Category: Best Practices for Merchants

September 22nd, 2015 by Elma Jane

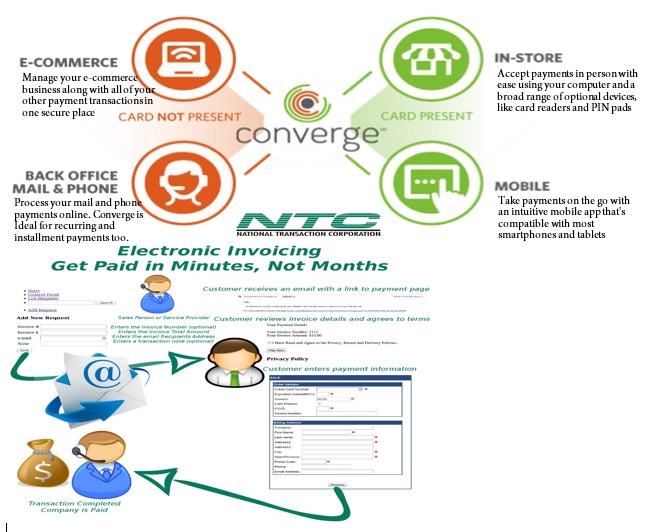

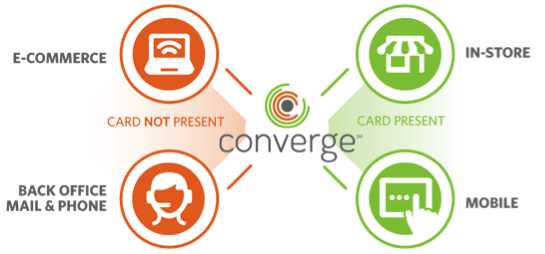

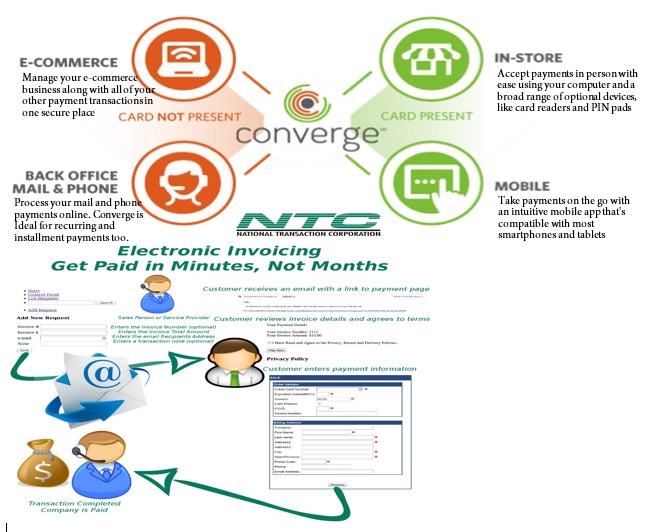

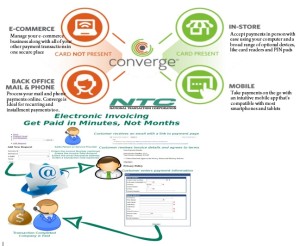

Virtual Merchant/Virtual Merchant Mobile now called Converge, is a popular product offering solutions for retail stores, Non Face to Face businesses along with E-commerce/Internet sites. Converege can be access anywhere with internet. Users can download the application on their smartphone or tablet. Converge also gives users the convenience of sending an invoice to customers electronically with NTC e-Pay!

For Retail store National Transaction offers the latest in EMV and NFC technologies. NTC customers can accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. NTC offers different solutions that cater to your business needs. For those already using a POS system, NTC integrates with most systems. NTC has you covered.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: Apple Pay, contactless payment, Converge, e-commerce, EMV, Google Wallet, nfc, POS system, smartphone, tablet, virtual merchant

September 14th, 2015 by Elma Jane

The security rules for fraud liability of credit and debit cards will change in the United States, starting October 1, 2015.

The new security rules would prompt major plastic card brands like MasterCard and Visa to upgrade their magnetic stripe based cards to more modern and secure chip technology based cards.

Credit and debit card fraud amount in the U.S. reached around $11.27 billion, in 2012.

