Category: Best Practices for Merchants

December 14th, 2015 by Elma Jane

Samsung Pay now supports 50 popular merchant gift cards as well as a gift card store that enables users to buy gift cards from supported merchants, within the Samsung Pay app. According to press release, more gift card options will be added to Samsung Pay in the coming months. Samsung Pay is bringing consumers an easier way to use gift cards. With Samsung Pay, you can easily carry your gift cards with you everywhere you go and not to have to worry about a card going unspent.

http://paymentweek.com/2015-12-14-samsung-pay-adds-support-for-popular-gift-cards-9116/

Posted in Best Practices for Merchants, Smartphone Tagged with: cards, Gift Cards, merchant

December 11th, 2015 by Elma Jane

The use of in-store mobile payments increased in the US this year, from 5% in 2014 to 18% in 2015, research reveals, with approximately one in five consumers using their phone to make a payment at the point of sale.

The most popular uses of mobile payments in the US:

Public Parking (19%)

Gas Station Purchases (18%)

Coffee Shops and Fast Food Dining (17%)

Paying for Groceries (16%)

Public Transportation (16%)

Paying for a Taxi (16%)

Paying for restaurant bills (15%)

Checking out of a Hotel and Paying the Bill (13%)

Shopping for Clothing (12%)

Shopping in General on the High Street or in the Mall (10%)

Other (7%)

US consumers aged between 25 – 34 were seen as driving the largest portion of mobile payment activity at 36%, with those aged from 45-74 accounting for less than 10% of activity.

Half of the survey’s 2,000 respondents in the US cited security concerns as the main reason for not using mobile devices for in-store payments, while consumers place the greatest trust in traditional financial institutions like banks (49%) for provision of payment services.

Mobile technology is now moving beyond simply being a mode of communication and advancing towards the era of the always-connected consumer, says US telecommunications sector leader at Deloitte.

http://www.nfcworld.com/2015/12/11/340588/store-mobile-payments-increase-four-fold-across-us/

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale Tagged with: banks, financial institutions, Mobile Payments, payment services, payments, point of sale

December 10th, 2015 by Elma Jane

American Airlines is upgrading its international travel, with Premium Economy on its international flights, featuring larger seats and more legroom of about six inches more, improved entertainment systems and meal service. The seats will be located behind business class, separated from the main cabin section.

AA’s premium economy international flights will become available in late 2016. No available information about the pricing.

The new class of service will also come with priority check-in and boarding as well as a checked baggage allowance.

International travelers who loves to travel have more choices when they fly!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: travel

December 10th, 2015 by Elma Jane

WALMART LAUNCHES QR CODE MOBILE PAYMENTS SERVICE

Customers at US retail giant Walmart will soon be able to pay for purchases by scanning a QR code at the point of sale using Walmart Pay. Walmart Pay will be integrated into the Walmart app, the retailer’s own mobile payment service introduced in selected stores this month, with a nationwide launch expected in the first half of next year.

With this launch, Walmart becomes the only retailer to offer its own payment solution that works with any iOS or Android device, at any checkout lane, and with any major credit, debit, prepaid or Walmart gift card all through the Walmart mobile app.

Walmart Pay will allow for the integration of other mobile wallets in the future.

http://www.nfcworld.com/2015/12/10/340527/walmart-launches-qr-code-mobile-payments-service-in-the-us/

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: credit, debit, gift Card, mobile payment, mobile payment service, mobile wallets, payment service, payment solution, point of sale, prepaid

December 9th, 2015 by Elma Jane

The RushCard catastrophe affected more than 132,000 consumers, without access to their prepaid card accounts to get their paychecks, buy groceries, pay bills or pay rent for days.

The total number of customers, and a tally of how many people were affected, haven’t previously been disclosed because it is a privately held company.

Senator Brown urged UniRush on Monday to cooperate with an investigation from the Consumer Financial Protection Bureau, which has requested documents and other information to determine what caused the outage and what the company was doing to compensate consumers.

The card company petitioned to push back the deadline for compiling the information to Jan. 15, from Nov. 10, calling the request broad and overly burdensome, but the bureau denied the request last week.

The prepaid card company announced in October that it would create a multimillion-dollar fund to compensate customers who faced financial issues after being locked out of their accounts.

