Category: Best Practices for Merchants

March 30th, 2017 by Elma Jane

Credit Card Terminal

Factors to Consider When Buying a Credit Card Terminal:

- NFC – check out the payment wave of the future. NFC technology features, where you can accept Apple Pay and Android Pay for payments.

- Security and Stability – do I have a computer tablet or other device that will accommodate the future technology? Newer credit card machine work faster, they also protect sensitive card data and have the ability to accept EMV and PIN. Older terminals may not comply with today’s PCI security standards.

Mobile/Wireless Connectivity – credit card terminal should be able to quickly and easily accept credit card payments and work with your payment processor anywhere.

- Connectivity – do you use mobile, Wi-Fi, dial, or (IP) Internet connection? Most current credit card terminals use both technologies, but when connected to dial-up your transactions can be quite slow, unlike IP connection which can speed up your transactions.

- Programmable or Proprietary – if they will not let you program it why NOT?

There are many options when searching for the right credit card terminal for your business but there are also a number of factors to consider before making an investment.

Give us a call at 888-996-2273 and talk to our Payment Consultant!

Posted in Best Practices for Merchants Tagged with: credit card, data, EMV, nfc, payments, PCI, PIN, processor, terminal

March 29th, 2017 by Elma Jane

Follow NTC on Klosebuy!

As a valued customer, you can see our most current advertisements, specials, offerings, and events we have going on.

Download the Klosebuy app in the App Store or Google Play store, and search for National Transaction (NTC), and make sure to mark NTC as a favorite business.

Joining Klosebuy is FREE! Receive 25 points when you join Klosebuy and another 25 points for favoring our business ($5.00 value).

Review our latest specials and events, save them to use, and share them socially with your friends.

Collect Klosebuy points along the way and redeem them from Klosebuy’s online catalog for great gifts.

Refer your friends and you both get 100 points when they join ($10.00 value).

Don’t have a smart phone? Join Klosebuy at www.klosebuy.com.

We look forward to seeing you soon!

