Category: Credit Card Reader Terminal

August 30th, 2024 by Admin

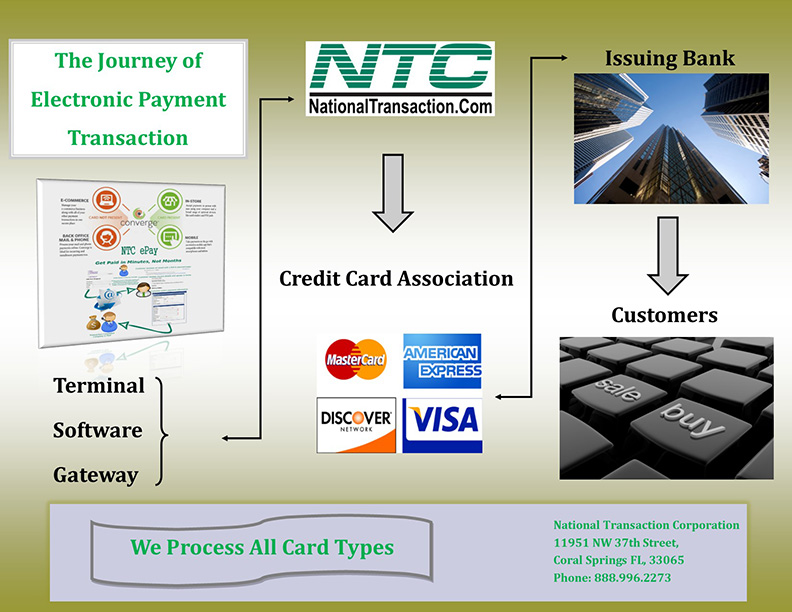

According to a poll by OnePoll on behalf of I Love Velvet titled “Consumer Mobile Point-of-Sale (MPOS) Attitudes Report” over half of retail customers think cash registers are outdated. The poll found that 51% of Americans think the cash register could soon be gone altogether as retailers opt for mobile point of sale systems. Consumers seem to favor MPOS systems allowing the shoppers to check out from anywhere in the store and that they return more often to stores with modern electronic payment technologies. Thirty five percent cited they would shop more often at stores with mobile point of sale payment systems. An additional 17% said they would share their shopping experience via social networking sites and 35% report they likely would tell a friend or recommend stores with these technologies. Forty six percent say that stores that have mobile payment systems seem to be more tech savvy and even more (56%) praise the store for making the experience more convenient and secure. Retailers are struggling to modernize their payment platforms to cut down long lines at registers, and place staff on the floor for better customer access. “It’s a great opportunity for retail store owners to dip into the mobile point of sale arena” said Richard Delos Santos of National Transaction Corporation.

Mobile point-of-sale equipment and software manufacturers are stepping up to the security plate as they seek to pass PCI DSS and other security related issues. As new mobile kiosks and point of sale hardware and software evolve so do the security challenges used to thwart credit card fraud and identity theft. The challenge for point of sale system providers is to create an increasingly secure and convenient way for customers to make electronic payments in-store or on their mobile devices. iPads, iPhones and Android tablets are often used by curious shoppers to compare and contrast features, prices and availability, why not let digital wallets be used to close the transaction? The use and connectivity of these new devices mean more complex security measures are needed to thwart attackers, crackers, and hackers.

In the coming years everything from NFC, to fingerprint readers in smartphones and tablets and even QR codes will change the landscape of mobile payment transaction processing and things are beginning to heat up. An estimated $17 Trillion of mobile transactions are predicted by 2020 and security and adoption will reign king on the streets. It might be time to look into the security and features that a mobile point-of-sale system can add over any existing point of sale systems and cash registers. Mobility is a great tool for a sales force, but security and convenience for the customer is a necessity that will only grow in the future.

If You need help setting up a merchant account, Call 888-996-2273 Today!

Posted in Credit Card Reader Terminal, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: Android, ipad, Iphone, mobile, MPOS, payments, point of sale, Processing, smartphone, tablet, transaction

Apple Pay is a revolutionary mobile payment and digital wallet service developed by Apple Inc., designed to provide users with a seamless, secure, and convenient way to make payments using their Apple devices. Launched in 2014, Apple Pay has rapidly gained popularity, transforming how people shop and transact in physical stores, within apps, and online. This comprehensive article delves into the intricacies of Apple Pay, its working mechanisms, benefits, security features, and its integration across the Apple ecosystem.

