Category: Best Practices for Merchants

August 23rd, 2017 by Elma Jane

Over the last couple of years, the payments processing industry has had a major shakeup. Electronic payments are the new payment form to watch.

It’s hard to imagine that online shopping used to require you to mail a check or money order to the seller. Forget about sending your credit card information in an email.

In 2015, Apple launched Apple Pay. While usage was low at first, it quickly grew the following year. Competitors such as Samsung and Android have introduced their own digital wallets.

In a world where hackers and skimmers have customers and merchants on edge, payment security is a high priority. Digital wallets make transactions secure by removing the card from them altogether.

Credit card credentials are saved in a digital wallet on a smartphone. The customer can then make payments by placing their phone near a reader and authenticating it on the screen.

Many large companies have adopted digital wallets as a method to accept payments. You can even use Apple Pay in some drive-thrus.

Accepting digital payments is relatively simple. Most are compatible with other contactless Point of Sale systems, and they don’t even charge extra fees for transactions.

Credit Card Processing in the Modern Age

Technology is moving faster than ever, and it’s taking credit card processing with it.

Make sure to follow our blog for more articles about changes in the world of finance.

For Electronic Payment Set Up Speak to our Payment Consultant 888-996-2273 or Click Here to get started!

Posted in Best Practices for Merchants Tagged with: contactless, credit card, credit card processing, customer, Digital wallets, electronic payments, finance, merchants, payments processing, point of sale, Security, smartphone, transactions

August 18th, 2017 by Elma Jane

Before you can start accepting credit card or electronic payments, there are a number of factors to consider.

You will need to decide on a Point of Sale system. Some Merchant Services Providers require you to use only their equipment.

Some of these systems have expensive equipment costs. Others will provide you with free card readers. Companies offering free equipment may do so in exchange for higher processing fees.

Before you choose a Merchant Services Provider, you should look into how they work those fees.

Understanding Processing Fees

Credit card processing fees have several moving parts, so we aren’t going to dive too deeply into how these fees are determined. We will, however, take a broad overview.

Merchant Services Providers will charge either a flat rate, a percentage, or a combination of the two. This fee is called an interchange rate.

Interchange rates vary between card providers, which is why some sellers don’t accept certain credit cards and why many small companies have minimum requirements for credit card payments.

Some Merchant Services Providers don’t charge a flat transaction fee, however, they usually charge a higher percentage for payments.

Each model has its benefits and disadvantages.

Before choosing a Merchant Services Provider, familiarize yourself with their processing fees. Consider how they will fit with your business model. Are most of your transactions smaller or larger? How much will a free card reader save you?

Weigh every option out before you lock yourself into an agreement.

For Payment Consultation call now and speak to our Payment Consultants 888-996-2273!

Posted in Best Practices for Merchants Tagged with: card readers, credit card, electronic payments, interchange, merchant, point of sale, transaction

August 17th, 2017 by Elma Jane

How Do Credit Cards Work?

Paying with a credit card seems like a simple process. You charge the customer, they swipe their card, and then they walk out the door.

But behind the scenes, it’s a bit more complicated.

A credit card payment involves four parties.

- The Merchant

- The Customer

- The Issuing Bank

- The Merchant Services Provider

You know who the Merchant and Customer are – that’s the easy part.

The Issuing Bank is the institution that lends money to the Customer.

When the Customer swipes their card, the Issuing Bank lends them the sale amount. This loan is given with the understanding that the Customer will pay the amount back within 30 days or repay it with interest.

Before the Merchant sees any of that money, it goes through the Merchant Services Provider. In exchange for their credit card processing services, they take out a fee before paying that money to the Merchant.

These fees vary between Merchant Services Providers, but one thing is certain: The Merchant always receives less money than the Customer paid them.

This might seem like a raw deal. However, accepting credit cards can lead to more sales than if you only accept cash.

On our next article we will discuss how to start accepting credit card payments and understanding the processing fees….so stand by for more information about Electronic Payment Processing.

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments Tagged with: bank, credit card, customer, electronic payment, loan, merchant, payment

August 16th, 2017 by Elma Jane

National Transaction.Com

We work with Business owners to find the easiest and least expensive way for your business to access capital. For Loan Consultant call now at 888-996-2273 Ext 1159

Thank You – from my MMC!

First approved loan $1.2 Million August 10, 2017 Thursday! Very cool

1.2-Million 4.35%

Thank you for all the help -all done First business- towards many More.

