Category: Best Practices for Merchants

June 30th, 2016 by Elma Jane

Let’s face it, it’s hard to build a customer email list if you continue getting declined. There’s a way for a customer to say YES!

Get Exclusive – let your customers know that you treat your email list to exclusive offers and information. Offering a special email customer only discount code or exclusive benefits to members on your email list.

Make it Creative – whether you’re collecting emails online or at the checkout counter, make it creative. Getting creative with how you sell your email program will help you get more YES at the point of subscription.

Offer Value – Give your customers something in return for their email address. Make your customers feel like they are receiving something rather than just giving out their personal information. Identifying what piques your customer’s attention and offering that as an added value to their email subscription, your customers will see value in giving out their information when they receive something in return.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: customer, online

June 28th, 2016 by Elma Jane

Financial Cost – on average, it costs a small business between $36,0000 and $50,000 in the event of a data breach. From PCI examination to liability costs and POS upgrades. The many costs of a data breach add up.

Notification Cost – if your business falls victim to a data breach, it is your moral and sometimes legal (depending on the state in which your business operates) obligation to notify your customers of the breach.

Reputation Cost – data breach lessens your credibility and trust with your customers. This can have a long-term affect on your business.

Time Cost – as a small business owner, your focus is on the daily operations of your business. In the event of a data breach, your focus will be shifted entirely to clearing up the issue.

The cost of a data breach is more than financial and can often have a lasting negative impact on your business.

The quickest and easiest way to protect your business is to prevent fraud from happening. At National Transaction, we give importance to your security. For your electronic payments needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: customers, data breach, electronic payments, financial, fraud, PCI, POS, Security

June 22nd, 2016 by Elma Jane

What is ARC, IATA, and CLIA? what’s the difference? What it does and what type of agents would benefit most from it.

CLIA Number – is issued by the Cruise Lines International Association. It’s a way for vendors to identify you as a travel agent. It serves the same purpose as the ARC or IATA number, it’s just issued by another organization and has different barriers to entry and costs associated with it. CLIA agencies without ARC accreditation cannot issue airline tickets since CLIA numbers were designed specifically for cruise-focused travel agencies. You can always go under an umbrella organization like a host agency, you don’t need to get your own CLIA number if you’re working with a host agency. You can use their identification number and won’t incur the costs associated with obtaining your own CLIA number. While CLIA is accepted nearly everywhere, it’s NOT accepted by the airlines. If you are not issuing airline tickets, CLIA is a practical option.

CLIA vs. ARC/IATA Number – If you’re ticketing air-only reservation, ARC and IATA are must-haves.

ARC (Airlines Reporting Corporation) – gives out these ARC numbers to accredited agencies, which allows travel agencies to issue airline tickets. The use of an ARC number extends from a hotel to a cruise ship booking not only air tickets for travel agencies. For a home-based travel agent or a storefront agency that only books leisure travel (no air), having your own ARC number is too much.

IATA – International Air Transport Association Network (IATAN) use extensive data resource to connect the suppliers to the U.S. travel distribution network. IATAN ID card holders get promotional benefits and concessionary incentives from suppliers (participating members) who identify the agent with an IATA/IATAN number as a valid associate, in addition to approving travel agents for the sale of travel tickets. IATA certifies a referral agent or an affiliate travel agent to find clients for the hosting travel agency’s business needs as well.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: agents, card, data, host agency, travel agent, vendors

June 21st, 2016 by Elma Jane

The Ingenico iPP320 PIN pad (Item Code: 320CV) is officially launched for Converge, making this the third EMV and NFC-enabled device available to our merchants. The iPP320 accepts mag stripe, chip cards, manual card entry and contactless payments, including Apple Pay.

Don’t Forget!

- Customers can hand-key card information into all of the new Converge PIN pads to encrypt payment information at the point of entry, including card-not-present payment environments. Encryption is a standard feature with all new PIN pads.

- In the February release, gratuity support was launched on devices, which means the consumer will be prompted to add a tip to the payment amount using the PIN pad, versus the business entering an amount into Converge.

