Category: Best Practices for Merchants

May 9th, 2016 by Elma Jane

Double refunds are when a customer is provided with two refunds for the same transaction. Chargebacks can be involved in a double refund.

Double Refunds Happen When:

Chargebacks are filed after a refund is issued. The consumer contacts the merchant and requests a refund, but the funds aren’t returned immediately. The consumer thinks the request for the refund was ignored and files a chargeback. Then both the chargeback and the refund are being processed.

Chargebacks are filed before a refund is issued. The consumer calls the bank and initiates a chargeback. Then, the consumer calls the merchant and expresses dissatisfaction. To try to avoid a chargeback, the merchant provides a refund. However, the merchant has no idea of the fact that a chargeback has already been filed because the consumer calls the bank first

Even thou a merchant provided a refund with a customer that doesn’t guarantee that a chargeback won’t be initiated. Same thing with chargeback that has been filed doesn’t guarantee that customer won’t contact the merchant and demand a refund as well.

Just because a merchant provided a customer with a refund that doesn’t guarantee that a chargeback won’t be initiated. Same thing with chargeback that has been filed doesn’t guarantee that customer won’t contact the merchant and demand a refund as well.

It is possible for the customer to receive a double refund for the one purchase transaction.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargebacks, consumer, customer, merchant, refunds, transaction

May 6th, 2016 by Elma Jane

A data breach is any instance in which secure data information has been released or stolen intentionally or unintentionally. The organization that exposed or lost your information will notify you. The steps you should take depend on the type of information that was lost or stolen. In general, you may choose to do one or more of the following:

- Monitor all bank and other accounts for suspicious activity.

- Change all passwords, PINs, or user names associated with compromised accounts.

- Order a copy of your credit report.

- Place a fraud alert or credit freeze on your credit file.

Posted in Best Practices for Merchants, Credit Card Security, Travel Agency Agents Tagged with: accounts, bank, credit, data, data breach, fraud

May 5th, 2016 by Elma Jane

Businesses or merchants accepting payments online needs an up-to-date and active security software that includes:

- FIREWALL PROTECTION – a software program that helps to screen out malware and hackers that try to reach you through the internet.

- ANTI-VIRUS PROGRAMS – Not all anti-virus program offers protection against all kinds of malware. Viruses are one type of malware. Spyware is another type of malware that can steal credit card information or your bank account.

Update:

- Keeping your operating systems, security software programs, and browser current can help secure your data information.

- Evaluate browser’s privacy settings, limit or disable cookies. Other cookies can be used maliciously and collect data information.

- Back up your data regularly. If your computer or device got compromised, you still have access to important files.

Need to set up an account give us a call at 888-996-2273

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank account, credit card, data, merchants, online, payments, Security

May 5th, 2016 by Elma Jane

- A terminal lease carries with it a 48-month lease agreement.

- The cost of that lease can run anywhere from $50-$100/month.

That is a LONG time to be paying for a terminal equipment that doesn’t cost more than $400 these days.

- If a merchant pays upfront the cost of the purchase is completely tax deductible, you don’t need to pay $2400 for a terminal equipment that costs $400.

If you can’t pay cash for your credit card terminal, you can just charge it to a business credit card. The interest paid is still tax deductible. That’s a savings of nearly $2,000 that can be better directed toward developing and expanding your business.

Need to set up account give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, terminal

May 4th, 2016 by Elma Jane

Credit Card Terminal for…..

Some processors offer a free terminal to their merchants, but as we all know, there ain’t no such thing as a free lunch! A free terminal carries with it a yearly Terminal Replacement or Warranty charge of $50 to $100/year. That’s still much less than what a lease would cost you, but it’s not really FREE

If you’re not currently in a lease but are considering one, don’t be deceived. Instead, calculate the total cost of leasing vs. owning. The best and most affordable option still lies in ownership.

If you need to set up an account give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchants, processors, terminal

May 4th, 2016 by Elma Jane

Some processors specialize in leasing terminals, but equipment lease locks up merchants and ends up costing you more, whereas you could get that same machine in a matter of months and get more than one.

If you lease a terminal you may also be required to purchase equipment insurance, another added cost. And, have the equipment return at the end of your lease. If a merchant owns an existing equipment, it can be reprogrammed at NO CHARGE and the merchant can continue to use it.

For account set-up, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: merchants, processors, terminals

May 3rd, 2016 by Elma Jane

MerchantConnet is a great tool for merchants, it contains all the information that a merchant needs to manage their electronic payment activity. It’s fast, easy and secure!

- Merchant can view or update account information and make changes.

- Find copies of statements.

- Find valuable products and services to help merchant with their business.

View recent deposits and other information about account activity including:

- Batch Details

- Chargeback

- Retrieval Status

- Deposit History.

The merchant can also find news and information to help manage payments at your business. Learn how to:

- Best Qualify Transactions

- Reduce Risk

- Manage Chargebacks

- Find reference guides to help operate your payment terminal.

