Category: Credit card Processing

April 8th, 2014 by Elma Jane

Today’s consumers are defining themselves by their mobile devices, their social presences and how they interact with brands, both offline and online. The digital evolution of the average consumer is alive and kicking.

Today’s consumer is more connected than ever, with more access to and deeper engagement with content and brands. Thanks to the proliferation of digital devices and platforms. Content that was once only available to consumers via specific methods of delivery such as via print, radio and broadcast television can now be sourced and delivered to consumers through their multiple connected devices. This is driving the media revolution and blurring traditional media definitions.

What are the specific characteristics or dynamics shaping today’s consumer behavior? Digital consumers are social-savvy and more connected to their friends, family and favorite brands than ever before.

Focused On The Gadgetry

Consumers love gadgets.

One out of four Americans plan to buy a smartphone in the near future. Thirty percent intend to upgrade from a regular mobile phone to a smartphone once able. For those ages 18 to 24, 49 percent they want to upgrade to a smartphone.

How frequently consumers use their mobile devices in a given month? Consumers spent an average of 34 hours and 17 minutes per month using apps on their devices, an increase of 9 hours and 52 minutes from 2012.

Interestingly, the amount of time consumers spend surfing the Web fell 1 hour and 54 minutes to a total of 27 hours and 3 minutes. The amount of time used to watch videos online increased by 43 minutes, to 6 hours and 41 minutes.

Social Media & Everyday Life

Digital consumers, by and large love their social media.

Sixty-four percent said that they use social media at least once per day. For mobile however, the growth figures reported suggest a broad shift is happening, pushing more people to access social networks via mobile platforms.

Forty-seven percent of smartphone owners log onto a social network each day. Additionally, the number of people who use social-media apps on their smartphones rose by 37 percent from 2012.

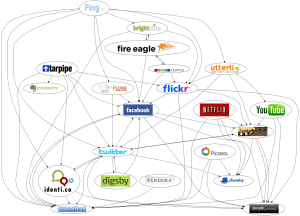

Digital consumers are also diversifying their choice of social networks, opting to use LinkedIn and Pinterest in addition to so-called traditional social media platforms like Facebook and Twitter.

As digital consumers find their own mix of devices and platforms to access and engage with social media, they are building profiles and connections on multiple social networks as well.

Two Screens Is A King

Digital consumers also rely on their mobile devices as a second type of television screen.

In a survey, eighty-four percent said they use their smartphone or tablet to surf the Web or to use apps while watching television. Of those, 44 percent of tablet owners shopped while watching TV, and 24 percent used their smartphones to make purchases.

Fourteen percent of tablet owners used their device to buy a product or service as it was being advertised on TV. Just 7 percent of smartphone owners said they would do the same.

Posted in Best Practices for Merchants, Credit card Processing, Financial Services, Merchant Services Account, Mobile Payments, Small Business Improvement, Smartphone Tagged with: apps on their devices, average consumer, content, deeper engagement, digital consumers, digital devices, digital evolution, Facebook, gadgets, linkedin, media revolution, Mobile Devices, mobile platforms, offline and online, pinterest, regular mobile phone, smartphone, social media, social network, social presences, social-media apps, social-savvy, tablet, traditional media, twitter

April 7th, 2014 by Elma Jane

Integrate Cloud-Based Platforms

E-commerce businesses increasingly rely on cloud-based applications, such as hosted shopping carts, analytics platforms, cloud-based accounting, customer service tools, and more.

To operating smoothly, a merchant’s cloud-based apps should integrate with each other, to save time and to otherwise prevent data loss and ensure accurate reporting.

It’s important, therefore, to have an integration mindset when choosing and using software-as-a-service solutions.

Some tips:

Ask Around

As with evaluating any vendor for your company, go beyond the company’s website. Ask the vendor about other customers. Get references. Contact those companies and ask how the platform is working. Is it easy to set-up? Does it integrate seamlessly with other apps? How long does it take to transfer data from one app to the other? These are just some of the questions you need to ask when evaluating an app. Also check social media sites for any discussions pertaining to the program. Read what people are tweeting. Check relevant LinkedIn groups.

Check the Company’s Integrations Page or API

When evaluating a software-as-a-service (SaaS) solution, first determine if it integrates with the platforms that you’re already using. Pre-built integrations will save much time. Alternatively, if a company has an application programming interface (API), use it to integrate the app with your existing systems.