Understanding Apple Pay

Apple Pay allows users to store their credit, debit, and prepaid card information securely on their Apple devices. Instead of carrying physical debit and credit cards, users can simply use their iPhone, iPad, Apple Watch, or Mac to make payments at compatible point-of-sale terminals or within apps. The technology utilizes Near Field Communication (NFC) for contactless payments at physical stores, while in-app and online payments are facilitated through secure tokens and biometric authentication.

How Apple Pay Works

- Adding Cards: Users can easily add their card information to Apple Pay through the Wallet app by either manually entering the details or using the device’s camera to scan the card.

- Authentication: For security, Apple Pay requires users to authenticate their identity using Touch ID, Face ID, or a passcode before completing a transaction.

- Contactless Payments: At NFC-enabled terminals, users simply hold their device near the reader, and the transaction is processed instantly.

- In-App and Online Payments: When shopping within apps or on websites that support Apple Pay, users can choose Apple Pay as their payment method and authorize the transaction using biometrics or a passcode.

Benefits of Apple Pay

Apple Pay offers numerous advantages for both consumers and businesses:

- Convenience: Eliminates the need to carry physical cards, making payments quicker and easier.

- Security: Employs tokenization and biometric authentication, ensuring that card details are not shared with merchants, reducing the risk of fraud.

- Speed: Transactions are processed rapidly, improving the checkout experience.

- Acceptance: Widely accepted at millions of locations worldwide and in numerous apps and websites.

- Rewards: Users can still earn rewards and benefits associated with their credit cards when using Apple Pay.

Apple Pay and the Apple Ecosystem

Apple Pay seamlessly integrates across the Apple ecosystem, enhancing its usability and convenience:

- iPhone and iPad: Users can make payments at physical stores, within apps, and on websites.

- Apple Watch: Offers a convenient way to make payments on the go without having to take out a phone.

- Mac: Allows users to make secure online purchases in Safari.

- Business Integration: Apple Pay can be integrated into various business solutions, including point-of-sale systems and e-commerce platforms.

Security Measures

Apple Pay prioritizes security by implementing several layers of protection:

- Tokenization: Replaces actual card numbers with unique tokens, safeguarding sensitive card data.

- Biometric Authentication: Uses Touch ID or Face ID to verify the user’s identity.

- Device-Specific Cryptography: Encrypts payment information and securely stores it within the device’s Secure Element.

- No Data Storage: Apple does not store or share transaction details with merchants.

Apple Pay has revolutionized mobile payments, providing a convenient, secure, and efficient way to transact using Apple’s iOS devices. Its seamless integration across the Apple ecosystem and robust security measures have made it a popular choice for consumers and businesses alike. As technology continues to evolve, Apple Pay is expected to further expand its reach and capabilities, solidifying its position as a leading player in the mobile payment industry.

Posted in Credit Card Reader Terminal, Mobile Payments, Mobile Point of Sale, Smartphone

February 9th, 2022 by Admin

John Stewart

January 17, 2022

https://www.digitaltransactions.net/trends-like-open-banking-and-bnpl-will-sustain-e-commerces-hot-streak-a-report-says/

Open banking, single-click checkout wallets, and the hot buy now, pay later trend will all help drive e-commerce volume worldwide in the coming five years, predicts Juniper Research in a report released Monday. This momentum is likely to push online sales long after the short-term impetus from the pandemic subsides, Juniper says.

E-commerce volume totaled $4.9 trillion globally in 2021, a figure the United Kingdom-based research firm forecasts will reach $7.5 trillion in 2026, when China will control a 37% share. Wider availability of multiple e-commerce channels, including mobile devices, will propel the overall growth worldwide, Juniper says. But along with the boom in e-commerce will come a corresponding growth in fraud via identity theft, account takeovers, and fraudulent chargebacks, the report warns. China, for example, will account for more than 40% of fraud losses worldwide in 2025, at more than $12 billion, Juniper forecasts.