Elisea

Sent from my iPhone

Posted in Best Practices for Merchants Tagged with: loan

August 1st, 2017 by Elma Jane

NTC Gives™ is an Electronic Payment Organization that allows congregations to accept payments on multiple platforms and support non-profit organizations, utilizing the award-winning customer service and industry leading technology of National Transaction Corporation™.

Accept Donations and Giving In-Church or Mobile

IN-CHURCH – accept donations in person with ease using broad range of optional devices.

MOBILE – make donations on the go with an intuitive mobile app.

- Accept and Receive Donations Anywhere

- Easy Automatic Recurring Donations

- Credit, Debit and ACH

- Data Tracking and Security

WATCH NTC GIVES HERE

Posted in Best Practices for Merchants

July 26th, 2017 by Elma Jane

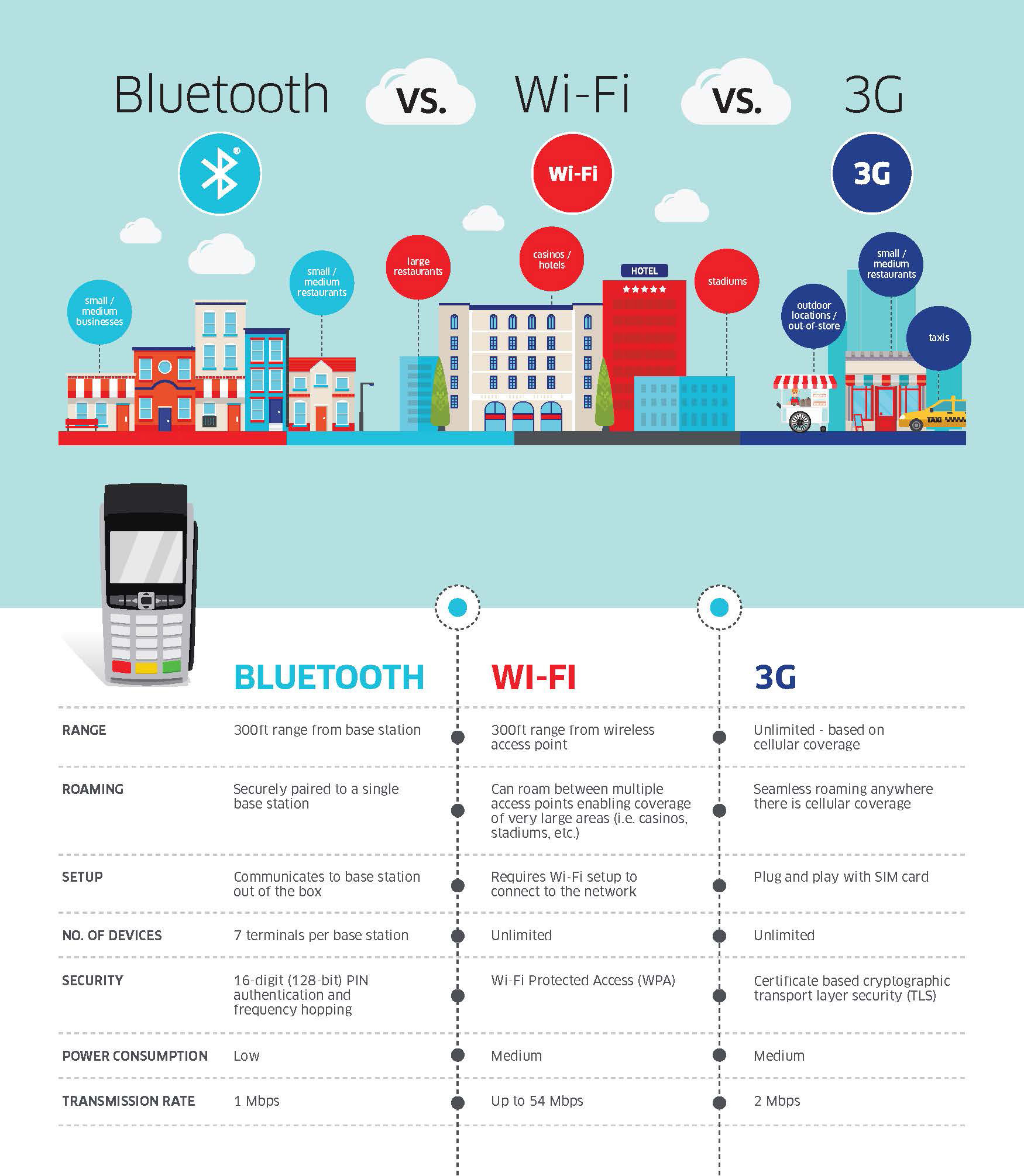

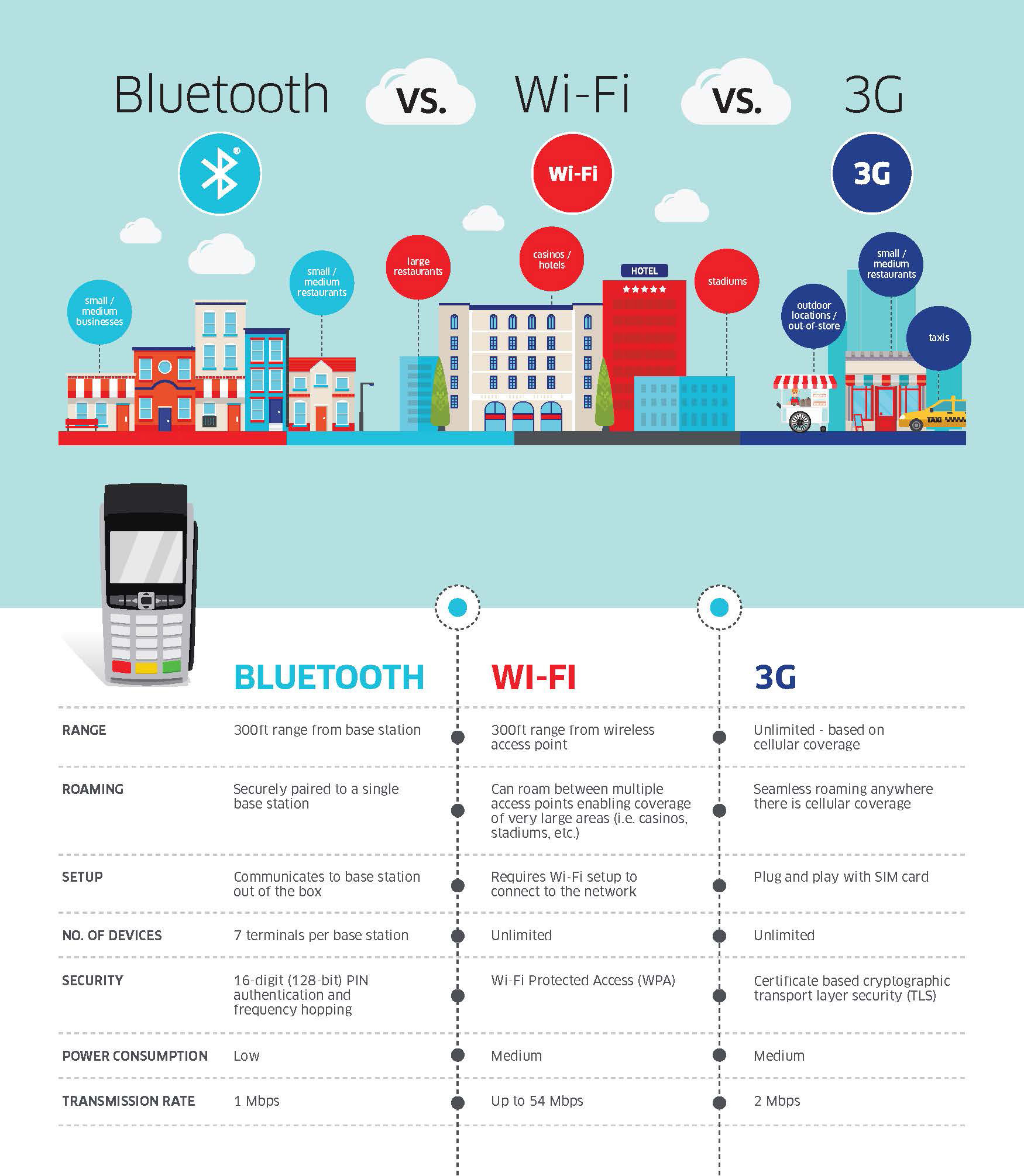

Check out the wide range of smart wireless terminal connectivity options and know the difference.

Bluetooth Wireless: Designed for reliable Bluetooth connectivity even in the most demanding environments.

Rage – 300ft from base station

Roaming – paired to single base station

Setup – Communicates to base station out of the box

No. Of Devices – 7 Terminals per base station

Security – 16-Digit (128-Bit) PIN authentication and frequency hopping

Accept EMV Chip & PIN, magstripe and NFC/Contactless

WiFi: Designed for reliable WiFi connectivity, Wireless mobility for the point of sale.

