Category: Best Practices for Merchants

November 15th, 2016 by Elma Jane

SMART TERMINAL

Another all-in-one mobile (IP countertop and Wi-Fi capable) terminal that gives customers the functionality they want and need.

Sleek modern device that delivers an incredible customer experience, and is a great option for retailers, coffee shops, and pop-up shops.

Includes two touch screens: a larger one for easy visibility of orders and other information, as well as a cardholder facing one that can be used for payments and tipping. It also offers a dashboard function, so your customers can monitor their transactions and other reports remotely. On top of that, it comes with the powerful security of Safe-T built in.

For your EMV/NFC terminal needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Reader Terminal Tagged with: cardholder, customers, EMV/NFC, mobile, payments, Security, terminal, transactions

October 20th, 2016 by Elma Jane

Ways consumer can use NFC!

Near field communication technology (NFC) is on the rise, and as a result consumers can use NFC not just for making payments.

Top ways consumers can use NFC (Near field communications):

NFC Access Keys – can also be used as your access to certain buildings or hotels.

NFC Boarding Pass – are used in airports to expedite the boarding process. No more keeping track of that printed boarding pass!

File Sharing – on certain Android phones, consumers can also share songs, contacts and files from phone to phone with a simple tap.

Retail – Paying in stores simply requires a wave of the customer’s smartphone. This provides speedier transactions, but also provides merchants the opportunity to offer their customers loyalty points and rewards.

NFC Ticketing – speeds up subway boarding time by allowing consumers to use their phones also at the reader.

Vending Machines – NFC-enabled vending machines will allow customers to simply tap and go.

With the growing list of NFC technology uses, merchants should be prepared for the adoption. Upgrade your terminal to be NFC-enabled give us a call at 888-996-2273

Posted in Best Practices for Merchants, Near Field Communication Tagged with: customers, merchants, nfc, payments, terminal, transactions

October 14th, 2016 by Elma Jane

Merchant Account is a LOAN!

Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for processors or payment providers; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Posted in Best Practices for Merchants, Financial Services, Travel Agency Agents Tagged with: bank, credit, credit card, customer, loan, merchant, merchant account, payment, payment providers, processors

October 13th, 2016 by Elma Jane

Code 10 merchants first line of defense!

How to use “Code 10”

- Call the voice authorization phone number provided by your Merchant Provider. This number can be found on the sticker on your terminal or call your Merchant Service provider and ask to be transferred to the Voice Authorization department.

- Choose the prompt for “Code 10”. Never call a phone number for the card issuing bank provided by a customer; or let the customer call the card issuing bank for you to obtain an authorization code. Do not accept an authorization code given to you by a customer. Authorization code obtained from your Authorization Center can be verified; but not the one from other sources.

- Provide the cardholder name, billing address and shipping address, if the order is a mail order, phone or Internet sale. The representative will attempt to verify the information you provide with the bank that issued the card to the customer.

- The representative will attempt to verify the cardholder information during your call; the data will be forwarded to an investigator for further research and will attempt to contact you within 24 – 72 hours with the current status or results of the investigation.

- Request another form of payment other than a credit card if an authorization request is declined. Do not split a declined transaction into smaller increments to obtain an authorization.

- Obtain an authorization code for the full amount of the sale. Always obtain the authorization code before shipping the merchandise.

Whether you are in a face-to-face environment, or via mail, phone or Internet that sell goods and services you can employ a “Code 10” authorization to verify additional information on a suspicious transaction.

You may be prompted by your processing terminal to call for voice authorization of the charges (CALL AUTH), or you may simply not feel right about the transaction. In either case, you can use “Code 10” to gain additional information before you release your merchandise.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank, card, cardholder, customer, internet, merchant provider, merchants, service provider, terminal, transaction

October 11th, 2016 by Elma Jane

Cybersecurity via Converge:

Converge uses a multi-layered approach to security which helps keep cardholder data safe throughout the entire payment process; from beginning to end.

- EMV: All new Ingenico PIN pads and readers – iCMP and RP457c used with Converge Mobile offer EMV to help protect against counterfeit card use. The PIN pads go a step further in helping protect against lost; stolen and NRI (never received/issued) when a PIN-preferred card is accepted with PIN entry.

- Encryption: All new Ingenico devices also include encryption as a standard security component in addition to protect card data in transit.

- Tokenization: An enhanced security feature that is particularly valuable in card-not-present (CNP) environments when cards are stored on file for processing at a later time, or either for recurring/installment payments.

