Category: Best Practices for Merchants

April 28th, 2016 by Elma Jane

You may now give your customers the option to pay with PayPal in person. There is nothing you or they need to do – merchant card processing accounts with NTC have been automatically updated to accept PayPal in-person payments in addition to the other payment options currently offered.

How PayPal transactions work

When businesses accept a PayPal in-person payment, it could be processed in a number of ways. This will be reflected on the monthly processing statement and customer receipts, and the businesses you serve will receive the same pricing they currently do for payments over these networks:

- PayPal mobile payments will be processed as Discover transactions and are subject to Discover operating regulations.

- PayPal-branded card payments will be processed over the payment network designated on the card and are subject to operating regulations designated by the network on the card.

Posted in Best Practices for Merchants, Credit card Processing Tagged with: card, card payments, card processing, customer, merchant, Mobile Payments, payment network, payments, transactions

April 27th, 2016 by Elma Jane

EMV Cards (Europay, MasterCard, and Visa) are smart cards (chip cards or IC cards) which store their data on integrated circuits rather than magnetic stripes. They can be contact cards that must be physically inserted or dipped into a card reader. Payment cards that comply with the EMV standard are often called chip-and-PIN or chip-and-signature cards, depending on the authentication methods required.

Posted in Best Practices for Merchants Tagged with: card reader, cards, chip cards, data, EMV, payment

April 27th, 2016 by Elma Jane

Near field communication is a contactless communication protocol between devices like (smartphones, tablets, smartwatches or even credit cards themselves) with a nearby NFC-enabled terminal by simply authorizing your device with a passcode or fingerprint authentication.

Both merchants and customers benefit from near field communication technology, by integrating credit cards, train tickets, and coupons all into one device. Faster payment transaction times and fewer physical cards to carry around.

If your smartphone has an integrated NFC chip, you can use a mobile wallet app like Apple Pay, Android Pay and Samsung Pay for items at retailers that support NFC transactions. Just load up your credit cards on your mobile device and wave or tap your device near an NFC compatible terminal to pay, no card swiping required.

As the technology keeps growing, more NFC compatible smartphones will be available and more businesses will offer NFC card readers for customer’s convenience.

Apple Pay, integrated into the newest generation of Apple mobile devices and incorporates NFC technology. If it becomes widely used by many iPhone users, perhaps merchants will be encouraged to more quickly adopt NFC technology.

Many major banks and credit cards are supporting NFC technology, issuing new cards with embedded NFC chips. This means that you may be able to tap or wave your card at the terminal instead of swiping, no phone required, in the next few years.

Posted in Best Practices for Merchants, Near Field Communication Tagged with: cards, contactless, credit cards, customers, merchants, mobile wallet, Near Field Communication, nfc, payment, Smartphones, tablets, terminal, transaction

April 26th, 2016 by Elma Jane

Posted in Best Practices for Merchants

April 26th, 2016 by Elma Jane

The PCI-DSS is a security standard for organizations that handle branded credit cards from the major card including Visa, MasterCard, Amex, Discover, and JCB. It is designed to ensure that ALL companies that process credit card information maintain a secure environment.

PCI applies to organization or merchant, that has a Merchant ID (MID), regardless of size or number of transactions, that accepts credit card.

Merchants will fall into one of the four merchant levels based on Visa transaction volume over a 12-month period.

| Merchant Level |

Description |

| 1 |

Any merchant — regardless of acceptance channel — processing over 6M Visa transactions per year. Any merchant that Visa, at its sole discretion, determines should meet the Level 1 merchant requirements to minimize risk to the Visa system. |

| 2 |

Any merchant — regardless of acceptance channel — processing 1M to 6M Visa transactions per year. |

| 3 |

Any merchant processing 20,000 to 1M Visa e-commerce transactions per year. |

| 4 |

Any merchant processing fewer than 20,000 Visa e-commerce transactions per year, and all other merchants — regardless of acceptance channel — processing up to 1M Visa transactions per year. |

Does is each location required to validate PCI Compliance for multiple business locations?

If a business locations process under the same Tax ID, then you are only required to validate once annually for all locations.

