Archives for September, 2016

The Process of Underwriting! Some of the key things that are reviewed in setting up electronic payments. Getting a merchant

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: cardholder, chargeback, credit, electronic payments, merchant account, processors, travel agency

MerchantConnect is a great tool for merchants because it contains all the information that a merchant needs to manage their

Posted in Best Practices for Merchants, Electronic Check Services, Electronic Payments Tagged with: bank, card, chargeback, electronic payment, merchants, payments, risk, terminal, transactions

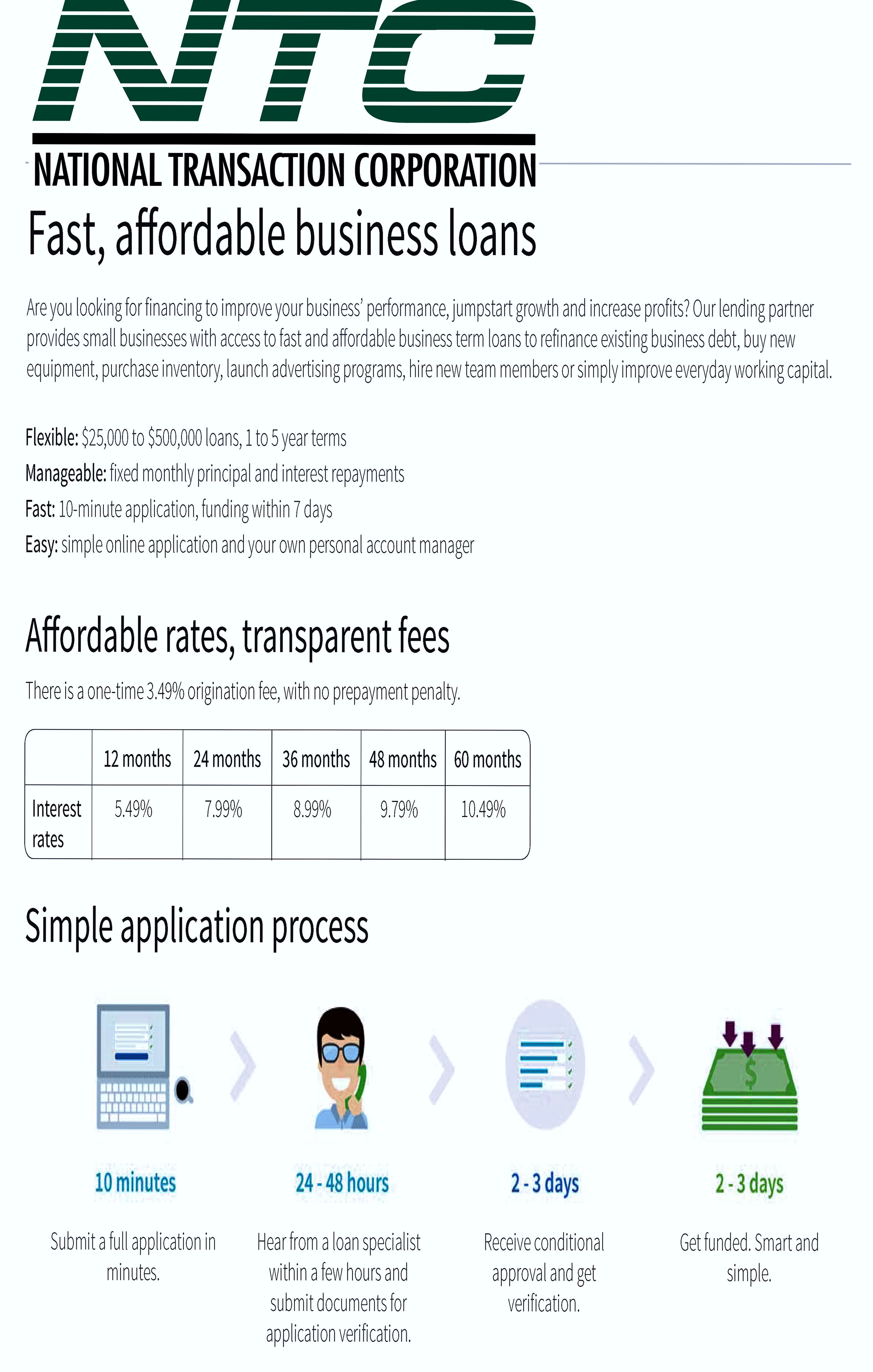

Business Lines of Credit – is for businesses with an inconsistent cash flow. Either businesses that needs to borrow a

Posted in Best Practices for Merchants, Merchant Cash Advance, Small Business Improvement Tagged with: cash advances, credit, financing, loans, merchant

What is ARC, IATA, and CLIA? what’s the difference? What it does and what type of agents would benefit most

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card holders, payments, travel, travel agencies, travel agent

PCI compliance applies to any company, organization or merchant of any size or transaction volume that either accepts, stores or

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security, Visa MasterCard American Express Tagged with: American Express, cardholder, compliance, credit, customer, data, debit card, Discover, jcb, MasterCard, merchant, Payment Card Industry, payments, PCI, transaction, visa

Avoiding Chargeback! Always ask for the card security codes: CVV2 for Visa CVC2 for MasterCard CID for Discover and

Posted in Best Practices for Merchants, Credit Card Security

Terminal or credit card machines are used for processing debit and credit card transactions. Therefore, are often integrated into a

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Near Field Communication, Visa MasterCard American Express Tagged with: chip, contactless, credit card, debit, EMV, mobile, nfc, PIN, point of sale, Security, terminal, transactions, visa

National Transaction offer valuable features and benefits, if you want to improve your business’s productivity, you should look for the following

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Breach, card data, card reader, chip card, contactless payments, data, EMV, encryption, merchants, mobile, mobile payment, nfc, payments, Payments provider, point of sale, provider, Security, service provider, smartphone, swipe, tablet, terminal, tokenization, transactions

Storing credit card data for recurring billing are discouraged. But many feels storing is necessary in order to facilitate

Posted in Best Practices for Merchants, Credit Card Security Tagged with: billing, cardholder, credit card, data, payment gateways, payments, PCI, recurring, token, tokenization

Ingenico RP457c card reader is now available at NTC for $75.00 plus encryption and shipping! NTC are pleased to announced

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Smartphone Tagged with: card data, card reader, Chip & PIN, chip and signature, contactless payments, customers, mobile wallets, payment, PIN pad, Security, signature debit, smartphone, transactions