Category: Credit card Processing

February 13th, 2014 by Elma Jane

Becoming an e-commerce entrepreneur is an increasingly attainable dream for many aspiring business owners, as new online sales platforms and Web design tools continue to emerge. While just about anyone can launch an online business, it takes a dedicated salesperson to actually succeed, and that means staying on top of current marketplace trends.

If you’re ready to take your e-commerce business to the next level in 2014, watch these five current trends in online sales:

Access through smartphones, tablets and other mobile devices. Major gains seen in e-commerce usage of mobile devices such as smartphones and tablets, especially during the holiday season. Trend to accelerate as mobile adoption continues to increase and more mobile technologies become available. Small businesses should have a mobile version of their website, with mobile-optimized checkout to help facilitate a better mobile experience. Small retailers should also look at their site across multiple mobile devices and pay attention to new technologies, such as smartwatches.

Goodbye, traditional SEO. Google is constantly updating its algorithm in an effort to serve the best, most relevant content to its users. This means that traditional (SEO) search engine optimization tactics are falling by the wayside, and an increased push toward quality, unique content — along with social media signals — will be of huge importance in 2014. To help stay ahead of the SEO curve, small retailers should focus less on Traditional SEO Tenets like keyword usage and density, and instead aim efforts toward creating content that is tailored and useful for their target audience. Example, create more lifestyle-oriented content in the form of blog posts, videos and other types of media that encourage sharing by readers.

Increased dependence on data. Smaller online businesses continue to expand their presence across channels, the need to turn to performance data from both a channel-specific and holistic standpoint becomes even more important. Google Analytics is a good tool for this, because business owners can measure their site traffic from multiple devices and referral sites.

Small shops squeezed by larger merchants. Mega-retailers like Amazon continue to steal market share from other big-box retailers (both online and offline), smaller online businesses will need to become more nimble in how they compete, from a price, customer-service and marketing standpoint. This involves identifying true points of difference from larger merchants, showcasing these points in marketing and branding, and delivering personalized experiences.

The importance of multichannel selling. Customer shopping behaviors become more fragmented, so must the presence of small online businesses owners. Simply having an e-commerce site is no longer enough. Small and medium-size businesses (SMBs) should begin looking for efficient ways to expand their presence, including integrations with various shopping feeds and other outlets that can reach more consumers.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Point of Sale, Small Business Improvement, Smartphone Tagged with: content, e-commerce, integrations, mobile adoption, Mobile Devices, mobile version, mobile-optimized checkout, multiple devices, online business, online sales, search engine optimization, shopping feeds, Small and medium-size businesses (SMBs), small online business owners, small retailers, Smartphones, smartwatches, social media signals, tablets

February 10th, 2014 by Elma Jane

Is traditional POS on its way out? Not so fast. It is likely to be an enhancement rather than a replacement to traditional POS.

Trending topic when it comes to POS is all about the mobile kind because Mobile Point of Sale (POS) systems have rocked the retail world. When one searches the term POS, nearly every article that comes up is all about mobile. Many seem to believe it will change the retail industry.

There is definitely a need and a place for both.

Retailers everywhere have incorporated the Internet into their business model by creating multi-channel sales strategies, such as e-commerce, digital marketing, social media marketing, online product information, specifications, reviews and online customer service.

In addition to their online presence, these same retailers have started to bring the Internet in-house by integrating such services as customer centric promotions at point of sale, introducing loyalty programs and member registration, facilitating digital signage, offering e-receipts via email, and self check out centers; all at the traditional POS kiosk. In fact, 95% of all sales transactions are conducted via traditional POS terminals.

Why bother with mobile POS anyway?

While it’s true that traditional POS system won’t be going anywhere soon and with good reason, mobile POS systems have allowed retailers to make great strides when it comes to efficiency and customer service, as well as customer satisfaction.

Companies have made big changes in the way they handle customer transactions in-store, thus affording faster checkout, waiting line reduction, consultative selling and more.

