Category: Best Practices for Merchants

January 25th, 2016 by Elma Jane

New Timeframes for Electronic Gift Card Orders

Please be aware that NTC’s Electronic Gift Card (EGC) Design & Artwork team has upgraded their printers. The new timeframes for both FanFare and EGC (Givex) gift card shipments during non-peak times are the following:

- Standard Card Orders: 8 Business days, plus 2 Day Delivery

- Custom Card Orders: 12 Business days, plus 2 Day Delivery

Converge Mobile: Frequently Asked Questions

Will there be more EMV chip card readers in the future? Yes! Additional devices ranging in price points and feature/functionality will be introduced throughout 2016.

Do VirtualMerchant Mobile login credentials work with Converge Mobile?Yes! The mobile login credentials that customers use today for VirtualMerchant Mobile are the same for Converge Mobile.

Is the talech iCMP the same as the one sold for Converge and Converge Mobile? No! Please use item code CICMP for devices that will be used with Converge and/or Converge Mobile. Otherwise, there is device reconfiguration work that has to take place resulting in a negative customer experience.

UPCOMING EVENTS

April 19-21 May 2-4

TRANSACT 16 (ETA) Southeast Acquirers Association (SEAA)

INDUSTRY LINKS

|

|

Posted in Best Practices for Merchants, nationaltransaction.com Tagged with: card, chip card, Electronic gift card, EMV, gift Card, merchant, mobile, payment, payment technology, processor, travel, travel industry

January 21st, 2016 by Elma Jane

Merchant accounts are as varied as the merchants themselves and the goods being sold.

What kind of account would you fall under:

High Risk Merchant Accounts – Finding a processor who is willing to take your account can be more challenging. High risk merchants range from travel agencies to multi-level marketing companies, credit restoration merchants, casinos, online pharmaceutical companies, adult/dating merchants and many other.

Internet based merchant account (Ecommerce/Website order processing) – E-Commerce is a booming market, with so many people buying and selling goods online due to the wide reach and easy access to the internet.

Mobile or Wireless merchant account – This merchant is specifically designed for small businesses, solo professionals, and mobile services (including lawyers, landscapers, contractors, consultants, repair tradesmen, etc), who are constantly on the move and require a payment to processed on the spot.

MOTO (Mail or Telephone order) – This enables phone based or direct mail orders processing for customers who can buy your product or service from the comfort of their home. Since there is no card present there is no need for traditional equipment.

Multiple Merchant Accounts – Some businesses can have merchant accounts of a couple or all different types. Merchants who fall into this category are called multi-channel merchants as they sell their goods through a number of different channels. Most commonly this is related to retail stores who also have an online presence to sell their goods. This is very common in today’s competitive market where constant contact with customers is critical to success.

Traditional Account with Equipment – Most commonly used for retail businesses (grocery, departmental stores etc) where the transactions are processed in a face to face interaction also known as Point of Sale (PoS).

Interested to setup an account give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Point of Sale, Travel Agency Agents Tagged with: account, card, card present, credit, customers, e-commerce, high risk merchant, internet, merchant accounts, merchants, mobile, mobile services, moto, multi-channel merchants, payment, point of sale, POS, processor, transactions, travel, travel agencies

January 21st, 2016 by Elma Jane

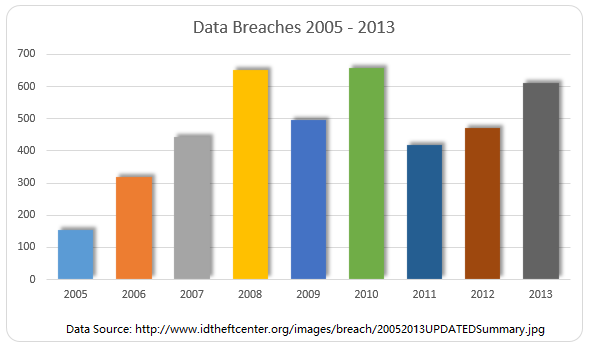

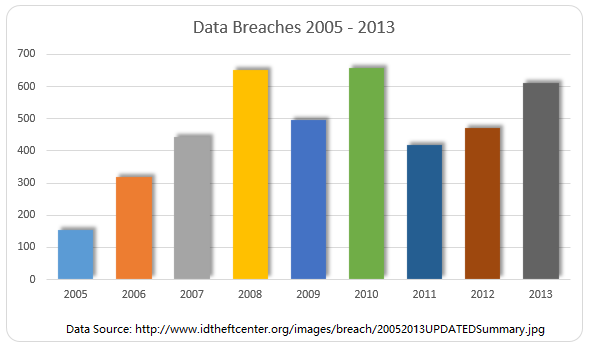

HYATT DATA BREACH HITS 250 HOTELS WORLDWIDE

Hyatt hotel company noted that the breach that occurred over the course of almost four months hit 250 different hotels over the span of about 50 countries.

