Category: Best Practices for Merchants

April 27th, 2017 by Elma Jane

Adding Tokenization Service

Important notes when adding tokenization:

– Tokens replace credit or gift card numbers.

– The terminal must be enabled to accept tokenization.

– Tokens are unique for each merchant, for example:

The same card will produce a different token for each merchant.

– Merchants with multiple terminals sharing tokenization domains will receive the same token for a unique card and the token can be used across their stores if they wish to do so.

– Merchants may supply the token in place of card information in any subsequent transaction.

– Tokenization is supported for both credit cards and gift cards.

Tokenization protects card data when it’s in use and at rest. It converts or replaces cardholder data with a unique token ID to be used for subsequent transactions. This eliminates the possibility of having card data stolen because it no longer exists within your environment.

Tokens can be used in card not present environments such as e-commerce or mail order/telephone order (MOTO), or in conjunction with encryption in card present environments.

Tokens can reside on your POS/PMS or within your e-commerce infrastructure “at rest” and can be used to make adjustments, add new charges, make reservations, perform recurring transactions, or perform other transactions “in use”.

For Electronic Payment Set up with Tokenization call now 888-996-2273

or click here NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit, e-commerce, electronic payment, encryption, gift Card, merchant, moto, POS, terminals, tokenization, tokens, transaction

April 26th, 2017 by Elma Jane

Best Practices For Merchants!

Recurring and Installment Payments:

Recurring Payments – allows merchant to set up payment amounts and billing cycles in which the payments occur.

Installment Payment – allows merchant to set up payment amounts, the number of payments and the billing cycle in which the payments occur.

Recurring is a useful feature with multiple applications: Donations, Memberships, Subscriptions and Utility Payments.

For Electronic Payments Set up call now 888-996-2273!

or click here NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: electronic payment, merchants, payments, recurring

April 24th, 2017 by Elma Jane

Recurring Payments through VirtualMerchant

Providing recurring payments is an easy way to increase retention, grow loyalty, and improve customer satisfaction.

Recurring Payments are automatic credit card payments where a customer authorizes a merchant to collect the total charges from a customer’s credit card or bank account at customizable intervals. It is a useful feature for multiple applications: Donations, Memberships, subscriptions and utility payments to name a few.

Handle your recurring and installment payments with our secure tokenization solution.

To set up a recurring payment, the merchant simply enters the specified charge, chooses the frequency of payment (weekly, monthly, annually) and the customer’s card is billed on a recurring basis.

Automated recurring billing is an efficient, secure, convenient and hassle-free service that can help merchants build and manage their business growth.

To set up recurring payment through ConvergePay Virtual Terminal call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: bank, credit card, merchant, payments, recurring

April 18th, 2017 by Elma Jane

NTC Amex OptBlue Program rate are a lot more competitive, with NTC Amex OptBlue you can find a rate that’s right for your business and a faster, easier way to accept the card.

Amex OptBlue Program allows smaller businesses to accept American Express credit cards without paying excessively higher rates. Those who sign up for this program can automatically bundle American Express along with the other major card brands that they already accepting.

Before Optblue, you had one rate option for American Express Card acceptance. Now, because your Merchant Service Provider sets the rate, you could find a deal that works for you.

In some cases, Amex OptBlue is lower than Visa and MasterCard.

If you’re an existing merchant adding Amex Optblue is easy with NTC. You’ll get paid at the same time as your other card brands. One fast deposit!

All the credit cards you accept in one simple statement.

One Customer Service Contact. We can answer questions for every card you take with us.

Give us a call now 888-996-2273 or fill out the form NationalTransaction.Com and we’ll help you get going with Amex OptBlue.

Posted in Best Practices for Merchants Tagged with: amex, card, MasterCard, merchant, payment processing, service provider, visa

April 12th, 2017 by Elma Jane

NTC’s Advantage Benefits and Perks Program exclusive to our Merchants!

The advantage benefits and perks program focuses on delivering discounts that will help our merchants reduce operating business expenses.

Start saving Money, Get 30 DAY FREE TRIAL!

Take advantage of these discounts, with access to over 15 categories of vendors covering:

Shipping – Save up to 28% on shipping with the world’s largest package delivery company.

Legal Services – Save 15% from the leading provider of online legal document services.