Open banking is a trend by which fintechs can verify balances in consumers’ accounts and transfer funds to pay for online purchases. As standards bodies work to promulgate standards for this business, e-commerce payment providers “should … partner with specialists in … specific emerging payment areas to keep pace with changing merchant expectations around acceptance types,” the research firm says in its release, referring to digital wallets and crypto as well as open banking.

Open banking has taken on a higher profile in the global payments market with efforts by both of the global card networks to acquire firms that specialize in this area. Visa Inc. has acquired Tink AB, while Mastercard Inc. bought Aiia and Finicity Corp.

Physical goods will continue to dominate e-commerce spending, the report says, accounting for 82% of payment value by 2026. To tap into the trend, Juniper advises, payments providers should support buy now, pay later plans, which allow consumers to split purchases into four equal installments paid over a six-week period at no interest. BNPL is becoming more controversial, however, as the Consumer Financial Protection Bureau has launched an investigation of the option and as reports emerge that consumers with multiple accounts are more likely to miss a payment.

While still a big trend, e-commerce sales in the U.S. market cooled significantly last year as the pandemic effect lost some of its force. Third-quarter sales in 2021 reached $214.6 billion, up 6.6% year-over-year, according to the Census Bureau, which tracks retail sales. That follows an 8.9% rise in the second quarter and three straight quarters with increases of 32% or more. Fourth-quarter 2021 results are not yet available.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Financial Services, Mail Order Telephone Order, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Point of Sale, Small Business Improvement, Smartphone, Uncategorized, Visa MasterCard American Express Tagged with: banking and e-commerce, e-commerce, e-commerce businesses, e-commerce merchants, e-commerce processor, e-commerce transactions, ecommerce, ecommerce merchant, ecommerce merchants, ecommerce sites, mobile commerce payment, mobile payment, Mobile Payments, mobile processing transactions, mobile transactions, mobile wallet, mobile wallet transactions, mobile wallets, mobile-commerce payments, online transactions, point-of-sale transactions, transaction processing, transactions, wallet