The breach covered payment card data from the cards used at various Hyatt hotels in that range of dates, reports note, and most of the breaches seem to have hit at hotel restaurants. Those who also hit the spas at Hyatt, along with front desks, gold shops, and even parking structures may also have been impacted by the breach.

The company couldn’t confirm how long the network was vulnerable nor if any payment card data had actually been stolen.

Perimeter Defense where data is protected with passwords and firewalls and the like is fine and well, but more needs to be put into protecting the data in the event someone clears security.

Encrypting Data is a great step to take, assuming someone manages to clear the perimeter, the encryption makes the data itself much more difficult to access and use. So while perimeter defense keeps unauthorized users away from data, encryption keeps those who reach the data from being able to readily read it.

Data Security is something none of us can take for granted, so doing what we can to protect that data being vigilant about statements, putting up proper security, encrypting data all of these contribute to better protected data and a safer time online.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card data, cards, data, online, payment, Security

January 19th, 2016 by Elma Jane

2015 was a major period of growth for the online and mobile payment industry. Close to 60 million Americans used mobile payments on a consistent basis, representing close to 18 percent of the population. However, around 52 percent of Americans are aware of mobile payments and how to use them.

Because of both the wide awareness and accessibility of mobile payments, analysts expect consistent mobile payment use to double this year. Millennials and high-income spenders tended to adopt the technology more quickly, at 23 percent and 38 percent consistent usage respectively.

Even more intriguing than the wide-spread use of mobile payments is how large the market grew. In 2015, $8.71 billion passed through online payment services providers. Even more intriguing is the prediction that this market will more than triple to $27.05 billion by the end of this year.

Posted in Best Practices for Merchants Tagged with: mobile payment, online, online payment, payment, payment industry, payment services, provider's, services providers

January 18th, 2016 by Elma Jane

EMV + NFC = BIG PLUS FOR YOUR BUSINESS

The business is already making upgrades, so If you’re a merchant, business owner who’s still on the fence about upgrading your payment processing equipment to accept EMV cards why not take that upgrade a step further and add NFC while adding EMV systems?

Not only will the upgrade help prevent potential financial responsibility for fraudulent transactions, but you can also realize the added benefit of being able to process NFC transactions at the same time.

Customers want the ability to pay with a mobile device, and NFC will allow for such transactions to go on.

Having NFC tools in place will help provide a valuable note of future-proofing to systems in place, being ready for it will be to the business’ benefit.

EMV and NFC technology is just good business sense for three important reasons Added Security, Economic Sense and Staying Current.

For more information about terminal upgrade and features that suits best for your business give us a call at 888-996-2273.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale, Smartphone Tagged with: cards, customers, EMV, merchant, mobile, nfc, Security, transactions

January 14th, 2016 by Elma Jane

We would like to let our customers know of additional benefits that are coming, in addition of the protection that chip card technology provides.

On January 24, Verifone will release a software update for your card terminal that will include two important new features:

- PIN Debit: With this feature, when your customer pays with a Visa, MasterCard or Discover chip debit card, your terminal will allow you to process it as a debit transaction. The update will change the prompts you’re used to seeing based on how the card is configured.

- Tip Adjust: If your business accepts tips, you will now have the option to add the tip at the time of sale or adjust it later, just like with non-chip card transactions. To use the tip adjust feature, simply skip the tip prompt during the sale.

Once the download is available, your card terminal will automatically receive the new application during its monthly update. For best results, leave your terminal on overnight to ensure it receives the update.

We appreciate your business and we are committed to providing you with solutions to ensure your ongoing transition to chip card acceptance is smooth.

For more information on terminal upgrade, please visit www.chipcardsuccess.com.

Start accepting credit card payments at your business with the following features on your new POS terminal: NFC + EMV PIN & Signature capable. Give us a call now at 888-996-2273 or visit our website www.nationaltransaction.com Payments Expert for Travel Merchants and more!

