Category: Best Practices for Merchants

February 14th, 2017 by Elma Jane

Prevent Freeze, Holds, and Terminations

Common ways to prevent freezing; holds and termination to your account.

Minimize Chargebacks – chargeback should always be limited. An excessive number of chargeback whether won or lost is a red flag.

Minimize Fraud – if fraud is suspected, your account will be frozen pending an investigation.

One account per business type – if you have multiple businesses, you must have a separate account. If one account is being used for a different business altogether, that’s the quickest way for an account to be fully terminated.

Sell only the services or products you said you’d sell – selling other product or services could violate your Marketing Services Agreements.

Stay within your average monthly volume and ticket – an unusually high processing volume or average ticket is one of the fastest ways to get your funds held. To avoid this, notify your provider of an expected busy month. Call your provider for a large transaction before running it.

Use appropriate payment account types – card present (retail) and card-not-present accounts (internet). Card present means both customer and their credit card are present in the store. Card-not-present means card nor the person are not physically present at the time of the transaction. A large number of card present transactions on a card-not-present account or vice versa can result in a hold or termination of an account.

For Electronic Payments call now 888-996-2273 or got to www.nationaltransaction.com and click on get started

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargeback, electronic payments, fraud, provider

February 13th, 2017 by Elma Jane

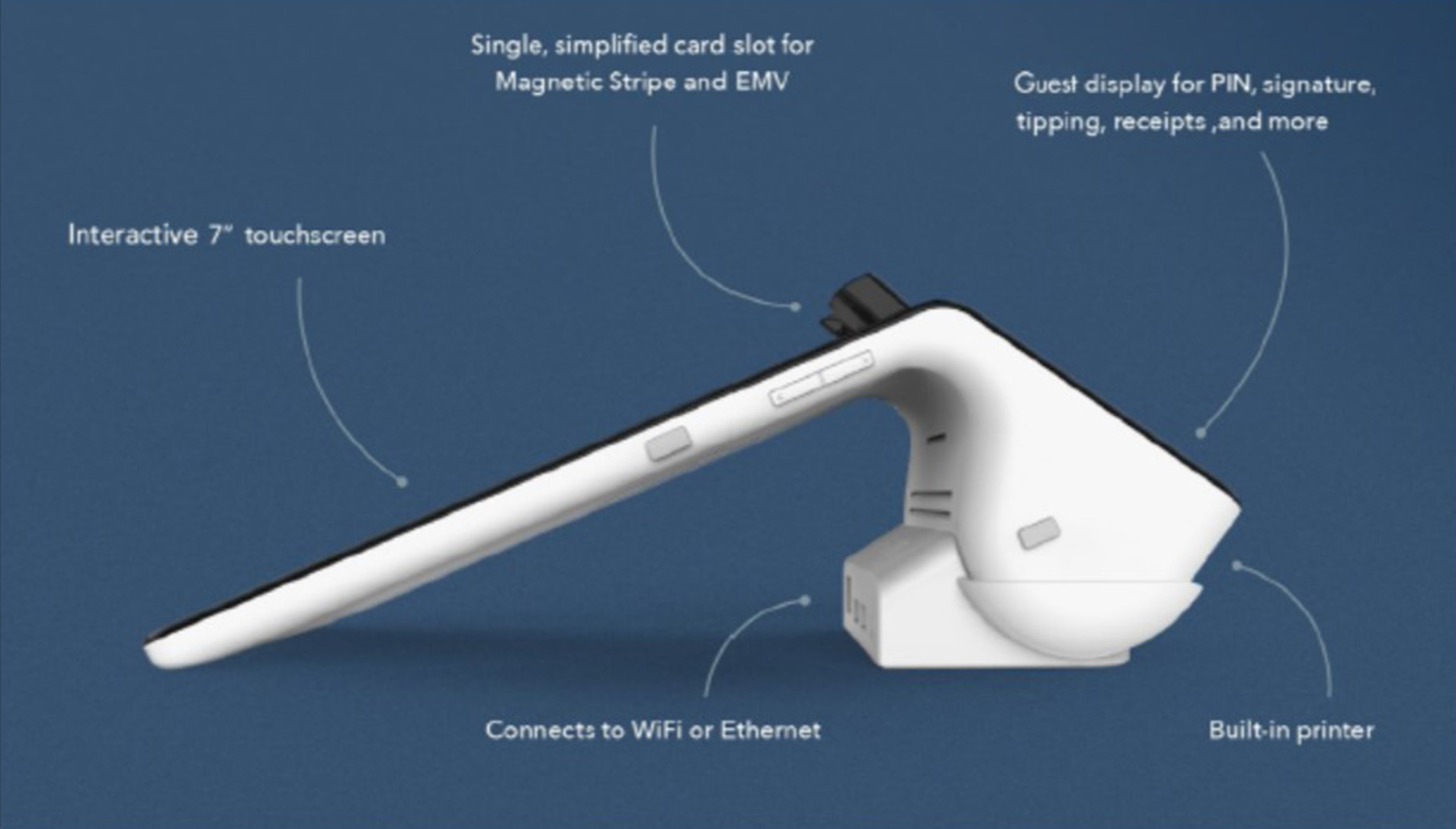

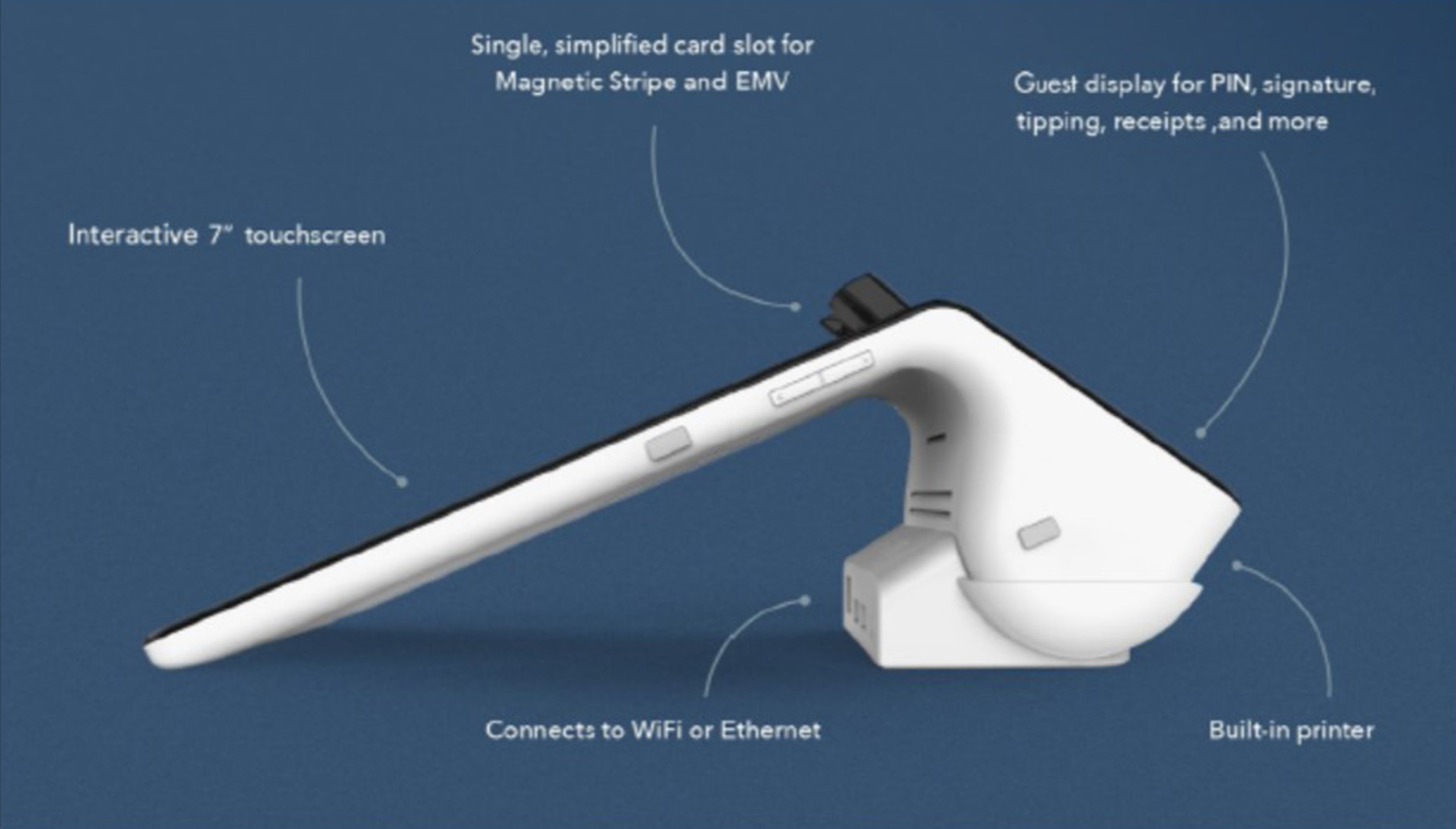

Smart Device for Lodging Transactions

Function meets form with this latest payment terminal.

