Category: Best Practices for Merchants

March 9th, 2017 by Elma Jane

Merchant Cash Advance

A Merchant Cash Advance is a funding product providing working capital to businesses. When it comes to securing a merchant cash advance, businesses are far more likely to be approved and secure the amount of funding you actually need because cash advance is not a loan.

Merchants sell a specific amount of their business’ future credit and debit card receivables at a discount in exchange for the capital they can use for business. Payments are often more flexible as they are based on sales.

For your loans and funding needs call now at 888-996-2273 Extension 1159

Posted in Best Practices for Merchants Tagged with: cash advance, credit, debit card, loan, merchant, payments

March 7th, 2017 by Elma Jane

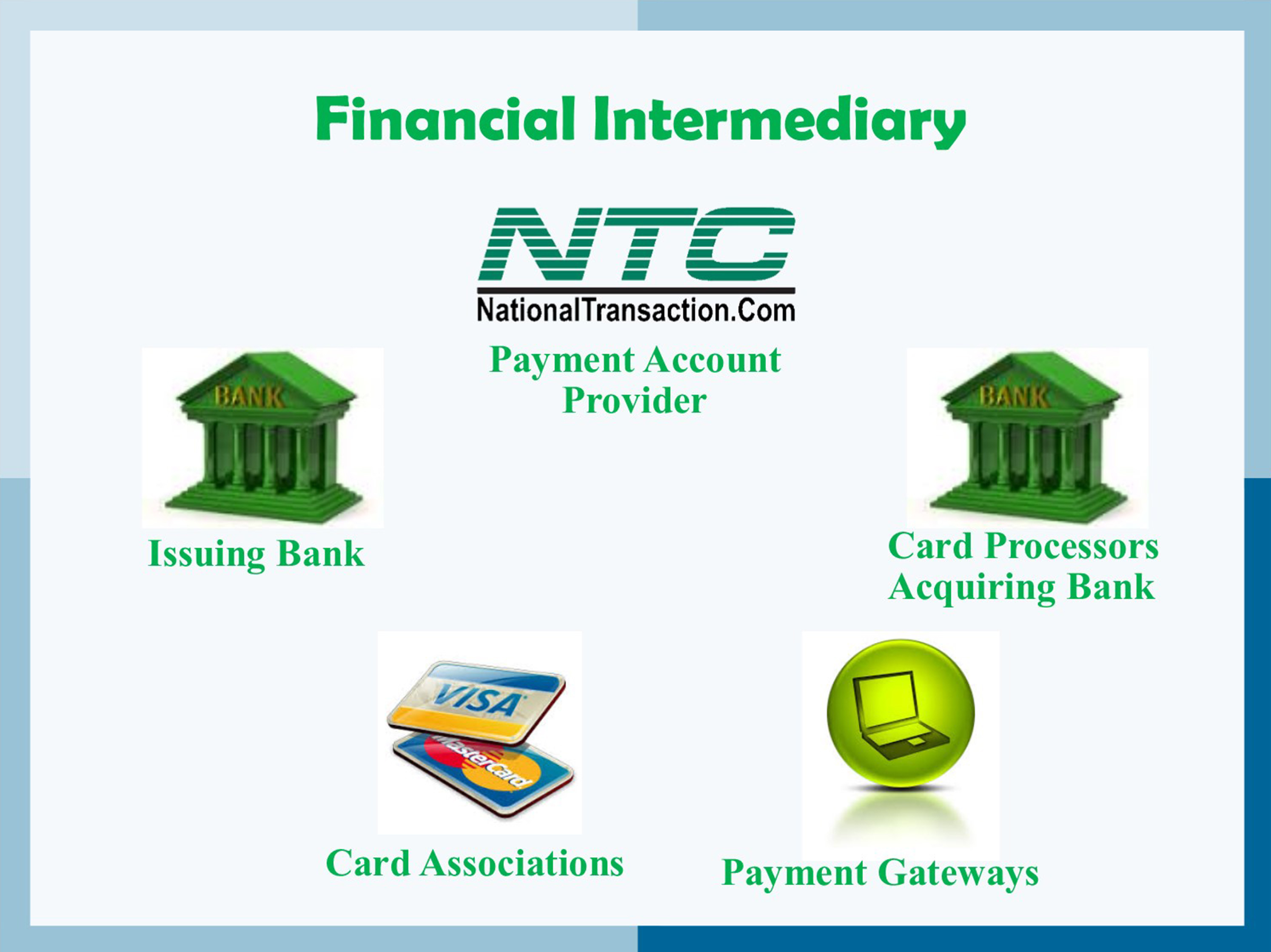