If you can’t find the integration you need or if you want to avoid the API option, contact the vendor directly and ask if it can make its platform sync with your existing solutions. Don’t underestimate the power of reaching out to your vendors.

Use Cloud App Integration Services

Another option is to use SaaS integration services. You have plenty of choices, depending on what you need to connect. If you just need to integrate two apps, like Dropbox to Gmail, for instance, you can use (IFTTT) If This Then That – a service that lets you assign triggers and actions to each app through a drag-and-drop interface. When one program does something, it will automatically trigger another app to perform an action. For example, you can create a recipe wherein all your Gmail attachments are automatically saved to your Dropbox folder. IFTTT is free to use, to integrate up to 80 apps.

A similar service, Zapier, lets you do the same thing, but on a larger scale. It supports more than 250 applications, including Salesforce, Zoho CRM, Xero accounting, Campaign Monitor email, and more. Zapier is free for five integrations. It also offers Basic, Business, and Business Plus plans that cost $15, $49, and $99 per month, respectively.

IFTTT and Zapier work well to integrate two cloud applications. However, if you’re running a combination of cloud and on-premise applications, or if you have an ecosystem of apps and data sources that have to connect and exchange data, you need more sophisticated options.

That’s where services such as Dell Boomi and SnapLogic come in. Like IFTTT and Zapier, these solutions use a drag-and-drop interface, but at a larger scale. They connect multiple combinations of cloud and on-premise applications.

Use Free Trials

Always test-drive your apps or integration services. Most SaaS platforms offer free trials. Take note of user-friendliness, functionality, and observe how they function with programs you already have.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Financial Services, Internet Payment Gateway, Payment Card Industry PCI Security, Small Business Improvement, Visa MasterCard American Express Tagged with: api, apps and data sources, cloud applicaitons, cloud based applications, cloud based apps, cloud-based accounting, customer service, dropbox, e-commerce, ecommerce, exchange data, existing systems, gmail, integration, SAAS, salesforce, shopping carts, social media, software-as-a-service, sync, zapier

April 7th, 2014 by Elma Jane

Business-to-business ecommerce describes Internet-enabled transactions between businesses, such as a manufacturer and a wholesaler, a wholesaler and a retailers, or a wholesaler and a business user. The B-to-B ecommerce market was expected to exceed $550 billion in the U.S. last year, offering great opportunities for distributors and manufacturers to streamline sales, boost profits, and engage with new customers.

Since the late 1990s, businesses have been using the Electronic Data Interchange (EDI) system to transfer purchase orders and similar structured information electronically, representing, if you will, a form of B-to-B ecommerce.

Separately, some B-to-B sellers have created websites on which business customers can make purchases as if they were shopping on a business-to-consumer site. This category of B-to-B ecommerce may enjoy the most growth and offer the most opportunity.

Important points to consider of running a B-to-B ecommerce site.

B-to-B Customers Are also B-to-C Customers

B-to-B sites often trail consumer sites in technology, function, capabilities, and design. Typically not good enough.

As an example, the U.S. B-to-B site for a major multinational manufacturer, which includes information for dealers in the U.S., can only be viewed on Internet Explorer, and won’t work in any other browser, including Firefox, Chrome, Opera, or Safari. And don’t even think about visiting this site on a mobile device. It just won’t work.

This is a ridiculous business decision. It forgets a fundamental fact about B-to-B ecommerce customers. They are also B-to-C ecommerce customers.

It is extremely likely that the professional shopper on an ecommerce-enabled B-to-B website has had at least some experience shopping on consumer ecommerce sites, which all have compelling product photography, good navigation, good search capabilities, and good content.

A B-to-B ecommerce site must provide the same visual and functional experience as the best B-to-C ecommerce sites.

Personalization Is Vital

B-to-B shoppers may require a greater level of personalization than B-to-C customers, since businesses may have contract prices, special payment terms, or negotiated shipping rates.

Business relationships may be very deep and complicated. It is not unusual for B-to-B ecommerce sites to require registration before showing prices or shipping rates or offering a quote. This login requirement allows the B-to-B ecommerce site to personalize almost every aspect of the transaction.

A good B-to-B ecommerce site may take a little longer to launch since the system for handling relatively complex business relationships can take some time. But once it is in place, this personalization will mean that the relationship could be longer lasting.

