Category: Best Practices for Merchants

July 10th, 2015 by Elma Jane

Every Merchant in the country needs to upgrade their terminal. Are you ready for the October 1, 2015 Liability Shift?

Beginning October 1, 2015, all businesses that accept in-person payments must be able to take cards embedded with chips to avoid liability for fraud. The chips are more secure than magnetic stripes.

National Transaction brings the latest EMV and NFC technologies to Merchants.

NTC Clients will be able to accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. Additionally, the Ingenico terminals are EMV Enabled, delivering the latest in fraud prevention technology.

The new EMV enabled terminals are designed to accept EMV chip cards and magnetic stripe cards.

EMV (an acronym for Europay, MasterCard® and Visa®) is a global technology standard for payment cards.

What are the benefits of having an EMV terminal?

These next generation terminals can reduce your risk of accepting counterfeit cards, as chip and PIN transactions verify both the card and the cardholder.

Eliminate your card present fraud liability exposure associated with the October 1st, 2015* liability shift imposed by the card brands.

Improve customer service for your international cardholder customer. EMV cards are already the standard in over 80 countries.

Be on the lookout for more information about how to be chip card ready before OCTOBER.

*Businesses with Automated Fuel Dispensers (also called “Pay at the Pump”) acceptance methods have until October 2017 to comply with the new standard.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: cardholder, cards, chips, EMV, emv cards, EMV terminal, EuroPay, magnetic stripes, MasterCard, merchant, nfc, payment cards, payments, PIN transactions, terminal, visa

July 7th, 2015 by Elma Jane

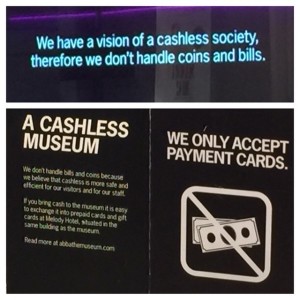

Cashless society is about to happen, hard to believe for some. We are all unable to decide on the edge of a new, cashless world where mobile payments reign supreme. If so, is this a bad thing? For some people yes, because for them change can be scary.

Every revolution needs a good crisis in order to grow its seed. The cashless revolution is the same. Current global financial conditions serves as the potential crisis, and truly the cashless revolution is upon us. Society is on the brink of great economic change, which will likely usher in a new era of worldwide, electronic currencies. The cashless society is coming.

Advances in mobile payment options as evidence of this impending cashless society, consider the practical benefits of mobile payments for the consumer. The most obvious is convenience. Many people prefer to swipe their smartphone atop a scanner to carrying around a stack of cash. Electronic payments are traceable, which is useful for tracking one’s spending and can add a sense of security. Also, carrying around large stacks of cash isn’t always feasible or safe.

Mobile payments also offer interested individuals a way to incorporate social media into their purchases; they can check-in to a site and tell all their friends about an exciting new product they bought, or announce their presence at a new coffee shop, all with that same initial swipe of an NFC-enabled phone. Add to this the many practical benefits of mobile payments as far as business owners are concerned, and it’s easy to see why so the technology is becoming so widespread.

And yet for all the benefits of mobile payments and point of sale technology, the two don’t necessarily exclude cash. Other company focuses on blending cash transactions with POS. This allows technologically savvy businesses to incorporate POS and mobile payment technology into their business, without excluding potential customers who prefer to use cash.

We aren’t necessarily evolving towards a cashless society, but towards a society with a plethora of payment options. POS technology is all about options. Want to pay with a swipe of your credit card? Swipe your credit card. Want to tap your NFC-enabled phone against a console. Tap and go. Want to pull a crisp twenty-dollar bill from your wallet and walk away from the counter with milk and eggs in your hand and a handful of coins jingling in your pocket? Go for it.

The question is: Will we ever become a truly cashless society? Maybe, maybe not, but as mobile payments become increasingly common, cash may very well fall into the retro category.

Posted in Best Practices for Merchants, Mobile Payments, Near Field Communication, Point of Sale Tagged with: credit card, electronic currencies, electronic payments, Mobile Payments, nfc, point of sale, POS, swipe

July 7th, 2015 by Elma Jane

The global brand MasterCard is in the process of launching a pilot program with the help of Google, BlackBerry, Apple, Microsoft, and Samsung to boost security for online payments using facial recognition systems.