Get the Ingenico iCMP EMV PIN Pad for only $130.00.

For all payment applications, either Debit or Credit PIN Transaction. Work with both Apple and Android Devices.

Ingenico EMV RP457c card reader for only $75.00.

For Merchants that do not need PIN Pad. Works with hundreds of mobile devices.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Smartphone Tagged with: card, card-not-present, cardholder, data, EMV, mobile, payment, PIN pads, Security, tokenization

October 7th, 2016 by Elma Jane

NEXT DAY FUNDING

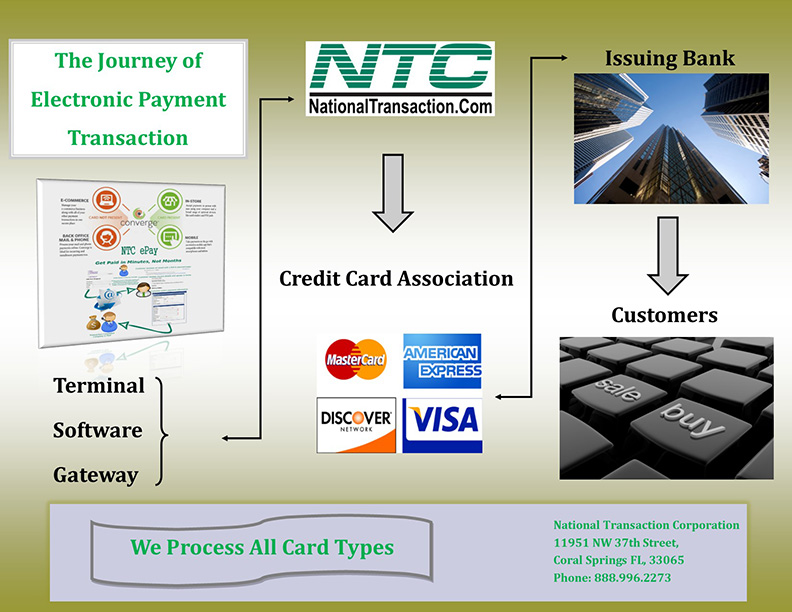

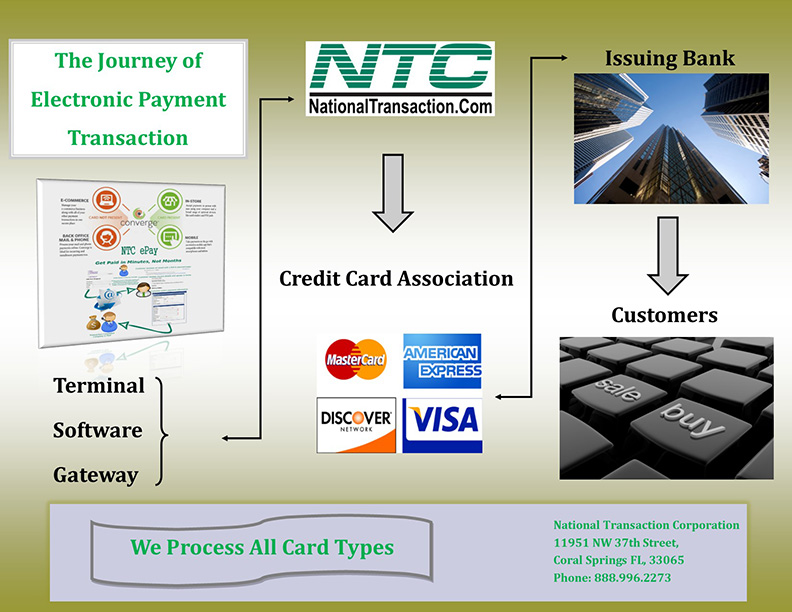

To be responsive to the needs of our merchants and to meet that needs, NTC offers next day funding in addition to the value added service for customers and businesses that need to have their funds available quickly.

National Transaction also offers a variety of electronic payment services and technology for businesses; with more than 15 years of experience.

Our services include:

- Currency Conversion

- Credit and debit card processing

- E-commerce and gateways

- Electronic checks

- Gift and loyalty card programs

- Mobile processing

- Cash advances and loans/funding program

- NTC e-Pay and MediPaid

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay!

Free Setup, nothing to Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. In addition, our e-Pay Platform can help Travel Merchants bring new customers while encouraging repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. Another payment platform that flexes with your business.

