Category: Best Practices for Merchants

July 14th, 2014 by Elma Jane

French financial services company LCL has introduced a service that securely issues payment card PIN codes to customers via SMS texting. The programme has been introduced initially for cardholders who forget their confidential code when out shopping or withdrawing cash. In a second phase, the bank intends to extend PIN issuance to coincide with the mail-out of newly-created cards.

LCL is using Gemalto’s Netsize platform, which offers direct connections to more than 160 mobile operators globally for message delivery. LCL recognizes the mobile channel as a new opportunity to support their continued drive to optimize card activation rates and be the top-of-wallet choice for payment. Enabling cardholders to get their PIN code on their mobile phone prompts them to start using their banking card as soon as they receive it.

Posted in Best Practices for Merchants, Mobile Payments, Smartphone Tagged with: bank, card, cardholders, codes, customers, mobile, mobile channel, payment, PIN, Rates, sms, wallet

June 24th, 2014 by Elma Jane

Compliance with a single set of regulations is often taxing enough, without other regulations causing a conflict, but this is exactly the situation that the insurance industry finds itself in with its contact centres.

PCI-DSS compliance insists that sensitive information in particular credit card numbers, must be protected and cannot be stored. However, the Financial Conduct Authority (FCA), the UK regulator for the financial services industry, demands that insurers keep sufficient detail of their transactions.

In insurance contact centres, FCA recommendations are met by recording calls. So in order to comply with PCI-DSS regulations, some contact centres simply pause recordings while the card information is read out, and resume recording once the payment process is complete. There’s a very big problem with this method, it undermines the very reason calls are recorded. The call recording is there to provide an unequivocal record of the circumstances under which the policy is granted. A gap in this record creates doubt. What was said during this time? If a customer is claiming a policy is mis-sold or they were misinformed in some way, a complete record to refute this claim no longer exists. Because of situations such as this, the insurance industry has an inherent dependence on contact centres and person-to-person interaction when selling policies, though in the process has to somehow comply with both regulations. But how? One way is to get the sensitive card information directly and securely to the bank’s payment gateway without storing it. Online, this is done quite easily, insurers can embed a secure payment page into a website and the customer can enter information securely that way. By phone a similar method can be used. A caller can input information directly on their telephone keypad and the tones are only transmitted to the credit card payment gateway not the contact centre. This solves the paradox of the conflicting regulations.

Insurance contact centres need to walk a very fine line, ensuring that they comply with all of the relevant regulations from multiple regulators – even those that, at first glance, contradict each other.

Posted in Best Practices for Merchants, Credit Card Security, Payment Card Industry PCI Security Tagged with: (FCA), card information, compliance, contact centres, credit card payment, credit-card, customer, Financial Conduct Authority, financial services industry, insurance industry, payment gateway, payment process, PCI-DSS, phone, regulations, secure payment, taxing, telephone keypad, transactions, website

June 20th, 2014 by Elma Jane

A recent survey said, 82 percent of e-commerce merchants who currently do not employ a consumer authentication solution are afraid that such solutions will scare off online shoppers, but with more and more fraud expected to migrate online in the coming years, the payments industry needs to do a better job of informing merchants why authentication in the card-not-present realm is crucial to data security.

While a majority of payment service companies employ some type of 3-D Secure online authentication, and most large merchants do likewise, the rest of the merchant population, especially in North America, apparently do not. 55 percent of merchants surveyed, a majority of which are U.S.-based, do not use online authentication, noting that North America is the only world region where less than half of merchants use the technology. The reason so many U.S. merchants eschew consumer authentication is they see it as a sales killer.

The main reason appears to be fear, uncertainty and doubt (FUD) about how consumer authentication will impact sales conversion and user experience, 43 percent of merchant respondents are FUD-preoccupied, with 20 percent concerned about the effect of the technology on sales conversion, 13 percent worried about changing the user experience and 10 percent simply want nothing to do with consumer authentication. Beyond the FUD concerns, there is also a very real perception with merchants and service providers that integration is long and difficult, adding that 21 percent of merchants who do not employ authentication, citing the time and/or cost of integration as the barrier.