With the new rules, any financial institution and payment processing merchant who would not upgrade their cards to chip technology would be held responsible for any committed fraud with their cards instead of their customers. This new rule would effectively transfer the liability in case of a fraud from the consumer to the least secure card provider. The rule specifically says that liability will fall on the bank or retailer with the least secure technology.

If the bank has not given you a new chip card, and you use your magnetic swipe card and there’s resulting fraud, the bank will be responsible for that.

All merchants who do not offer payment terminals that support chip based cards would be held liable for any fraud committed on their premises as well, from October 1. The new rules say that if the card is chip based and the merchants fail to offer a chip based terminal, and a fraud is committed, they would be held liable instead of the card holder.

With chip based cards, the customer would need to insert their card inside a chip enabled payment terminal while making a purchase. Then, they need to confirm the amount and enter a private pin to verify their identity. The customer would also sign for the purchase like using a regular magnetic card.

Besides MasterCard, Visa has already rolled out the new chip based terminals in the U.S. under its Zero Liability Policy.

The chip based cards are more secure compared to the old magnetic technology. That is one of the reasons why the new rules are promoting the chip based technology over the 55 years old magnetic cards.

Not all merchants have to replace their old magnetic terminals and it is still an optional decision, but industry analysts think that the shift of liability in case of fraud from consumers to financial institutions and merchants would likely prompt them to start using chip based technology.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank, card holder, card provider, chip card, debit cards, magnetic swipe, magnetic terminals, merchants, payment processing, payment terminals

September 11th, 2015 by Elma Jane

National Transaction Terminals with NFC (near field communication) Capability

To accept Apple Pay transactions at your business, you will need to adopt point-of-sale devices with NFC/contactless readers.

National Transaction offer a range of options to suite your specific needs:

Tablet solutions: Talech with iCMP device and NCR Silver.

Short-range wireless terminals for pay at the table: Bring the point-of-sale to your customers. Ideal for table-service restaurants, curbside pick-up, salons and more.

These terminals are all-in-one solutions with an integrated PIN Pad and printer. The short range terminals use secure, encrypted Bluetooth technology, allowing only the base and terminal to talk to each other, while also monitoring channels to prevent interference from other devices.

The Bluetooth terminals we offer are: VeriFone VX680B and Ingenico iWL220B. (Both Bluetooth Wireless)

Long-range wireless (cellular/mobile) terminals: Have a long-life battery and compact design, which allows you to process transactions anywhere your customers are ideal for deliveries, kiosks and more.

These terminals are all-in-one solutions with an integrated PIN Pad and printer. Phone lines and internet connections are not required to take advantage of our mobile payment solutions.

The GPRS wireless terminals we offer are: VeriFone VX680G and Ingenico iWL250G. (Both GPRS Wireless)

Countertop terminals:

Ingenico iCT250 – has a “magic box” cable management system that prevents cable tangle and clutter. The terminal boasts a color display for improved readability and ease of use.

Verifone VX520 – has a built-in secure software authentication process which prevents unauthorized software applications from being downloaded.

Ingenico iCT220 with iPP320 external PIN pad – has a “magic box” cable management system that prevents cable tangle and clutter, along with a black and white screen for crisp visual clarity. Combine with an iPP320 for a consumer- facing solution to support contactless payments. (Note: the iCT220 device only supports contactless transactions when connected to this external PIN pad).

Whether you need a stand-alone POS terminal, want to take advantage of your existing tablet or PC, or require a wireless or mobile solution, National Transaction Corp., offers numerous user-friendly options. No matter how your customer wants to pay, NTC will help you enable quick and easy transactions from Traditional credit and debit cards, gift cards, smart cards (or EMV), mobile or digital wallets like Apple Pay and eCommerce or MOTO transactions.

Start growing your business quickly by accepting all kinds of credit card payments and debit cards. Choose a state-of-the-art solution so you can accept payment in store or on your mobile device. With transparent pricing, live customer support, no cancellation fees and a secure platform, you’ll be confident you made the right partner for your business with National Transaction Corp.

Learn how easy it can be to accept any contactless or Apple Pay transactions.

Click here for more information about Apple Pay.