List of mobile POS benefits goes on:

Email Receipts – Better for the environment, more convenient for customers and faster to process, a digital purchase receipts sent via email tells the customer that you care about the earth and about them.

Expanded Reach – With mobile POS, your sales are no longer confined within the four walls of your brick and mortar store. Sidewalk sales, seasonal mall kiosks, and special sponsorship events are just a few examples of all the places you can take your retail sales to, with a POS in hand.

Inventory and Price Search – When customers can be assisted with finding an item color, size or availability on the spot, rather than having to wait in line to do so, it makes them happier. The same can be said for pricing. POS in the hands of store reps can go a long way toward customer satisfaction.

Inventory Return Stations – There is always a certain volume of returns, but that volume increases for retailers particularly after the holidays. The implementation of mobile POS allows for retailers to set up additional return stations in order to avoid long lines and customer frustrations.

Mobile POS goes Mobile – Your investment in your company POS system doesn’t need to be one size fits all, regardless of store traffic volume in one location or another. Retailers may opt to have a blow out sale in one location, thus require additional checkout power for that location for a specific period of time. With mobile POS, devises and licensing can be utilized throughout different store locations on an as needed basis.

Optional Seasonal Subscription – The great thing about mobile POS is that you needn’t pay for a POS system year round if you’re not using it year around. Seasonal spikes in retail sales warrant the additional cost of extra POS licensing and hardware, but the rest of the year your budget shouldn’t need to encompass more than what is needed. Mobile lets you better manage your overall POS investment.

Storewide Promotion Opportunities – Mobile POS has allowed retailers to drive sales in various sections of the store by holding demonstrations or promotions in different departments to tout products or services. Customers can be marketed and sold to, on the spot.

The growing industry of mobile payments doesn’t stop at in-store mobile POS. Digital wallets like Google Wallet and Apple Passbook, mobile-to-mobile cell phone transfers, Near Field Communication (NFC) payments, mobile device credit card swipe and other emerging technologies are quickly changing our cash and credit card world.

What about traditional POS?

Mobile payment systems are indeed terrific. So, when should you consider going with traditional POS? The reality is, in addition to the aforementioned benefits of traditional checkout kiosk functions, there times when mobile POS simply will not suffice.

Mobile POS is great when a customer wants to choose and pay for one item while on the sales room floor, but what about when the customer has a multitude of items? Ringing up and bagging groceries, removing anti-theft mechanisms, neatly folding and bagging clothing items and managing the sales of numerous agents, stations or departments are just a few examples of situations that often require the traditional POS checkout station.

By combining traditional POS strategies with mobile POS flexibility, retailers can leverage the command of a complex, and multi-dimensional, marketing and retail sales management system.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: apple passbook, checkout station, credit card swipe, customer satisfaction, e-commerce, e-receipts via email, faster process, Google Wallet, Loyalty Programs, mobile payment system, mobile point of sale, mobile pos, mobile-to-mobile cell phone transfers, MPOS, multi-channel sales strategies, Near Field Communication, nfc, online customer service, online presence, POS, retail industry, retail sales, retail sales management system, traditional POS kiosk

February 3rd, 2014 by Elma Jane

National Transaction and Virtuoso Agreement Official

National transaction and Virtuoso signed a preferred supplier agreement this 30th of January. NTC’s Electronic Payment System will be offered to its more than 330 agencies with 7,200 elite advisors in 20 countries.

Virtuoso is the travel industry’s leading luxury network. Travelers who use Virtuoso’s Advisors get access to more than 1,300 of the world’s premier travel providers, as well as exclusive, experiences and products. Virtuoso’s history dates to the 1950s, when the tour company Allied Travel formed to help travel agencies with foreign, international and group trips. In 1986, Allied Travel merged with Percival Tours to form (API) Allied Percival International, joining the best travel agents in the country. In 2000, API was rebranded Virtuoso, and has since become the leading travel network in the world.