RushCard spokesman said Monday that the company has started to compensate customers, even hand delivering cash in some cases, but he wouldn’t specify how many people had received payments.

RushCard is a Prepaid Card Company co-founded by Russell Simons.

Posted in Best Practices for Merchants Tagged with: card, card company, payments, prepaid card

December 8th, 2015 by Elma Jane

The President blamed (Visa Waiver Program) a special visa travel program for allowing one of the San Bernardino terrorists into the country.

The Visa Waiver Program eases entry into the United States for 20 million visitors from nations that meet certain conditions. Mainly tourists and overseas relatives of American citizens and residents, are able to enter the U.S. easily. Passport holders from 38 countries currently qualify for a 90-day visa-free stay in the US.

Visa waiver program is considered crucial to the multibillion dollar travel and tourism business. New York City’s Manhattan, Florida’s theme parks, the Grand Canyon, Hollywood and Las Vegas get a high amount of tourist traffic because of the Visa Waiver Program.

The House will vote on changes to the program today, a worrying news for Travel Industry.

The U.S. travel industry has seen these kinds of changes coming for some time now. The U.S. Travel Association has spent $2 million on lobbying this year alone. The group is not fighting against all changes to the visa program, but instead wants to make certain that any new facets do not go overboard and are not redundant.

Credits

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: tourism business, travel, Travel Association, travel industry, travel program

December 8th, 2015 by Elma Jane

In Travel Industry, it’s beneficial if travel agents could write and share some of the things that really work for them in running their business and the things that didn’t, whether you’re an online travel agents, homebased travel agents to tour operators. It’s not about being an expert, but the ideas that you can present and task that you face on a daily basis with Travel that may work for some or none will be a great tool to 70,000 agents. This is also a great way to market your Travel Agency. If you’re a travel agent who’s willing to discuss your successes and challenges in a monthly column check this out.

http://www.travelresearchonline.com/blog/index.php/2015/12/and-with-that-the-2015-travel-agent-diaries-are-a-wrap-but-what-about-2016/

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: homebased travel, online travel, tour operators, travel, travel agency, travel agents, travel industry