For Merchant Account Setup give us a call at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: Apple Pay transactions, contactless readers, Countertop terminals, credit card, debit cards, Digital wallets, ecommerce, Gift Cards, mobile payment, moto, Near Field Communication, nfc, PIN pad, point of sale, POS terminal, smart cards, wireless terminals

September 8th, 2015 by Elma Jane

A card not present transaction (CNP, MO/TO, Mail Order / Telephone Order, MOTOEC) is a payment card transaction made where the cardholder does not or cannot physically present the card for a merchant’s visual examination at the time that an order is given and payment effected, such as for mail-order transactions by mail or fax, or over the telephone or Internet.

The Card Associations created this term to help identify these Transactions, because CNP situations tend to be where the majority of fraudulent activity occurs; it is difficult for a merchant to verify that the actual cardholder is indeed authorizing a purchase.

The card security code system has been set up to reduce the incidence of credit card fraud arising from CNP.

Types of Security codes:

CVC1 or CVV1, encoded on track 2 of the magnetic stripe of the card and used for card present transactions. The purpose of the code is to verify that a payment card is actually in the hand of the merchant. This code is automatically retrieved when the magnetic stripe of a card is swiped on a point-of-sale (card present) device and is verified by the issuer. A limitation is that if the entire card has been duplicated and the magnetic stripe copied, then the code is still valid.

The most cited, is CVV2 or CVC2. This code is often sought by merchants for Card Not Present Transactions occurring by mail, fax, telephone or Internet. In some countries in Western Europe, card issuers require a merchant to obtain the code when the cardholder is not present in person.

Contactless cards and chip cards may supply their own electronically-generated codes, such as iCVV or Dynamic CVV.

Code Location

The card security code is typically the last three or four digits printed, not embossed like the card number, on the signature strip on the back of the card.

American Express Cards have a four-digit code printed on the front side of the card above the number.

Diners Club, Discover, JCB, MasterCard, and Visa Credit and Debit Cards have a three-digit card security code. The code is the final group of numbers printed on the back signature panel of the card.

For Merchant Account Setup give us a call at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: card transaction, card-not-present, cardholder, chip cards, cnp, contactless cards, credit card, debit cards, magnetic stripe, merchant, moto, security code

September 3rd, 2015 by Elma Jane

Fanfare Refresher training on Thursday, September 10 at 2pm ET.

Session will cover some of the things done to improve the Fanfare experience for you and your customers. It will also focus on key Fanfare features and functionality, best practices for selling the value of loyalty marketing and in establishing a core loyalty program, the boarding process and who you and your customers can contact with support questions.

Register Now!

Posted in Best Practices for Merchants

September 3rd, 2015 by Elma Jane

Today, there are numbers of dedicated invoicing software solutions to choose from, but also, specifically built to handle all aspects of invoicing. Whether you send out invoices in the mail, electronically or both. NTC’s Cloud-based invoicing software is a way to simplify your invoicing processes.

National Transaction help merchants consider making the switch to online invoicing methods.

If you’re considering making the transition, check National Transaction’s Electronic Invoice.

Once the transaction is approved a confirmation email is sent to the merchant and consumer.

Benefits of Electronic Invoicing:

Ease of use – Merchants only needs to enter the email address and the amount of sale to complete order.

Better security – Card Holder enters credit card data directly into an acquiring bank system. Bank stores such sensitive information in an encrypted format on remote servers. This reduces your liability and makes it so you won’t lose all your important data if your server gets hacked or destroyed.

Collect useful sales information – Most invoicing software has reporting capabilities which let you track payments, projected income and client history.

Get paid faster – E-Invoice can be paid the same day. The sooner you send your invoices, the sooner you are likely to get paid. With NTC Electronic Invoice, you can schedule invoices to be sent out ASAP, which means faster, more reliable income for your business.

Look more professional – Invoicing software typically includes professional-looking invoice templates, which you can customize with your business name and logo.

Emailing clients invoices instead of mailing them printed bills, is approximately 10 times cheaper than paper invoicing.

Send invoices from anywhere – Cloud-based invoicing software can be accessed from anywhere with an internet connection. This means you can easily invoice customers or access your business’s billing information wherever you are in the world, and even from your phone if you need to.

Interested in Electronic Invoicing? Give us a call 888-996-2273 or go to our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: bank, card, card data, credit card, Electronic Invoice, invoicing, merchants

August 27th, 2015 by Elma Jane

Merchant processing fees is one expense you should look at as an investment. If you try to avoid merchant processing fees, you risk antagonizing prospective buyers and losing opportunities.

