Category: Best Practices for Merchants

February 14th, 2014 by Elma Jane

News from Target, increasing the number of cards compromised to 70 million and the expansion of data loss to mailing and email addresses, phone numbers and names, affirms that we are in a security crisis.

Card data is from a brand and business perspective, the new radioactive material. Add personally identifiable information (PII) to the list of toxic isotopes.

The depressing vulnerabilities these breaches reveal are a result of skilled hackers, the Internet’s lack of inherent security, inadequate protections through misapplied tools or their outright absence. Security is very very hard when it comes to playing defense.

There is a set of new technologies that could, in a combination produce a defense in depth that we have not enjoyed for some time.

Looking at the Age of Context (ACTs)

Age of Context released, a book based on the hundreds of interviews conducted with tech start-up and established company leaders. A wide-ranging survey. They examine what happens when our location and to whom we are connected are combined with the histories of where and when we shop. Result is a very clear picture of our needs, wants and even what we may do next.

Combining the smartphone and the cloud, five Age of Context technologies ACTs, will change how we live, interact, market, sell and navigate through our daily and transactional lives. The five technologies are:

1. Big Data. Ocean of data generated from mobile streams and our online activity, can be examined to develop rich behavioral data sets. This data enables merchants to mold individually targeted marketing messages or to let financial institutions improve risk management at an individual level.

2. Geolocation. Nearly every cell phone is equipped with GPS. Mobile network operators and an array of service providers can now take that data to predict travel patterns, improve advertising efficiency and more.

3. Mobile Devices and Communications. These are aggregation points for cloud-based services, sending to the cloud torrents of very specific data.

4. Sensors. Smartphones, wearables (think Fitbits, smart watches and Google Glass) and other devices are armed with accelerometers, cameras, fingerprint readers and other sensors. Sensors enable highly granular contextual placement. A merchant could know not only which building we are at and the checkout line we are standing in but even which stack of jeans we are perusing.

5. Social. Social networks map the relationships between people and the groups they belong to, becoming powerful predictors of behavior, affiliations, likes, dislikes and even health. Their role in risk assessment is already growing.

The many combinations and intersections of these technologies are raising expectations and concerns over what is to come. Everyone has a stake in the outcome: consumers, retailers, major CPG brands, watchdog organizations, regulators, politicians and the likes of Google, Apple, Microsoft, Amazon, eBay / PayPal and the entire payments industry.

We are at the beginning of the process. We should have misgivings about this and as an industry, individuals and as a society, we need to do better with respect to privacy and certainly with respect to relevance.

Provided we can manage privacy permissions we grant and the occasionally creepy sense that someone knows way too much about us, the intersections of these tools should provide more relevant information and services to us than what we have today. Anyone who has sighed at the sight of yet another web ad for a product long since purchased or completely inappropriate to you understands that personalized commerce has a long way to go. That’s part of what the Age of Context technologies promise to provide.

ACTs in Security

ACTs role in commerce is one albeit essential application. They have the potential to power security services as well, specially authentication and identity-based approaches. We can combine data from two or more of these technologies to generate more accurate and timely risk assessments.

It doesn’t take the use of all five to make improvements. One firm have demonstrated that the correlation of just two data points is useful, it demonstrated that if you can show that a POS transaction took place in the same state as the cardholder’s location then you can improve risk assessment substantially. (based off of triangulated cell phone tower data).

Powerful questions of each technology that ACTs let us ask:

Data – What have I done in the past? Is there a pattern? How does that fit with what I’m doing now?

Geolocation – What building am I in? Is it where the transaction should be? Which direction am I going in or am I running away?

Mobile – Where does device typically operate? How’s the device configured? Is the current profile consistent with the past?

Sensors – Where am I standing? What am I looking at? Is this my typical walking gait? What is my heart rate and temperature?

Social – Am I a real person? Who am I connected to? What is their reputation?

Knowing just a fraction of the answers to these questions places the customer’s transaction origination, the profiles of the devices used to initiate that transaction and the merchant location into a precise context. The result should improve payment security.