The merchant can also utilize the BIN Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information.

If you need a to set-up an account and want to use this tool give us a call at 888-996-2273

Posted in Best Practices for Merchants Tagged with: bank, card, chargeback, merchants, payment, terminal, transactions

May 2nd, 2016 by Elma Jane

The American Society of Travel Advisors has launched an online course for those interested in learning the ropes of becoming a travel agent.

The course is about the travel industry in general and giving tips on how to launch a career as a travel adviser.

The tutorial is designed for those who are entrepreneurial skills, have great social interaction and always wanted to play a key role in this exciting yet complex industry.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: travel, travel agents, travel industry

April 29th, 2016 by Elma Jane

The credit card industry in the U.S. underwent a liability shift October 1st of 2015. The one major exception to the October 2015 liability shift has been automated fuel dispensers. Automated payment terminals at the pumps were given until October of 2017, to comply with the new standard.

Upgrading a gas pump payment terminal is more expensive than what other retailers face upgrading a typical credit card reader.

• First, the cost of replacing the payment terminal itself.

• After replacing gas station’s payment terminal, it also needs to re-certify the entire pump, which costs additional time and money.

• Gas pumps also have to be certified by state officials, to make sure that they are dispensing and charging correctly.

Consumers need to be vigilant while gas stations are getting a break, the card might be exposed to counterfeit credit card fraud, because whenever the card is swiped the traditional way using the mag-stripe, that EMV chip is not doing anything.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa Tagged with: card reader, chip, consumers, credit card, EMV, fraud, payment, terminals