Posted in Best Practices for Merchants

March 27th, 2017 by Elma Jane

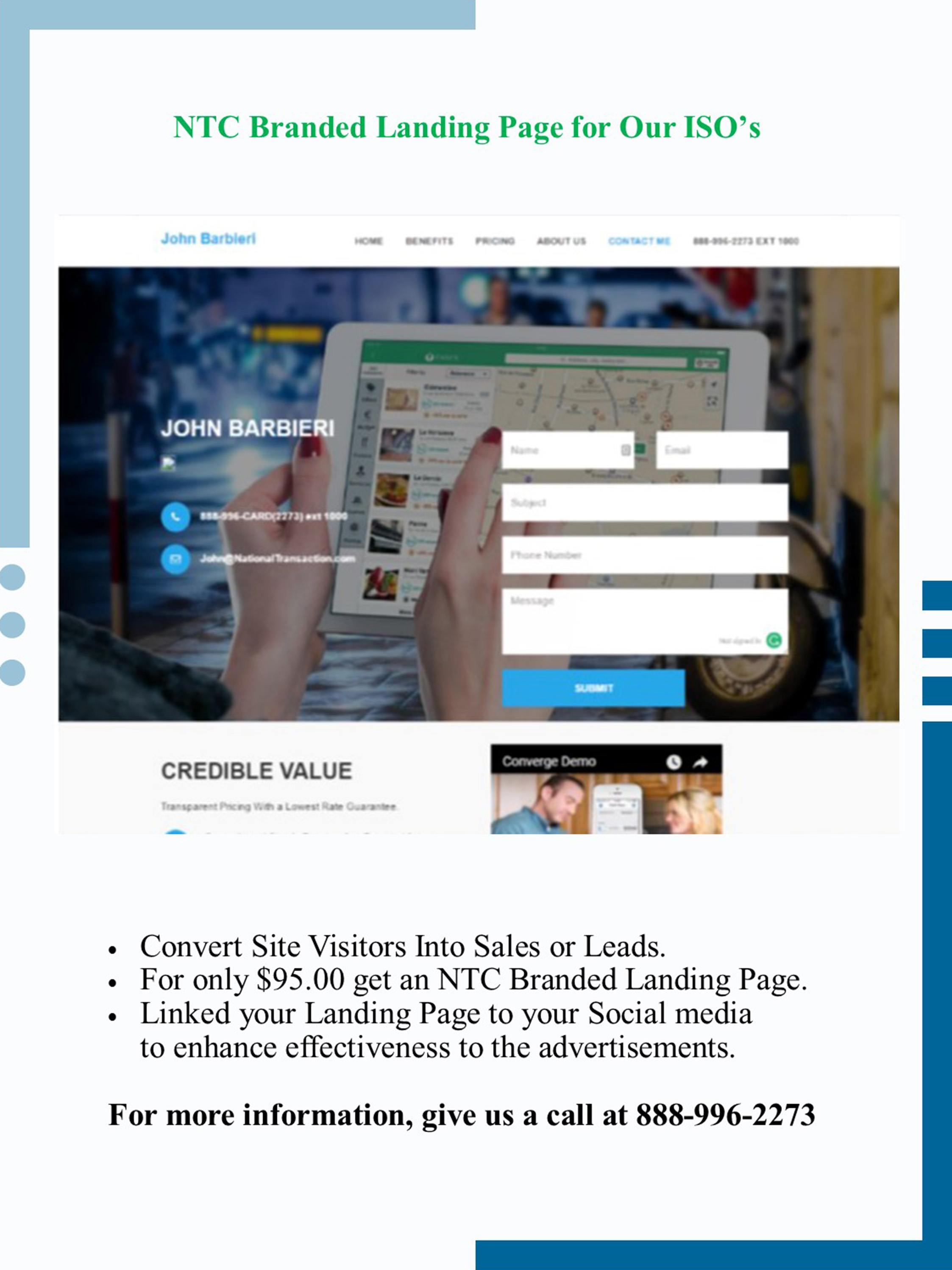

NTC Branded Landing Page for our ISO’s

- Convert Site Visitors into Sales or Leads

- For only $95.00 get an NTC Branded Landing Page and Business Card.

- Link your Landing Page to your Social Media to enhance effective advertising.

For more information, give us a call at 888-996-2273!

{Check out our ISO’s Landing Page Here}

john.nationaltransaction.com

adam.nationaltransaction.com

andrew.nationaltransaction.com

richard.nationaltransaction. com

chrism.nationaltransaction.com

megan.nationaltransaction.com

patrick.nationaltransaction. com

Posted in Best Practices for Merchants

March 24th, 2017 by Elma Jane

NTC’s Payment Consultants!

For Electronic Payment Setup, consult with our payment specialists below:

Avail of our Free Rate Review and get 500 points!

A points code or certificate for Klosebuy, our new program.

You can use it to see our specials and collect points.

Get cool items in Klosebuy catalog. It’s free to join.

For Account Setup

Guaranteed Lowest Rates!

No Setup or Cancellation Fees

First Month Free!

No risk!

Posted in Best Practices for Merchants Tagged with: electronic payment, payment

March 21st, 2017 by Elma Jane

Accepting Electronic Payments

Why do you need to accept electronic Payments?

Accepting credit card payment is becoming a must for businesses because 70% of consumer spending is done electronically.

Signing up with NTC is easy. No Setup or Cancellation Fees. No Risk!

Already accepting credit card payments? We can do FREE Rate Review and get 500 Points.

Call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, electronic payments, payments

March 20th, 2017 by Elma Jane

Process Your Travel Agency Payments For Less. Get 100% Funding The Next Day!

Call now 888-996-2273 or Sign Up now!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: payments, travel agency

March 17th, 2017 by Elma Jane

Southeast Acquirers Association (SEAA)

NTC will be attending the 2017 Southeast Acquirers Association (SEAA)

on March 20-22 at Le Meridien – 555 S McDowell Street, Charlotte, NC 28204

SEE YOU ALL!

For electronic payments setup, call us now 888-996-2273

Posted in Best Practices for Merchants Tagged with: electronic payments, payments

March 15th, 2017 by Elma Jane

Payment Options

Technology continues to evolve, offering multiple billing and payment methods increases satisfaction by improving customer experience.

Customers will continue to move toward digital life, like embracing different forms of online billing and ways to accept payments.

Creating convenient ways to accept payments and having more options can reduce the time it takes your business to get paid.

Accept debit and credit card payments online; to offer this feature you need to get a merchant account.

Options for accepting payments:

Electronic Check Service (ECS) – convert paper checks to electronic transactions, with NTC’s ECS. Converting paper checks to electronic transactions eliminates many of the risks and costs, adding money to your bottom line.

Mobile Payments – the opportunity to increase revenue through mobile payments is huge. Many consumers find that mobile bill pay makes shopping easier, more convenient and saves time. Converge Mobile Solution lets you accept card payments using smartphone or tablet. The app works with most Apple and Android mobile devices.

Online Payment Gateway – offering customers an online payment form enables them to pay you easily and allows you to accept payments by credit card, debit card or echeck.

Electronic Invoicing (NTC ePay) – send your customers an invoice by email and get paid in minutes. Electronic Invoicing gives your customer the ability to pay their bills and receive a receipt in seconds by email.

Learn more about accepting electronic payments with NTC or sign up with us.

No setup or cancellation fees, there’s no risk! call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, echeck, ECS, Electronic invoicing, electronic transactions, merchant account, mobile, online, payment, payment gateway

March 13th, 2017 by Elma Jane

SECURITY PROTECTION

Make smart decisions when it comes to protecting your business with five layers of protection.

Posted in Best Practices for Merchants, Payment Card Industry PCI Security Tagged with: Security

March 10th, 2017 by Elma Jane

Qualified vs Non-Qualified credit card rates

The most common forms of rate structures for credit card rates are:

2-Tiered: Qualified and Non-Qualified

3-Tiered: Qualified, Mid-qualified, or Non-qualified

Each and every transaction you accept is classified into one of the above and is the basis for the credit card rate you see on your statement.

As a general rule, qualified transactions are going to be “standard” cards; without any consumer or corporate rewards associated with them. Accepted in the “standard” method expressed in your merchant processing agreement, this is where Card-Not-Present (CNP) setup comes into play.

Mid and Non-Qualified transactions include:

Rewards cards, keyed-in payments (for swipe accounts), AVS (Address Verification Service) does not match or is not performed, not all required fields are entered, or the payment was entered in a late batch. Ex. the payment was sent to the processor 48 hours or more past the time of the authorization.

Posted in Best Practices for Merchants, Travel Agency Agents