Category: Best Practices for Merchants

April 14th, 2016 by Elma Jane

Accepting credit card payments is a must if you’re planning to start a business. It’s good to know what is out there and how it applies to your situation. So you need to learn about credit card processing machines, depending on your business.

Here are some of the different types of credit card processing machines:

Dial-Up Terminal – the grandfather of credit card processing machines. Dial-up terminals use a phone line to connect with a credit card processing company. The advantage is that they are normally inexpensive than some higher-end options. The disadvantage is slower processor speed.

IP Terminal – connect the merchant over a high-speed internet connection. The advantage of IP terminal over dial-up terminal is speed. IP machines can process transactions as fast as 3 seconds as opposed the 10 to 25 seconds that a dedicated dial-up machine might take. IP terminals now cost about the same as dial-up units and that a single DSL link can accommodate more than one credit card terminal.

Wireless Terminals – the priciest yet most convenient type is a wireless machine that runs on a wireless network, much like your mobile phone.

Virtual Terminal – virtual terminals are computers running credit card processing software connected to a credit card reader. Virtual terminals are a great addition to an office because they don’t require a standalone credit card processing terminal.

There are many options available for your business, whether you’re e-Commerce, MOTO, In-Store or Mobile there’s a credit card processing machine and platform out there that will fit your business.

Give us a call to know more at 888-996-2273 or visit us at www.nationaltransaction.com

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce Tagged with: card reader, credit card, credit card processing, e-commerce, merchant, mobile, moto, payments, terminal, virtual terminal

April 12th, 2016 by Elma Jane

Bank Identification Number or (BIN) is the link between the customer and their credit, debit, prepaid or gift card.This help merchants identify the card, its owner, and the issuing bank. The first six digits are used to identify the issuing bank. These six digits are the Bank Identification Number (BIN).

What is a BIN LookUp and how can it help merchant?

The BIN and additional data about the card and the bank can be stored in a database since every card is associated with a bank. BIN lookup allows any merchant or institution doing card based transaction to check more about the transaction other than ensuring that the correct pin has been provided.

BIN LookUp gives the merchant added security and a number of benefits.

- Protection against fraud and reversals of payments. Bank institution allow merchants a limited number of reversals and fraud before stopping their card privileges, and each card chargeback costs you money.

- Permits a closer monitoring of the sales process. Who, what and where? Using these details you can service your customers better.

- You can also gain from using the BIN system if you issue your customers’ gift card or pre-loaded cards.

How Can BIN LookUp or Cardholder Bank LookUp Help Merchants?

Utilize the Cardholder Bank Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information. Merchant Connect BIN lookup data is accurate, it is an added protection to your business, assets, and your financial transactions.

For your payments technology needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, cardholder, chargeback, credit, customer, database, debit, financial, fraud, gift Card, merchants, payments, prepaid, Security, transaction

April 11th, 2016 by Elma Jane

Card-not-present fraud is projected to worsen. However, 3D secure technology has made progress and is gaining more and more adoption.

How can e-Commerce merchants avoid CNP fraud?

Here are other ways to make card-not-present transaction safe:

Biometrics – Using Fingerprint Scans and Facial Recognition or Selfie. To validate the identity of the consumer.

Challenge Questions – Such as listing your father’s middle name or a fact known only to the consumer is an effectively added layer of security.

Location Data – Another way to fight against fraud is location data and the use of IP addresses to certify the location and identity of the consumer making the transaction.

Outsource Your Payment Platform – Payments pages hosted by a reputable payment service provider are much more secure.

One-time Passwords – During the checkout process, there will be a window to enter a one-time password which the consumer receives a text message on his/her mobile phone. The consumer enters the password within a short time frame to authenticate the transaction. This solution is especially effective against cyber criminals who steal credentials.

For your payment services needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Credit Card Security, e-commerce & m-commerce Tagged with: 3D Secure, biometrics, card-not-present, cnp, consumer, data, e-commerce, fraud, merchants, payment, Security, service provider, technology, transaction