December 7th, 2015 by Elma Jane

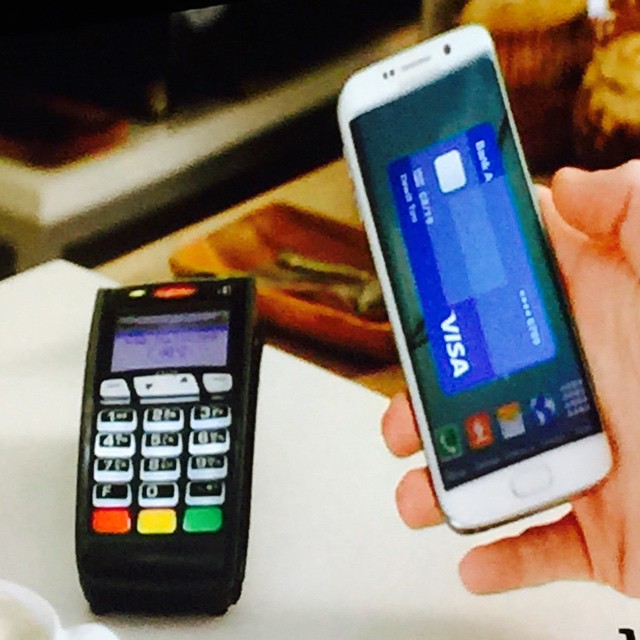

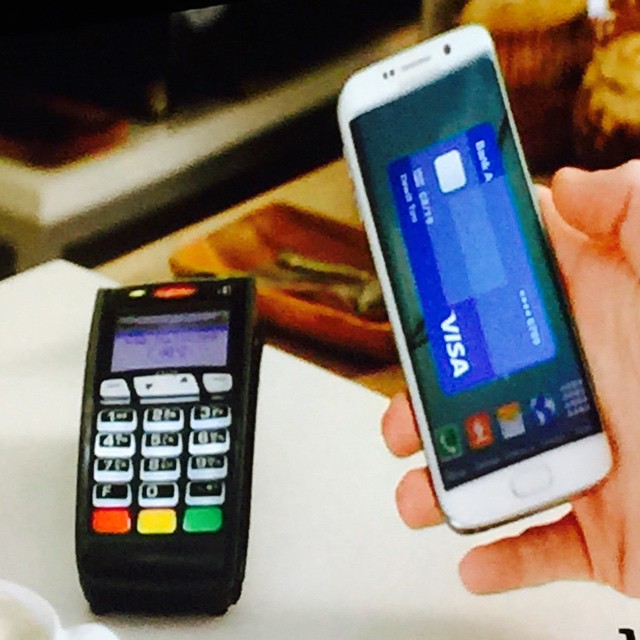

Most payments will probably be made with apps in phones or smartwatches in less than a decade from now, using NFC, biometrics or other mechanisms that don’t involve swiping or using plastic cards.

If your mobile device has an integrated NFC chip, you can use a mobile wallet app like Apple Pay and Android Pay to pay for items that support NFC transactions at a retail store. Simply wave your device near an NFC compatible terminal to pay, no card swiping required.

Both Apple Pay and Android Pay have fingerprint scanners on phones, you can enable payments with just a fingerprint scan.

In some countries, it’s easy for consumers to get credit cards with imbedded NFC chips. This means that you may be able to wave your card at the terminal instead of swiping, no phone required. In America, though, because NFC hasn’t caught on until recently, analysts expect that NFC via smartphone and smartwatch services such as Apple Pay and Android Pay will dominate contactless transactions in the next few years.

Just as credit cards replaced cash, credit cards will be replaced by digital payments which will continue to rely on the credit infrastructure but will obscure the plastic card itself.

As consumers, we love to see better products. When it comes to payments, we need Standards and Reliability.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: biometrics, cards, contactless transactions, credit cards, digital payments, mobile wallet, nfc, NFC chip, payments, smartphone, terminal

December 4th, 2015 by Elma Jane

The payments world continues to reinvent itself almost daily, predictions have now become reality. Demand for mobile payments are growing, with the increasing mobile internet penetration that enables the users to process Mobile Point-of-Sale (MPOS) and close the sales process quickly. Moreover, the rising adoption of tablets and smartphones across the globe allows the retailers and merchants to integrate MPOS into their payment systems.

Mobile presents a tremendous opportunity for merchants today. The usage of cloud-based solutions is expected to fuel the MPOS market. These solutions enable merchants to access customer information and product data across multiple platforms. Large amount of data would require highly compatible Mobile Point-of-Sale (MPOS) that will capture information such as payment preferences, and buying behavior to fuel the market. MPOS would also enable merchants to store a large amount of data that can be accessed from anywhere across the globe by authorized personnel. The value that this channel can provide is very powerful creating new business opportunities.

Interested in Electronic Payments give us a call now at 888-996-2273

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale Tagged with: merchants, mobile, mobile internet, mobile point of sale, MPOS, payments, point of sale

December 3rd, 2015 by Elma Jane

Industry professionals agree that mobile payments technology has surpassed e-commerce as the trend in the daily spending behavior of modern retail customers.

E-commerce’s impact on consumer spending has actually decreased, but it seems that the ability to pay with mobile devices has finally swayed consumers away from their computers.

The payments outlook has changed rapidly with the increasing availability of mobile technologies to the average retail consumer within the last year. Products like Apple Pay, Android Pay and Samsung Pay have totally altered the landscape of payment options.

Small Businesses will have to adapt in order to keep up with the rapid pace of technological developments. The evolution of payments technologies not only alters how consumers spend their money, but how that money is processed during a transaction.

There are still some concerns over cyber risks and data security, which led 58 percent of surveyed professionals to agree that point-of-sale debit and credit card transactions were still the safest form of payment, while mobile payments garnered 20 percent of support. But hypothetical worries over security aren’t real enough to slow mobile payments’ momentum moving forward.

Mobile payments transaction value is expected to hit $8.71 billion by the end of 2015. That figure will triple to $27.05 billion in comparison to 2016, according to new research; as a bigger base of consumers begin to use their phones for point-of-sale transactions and a wider range of merchants begin to accept mobile payments. By 2019, essentially all mobile payment transactions will be done on smartphones.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Point of Sale Tagged with: credit card, credit card transactions, debit, e-commerce, merchants, Mobile Payments, payments technologies, point of sale