Category: Best Practices for Merchants

January 19th, 2015 by Elma Jane

NTC Preferred and Trusted Talk to us NOW! 888- 472-7112

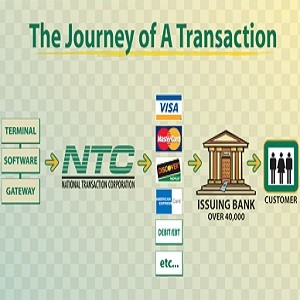

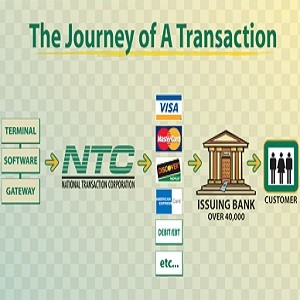

National Transaction Corporation’s goal was to make any transaction as effective and efficient as possible. The mission was to make digital transactions reliable and simple to the merchant and familiar to the consumer, reducing the complexity and expense to both.

NTC is the preferred payment processor for many organizations and associations. STAA (Specialty Travel Agent Association), Cruise Holidays, ASTA, CLIA (Cruise Lines International Association), Home Based Travelagent.com and Travel Leaders.

NTC is a trusted merchant account service provider through integrations, security compliance and many more. Trustwave, TRAMS a Sabre solution, PCI Security Standards Council, VeriFone, Vital and TSYS.

Posted in Best Practices for Merchants

January 15th, 2015 by Elma Jane

The fact that your business needs a mobile presence is by no means news. Brands today know that being accessible to the increasing number of smartphones and tablet users is a must NOW, the goal is to provide a top-notch user experience.

Mobile is opening the door for designing new experiences that complement a brand’s physical presence. The context of WHEN, WHERE and WHAT a customer is doing during their day allows companies to enhance a person’s interaction and customize device-specific experiences.

Brands will need to meet the following mobile experience expectations in 2015:

Combating fraud through mobile. Mobile users want to safeguard themselves against fraud, and 56 percent are willing to deal with a slightly more complex user experience if it means greater protection. Businesses can provide an intuitive, high-quality mobile experience that also protects against fraud by offering to validate transactions, set fraud controls and generate unique payment IDs through the user’s mobile device.

Complement, not copy: E-commerce providers must leverage mobile to complement the user experience, rather than provide a replica of what users get through a Web browser. Nearly 4 in 10 mobile users are most likely to use their mobile phone for shopping, so businesses need to ensure that those customers are getting something unique from their mobile interaction.

CRM through mobile marketing: Mobile marketing isn’t just for acquisition anymore. Today, it’s about boosting loyalty by using mobile for customer, consumers always have their mobile device on them and check it more than 150 times a day. Businesses can communicate with their existing customers through alert notifications, in-app, email and mobile Web. But don’t overdo it. The key to maintaining an effective relationship is doing so in a complementary way, giving users what they need when they need it.

Mobile apps and mobile Web: Got a mobile app but not a mobile-friendly website, or vice versa? You might want to put your energy into leveling out your mobile presence. Consumers are about equally split when it comes to their preference of app versus browser: The percentage of users who prefer their mobile browser when completing a task 28 percent is only slightly higher than the 23 percent that prefer to use an app. Both app and Web designs are critical for businesses in the mobile space, so it pays to do them right.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: consumers, crm, customers, e-commerce, mobile, mobile device, payment, provider's, Smartphones, transactions

January 12th, 2015 by Elma Jane

Mobile Point of Sale (POS) systems have rocked the retail world and the trending topic when it comes to POS is all about the mobile kind. When one searches the term POS, nearly every article that comes up is all about mobile, and many seem to believe it will change the retail industry.

Is traditional POS on its way out? Not so fast.

While mobile POS is indeed a hot topic, it is likely to be an enhancement, rather than a replacement, to traditional POS

There is definitely a need and a place, for both.

Everyone was certain that dot.coms would eradicate brick-and-mortar stores; they are still alive and well, and traditional brick-and-mortar stores have, like traditional POS, embraced the Internet and allowed it to serve them in the capacity of extension.

