Category: Best Practices for Merchants

December 19th, 2013 by Elma Jane

NTC’s BIG DATA

Improving Collection and Analytics tools to Create Value from Relevant Data.

Big data is a popular term used to describe the exponential growth and availability of data, both structured and unstructured. And big data may be as important to business…and society… as the Internet has become. Why? More data may lead to more accurate analyses. More accurate analyses may lead to more confident decision making, and better decisions can mean greater operational efficiencies, cost reductions and reduced risk.

With NTC Virtual Merchant product, it captures email addresses at the Point-of-Sale (POS) into a database to assist merchants and consumer stay connected, and for future Marketing.

In understanding Big Data For Merchants, NTC’s President Mark Fravel, provided a general overview of how online merchants can use Big Data. Large amounts of seemingly random data from many sources…can be used to create competitive advantages.

Necessity of Analytical Tools

Collecting Big Data is the easy part. Storing, organizing, and analyzing it is much more complex. One seam of data that several experts identify as a particularly rich, emerging source of information can be as diverse as CRM software, AdWords, and your own website. Mobile communications, including text messages and social media posts such as Facebook and Twitter. Making sense of it can be overwhelming without analytical tools. These tools facilitate the examination of large amounts of different types of data to reveal hidden patterns and correlations that are not otherwise easily discernible.

A good example is NTC, they could analyze data on visitor browsing patterns, login counts, phone calls, and responses to promotions…they can monitor to eliminate what isn’t working and focus on what does. Some of the off-the-shelf analytic solutions are so finely tuned, they can tell a vendor whether it needs to offer a 25 percent discount or if a 15 percent discount will suffice for a particular customer.

Association rule learning is another analytics method that is a good fit with Big Data. This could be, for example, a shopping cart analysis, in which a merchant can determine which products are frequently bought together and use this information for marketing purposes.

Uses of Big Data Analytics:

Big Data can be most useful in analyzing a customer’s shopping and purchasing experience, which can help a merchant in the following four ways.

Become more efficient by alerting you to merchandising efforts that are ineffective, and products that are not selling.

Encourage more purchases by presenting existing customers with complementary items to what they’ve purchased previously.

Enhance inventory management by eliminating slow-moving items and increasing the supply of fast-moving merchandise.

Example: A top marketing executive at a sizable U.S. retailer recently found herself perplexed by the sales reports she was getting. A major competitor was steadily gaining market share across a range of profitable segments. Despite a counterpunch that combined online promotions with merchandising improvements, her company kept losing ground….The competitor had made massive investments in its ability to collect, integrate, and analyze data from each store and every sales unit and had used this ability to run myriad real-world experiments. At the same time, it had linked this information to suppliers’ databases, making it possible to adjust prices in real time, to reorder hot-selling items automatically, and to shift items from store to store easily. By constantly testing, bundling, synthesizing, and making information instantly available across the organization…the rival company had become a different, far nimbler type of business.

Increase conversion rates by better identification of successful sales transactions.

Is Big Data Analysis Affordable?

NTC Data Storage is also a good alternative for small ecommerce merchants because it is relatively inexpensive and is scalable it can expand as data requirements grow.

Relying on data-driven decision-making is crucial in industries in which profit margins are slim. Amazon, which earns increasingly thin profit margins, is one of the most effective users of data analytics. As more Big Data solutions for small online businesses come to market and more online merchants incorporate Big Data into their business tool set, employing Big Data will become a necessity for all Merchants.

Using data wisely has the potential to boost margins and increase conversions for online merchants, and investors are banking on it.

This is Big Data for NTC we know WHO, WHAT,WHEN, AND WHERE a purchase took place.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Point of Sale, Visa MasterCard American Express Tagged with: analyses, analytic, big data, communications, competitive, consumer, cost, database, decision, ecommerce, email, internet, marketing, Merchant's, mobile, monitor, ntc, online, orgainizing, patterns, point of sale, POS, profit margins, promotions, risk, scalable, solutions, storing, text messages, virtual merchant, website

December 16th, 2013 by Elma Jane

1. Account Updater (Visa)

Incorrect billing information leads to declined credit cards, loss of sales and unhappy customers.