While National Transaction with over 15 years in the payment service industry, has gained experience to integrate vast range of payment services. Processing digital transactions for more than 3,000 business owners and has been the preferred merchant account provider for many industry associations including ASTA, CLIA, HBTA, ARTA OSSN and now VIRTUOSO.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Travel Agency Agents, Visa MasterCard American Express Tagged with: arta, ASTA, clia, hbta, merchant account provider, National Transaction Corporation, ossn, travel, travel agencies, travel industry's, travel network, travel providers, travelers, Virtuoso

February 3rd, 2014 by Elma Jane

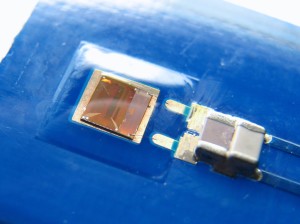

The migration to cards that use chips instead of magnetic strips, known as EMV technology, is well underway in the U.S. No government regulation is needed to make it happen. But the EMV migration and the Target breach are different things. It’s true that EMV chip cards can prevent criminals from producing counterfeit cards using stolen account numbers. But EMV doesn’t stop criminals using stolen cards online. So innovators are deploying new technologies to deter other forms of fraud.

Headline-grabbing events inevitably lead to calls for new laws. But in the case of our nation’s electronic payments systems, new government mandates would stifle marketplace innovations that hold great promise for providing consumer benefits and reducing criminal activities.

Financial institutions compete for customers by providing consumer protections even beyond requirements of current law. Many retailers also offer customers speedy transactions, such as “sign and go” and “swipe and go” for small transactions, while the payments industry ensures consumers still have zero liability. These protections and flexibility are why U.S. consumers are going cashless and carry more than one billion debit and credit cards. More than 70% of retail purchases are made with electronic payments, and our member companies process more than $4 trillion in electronic payments each year.

Fraud accounts for fewer than six cents of every $100 spent on payments systems – a fraction of a tenth of a percent. U.S. companies have made significant financial and technological investments, building sophisticated fraud tools that insulate consumers from liability. To build on this, Congress should foster greater international law enforcement cooperation to fight cybercrime, particularly in countries that harbor crime rings, and replace 46 divergent state breach notification laws with a uniform national standard.

The private sector is best positioned to address the constantly shifting tactics of criminals, and it is doing so without government mandates. Do Americans really want the government in charge of the security and monitoring of our payments?

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Visa MasterCard American Express Tagged with: counterfeit cards, cybercrime, data breach, debit and credit cards, electronic payment systems, electronic payments, emv chip cards, emv technology, fraud, liability, magnetic strips, migration, online, security and monitoring of our payments, small transactions

January 29th, 2014 by Elma Jane

More than 60 percent of online shoppers returned or exchanged at least one item. About 95 percent of customers will go back to an online merchant and make additional purchases after a positive return or exchange experience, making managing the process important for e-commerce success.

Exchanges and returns will shortly be a hot topic for online retailers as Christmas gift recipients contact sellers in the wake of an exceptional holiday selling season. These Christmas gift recipients will want to exchange and return unwanted gifts, items that are wrong size, or even items that may have been damaged in transit.

Returns and exchanges are important for building long term customer relationships, with some 95 percent of shoppers going back to online merchants that have offered a good exchange or return experience in the past, according to data from Endicia, an electronic postage solution provider. Conversely, about 85 percent of consumers will not return to an online shop after a poor return or exchange experience, again according to Endicia.

What follows are tips for offering a better exchange or return experience for online shoppers.

Create an Opportunity

Returns and exchanges are also an opportunity to make additional sales. As mentioned above, about 95 percent of shoppers will return to an online store and make an additional purchase after a positive return or exchange experience.

Similarly, about 45 percent of shoppers will actually recommend an ecommerce merchant, again according to Endicia, after a positive return experience, meaning that taking care of an existing customers could lead to new customers too.