More payments security firms are making use of data signals from non-payment sources, going beyond the traditional approach of assessing risk based primarily on payment data. One firm have added social data to improve fraud detection for ecommerce payment risk scoring. Another firm, calling its approach Social Biometrics, evaluates the authenticity of social profiles across multiple social networks including Facebook, Google+, LinkedIn, Twitter and email with the goal of identifying bogus profiles. These tools are of course attractive to ecommerce merchants and others employing social sign on to simplify site registration. That ability to ferret out bogus accounts supports payment fraud detection as well.

This triangulation of information is what creates notion of context. Apply it to security. If you can add the cardholder’s current location based on mobile GPS to the access device’s digital fingerprint to the payment card, to the time of the day when she typically shops, then the risk becomes negligible. Such precise contextual information could pave the way for the retirement of the distinction between card present and card-not-present transactions to generate a card-holder-present status to guide risk decision-making.

Sales First, Then Security

The use of ACT generated and derived signals will be based on the anticipated return for the investment. Merchants and financial institutions are more willing to pay to increase sales than pay for potential cost savings from security services. As a result, the ACTs will impact commerce decision making first-who to display an ad to, who to provide an incentive to.

New Combinations

Behind the scene, the impact of the ACTs on security will be fascinating and important to watch. From a privacy perspective, the use of the ACTs in security should prove less controversial because their application in security serves the individual, merchant and the community.

Determining the optimal mix of these tools will take time. How different are the risks for QR-code initiated transactions vs. a contactless NFC transaction? What’s the right set of tools to apply in that case? What sensor-generated data will prove useful? Is geolocation sufficient? Will we find social relationships to be strong predictor of payment risk or are these more relevant for lending? And what level of data sharing will the user allow-a question that grows in importance as data generation and consumption is shared more broadly and across organizational boundaries. It will be important for providers of security tools to identify the minimum data for the maximum result.

I expect the ACT’s to generate both a proliferation of tools to choose from and a period of intense competition. The ability to smoothly integrate these disparate tools sets will be a competitive differentiator because the difficulty of deployment for many merchants is as important as cost. Similar APIs would be a start.

Getting More from What We Already Have

The relying parties in a transaction – consumers, merchants, banks, suppliers – have acquired their own tools to manage those relationships. Multi-factor authentication is one tool kit. Banks, of course issue payment credentials that represent an account and proxy for the card holder herself at the point of sale or online. Financial institutions at account opening perform know your customer work to assure identity and lower risk.

Those siloed efforts are now entering an era where the federated exchange of this user and transactional data is becoming practical. Firms are building tools and the economic models to leverage these novel combinations of established attributes and ACT generated data.

The ACTs are already impacting the evolution of the payments security market. Payment security incumbents, choose just two from the social side, find themselves in an innovation rich period. Done well, society’s security posture could strengthen.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Payment Card Industry PCI Security, Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: big data, breaches, card data, cardholders, checkout lines, commerce, data loss, data sets, digital, ecommerce, geolocation, GPS, inherent security, Merchant's, Mobile Devices, mobile network, online activity, personally identifiable information, pii, POS, Security, security crisis, sensors, smartphone, social networks, transaction, transactional, travel patterns, vulnerabilities

February 13th, 2014 by Elma Jane

How To Target Customers Based on Past Purchase Behavior

One of the best ways to predict how someone will behave in the future is to look at what they’ve done in the past. By tracking a consumer’s past purchasing behavior, marketers can design highly targeted ads based on the specific preferences and tastes of individual customers.

The question, of course, is how to gain access to data about a consumer’s spending history without violating privacy standards. For many marketers, the answer is to partner with a vendor that provides card-linked offers. A survey of 300 marketers found that three-quarters believe card-linking marketing programs will replace existing types of advertising in the years to come – a strong vote of confidence from the very industry vendors are trying to tap.

Here are tools that marketers can use to gather information about their customers’ past purchasing habits.