July 26th, 2017 by Elma Jane

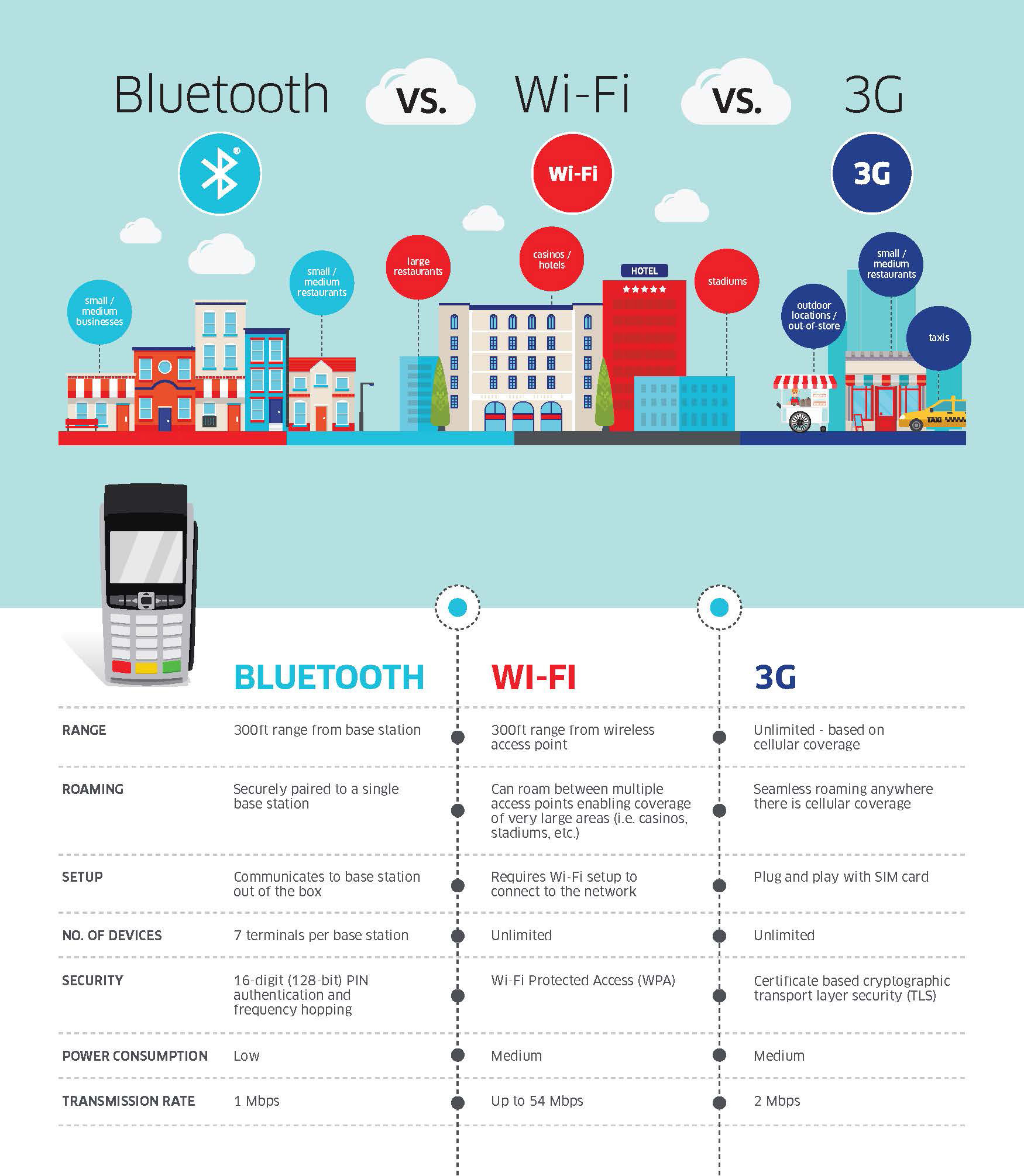

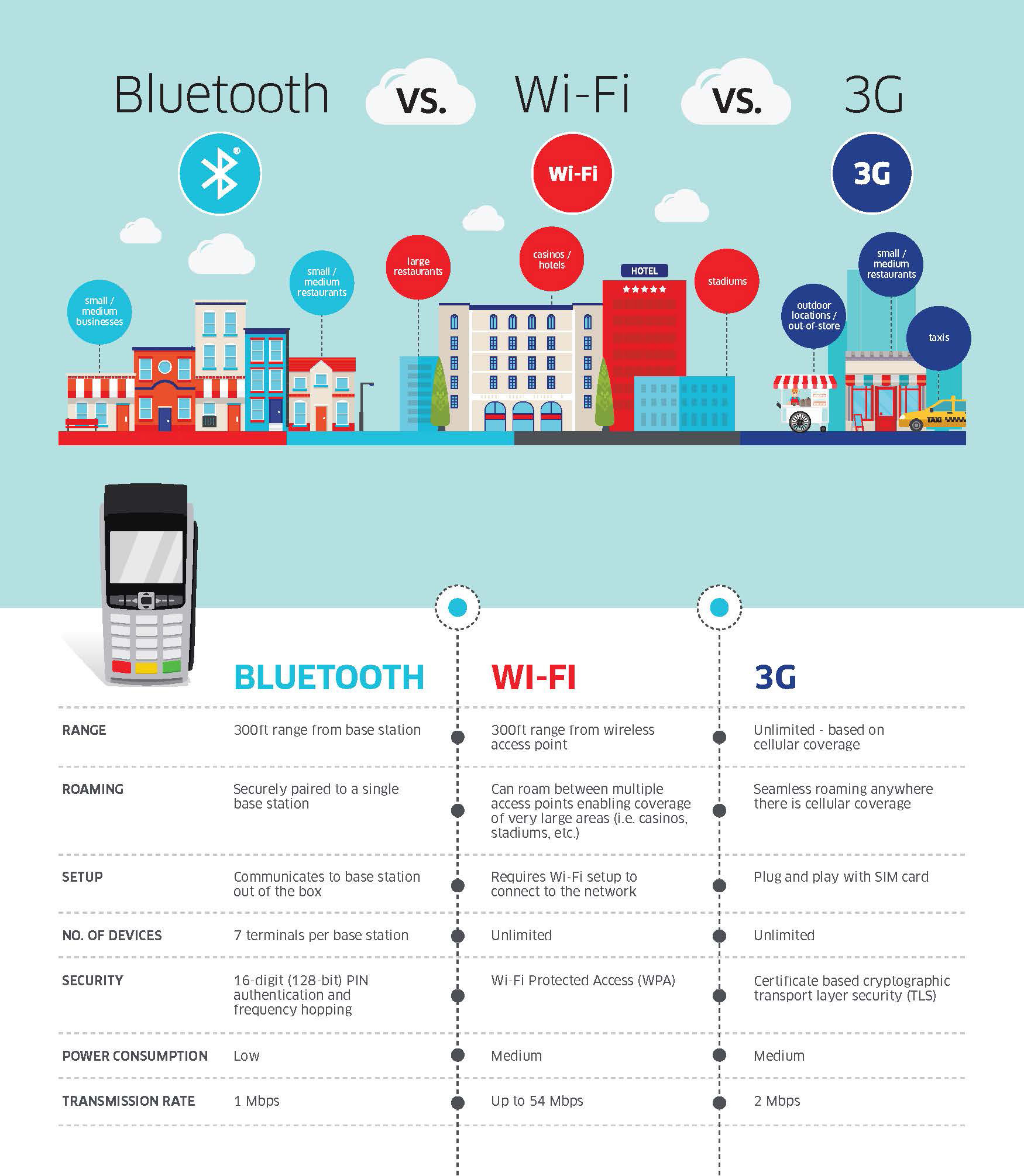

Check out the wide range of smart wireless terminal connectivity options and know the difference.

Bluetooth Wireless: Designed for reliable Bluetooth connectivity even in the most demanding environments.

Rage – 300ft from base station

Roaming – paired to single base station

Setup – Communicates to base station out of the box

No. Of Devices – 7 Terminals per base station

Security – 16-Digit (128-Bit) PIN authentication and frequency hopping

Accept EMV Chip & PIN, magstripe and NFC/Contactless

WiFi: Designed for reliable WiFi connectivity, Wireless mobility for the point of sale.

Rage – 300ft from base station

Roaming – can roam between multiple access points enabling coverage of very large areas.

Setup – Requires WiFi Setup to connect to the network

No. Of Devices – Unlimited

Security – WiFi Protected Access (WPA)

Accept EMV Chip & PIN, magstripe and NFC/Contactless

3G Wireless: Bring compact, reliable 3G Wireless Technology and mobility to the point of sale.

Rage – unlimited – based on cellular coverage

Roaming – Seamless roaming anywhere there is cellular coverage

Setup – Plug and play with SIM card

No. Of Devices – Unlimited

Security – Certificate based cryptographic transport layer security

Accept EMV Chip & PIN, magstripe and NFC/Contactless

Wireless terminals provide merchants with a number of benefits including:

Mobility – enable merchants to better serve the customer and bring the transaction right to the point of service.

Printed Receipt – give your servers the capability to print a receipt for the customer even when away from the POS.