Rage – 300ft from base station

Roaming – can roam between multiple access points enabling coverage of very large areas.

Setup – Requires WiFi Setup to connect to the network

No. Of Devices – Unlimited

Security – WiFi Protected Access (WPA)

Accept EMV Chip & PIN, magstripe and NFC/Contactless

3G Wireless: Bring compact, reliable 3G Wireless Technology and mobility to the point of sale.

Rage – unlimited – based on cellular coverage

Roaming – Seamless roaming anywhere there is cellular coverage

Setup – Plug and play with SIM card

No. Of Devices – Unlimited

Security – Certificate based cryptographic transport layer security

Accept EMV Chip & PIN, magstripe and NFC/Contactless

Wireless terminals provide merchants with a number of benefits including:

Mobility – enable merchants to better serve the customer and bring the transaction right to the point of service.

Printed Receipt – give your servers the capability to print a receipt for the customer even when away from the POS.

Variety of Payment Options – provide the ability to accept magstripe, EMV, and NFC payments including the latest mobile wallets.

For Electronic Payment Set Up Call Now 888-996-2273

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: bluetooth, chip, Contacless, EMV, magstripe, nfc, PIN, Security

July 12th, 2017 by Elma Jane

NTC Gives™ is an Electronic Payment Organization that allows congregations to accept payments on multiple platforms and supports non-profit organizations in our communities utilizing the award-winning customer service and industry leading technology of National Transaction Corporation™.

Keep Giving – allows recurring donations regardless of your worshipers attendance.

Mobile Giving – accept donations on a multitude of devices.

Secure Donations – Offload your protection mechanism to the banks payment gateway to ensure security breach while protecting your members.

For church congregations, start accepting donations online as well as recurring donations. Call now 888-996-2273 or go to NTC GIVES.Com

Posted in Best Practices for Merchants Tagged with: banks, electronic payment, gateway, Security

July 10th, 2017 by Elma Jane

One of the most advanced and eye-pleasing smart terminals has generated some buzz. Specifically configured for small and independent hotels to help manage their businesses and provide an exceptional guest experience.

For SMB/independent lodging establishments, the benefits include:

- Availability of an EMV terminal solution – a first for the lodging industry – as this option has not been offered in the lodging sector by competitors or legacy terminal providers

- Dynamic, all-in-one smart device that looks great and delivers an exceptional guest experience

- A modern, simple, and intuitive interface (think iPhone/Android) enables lodging establishments to get up and running quickly with minimal employee training

- Powerful security to ensure maximum security, including EMV, encryption, tokenization, and PCI protection

- Robust, cloud-based reporting to help hotel owners manage their business, and see transactions and settlements in real time

Hotel, Motel and Bed & Breakfast customers will benefit from this smart terminal:

- Smaller, independent motels or hotels

- Hotels without property management systems

- Existing hospitality customers using Hypercom terminals (in need of EMV terminal solution)

Branded hotels:

- For pool decks, spas, golf courses, gift shops, and other non-front desk locations

- As a backup for existing systems

For Electronic Payment Account Set Up Call Now! 888-996-2273

Or let’s get started NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: EMV, encryption, PCI, Security, terminal, tokenization, transactions

June 27th, 2017 by Elma Jane

E-commerce has been growing, and now the overall market is starting to take notice; thanks to advances in online payment processing and electronic payment technology, as well as the willingness of almost all merchants to accept credit cards online.

E-commerce ecosystem are set to double and will account for a rising share of overall card payments. In addition to increased internet and smartphone penetration; more e-commerce merchants and an increase in the use of digital wallets.

Cardholders globally are becoming more confident in the security of the e-commerce channel, with the expected implementation of 3D-Secure 2.0 and increased use of sophisticated anti-fraud systems in many markets it gives consumer assurance that payment cards are safe to use for e-commerce purchases.

Trends indicate that e-commerce is the wave of the future for shoppers. But digital shopping is just one piece of the broader payments ecosystem.

For Electronic Payment Set Up Call Now! 888-996-2273

Let’s Get Started National Transaction.Com

Posted in Best Practices for Merchants Tagged with: card payments, credit cards, Digital wallets, e-commerce, electronic payment, merchants, online, payment, Security, smartphone

June 22nd, 2017 by Elma Jane

Join National Transaction on September 13th with LES BROWN

Roz & Cal Kovens Center, FIU Biscayne Bay North Campus

SOUTH FLORIDA’S TOP DECISION MAKERS WILL BE HERE…. WHERE WILL YOU BE?

Read More

Read More

Posted in Best Practices for Merchants