Visa touts its Account Updater as an easier way to keep customer data current. The tool appends all card data with up-to-date customer info so businesses can avoid difficulties over address changes, name changes, expired cards and more.

The tool can benefit any business that bills customers on a recurring basis.

It eliminates the need for manual administration, so it can lower your business’s operational costs and customer-service expenses. And by saving your clients the hassle of a declined payment, you can boost customer satisfaction and overall sales.

2. Netswipe

Paying online is convenient for customers, but keying in an unwieldy credit card number is still a pain.

Netswipe from Jumio gives customers an easier way: The tool lets users pay by snapping a photo of their credit card; it’s almost as easy as swiping your card through a traditional card reader.

According to Jumio, customers can use their smartphone or tablet to scan a card in as little as 5 seconds, whereas traditional key entry takes 60 seconds or more, on average. Having a quick and convenient way to pay could help contribute to a positive buying experience and encourage repeat business.

The system is compatible with any iOS or Android mobile device, as well as with any computer with a webcam.

3. Netverify

Jumio’s fraud-scrubbing tool helps you determine if your customers are who they say they are.

Net verify allows customers to snap a picture of their driver’s license or other identification using a smartphone, tablet or PC webcam. Once the image is taken, the tool can verify the authenticity of the documentation in as little as 60 seconds.

That’s much faster and more convenient than asking a customer to fax or mail a copy of their ID in the middle of a transaction.

The tool can verify identifying documents from more than 60 countries…including passports, ID cards and driver’s licenses, and even bank statements and utility bills. Jumio says its software is smart enough to automatically reject nonauthentic documents.

And customers can rest easy knowing that all submitted information is protected with 256-bit encryption to prevent identity theft.

Online merchants embed Netverify into their websites as part of the checkout process.

4. Payment Gateway

Payment Gateway service does all the heavy lifting of routing and managing credit card transactions online.

Portals like this one benefit small businesses by providing a fast and secure transmission of credit card data between your website and the major payment networks. It works a lot like a traditional credit card reader, but uses the Internet to process transactions instead of a phone line.

Payment Gateway also offers built-in fraud-prevention tools and supports a range of payment options, including all major credit cards and debit cards.

5. PayPal Here

Mobile credit card processing services like PayPal Here make it easy to accept credit cards in person using a smartphone or tablet.

PayPal Here and other similar services send you a dongle that attaches directly to your iPhone, iPad or Android device, allowing you to swipe physical credit cards wherever you are.

One major benefit of mobile credit card readers is that they work with the devices you already own. That means there’s no need to carry around additional hardware, aside from the reader add-on itself. Most credit card readers attach to your device via the headphone jack or charger port, and are small enough to fit in your pocket.

The smallest businesses have the most to gain by opting for mobile credit card readers, which are cheaper and far more portable than traditional options.

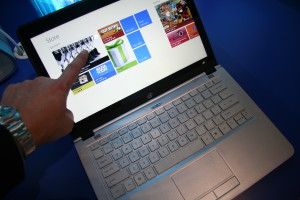

6. Virtual Terminal

If you do business online, your website needs the infrastructure to accept credit card information.

Web-based applications like virtual terminal offer the basic processing functionality of a physical point-of-sale system, and are easy to install on your business’s website.

The system allows merchants to collect orders straight from the Web, or take orders via phone or mail and before initiating card authorizations online.

It also includes extensive transaction history to help you manage payment data, split shipments, back orders and reversals. Business owners can even receive a daily email report of all credit card transaction activity from the prior day.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, e-commerce & m-commerce, Electronic Payments, EMV EuroPay MasterCard Visa, Gift & Loyalty Card Processing, Mail Order Telephone Order, Merchant Cash Advance, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: account, Android, authenticity, card data, card reader, checkout, checkout process, credit card number, credit card transactions, debit cards, declined payment, expired, fraud, id, iOS, mail, mobile device, nonauthentic, online, online merchants, passports, payment data, payment gateway, payment options, phone, point of sale, recurring, smartphone, tablet, verify, visa, webcam

December 12th, 2013 by Elma Jane

Virtual Merchant Processing Gateway

Virtual Merchant

A virtual merchant is a website that sells goods and services to the public via online transactions with debit and credit card processing. The end result is a fully online experience where consumers can virtually visit a store to browse goods, purchase them fully online and receive them in the mail several days later, all from the comfort of your personal computer.