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Near Field Communication, Point of Sale, Travel Agency Agents, Visa MasterCard American Express Tagged with: card, customers, EMV, MasterCard, merchants, nfc, payments, POS, transaction, travel, visa

January 13th, 2016 by Elma Jane

If you’re a travel merchant or any merchants using Internet Explorer we want to share this information with you.

As Microsoft ends support for anything older than Internet Explorer 9 (IE9), security experts urged IT managers to migrate to newer versions of Internet Explorer to avoid risk exposing themselves to a new wave of attacks.

Back in August 2014, IEBlog shared important information on migration resources, upgrade guidance, and details on support timelines.

After January 12, 2016, only the most recent version of Internet Explorer available for a supported operating system will receive technical support and security updates.

Vista SP2 and Server 2008 SP2 users will only be supported on IE9; Windows 7 SP1, Windows Server 2008 R2 SP1, Windows Server 2012 R2 and Windows 8.1 users will need to upgrade to IE11; and Windows Server 2012 customers will need to migrate to IE10.

This will apparently ensure they get the benefit of Microsoft security updates and technical support.

Internet Explorer is one of the most commonly targeted platforms in the world for cyber-criminals, businesses would do well to get their house in order. Staying on unsupported versions will have a serious impact on your business.

To know more about Support Lifecycle Information click here

Posted in Best Practices for Merchants Tagged with: merchants, travel, Travel Merchant

January 12th, 2016 by Elma Jane

Can we securely store card data for recurring billing?

PCI DSS discourages businesses from storing credit card data, Merchants feel the practice is necessary in order to facilitate recurring payments.

The Payment Card Industry Data Security Standard (PCI DSS) is a proprietary information security standard for organizations that handle branded credit cards from the major card schemes including Visa, MasterCard, American Express, Discover, and JCB.

In order for the electronic storage of cardholder data to be PCI Compliant, appropriate encryption must be applied to the primary account number (PAN). In this situation, the numbers in the electronic file should be encrypted.

All PCI controls would apply to the environment in which the cardholder data is transmitted and stored. Tokenization can be implemented for recurring and/or delayed transactions. Travel Merchants and or Storage Facility could use this feature to help reduce the need for electronically stored cardholder data while still maintaining current business processes.

The best thing you can do for your business is to not store any cardholder data or personally identifiable information.

Tomorrow let’s tackle Encryption and Tokenization a strong combination to protect card data while reducing the cost of compliance!

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Payment Card Industry PCI Security, Travel Agency Agents, Visa MasterCard American Express Tagged with: cardholder data, credit card, data, merchants, payments, Security, tokenization, transactions, travel

January 11th, 2016 by Elma Jane

Chase Commerce Solutions, the global payment processing and merchant acquiring business of JPMorgan Chase & Co., sold its entire portfolio of Independent Sales Organization (ISO) accounts and associated contracts.

Financial terms of the deal were not disclosed.

Chase has been decreasing the number of merchant relationships it supports through traditional ISOs and increasing the number of direct acquiring relationships it has with merchants since it formed Chase Merchant Services, a partnership with Visa that began 2013.

During that time it has focused more on e-commerce, reports said, though the biggest news for Chase Commerce Solutions recently was its agreement with Starbucks in November to take over processing of all its non-mobile payments.

Posted in Best Practices for Merchants Tagged with: Commerce Solutions, e-commerce, Independent Sales Organization, ISO, merchant, merchant services, Mobile Payments, payment processing, visa

January 7th, 2016 by Elma Jane

National Transaction is now offering Apple Pay to Canadian Merchants.

Apple Pay works with NTC’s EMV-contactless point of sale terminals in Canada.

Security and privacy is at the core of Apple Pay, and when a consumer adds a credit card to Apple’s mobile wallet, the actual card numbers are not stored on the device, or on Apple servers.

Apple Pay will create a unique Device Account Number that is assigned, encrypted and securely stored in the secure element on the device, the same way it operates in the U.S. Each transaction is authorized with a one-time unique dynamic security code.

To pay, consumers simply hold their mobile device near the contactless reader, exactly as they would a contactless card today. The payment information is then passed to the POS system once the consumer confirms the transaction using Touch ID on their device.

Bringing Apple Pay to NTC terminals addresses an increasing consumer demand for contactless payments, while also allowing Canadian businesses to offer customers the convenience of paying through an iPhone, iPad or Apple Watch.

American Express is Apple’s issuing partner in Canada.

Posted in Best Practices for Merchants Tagged with: Contactless card, contactless point of sale, contactless reader, credit card, EMV, merchants, mobile device, mobile wallet, payment, POS system, security code, terminals