December 27th, 2016 by Admin

Merchant aggregator is an entity that can run many transactions through a single merchant account, an opposite to the traditional merchant account since you’re the sole owner.

Preferred for a smaller business because its not intended as a long term scalable solution to accepting payments.

For businesses that want to expand their processing needs, traditional merchant account will outgrow an aggregator, since the goal is for a business to grow, but it will always come to what’s best for individual business.

While you have the pros of quick application process and instant approval there are a lot of cons to check before getting an aggregator account.

CONS of an aggregator account:

CUSTOMER SERVICE – aggregators are hard to get hold of.

FEES – fixed fees .

FREQUENT HOLDS and DELAY OF FUNDS – aggregators hold funds 24-48 hours before depositing, while longer holds occur 30 days. (A client of ours who signed up with an aggregator came back in tears and wants to open her merchant account with us again because her funds was held with the merchant aggregator. She then promised will not leave and stay for life with NTC).

LOWER LIMITS – processing limits lower, annual limit of $100k.

PROS of a Traditional Account:

CUSTOMER SERVICE – 24/7 technical support.

FUNDS – next day funding, no frequent account holds.

FEES – tailored to your business needs.

LIMITS – varies by financial strength and business

Setting up a Merchant Account? Call us now! 888-996-2273 or go to www.nationaltransaction.com

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: customer, fees, funds, merchant, merchant account, payments, transactions

December 22nd, 2016 by Elma Jane

What is a Merchant Account?

If you want to remain competitive virtually, every business needs access to a merchant account to accept card payments from their customers. “Merchant” is another word for a seller or business owner. Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. This allows a merchant to receive funding for the credit transaction. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for payment providers or processors; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Merchant account helps facilitate the complex interactions that need to occur between your business and your customer, the credit card networks (Amex, Discover, MasterCard, Visa) and your payment provider every time you receive a card payment. It helps to ensure that you receive funding as quickly as possible, that the banks are protected from losses, and that buyers are protected from scams. Everyone is held accountable based on the rules of the credit card processing agreement with a merchant account.

There’s cost associated in taking credit cards, but it’s much easier and more secure to open a merchant account than it is to keep a book of credit accounts for all of your customers!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: amex, card, credit, customers, Discover, loan, MasterCard, merchant account, payment provider, payments, transaction, visa

December 6th, 2016 by Elma Jane

The Process of Processing Electronic Payments

Today new technologies are emerging in electronic payment that allow merchants to collect valuable data on their customers; from emailing receipts to providing incentives to mention the merchant on social media.

So what’s behind the process of processing electronic payments? The heart of all your payment processing needs will most likely lie in a merchant account; with a merchant account you can deposit funds from ebt cards, debit cards, gift or loyalty cards and even checks into your bank account. If your business has never had its own merchant account, it’s probably missing out on some very valuable opportunities.

At National Transaction Corporation this process is simplified to a signature page and a voided check. We consult your business personally to establish the lowest rates and fees possible with your electronic payment processing. We ask detailed questions about how you process your transactions, and if you already process credit cards, we offer a free statement review where we determine your most common transaction types and how to lower their fees and rates.

How Much Will Electronic Payment Processing Cost?

There are three parts to the answer:

Up front or startup costs – include things like an application fee, an account setup fee and equipment fees. At NTC, we don’t have any application, setup or cancellation fees on our services. Our credit card readers and terminals are nonproprietary and will work with almost any merchant services provider and we sell them at cost to make it easier on our merchants.

When you buy a terminal from us you own it and are free to leave us at any time and use the terminal to process through another merchant account provider with no penalty payments at all.

Other startup costs might be:

- check readers,

- cash registers and receipt printers

- mobile point of sale software

- credit card swipe readers

- Accounting software (Intuit’s Quickbooks Pro or PeachTree)

If you already own any of this equipment we can integrate your existing hardware into our services.

Monthly service fees – depend on what services are required; included in the monthly fee detailed statements and reporting on transaction activity.

Transaction fees – MasterCard, Visa and American Express set what are called interchange rates. Interchange rates are a per transaction fee and/or a percentage rate based on the total of a sale. Interchange rates are very complex and consume hundreds of pages of different types of electronic transactions. These transactions are based on the type of business processing the transaction, the way the credit card data is input (like a credit card that is swiped in or manually keyed into a credit card terminal of some type) and the type of credit card used for the transaction (rewards card, corporate card, travel and entertainment credit cards, ebt cards and so on). With so many types of cards and businesses to process it’s impossible to give an accurate rate for all charges.