1. BlueKai: Find prospects based on previous buying habits.

BlueKai offers marketers a third-party marketplace, known as the Audience Data Marketplace, where they can collect data on consumers in their target demographics. One type of data that marketers can collect is past purchasing behavior. Marketers can search for consumers who are likely to buy their products based on their previous spending habits. For example, an electronics brand may search for data about consumers who’ve purchased laptops in the past year. Using this information, marketers are able to create more targeted campaigns that are delivered only to those shoppers in qualified demographics.

2. Cardlytics: Learn where else your customers shop.

Cardlytics provides advertisers with insight into the purchasing behavior of more than 30 million households. Marketers have the option to target only those buyers who have been active in their sector. Cardlytics tracks where a consumer shops, when they shop, where they live, and how much they spend. For example, a retailer might only collect information about consumers who have spent more than $1,000 at competing businesses in the tri-state area. Using the Cardlytics platform, advertisers can create targeted offers meant to improve loyalty or build stronger customer relationships. Cardlytics offers pay-for-performance pricing.

3. Cartera: Reward consumers for shopping at retail partners.

Businesses that are looking to improve the effectiveness of their rewards programs can use Cartera’s card-linked platform to gain additional insight into the spending patterns of their top customers. By connecting loyalty programs to their customer’s credit and debit cards, marketers can offer better rewards — including cash back and airline miles. Retailers also have the option to reward consumers for shopping at “complementary merchants.” A few of Cartera’s best-known clients include Best Buy and Charter Communication.

4. Catalina: Actively pinpoint the shopping behaviors of specific buyers.

Using Catalina’s BuyerVision tool, marketers are able to target their digital advertising – including display, video and mobile – based on past purchasing behaviors. Catalina analyzes the in – store purchasing behavior of consumers and matches that data to online behaviors using cookies. For example, a grocery store could send recipe ideas to consumers who have purchased a specific combination of items in the past week. The company says it has access to transactions at more than 30,000 stores, allowing its clients to define their target audiences send mobile ads to more than 70 million households.

5. Edo Interactive: Target consumers based on competitive spending patterns.

Brands, agencies, and even small businesses can use edo Interactive’s card-linked marketing platform to send targeted offers to consumers based on their competitive spending patterns. The company has partnered with more than 200 banks, giving clients access to information about 200 million consumers. As a result, marketers connect their advertising to in-store purchases and send consumers relevant offers that they’re likely to redeem. Taking it a step further, edo’s Geocommerce feature combines purchase data with location information. Edo operates on a pay-for-performance model, which means marketers only pay when the customers they’ve targeted make purchases at their businesses.

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments Tagged with: access to transactions, competitive spending patterns, complementary merchants, consumer's spending, customer's credit and debit cards, customers purchase, in-store-purchases, Loyalty Programs, marketing platform, online behaviors, previous buying habits, purchasing behavior, purchasing behaviors, retailers, rewards, shoppers, store purchasing behavior, target demographics, targeted campaigns

February 13th, 2014 by Elma Jane

Core Elements of PCI’s Data Security Standard

This organization provides an international platform for the ongoing development, enhancement, storage, dissemination and implementation of security standards for account data protection. It is impossible to be involved in the credit card processing industry and not be aware of the PCI Security Standards Council.

As such it is important to be aware of the core elements of the PCI’s Data Security Standard (DSS).

The following are the current fundamental principles and requirements:

Build and Maintain a Secure Network

Requirement a. Install and maintain a firewall configuration to protect cardholder data

Requirement b. Do not use vendor-supplied defaults for system passwords and other security parameters

Implement Strong Access Control Measures

Requirement c. Restrict access to cardholder data by business need-to-know

Requirement d. Assign a unique ID to each person with computer access

Requirement e. Restrict physical access to cardholder data

Maintain a Vulnerability Management Program

Requirement f. Use and regularly update anti-virus software

Requirement g. Develop and maintain secure systems and applications

Maintain an Information Security Policy

Requirement h. Maintain a policy that addresses information security

Protect Cardholder Data

Requirement i. Protect stored cardholder data

Requirement j. Encrypt transmission of cardholder data across open, public networks