Sales people Are the Primary Marketing Vehicle

While it is both possible and likely that B-to-B ecommerce sites will be able to acquire new customers simply by making products easy to order online, salespeople who contact customers are probably the B-to-B ecommerce seller’s primary and best marketing channel.

Salespeople can attract new customers or deepen relationships with existing shoppers. Sometimes, it can be enough to follow up after a B-to-B sale with a call to make certain that the transaction went as expected.

Shopping Is Part of Your Customer’s Profession

One of the most significant differences between B-to-B and B-to-C ecommerce is that shopping is part of the B-to-B ecommerce customer’s daytime job.

This means that the stakes can be higher for the B-to-B seller. If the shopper has a good experience, that shopper is likely to return and reorder repeatedly – even suggesting the seller to co-workers or other divisions. But if something goes wrong, particularly something that would cause the shopper to miss deadlines at work or appear in some way to have done a poor job, that shopper will likely blame the B-to-B seller. Depending on the unhappy shopper’s influence, the B-to-B seller might lose the entire account, including many individual buyers or divisions.

This means that order handling and transactional communications must be top notch. Some B-to-B ecommerce sellers will call customers to confirm orders or shipments when the customer has ordered a large quantity, very expensive items, or requested express shipping, since these orders may represent important transactions to the customer.

What Ecommerce Can Do for your B-to-B Business

If you sell to other businesses, ecommerce should have three potential benefits for your business.

First, it may help new customers find you. Having an easy-to-find and use ecommerce site means that new customers – customers with a need – will be able to locate your business regardless of geography or prior relationships.

Second, B-to-B ecommerce may streamline sales for existing customers. Some of your current customers will appreciate the ability to order online, 24 hours a day 7 days a week. The process may also be faster than sending emails or, even worse, faxed orders.

Finally, B-to-B ecommerce may improve margins and boost profits. It may be possible to provide customers with a better ordering experience and better customer service using ecommerce while spending less on labor and order processing. Any cost savings that B-to-B ecommerce brings may drop straight to your business’s bottom line.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Small Business Improvement Tagged with: account, b-to-b, b-to-c, better ordering experience, boost profits, business-to-business, business-to-consumer, business's bottom line, communication, consumer, cost savings, customer service, e-commerce, ecommerce, ecommerce sites, electronic data interchange, faxed orders, growth, improve margins, new customers, online, order handling, order processing, personalization, profits, purchase orders, salespeople, seller, sending emails, shopper, special payment terms, transaction, wholesaler

March 31st, 2014 by Elma Jane

A payment processor is a company often a third party appointed by a merchant to handle credit card transactions for merchant acquiring banks. They are usually broken down into two types: Back and Front-End.

Back-End Processors accept settlements from Front-End Processors and, via The Federal Reserve Bank, move the money from the issuing bank to the merchant bank.

Front-End Processors have connections to various card associations and supply authorization and settlement services to the merchant banks’ merchants. In an operation that will usually take a few seconds, the payment processor will both check the details received by forwarding them to the respective card’s issuing bank or card association for verification, and also carry out a series of anti-fraud measures against the transaction.

Additional parameters, including the card’s country of issue and its previous payment history, are also used to gauge the probability of the transaction being approved.

Once the payment processor has received confirmation that the credit card details have been verified, the information will be relayed back via the payment gateway to the merchant, who will then complete the payment transaction. If verification is denied by the card association, the payment processor will relay the information to the merchant, who will then decline the transaction.

Modern Payment Processing

Due to the many regulatory requirements levied on businesses, the modern payment processor is usually partnered with merchants through a concept known as software-as-a-service (SaaS). SaaS payment processors offer a single, regulatory-compliant electronic portal that enables a merchant to scan checks “often called remote deposit capture or RDC”, process single and recurring credit card payments (without the merchant storing the card data at the merchant site), process single and recurring ACH and cash transactions, process remittances and Web payments. These cloud-based features occur regardless of origination through the payment processor’s integrated receivables management platform. This results in cost reductions, accelerated time-to-market, and improved transaction processing quality.

Payment Processing Network Architecture

Typical network architecture for modern online payment systems is a chain of service providers, each providing unique value to the payment transaction, and each adding cost to the transaction. Merchant>Point-of-sale SaaS> Aggregator >Credit Card Network> Bank. The merchant can be a brick-and-mortar outlet or an online outlet. The Point-of-sale (POS) SaaS provider is usually a smaller company that provides customer support to the merchant and is the receiver of the merchant’s transactions. The POS provider represents the Aggregator to merchants. The POS provider transaction volumes are small compared to the Aggregator transaction volumes. The POS provider does not handle enough traffic to warrant a direct connection to the major credit card networks. The merchant also does not handle enough traffic to warrant a direct connection to the Aggregator. In this way, scope and responsibilities are divided among the various business partners to easily manage the technical issues that arise.