Variety of Payment Options – provide the ability to accept magstripe, EMV, and NFC payments including the latest mobile wallets.

For Electronic Payment Set Up Call Now 888-996-2273

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: bluetooth, chip, Contacless, EMV, magstripe, nfc, PIN, Security

May 10th, 2017 by Elma Jane

Mobile Wallet Technology have flooded the market in the last few years with offerings such as Apple Pay, Android pay, Samsung Pay and more. And so far, they seem to be succeeding.

To understand how contactless payments work, here is an example.

A smart phone like Android or iPhone allows you to take advantage of mobile wallets like Android Pay, Apple Pay or Samsung Pay. You input your credit card information onto your phone, which stores it for later use.

If you’re shopping at a store that has mobile payment readers at the register, rather than reach for your wallet and get your credit card; you take out your phone to make a payment.

The point-of-sale (POS) terminal will automatically reads the payment information stored by holding your mobile phone a few inches away from the POS, and then processes the transaction. When the mobile device is in range, a wireless communication protocol links the terminal and the phone, which exchange information and conduct a secure transaction in a fraction of a second.

Near-field communication or NFC technology, works by bringing together two electronic devices. In terms of payments technology, a mobile device such as a smartphone and a reader. The reader would be the initiator and the smartphone would be the target, which contains the stored credit card information.

The market potential for NFC payment technology is huge, as more merchants adopt the EMV. EMV compliant terminals accept NFC payments through mobile wallets.