Virtual Merchant Element

Virtual merchants are made up of multiple features that basically make a website into an online store. Online stores provide e-commerce capabilities in the form of processing payments for orders and then shipping the goods or services either digitally or physically. Some brick and mortar companies may create a Web presence that only describes the store or displays the goods it sells, but they may not sell anything online.

Virtual merchants are a different breed from simple informational websites, utilizing a merchant account to create a secure online storefront. Merchant accounts create a contract between the store and online credit card processing companies. As part of this merchant account agreement, the virtual merchant pays the processor vendor a percentage of each transaction made via the online store. In some cases, this fee comes out to a monthly rate with a set per-transaction fee.

Virtual Merchant Services

Many virtual merchant services exist that cater to both online and offline business presences, though many that specialize in online retail offer more features and functionalities. These service providers offer virtual terminals to create a fully-functional payment gateway for processing purchases and creating a fluid shopping experience. Companies like National Transaction Corporation stand out as among the most popular of options due to their low merchant account fees and comprehensive virtual merchant services.

Benefits of Virtual Merchant

Virtual merchants expand the functionality of a website beyond a simple informational resource into a usable storefront. As is the case with most any type of online service, a virtual merchant service will help reduce overall work and costs associated with creating an online storefront, freeing you up to run your business as it was meant to be.

Using virtual merchant services for your website can benefit business in the following ways:

1. Easily integrates with your existing website for brand continuity

2. Facilitates more positive sales experiences

3. Improves customer service levels

4. Reduces administration and maintenance times for online retail websites

5. Removes geographic barrier from consumers, allowing for national and international sales

Secure information

Making each transaction as secure as possible becomes a main selling point of any company trying to build credibility through a Web presence. Virtual merchant services become an ideal solution as they offer all the necessary security measures to protect and keep private each buyer’s payment information.

The end result becomes that the payment process is protected through secured-socket layering (SSL) encryption to prevent data interception during an order, and account information is stored in multi-tiered firewall protection.

Straightforward online ordering

The most important part of any online purchasing experience is the ease of the ordering process. Through the use of features like a shopping cart, purchasing all items in the cart and creating an account to remember purchasing information all contributes to customer retention. When a consumer chooses to buy their goods online, a typical order processing form will entail entering credit card and billing address information as well as a shipping address and shipping options.

Each of these functionalities is ultimately governed through virtual merchant software to ensure a seamless and painless experience. The software is often available in one of two formats, either hosted or in-house. As a hosted solution, the virtual merchant service maintains the payment portal and allows you to edit its look and essentially create your store on their servers and databases. As an in-house solution, you install the software onto your own website servers and integrate the merchant application into the existing website. Both offer inherent benefits from customization to reliable management, but it ultimately depends on a company’s overall needs.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Point of Sale Tagged with: credit card processing, debit and credit card processing, digitally, e-commerce, hosted, low merchant account fees, merchant account, online retail websites, online transactions, payment gateway, payment process, per-transaction, processing payments, processing purchases, processor, secure, store, storefront, transaction, virtual merchant, virtual terminals, virtually, website

December 3rd, 2013 by Elma Jane

De-clutter

A messy workplace is annoying, distracting, and can get out of hand. Keep clutter at bay by regularly tidying up.

Clutter can also exist inside the mind. Having piles of paper on your desk can keep you from finding a pen, having too many thoughts can curb your focus.

Fix this by de-cluttering your mind. Use a mind-mapping tool to organize all the ideas, tasks, or worries in your head.

Eat your Frog Early

When you arrive in the office every morning, do you dive right into your biggest task or do you get the minor stuff out of the way first? Author and personal development coach Brian Tracy says that the former is more effective in terms of productivity.