Penalties for non-compliance

The payment brands may fine an acquiring bank $5,000 to $100,000 per month for PCI compliance violations. The banks will pass this fine along until it eventually hits the merchant. The bank will also terminate your relationship or increase transaction fees.

PCI Compliance Manager

To help you achieve and report compliance, we have Trustwave PCI Compliance Manager. It’s an online portal that enables you to understand requirements that apply to your business, and guides you through your self-assessment, step by step.

If you have any questions regarding your PCI Compliance please call our office at 888-996-2273. We would be more than happy to help.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: banks, credit cards, merchant, PCI-DSS, Security, transactions

April 25th, 2016 by Elma Jane

There are a lot more details of what makes up a credit card rate, this information is a good start to know more about a merchant account. All merchant accounts are subject to the same costs with respect to interchange fees and assessments.

Most rates are made up of three parts:

Assessments – are paid directly to card network associations (Visa, MasterCard, Amex, etc.)

Interchange – are paid to the issuing bank that issued the card, and is typically made up of a flat rate.

Card present transactions (the card is physically present or swiped) are typically lower than card-not-present transactions (the card is keyed-In like e-commerce and mail-order transactions).

Card-not-present transactions have higher interchange rates because they are riskier.

Processor fees – the fees involved with providing the service, risk assessments, the type and size of the transaction. This includes the margin between the total rate and the two previous parts, along with other fees, like chargeback or statement fees.

Posted in Best Practices for Merchants, Credit card Processing, Travel Agency Agents Tagged with: bank, card, card network, chargeback, credit card, merchant account, rate, transaction