Transaction Processing Quality

Electronic payments are highly susceptible to fraud and abuse. Liability to merchants for misuse of credit card data creates a huge expense on merchants, if the business were to attempt mitigation on their own. One way to lower this cost and liability exposure is to segment the transaction of the sale from the payment of the amount due. Some merchants have a requirement to collect money from a customer every month. SaaS Payment Processors relieve the responsibility of the management of recurring payments from the merchant and maintain safe and secure the payment information, passing back to the merchant a payment token. Merchants use this token to actually process a charge which makes the merchant system fully PCI-compliant. Some payment processors also specialize in high-risk processing for industries that are subject to frequent chargebacks, such as adult video distribution.

Posted in Best Practices for Merchants, Credit card Processing, Electronic Check Services, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Payment Card Industry PCI Security, Point of Sale, Visa MasterCard American Express Tagged with: aggregator, aggregator transaction volumes, back end, card associations, card data, chargebacks, credit card transactions, electronic portal, front end, front-end processors, issuing bank, merchant, merchant bank, network architecture, online payment systems, payment gateway, payment processing, payment processor, payment transaction, pci-compliant, point of sale, POS, SAAS

March 17th, 2014 by Elma Jane

Young people and Londoners are leading the way in adopting cashless payments in the U.K., The U.K.-based market research firm also found that non-bank electronic payment methods such as PayPal are trusted more than contactless and mobile card payments.

According to research, 38 percent of British people are interested in being able to make mobile payments and an enthusiastic 8 percent claim they would apply for mobile payment services straight away. Eighteen percent of U.K. Internet users say they would prefer to be able to stop using cash altogether.

Support for a cashless society is strongest in London, with 30 percent prepared to stop using cash. And it is the nation’s youth who are leading the way in new payment forms. Twenty-two percent of those aged 25 to 34 have used Barclays’ Pingit peer-to-peer mobile payment system, compared to 5 percent of those aged 45-54. About 17 percent of 25- to 34-year-olds have used the virtual currency Bitcoin at least once.

However, consumers are more concerned about the security of mobile payments than card payments. Sixty-five percent of consumers showed some concern about mobile payment security and 61 percent showed some concern about contactless cards, compared with 34 percent who were concerned about using debit cards and the 33 percent who were concerned about credit cards.

Consumers were notably less concerned about using non-bank payment services such as PayPal, which protect users’ financial data from being seen by third parties. Only 27 percent of Internet users are concerned about using non-bank payment services such as PayPal.

Posted in Credit card Processing, Credit Card Security, Digital Wallet Privacy, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: card payments, cashless payments, cashless society, contactless, contactless cards, credit cards, debit cards, electronic payment methods, financial data, internet users, mobile card payments, mobile payment security, mobile payment services, non-bank, non-bank payment services, peer-to-peer mobile payment system, Security, Virtual Currency

March 17th, 2014 by Elma Jane

Lots of talk has gone on since the recent spate of merchant data breaches on ways to potentially prevent hackers from gaining access to stored payment card data. Use of biometric information, such as a fingerprint, to access stored credentials is among the solutions often bandied about.

The prospects of using individuals’ biometric information for credentialing is fairly scary. Security may be what biometrics is trying to achieve, but it’s also its biggest flaw. Imagine having your fingerprint information stored at Target this holiday season, that information would now be in the hands of lots of people not intended to have access to it. Unlike a password, someone can’t change his or her fingerprint. So once someone has the print, they have it forever. So even if something is biometric based, it also has to have a lot of other security measures, and that could include GPS-based location services tied to an individual’s smartphone.

Biometrics alone won’t work. It’s very scary that that information could be stored in a way that someone could figure out how to get it. Even if encrypted, that’s a huge security concern. You can’t change your fingerprint.