Regularly Monitor and Test Networks

Requirement k. Track and monitor all access to network resources and cardholder data

Requirement l. Regularly test security systems and processes

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Payment Card Industry PCI Security Tagged with: account data protection, cardholder data, credit card processing, information security, open public networks, PCI Data Security Standard, secure network, secure systems and applications, security standards council, security systems and processes, vulnerability management

February 13th, 2014 by Elma Jane

Becoming an e-commerce entrepreneur is an increasingly attainable dream for many aspiring business owners, as new online sales platforms and Web design tools continue to emerge. While just about anyone can launch an online business, it takes a dedicated salesperson to actually succeed, and that means staying on top of current marketplace trends.

If you’re ready to take your e-commerce business to the next level in 2014, watch these five current trends in online sales:

Access through smartphones, tablets and other mobile devices. Major gains seen in e-commerce usage of mobile devices such as smartphones and tablets, especially during the holiday season. Trend to accelerate as mobile adoption continues to increase and more mobile technologies become available. Small businesses should have a mobile version of their website, with mobile-optimized checkout to help facilitate a better mobile experience. Small retailers should also look at their site across multiple mobile devices and pay attention to new technologies, such as smartwatches.

Goodbye, traditional SEO. Google is constantly updating its algorithm in an effort to serve the best, most relevant content to its users. This means that traditional (SEO) search engine optimization tactics are falling by the wayside, and an increased push toward quality, unique content — along with social media signals — will be of huge importance in 2014. To help stay ahead of the SEO curve, small retailers should focus less on Traditional SEO Tenets like keyword usage and density, and instead aim efforts toward creating content that is tailored and useful for their target audience. Example, create more lifestyle-oriented content in the form of blog posts, videos and other types of media that encourage sharing by readers.

Increased dependence on data. Smaller online businesses continue to expand their presence across channels, the need to turn to performance data from both a channel-specific and holistic standpoint becomes even more important. Google Analytics is a good tool for this, because business owners can measure their site traffic from multiple devices and referral sites.

Small shops squeezed by larger merchants. Mega-retailers like Amazon continue to steal market share from other big-box retailers (both online and offline), smaller online businesses will need to become more nimble in how they compete, from a price, customer-service and marketing standpoint. This involves identifying true points of difference from larger merchants, showcasing these points in marketing and branding, and delivering personalized experiences.

The importance of multichannel selling. Customer shopping behaviors become more fragmented, so must the presence of small online businesses owners. Simply having an e-commerce site is no longer enough. Small and medium-size businesses (SMBs) should begin looking for efficient ways to expand their presence, including integrations with various shopping feeds and other outlets that can reach more consumers.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Point of Sale, Small Business Improvement, Smartphone Tagged with: content, e-commerce, integrations, mobile adoption, Mobile Devices, mobile version, mobile-optimized checkout, multiple devices, online business, online sales, search engine optimization, shopping feeds, Small and medium-size businesses (SMBs), small online business owners, small retailers, Smartphones, smartwatches, social media signals, tablets

February 3rd, 2014 by Elma Jane

National Transaction and Virtuoso Agreement Official

National transaction and Virtuoso signed a preferred supplier agreement this 30th of January. NTC’s Electronic Payment System will be offered to its more than 330 agencies with 7,200 elite advisors in 20 countries.

Virtuoso is the travel industry’s leading luxury network. Travelers who use Virtuoso’s Advisors get access to more than 1,300 of the world’s premier travel providers, as well as exclusive, experiences and products. Virtuoso’s history dates to the 1950s, when the tour company Allied Travel formed to help travel agencies with foreign, international and group trips. In 1986, Allied Travel merged with Percival Tours to form (API) Allied Percival International, joining the best travel agents in the country. In 2000, API was rebranded Virtuoso, and has since become the leading travel network in the world.