End to FUD

The solution to merchant adoption of some form of 3-D Secure technology is apparently education. Many FUD concerns are related to a hangover effect caused by bad experiences with previous iterations of consumer authentication. But the report provides evidence that the FUD factor can be overcome because of the happiness factor that authentication-using merchants express. 81 percent of merchant respondents showing satisfaction with the solutions they have employed.

The report said nearly half of merchants surveyed said authentication had no effect on sales conversion, either positive or negative; however, almost 20 percent believe it has had a positive effect on sales. The positive result seems to be related to merchants who use authentication selectively, on specific transactions rather than on all of them. Additionally, the technology results in many merchants experiencing lower numbers of chargebacks. Amongst merchants, 59 percent overall say the authentication program brought a decrease in chargebacks and this is true for more than half of merchants from each geographic region.

FYI on FUD

The adoption is very low because not many people understand it. Online verification does retard the checkout process as a second screen pops up that consumers must navigate in order to proceed with the purchase. However, these barriers can be overcome with education and simply getting people comfortable with the technology. If we had this solution from day one on all e-commerce sites today nobody would be complaining because people would be used to doing it. It is a question of achieving ubiquity rather than taking a piecemeal approach to implementation. It is a matter of if you do it at one place or every place. If you have to do it at only one location that makes that site really secure. If all sites ask the same question, you get used to it.

Consumer authentication is also something that requires buy-in from issuers, acquirers and merchants. It is a participation solution where the issuer and the acquirer have to be participating in it. If you are an e-commerce site and you are certified with Verified by Visa the card brands proprietary version of 3-D Secure, if the card issuer has not embraced that, then the security will not happen.

Increasing number and frequency of breaches is slowly eroding consumers’ trust in the safety of e-commerce It’s not good for the whole ecosystem. At some point people will come back and say, this is too risky to do online transactions with cards. Before that point is reached, businesses should improve their online defenses, and consumer authentication is central to that defense. With the U.S. payments infrastructure in the process of transitioning to the Europay/MasterCard/Visa (EMV) chip card standard at the physical POS, fraud in the United States will sharpen its focus on the less secure online channel. EMV will do a lot of good in terms of card present security, but it does not do anything for card-not-present environments. So how are we going to contain the online fraud? We have to go to a 3-D Secure type solution

Posted in Best Practices for Merchants Tagged with: 3-D Secure online authentication, card, card present security, card-not-present, chargebacks, chip, chip card, consumer, data security, e-commerce, e-commerce merchants, EMV, Europay/MasterCard/Visa, fraud, Merchant's, online authentication, online channel, online fraud, online shoppers, online transactions, payment service, payments industry, POS, sales conversion, technology, Verified, visa

June 19th, 2014 by Elma Jane

Analytics versus Intuition:

Human behavior plays a big role in sales forecasting. We have a number to shoot for, and often we try to figure out ways to make it, regardless of the soundness of our reasoning. So we assume deals are going to close even if it means we have to ignore telltale signs of trouble until its too late. Using modeling and analytics to evaluate your company’s position in each deal. The model could tell you the warning signs, because analytics would reveal how closely any deal fit with the model’s known history of success. As with weather forecasting, there would be no value judgement, just a probability of rain. Managers would still need to apply their reasoning, but armed with this kind of knowledge, sales people up and down the organization could evaluate scenarios constructed to make their deals match up with the ideal.