Posted in Credit card Processing, Credit Card Security, Electronic Payments, Payment Card Industry PCI Security, Smartphone Tagged with: biometric, card data, credentialing, encrypted, fingerprint, gaining access, gps-based, merchant data breaches, password, prevent hackers, Security, security measures, smartphone, stored credentials

March 14th, 2014 by Elma Jane

Merchant and Consumer Groups Seek Senate Support To Forego EMV Chip and Signature As Breach Concerns Rise

There’s no shortage of answers in trying to put a stop to hackers set on throwing chaos into the way consumers transact at the point of sale, or online for that matter. Yesterday, the Banking, Housing and Urban Affairs subcommittee on national security and international trade and finance got its chance to hear some of them.

During the hearing, William Noonan, deputy special agent in charge, U.S. Secret Service, noted the advances in computer technology and greater access to personally identifiable information online, which have created a virtual marketplace for transnational cyber criminals to share stolen information and criminal methodologies. As a result, the Secret Service has observed a marked increase in the quality, quantity, and complexity of cyber crimes targeting private industry and critical infrastructure. These crimes include network intrusions, hacking attacks, malicious software, and account takeovers leading to significant data breaches affecting every sector of the world economy.

The recently reported data breaches of Target and Neiman Marcus represent only the most recent, well-publicized examples of this decade-long trend of major data breaches perpetrated by cyber criminals intent on targeting the nation’s retailers and financial payment systems. The increasing level of collaboration among cyber-criminals allows them to compartmentalize their operations, greatly increasing the sophistication of their criminal endeavors and allowing for development of expert specialization. These specialties raise both the complexity of investigating these cases, as well as the level of potential harm to companies and individuals.

So how should the industry react to prevent further breaches? Those opinions provided during testimony at the hearing varied widely, though both consumer and merchant groups would like the card networks to give up requiring only signatures for smart card purchases at the point of sale.

Consumer program director at the U.S. Public Interest Research Group, called for myriad of changes, citing that the greater risk from the recent breaches is less related to identity theft than it is to fraud on existing accounts, and he said it’s time for players on both sides of the transaction to focus more on protecting consumers than on managing their own risk.

Until now, both banks and merchants have looked at fraud and identity theft as a modest cost of doing business and have not protected the payment system well enough. They have failed to look seriously at harms to their customers from fraud and identity theft -including not just monetary losses and the hassles of restoring their good names, but also the emotional harm that they must face as they wonder whether future credit applications will be rejected due to the fraudulent accounts.

As a first step, Congress should institute the same fraud cap, $50, on debit/ATM cards that exists on credit cards, or eliminate the $50 cap entirely, since it is never imposed because of the zero-liability policies issuers have voluntarily have imposed. Congress also should provide debit and prepaid card customers with the stronger billing-dispute rights and rights to dispute payment for products that do not arrive or do not work as promised, just as many credit card users enjoy.

Congress should endorse a specific technology, such as EMV smart cards and if it does, require the use of PINs when initiating smart card transactions. The current pending U.S. rollout of chip cards will allow use of the less-secure chip-and-signature cards rather than the more-secure chip-and-PIN cards. Why not go to the higher-and-PIN authentication standard immediately and skip past chip and signature? There is still time to make this improvement.”

Retailers have spent billions of dollars on card-security measures and upgrades to comply with PCI card security requirements, but it hasn’t made them immune to data breaches and fraud. The card networks have made those decisions for merchants, and the increases in fraud demonstrate that their decisions have not been as effective as they should have been.

The card networks should forego chip and signature and go straight to chip and PIN. To do otherwise would mean that merchants would spend billions to install new card readers without they or their customers obtaining PINs’ fraud-reducing benefits. We would essentially be spending billions to combine a 1990’s technology chips with a 1960’s relic signature in the face of 21st century threats.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Merchant Services Account, Payment Card Industry PCI Security, Point of Sale, Small Business Improvement, Visa MasterCard American Express Tagged with: banking, Breach, card networks, card-security, chip and signature, chip cards, chip-and-PIN cards, computer technology, credit applications, credit cards, critical infrastructure, cyber crimes, cyber-criminals, data breaches, debit atm cards, EMV, hackers, hacking attacks, international trade and finance, malicious software, managing risk, merchant, national security, netwrok intrusions, new card readers, online, payment system, pci card security requirements, PIN, point of sale, prepaid card customers, smart card transactions, technology chips, the secret service, transnational cyber criminals, virtual marketplace, world economy

March 6th, 2014 by Elma Jane

MPOS Mobile Point-of-sale.

Mobile point-of-sale is evolving as more merchants and consumers begin to accept payment through smartphones and tablets. The end of 2013 saw a number of acquisitions and new players shape the market, and all the signs are pointing to 2014 as the year in which MPOS goes mainstream.