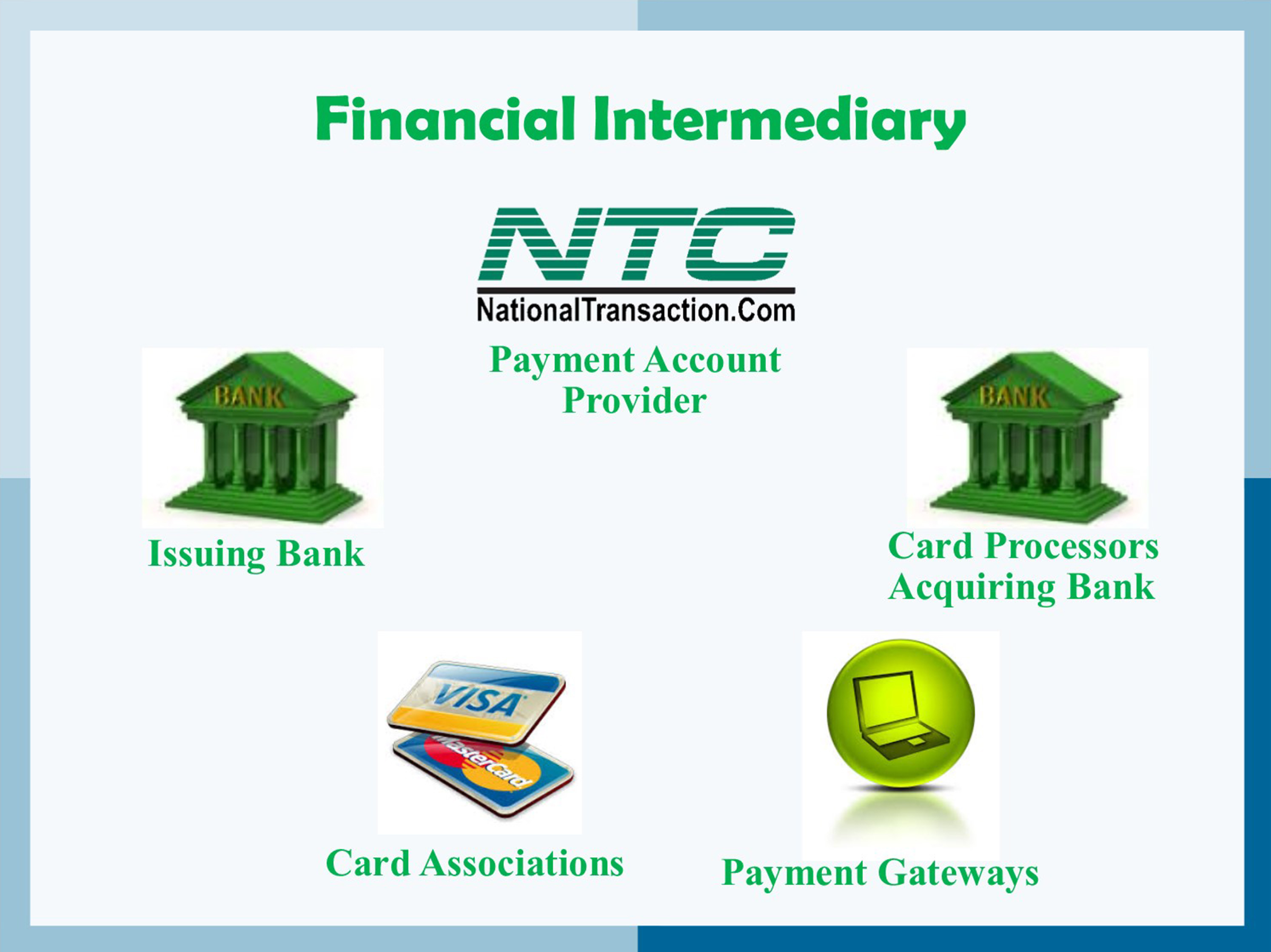

Financial intermediary between a customer and merchant include:

Card Associations – Visa, MasterCard, and American Express.

Card Issuing Banks – are the financial institutions affiliated with the card association brands and provides credit or debit cards directly to customers.

Card Processors – also known as Acquirer or Acquiring Banks. They pass batch information and authorization requests so that merchant can complete transactions in their businesses. These institutions are the link between payment account providers and card associations.

Payment Account Providers – are companies like NTC that manage credit card processing, usually through the help of a Card processor also known as Acquiring Banks.

Payment Gateways: These are special portals that route transactions to a card processor or acquirer.