Retailers everywhere have incorporated the Internet into their business model by creating multi-channel sales strategies, such as e-commerce, digital marketing, social media marketing, online product information, specifications, reviews and online customer service.

In addition to their online presence, these same retailers have started to bring the Internet in-house by integrating such services as customer centric promotions at point of sale, introducing loyalty programs and member registration, facilitating digital signage, offering e-receipts via email, and self check out centers; all at the traditional POS kiosk.

Why bother with mobile POS anyway?

While it is true that traditional POS systems won’t be going anywhere soon, and with good reason, mobile POS systems have allowed retailers to make great strides when it comes to efficiency and customer service, as well as customer satisfaction.

Since the advent of Mobile POS, companies have made big changes in the way they handle customer transactions in-store, thus affording faster checkout, waiting line reduction, consultative selling, and more.

The list of mobile POS benefits goes on and on:

Email Receipts: Better for the environment, more convenient for customers and faster to process. A digital purchase receipts sent via email tells the customer that you care about the earth and about them.

Expanded Reach: With mobile POS, your sales are no longer confined within the four walls of your brick and mortar store. Sidewalk sales, seasonal mall kiosks, and special sponsorship events are just a few examples of all the places you can take your retail sales to, with a POS in hand.

Inventory and Price Search: When customers can be assisted with finding an item color, size or availability on the spot, rather than having to wait in line to do so, it makes them happier. The same can be said for pricing. POS in the hands of store reps can go a long way toward customer satisfaction.

Inventory Return Stations: There is always a certain volume of returns, but that volume increases for retailers particularly after the holidays. The implementation of mobile POS allows for retailers to set up additional return stations in order to avoid long lines and customer frustrations.

Mobile POS goes Mobile: Your investment in your company POS system doesn’t need to be one size fits all, regardless of store traffic volume in one location or another. Retailers may opt to have a blow out sale in one location, thus require additional checkout power for that location for a specific period of time. With mobile POS, devises and licensing can be utilized throughout different store locations on an as needed basis.

Optional Seasonal Subscription: The great thing about mobile POS is that you needn’t pay for a POS system year round if you’re not using it year around. Seasonal spikes in retail sales warrant the additional cost of extra POS licensing and hardware, but the rest of the year your budget shouldn’t need to encompass more than what is needed. Mobile lets you better manage your overall POS investment.

Storewide Promotion Opportunities: Mobile POS has allowed retailers to drive sales in various sections of the store by holding demonstrations or promotions in different departments to tout products or services. Customers can be marketed, and sold to, on the spot.

The growing industry of mobile payments doesn’t stop at in-store mobile POS. Digital wallets like Google Wallet and Apple Passbook, mobile-to-mobile cell phone transfers, Near Field Communication (NFC) payments, mobile device credit card swipe and other emerging technologies are quickly changing our cash and credit card world.

What about traditional POS?

Mobile payment systems are indeed terrific. So, when should you consider going with traditional POS? The reality is, in addition to the aforementioned benefits of traditional checkout kiosk functions, there times when mobile POS simply will not suffice.

Mobile POS is great when a customer wants to choose and pay for one item while on the sales room floor, but what about when the customer has a multitude of items? Ringing up and bagging groceries, removing anti-theft mechanisms, neatly folding and bagging clothing items and managing the sales of numerous agents, stations or departments are just a few examples of situations that often require the traditional POS checkout station.

By combining traditional POS strategies with mobile POS flexibility, retailers can leverage the command of a complex, and multi-dimensional, marketing and retail sales management system.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: brick and mortar, credit card swipe, credit-card, customer service, digital marketing, Digital wallets, e-commerce, mobile device, Mobile Payments, mobile point of sale, mobile pos, multi-channel, Near Field Communication (NFC), POS, retail industry, social media

December 15th, 2014 by Elma Jane

Every business knows how crucial sales are to keeping a company going. Without paying customers, there’s no money coming in, which means no profits to help the business grow. But convincing people to buy something isn’t always an easy task for a sales person, and many entrepreneurs still struggle with selling.