About 500 customers are trialing for the new features, participants will provide feedback based on their experience. The company will continue to refine the product until ready to launch. MasterCard confirmed that it is planning to eventually release the new biometric security system publicly.

The payments company is also in the process of securing agreements with two major banking institutions. If all goes as planned, the undisclosed financial establishments will likely participate in the launching of the new security option.

When consumers shop on the Internet, their banks need ways to verify their identities. So this particular product seamlessly integrates biometrics into the overall payments experience, a security expert at MasterCard said.

The system does not actually save a photo of the user during the verification process. Instead, it creates a map of the individual’s face. Afterwards, the map is turned into code, which is sent to MasterCard for confirmation. The facial recognition feature only kicks in when an individual makes an online purchase.

During checkout, users will be prompted to confirm their identity using fingerprint scanning or facial detection.

To prevent criminals from using a photo to dupe the verification process, a user is required to blink once while having his or her face scanned. Technical specifications and mobile requirements for the security feature are still unknown.

With the test of facial recognition, MasterCard seemingly hopes to move away from password-based protocols by providing additional security options for consumers.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: consumers, financial establishments, MasterCard, online payments, payments, payments company, products, Security

June 26th, 2015 by Elma Jane

As you can tell from the name, Android Pay playbook is remarkably similar to Apple Pay. Android Pay will use an on-board Near Field Communication (NFC) chip and tokenization services from the major networks to deliver a token from the phone to an NFC-enabled point of sale. Just like Apple Pay. Android Pay is supported by more than 700,000 merchant locations and Android Pay will provide APIs for app developers to take in-app payments from the on-board wallet. Both Apple Pay and Android Pay have fingerprint scanners on phones, you can enable payments with just a fingerprint scan.

While details are barely sufficient, rumor has it Google won’t charge banks a fee as Apple does on the transactions and that’s the difference. Additionally, technical differences in the operating systems underlying the payment system exist, but they won’t affect how every day users experience the system. Android Pay will suffer a slower upgrade path than Apple Pay, due to the lack of hardware support for the newer operating system (it can take Android twice as long to get users upgraded).

There is no war between Apple and google. NFC won the war! We are seeing all of the armies gather together under its flag. As consumers, we love to see better products. When it comes to payments, we need standards and reliability.

With the alignment of the two operating system platforms on NFC, on user experiences like fingerprint unlocking and on both in-app and retail payments, consumers, retailers, and app developers can build an ecosystem we can all understand. Credit cards work great because they are ubiquitous. Everyone can use them everywhere, and every retailer has incentives to be a part of the system.

An NFC-based mobile payments experience will have this same effect. Over the next five years more and more retailers will add NFC-capable terminals. More phones will be fully capable of NFC payments with fingerprint sensors. More consumers will carry those phones.

So if it’s not a war, are there any losers? Companies focused on plastic cards, but not NFC. Transitory technologies like Samsung Pay’s MST (magnetic secure transmission) also have a strong transition period as they enable payments at non-NFC enabled terminals. MST (magnetic secure transmission) is a strong player because the user experience is very similar (hold a phone to a reader), even if the technical method is not the same.

Posted in Best Practices for Merchants, Near Field Communication Tagged with: banks, chip, credit cards, merchant, Mobile Payments, Near Field Communication, nfc, NFC payments, NFC-capable terminals, NFC-enabled, payment system, payments, point of sale, tokenization

June 25th, 2015 by Elma Jane

A product or service using a credit card or debit card should be efficient, fast and most importantly safe. There are a lot of regulations in place to make sure that the processing of payments using a card is safe and secure. One of the way is the EMV (Europay, MasterCard and Visa) technology, where payment cards used in an ATM and POS Terminals have been embedded with microchips. This form of payment technology has long been in use and is widely accepted in many regions such as Europe, Canada and Asia Pacific. The US, which is considered to be the largest number of plastic card users is one of the countries that have not yet fully optimized this otherwise global standard.

Advantages Of EMV – EMV embedded chip is a lot more secure than the traditional magnetic stripe, especially when it comes to face-to-face credit/debit card transactions. Credit card fraud is rampant, but using this embedded chip has added another layer of protection against consumer fraud. Once the card has been inserted into a terminal, the payment will then be authenticated and processed using the EMV network. The chip within the card is hard to duplicate.

What Does This Mean For Your Business? – You will create more credibility and garner more customers in the market place by utilizing this more safe and secure payment method. There will be increased in consumer confidence.

