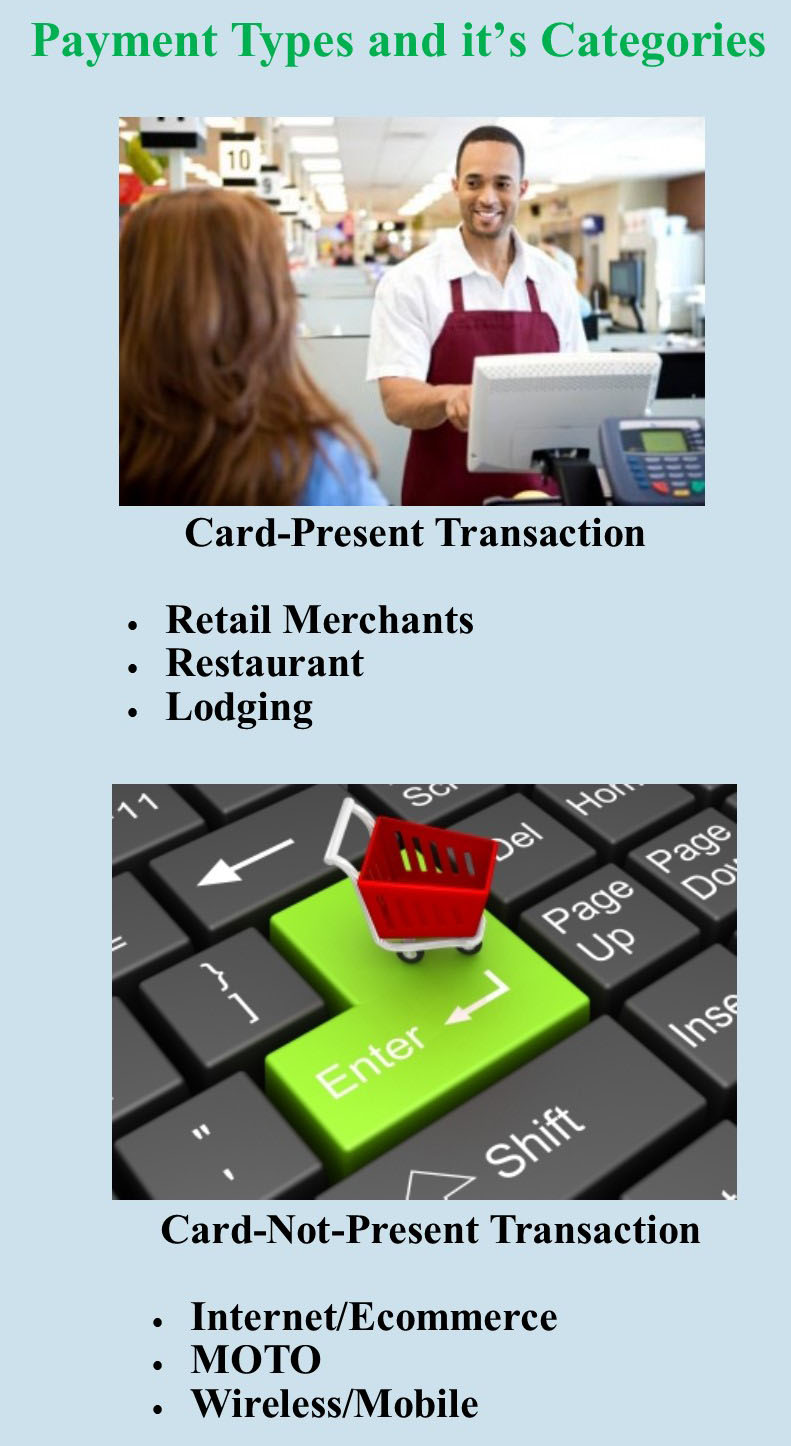

Payment types and it’s categories

The two main category types when it comes to credit card processing are swiped and keyed. Card present or card-not-present.

Swiped or card present transaction – merchants do a face-to-face transaction. A merchant can capture card information by dipping the chip or swiping the card in the terminal or POS. Merchants directly interact with a customer so the risk is low.

Card-Present Sub Categories:

Retail Merchants – conduct transactions face to face in a retail environment.

Face to Face (mobile) – this type of merchant is typically on the go, such as a vendor at a trade show. You can use a service like converge mobile that allows you to take the information in person.

Restaurant – the same as retail merchants, the difference is they may require the ability to add tips to their charges.

Lodging – processes their transactions like retail merchants except they may adjust the settlement amount depending on the customer’s length of stay.

Keyed or card-not-present are high risk, because merchants indirectly collect customers card information, and can process transactions in various ways.

Card-Not-Present Sub categories:

Internet/Ecommerce – conducts business through a web site by utilizing a shopping cart and an Internet payment gateway service. The payment gateway then collects the credit card information and processes it in real time.

Mail & Telephone Order (MOTO) – typically take the customer’s credit card information over the phone, by mail or through the Internet. They then manually process the transaction by keying it into either a credit card machine or through a virtual terminal such as Converge.