Cloudy With 30 Percent Chance Of Sale

Take a more scientific approach. The sales process stage is one of the variables in the model that the company uses to evaluate deals. More importantly, the busisness applies analytics to the deal data rather than expecting managers to review all of it. Analytics would have no trouble spotting the incomplete deal stage and would downgrade the forecast appropriately. A report then would show the variance between the forecast and the model. If you apply this logic to every deal in the forecast, then you have a range of probabilities similar to those weather people rely on to tell you about Saturday’s conditions. More importantly and unlike a weather report, the forecast is also prescriptive because it shows you how you can improve it. Get that meeting with the decision maker if you want to close the deal. Everyone complains about the weather but no one does anything about it. If you’re tired of complaints about sales forecast accuracy, consider building an accurate model and applying analytics. It works for the weather.

Posted in Best Practices for Merchants Tagged with: analytics, data, deals, sales

June 19th, 2014 by Elma Jane

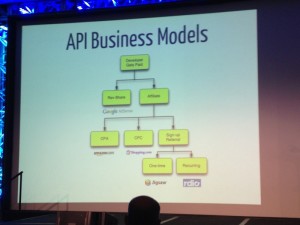

API Software Inc. has created an application ISOs can use to help merchants tabulate the best payment services deals. The Square Deal Pro app for the merchant services industry enables sales reps to compare their company’s rates to those of Square, PayPal, Stripe and other payments aggregators. Essentially, the application takes the mathematics burden off of the merchant and helps an ISO or agent compare bundled pricing with interchange-plus pricing.

Frank Haggar, a software developer, started asking merchants why they chose a certain provider and they just said the pricing was simpler. It might be more expensive, but it was easier for them to understand. That moved to develop Square Deal Pro. It’s a software that salespeople can have right on their phones and it makes a comparison and is easy to understand. Square Deal Pro, which operates on iPhones, Android devices and Windows phones, was established as a vendor-neutral tool that is also available for merchants to download if they were inclined to want to crunch numbers themselves. Service providers pay for the application and all of its sales features, but a free version for price comparisons only is available to merchants.

Merchants are experts in what they know how to do and they may not want something that includes math distracting them from that, but the sales rep can do it for them and use it along the lines of a calculator helping someone figure out mortgage rates. ISOs have various tools at their disposal and lock in key information in their brains to prepare for sales presentations, but most will likely find Square Deal Pro a valuable addition. Something that takes complicated pricing schemes and factors it all into an easy interface that puts out a clear comparison that is valuable, certainly out in the field.

API Software has to deliver something difficult or impossible to copy because that would set this permanently apart as opposed to being a lead to other similar products in the market. An ISO can change rates or make adjustments for a client if the numbers show that another provider is offering a less expensive option, but the numbers in the app don’t lie. The app will show how a bundled rate can work in your favor, such as if you are selling Girl Scouts cookies at $3 a box. Then use Square all day long, but an ISO can compare how his product works compared to others and the app can show, that at a certain time, it might be beneficial to switch over.

Square Deal Pro takes into account factors other than interchange rates, including merchant volume, average ticket price and whether transactions are keyed or swiped or both. All of those things determine where you fit in on the diagram of how your rate should be structured. There is a lot of analysis on minimal focal points. The application may also help defuse potential problems with merchants who sometimes feel their sales rep was not providing a fair assessment of pricing structure or comparisons.

As for the application’s name, Haggar doesn’t want any confusion over whether this might be a new Square product.

Posted in Best Practices for Merchants Tagged with: account, aggregators, Android, assessment, bundled pricing, developer, devices, interchange, interchange rates, interchange-plus pricing, iPhones, ISOs, market, merchant services, merchant volume, Merchant's, mortgage rates, payment, PayPal, phones, pricing, Pro app, products, provider, Rates, sales, Service providers, software, Square, Square Deal Pro app, Stripe, transactions, Windows phones

June 17th, 2014 by Elma Jane

BioCatch, an Israeli startup that uses behavioural biometrics to authenticate visitors to banking and e-commerce sites, has raised $10 million in a funding round. BioCatch aims to eliminate passwords and authentication dongles for online banking and shopping, replacing them with a system that recognizes users by how they physically use their computer or tablet. The firm’s technology collects and analyses over 400 bio-behavioral, cognitive and physiological parameters based on how people type and move a cursor around to create unique profiles for visitors to sites.

