Archives for October, 2015

If you’re a merchant accepting credit cards, you’re probably aware that things are changing. As of October 1st, 2015, merchants

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: bank cards, chip cards, credit cards, data, EMV, financial institutions, magnetic stripes, merchant, mobile payment, PIN, POS terminal, processor, retail business, terminal slot

Small merchants don’t consider themselves at risk for a cyberattack. But Cybercriminals thrive on data about employees, customers, bank accounts

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: bank accounts, banks, chip card, credit card, data, EMV, magnetic strip, merchants, payment cards, payment systems, processors

With the EMV liability shift that takes effect in October 2015, how much you’ll be affected depends on how you

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Point of Sale Tagged with: banks, Card Not Present Transaction, card-present transactions, chip cards, cnp, credit card, debit cards, EMV, merchant, payment gateway, payments, POS, terminal

U.S. customers with the Ingenico iSC250 may now process EMV chip card transactions for Visa, MasterCard, American Express and Discover, (as

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa Tagged with: chip card, EMV, mag stripe

There are numbers of guidelines issued for accepting card payments, and merchants are expected to understand them all. To avoid

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security Tagged with: amex, card network, card payments, card-not-present, chargebacks, chip cards, credit card, credit card companies, Data Security Standard, EMV, EuroPay, MasterCard, merchants, MID, Payment Card Industry, PCI-DSS, POS system, U.S. banks, visa

It is difficult to believe that many businesses still do not accept credit or debit cards for payments, while most

Posted in Best Practices for Merchants Tagged with: (POS) systems, Android Pay, Apple, Chip and PIN, contactless payment, credit card, debit cards, EMV, Gift Cards, merchant, merchant account, merchant service provider, merchant services, NFC technologies, payments, point of sale

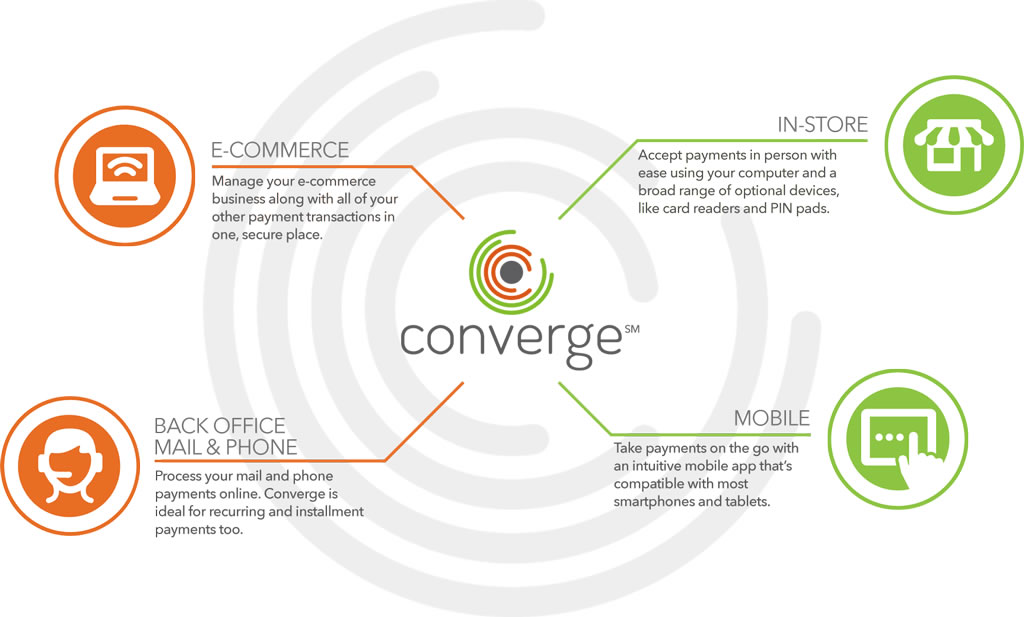

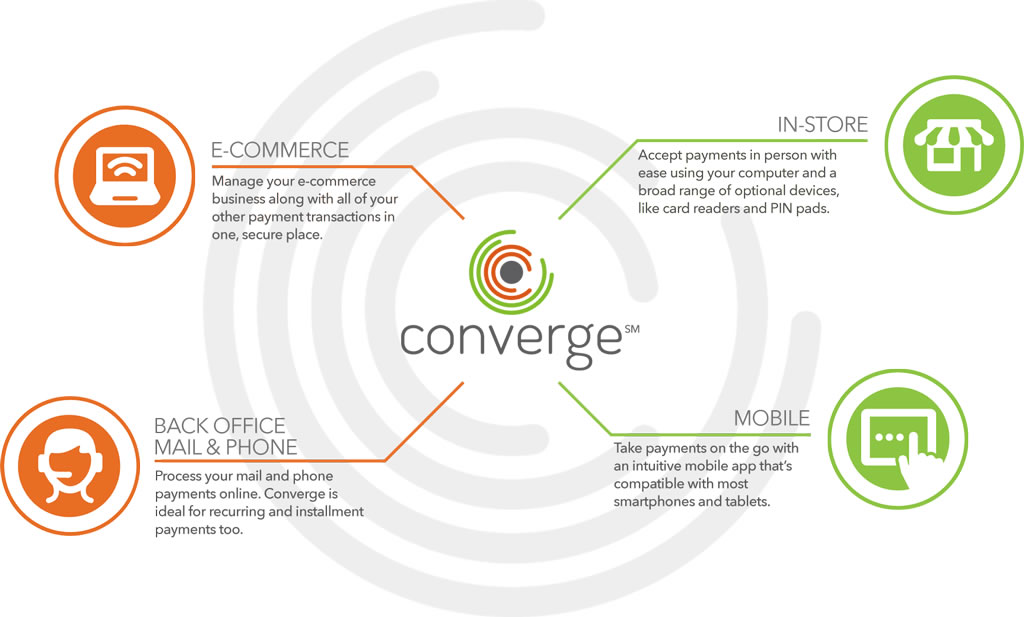

Setting up a merchant account. First find a Merchant Service Provider. Then setup your Business Profile. Put together your business

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: ach, Converge, credit card terminal, e-commerce, Electronic Check, merchant account, merchant service provider, NTC e-Pay, payments, Travel Company, virtual merchant

Credit card fraud is much more difficult to prevent in a card-not-present transaction. In a face-to-face setting the merchant can

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Payment Card Industry PCI Security, Travel Agency Agents Tagged with: American Express, card-not-present, card-security, cardholder, cnp, credit card, Discover, EMV, MasterCard, merchant, Payment Card Industry, payments, PCI, visa

In order to maintain some sort of order within PCI Compliance, VISA and MasterCard have created 4 risk levels that will

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce, Payment Card Industry PCI Security Tagged with: MasterCard, merchant, PCI Compliance, visa