For terminal upgrade give us a call at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: card-not-present, chip cards, contactless payments, customers, EMV, merchants, nfc, payment

June 20th, 2016 by Elma Jane

Batch – is a collection of credit card transactions, usually a single day’s worth.

Batch Processing – refers to a one-time closing or settling the entire batch of transactions.

The point-of-sale terminal or credit card processing software can be set on:

Manual Batch close – merchant will need to batch out at the end of each day. The processor will receive a command to settle all transactions that have been entered. There will be a printed report showing the transaction totals in the batch once a batch is settled.

Changes can be made to existing transactions in the batch before a batch is settled. Example: If you want to change an amount of one of the transactions or you want to void a transaction.

Automatic Batch close – The terminal or software will automatically close the batch, (settle the transactions) at a certain time each day, no manual intervention is needed by the merchant or in some case the processor will settle the batch (called host batch close at the processor level). Automatic batch close set-up is advisable for most businesses unless a tip edit function is required, manual batch close would be the better option.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, point of sale, processor, terminal, transactions

June 16th, 2016 by Elma Jane

Merchants and cardholders have been challenged by the perceived additional time to complete the EMV transaction.

To address concern over EMV checkout time Visa and MasterCard create an alternate EMV payment process that will improve the speed of transaction:

Quick Chip from Visa is available free-of-charge to acquiring banks, payment networks, and other payment processors to offer to merchants. The enhancement requires only a simple software update to the merchant’s card terminal or point-of-sale system.

M/Chip Fast from MasterCard merchants can easily integrate this with their current systems to provide both speed and security for all chip cards. Designed for select environments where fast transaction times, in addition to security, are at a premium.

The new card network options do not require the financial institution to reissue cards, or the merchants to re-certify their point-of-sale terminals.

Alignment in the payments industry and the ability to process a secure transaction in a timely manner for the consumer experience is important.

Keeping current on the payment industry news like Quick Chip and M/Chip Fast or discussion about EMV developments is a smart move for merchants and cardholder as well.

Posted in Best Practices for Merchants, Credit card Processing, EMV EuroPay MasterCard Visa Tagged with: banks, card, card network, cardholders, chip cards, EMV, financial institution, merchants, payment, payment networks, payment processors, payments industry, point of sale, Security, terminal, transaction

June 14th, 2016 by Elma Jane

Getting a merchant account is an important step for any business that sells services. Helping merchant to understand the underwriting process and some of the key things that are reviewed, in order to get approved.

Billing policy – Does the business bill in advance or after products or services are rendered? Businesses that bill too far in advance are at greater risk for a chargeback.

Example: A travel agency who sold travel destination packages six months in advance and cancel the trip, you’ll need to reimburse your customers.

Business type – Some business types are riskier. Industries with vague products or services are more highly to be examined in detail than those with concrete offerings.

Chargeback history – A business with a lot of chargebacks tied to their old merchant account will have a hard time with underwriting. A chargeback might be issued by the cardholder when they feel that the merchant does not fulfil the product or service being rendered as agreed.

Owner / signer credit score – Credit score plays a big role during merchant account underwriting. However, some processors will review financial statements instead in the case of poor credit. if the original signer’s credit score is insufficient, businesses with multiple partners can also try the application with a different signer.

Requested volumes – Are weighed against the processing volumes requested on the application. New businesses usually start with smaller volumes to build a trustworthy relationship before increasing their processing volumes.

Years in business – Long terms in business go a long way in merchant account underwriting, it speaks for their legitimacy. They are more prepared to respond to something like a chargeback and often have a more stable cash flow.

Posted in Best Practices for Merchants Tagged with: business, cardholder, chargeback, customers, financial, Industries, merchant account, products, services, travel, travel agency

June 13th, 2016 by Elma Jane

Lines of Credit – is for Businesses with an inconsistent cash flow, businesses that only need to borrow a small amount of capital, businesses that use invoices.

Different types of lines of credit:

Cash Account the most basic line of credit – which you can access when you’re in need of capital, whether to make a large purchase or cover a temporary gap in cash flow. This form of financing is that the money is always available when it’s needed, and you only have to pay interest on the amount that you borrow.