It’s not about giving a rundown of the facts and features of a product, it’s about communicating the ways in which it can help the buyer. Stop thinking from the sales perspective. Think about what it will do for others. Take your elevator pitch and transcend it to other people’s perspective and solve their problems.

Five key components to a successful sales presentation.

A call to action. Ask someone to take action at the end of a sales presentation. If you don’t ask for the sale, they probably won’t go through with it. Always approach sales from a helping perspective. Instead of putting pressure on sales reps to make the sale, focus on what the product means to the buyer.

If your sales team focus on how to communicate effectively and help the person, it takes pressure off and puts the focus and energy where it needs to be. A superior salesperson inspires the buyer to feel the benefits of what they have.

A grabber. This is a mutual point of agreement where sales person connect with the buyer. This is usually established in a face-to-face conversation (the person nods in agreement when sales reps speak to them), but if you’re not able to see the person, you need to start off with the mind-set that he or she agrees with what you’re saying.

A point of difference. Explain to the buyer what’s different about your product, and why it occupies a unique space in the market.

A solution to a problem. Consumers purchase products that they believe will solve a problem they have. Your product may be the perfect solution, but they won’t know that unless sales reps explain the problem and how they can solve it. Stating the problem you solve and talking about it as much as if not more than the solution.

WSGAT. (What’s So Great About That?) is all about demonstrating the benefits of using your product. When discussing your product’s features, a sales person can’t just spout facts. You need to understand why a buyer should care about that feature, and how it contributes to solving the problem you outlined.

Posted in Best Practices for Merchants Tagged with: consumers, customers, product, sales

December 15th, 2014 by Elma Jane

Every business knows how crucial sales are to keeping a company going. Without paying customers, there’s no money coming in, which means no profits to help the business grow. But convincing people to buy something isn’t always an easy task for a sales person, and many entrepreneurs still struggle with selling.

It’s not about giving a rundown of the facts and features of a product, it’s about communicating the ways in which it can help the buyer. Stop thinking from the sales perspective. Think about what it will do for others. Take your elevator pitch and transcend it to other people’s perspective and solve their problems.

Five key components to a successful sales presentation.

A call to action. Ask someone to take action at the end of a sales presentation. If you don’t ask for the sale, they probably won’t go through with it. Always approach sales from a helping perspective. Instead of putting pressure on sales reps to make the sale, focus on what the product means to the buyer.

If your sales team focus on how to communicate effectively and help the person, it takes pressure off and puts the focus and energy where it needs to be. A superior salesperson inspires the buyer to feel the benefits of what they have.

A grabber. This is a mutual point of agreement where sales person connect with the buyer. This is usually established in a face-to-face conversation (the person nods in agreement when sales reps speak to them), but if you’re not able to see the person, you need to start off with the mind-set that he or she agrees with what you’re saying.

A point of difference. Explain to the buyer what’s different about your product, and why it occupies a unique space in the market.

A solution to a problem. Consumers purchase products that they believe will solve a problem they have. Your product may be the perfect solution, but they won’t know that unless sales reps explain the problem and how they can solve it. Stating the problem you solve and talking about it as much as if not more than the solution.

WSGAT. (What’s So Great About That?) is all about demonstrating the benefits of using your product. When discussing your product’s features, a sales person can’t just spout facts. You need to understand why a buyer should care about that feature, and how it contributes to solving the problem you outlined.

Posted in Best Practices for Merchants Tagged with: consumers, customers, product, sales

December 1st, 2014 by Elma Jane

Few Americans will likely remember the life and work of Martin Cooper, largely because most Americans have no idea who Martin Cooper is. Without Martin Cooper much of what we identify as normal life for the last two decades would not have been possible, as without his invention we would still be looking for pay phones, dropping off film to be developed, printing out boarding passes and contemplating a future where a plastic rectangle was the height of payments technology.

Anyone reading this has a phone with internet access which means no one has to guess, with a few taps on a smartphone most readers who didn’t already know were able to find out that Martin Cooper invented the handheld mobile phone and by so doing changed the lives of not just Americans, but people all over the world.

Mobile has integrated so seamlessly into our life that we didn’t realize it was changing everything we do.