In addition, the system creates invisible challenges for visitors to sites. For example, when a user moves the cursor towards a button, they are deliberately knocked slightly off course and subconsciously have to correct in what the company says is a way unique to them. This, argues BioCatch, is more secure than traditional authentication methods, demonstrating an 80% reduction in false positives for detecting the same amount of fraud. It also significantly reduces friction for the customer because the system automatically kicks in when they visit a site using the technology. BioCatch says that it has signed up several unnamed banks and e-commerce sites, and that it will use the new funding to push on in North American and Europe as well as to expand R&D efforts. Funding will also allow to continue strengthening BioCatch offering and expand global reach in strategic markets, while keeping the world’s largest and most influential institutions safe and secure.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: banking, banking and e-commerce, behavioural biometrics, BioCatch, biometrics, computer, e-commerce, funding, online banking, R&D, tablet

June 16th, 2014 by Elma Jane

Visa announced yesterday a new designation for consumer reload-able prepaid products that aims to simplify and clarify fees, step-up consumer protections and make prepaid solutions a valid tool for getting onto stronger financial footing. Consumers have been confused by an often complex prepaid landscape. As a prepaid leader, it is important to go beyond current requirements in the marketplace and bring transparency to this growing product area. This Visa designation will signify a new level of simplicity, protection and opportunity, enabling cardholders to confidently manage their spending every day.

To qualify for the Visa prepaid designation, prepaid programs must offer things like simplified fees and transparent disclosures of them. The new designation also bans some types of feeing such as transaction decline fees, customer service fees or overdraft protection (which is not to be offered) fees among others. Once designated, cards products will receive a seal that will be visible on card packaging and materials.

Visa’s efforts to raise the bar on quality in the prepaid industry by building Compass Principles are vital because millions of Americans are searching for tools to help them reduce financial friction, and prepaid cards can be a valuable option.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: consumer, customer service fees, overdraft protection fees, prepaid products, prepaid solutions, simplified fees, transaction decline fees, visa

June 16th, 2014 by Elma Jane

Credit card companies are racing against tech giants like Apple and Google to create what would thin our wallets forever. The race, which started to replace paper with plastic, is now entering a new phase of combining our cell phones and credit cards. Credit card giant American Express is working on developing a next generation app, which would let consumers shop using their virtual credit cards just like virtual boarding passes on an iPhone Passbook. Amex doesn’t stand alone in the race. Google, Square and Apple are some of the many companies in Silicon Valley, which are working on taking the leap. While Google Wallet and PayPal are some of the available products providing customers with a virtual wallet experience. The credit card companies still continue to benefit being the point of sale for these products. This puts Amex in a unique position, as it doesn’t have to struggle becoming the card customers choose to use. Amex is just a jump away in moving from customers’ wallet to cellphone.

Posted in Best Practices for Merchants, Visa MasterCard American Express Tagged with: American Express, amex, app, Apple, card, cellphone, credit-card, customers, google, Iphone, virtual credit cards, wallet

June 12th, 2014 by Elma Jane

QR: The Bridge to the Modern World

Involvement devices have come a long way from the time of Clearinghouse mailings, where you would peel off a label and stick it onto another page before dropping it back in the mail.

Today, print’s best involvement device is the QR code. It works as a portal or bridge into the mobile online world where the cataloger’s brand lives and breathes in real time. Even better, it can lead the customer from the catalog page to the checkout button on their smartphone within minutes.

The printed catalog delivers rich colors and a personal, tactile experience still not attainable through any mobile device. In many ways, though, it is a vestige of a bygone era, and an expensive one at that. Catalogers know this. Even the U.S. Postal Service also knows this. That’s why the USPS is running a postage discount promotion for the second year in a row this summer to encourage the use of QR codes by direct mailers.