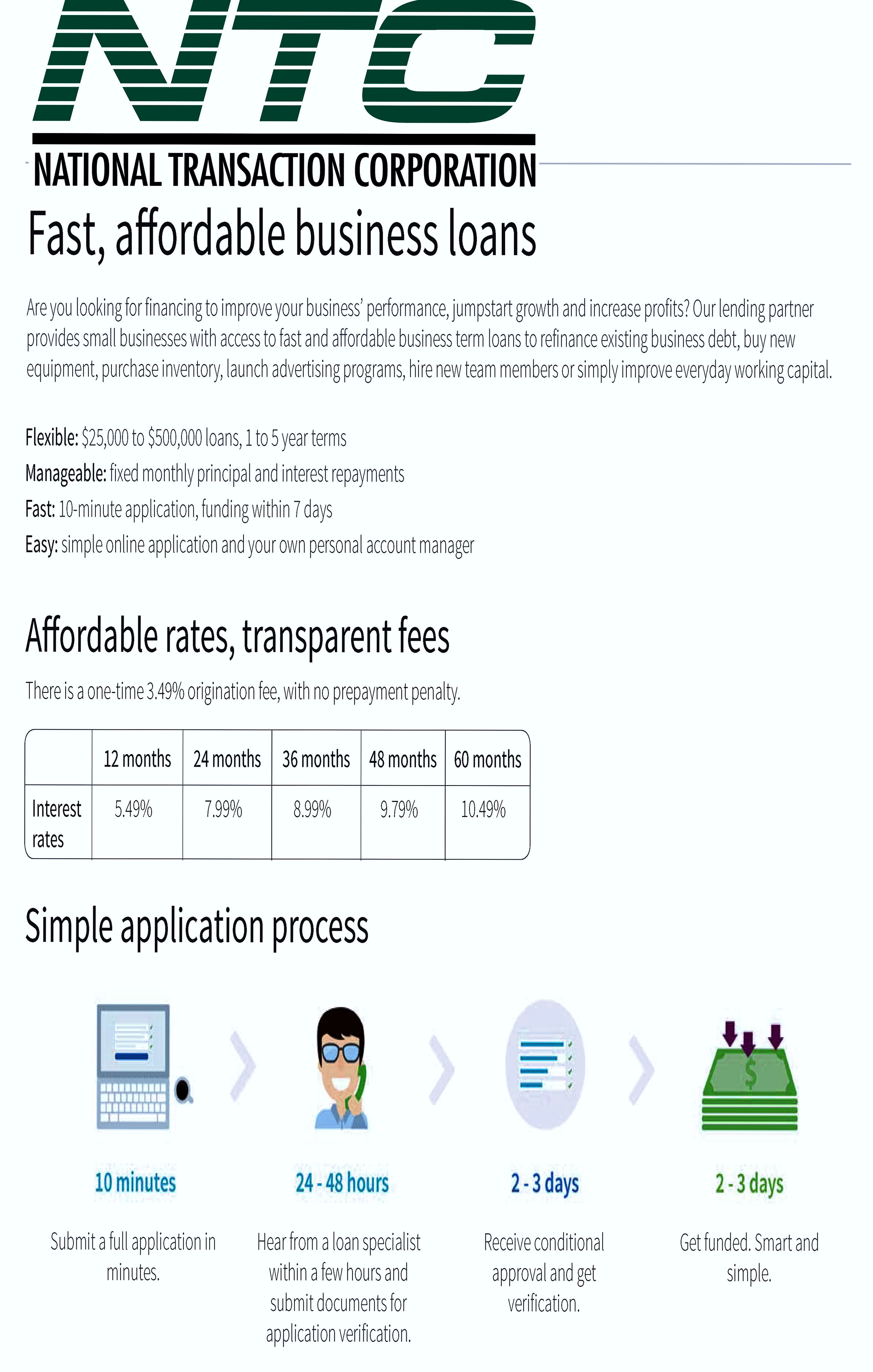

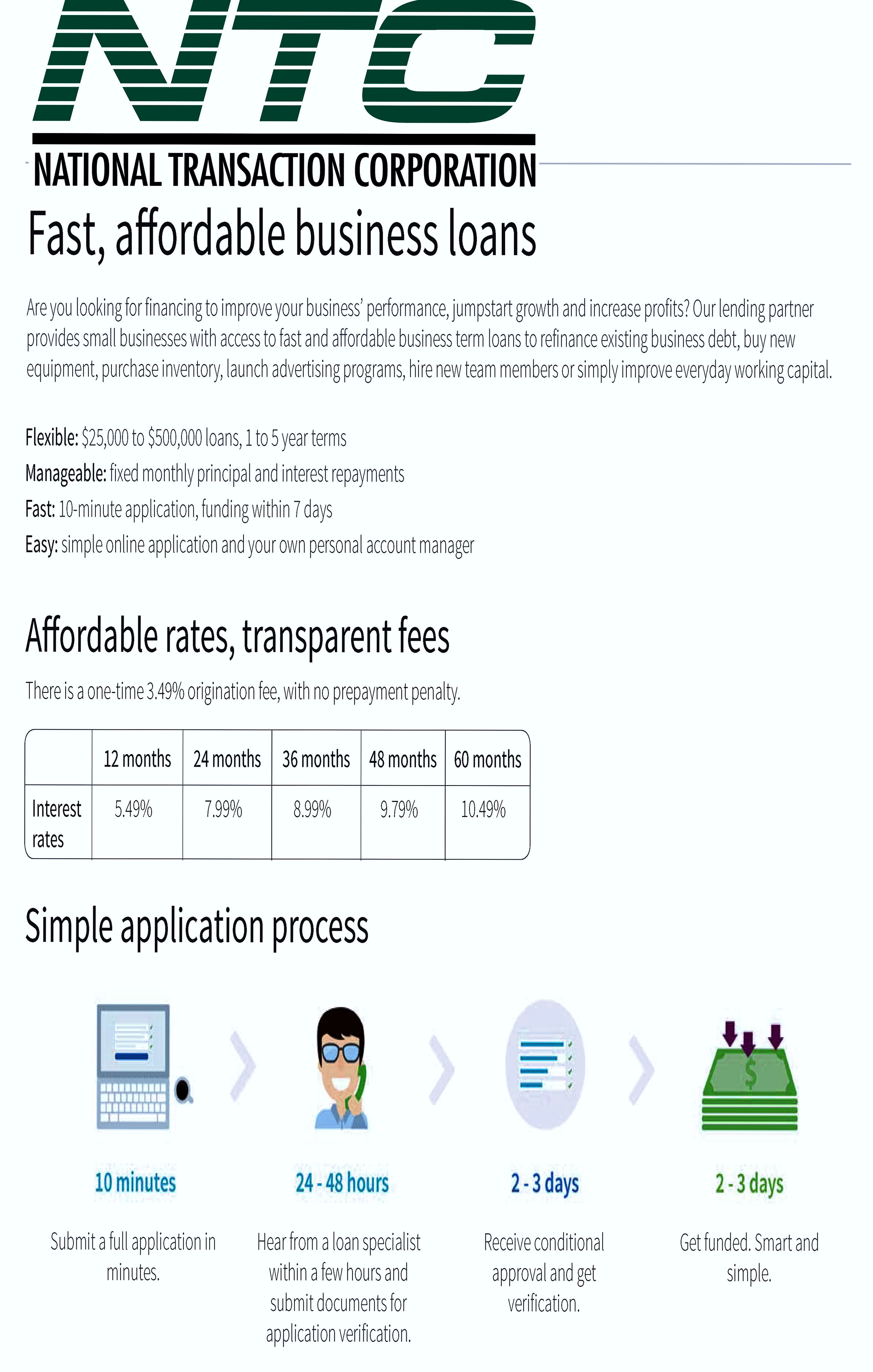

NTC Business Loans – Fast yet Affordable and most of all Simple Application Process.

MediPaid – another medical health insurance claims payment. Delivering paperless and next-day deposits for Health Insurance Payments.

Furthermore, NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants consequently providing 24/7 customer service and technical support!

To know more about our product and services call us now! 888-996-2273

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Internet Payment Gateway, Medical Healthcare, Mobile Payments Tagged with: credit, Currency Conversion, customers, debit card, e-commerce, E-Pay, electronic checks, electronic payment, funds, gateways, loans, Loyalty Card, merchants, payment services

October 6th, 2016 by Elma Jane

A personal guarantee is an agreement. The guarantors are responsible for repaying the loan with their personal assets; if a business is unable to finish repaying a loan.

This type of agreement is commonly required when you borrow capital from any bank; and also applies to many business credit cards. Traditionally, it is signed by anybody who at least owns 25% of the business.

Different Types of Agreements:

Some of them offer more protection for you and your business partners.

Unlimited Guarantee – is the only agreement available for a single-owner business, there’s a possibility that limitations are negotiable with your lender upon the agreement.