Here are the list of all of the ways that mobile has improved life for us all.

We All Get To Know Everything All The Time, with just a smartphone. Impulse buy is a thing of the past because consumers just don’t buy on impulse as much anymore. A new intentionality has taken hold of shopping. Many Americans have the money and the will to spend. But they are time-pressed and deal savvy, visiting stores only when they run out of items like cereal or toilet paper and after doing extensive research on purchases online and with friends. They buy what they came for and then leave. Plus consumers are harder to fool, they know if they are being overcharged because they can look it up in real time while they are in the showroom.

Full Price Is A Notion Utterly Without Meaning. There are sites like Groupon, LivingSocial and a thousand imitators offer coupons pretty much across every retailer that mean no matter where one is shopping or eating they’re probably a few button taps away from paying less for the type of service they are out for. And then there are the retailer rewards programs all bent on giving consumers more stuff for free as long as they use their mobile coupons.

We All Think Way More About Privacy And Digital Security Than We Used To. Twenty years ago one’s largest security concern was probably that their home or car would be broken into, followed closely by their wallet being stolen. Now we wait for Russian cybercriminals to steal our cards by hacking into POS systems and lifting the data. Or for cybercriminals to hack our phones and upload naked pictures of us to the internet (celebrity readers only). Or for Nigerian princes to trick our grandparents into wiring them money. In short, while we still fear for our physical possessions as much as we ever did, the mobile world gave us something entirely new to worry about, the integrity of our data and who could use our phones, cards and email accounts as a backdoor into our entire personal and financial lives.

We Want It All, And We Want It Now. Anyone with a phone in their pocket can, in one way or another, buy it on the spot. Which has given rise to the push for same-day delivery, consumers who can buy it now, also want to be able to get it now, or as close to now as possible.

We Also Want It Later. Maybe the consumer likes going to the store, enjoys the Christmas lights, wants to eat at a mall food court, they just don’t want to stand inline. And now, through the magic of omnichannel commerce, they may not have to do. Through the magic of multi-device shopping an instore pick-up, consumers are increasingly getting used to finding something on their mobile, paying on their computer and picking up in store. Or some combination thereof.

Mobile has made commerce less a race between the e-markets and the brick-and-mortars, and more a race to offer the most seamless commerce experience. Mobile has taught ever one to care less about where they buy, and more about what the total buying experience is.

We Pay For Access Instead Of Objects. Ten years ago when your family set about its early experiments in binge watching television with the first season of Lost, odds are everyone gathered round and watched a DVD set or maybe a Blue Ray, if your family happened to be full of early adopters.

This weekend, when entire families are sitting down to watch How To Get Away With Murder, more likely than not they are streaming it through Hulu. Unless they don’t want to watch that, in which case, they are watching something else on Netflix on their phone while sitting in the same room with their family. Unless of course this is a football family, in which case you are paying the NFL for access to every football game played everywhere in America tomorrow and a cable company to watch in HD.

We Want To Use A Phone To Access Everything. It’s almost now quaint to refer to a time when phones were used primarily to talk. With the rapidly emerging internet of things, it will soon be quaint to talk about a phone as a tool used primarily for communicating and shopping.

The smartphone is already heading toward being the key interface between connected devices and products (The Internet of Things) and their users. Among other things, people will use the device to remotely control household appliances, interact with screens and automatically adjust car settings to their preferences.

We Kinda Hope The Phone Might Keep Us Alive. With the release of Apple Pay, also came the release of Apple Health that has widely been reported as ushering in the age of mobile device as wellness guru. Smartphones can already help people lead healthier lives by providing information, recommendations and reminders based on data gathered through sensors embedded in users’ clothing (shoes, wristbands, etc.) or through other phone capabilities (motion detectors, cameras, etc.).

And, even if you don’t listen to your phone and put your health at risk, it will still probably save you. Internet-enabled mobile devices are becoming important tools in broadening access to health care, diagnosing diseases and saving lives in crisis situations.

Making Life A Lot Better For Everyone. Small merchants can do something now that they couldn’t do en masse twenty years ago. Take credit card payments and use a tablet to do that and run their business. With the emergence of mobile, came thousands of the other mPOS solutions and platforms exploding all over the world. This has not only changed the way these small businesses operate, it has changed their entire pitch to their customers.