While National Transaction with over 15 years in the payment service industry, has gained experience to integrate vast range of payment services. Processing digital transactions for more than 3,000 business owners and has been the preferred merchant account provider for many industry associations including ASTA, CLIA, HBTA, ARTA OSSN and now VIRTUOSO.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Travel Agency Agents, Visa MasterCard American Express Tagged with: arta, ASTA, clia, hbta, merchant account provider, National Transaction Corporation, ossn, travel, travel agencies, travel industry's, travel network, travel providers, travelers, Virtuoso

February 3rd, 2014 by Elma Jane

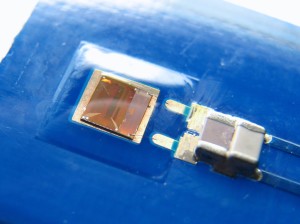

The migration to cards that use chips instead of magnetic strips, known as EMV technology, is well underway in the U.S. No government regulation is needed to make it happen. But the EMV migration and the Target breach are different things. It’s true that EMV chip cards can prevent criminals from producing counterfeit cards using stolen account numbers. But EMV doesn’t stop criminals using stolen cards online. So innovators are deploying new technologies to deter other forms of fraud.

Headline-grabbing events inevitably lead to calls for new laws. But in the case of our nation’s electronic payments systems, new government mandates would stifle marketplace innovations that hold great promise for providing consumer benefits and reducing criminal activities.

Financial institutions compete for customers by providing consumer protections even beyond requirements of current law. Many retailers also offer customers speedy transactions, such as “sign and go” and “swipe and go” for small transactions, while the payments industry ensures consumers still have zero liability. These protections and flexibility are why U.S. consumers are going cashless and carry more than one billion debit and credit cards. More than 70% of retail purchases are made with electronic payments, and our member companies process more than $4 trillion in electronic payments each year.

Fraud accounts for fewer than six cents of every $100 spent on payments systems – a fraction of a tenth of a percent. U.S. companies have made significant financial and technological investments, building sophisticated fraud tools that insulate consumers from liability. To build on this, Congress should foster greater international law enforcement cooperation to fight cybercrime, particularly in countries that harbor crime rings, and replace 46 divergent state breach notification laws with a uniform national standard.

The private sector is best positioned to address the constantly shifting tactics of criminals, and it is doing so without government mandates. Do Americans really want the government in charge of the security and monitoring of our payments?

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Visa MasterCard American Express Tagged with: counterfeit cards, cybercrime, data breach, debit and credit cards, electronic payment systems, electronic payments, emv chip cards, emv technology, fraud, liability, magnetic strips, migration, online, security and monitoring of our payments, small transactions

January 30th, 2014 by Elma Jane

As many as 40 million Target customers hacked over the holidays when thieves got into their credit and debit card. If you shopped at Target between November 27 and December 15 while thieves were hacking data, you’re unlikely to lose a dime. Federal law and industry practices protect virtually all customers from any liability for fraudulent charges. So many breaches occur in the first place. Credit and debit card fraud has nearly quadrupled in the past decade, hitting $11.3 billion in losses worldwide last year. That hurts profits and raises the cost of goods. The U.S. accounts for more than its share of fraud, and hardly a month goes by when there isn’t a breach from some large U.S. retailer, in part because the U.S. lags other countries in card security.

After the Target breach, the stolen account information flooded underground markets that operate on the Internet, selling batches of data that allow thieves to counterfeit cards and shop till they drop. The best thing that could happen is if this latest megabreach forced the industry and Congress to fix some of the system’s most troubling vulnerabilities.

Cyberthieves are growing more sophisticated, and nothing can prevent every data breach. But when a company as big as Target can be hacked for 19 days to the tune of 40 million records, consumers deserve more modern and tougher protections.

Some ideas for curbing cybercrime:

Put stronger protections on debit cards. Credit cards carry the gold standard in protection against having to pay for fraudulent charges. Federal law limits losses to $50, and most issuers take that down to zero. After a data breach, debit cards are similarly protected. But if your debit card is lost or stolen, by law you could lose up to $500, and reimbursement may depend on how quickly you report the loss. There’s no sound reason for the gap. It should be eliminated.