Indeed, 2014 should be a defining year for MPOS. Data contained in the most recent MPOS Tracker as an indication that the major players are moving seriously to capture market share, educate merchants on the benefits of MPOS and work to make interaction with the systems simpler for consumers.

Existing companies bringing out new platform enhancement, new players popping in, partnership made it was more active, and it’s been very active in the past. This technology is going in the market, and where this industry is headed is upmarket and globalization. In order for each of these things to happen, it’s much more about the application programming interfaces and the platform that enables than the actual app itself.

A critical trend this year is global expansion outside of the U.S. This growth will help promote MPOS and push it into the mainstream as a vehicle for payment.

More adoption happening as major retailers start to integrate MPOS into their existing systems. Over time, consumers will start to use their mobile devices to make payments more frequently.

In the past, most of the activity has been in the small and midsize business space in the U.S. A lot of the use cases were niche markets, as this technology moves up to major retailers, it will become more visible to consumers that it’s not just a niche application, but it’s a regular, day-to-date encounter for them to run into MPOS.

As for the future, the signs point to continued growth both in terms of new players appearing and in market consolidation among the smaller players. However, some will have a tougher time than others as new MPOS companies seek both market share and relevance in the wider ecosystem.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Point of Sale, Small Business Improvement, Smartphone, Visa MasterCard American Express Tagged with: accept payment, app, application programming interfaces, integrate mpos, major retailers, make payments, Merchant's, Mobile Devices, mobile point of sale, MPOS, platform, Smartphones, tablets

March 4th, 2014 by Elma Jane

Setting the right price for your products or services can be challenging, particularly given the many outdated ideas and misconceptions surrounding pricing structure. The problem with conventional wisdom is that it’s not always wise to follow. Let’s consider four commonly held ideas about pricing and why they may be standing in the way of increased profit for business.

Price Drives Sales More Than Anything Else (Quantity/Price)

Price is definitely a key component in a customer’s having decision but managers overestimate its importance. A computer error caused prices for online retailer products to be displayed at wholesale rather than retail prices for a weekend. The company expected a huge surge in sales, but increase was only marginal, revealing that the company’s customers were more motivated by other factors, such as customer service and the quality of the products themselves, rather than price.

Managers remember the 10-15% of customers that balked at buying due to price instead of noting that 85-90% of customers did not have a problem with the price.

Price Reign Supreme

Finding the perfect price is not the Holy Grail. Small businesses would do better to treat price as function of the value they provide to customers. The greater the value, the higher the price that can be set. Value represents a customer’s return on spending. The benefits receives for each dollar paid. Customers don’t mind paying more if we get more in return, whether the benefits are real or perceived.

Pricing Structure Always Depends On Your Competition

Small businesses set their prices based on what their competitors are charging, but this approach may end up hurting the company. Instead, try to understand how your customers view your product and your brand. Pricing structure shouldn’t depend on your competitors prices unless you and your competitors offer the same bundle of benefits.

Spread Out Price Increases

People gripe about air travel, but many small businesses might benefit by taking a page out of the airline industry’s dynamic pricing playbook. Don’t treat prices as set in stone. Sell 2014 products and services at 2014 prices. Consumers are less likely to grumble about regular, incremental price adjustments than larger increases spread further apart specially, if they aren’t linked to any visible improvements. You’re also more likely to fall out of sync with market realities if you initiate significant price hikes at multi-year intervals.

If you haven’t raised prices since 2006, you might not be losing money, but you’re still losing margin. Your customers want you to stay in business, and you can’t do that if the times change but your prices don’t.

What are you offering that the competition isn’t? (Yours VS Theirs)

Are your locations or hours more convenient?

Do you offer training or other support?

Is same-day delivery available?

Is your sales staff more knowledgeable?

Marketing isn’t about paying people to buy from you by giving away margins. It’s about creating valuable perceived differences between you and your competition, in the eyes of buyers and charging buyers for those differences. Anything out of the ordinary gives existing and potential customers a reason to drop by or click.

Posted in Best Practices for Merchants, Credit card Processing, Small Business Improvement Tagged with: greater value, losing margin, losing money, online retailer, price, pricing, pricing playbook, pricing structure, products or services, profit for business, retail prices, small businesses

March 3rd, 2014 by Elma Jane

Interchange is a word that’s talked about a lot in the payments industry. If you didn’t have to pay interchange fees, what would your business spend the money on? At its most basic, interchange is the fees businesses pay to credit card processors to swipe your credit and get paid – or the cost of moving money. Businesses are sick and tired of paying high fees and getting very little in return. Customers are sick and tired of seeing prices of items tick upwards as businesses are forced to charge more to cover the cost of interchange.