Consider sending each shopper who returns or exchanges an item a follow-up email, asking for feedback about the experience. Identify ways to improve the return process, and business in general will improve too.

Know the Cost of Returning

A guitarist for a popular party and event band recently ordered a new guitar strap from a merchant on the Amazon marketplace. Unfortunately, there was an error in the shipment, and the merchant apparently sent a shorter strap than expected. When this guitarist contacted the seller about an exchange, he was told that a new strap would be shipped that day and that he could simply keep the smaller strap.

This solution was great for the customer, who did not have to repackage the strap or arrange for a carrier to pick it up. He was generally happy with the experience. This was probably also better for the merchant, who might have simply been able to order a new guitar strap from its distributor for about the same cost has having the strap returned.

To make this sort of business decision, it is important to understand the real cost of managing a customer return, including the cost of the shipping and the labor necessary for processing the return once it arrives back at the seller’s warehouse. If it cost as much or nearly as much to return the item as it would to simply purchase another one wholesale, consider letting the customer just keep it, saving everyone involved time and expense.

Provide Return Instructions or a Return Label in Every Order

Shoppers don’t want to wait for return labels. In fact, about 62 percent of online shoppers want a return label included in the initial shipment, according to Endicia. Including a return label is not difficult, and many online sellers may find that the ability to do so is either built directly into the retailer’s ecommerce platform or is available via an extension to the ecommerce platform.

A second option may be to offer shoppers a simple, self-service way to print a return label from your site. This self-service option does not require the customer to contact the shipper to get authorization or wait for an emailed label. According to the Endicia data, about 61 percent of shoppers will be happy with an easy way to print return or exchange labels.

State Return and Exchange Policies Clearly

Let customers know exactly what to expect from the return and exchange process. Post clear, simple-to-understand policies on a page of the site specifically designated for returns or shipping policies.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Gift & Loyalty Card Processing, Internet Payment Gateway, Visa MasterCard American Express Tagged with: Amazon, ecommerce, gift recipients, marketplace, online merchant, online retailers, online sellers, online shoppers, return or exchange, returns and exchanges, self-service

January 29th, 2014 by Elma Jane

Ecommerce and mobile-based e-commerce have grown significantly this year. Cyber Monday ecommerce sales, as an example, reached $1.735 billion originating from desktop and laptop devices, according to comScore. Even Black Friday, which is better known for brick-and-mortar retail sales, saw online spending reach $1.198 billion in the United States, again according to comScore. Mobile online spending may also have grown, as some reports indicate that mobile-based site traffic was up 55 percent around Thanksgiving.

Many ecommerce merchants are enjoying a robust holiday selling season even as some brick-and-mortar stores are seeing relatively flat Christmas sales. To ensure continued growth and success, Internet retailers may want to challenge their businesses to improve in several areas in 2014.

Retailers, however, should not rest on their current success, but rather should challenge their businesses to improve in several areas, including free shipping offers, mobile optimization, personalization, data driven decision making, and cross channel sales.

Offer Free, Two-Day Shipping

The first challenge for online sellers in 2014 may be to find ways to offer free, two-day shipping to all or most shoppers. While it is likely there will still be minimum purchase and maximum weight requirements and restrictions, online shoppers are going to expect faster free shipping options thanks, in part, to the growth in services like Amazon Prime and ShopRunner.

Consider order fulfillment services, distributed warehouses, drop shipping, or even partnerships with other retailers to help meet this challenge.

Offer Personalization and Customization

Personalization and customization could be a significant competitive advantage in 2014.

Challenge your business to finally begin offering personalization and customization both onsite and in marketing. The easiest place to start may be with email marketing. Work to segment email marketing campaigns so that they address customers by name and with relevant products and offers that are based on an individual’s or group of shoppers’ stated preferences or on-site behavior.