Mobile has made life easier for many consumers, but for some businesses and many people mobile has made mainstream financial participation possible.

Posted in Best Practices for Merchants, Smartphone Tagged with: (POS) systems, brick-and-mortars, cards, consumers, credit card payments, customers, data, e-markets, email accounts, mobile, mobile coupons, mobile device, mPOS solutions, omnichannel commerce, pay phones, payments technology, platforms, Small merchants, smartphone, tablet

November 4th, 2014 by Elma Jane

“Healthcare’s Unique, Robust MEDIPAID Rolls Out”

Delivering paperless, next-day deposits for Medical Billers

National Transaction Corporation (NTC) in Coral Springs, Florida announced today that, by the first of December 2014, their paperless medical insurance electronic funds capturing suite: MEDIPAID will be fully functional nationwide. NTC’s MEDIPAID delivers next-day deposits for any Medical entity that must bill health insurance companies.

MEDIPAID will bring the speed, ease and convenience of credit card merchant accounts to the world of medical insurance billing. Upon MEDIPAID’s deployment, the medical office receives its payments considerably faster. The revenue is immediately available since it is paid directly into the businesses’ checking account with secure electronic payments.

NTC’s agents help merchants standardize their Electronic Remittance Advice (ERA) and distribution options to automate posting which further reduces paper and time burdens. At a rate far less than credit card processing or third party billing companies, MEDIPAID is designed to eliminate the healthcare provider’s paper check payments with electronic payments that include the remittance detail (ERA) and further allows providers to take advantage of distribution options to automate the claims payment posting processes.

For more information, Contact us anytime.

National Transaction Corporation

Posted in Best Practices for Merchants, Medical Healthcare Tagged with: billing, check payments, credit card processing, credit-card, electronic funds, electronic payments, Electronic Remittance, health insurance, Medical Billers, merchant accounts, Merchant's, paperless medical insurance, secure electronic payments

October 31st, 2014 by Elma Jane

It is a given that damage to a retailer’s reputation is one of the biggest negative outcomes from a big data breach. However, research said that customer service or the lack thereof, is a bigger turn-off for consumers than a data breach, and by a wide margin.

In April 2014 research, 75 percent of almost 800 survey respondents said poor customer service would have the greatest impact on a company’s reputation. Some type of environmental incident was the second most determining factor in reputational damage, at 33 percent, with a data breach coming in third at 30 percent.

Data breach management

According to the 2014 survey, businesses can do themselves the most good in the wake of breaches by explaining the potential risks or harms of the compromises, disclose the facts of the incidents and tell the unvarnished truth. Sixty-seven percent of respondents believe explaining the risks/harms to them of data breaches is the best way companies can improve communications, followed by fact disclosures and not sugar coating the message.

When asked what businesses could do to prevent customers from ending relationships with them following breaches, 41 percent said offering free identity theft protection and credit monitoring services would help out.

Consumer attitudes contradictions

When consumers are victimized by data breaches, their fears of also becoming victims of identity theft increase. Following a data breach, that fear nearly doubles. Furthermore, following breaches, victimized consumers in the survey said that their identities were at risk for years or forever.

But curiously enough, when consumers received data breach notifications that they may have been victimized, 32 percent of respondents ignored the notifications and took no action and only 18 percent followed the advice provided in the notifications.

Nevertheless, most consumers seem to recognize what types of data are the most sensitive and would cause the most stress and financial damage if compromised. Respondents said the compromise of Social Security numbers would lead to the most potential damage, followed by password/PIN and bankcard account information.

If you are out of business because of financial impact the data breached cost you. How good is your service? Losing even a single customer can be very costly. It’s critical for companies to turn a complaint into a positive for the customer and for the company moving forward.

Posted in Best Practices for Merchants Tagged with: bankcard account, consumers, credit monitoring services, customer service, data breach, password/PIN

October 30th, 2014 by Elma Jane

A partial authorization request enables an issuer to approve an amount that is lower than the total transaction amount in cases when the available card balance is not sufficient to cover the full transaction amount. It can also approve a $1500 authorization for a $15.00, and if the merchant does not look closely and pay attention to the details they may lose a lot.