April 28th, 2016 by Elma Jane

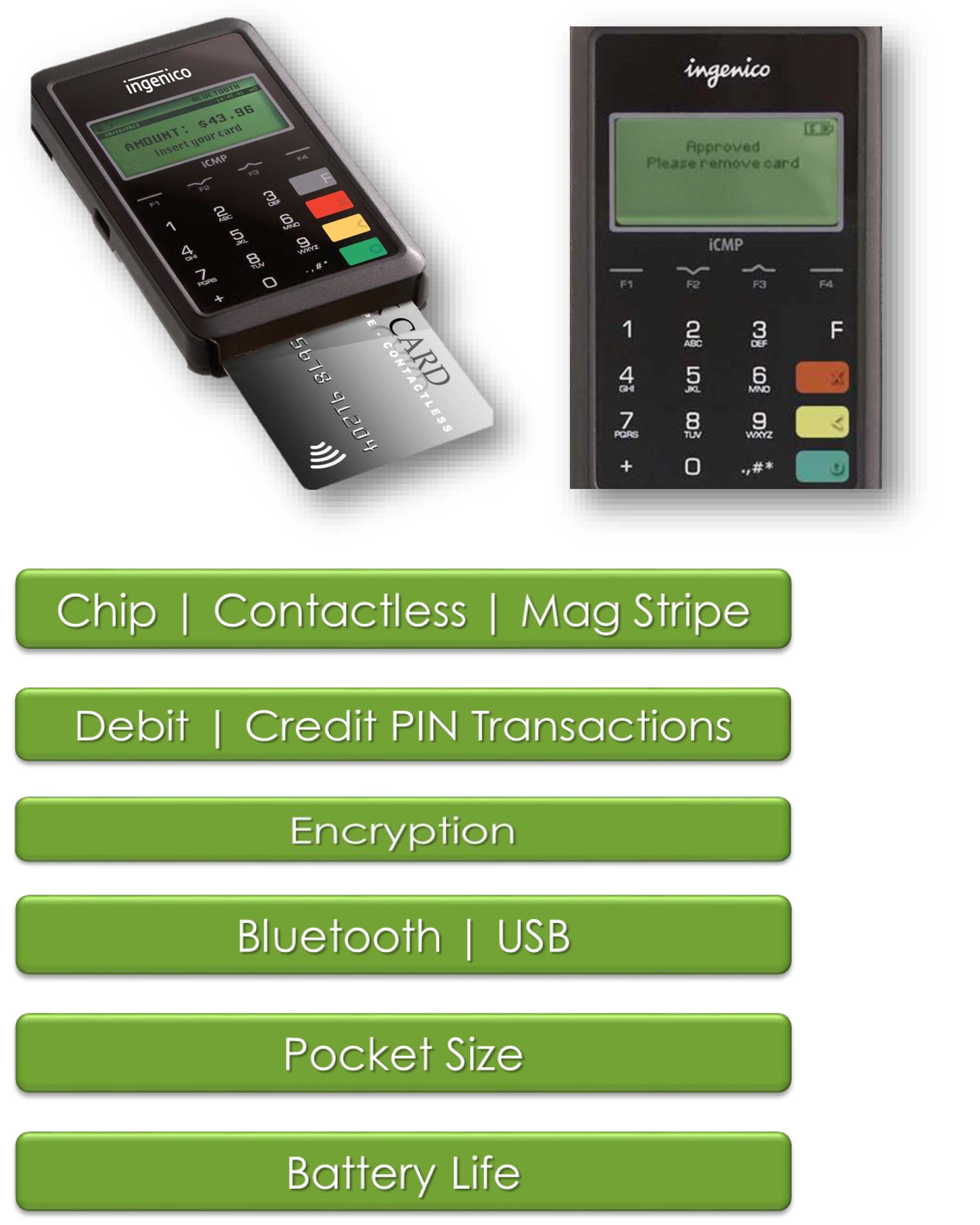

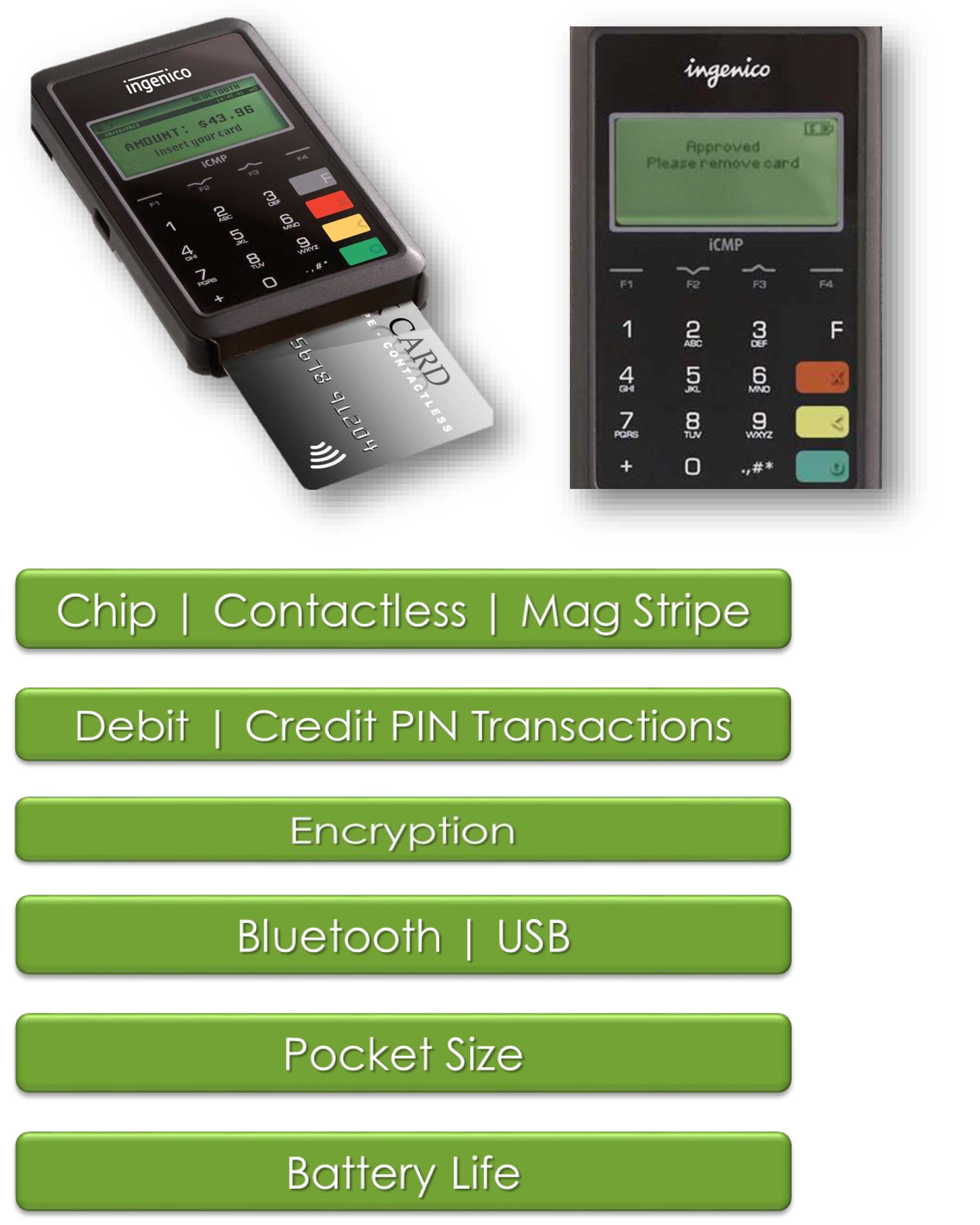

You can offer your customers preferred payment method with the next generation point-of-sales terminals, an all-in-one credit card processing experience: which not only support Near Field Communication (NFC) contactless payment transactions such as Apple Pay but chip cards and the traditional magnetic stripe cards; and manual entry transactions as well.

Contactless payment transactions are happening now. NTC are here to help.

Posted in Best Practices for Merchants Tagged with: chip cards, contactless payment, credit card processing, customers, magnetic stripe cards, Near Field Communication, nfc, payment, point-of-sales, terminals, transactions