Let’s take a quick look at the way a few catalogers are using QR codes.

Anthropologie

Anthropologie’s marketing strategy is more about selling a lifestyle than selling products. That explains why making it easy for customers to move toward actually buying something doesn’t seem like such a big priority in their catalog. They did not include a QR code anywhere. The closest they came was one line next to the address: For store information, go to www.anthropologie.com. Their 800 number, they do take phone orders is printed only once in tiny type, so having no QR code seems to fit in with their attempts to play hard to get. Marketing critique aside, by not using a QR code on their catalog, they are missing the opportunity to draw customers into closer involvement with their brand, whether or not they intend to make an immediate sale.

Best Practices

With these few examples in mind, it’s time to look at best practices for using QR codes in catalogs, which can be a two-sided equation. There is the technical aspect and the branding/selling aspect. As far as the technical side goes, customers need to use their smartphone to scan the code successfully, and the destination on the other end must be optimized for mobile access. Sometimes the hardest part is organizing the resources required to execute the backend side of things, especially if the goal is to make an immediate sale.

The main thing to consider is that QR codes work as a bridge and that bridge is a smartphone, iPad, or some other tablet with all their usual constraints (screen size, internet connection, quality of camera, QR reader app, user proficiency, etc.). Also, don’t assume that everyone has a QR reader or even knows what a QR code is. Especially in catalogs, where customers have been seeing postal service barcodes for years, people may assume that the pixelated square thing is just something else for the USPS to lose money on. Instead, including a brief call to action to scan the QR code should do the trick.

Crossing the Bridge

Getting customers to scan the QR code is only half the battle. Now you need to make sure they feel it was worth their while to scan. It’s all about the next steps in your customer relationship. If you have an Apple or Android app, then that’s where to send people if you know that you can convert sales successfully on mobile devices. Sending them to your Facebook fan page is an option too, but not a big win if a majority of your customers are already fans.

Special promotions, optimized for mobile access, will certainly earn your QR its keep. If your goal is to inspire a trip to one of your stores, then do what Brookstone does and send customers to a Google map with all store locations within a hundred miles. It’s also possible to send scanners to a dedicated page, again, optimized for mobile where you give them a number of options: Facebook, shop, app, etc.

Delia’s

By appealing to fashion-hungry American teens via retail stores, web, and catalog, Delia’s sold over $220 million in 2011. In the single catalog we looked at, Delia’s had a QR code on its back cover. When scanned, the code points to Delia’s Facebook page. That’s certainly one way to build involvement with the Delia’s brand, but it may not be the best. Delia’s has an Apple app with full e-commerce capabilities, so Delia’s could be missing out on the opportunity to help the customer cut to the chase and get straight to their virtual shopping bag. Still, at least they’re using the code.

King Schools

Unless you’re a pilot in training or know one fairly well, you have probably never heard of King Schools. They offer more than 90 flight training courses, plus all sorts of accessories for pilots-in-training. They have no retail stores, but that’s all the more reason to mention them here, retailers can learn a lot from King Schools about how to use QR codes in their catalogs.

In the one catalog, King used a QR code on the front cover and the back cover. Now, the iPad shows enormous potential for use in general and commercial aviation, so King is smart to use their QR codes to point customers directly toward their mobile apps and offerings. In fact, King Schools uses QR codes on the Take Courses on Your iPad landing page itself.

In most cases it seems counterintuitive to display a QR code on a website for people to scan. After all, they’re already there. It’s a smart use of codes in this case, for two reasons. First, the codes lead the customer directly to the Apple app store, so it actually makes sense to scan the codes even though the customer is already on their website. The customer is now just a few clicks away from buying and installing the app. Second, there is one QR code for their app store in general, and then there are unique codes for individual apps.