Accepts All Payments – Magstripe, Chip (EMV) Cards, Mobile Payments like Apple Pay (NFC) and Manual Keyed.

An All-In-One Smart terminal – simplified, single card slot for Magnetic Stripe and EMV. Customer display for PIN, signature, tipping, receipts and more. Interactive 7″ touchscreen. Connects to Wifi or Ethernet. With built-in printer.

Security – PCI certified, End-to-End Encryption. Data is protected by the latest technology.

Supports Lodging Transactions – Check-In/Check-Out, Quick Stay, Incremental Authorization/Update. Sale, refunds, and voids.

Reporting (HQ) – a simple dashboard where you can monitor your sales, refund transactions, get business insights and alerts, and view settlements and transaction in real time. Accessible on the internet or from the HQ App on your Smartphone.

Robust Payment processing – access your funds within 24-48 hours, 24/7 customer service, convenient reporting, PCI program & data breach coverage.

For Electronic Payments call now 888-996-2273 or go to www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Electronic Payments, EMV EuroPay MasterCard Visa, Near Field Communication, Payment Card Industry PCI Security Tagged with: data, EMV, mobile, payment, PCI, Security, terminal, transactions

February 10th, 2017 by Elma Jane

NTC’s Benefits and Perks Program!

Start saving now with NTC’s Advantage Benefits and Perks Program exclusive to our Merchants!

The advantage benefits and perks program focuses on delivering discounts that will help our merchants reduce operating business expenses.

Take advantage of these discounts, with access to over 15 categories of vendors covering:

Travel Services Office Supplies Telecommunications

Web Design and Services, and more

Save up to 28% on shipping with the world’s largest package delivery company.

Save 15% from the leading provider of online legal document services.

Saving of up to 35% on computer and electronics.

Save 27% off on payroll services and retirement services.

Save between 12% to 15% on business lines, and 10% on personal lines.

Rental Cars Save up to 25% on your car rental.

For more information call now 888-996-2273! For products and services go to www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: merchants, online, travel

February 9th, 2017 by Elma Jane

Electronic Giving Is it Right for your Church?

The congregation is ready for Electronic Giving, implement Electronic Giving in your Chruch with NTC.

According to Federal Reserve Bank, people are writing fewer checks and using electronic payments more.

Reasons Church should offer Electronic Giving:

Donors can make additional contributions.

Electronic Giving encourage and promote Financial Health.

Infrequent givers become regular givers with Recurring Payments.

People who can’t attend service or forgot to bring checkbook can still give.

NTC Electronic Giving Offers:

Mobile offsite activities fundraising-NTC E-Pay email invoicing-Security data Breach Protection

Automatic, recurring donations: Reoccurring Donations: Secure Payment Form For:

Online Electronic Giving Auto updater Website

Use credit or debit card Web Form Social Media

For Electronic Giving call now 888-996-2273 or visit www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants Tagged with: credit or debit card, E-Pay, electronic, electronic payments, financial, invoicing, mobile, online, Recurring Payments, Security

February 6th, 2017 by Elma Jane

Managing Chargeback:

Chargeback – a forcible reversal of funds due to a credit card holder’s dispute of the transaction. Chargebacks can be a huge headache for a business owner, it can affect a business’ ability to maintain a credit card processing account and put funds on hold.

How can you protect your business and maintain a good processing account? First, you need to know the basic chargeback types:

- Clerical – duplicate billing, incorrect amount billed or refund never issued.

- Fraud – consumer claims they did not authorize the purchase or claims identity theft. Fraud disputes can be more complicated since they are the result of fraudulent consumer purchases.

- Quality – consumer claims to have never received the goods as promised at the time of purchase.

- Technical – expired authorization, non-sufficient funds or bank processing error.

Managing chargebacks is an important piece and it can certainly be reduced, to save your business, time, money and reputation.