Businesses spend an exorbitant amount of money each year to accept credit cards – to the tune of $50B. Businesses could reinvest the money they’ve been spending on interchange to better connect with customers, enhance marketing initiatives and grow faster and smarter. Just imagine for a second the economic stimulus the country would get if all that money was put back into the business to drive growth, or back into the pockets of customers to lower costs.

In the past 30 years, interchange fees have mainly gone in only one direction: up. Luckily, things are starting to change, and I think we’re going to start seeing interchange being driven down. The days of a 3 -or 4-percent interchange rate are beginning to look numbered and here’s why:

Competition

There are nearly 200 players in the mobile payments space, with more entering daily. New opportunities are providing businesses with alternative payment options that are outside of Mastercard and Visa’s clutches. While there might be 1,000-plus credit card processing companies, they’re all based on the Mastercard/Visa rails, which provides a fixed floor. But not so with many of these new payment options. As such, traditional methods of payment (cash, credit cards) are facing an increasing amount of competition, and merchants are starting to pay attention.

It’s unlikely that cash and credit cards are going away anytime soon, but it only takes a small shift in volume (maybe 5 percent) for the card issuers to start paying attention. There are a number of ways for them to react, but if history is any guide, one of them will be to start lowering their prices. Alternatively, they could find ways to offer more value to their merchants. Either way, competition is offering merchants new ways to accept payments, and this will lower fees over time.

Innovation

The second thing driving down costs for merchants is rapid innovation, and like a good deal of innovation these days, much of it is centered around mobile. Mobile payments are starting to gain significant traction among consumers, accounting for $640M in 2012 and expected to have grown by an additional 234 percent in 2013.

QR codes, NFC, peer-to-peer payments, card emulation – the list of new technologies trying to disrupt the payments space goes on and on. These new alternatives are challenging the current payments system and shedding light on the opportunities for businesses. This innovation is beneficial in two ways. The first, as discussed above is that more competition will naturally drive costs down. The second is that alternative payment options are focusing on value beyond the transaction.

There are new payment options out there that provide tangible information, such as data analytics, which help companies drive sales and increase revenues. New options are allowing small businesses access to the same technology and analytics that were previously reserved for big-box retailers or e-commerce sites only. These additional value propositions not only help businesses, they also provide new ways for payments companies to monetize, removing the need for them to make all of their money from interchange. With two (or more) revenue lines, lowering interchange is suddenly a lot more feasible.

Legislation

The Durbin Amendment is designed to introduce competition in the debit card processing network and limit fees for businesses. For all of its unintended consequences, Durbin legislation is actually helping to drive down interchange; it’s opening up competition for non-card-brand network players and lowering debit card fees. While it is certainly rife with controversy, this amendment is opening up new ways to move money that will, over time, contribute to a less expensive payment processing ecosystem.

Merchant demand

Business owners are smart and savvy. They pay attention to trends, focusing on finding new ways to set their business apart. Business owners are also conscious of ROI, and how much they’re spending to attract and retain customers. They understand there is some cost to accept payments, but are becoming more and more frustrated at the high swipe fee costs from traditional credit card processors and minimal return for those fees.

Businesses are looking to new, innovative solutions to provide more than just payment processing – they want to understand and better connect with their customers. In short, merchants are ready for a new payments ecosystem, and where there’s this much demand from a group this big and influential, a solution can’t stay away for too long.

Interchange rates are not going away entirely in the near future, although it will happen eventually. A lot of powerful wheels are in motion to significantly reduce the interchange rates that merchants currently pay. Right now the impact might be small, but it’s growing quickly. In a few years, 3- to 4-percent interchange could be relegated to the same bit of history as $1.99 international phone calls.

Posted in Credit card Processing, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Internet Payment Gateway, Small Business Improvement Tagged with: accept credit cards, accept payments, alternative payment, credit card processing, credit card processors, credit cards, debit card processing network, e-commerce, interchange, interchange fees, interchange rates, lowering debit card fees, lowering interchange, Merchant's, Mobile Payments, payment processing, payments, payments industry, swipe your credit card