Inventory Line of Credit – specifically intended for purchasing inventory.

This kind of loans give the merchant, two advantages:

First, you can purchase inventory wholesale.

Second, purchasing inventory won’t take a large amount out of your cash flow because you’ll be paying in increments instead of one lump sum.

Invoice Financing – basically, this is a line of credit where invoices are the collateral.

Personal Loans Used for Business: Startups and young businesses, merchants who have excellent personal credit.

If your business is new to qualify for a business loan, consider using a personal loan. Personal loans are term loans that can be used for a number of purposes.

Short Term Financing: Is for young businesses experiencing rapid growth.

Short term financing covers merchant cash advances and short term loans.

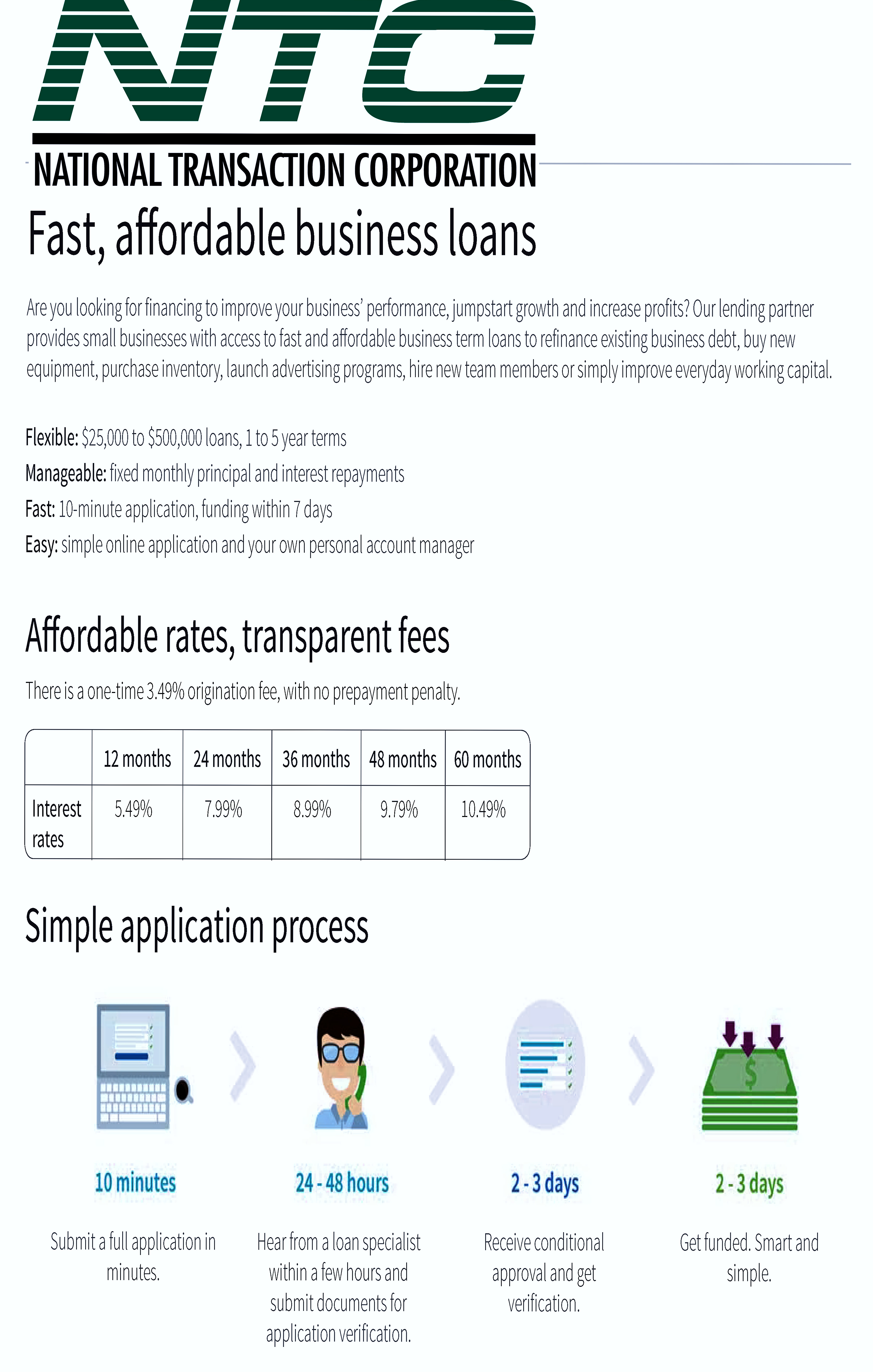

Term Loans: Is for Businesses that need cash to fund one-time expenses like equipment purchase/real estate or expanding a business. Term loans are basic, everyday loans. The merchant receives the capital in one lump sum and repayments are almost always monthly.

For more information about Loans/Financing give us a call at 888-996-2273

Posted in Best Practices for Merchants, Merchant Cash Advance Tagged with: cash advances, credit, financing, loans, merchant

June 8th, 2016 by Elma Jane

Near field communication technology (NFC) is on the rise, and consumers can use NFC not just for making payments.

Top ways consumers can use NFC (Near field communications):

NFC Access Keys – can also be used as your access to certain buildings or hotels.

NFC Boarding Pass – are used in airports to expedite the boarding process. No more keeping track of that printed boarding pass!

File Sharing – on certain Android phones, consumers can share songs, contacts and files from phone to phone with a simple tap.

Retail – Paying in stores simply requires a wave of the customer’s smartphone. This provides speedier transactions, but also provides merchants the opportunity to offer their customers loyalty points and rewards.

NFC Ticketing – speeds up subway boarding time by allowing consumers to use their phones at the reader.

Vending Machines – NFC-enabled vending machines will allow customers to simply tap and go.

With the growing list of NFC technology uses, merchants should be prepared for the adoption. Upgrade your terminal to be NFC-enabled give us a call at 888-996-2273