April 21st, 2016 by Elma Jane

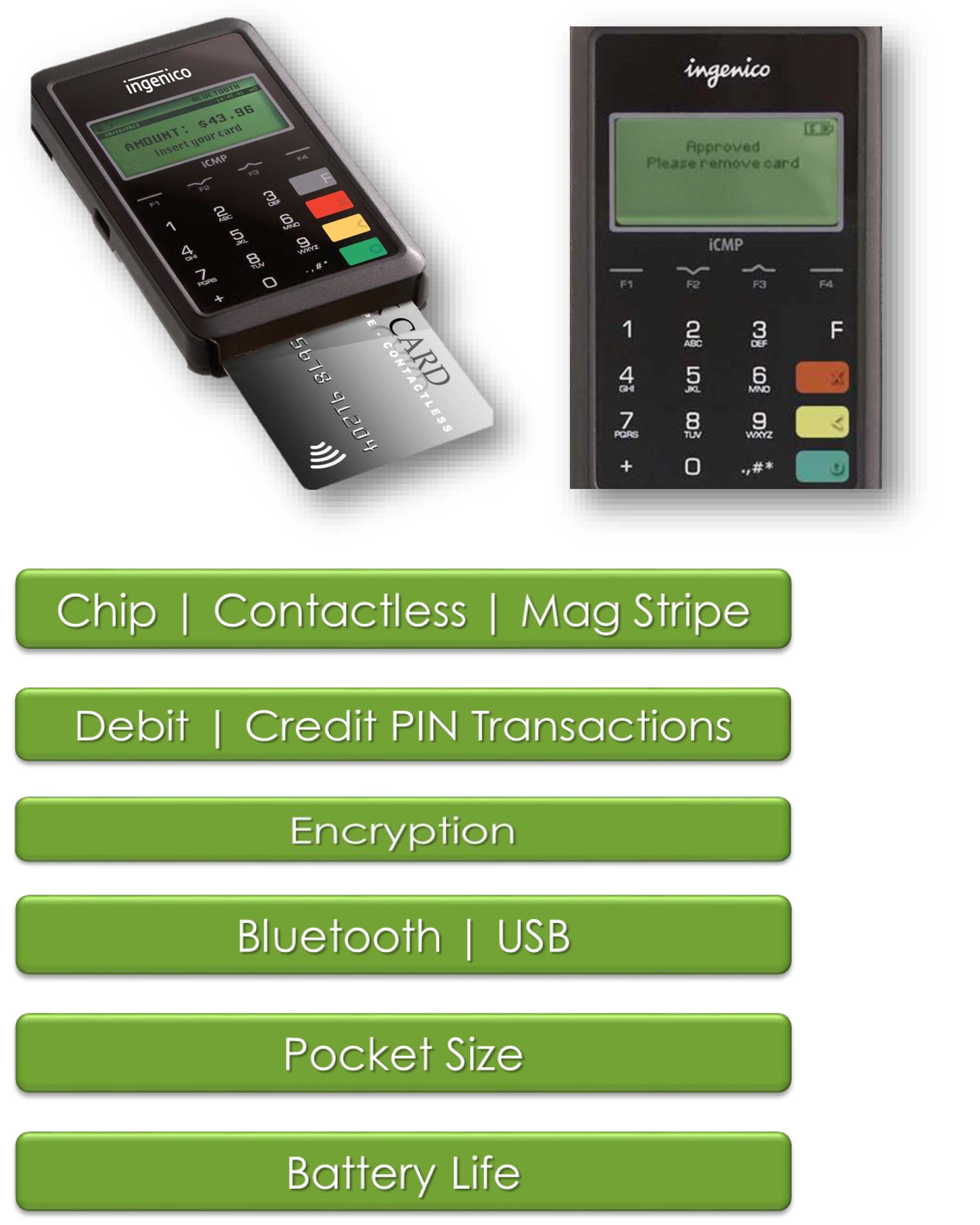

Payment Acceptance

EMV Contact/Contactless

NFC Contacless

Mag Stripe

Premium NFC + EMV/PIN & Signature

Payment Acceptance

EMV Contact/Contactless

NFC Contactless

Mag Stripe

Basic NFC + EMV/PIN & Signature

For orders Plus Tax and Shipping If Applicable.

For more information give us a call at 888-996-273

Posted in Best Practices for Merchants Tagged with: chip, contactless, EMV, nfc, PIN

April 20th, 2016 by Elma Jane

ECS: An Electronic Mode Of Funds Transfer From One Bank Account To Another

- Paper check conversion

- Debit Processing

- Automated Returns Management

- Reporting: Merchant Connect, ACS Standard and Custom Files, Enquire and Corporate Management Reports

- Monthly Statement

- Risk Services: Verification, Conversion

- Image

ACH E-CHECK: Uses Bank Routing and Account Number In a CNP Environment.

- Card-Not-Present e-Processing of ACH Debit

- Known Relationship B/Consumer and Business

- NOT for Ecommerce “Sale of Goods and Services”

- Debit Processing

- Automated Returns Management

- Reporting: Merchant Connect, ACS Standard and Custom Files, Enquire and Corporate Management Reports

- Monthly Statement

- Risk Services: Verification, Conversion

- No Image

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: account, ACS, bank, card-not-present, cnp, consumer, debit, ecommerce, ECS, merchant, risk, services

April 19th, 2016 by Elma Jane

Electronic Benefit Transfer (EBT) is an electronic system that allows a recipient to authorize a transfer of their government benefits from a Federal account to a retailer account to pay for products received. Very much similar to purchasing something using a credit card.

Posted in Best Practices for Merchants Tagged with: account, credit card, EBT, electronic, Electronic Benefit Transfer

April 15th, 2016 by Elma Jane

Dynamic Currency Conversion

- Five supported currencies

- Retail, Restaurant, MOTO, E-commerce

- Price listed in merchant’s currency

- Customer is aware of currency conversion

- Customer may opt-out at the point of sale

- Conversion occurs at the point of sale

- Merchants may choose settlement method & time

- Supported by terminals, viaWarp and Virtual Merchant

- Merchant rebate up to 100bp

Multi-Currency Conversion

- 100+ supported currencies

- E-commerce only

- Price listed in customer’s currency

- Customer is not aware of currency conversion

- Customer may not opt-out at the point of sale

- Conversion occurs between the point of sale and settlement

- All transactions auto settle at 6pm (eastern) daily

- Supported by Internet Secure or direct certification

- No merchant rebate

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Merchant Account Services News Articles, Travel Agency Agents Tagged with: currency, Currency Conversion, customer, e-commerce, merchants, moto, point of sale, terminals, virtual merchant