Posted in Best Practices for Merchants Tagged with: banks, card associations, credit, customer, debit cards, financial, gateways, merchant, payment, processors, provider's, transactions

March 6th, 2017 by Elma Jane

Electronic Payments Processing

Credit and debit card industry grows in electronic payment processors and the services they offer; unfortunately, customer support seems to be considered to be less important.

National Transaction believes that customer support is of greater value. Any merchant would love to get new a new equipment or credit card terminal for free, but what about support for this service? Get the most from your Electronic Payments Processing!

NTC offers the following:

Live US Based Customer Support within three rings

Guaranteed Lowest Rates

Next Day Funding

NTC ePay Electronic Invoicing (allows the merchant to simply email payment request).

Online Reporting and Processing Tools Included

Security (PCI Compliance, Tokenization, and Encryption).

Call us now 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: credit, customer support, debit card, Electronic invoicing, electronic payment, encryption, merchant, payment, payment processing, PCI, processors, Security, terminal, tokenization

March 3rd, 2017 by Elma Jane

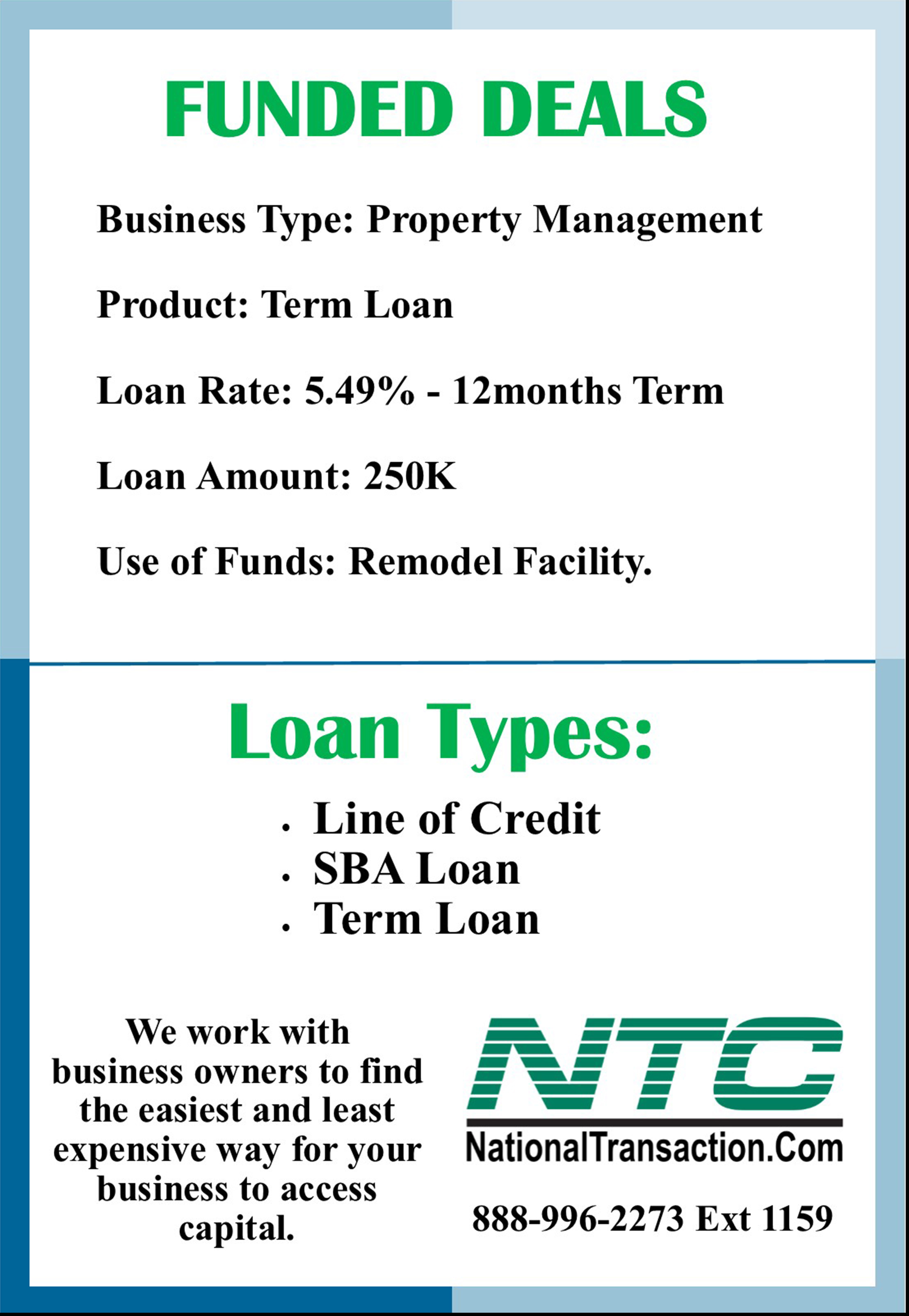

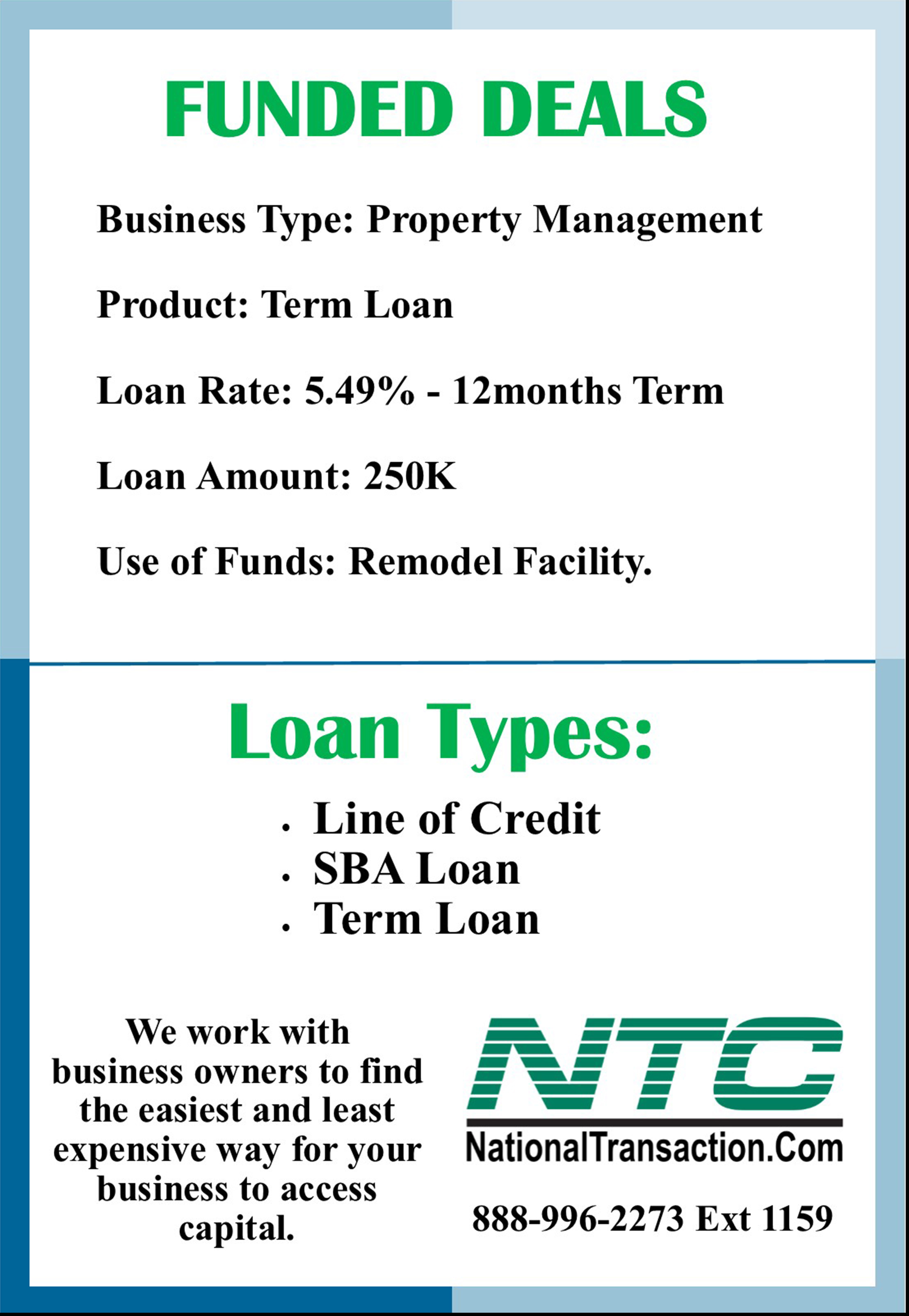

RECENTLY FUNDED DEALS

Our Loan Specialist work with business owners to find the easiest and least expensive way to access capital.