Again, we have no fees associated with applying for or setting up the merchant account and there is no penalty for cancellation so there are no risks in trying it out. We can do merchant rate review for free. Call us now 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit cards, customers, data, electronic payment, merchant account, merchants, mobile, payment processing, point of sale, services provider, terminal, transactions

November 29th, 2016 by Elma Jane

GET THE LOWEST CREDIT CARD TRANSACTION RATES & FEES BY DOING THE FOLLOWING:

1. Use newer POS systems to reduce credit card fees.

2. Find out what percentage of your gross sales go toward credit card rates.

3. Perform a statement review at least annually.

Any time a customer uses a credit card to purchase services and goods the merchant pays various rates and fees processing those transactions. Most of these fees go to the bank issuing the credit card as they take on the bulk of the risk in credit card transactions.

Visa, American Express and Discover own the network on which these credit card transactions are processed on and they receive part of the fee and percentage rate as well as establish these rates and fees. Finally the bank that provides merchant account services gets part of these rates and fees.

To a small business 2, 3, or even 4% might not sound like much but when these fees are on the gross total of sales they can be significantly higher than originally thought.

For this reason it’s a great idea to assess your merchant account statement to see if rates are in line and that your most frequently used cards and transaction types are getting the best rate possible. By going over your statement, you can see exactly what you pay per transaction and get details about your most common transaction types and credit card used to get the process going.

If you are unfamiliar with what these rates and fees mean on your statement companies like National Transaction can perform the review for you. Free of charge.

Ultimately the best thing to have is a merchant account service provider that will take the time to go over your business with an eye lowering your rates and fees. The savings can be significant. As a business grows it changes and there should be an ongoing strategy at maintaining the best processing rates and fees possible. Today with so many different credit card types, like rewards cards, airline miles programs and more it can pay off to check once or twice a year.

For FREE Rate Review give us 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, credit card, customer, merchant, merchant account, POS, rewards cards, service provider, transaction

November 28th, 2016 by Elma Jane

Payment acceptance is key to making more money.

Let’s talk about your money, and how to make more of it. Today money is taking on a new form. It’s digital, it’s electronic and it’s everywhere and anywhere 24/7/365.

Payment acceptance is key to making more money. You don’t make more money by not accepting a transaction, and making the experience convenient and safe to your customer can bring loyalty.

Let’s break down a transaction.

Cash, but that would mean that the customer has to be in front of you. You could take checks, those are safe to mail, but then you don’t have your money until you drive to the bank and cash or deposit the check.

So how do we easily and securely transfer funds for a transaction? The answer lies in digital or electronic payments. Accepting credit cards, debit cards, ebt cards or even gift & loyalty cards and electronic checks. These provide secure and convenient ways to complete transactions for your customers. If you want to make more money, make it easy for customers to spend it while making it faster for you to receive it. That’s where a merchant account comes in.

A merchant account allows you to deposit funds directly into your bank account in as little as a few hours. Whether the customer swipes their card into your smartphone, calls it in over the phone or keys it into your web site, just having a merchant account can be a huge advantage over competitors.

It allows you to conduct transactions in more ways than cash or checks alone. Transactions are recorded automatically and can easily be reconciled for both customer and merchant. Most importantly it widens the opportunities to conduct sales to the widest customer audience possible.

No matter what you sell or how you sell it, the sale is only complete once the funds are transferred from one party to the other.

It’s important to recognize your missed opportunities. Could accepting electronic payments help increase your revenue stream? We’re here to help you make more money, let us show you the many ways we can do just that. Let’s talk, 888-996-CARD (2273)

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Mail Order Telephone Order, Mobile Payments, Travel Agency Agents Tagged with: credit cards, customer, debit cards, ebt cards, electronic checks, electronic payments, gift & loyalty cards, merchant account, payment, smartphone, transaction

November 22nd, 2016 by Elma Jane

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

In addition, you can enjoy from e-commerce payment gateways to retail and restaurant solutions, business-to-business processing capabilities to electronic invoicing (NTC ePay).

NTC is offering a cost-effective credit card payment processing services that are very fast, secure and easy to integrate.

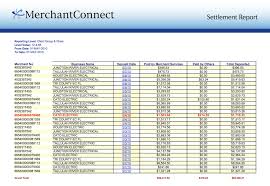

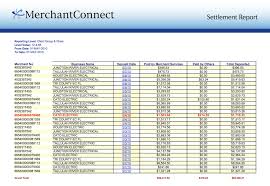

Get your Secure MerchantConnect Reporting Tool:

Get your Secure MerchantConnect Reporting Tool:

- Review and reconcile all of your transactions settle or batch settle and also much more.

- Create and save your custom reports that also can be imported or exported easily.

- Use our solution to turn any computer, laptop, smartphone or tablet into a processing center.

- Run & enjoy this on one or more devices to process credit card transactions with your merchant account.

- Peripherals allow swiping transactions and printing out receipts.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Receive up to $150,000 per location in less than 10 business days—sometimes in as few as 72 hours.

National Transaction Merchant Cash Advance eliminates many hassles and delays common with bank loans.

Our Merchant Cash Advance builds on the strength of your business’ future credit and debit card sales, so a damaged personal credit history is not an immediate disqualifier.