Talk to our payment consultant to know the best solution for your business.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit card, customer, ecommerce, merchants, payment, payment gateway, POS, swiped and keyed, terminal, virtual terminal

March 30th, 2017 by Elma Jane

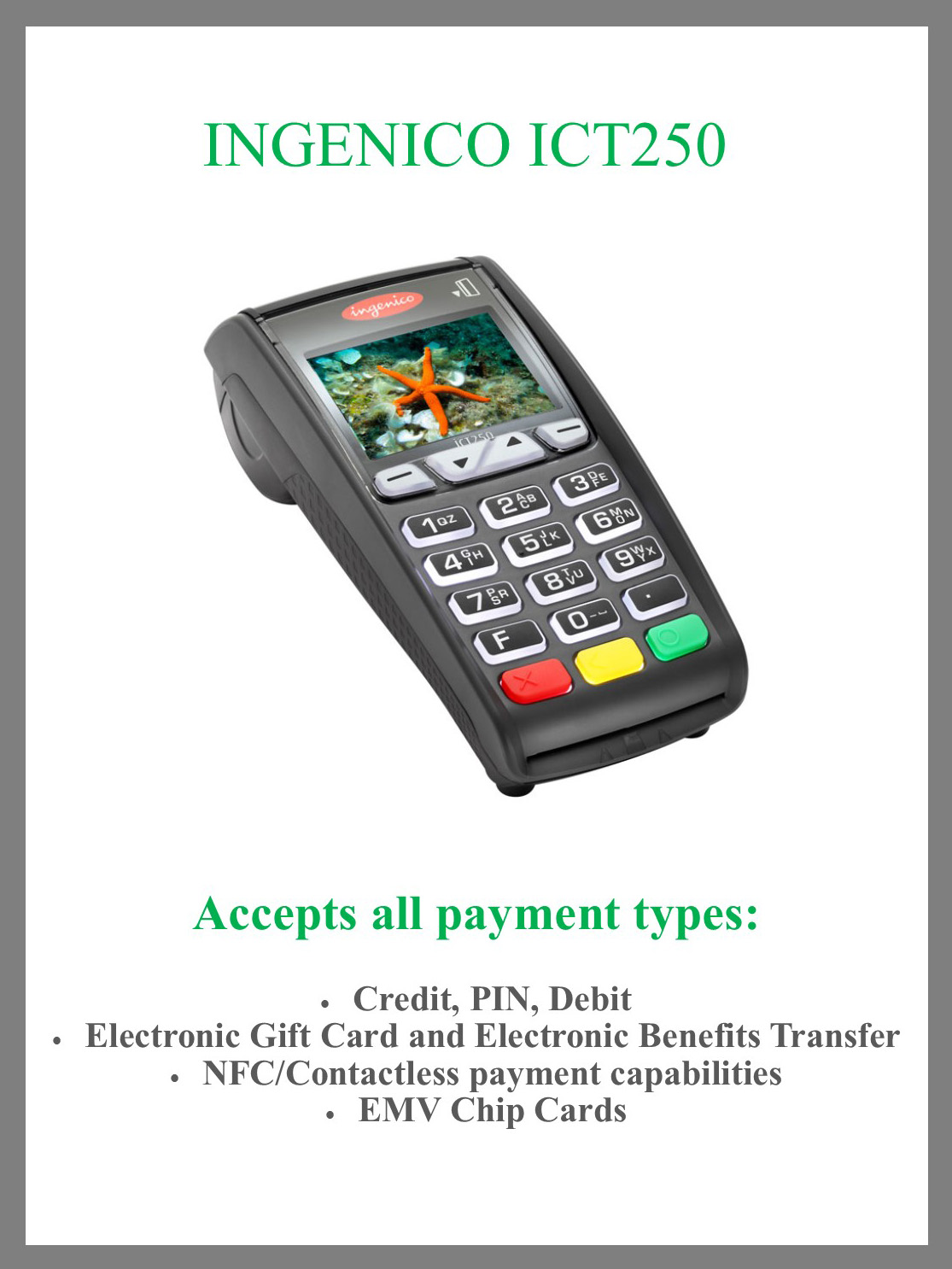

Credit Card Terminal

Factors to Consider When Buying a Credit Card Terminal:

- NFC – check out the payment wave of the future. NFC technology features, where you can accept Apple Pay and Android Pay for payments.

- Security and Stability – do I have a computer tablet or other device that will accommodate the future technology? Newer credit card machine work faster, they also protect sensitive card data and have the ability to accept EMV and PIN. Older terminals may not comply with today’s PCI security standards.

Mobile/Wireless Connectivity – credit card terminal should be able to quickly and easily accept credit card payments and work with your payment processor anywhere.

- Connectivity – do you use mobile, Wi-Fi, dial, or (IP) Internet connection? Most current credit card terminals use both technologies, but when connected to dial-up your transactions can be quite slow, unlike IP connection which can speed up your transactions.

- Programmable or Proprietary – if they will not let you program it why NOT?

There are many options when searching for the right credit card terminal for your business but there are also a number of factors to consider before making an investment.

Give us a call at 888-996-2273 and talk to our Payment Consultant!

Posted in Best Practices for Merchants Tagged with: credit card, data, EMV, nfc, payments, PCI, PIN, processor, terminal

March 21st, 2017 by Elma Jane

Accepting Electronic Payments

Why do you need to accept electronic Payments?

Accepting credit card payment is becoming a must for businesses because 70% of consumer spending is done electronically.

Signing up with NTC is easy. No Setup or Cancellation Fees. No Risk!

Already accepting credit card payments? We can do FREE Rate Review and get 500 Points.

Call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, electronic payments, payments