Call now 888-996-2273 Ext 1159

Posted in Best Practices for Merchants Tagged with: loan

March 1st, 2017 by Elma Jane

ELECTRONIC PAYMENTS

When it comes to electronic payments, certain types of businesses are considered high risk.

Most merchants do not realize that electronic payment processors carry a financial risk on merchant accounts, and normally fund merchants prior to receiving payment from the client’s bank.

Essentially, a merchant account is an unsecured loan.

Different factors used to determine when a business is a high risk are:

- Types of products

- Services they sell how

- How they sell them

Online transactions are considered high risk because there are increased risks of fraud.

A key factor used to determine the risk of a business is chargebacks.

Chargebacks include customer refunds and fraudulent transactions.

Payment providers assess this risk to determine the percentage of chargebacks your business is likely to experience.

Businesses that are considered high risk where they take advanced payments:

- Travel agencies

- Ticketing services

Electronic payments provider is necessary if you want to accept debit and credit card transactions.

For high-risk electronic payments please feel free to call us at 888-996-2273.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargebacks, credit card, debit, electronic payments, fraud, loan, merchant accounts, merchants, online, payment processors, transactions, travel agencies

February 22nd, 2017 by Elma Jane

BEST PRACTICES

Posted in Best Practices for Merchants Tagged with: card, cardholder, voice authorization

February 22nd, 2017 by Elma Jane

Recently Funded Deals

Business: SPA

Product: SBA Loan

Loan Rate: 6.25%

Term: 10-Year

Funded Amount: 100K

Monthly: $1247

Use of Funds: Equipment Purchase

888-996-2273 Ext 1159

888-996-2273 Ext 1159

NTC works with business owners to find the easiest and least expensive way for your business to access capital.

Loan Types:

Line of Credit

SBA Loan

Term Loan

Posted in Best Practices for Merchants Tagged with: loan

February 21st, 2017 by Elma Jane

The Travel Payment Expert

No Setup or Cancellation Fees

100% Next day Funding

Lowest price Guarantee

24/7 US Based Support

#1 Preferred Payment Processor among Travel Associations

NTC ePay, our exclusive electronic invoicing platform. (Email customers invoices and get paid even faster, eliminating paperwork and saving time).

For Electronic Payment Setup or FREE Rate review, call us now 888-996-2273

or visit www.nationaltransaction.com/travel/ and use our contact form.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: Electronic invoicing, electronic payment, payment, processor, travel

February 20th, 2017 by Elma Jane

Save Money, Get 30 DAY FREE TRIAL!

Start saving now with NTC’s Advantage Benefits and Perks Program exclusive to our Merchants!

The advantage benefits and perks program focuses on delivering discounts that will help our merchants reduce operating business expenses.

Take advantage of these discounts, with access to over 15 categories of vendors covering:

Shipping – Save up to 28% on shipping with the world’s largest package delivery company.

Legal Services – Save 15% from the leading provider of online legal document services.

Computer & Electronics – Saving of up to 35%.

HR & Payroll Services – Save 27% off.

Telecommunications – Save between 12% to 15% on business lines, and 10% on personal lines.

Web Design and Services, and more.

For more information call now 888-996-2273

Posted in Best Practices for Merchants Tagged with: merchants

February 16th, 2017 by Elma Jane

Chargeback Cycle

A chargeback is also known as a reversal; a credit card transaction that is reversed to a merchant because of the customer or customer’s bank disputes charges. Other reasons include fraud, credit card processing errors, authorization issues and non-fulfillment of copy requests. There’s an assigned reason code for every chargeback. Reason codes may vary by VISA and MasterCard.

How does the chargeback cycle work?

1. A customer files a complaint to card-issuing bank.

2. The bank sends disputed transaction (chargeback) to acquirer.

3. Acquirer receives chargeback and resolves it or forwards to the merchant for documentation.

4. Merchant accepts chargeback or addresses issues and resubmits to Acquirer.

5. Acquirer represents the chargeback to the issues once acquirer agrees the merchant has properly addressed it.

6. The issuer resolves the dispute by reposting to the cardholder’s account.

7. The cardholder receives dispute information and may be rebilled or credited.

Every merchant that offers credit card processing to its customers should be concerned about chargebacks to their merchant account.

Lower your risk of chargebacks by following the tips below:

Verify card logos, credit card numbers, identification, customer signature and check the expiration date.

Call for voice authorization if the card stripe doesn’t work or if the terminal is down or cannot authorize.

Authorize every transaction.

Be sure your customers are familiar with your return or exchange policy.

Posted in Best Practices for Merchants Tagged with: bank, cardholder, chargeback, credit card, customer, merchant, merchant account, transaction