Posted in Best Practices for Merchants Tagged with: bank, cash advance, credit card, debit card, e-commerce, Electronic invoicing, electronic payment, gateways, loans, merchant account, payment, payment services, Security, smartphone, transactions

October 14th, 2016 by Elma Jane

Merchant Account is a LOAN!

Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for processors or payment providers; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Posted in Best Practices for Merchants, Financial Services, Travel Agency Agents Tagged with: bank, credit, credit card, customer, loan, merchant, merchant account, payment, payment providers, processors

September 30th, 2016 by Elma Jane

The Process of Underwriting!

Some of the key things that are reviewed in setting up electronic payments.

Getting a merchant account, is an important step for any businesses that sells services.

Merchants need to understand the following process:

Billing policy – Businesses that bill too far in advance are at greater risk for a chargeback. Knowing how does the business bill is important.

Example: A travel agency who sold travel destination packages six months in advance and cancel the trip.

Business type – Businesses at a higher risk are industries with vague products or services; which are more highly to be examined in detail than those with concrete offerings.

Chargeback history – A business with a lot of chargebacks tied to their old merchant account will have a hard time with underwriting. A chargeback can be issued by the cardholder; if the merchant does not fulfill the product or services being rendered as agreed.

Owner/signer credit score – Credit score plays a big role during merchant account underwriting. However, some processors will review financial statements instead in the case of poor credit. if the original signer’s credit score is insufficient, businesses with multiple partners can also try the application with a different signer.

Requested volumes – This are weighed against the processing volumes requested on the application. New businesses usually start with smaller volumes to build a trustworthy relationship before increasing their processing volumes.

Years in business – Long terms in business go a long way in merchant account underwriting; it speaks for their legitimacy and they are more prepared to respond to something like a chargeback and often have a more stable cash flow.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: cardholder, chargeback, credit, electronic payments, merchant account, processors, travel agency

August 19th, 2016 by Elma Jane

Merchant aggregator is an entity that can run many transactions through a single merchant account, an opposite to the traditional account since you’re the sole owner.

Preferred for a smaller business because its not intended as a long term scalable solution to accepting payments.

For businesses that want to expand their processing needs, traditional merchant account will outgrow an aggregator, since the goal is for a business to grow, but it will always come to what’s best for individual business.

While you have the pros of quick application process and instant approval there are a lot of cons to check before getting an aggregator account.

CONS of an aggregator account:

CUSTOMER SERVICE – aggregators are hard to get hold of.

FEES – fixed fees .

FREQUENT HOLDS and DELAY OF FUNDS – aggregators hold funds 24-48 hours before depositing, while longer holds occur 30 days.

LOWER LIMITS – processing limits lower, annual limit of $100k.

PROS of a Traditional Account:

CUSTOMER SERVICE – 24/7 technical support.

FUNDS – next day funding, no frequent account holds.

FEES – tailored to your business needs.

LIMITS – varies by financial strength and business

For more information in setting up an account with NTC give us a call at 888-996-2273 or go to www.nationaltransaction.com

Posted in Best Practices for Merchants, Merchant Services Account Tagged with: fees, funds, merchant account, Merchant aggregator, payments, transactions

July 21st, 2016 by Elma Jane

Always ask for the card security codes:

CVV2 for Visa

CVC2 for MasterCard

CID for Discover and American Express.

Always use the Address Verification Service (AVS) and only process sales after receiving a positive AVS response.

Avoid using voice authorizations, unless absolutely necessary.

Billing descriptor must set up properly and shows your phone number. Customer can contact you directly if there is an issue,

Consider using the associations’ 3-D secure services:

Verified By Visa

SecureCode by MasterCard

A 3-D transaction confirmation proves card ownership and protects you from certain types of chargeback. An additional layer of security for online credit and debit card transactions.

Inform your customers by email when a refund has been issued or a membership service cancelled. Notify them of the date the refund was processed and provide a reference number.

Make available customer support phone number and email address on your website so that customers can contact you directly. You need to meet this requirement before opening a merchant account.

Make it easy for your customers to discontinue a recurring plan, membership or subscription. Have a no-questions-asked policy.

Notify your customers by email of each transaction and indicate that their cards will be charged.

Obtain a confirmation of delivery for each shipment.

Process refunds as quickly as possible.

Secure an authorization approval for every transaction.

Secure customers’ written or electronic signatures, for recurring payments or monthly fees. Giving you express permission to charge their cards on a regular basis.

Terms and conditions must be clearly stated on your website. Customers must acknowledge acceptance by clicking on an Agree or a similar affirmative button.

Transaction amount must never exceed the authorized amount.

You are required to reauthorize the transaction before settling it if an authorization approval is more than seven days old.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Merchant Services Account Tagged with: card, chargeback, credit, customer, debit, merchant, merchant account, online, sales, Security, service, transaction