Technicalities

The content in a QR code tops out at 4,296 alphanumeric characters, but catalogers only need a fraction of that to get the customer to where they want them. However, even when the character count is down to a few dozen, size does matter, because QR codes with more data embedded in them are more complex visually. This means that even smartphones with the latest and greatest optics will have trouble reading densely populated codes. Make sure the QR code is big enough. Even the simplest codes will frustrate the scanning process if they are too small or if there isn’t enough white space around them. Maybe a QR code isn’t the most photogenic thing in the world, so it’s a good challenge for catalog art directors to incorporate it into the design without shrinking it into oblivion.

More sophisticated catalogers will want to use personalized QR codes. Today, even local printers are likely to have the means to print unique QR codes for each recipient in a mailing. This creates the ability to track scans back to the individual, a marketer’s dream when it comes to one-to-one marketing relationships.

Innovation can get you traction within the social media realm and that’s money in the bank. Whether you’re a major catalog player or using QR for something completely different, always consider getting the marketing and PR people involved to leverage any novelty aspects of the application.

The benefits pile up quickly to those catalogers who take the time to get smart about QR codes. Thick catalog books can be thinned down a bit if QR codes succeed in pulling customers from the page and onto their site or apps, cutting postal costs for the millions of mailings every year. And, even if the cataloger doesn’t go to the extreme of printing unique QR codes, the branding value of offering that connection from the old-style printed piece to the dynamic world of interactive mobile technology makes it well worth the effort.

The ink needed to print a QR code on a major retailer’s catalog might weigh only a fraction of an ounce, but when used right, it’s worth its weight in gold. Too bad the majority of catalogs seem to be squandering the opportunity by underutilizing the code or worse, not including any at all. In a world where an integrated multi-channel approach is a must-have for any retailer to survive, the stakes of leveraging every opportunity for interaction are higher than ever.

Posted in Best Practices for Merchants, Smartphone Tagged with: Android app, Anthropologie, app, Apple, bank, barcodes, Best Practices, Brookstone, clearinghouse, code, commercial aviation, Crossing the Bridge, customer relationship, data, data embedded, Delia’s, e-commerce, Facebook, google, Google map, interactive mobile technology, ipad, King Schools, marketing, mobile, mobile access, mobile device, mobile online, mobile technology, multi-channel, phone, portal, Postal Service, QR code, QR reader, retail stores, scan, scanners, smartphone, social media, tablet, USPS, virtual shopping, web, website

June 10th, 2014 by Elma Jane

Local businesses with brick-and-mortar stores have not been early adopters of ecommerce. But, with the proliferation of mobile devices and with changes in how consumers research and buy products, most local businesses now have websites, many of them mobile optimized. Smart brick-and-mortar retailers invest in local search engine optimization to ensure that their stores are found when a local shopper searches on products that they sell. More aggressive retailers also invest in pay-per-click advertising on Google to ensure that their store names, phone numbers, and addresses are visible to a local shopper that is researching on a smartphone. Google is by far the primary search engine used by mobile shoppers. Google favors mobile friendly online stores and rewards mobile sites with high search rankings. The next logical step for local retailers is investing in on online store.

There are several reasons:

1. Having an online store will help local retailers optimize Google rankings for specific products and brands.

2. Being able to show that an item is in stock may eliminate competitive shopping.

3. Eventually local retailers could sell products to consumers outside the retailers’ immediate area, and thus expand their business.

Many local businesses are hesitant to open an online store. Here is why:

1. Local businesses are typically unfamiliar with running an ecommerce business.

2. Have little ability to ship or fulfill online orders.

3. Cannot accommodate sales tax collection outside their local area.

4. Avoid the investment required.

To be sure, adding an online store is not for every local business. But, if a local retailer offers a unique set of products, she may want to evaluate the concept.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: brands, brick and mortar, brick-and-mortar stores, consumers, ecommerce, google, Mobile Devices, mobile optimized, mobile sites, online orders, online stores, pay-per-click, products, sales tax, search engine, search engine optimization, smartphone, websites