Set federal standards to protect data. The industry, led by Visa and MasterCard, has always provided its own security standards to keep data safe. Obviously, they’re not working. Federal standards could help, especially if backed by sanctions for flouting them. The Federal Trade Commission has some authority, but the law is nearly 100 years old, and some companies have challenged the agency in court. Since the Target breach, several senators are calling for more federal authority.

Get with the 21st century. The U.S. is far behind Europe, which almost a decade ago replaced the magnetic strip on cards with a digital chip that prevents thieves from counterfeiting cards with stolen data. That’s one reason the U.S. has become a mecca for hackers. The U.S. industry is migrating to these “EMV” cards, but it has moved slowly. The players fight among themselves over everything from who pays to the type of security. Requiring cardholders to use PIN numbers would provide the best security. Whatever the decision, the industry needs to get moving to meet a self-imposed 2015 deadline.

Posted in Best Practices for Merchants, Credit Card Security, Digital Wallet Privacy, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Payment Card Industry PCI Security, Visa MasterCard American Express

January 30th, 2014 by Elma Jane

Some employers might think that setting limitations on things like mobile devices and Internet access is the answer to get more done during workday, but many companies have found that giving their workers more freedom and flexibility through certain policies is the key to increased efficiency.

Progressive companies are evolving their benefits programs and finding ways to drive employee productivity without breaking the bank, said Chris Duchesne, vice president of global workplace solutions at Care.com, a care provider matching service. They are providing tools to help reduce the amount of time employees spend on personal issues, giving them time back in their day that they often designated back to working.

Duchesne suggested a few policies that can be implemented to boost productivity, morale and culture among employees: Ways to improve Work-Life Balance Today

Demonstrate Leadership. There’s a trickle-down approach to how supervisors mentor. It starts with human resources departments and top executives recognizing and rewarding employees for their advances and their contributions. Public shout-outs, spot awards and profiles in regular company communications demonstrate company values and reinforce them across the workforce. The most productive companies have a policy and culture in place where the appreciation for each employee is apparent.

Some companies are hesitant to implement changes because they are concerned about costs, but these policies are often not as expensive as employers may think. Even if they do cost money, they don’t have to happen all at once.

Change happens gradually, and employers should feel comfortable implementing new work-life policies in stages. They should figure out what the actual costs will be and even have pilot programs before rolling them out company-wide. There is also a misperception that employers will have to bring on additional staff to support these new programs. You likely have existing employees who can fit these new programs into their current job responsibly. Most people are passionate about work-life issues and will be happy to help you implement new policies to make their lives easier.

In the long run, these types of benefits programs and policies can actually have a positive impact on company’s bottom line as well.

Employers lose billions of dollars each year in total productivity loss when employees take unexpected leave due to personal issues. Work-life and culture programs will be a critical differentiator in the new workplace and have the ability to drive innovation, creativity, loyalty and increased productivity.

Encourage breaks. Creating mandatory fun sounds like a contradiction, but celebrating birthdays, allowing budget for team lunches, holding quarterly group activities or even having a beer or snack cart for random holidays can boost team spirit and culture. A break for forced fun can reduce mental fatigue, increase collaboration and morale, and offer employees the opportunity to clear their heads.

Provide flexible work options. With respect to both work schedule and work location, as long as work gets done, it shouldn’t matter where or when it was accomplished. Recent Gallup research found that employees who work remotely even part of the time are both more engaged and more productive. If it’s possible for your employees to complete their tasks outside the office, give them the option to do so.

Reduce stress through family-care programs. Help employees manage their personal and professional lives with programs and services that help them address the most pressing and stressful needs in their lives, their families. And it’s not just about child care, either. Think about how you can help them take care of their aging parents, their pets and their households, too.

Posted in Best Practices for Merchants, Small Business Improvement, Smartphone Tagged with: boost productivity, communications, employee productivity, freedom and flexibility, human resources, implement, internet access, leadership, Mobile Devices

January 29th, 2014 by Elma Jane

More than 60 percent of online shoppers returned or exchanged at least one item. About 95 percent of customers will go back to an online merchant and make additional purchases after a positive return or exchange experience, making managing the process important for e-commerce success.