Computer & Electronics – Saving of up to 35%.

HR & Payroll Services – Save 27% off.

Telecommunications – Save between 12% to 15% on business lines, and 10% on personal lines.

Web Design and Services, and more.

For more information call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: merchants

April 10th, 2017 by Elma Jane

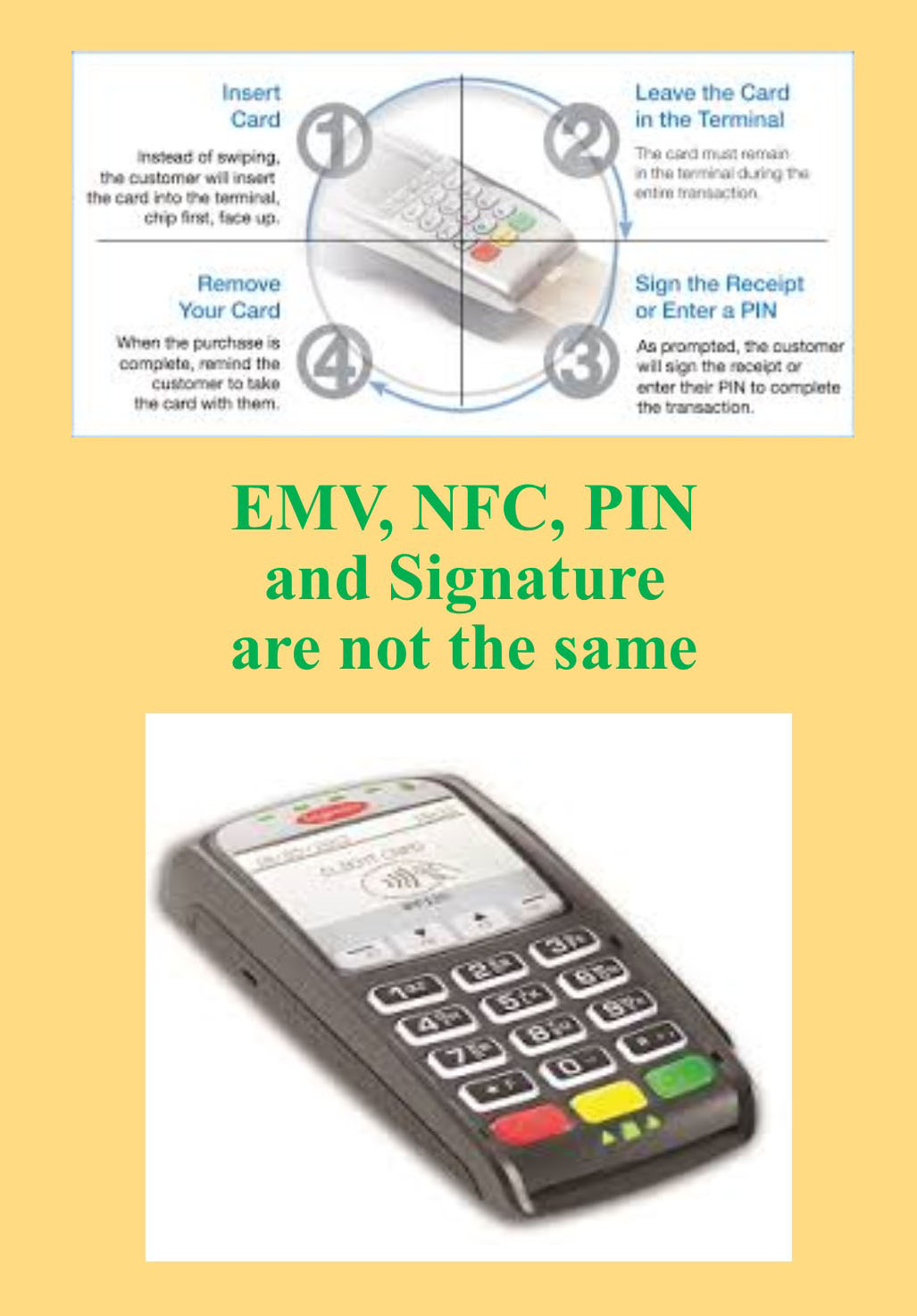

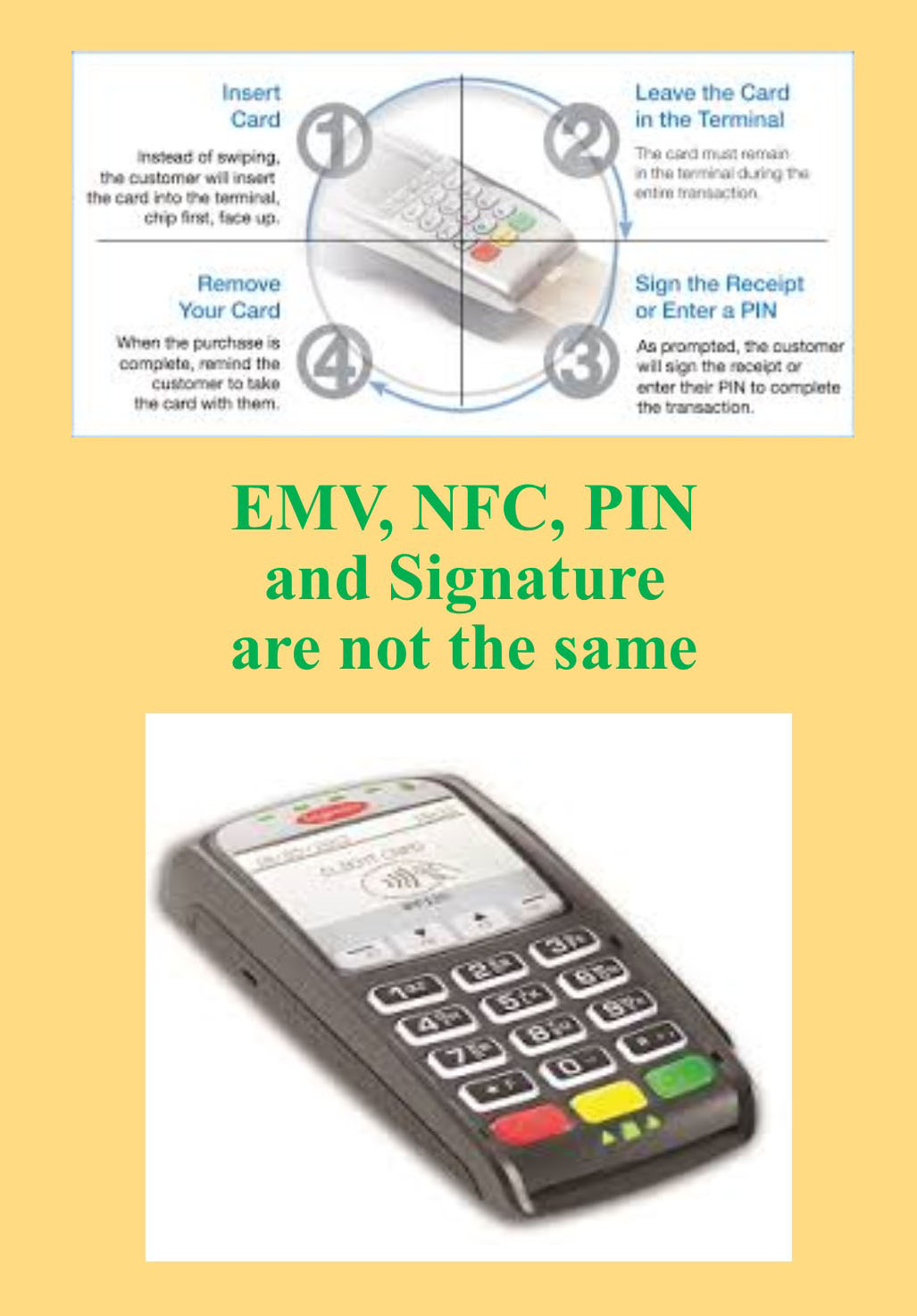

EMV, NFC, PIN and Signature are not the same

EMV (Europay, MasterCard and Visa) is a payment technology.

NFC (Near-Field Communication) is a technology that enables contactless EMV.

Apple Pay, Android Pay and Samsung Pay uses NFC technology to process payments in a tap at any contactless payment terminal.

NFC payments made with a mobile phone in-store by tapping the phone to an NFC-capable terminal are considered card-present transactions. NFC in-app purchases are considered card-not-present transactions.