In his book Eat That Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less Time, Tracy cited a famous Mark Twain quote, “Eat a live frog first thing in the morning and nothing worse will happen to you the rest of the day.”

He used frog eating as a metaphor for task completion, in which the frog “is your biggest, most important task, the one you are most likely to procrastinate on if you don’t do something about it.” Finish that task as early as possible, and you can spend the rest of the day knowing that you’ve accomplished a big goal.

Resist the urge to complete smaller jobs first. Doing so will only feed your procrastination and won’t take you any further towards completing your big tasks.

When deciding on what to prioritize in your business, always put your highest-impact goals at the top of your to-do list. What step can you take today that will have the biggest effect on your company? Start with that, and either delegate or hold-off on the low-level tasks. This tough to do.

Follow the 80-20 Rule

The 80-20 rule, developed by Italian economist Vilfredo Pareto states that for many situations, about 80 percent of the effects or outcomes come from just 20 percent of the causes.

In business, the 80-20 rule comes into play when 80 percent of a company’s clients are generated from 20 percent of its sales staff, or when 80 percent of returns come from 20 percent of its customers.

Determine how the 80-20 principle applies to your business, then address that 20 percent so you can generate more results, or eliminate problems.

For instance, if you discover that 80 percent of your profits come from 20 percent of your customers, then nurture your relationships with those customers and reward them for their loyalty. Or perhaps you notice that 20 percent of your online marketing efforts are bringing in 80 percent of your site traffic. Stop spending resources on the low-performing strategies, and focus your efforts on the channels that work.

Have a Meeting Policy

If you must hold meetings in your company, keep them brief. Always have an agenda and a clear purpose for the meeting.

You may also want to consider having company-wide policies that tell people when and how to set-up meetings. Some companies for example, always hold meetings on the same day and time each week…e.g., Monday mornings, Thursday afternoons. This schedule enables people to plan their days and weeks more effectively.

Optimize your Relationships with Vendors

You optimize your site for speed and user-friendliness. Why not do the same for your suppliers and service providers?

Check with your vendors to ensure you’re working efficiently. Ask if there’s anything you can do to make their jobs easier, or recommend any improvements that they can implement. Don’t view your relationship as a service provider and client. Instead, treat your vendors as your partners.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Environmentally Green, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale Tagged with: agenda, business, ecommerce, loyalty, marketing, mind-mapping, online, optimize, organize, policies, prioritize, procrastinate, procrastinating, procrastination, spending, strategies, suppliers, task

November 18th, 2013 by Elma Jane

Big players are entering the merchant cash advance business and the industry’s smaller players are maturing. Meanwhile, the market is growing with the help of automated clearinghouse transactions.

The industry has caught the attention of high rollers who are transforming merchant cash advance into a mainstream option for funding small to midsize businesses.

In the past two years, venture capitalists and hedge funds have invested tens of millions of dollars in long-standing merchant cash advance firms and startups alike.

Meanwhile, big players such as PayPal and the card brands have launched their own programs to provide working capital to merchants.

The business has changed so much in the five years, it’s almost not the same business anymore, says a hybrid ISO and merchant cash advance company based in New York.

CEO of Capital Stack LLC, a merchant cash advance company in New York, has been monitoring the industry’s growth on his DailyFunder blog. He estimates that a year ago, there were about 50 merchant cash advance funders and about $1.5 billion in funding. This year, that number is north of 120, and the funding volume has doubled to $3 billion.

Counting mainstream funders such as Amazon and PayPal, which offer products that follow the cash advance model, the numbers are closer to $5 billion.

Until now, ISOs were using cash advances as an acquiring tool for credit card accounts. An estimate that of the 20 million to 25 million businesses in the U.S., about 5 million accept credit cards. When ACH opened up the remainder of those businesses for loans, the funding volume went off the charts. Now it’s going to grow 50-fold in a 10-year period, just because there are so many more businesses that are approvable.

The popularity of cash advance is good news for ISOs, who might have an easier time pitching the product to merchants because they already know about it and know to ask for it.

A number of factors have coincided to make merchant cash advances more attractive.