What Happens When You Don’t Upgrade? – There is a Liability Shift. Currently, If a payment processing transaction has been approved and it turns out to be fraud, it’s the card issuer loss. With the new rule, liability shifts to merchants who has not implemented the EMV technology. When fraud happens, the responsibility falls on the business owner who makes the transaction.

How To Prepare Your Business For EMV? – Upgrade your terminal. Contact National transaction and we’ll help you prepare your business for the EMV migration.

Upgrading your current payment processing system is easy with NTC.

Give Us A Call Now! 888-996-2273

Check our website http://nationaltransaction.com click Demos and Videos to learn more!

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Point of Sale Tagged with: atm, card, chip, credit card, Credit card fraud, debit card, Debit Card transactions, EMV, EMV migration, EMV network, EuroPay, magnetic stripe, MasterCard and VISA, merchants, microchips, payment, payment cards, payment processing, payment technology, payments, POS terminals, terminal

June 18th, 2015 by Elma Jane

Every Merchant in the country needs to upgrade their terminal.

Are you ready for the October 1, 2015 Liability Shift?

Beginning October 1, 2015, all businesses that accept in-person payments must be able to take cards embedded with chips to avoid liability for fraud. The chips are more secure than magnetic stripes.

National Transaction brings the latest EMV and NFC technologies to Merchants.

NTC Clients will be able to accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. Additionally, the Ingenico terminals are EMV Enabled, delivering the latest in fraud prevention technology.

The new EMV enabled terminals are designed to accept EMV chip cards and magnetic stripe cards.

EMV (an acronym for Europay, MasterCard® and Visa®) is a global technology standard for payment cards.

By accepting chip cards EMV terminal, you help protect your business from card present fraud liability and prepare your business for the future of payment application technology. If your business accepts and processes a counterfeit card transaction on a non-EMV terminal, the liability for that fraudulent transaction is yours, not incurred by the card issuers.

How do you process an EMV chip card transaction?

- Insert Card. Instead of swiping, the customer will insert the card into the terminal, chip first, face up.

- Leave the Card in the Terminal. The card must remain in the terminal during the entire transaction.

- The Receipt or Enter a PIN. As prompted, the customer will sign the receipt or enter their PIN to complete the transaction.

- Remove Your Card. When the purchase is complete, remind the customer to take the card with them.

What are the benefits of having an EMV terminal?

These next generation terminals can reduce your risk of accepting counterfeit cards, as chip and PIN transactions verify both the card and the cardholder.

Eliminate your card present fraud liability exposure associated with the October 1st, 2015* liability shift imposed by the card brands.

Improve customer service for your international cardholder customer. EMV cards are already the standard in over 80 countries.

Be on the lookout for more information about how to be chip card ready before OCTOBER.

*Businesses with Automated Fuel Dispensers (also called “Pay at the Pump”) acceptance methods have until October 2017 to comply with the new standard.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: cardholder, cards, chips cards, contactless payment, EMV, emv chip cards, EMV terminal, EuroPay, magnetic stripe cards, MasterCard, merchant, nfc, payment cards, payments, visa

June 16th, 2015 by Elma Jane

When you own a travel agency, a merchant account can take the worry out of the financial side of your business. Since many people prefer to pay for their vacation services with a credit card, your Merchant Account will ensure that you’re able to process those payments as easily and efficiently as possible.

Merchant accounts generally work in real time. Payment processing occurs immediately, with quick authorization, you and your customer will know right away that the payment has gone through. These types of accounts allow your business to accept almost every major brand of credit card. This further benefits your customers by allowing them to pay through the cards that they have.

You can also offer your customers advanced payment processing solutions that include more than simple credit card payments. That’s important in this economic climate, when many people are turning from credit cards to other methods of payment.

Debit cards, checks, pre-paid cards, and electronic transfers are all available through Merchant Accounts.

Debit cards are somewhat treated like credit cards when you have a Merchant Account, ensuring that you’ll receive the promised funds before your client sets foot on their cruise ship or the airplane.

New business should lead to repeat business, and with a loyalty program set up through your Merchant Account, it will! Your merchant account provider can customize a loyalty program for you.

Creating a loyalty program will bring repeat business, increase the amount of money that customers spend with you, attract new customers to your business and, most importantly, keep them coming back.