Not all EMV terminals has NFC technology. NFC Technology/EMV terminals can be considerably more expensive than standard EMV.

There are EMV terminals that NFC capable but not enabled.

Payment cards that comply with the EMV standard are often called Chip and PIN or Chip and Signature cards, depending on the authentication methods employed by the card issuer.

PIN Debit are transactions routed through (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

PIN Based Transactions have no chargebacks rights as they are considered cash not credit.

Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargebacks, EMV, nfc, payment, PIN, terminal, transactions

April 7th, 2017 by Elma Jane

Merchant Cash Advance Or Loans

Merchant Cash Advance – is a funding product providing working capital to businesses. When it comes to securing a merchant cash advance, businesses are far more likely to be approved and secure the amount of funding you actually need because cash advance is not a loan.

Loans generally are lower rates than MCA? Monthly payments not daily and many of these loans may also be lines of credit. Lines of credit sometimes have collateral, real estate or other guarantees. These options can be uncovered through consultation service at NTC.

MCA companies provide funds to businesses in exchange for a percentage of the businesses daily credit card income directly from the processor that clears and settles the credit card payment. A company’s remittances are drawn from customers’ debit-and credit-card purchases on a daily basis until the obligation has been met. Most providers form partnerships with payment processors and then take a fixed percentage of a merchant’s future credit card sales.

The Term Merchant Cash Advance – may be used to describe purchases of future credit card sales receivables, revenue and receivables factoring short-term business loans, and it has a different set of rules and rates.

Cash advance has some advantage over a conventional loan structure. Payments to the merchant cash advance company fluctuate directly with the merchant’s sales volumes, giving the merchant greater flexibility with which to manage their cash flow, particularly during a slow season. Advances are processed quicker than a typical type loan, giving borrowers quicker access to capital.

Merchant Cash Advances are often used by businesses that do not qualify for regular bank loans.

Ask our loan consultant if you were told you do not qualify for a loan.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, loan, merchant cash advance, payments