Partial authorizations are used for prepaid and check / debit cards and are now supported by both Associations, as well as their issuers and payment processing companies. They make it possible for merchants to complete a transaction by using the remaining available balance on the prepaid or check card and accepting an additional payment form (e.g. cash, check or another bank card) for the remaining balance. This type of transaction is known as split tender.

Partial authorizations provide you with a way to eliminate decline authorizations due to insufficient funds. You should take advantage of this opportunity and understand how to process them. There are reasons for authorization declines where there is nothing a merchant can do.

Partial Authorization Process

Customer swipes a card with available balance that is lower than the sale’s amount.

Merchant submits an authorization request with a Partial Authorization indicator to the issuer for the entire sale’s amount.

Issuer sends a partial authorization approval back to the merchant.

POS terminal subtracts the partially approved amount from total sale’s amount.

The customer makes a payment for the remaining balance using cash, check or another card.

The sale is now completed and a receipt is printed displaying the split tender amounts.

If the prepaid card used in a split tender transaction is a gift or an incentive card, the remaining balance is automatically sent to the point-of-sale (POS) terminal where it can be displayed to the merchant and printed on the sales receipt.

Posted in Best Practices for Merchants Tagged with: bank card, card balance, cash, check card, debit cards, merchant, partial authorization, payment form, payment processing, point of sale, POS terminal, prepaid and check, transaction

October 23rd, 2014 by Elma Jane

The U.S. government will replace roughly 9 million government-issued payment cards with EMV chip-and-PIN versions early next year in a push to increase awareness and use of the more secure cards. Between 5 and 6 million prepaid debit cards used for issuing government payments, including Social Security and veterans benefits, will be reissued in January 2015. Another 3 million cards issued to federal government employees will also be replaced with EMV versions through the General Services Administration’s SmartPay program.

All the cards will be set up for Chip and PIN security as a U.S. government standard under the upgrade program, rather than the Chip and Signature approach required by Visa and MasterCard for most U.S. retailers starting late next year. However, there was no indication that the new cards will actually have the less secure magnetic data stripe removed.

Finding the right answers with the latest technologies to stop these cyber thieves and taking proactive and positive steps by adopting PIN and chip technology for government-issued debit and credit cards shows the importance of protecting financial transactions. While EMV is important, it’s not a total solution to the issue of data security.

POS devices at all federal agencies that accept retail payments will also be converted to accept EMV cards on a schedule set by the U.S. Treasury Dept. No timetable was given for the federal POS conversion.

The rollouts at four of the six largest U.S. retail chains will give a boost to EMV, which despite an October 2015 deadline has seen slow uptake among retailers. Under a mandate by Visa and MasterCard, retailers who experience credit or debit card fraud after next October but haven’t upgraded their POS equipment to accept EMV cards will be liable for the loss. If the bank that issued the card hasn’t upgraded it to EMV, the bank will take the loss.

But despite that October deadline, fewer than half of retailers’ POS terminals are expected to be able to accept EMV cards by the end of 2015, and barely half of U.S. payment cards will have been upgraded by then, according to the Payments Security Task Force, a banking industry group tracking EMV uptake.

The 9 million federally issued cards are a tiny fraction of the 1 billion credit and debit cards in use in the U.S., so the overall impact of accelerated EMV conversion is likely to be small. However, the Buy Secure initiative also explicitly includes a consumer-education component. Visa said it will spend $20 million in a public service campaign, and American Express said it will launch a $10 million program to help small merchants upgrade their POS terminals.

Small merchants are less likely to know about EMV than large retail chains, which have been making implementation plans for years.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security Tagged with: American Express, bank, Chip and PIN, chip and signature, credit cards, data security, debit card fraud, debit cards, EMV, emv cards, EMV conversion, financial transactions, magnetic data stripe, MasterCard, Merchant's, payment cards, Payments Security, POS conversion, POS devices, POS equipment, POS terminals, retail payments, visa