Online payments are another benefit you’ll enjoy when you set up a Merchant Account. With online payments, your customers can click on your website, set up their own vacation itineraries, and pay for their trips simply by entering their payment data into a secure online form. The payments will be validated instantly, so your customers will know that their vacation has been authorized within seconds, and you will have access to those funds by the following day.

Finally, one of the best things about a merchant account is that the funds will be available to you the next day. Your customer pays you today and you can access the funds tomorrow. This improves your cash flow and makes it possible for you to take care of your business expenses in a timely manner. And, as you know, paying for things on time usually means those things cost you less money.

You’ll save money and time by setting up a merchant account, and you can do it today with National Transaction! (888)-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants, Merchant Account Services News Articles, Travel Agency Agents Tagged with: checks, credit card, credit card payments, debit cards, electronic transfers, loyalty program, merchant account, merchant account provider, online payments, payment data, payment processing, payments, pre-paid cards

June 15th, 2015 by Elma Jane

Merchants Provided Access to Digital Payments Innovations for Store-Branded Cards through Partnerships with Synchrony Financial and Citi Retail Services

Purchase, NY – June 15, 2015 – MasterCard today became the first payment network to provide tokenization services to private label (store-branded) credit card issuers, enabling merchants to take advantage of the latest digital payment innovations. BJ’s Wholesale Club, Kohl’s and JCPenney will be among the first retailers to bring mobile payments to their private label cardholders later this year. The company also announced partnerships with some of the largest private label credit card issuers in the U.S., including Synchrony Financial and Citi Retail Services, to enable consumers to use their eligible credit cards within participating mobile payment and digital wallet services.

According to Equifax’s National Consumer Credit Trends Report, the number of open retail credit card accounts exceeded the 195 million mark by the fall of 2014. As the only network to offer private label support for wallet service offerings, MasterCard continues to enable consumers to pay when, where and how they want – and on the device of their choice.

Tokenization support for private label issuers is made possible through the MasterCard Digital Enablement Service (MDES), which enables a connected device to be securely used for everyday shopping and payments. MDES supports contactless (NFC) payments with a mobile device at a physical point of sale, as well as from within a mobile app. Transactions are secured using industry-standard EMV cryptography and take full advantage of the most secure payments technology in the world.

“Thanks to our ongoing innovation and strategic partnerships, we are helping shape the future of how private label credit cards work in whichever digital wallet customers choose,” said Margaret Keane, president and CEO of Synchrony Financial. “It was recently announced that our retail partner, JCPenney, will be among the first to offer its private label credit cardholders the ability to checkout with Apple Pay later this year. We are committed to working with our retail partners, MasterCard, and key payments industry players to preserve the benefits of our private label credit cards and patented Dual Cards in third-party digital wallets.”

“We’re seeing significant momentum and innovation around digital wallets, and a key focus for MasterCard is that consumers can leverage these new offerings safely and securely. MDES was developed to ensure that any connected device can be used to make purchases, and deliver the simplicity, security and convenience people have become accustomed to when using a MasterCard account of their choice,” said Ed McLaughlin, chief emerging payments officer, MasterCard. “MasterCard is helping merchants capitalize on mobile payments, ensure the best possible consumer experience for their consumers and encourage both repeat business and customer loyalty.”

Since the announcement of MDES in 2013, millions of MasterCard accounts have been tokenized for use in popular digital wallet services. MDES currently provides tokenization services for credit, debit, co-brand, prepaid and small business cards, with private label tokenization beginning in the third quarter of this year.

Posted in Best Practices for Merchants Tagged with: credit cards, digital paymets, Digital wallets, merchants, Mobile Payments, payment network, technology innovation, tokenization

June 5th, 2015 by Elma Jane

Traditionally, travel-related merchants have a difficult time obtaining merchant accounts. National Transaction Corporation (NTC) is a full service merchant account provider with extensive experience in the travel arena and related markets, servicing thousands of travel-related merchant accounts by specializing in non-cash electronic transactions. Our services include processing credit card transactions, gift card transactions, and e-commerce transactions, among others. We offer a full line of products including credit card terminals, cellular devices, supplies, and accessories for each model sold. We offer aggressive rates and pricing for mail/telephone order, retail/restaurant, wireless, and online transactions while specializing in the travel and high volume sectors of merchant processing, and we are proud to be the preferred merchant provider for ASTA.