Exchanges and returns will shortly be a hot topic for online retailers as Christmas gift recipients contact sellers in the wake of an exceptional holiday selling season. These Christmas gift recipients will want to exchange and return unwanted gifts, items that are wrong size, or even items that may have been damaged in transit.

Returns and exchanges are important for building long term customer relationships, with some 95 percent of shoppers going back to online merchants that have offered a good exchange or return experience in the past, according to data from Endicia, an electronic postage solution provider. Conversely, about 85 percent of consumers will not return to an online shop after a poor return or exchange experience, again according to Endicia.

What follows are tips for offering a better exchange or return experience for online shoppers.

Create an Opportunity

Returns and exchanges are also an opportunity to make additional sales. As mentioned above, about 95 percent of shoppers will return to an online store and make an additional purchase after a positive return or exchange experience.

Similarly, about 45 percent of shoppers will actually recommend an ecommerce merchant, again according to Endicia, after a positive return experience, meaning that taking care of an existing customers could lead to new customers too.

Consider sending each shopper who returns or exchanges an item a follow-up email, asking for feedback about the experience. Identify ways to improve the return process, and business in general will improve too.

Know the Cost of Returning

A guitarist for a popular party and event band recently ordered a new guitar strap from a merchant on the Amazon marketplace. Unfortunately, there was an error in the shipment, and the merchant apparently sent a shorter strap than expected. When this guitarist contacted the seller about an exchange, he was told that a new strap would be shipped that day and that he could simply keep the smaller strap.

This solution was great for the customer, who did not have to repackage the strap or arrange for a carrier to pick it up. He was generally happy with the experience. This was probably also better for the merchant, who might have simply been able to order a new guitar strap from its distributor for about the same cost has having the strap returned.

To make this sort of business decision, it is important to understand the real cost of managing a customer return, including the cost of the shipping and the labor necessary for processing the return once it arrives back at the seller’s warehouse. If it cost as much or nearly as much to return the item as it would to simply purchase another one wholesale, consider letting the customer just keep it, saving everyone involved time and expense.

Provide Return Instructions or a Return Label in Every Order

Shoppers don’t want to wait for return labels. In fact, about 62 percent of online shoppers want a return label included in the initial shipment, according to Endicia. Including a return label is not difficult, and many online sellers may find that the ability to do so is either built directly into the retailer’s ecommerce platform or is available via an extension to the ecommerce platform.

A second option may be to offer shoppers a simple, self-service way to print a return label from your site. This self-service option does not require the customer to contact the shipper to get authorization or wait for an emailed label. According to the Endicia data, about 61 percent of shoppers will be happy with an easy way to print return or exchange labels.

State Return and Exchange Policies Clearly

Let customers know exactly what to expect from the return and exchange process. Post clear, simple-to-understand policies on a page of the site specifically designated for returns or shipping policies.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Gift & Loyalty Card Processing, Internet Payment Gateway, Visa MasterCard American Express Tagged with: Amazon, ecommerce, gift recipients, marketplace, online merchant, online retailers, online sellers, online shoppers, return or exchange, returns and exchanges, self-service

December 20th, 2013 by Elma Jane

16 Free Online Tools for Small Businesses

Whether you’re starting a small business or you’re just thrifty, you can likely benefit from some free online productivity tools.

There are apps for accounting, collaboration, customer management, development, scheduling, general office tasks and more. All of these tools have free plans, and several are entirely free.

Appointlet

If you make appointments with customers, you may need Appointlet, an online appointment-scheduling app for Google Calendar. Add it to your website and let your clients do the booking. Confirm, decline, cancel, or reschedule any appointment right from the comfort of your Google Calendar. Easily gather all the information from your clients that you need to fulfill the appointment.

Boomerang for Gmail

Lets you write an email now and schedule it to be sent automatically at the perfect time. Write the message as you normally would, then click the Send Later button. Tell Boomerang when to send your message by using the calendar chooser or the text box that understands language like “next Monday.