Limited Guarantee – the type of guarantee that are being used for businesses with multiple business partners are signing for a loan.

Two different types of limited guarantee:

Several Guarantee – means that you and your partner are responsible for a set percentage of the outstanding capital and legal fees. It is more desirable because each partner knows and agrees to how much they’ll be responsible for ahead of time.

Joint and Several Guarantee – This type of agreement could lead to problems between you and the other guarantors if something should go wrong because each guarantor is responsible for the full amount of the loan.

Read the fine print before signing a contract.

Posted in Best Practices for Merchants Tagged with: bank, credit cards, loan

September 30th, 2016 by Elma Jane

The Process of Underwriting!

Some of the key things that are reviewed in setting up electronic payments.

Getting a merchant account, is an important step for any businesses that sells services.

Merchants need to understand the following process:

Billing policy – Businesses that bill too far in advance are at greater risk for a chargeback. Knowing how does the business bill is important.

Example: A travel agency who sold travel destination packages six months in advance and cancel the trip.

Business type – Businesses at a higher risk are industries with vague products or services; which are more highly to be examined in detail than those with concrete offerings.

Chargeback history – A business with a lot of chargebacks tied to their old merchant account will have a hard time with underwriting. A chargeback can be issued by the cardholder; if the merchant does not fulfill the product or services being rendered as agreed.

Owner/signer credit score – Credit score plays a big role during merchant account underwriting. However, some processors will review financial statements instead in the case of poor credit. if the original signer’s credit score is insufficient, businesses with multiple partners can also try the application with a different signer.

Requested volumes – This are weighed against the processing volumes requested on the application. New businesses usually start with smaller volumes to build a trustworthy relationship before increasing their processing volumes.

Years in business – Long terms in business go a long way in merchant account underwriting; it speaks for their legitimacy and they are more prepared to respond to something like a chargeback and often have a more stable cash flow.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: cardholder, chargeback, credit, electronic payments, merchant account, processors, travel agency

September 29th, 2016 by Elma Jane

MerchantConnect is a great tool for merchants because it contains all the information that a merchant needs to manage their electronic payment activity. Furthermore, it’s fast, easy and secure!

- Merchant can either view or update account information and make changes.

- Find copies of statements.

- Furthermore find valuable products and services to help merchant with their business.

View recent deposits and other information about account activity including:

- Batch Details

- Chargeback

- Retrieval Status

- Deposit History

The merchant can also find news and information to help manage payments at your business. Learn how to:

- Best Qualify Transactions

- Reduce Risk

- Manage Chargebacks

- Find reference guides to help operate your payment terminal

The merchant can also utilize the BIN Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information.

If you need a to set-up an account and want to use this tool give us a call at 888-996-2273

Posted in Best Practices for Merchants, Electronic Check Services, Electronic Payments Tagged with: bank, card, chargeback, electronic payment, merchants, payments, risk, terminal, transactions

September 28th, 2016 by Elma Jane

Business Lines of Credit – is for businesses with an inconsistent cash flow. Either businesses that needs to borrow a small amount of capital, and businesses that use invoices.

Different types of lines of credit:

Cash Account, the most basic line of credit – which you can access when you’re in need of capital; whether you’re making a large purchase or covering a temporary gap in cash flow. You only have to pay the interest on the amount that you borrow; with this form of financing, the money is always available when it’s needed.

Inventory Line of Credit – specifically intended for purchasing inventory.

This kind of loans give the merchant, two advantages:

- First of all, you can purchase inventory wholesale.

- Second, purchasing inventory won’t take a large amount out of your cash flow because you’ll be paying in increments instead of one lump sum.

Invoice Financing – basically, this is a line of credit where invoices are the collateral.

Personal Loans Used for Business: Startups and young businesses, merchants who have excellent personal credit. Furthermore, personal loans are term loans that can be used for a number of purposes.

If your business is new to qualify for a business loan, consider using a personal loan.

Short Term Financing: Is for young businesses experiencing rapid growth.

Short term financing covers merchant cash advances and short term loans.

Term Loans: Is for Businesses that need cash to fund one-time expenses like equipment purchase/real estate or expanding a business. Term loans are basic, everyday loans. The merchant receives the capital in one lump sum and repayments are almost always monthly.

For more information about Loans/Financing call us at 888-996-2273

Posted in Best Practices for Merchants, Merchant Cash Advance, Small Business Improvement Tagged with: cash advances, credit, financing, loans, merchant