Posted in Best Practices for Merchants, Near Field Communication Tagged with: consumers, customer’s smartphone, merchants, Near Field Communication, nfc, payments, retail, rewards, technology, terminal, transactions

June 7th, 2016 by Elma Jane

Merchants need to stay competitive by offering the most modern forms of electronic payment processing technology to satisfy customers, because, in today’s world of smartphones and one-the-go payments, consumers have options in how they conduct their transactions. With proper education on the types of payment options, merchants can make the right decision for their business.

NTC is here to discuss that payment options.

EMV – or Europay, MasterCard, Visa is a fraud-reducing technology to protect card issuers, merchants, and consumers from counterfeit or stolen cards. The customer inserts or dips the chip card into the EMV terminal, rather than swiping the card at the point of sale. A one-time-use code is created for that transaction. This code makes it virtually impossible for anyone to duplicate, leaving customers safer from fraud.

NFC – stands for near field communication is a method of contactless data exchange between two electronic devices. NFC is used in mobile wallets such as Apple Pay, Android Pay, and Samsung Pay. More and more consumers leaning towards mobile wallets, merchants should be prepared to accept NFC payments by incorporating NFC-enabled equipment.

Virtual Merchant Mobile Payments – Mobile Payments are popular, you can take payments anywhere. Ideal for retail, restaurant and service businesses of any size. Accept payments your way online, in-store and on the go. Anytime and anywhere.

Offers flexibility you want with the payment security you and your customer need:

- Accept credit and debit cards, including mag stripe, chip cards, and contactless payments/NFC, like Apple Pay and other mobile wallets.

- Calculate discounts, taxes, and tips automatically.

- Email customer receipts.

- Help protect cardholder data with an encrypted, chip card device.

- Record cash transactions.

- Use your own smartphone or tablet (works with most IOS and Android mobile devices).

Check out NTC’s electronic payment solutions that are EMV-capable, NFC-enabled and mobile wallet ready.

Posted in Best Practices for Merchants, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: chip card, consumers, contactless payments, customers, data, debit cards, electronic payment, EMV, fraud, merchants, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, point of sale, Security, Smartphones, terminal, transactions