NTC is dedicated to providing the highest caliber of service and solutions in the merchant processing industry. We actually answer the phone when you need assistance! NTC has a team of dedicated employees providing personalized service to each account holder and are available directly through their toll free number, never hidden behind a menu system. Our excellent service truly separates us from everyone else in the industry. The principals of NTC have extensive experience in the processing arena for over 25 years, with experience in all facets of operation, including credit cards, credit initiation, credit investigation, loss prevention, deployment, and customer and terminal support. We employ internal sales associates as well as independent sales agents who offer many opportunities through their referral reward services and Independent Sales Organization (ISO) programs.

NTC’s online gateway allows for processing transactions, reviewing account history, and interacting with various shopping cart and accounting applications such as QuickBooks, Peachtree, and many other titles. Reservation software such as Trams are compatible and integrate well with all National Transaction merchant accounts. Whether you are a travel agency or an independent agent, we offer many solutions that cater to the travel industry and will increase your revenue with quicker deposits into your bank account.

Travel environments are unique in that your transactions are usually keyed; there is almost always a delayed delivery period, and large ticket transactions are not uncommon since one card holder may be paying for multiple tickets. They also tend to be seasonal, with peak season months generating an unusual spike in their “average” monthly volume, and charge-back’s pose a potential threat by travelers who are unable to complete their trip. Combine even a few of these factors together and you have cause for a reserve, or even account termination. National Transaction Corp specializes in understanding what makes your transactions unique, as a travel agent, and how they affect your merchant account.

The importance of customer service is something that is over looked when merchants compare the overall cost of monthly fees with their merchant account. That is, until the moment they need assistance with their account. Whether searching for missing deposits, having problems processing transactions, issuing refunds, processing voids, or questioning their billing statement, a merchant should always remember you get what you pay for. If you wonder why they can offer you no monthly fee, they are offering you no LIVE customer support. Customer support for them will come via means of email. You will wait hours for answers, and even days for a simple confirmation or general email, let alone a resolution.

National Transaction Corporation has over 17 years of dedication and experience in providing quality solutions in the credit card processing arena. From internet e-commerce applications to food stamp processing, from small start up businesses to fortune 500 companies, NTC has a complete product selection to customize a solution to grow with your business. We at NTC pride ourselves on being a full service, member service provider. It is our mission to provide the same dedication and service in maintaining your business as you experience in us earning your business. NTC will provide service after the sale. It is that service that sets us apart! For more information, contact NTC for world class service and solutions.

Contact National Transaction Corporation today at 888-996-2273 to see how we can help you with your travel merchant account, or visit us online at www.nationaltransaction.com for more information.

by Elizabeth Cody (Travel Research Online)

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Gift & Loyalty Card Processing, Merchant Account Services News Articles, Merchant Cash Advance, Travel Agency Agents Tagged with: ASTA, bank account, billing statement, credit card terminals, credit card transactions, credit cards, customer service, deposits, e-commerce, e-commerce transactions, electronic transactions, gift card transactions, Independent Sales Organization, ISO, merchant account provider, merchant accounts, merchants, service provider, travel, travel agency, travel agent, travel industry

June 4th, 2015 by Elma Jane

Electronic gift card processing increases revenues and attracts new customers. They also reduce the fraud and labor with traditional paper gift certificates.

National Transaction offers customized gift card processing merchant services tailored to your gift card processing needs.

Gift cards provide added incentives to your customers and employees such as:

Bring in New Customers – Cards given by loyal customers to friends and family increase your exposure to your intended market. Gift Cards are ideal for promotion through mailings, corporate gifts, charitable donations and many other marketing efforts.

Encourage Repeat Business – For regular customers, enable them to retain a prepaid balance for recurring services. Promote come back rewards such as receive $5 off of your next purchase of $50 or more.

Great for Gifts – Gift Cards are the perfect gifting solution for the holidays. They get to choose their own present. Attract new customers and boost sales all year long. Perfect for showers, Mother’s Day, Birthdays and Graduations.

Increased Sales and Profits – Gift Card Holders spend on average 25% more than the total value of the card. Because no cash back required, returns stay on the card and never leave your business.

Popular with your Employees – Employees love incentives. Provide bonuses and rewards to keep them happy and revenue within the business.

By issuing gift cards and not refund you get the money back into your store from returns and refunds. Gift cards are given to your new customers many times. You pay top dollar for advertising. Gift cards escort new customers in the door!

Posted in Best Practices for Merchants Tagged with: Electronic gift card, gift Card, Gift Card Processing, gift certificates, merchant, merchant services