April 8th, 2016 by Elma Jane

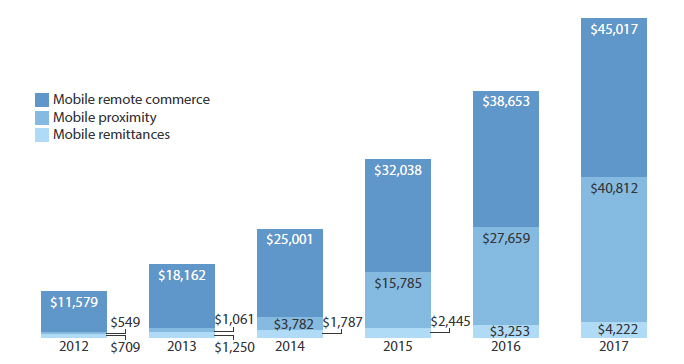

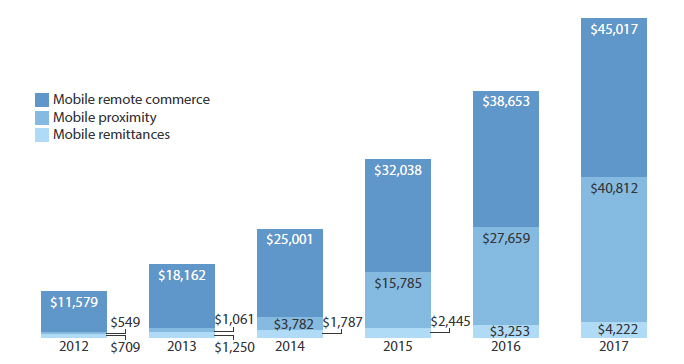

Mobile payments are soaring high. Many large retailers have embraced the innovation, but individual business owners have been slower to adopt.

Mobile payments can enhance customer engagement and loyalty. With mobile payment features, businesses can encourage more people to purchase using their mobile phone.

Customer experience will be the primary basis for competition.

The success of mobile payment providers and vendors are ultimately connected, as both need to work together. Small business merchants may not feel the urgent need to adopt mobile payments today, but they might lose in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Small business merchants may not feel the urgent need to adopt mobile payments today, but they might be left behind in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Competitive businesses need to get on board, they need to know the advantages and opportunities mobile payments can provide. To stay competitive and relevant, business merchants of all sectors and sizes need to explore the possibilities of mobile payments.

Posted in Best Practices for Merchants, Mobile Payments, Travel Agency Agents Tagged with: consumers, customer, merchants, mobile, Mobile Payments, payment providers, payments, provider's

April 7th, 2016 by Elma Jane

The EMV technology does improve security because EMV cards are more difficult to counterfeit. Since U.S. is using chip-and-signature cards not the one requiring a PIN, anybody can use an EMV chip card whether it might be a lost or a stolen card. EMV chips will not prevent the data breach from occurring, but it will make it harder for criminals to successfully profit from what they steal.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: cards, chip card, data, EMV, PIN, Security

April 4th, 2016 by Elma Jane

Accept Payments Your Way – In-Person, Online, and On The Go

Keeping up with customer demands and growing your business can be challenging. With NTC’s payments platform, you can process payments from customers quickly and securely, whether in-person, online or on the go. NTC can help you manage it all in one place, easily, securely and cost effectively.

Posted in Best Practices for Merchants Tagged with: customer, online, payments

April 4th, 2016 by Elma Jane

Visa

- Visa is introducing updates to their dispute process.

- Visa is introducing reduced timeframes for transaction processing and late presentment.

- Visa is eliminating the “Call Auth” referral responses, replacing them with Approved or Declined responses.

MasterCard

- MasterCard is adjusting some chargeback reason codes.

- MasterCard is introducing new standards for processing authorizations and pre-authorizations.

- MasterCard is introducing new auth reversal fees.

Discover

- Discover is introducing ProtectBuy for e-commerce transactions.

- Discover is modifying recurring payment interchange programs.

American Express

- American Express is introducing new MCC codes.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Visa MasterCard American Express Tagged with: e-commerce, payment, transactions

March 31st, 2016 by Elma Jane

E-commerce – the process of using the Internet or computer networks in order to buy or sell information, services, or products.

Everyday people go on the Internet and make purchases for different products or services, just like they would in a store. The act of buying or selling over these networks allows for secure paperless transactions to happen electronically.

Electronic transactions have been around for quite some time involving business to business transactions over private networks in the form of EDI. Electronic Data Interchange (EDI), which was a transfer of electronic data from a computer to another computer and Electronic Funds Transfer (EFT), which was a transfer of money electronically from a computer to another in order to do business with each other.

Accepting online payments is very rewarding. If you’re new to e-commerce keep things simple check out our NTC e-Pay the NO SHOPPING CART E-Commerce Solution!

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: e-commerce, Electronic Data, electronic transactions, online payments, payments, transactions

March 31st, 2016 by Elma Jane

Two key features have been released in the latest version (1.2.) of the Converge Mobile app for both iOS and Android:

- Bluetooth Printer Support – You can now use either of the Bluetooth printers – Star SM-T300i or Star SM-T220i – with the Converge Mobile app.

- Void – You can now void a transaction after it has been submitted and before it has been settled. Transactions that need to be reversed after settlement will need to be done as a refund. Both the Void and Refund functions are done from the transaction menu.

In addition to these features, enhancements were made to the first-time user experience to help get customers up and running on the new mobile app. Several bug fixes were also addressed, including a fix to remedy an issue where some cards were not being accepted via Apple Pay.

Users must download the latest version of the Converge Mobile app to receive these latest features. Updating the app will also push a hardware update to the Ingenico iCMP. We encourage our customers to enable automatic updates for Converge Mobile so you will always have the latest functionality.

Posted in Best Practices for Merchants Tagged with: customers, mobile, transaction