April 6th, 2017 by Elma Jane

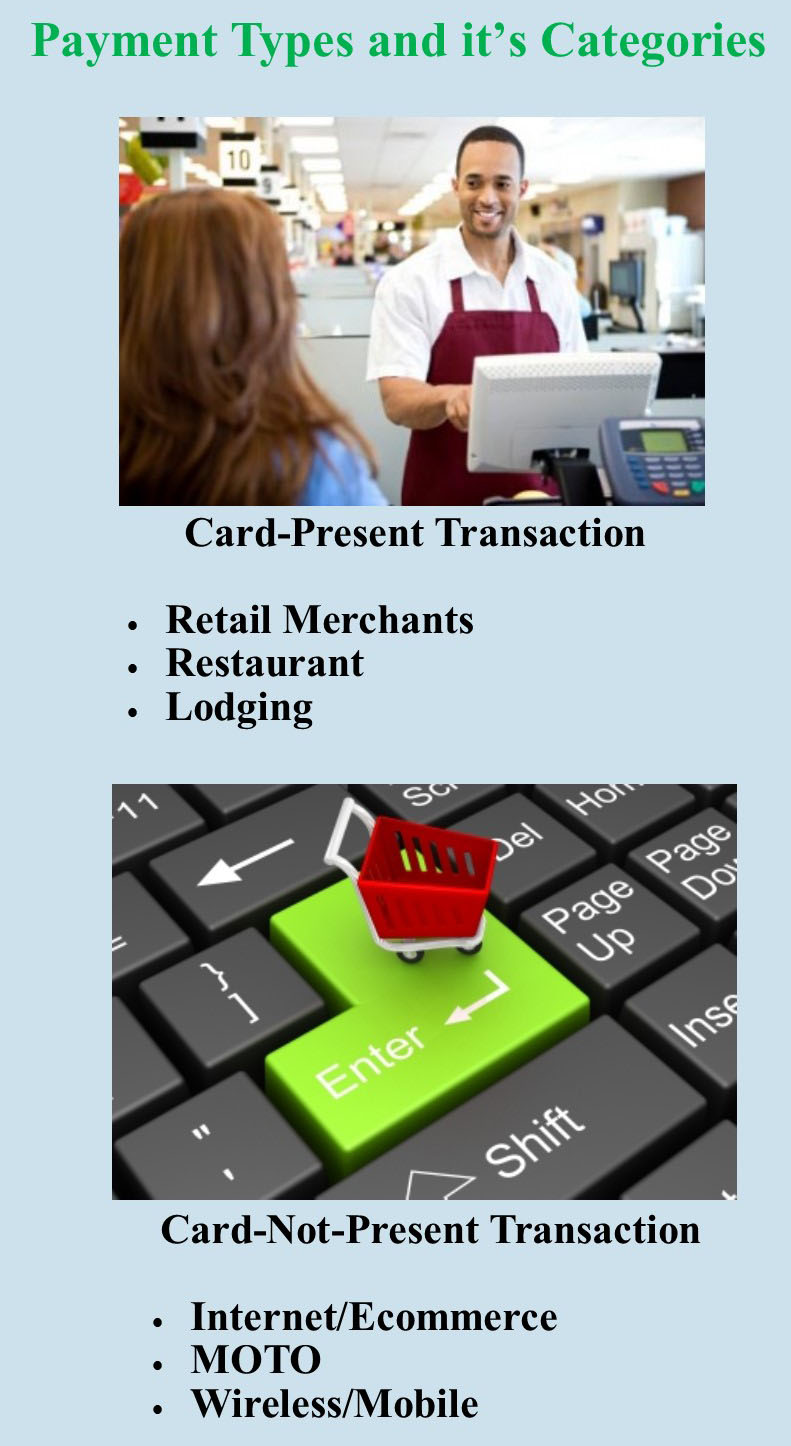

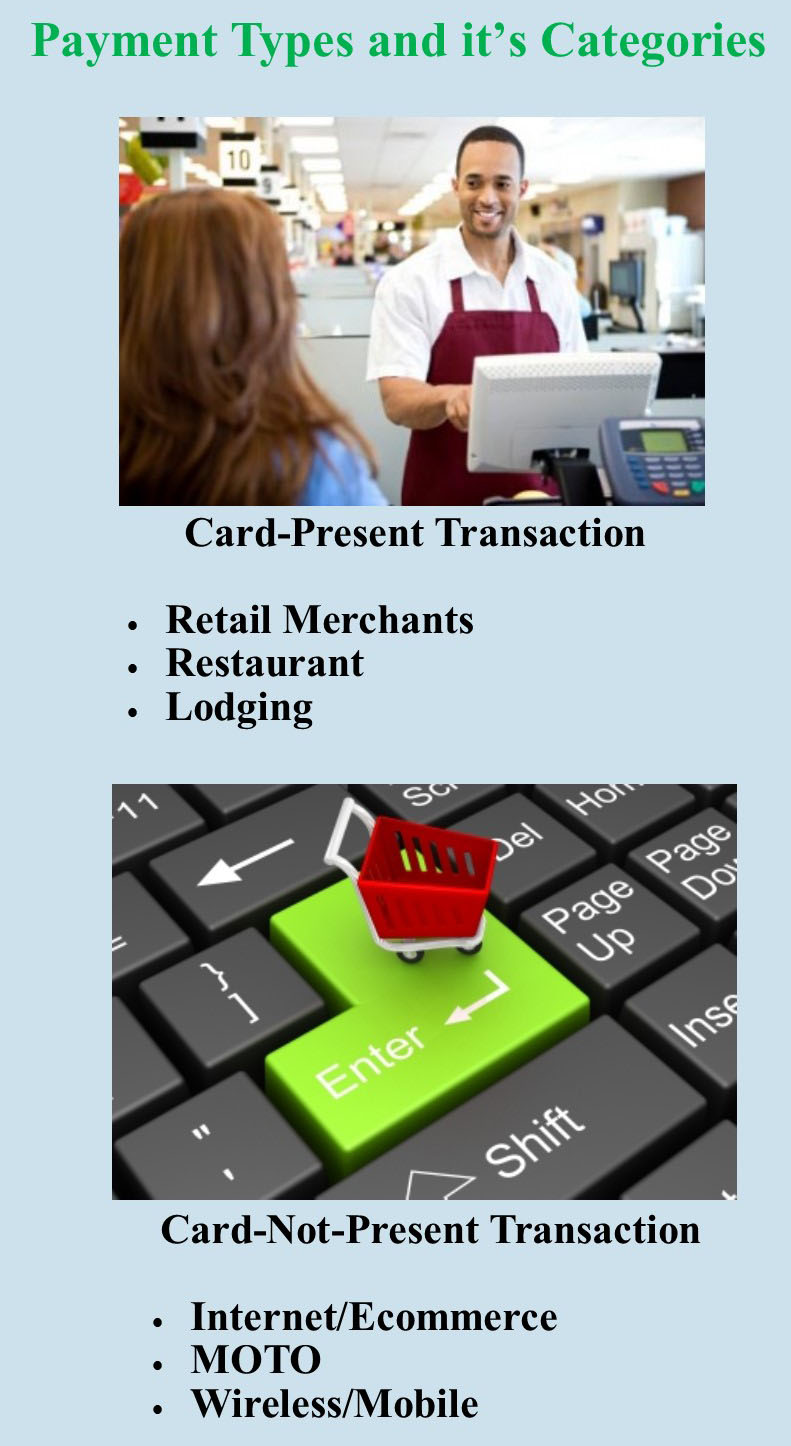

Payment types and it’s categories

The two main category types when it comes to credit card processing are swiped and keyed. Card present or card-not-present.

Swiped or card present transaction – merchants do a face-to-face transaction. A merchant can capture card information by dipping the chip or swiping the card in the terminal or POS. Merchants directly interact with a customer so the risk is low.

Card-Present Sub Categories:

Retail Merchants – conduct transactions face to face in a retail environment.

Face to Face (mobile) – this type of merchant is typically on the go, such as a vendor at a trade show. You can use a service like converge mobile that allows you to take the information in person.

Restaurant – the same as retail merchants, the difference is they may require the ability to add tips to their charges.

Lodging – processes their transactions like retail merchants except they may adjust the settlement amount depending on the customer’s length of stay.

Keyed or card-not-present are high risk, because merchants indirectly collect customers card information, and can process transactions in various ways.

Card-Not-Present Sub categories:

Internet/Ecommerce – conducts business through a web site by utilizing a shopping cart and an Internet payment gateway service. The payment gateway then collects the credit card information and processes it in real time.

Mail & Telephone Order (MOTO) – typically take the customer’s credit card information over the phone, by mail or through the Internet. They then manually process the transaction by keying it into either a credit card machine or through a virtual terminal such as Converge.

Talk to our payment consultant to know the best solution for your business.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit card, customer, ecommerce, merchants, payment, payment gateway, POS, swiped and keyed, terminal, virtual terminal

April 4th, 2017 by Elma Jane

Customer Service Revolution A State Of Being!