Taking on this challenge means that the retailer’s marketing department will need to collect meaningful information about what interests shoppers and organize separate, custom campaigns around those interests.

Put Mobile Design and Marketing First

In November, IBM reported that mobile devices accounted for 31 percent of U.S. ecommerce-related web traffic around the Thanksgiving holiday this year, and that 17 percent of ecommerce transactions came from smartphones or tablets. On average, tablet users spent more than $126.00 per order, and smartphone users spent about $106 per order.

This data shows that mobile e commerce is not simply a novelty, but rather a must have for 2014.

If an e-commerce business is not optimized for mobile sales, 2014 is the year to take on that challenge, including offering a responsive design and mobile friendly payment options.

Sell Seamlessly Across Channels, Devices

Try to think of every way that a shopper might interact with an online store, and then make all of those touch points work together in 2014.

Retailers online or in physical stores need to offer shoppers a seamless, cross channel shopping experience that makes buying things easier for the customer. To continue to enjoy success in 2014, consider offering shoppers the ability to share orders across devices, applications, and even marketplaces.

In practice, this might mean that items added to a cart in an online store show up in the cart for the retailer’s iPhone app too. Or that a customer’s order history displayed on a retailer’s site shows orders placed on-site and via a marketplace like Amazon or eBay.

Use Big Data for Big Information

In 2014, find sources of good, usable Big Data, and put the resulting big information to use.

As an example consider, Weather Trends International, a Big Data company that uses historical weather information and advanced data processing to accurately predict weather 11 months in advance. This sort of Big Data information could show a snowboard and ski retailer what sort of winter major ski resorts are likely to have next year, and could inform purchasing and inventory choices.

Similarly, knowing that a particular region is going to have a warmer than normal July and August might impact how, where, and when a clothing retailer promotes shorts or bikinis on Facebook or AdWords.

Big Data is a popular trend in business and in marketing. The concept can mean different things to different businesses. For ecommerce, retailers should seek to use Big Data to gather big information, if you will, that may be used to make better buying and selling decisions.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: adwords, Amazon, big data, big information, brick and mortar, cross channel, cyber, drop shipping, e-commerce, ecommerce, Facebook, internet retailers, laptop devices, Mobile Devices, mobile friendly payment options, mobile optimization, mobile-based site, on-site, online, online shoppers, online store, onsite, personalization, retailers marketing, retailers online, shopping experience, smartphone, Smartphones, tablet, tablets

January 13th, 2014 by Elma Jane

Most of the world has already migrated to EMV chip technology. EMV, as commentators have noted, affects not only hardware and software, but every card payment system, device and application. Looking ahead to the 2015 liability shift, stakeholders who have not made the switch should consider these benefits of EMV.

Rather than focusing on any potential expenses, however, stakeholders should instead consider the important elements they have to gain.

EMV is here.

Benefits of EMV:

Global interoperability – Since most of the world has migrated to EMV, U.S. banks can that transition gain the ability to have their cards used with full EMV security anywhere in the world. Further, merchants benefit from this global interoperability as it allows them to process transactions coming into the U.S. from foreign travelers in the same way as domestic transactions.

Higher security – The latest data indicates that 78 percent of all counterfeit card fraud originates in areas where EMV has not yet been widely implemented, and even the most ardent detractors of EMV admit that EMV is very secure.

All stakeholders, gain a higher level of security than was available through magnetic-stripe technology.

Roadmap to mobile – POS terminals that support contactless EMV will in turn enable mobile EMV on NFC at merchants, meaning merchants can take advantages of all manner of popular payment methods, as well as the latest loyalty, location-based and couponing capabilities of mobile.

Posted in Credit card Processing, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: card, card fraud, card payment system, chip, contactless emv, counterfeit, couponing, EMV, interoperability, magnetic stripe, Merchant's, mobile, nfc, payment methods, POS terminals, secure, Security, technology, transactions, transition, travelers

January 13th, 2014 by Elma Jane

Australia & New Zealand Banking Group plans to use voice biometrics for authorizing large-value transfers to external bank accounts via its mobile banking service.

