Here are some of the Common Business Loan Fees:

Application Fee – is a fee charged to cover the costs of processing and assessing your loan application.

Bank Wire Fee – When borrowing a loan, lenders commonly wire the money to your bank account via ACH, because the banks need to talk to each other and ensure the money is going to the right place and that no fraud is going on.

Check Processing Fee – ACH transfers are commonly used to collect periodic repayments from the debtor’s bank account. Some lenders offer the option of paying by check, but you’ll have to pay a fee for the extra cost involved.

Closing Cost – not to be confused with closing fees, encapsulate all the fees charged for processing a loan, including origination/closing fees, processing fees, referral fees, and/or packaging fees.

Draw Fee – similar to an origination fee, but is applicable instead for lines of credit.

Guarantee Fee – is charged on all SBA loans above $150K. Guarantee fee is charged to protect against credit-related losses in the mortgage portfolio.

Late Payment Fee – Missing a payment deadline can result in a late fee. A late payment may have an affect on your personal or business credit score.

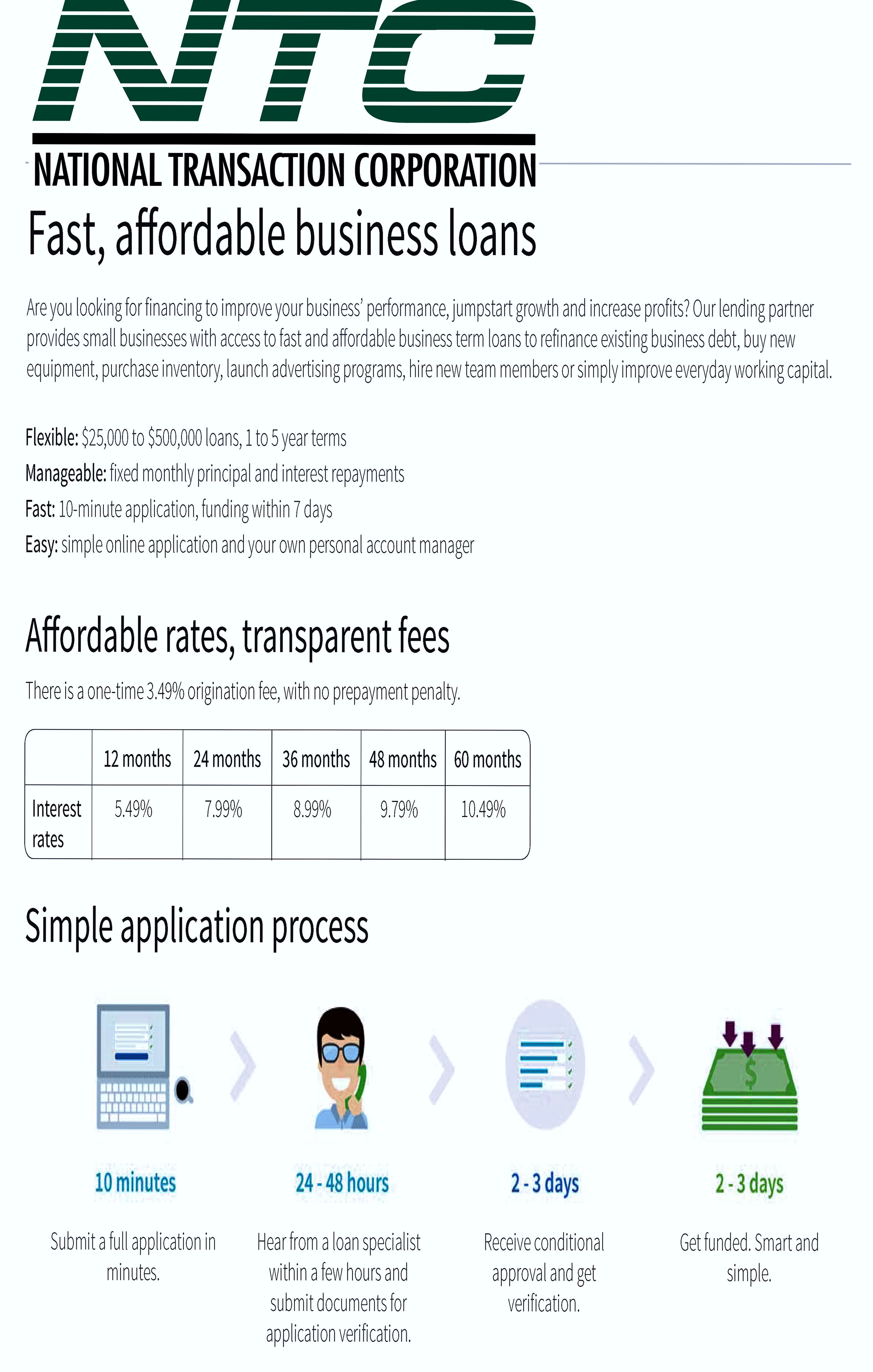

Origination Fee – an up-front fee charged for processing a new loan application. Prepayment

Penalty – Is a borrower, a bank or mortgage lender agreement that regulates what the borrower is allowed to pay off and when.

Servicing and Maintenance Cost – fees charged to cover the costs associated with collecting payments, maintaining records, following up on delinquencies and any other costs associated with maintaining a term loan or line of credit.

Business loans are available in different types, from merchant cash advances to lines of credit. The most effective way to get the best deal on a business loan is to be educated and know that Fees are Negotiable.