Customer experience will overtake price and product as a key brand differentiator. Every single interaction a customer has factors into whether they remain loyal or switch to a competitor. Customer experience affects brand loyalty.

Common mistakes when engaging customers and how to avoid them:

Being unprepared

Poor interaction related to customer support means losing customer or sale. Don’t be passive when a customer calls for help. Familiarize yourself with a customer’s background.

To ensure that the customer is using the product to the fullest extent, jump into each interaction with personalized tips on specific features. If you come to each call proactively prepared, your customers are getting the most value from your product.

Failing to build a relationship

Avoid negative engagement with a customer, track customers engagement. Plan targeted, purposeful interactions to ensure they remain happy. Take the time to get to know your customers before any issues arise. Developing strong relationships with customers means they are more likely to talk to you not resort to extreme measures.

Making a useless call merely to check in

Don’t reach out to your customer blindly, consider these questions:

Are they happy using the product? Are they using the most advanced feature? Dive deep into customer data to better understand how customers are using the product and what they might need.

NTC uses a range of tools to collect data and gather insights about our customers and use that data to understand which customers may need more hand-holding and training to increase their level of engagement.

Learn more about your customer in advance; with all of this knowledge you can better address questions or concerns with specific tips or support.

That is NTC’s Customer Service!!!

Posted in Best Practices for Merchants Tagged with: customer, data, product

April 4th, 2017 by Elma Jane

A Travel Merchant Account That Does More!

Call now 888-472-7112 or click the image to redirect you to contact form landing page.

Posted in Best Practices for Merchants Tagged with: merchant, travel