For Electronic Payments Set up call now 888-996-2273 or visit www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants Tagged with: bank, chargeback, consumer, credit card, fraud, funds, processing account, refund, transaction

January 31st, 2017 by Elma Jane

Selecting a Payment Provider

Selecting electronic payments provider for your business is critical. NTC believes that the process starts with an honest assessment of your business and the types of credit card processing options it requires. (Retail or e-commerce, Card Present or Card-Not-Present)

Card present transaction is the most common type of account. Card-Not-Present (CNP) is a different type of account if you run a MOTO (mail order telephone order) or Internet operation.

Here are some points to keep in mind in selecting your electronic payments provider:

Referrals from fellow business owners and checking out payment providers online.

Evaluate products and services as well as cost to determine which electronic payments provider offers the biggest savings for your business.

Make sure the deals you’re considering include all the features and services you need and none that you won’t use.

Keep upgrade options in mind.

Look for 24/365 support and discuss customer service support.

Read the fine print in your contract.

The merchant account provider’s reputation is important, so find out how long they’ve been in business and their reputation in the industry.

NTC has over 20 years’ of Bankcard History. Helping businesses of all sizes for over 25 years in the industry. Call us now 888-996-2273 and tell us all about your business needs and requirements and we’ll put together a package of products and services that will best serve your credit card processing needs. There are a variety of solutions, so it’s important to focus in on those that directly address your needs.

Posted in Best Practices for Merchants Tagged with: cnp, credit card, customer, e-commerce, electronic payments, internet, merchant account, online, payment provider, payments, retail, transaction

January 30th, 2017 by Elma Jane

U.S. Based Payment Processing Account?

How do you get a U.S.-based payment processing account when you are based outside of the country?

Here are several steps you need to take before applying a U.S. payment processing account:

The first thing you need to do is get incorporated.

Get an office – typically comes as a part of the package offered by the company that is doing your incorporation. Opt for real physical presence, rather than just a mailing address.

Get a U.S. representative – that representative is not only a name to use in the incorporation paperwork and in your office rental agreement. The U.S. representative person will be acting on behalf of your company in the U.S. This person will need to have a U.S. social security number (SSN) and will be the one who signs your credit card processing agreement.

If you are unable or unwilling to find one, you will not be able to get approved for a domestic payment processing account and will have to settle for an offshore one.

Lastly get a business checking account.

Only U.S.- based businesses are eligible for U.S. payment processing accounts, talk to a Payment Specialist 888-996-2273.

Posted in Best Practices for Merchants Tagged with: credit card, merchant account, payment, Security

January 30th, 2017 by Elma Jane

Posted in Best Practices for Merchants

January 25th, 2017 by Elma Jane

PIN vs. Signature: What’s the Difference?

PIN Debit – PIN transactions are routed through what are known as (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

Signature Debit – Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

Posted in Best Practices for Merchants Tagged with: credit card, customer, debit, debit card, electronic, electronic funds transfer, online, payment, PIN, POS, terminal, transactions

January 24th, 2017 by Elma Jane

How to set up a travel merchant account?

First, you need to find a Merchant Service Provider.

Put together your business profile so you can start applying for a merchant account.

There are questions that you’ll need to answer, that way merchant account providers have an idea of how they should set up your account.

Some of the questions are:

Is your business seasonal?

For Travel Agencies or Tour Operators, it is seasonal, there will be high and low volume. NTC works with seasonal downtime.

How do you intend to accept payments?

Different business models require different methods of accepting payments.

If you’re doing face to face transaction and have a physical location then you need a credit card terminal.

If you process checks, then you need Electronic Check and ACH Transfers.

For e-Commerce shopping carts, wireless/mobile, you can check out our Converge Virtual Merchant and NTC e-Pay.

How much volume do you plan on processing?

Merchant account providers are going to want to know how much sales volume you plan on processing per month.

If you’re new in the business – give just an estimate average of how much you’ll be processing (per month), within the first 6-months of operation.

if you’ve been in the business – you’ll already have this number ready.

What will be your average ticket price?

Example:

Total Sales Revenue = $150,000

Total Number of Sales = 500 150,000/500 = $300 (Average Ticket Price)

If you need to setup an account give us a call at 888-996-2273 or use our contact form.

Posted in Best Practices for Merchants Tagged with: ach, credit card, e-commerce, E-Pay, Electronic Check, merchant account, merchant service provider, mobile, payments, shopping carts, terminal, transaction, travel, virtual merchant