Previously, cash advances were associated with luring merchants into a high-rate source of cash. Funders could charge any rates they wanted because the industry was so unregulated. As the industry has matured, the more disciplined companies have survived, while the others have fallen by the wayside, and with the recession causing fewer banks to offer traditional loans, the market is wide open for alternative funders of all shapes and sizes to enter the fray.

The industry has also outgrown the one-size-fits-all pricing that once defined it. Before, all lenders set high prices. Now, companies rely on risk-based pricing, which means better clients get better deals, and ISOs can offer more competitive pricing. That changed the dynamics of the industry.

But the real change in merchant cash advance, members of the industry say, has been the widespread use of automated clearinghouse payment transfers. It used to be that merchant cash advance was available only to companies that accepted credit cards. Now with more businesses accepting payments online via ACH, there is another mechanism for collecting from merchants.

It took some time for people to accept people going into their bank account and debiting their account. Five or six years ago, no one would have allowed someone to do something like that.

Today, everybody’s fundable, as long as you have a bank account. Gone are the days when ISOs had to walk away from potentially big deals because the merchant didn’t accept credit cards, or didn’t have enough processing volume. ISOs and merchants now have more flexibility to walk into just about any business and offer financing. That’s why it’s mainstream.

Posted in Best Practices for Merchants, Financial Services, Merchant Cash Advance Tagged with: accept credit cards, accounts, ach, acquiring, Amazon, approvable, automated, clearinghouse, credit-card, funders, funding, high rate, high rollers, ISO, merchant cash advance, PayPal, traditional loans, transactions, unregulated, venture capitalist, working capital

November 15th, 2013 by Elma Jane

November 7, 2013 – Payment Card Industry (PCI) Council’s recent acceptance of the world’s first Point-To-Point Encryption-validated solution is great news for both acquirers and merchants, and will aid in reducing merchant scope and increasing business security worldwide. If your P2PE know-how is a little spotty, here are the basics.

What is P2PE?

Point-To-Point Encryption (P2PE) is the combination of hardware and processes that encrypts customer credit/debit card data from the point of interaction until it reaches a merchant solution provider’s environment for processing. Because card data is immediately encrypted as the card is swiped (or dipped), it prevents clear-text information from residing on the payment environment. Encrypted card data is then transferred to, decrypted by, and processed through the solution provider processor who is the sole holder of the decryption key.

In a POS environment, merchants often store decryption keys on their backend servers. Bad idea. If a cybercriminal hacks into that environment, they not only have access to the encrypted card numbers, but the decryption key as well. Hacker jackpot. Many question the difference between P2PE and typical point of sale (POS) encryption.

The reason P2PE is arguably the most secure way to process is because merchants don’t have access to decryption keys. If a hacker breaches a merchant using a validated P2PE solution, he/she will only recover a long string of useless encrypted card numbers with no way to decode them.

Why use P2PE?

Basically, P2PE increases data security and has the ability to make a merchant’s job of reaching PCI compliance easier. The main point of using a P2PE-valiated solution is to significantly lessen the scope of security efforts through PCI Data Security Standard (DSS) requirement and P2PE Self-Assessment Questionnaire (SAQ) reduction. Compared to the 80+ questions required of mainstream merchant SAQs, the P2PE-HW SAQ only requires merchants to answer 18 questions.

Are all P2PE solutions created equal?

Answer is no. Many P2PE solution vendors claim their solution reduces scope, but in order for a merchant to qualify, they must select only P2PE-validated solutions listed on the PCI Council’s website.

To get P2PE solutions and applications listed on the approved website, solution provider processors must go through a rigorous testing process performed by a qualified P2PE Qualified Security Assessor (QSA). P2PE QSAs help entities thorough the 210-page document of P2PE requirements, testing procedures, and controls required to keep cardholder data secure – a task which only a few companies in the world can do.