The Australian newspaper said ANZ is still piloting the voice biometrics feature, which would enable its mobile banking customers to make payments of more than A$1,000 ($910 U.S.)… The current limit for external transfers to clients of other banks using its smartphone app. Customers would authorize a higher-value payment by speaking into their smartphones, and ANZ’s IT system would compare their voices to digital voiceprints stored on its server.

The voice biometrics system will likely be launched within the next 12 to 18 months, Phil Chronican, the chief executive of ANZ’s Australia operation, said during a Sydney press conference last week.

Chronican added that ANZ also plans to use voice biometrics for authenticating transactions initiated at its call centers.

ANZ will launch the revamped mobile apps that it has been developing as part of the “Banking on Australia” initiative in the first quarter of 2014.

ANZ’s three-year old GoMoney mobile banking app and its more recent FastPay small business mobile payments service will both be re-released with new navigation and personalization options, iTNews said.

Posted in Credit card Processing, Credit Card Security, Mobile Payments, Smartphone Tagged with: authenticating, authorize, authorizing, biometrics, digital, mobile banking, Mobile Payments, mobile transactions, payments, personalization, smartphone app, transactions

January 6th, 2014 by Elma Jane

It can be difficult for travel agencies to choose a merchant services provider. The credit card processing industry generally categorizes travel agents as a high risk business type due to the fact that most travel agency transactions take place long before the actual product or service is delivered to the customer. This leaves travel merchants open to chargebacks and other payment disputes, which are costly procedures that deter many merchant services providers from offering travel merchant accounts.

National Transaction Corporation is one of the travel merchant account providers and credit card processors to provide high risk merchant services for travel agents. Most providers are geared toward e-commerce business types, although some offer options for traditional travel credit card processing. National Transaction Corporation (nationaltransaction.com) is a Coral Springs, FL-based, NTC’s member bank is US Bank Minneapolis, MN; that offers high risk travel agent merchant accounts. NTC’s credit card processing, no holds on funding, integration with Trams, Sabre, and ARC business solutions, and payment gateways for e-commerce travel merchants. National Transaction Corporation’s parent company Elavon, has a grade of “C” award. The Better Business Bureau (BBB) currently grants National Transaction Corporation an “A+” grade, citing only one complaint in the last three years.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Travel Agency Agents Tagged with: chargebacks, credit card processing, e-commerce, high risk, merchant services provider, no holds funding, payment disputes, payment gateways, provider's, transactions, travel agencies, travel agency, travel agents, travel merchant account, travel merchants

January 3rd, 2014 by Elma Jane

Results of a new survey on overall mobile use by consumers has several ramifications for payments using mobile devices. The report, from global management consultancy Deloitte, found the number of consumers who said their device is NFC-equipped more than doubled from 2012 to 2013. More importantly perhaps, for a technology many observers have pronounced dead and buried, of those whose devices are equipped with NFC technology, more than one-third said they have made a contactless payment using their phone in the past month.

The report also found that the number of app downloads decreased 13 percent this year in the U.S. and even more in other countries. Per-app spending also decreased during the year, but the report’s authors still believe the outlook for apps is positive.

The good news is, we see a lot of potential remaining in the apps market space over the long term. We believe that the overall declines indicated in this year’s survey may be due to increasing sophistication among consumers. It is likely that they have already obtained the core apps they prefer for work and play, with those choices persisting over time as they upgrade and change their devices said Craig Wigginton, vice chairman and U.S. telecommunications sector leader for Deloitte.

Posted in Credit card Processing, Electronic Payments, Environmentally Green, Mobile Payments, Near Field Communication, Smartphone Tagged with: apps, contactless, devices, equipped, mobile, nfc, outlook, payments, Per-app, phone, report, technology, upgrade