If you limit payment options for customers, you run a real risk of losing customers.

In addition to losing customers, you can run the risk of not being able to close deals. If you don’t provide your customers with easy, hassle free ways to pay they will likely seek out other vendors that do offer more convenient ways to pay for the services they need.

Do yourself and your business a favor, offer prospective customers and existing customers easy ways to pay you. Your customers will appreciate it and in return, are more likely to become repeat customers.

We live in a nearly cashless society. Accepting credit cards is a requirement in today’s business trend.

For Merchant Account Setup give us a call at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: cards, credit cards, merchant, merchant account, processing fees

August 24th, 2015 by Elma Jane

How can you protect your business if its card-not-present or keyed-in transactions?

Get to know your customer – Before processing large card-not-present transactions, make sure you know your customer. Be sure to check their ID and make sure the information on it matches the payment information they give you.

Have delivery confirmation – If shipping your product, make sure to request tracking information and a delivery receipt. If you are sending a large order, you will want to request a signature confirmation at delivery.

Match the billing and shipping zip codes – When shipping your product, you want to check to see if the billing zip code given for the payment matches the shipping address zip code. If the zip codes don’t match, ask your customer why. If their answer doesn’t make sense to you, or sound plausible – don’t accept the payment.

Obtain a signature – This is especially important for large transactions. Make your customer sign an invoice, a contract that states your refund policies and gives you authorization to take the payment or a credit card authorization form. Once signed, keep this document on file.

Request card information – Make sure customers can give you the name on the credit card, the card number, the expiration date, the CVV2 security code and the correct billing address if you are keying in a payment without a card.

A tip from National Transaction Corporation 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: card-not-present, credit card, keyed-in transactions, payment

August 24th, 2015 by Elma Jane

Mike Marchev has a saying every travel agent should repeat each day: “Your clients are somebody else’s prospects.” With others in the marketplace vying for the attention of your clients, it is important for you to consider exactly how accessible the public perceives your travel business. Accessibility is sum of the characteristics that makes you easy to remember, easy to find, approachable, likable, and worthy of trust. Each of these elements are wrapped up in your approach to the market and should be given fair consideration as you position your company in your community.

The public’s perception of your accessibility is shaped by how often they see your brand and the brand image you project. If the elements of your branding indicate a luxury travel niche, many consumers will be drawn to it and some portion of the market will find it unapproachable. If your branding efforts emphasize family travel, with images of children and families enjoying vacations together, then you will very likely attract that demographic. There is nothing wrong with either approach, but it is vital the brand you intend to project is indeed the brand that is reflected in your marketing efforts.

Your company name, logo, and contact information need to be “front and center” in each marketing effort you undertake. These are the key graphical elements by which your marketplace will identify and reach out to you. Reproduce these elements consistently in each and every point of contact where appropriate. The familiarity you thereby create is an important component to the sense of accessibility people will have of your company – they will feel as though they already know you, who you are, and what you do.

Likewise, your public relations efforts in your community should be geared to creating a fundamental familiarity with your branding and market position. The more “present” you are in your community, the more networking you undertake, the more events you sponsor or for which you volunteer, the better known will be your brand. The friendlier your persona, the more approachable you are and the degree to which you can engage your clients on an emotional level, the more approachable and accessible you will be perceived.

Remind your clients that you are there. How often do you reach out and touch each and every client in a personal way? How about a phone call, a hand written letter, or a lunch? Not to sell anything, but just to say “hello!” Want clients to think of you as accessible? Begin by first approaching them.

People do business with people. They want to engage with people they like, appreciate, and trust. If your company has a flat, dull persona, it is not likely consumers will perceive it as approachable. Clients want to do business with a personality. They want to know the people in charge of their plans, running the company, and protecting their interests. Your marketing should be charged with personality.

The energy required for marketing in this manner is considerable. Being in business requires a dynamic yet focused awareness of the impact of one’s brand on the public. For a travel consultant engaged in very personal one-on-one services, this means a personal investment in time and energy. Because, as a travel agent, you are your own brand.

by Richard Earls in Publishers Corner

Posted in Best Practices for Merchants Tagged with: business travel, travel, travel agency, travel agent, travel industry