As of this post, the only P2PE hardware solution approved by the PCI Council is European Payment Services’ (EPS) Total Care P2PE solution, validated by P2PE QSA SecurityMetrics. A number of other P2PE solutions are currently undergoing the review process and will be added to the list once approved.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, Merchant Services Account, Payment Card Industry PCI Security, Point of Sale, Visa MasterCard American Express Tagged with: acceptance, acquirers, backend, cardholder, credit/debit, cybercriminal, data, decode, decrypted, decryption, DSS, encrypted, encryption, encrypts, hacker, hardware, key, Merchant's, p2pe, p2pe-hw, Payment Card Industry, PCI Council, point of sale, point-to-point, POS, process, processed, processes, Processing, processor, provider's, saqs, secure, solution, transferred, validated

November 14th, 2013 by Elma Jane

Los Angeles-based company Verifi, providing antifraud and risk-management services recently secured a patent for its dispute-resolution technology that enables merchants to avoid chargebacks by turning them into refunds earlier in the process. According to the patent abstract, the patent covers “receiving, at the partner platform, an inquiry/dispute event notification,” and “refunding the transaction or canceling future or recurring charges associated with the transaction.”

Verifi noted in the patent application, consumers are increasingly contacting their issuing bank first in the case of a disputed credit or debit card charge, cutting the merchant out until later in the process. The patent in question, in addition to streamlining the process for issuers engaged in the dispute process, helps recurring merchants by removing cardholders from the recurring payment program during the resolution process so additional charges will not come into question until the original dispute is settled.

Posted in Best Practices for Merchants, Credit card Processing, Payment Card Industry PCI Security Tagged with: antifraud, cardholders, chargeback, consumers, dispute-resolution, disputed, inquiry/dispute, issuing, Merchant's, patent, payment, platform, process, receiving, recurring charges, refund, refunding, resulution, risk-management, Security, services, settled, transaction, verifi

October 29th, 2013 by Elma Jane

Three dimensions merchants must look for in a payment system PSP and ISO:

1. Ability to adapt and customize the solution.

2. Solutions that support broad range of payment methods.

3. Supports a full set of different channels and devices.

Difference between a PSP and ISO in the payments ecosystem? Online and Mobile Payments:

There are two types of merchant service providers and not all service providers are made equal, Processors and Resellers:

Resellers are known in the industry as Independent Sales Organizations (ISO’s) and/or Merchant Service Providers (MSP’s).

1) Resellers or ISOs – ISOs resell the products or services of one or multiple processors. They can also develop their own or aggregate other value added products and services. ISO’s range from a little sketchy to best in class providers.

2) Processors – Also known as Acquirers, processors are distinguished by their ability to actually process a transaction. To be a processor, a company must have the technical capability to receive transaction data from a merchant via a telephone line or the internet and then communicate with the appropriate financial institutions to approve or decline transactions. Processors must also be able to settle completed transactions through financial institutions in order to deposit funds into the merchant’s bank account.

Processors can be banks or non-banks. While processors do maintain a direct sales force of their own, they primarily work through ISOs to acquire and maintain their merchant base. A processor’s business model is really one of economies of scale. They’re volume shops. They essentially outsource the sales function to ISOs. The processing industry is highly concentrated with the top five processors maintaining over 70% of all transaction volume.

Types of ISOs:

1. Banks – Banks of all shapes and sizes are ISOs. Banks entered into the merchant services business because it was a natural fit with their product and service offerings. It’s a way to increase revenue per customer. Most, but not all banks, will private label the services so that it’s difficult to distinguish whether they are a processor or ISO. The benefit of working with a bank is that you can consolidate your financial services. The drawback is, the you usually get out of the box solutions and service.

2. Non-banks – These types of ISOs range from some of the most dynamic and capable providers to firms who don’t represent the industry very well.

Industry Dynamics – There are a few dynamics that make the industry landscape quite interesting. First, there are very barriers to entry due to the lack of certifications, licenses, and capital requirements. Secondly, there really is no active regulatory body that oversees and enforces acceptable practices. So naturally, with these two market conditions, merchants need to be mindful and thorough in selecting a provider.

Processors versus ISOs In comparing the two, ISOs offer all of the products and services that processors do (because they are reselling) but processors can’t always offer the same products and services as ISOs. This is because ISOs can resell for multiple processors and can either develop their own technologies or aggregate solutions from other providers. ISOs have largely been the most successful creators of value-added services. ISO’s also tend to be smaller, which usually (but not always) leads to better customer service.