Dropbox

Is a cloud-storage service that lets you access and sync files across all your devices. While Dropbox only offers 2 GB of initial free storage (Google Drive and SkyDrive offer more), it expands free storage up to 16 GB free for referrals. Dropbox offers native support for Linux and Blackberry, as well as Windows, Mac OS, iOS, and Android. To supercharge your Dropbox, utilize the many third-party apps, which offer enhanced file syncing with Dropbox’s new Datastore API.

Evernote

Is an app to remember everything, from lifelong memories and vital information to daily reminders and to-do lists. Everything you store in your Evernote account is automatically synced across all of your devices, making it easy to capture, browse, search, and edit your notes everywhere you have Evernote.

Gmail

Is a Google’s email application, which includes 15 GB of free storage (across Gmail, Google Drive, and Google+ photos). Gmail also lets you communicate via SMS, voice, or video chat. See who’s online and connect instantly. See your contacts’ profile photos, recent updates, and shared docs next to each email.

Google+ Hangouts

Turn any gathering into a live video call with up to ten friends or simply call a contact to start a voice call from your computer. Enhance your call with Cacoo for online drawing, SlideShare for sharing presentations, and Conceptboard for whiteboard collaboration.

HelloSign

Is an application for getting documents signed. It includes tools to facilitate document signing, tracking and management. Notifications keep you appraised of the signer’s activity. Signed documents are securely stored and always accessible. Sign an unlimited number of documents for free. HelloSign has mobile apps and a Gmail extension.

HootSuite

Is a social media dashboard to manage and measure you social networks. Manage your messages, get custom analytics on your social campaigns, and communicate internally without leaving the HootSuite dashboard. Access a single interface to monitor Twitter, Facebook, LinkedIn, Google+ Pages, WordPress and more. Or add more social networks with the HootSuite App Directory.

KeePass

Is a free password manager to help manage your passwords in a secure way. Put all your passwords in one database, which is locked with one master key or a key file. Remember one single master password or select the key file to unlock the whole database. The databases are encrypted using secure encryption algorithms (AES and Twofish).

Mural.ly

Is a visual-collaboration whiteboard app. Drag and drop images, links, and documents to organize your ideas. This simple visual tool can keep your team in sync through brainstorming, planning, or designing a project. Features include private murals, auto-save and backups, comments, activity feed, and chat.

NutshellMail

Takes copies of your latest updates in your social networking accounts and places them in a snapshot email. The NutshellMail update is then sent to your primary email address. NutshellMail supports Facebook, Twitter, LinkedIn, Yelp, MySpace, YouTube, Foursquare, and Citysearch. Receive updates as often as you wish.

Rapportive

Shows you everything about your contacts right inside your inbox. Immediately see what people look like, where they’re based, and what they do. Establish rapport by mentioning shared interests. Record thoughts and leave notes for later.

Streak

Is a customer relationship application for Gmail. Track your deals from your inbox. Group emails from the same customers together, utilizing spreadsheet view right inside Gmail. Use the mobile app to keep track of your customers, make calls, and send emails. Share selective parts of your inbox. Schedule emails to send later.

Trello

Is a collaboration tool that organizes your projects into boards. Trello tells you what’s being worked on, who’s working on what, and where something is in a process. Trello uses boards, lists, and cards to create projects and develop your workflow.

Wave

Offers online accounting and finance applications for small businesses. It includes invoicing, accounting, payroll, payments, receipts, and personal finance software. Accounting, invoicing, receipts, and personal finance applications are free.

Posted in Best Practices for Merchants, Merchant Account Services News Articles, nationaltransaction.com Tagged with: accounting, Android, appointlet, apps, automatically, boomerang, developer, dropbox, email, evernote, Facebook, free, gmail, google, hangouts, hellosign, hootsuite, iOS, keepass, linkedin, mac os, mural.ly, nutshellmail, online, passwords, scheduling, skydrive, small businesses, streak, sync, syncing, tools, trello, twitter, wave, windows, wordpress