Processors are usually a safer bet for newer merchants that are still learning about the industry. Most still maintain what consider less-than-upfront pricing practices, but with their services it is less common to hear about some of the more serious problems that merchants encounter when they deal with the wrong ISO. As for price, in most cases, there really is very little to no difference. I argue, and fully disclose my vested interest, that in nearly any situation a best in class, non-bank ISO can provide more value than a processor.

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments, Financial Services, Mail Order Telephone Order, Merchant Services Account, Visa MasterCard American Express Tagged with: account, acquirers, aggregate, approve or decline, bank, best in class, channels, customize, data, deposit, devices, financial, independent sales organizations, internet, ISO, merchant service providers, Merchant's, mobile, msp, non-banks, online, payment methods, payment system, payments, processors, psp, resellers, solution, telephone, transaction, value added

October 24th, 2013 by Elma Jane

Buoyed by an improving economy, business travelers are once again taking to the skies and spending more on corporate travel. The Global Business Travel Association has projected that $273.3 billion in travel dollars will be spent in 2013, and “that’s a whole lot of spending for corporate travel managers and individual business travelers to evaluate and track.”

Recognizing this problem, MasterCard launched Travel Controller on October 21. The new product is designed to give corporate users greater control over their travel expenses by directly addressing data concerns.

“Companies today are more than ever looking for more and better ways to help manage their corporate travel expense, to manage travelers that are outside of policy, and most importantly, reduce the amount of money they spend on travel.

Travel Controller is designed to be a modern solution to the problems posed by traditional lodge cards. Unlike these options, Travel Controller allows corporate users to identify individual travelers, trips and transactions, providing businesses greater insight into this spending than the available offerings that dominate the market.

Travel controller uses latest virtual card technology to generate a unique account number for each individual transaction, each hotel reservation and each ticket that’s purchased. And when its generating that card, it captures that data that’s important to the company for how they manage that.

Whether that’s the details of the transaction or things more specific to the trip or traveler or the way the company manages its budgets, all of this information is provided 100 percent of the time. This removes the headaches associated with central travel while still giving that control element that companies are looking for.

Travel Controller is around the goals of an end user organization, as a company that’s trying to manage their travel expenses more effectively.

There is a defined data set, and built in flexibility for companies to define their own customer-specific fields, that are important so that the data you get back isn’t just thousands of pieces of information, but rather its those things that are most important and its brought to you in a way that makes it easy to take advantage of.

Posted in Best Practices for Merchants, Credit card Processing, Financial Services, Merchant Services Account, Travel Agency Agents, Visa MasterCard American Express Tagged with: account, addressing, amount, association, business, card, controller, corporate, data set, dollars, dominate, element, expenses, generating, global, improving, individual, information, lodge, market, MasterCard, money, policy, reduce, spend, spending, traditional, transactions, travel, travelers, trips, unique, virtual

October 24th, 2013 by Elma Jane

You will be happy to learn that these days there is less hassle when setting up credit card payments online. In the past, companies were required to open a merchant account through a bank in order to be able to accept credit cards. Today, several services enable you to accept credit cards online without opening your own merchant account.

With more than 50 million users worldwide, Paypal is probably the most widely used such service. The company’s Payflow service is a turn-key solution with several added advantages such as recurring billing and fraud protection.

If you still want to take actual credit card payments online, a merchant account service is your best option. To open an Internet merchant account, you must fill in a merchant application and provide support documents. First, you must supply proof that you established a checking account for your Internet business.

If you have sole proprietorship or a micro business, you can open either a personal checking account or business checking account. If you opt for a personal checking account, the account must be in the name of the sole proprietor. If your internet business is a corporation, you must set up a corporate checking account.

This account will be used to deposit sales generated through your internet merchant account, but also to withdraw fees such as online payment gateway fees.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Visa MasterCard American Express Tagged with: accept, application, checking account, companies, credit-card, deposit, fraud protection, internet business, merchant account, merchant account service, micro business, online, payment gateway fees, payments, PayPal, recurring billing, sales, support, turn-key, worldwide