For Electronic Payment set up call now 888-996-2273!

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Mobile Payments, Near Field Communication, Smartphone Tagged with: contactless payments, credit card, electronic payment, merchants, mobile wallets, Near Field Communication, nfc, point of sale, POS, smart phone, terminal

February 13th, 2017 by Elma Jane

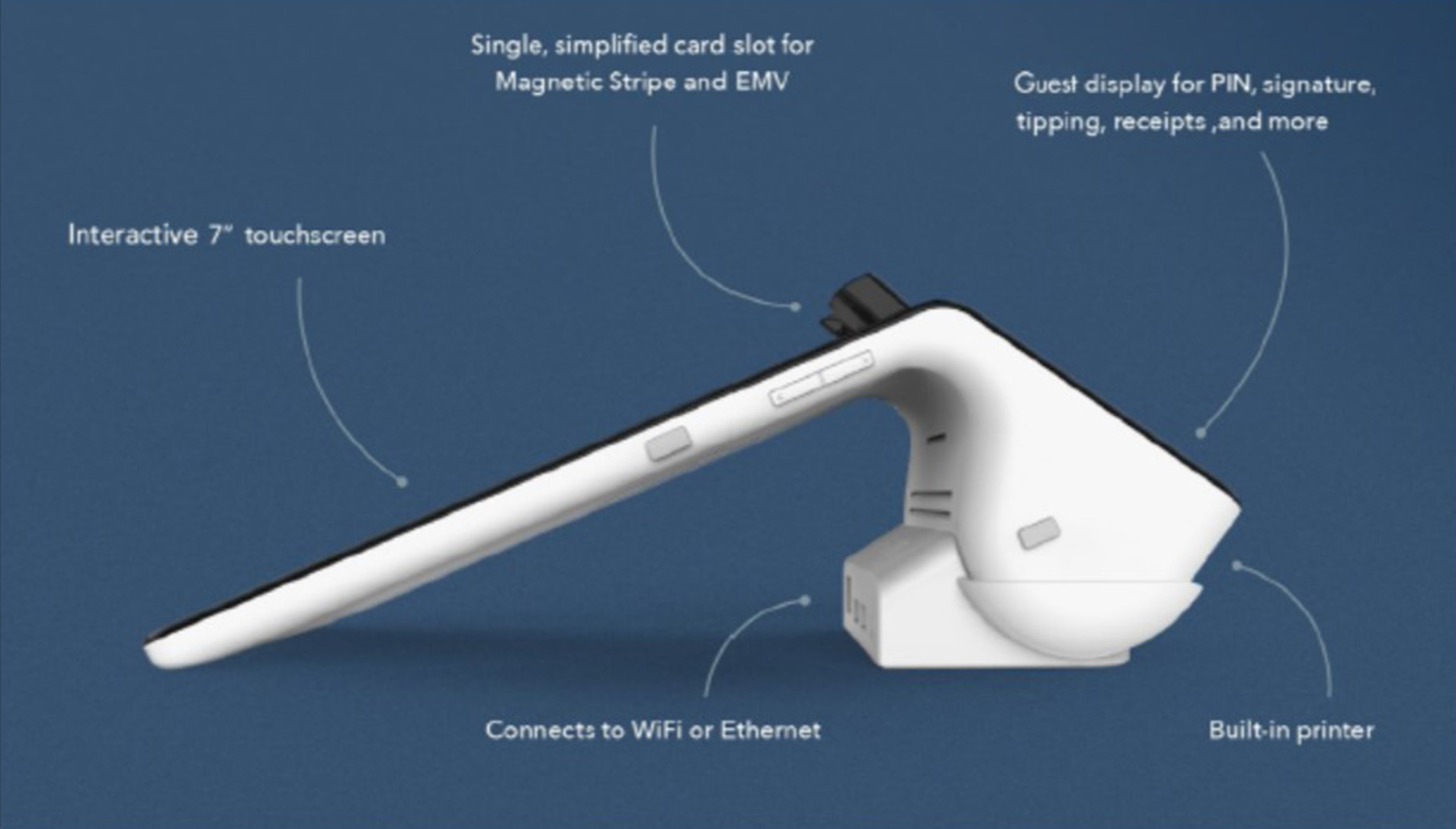

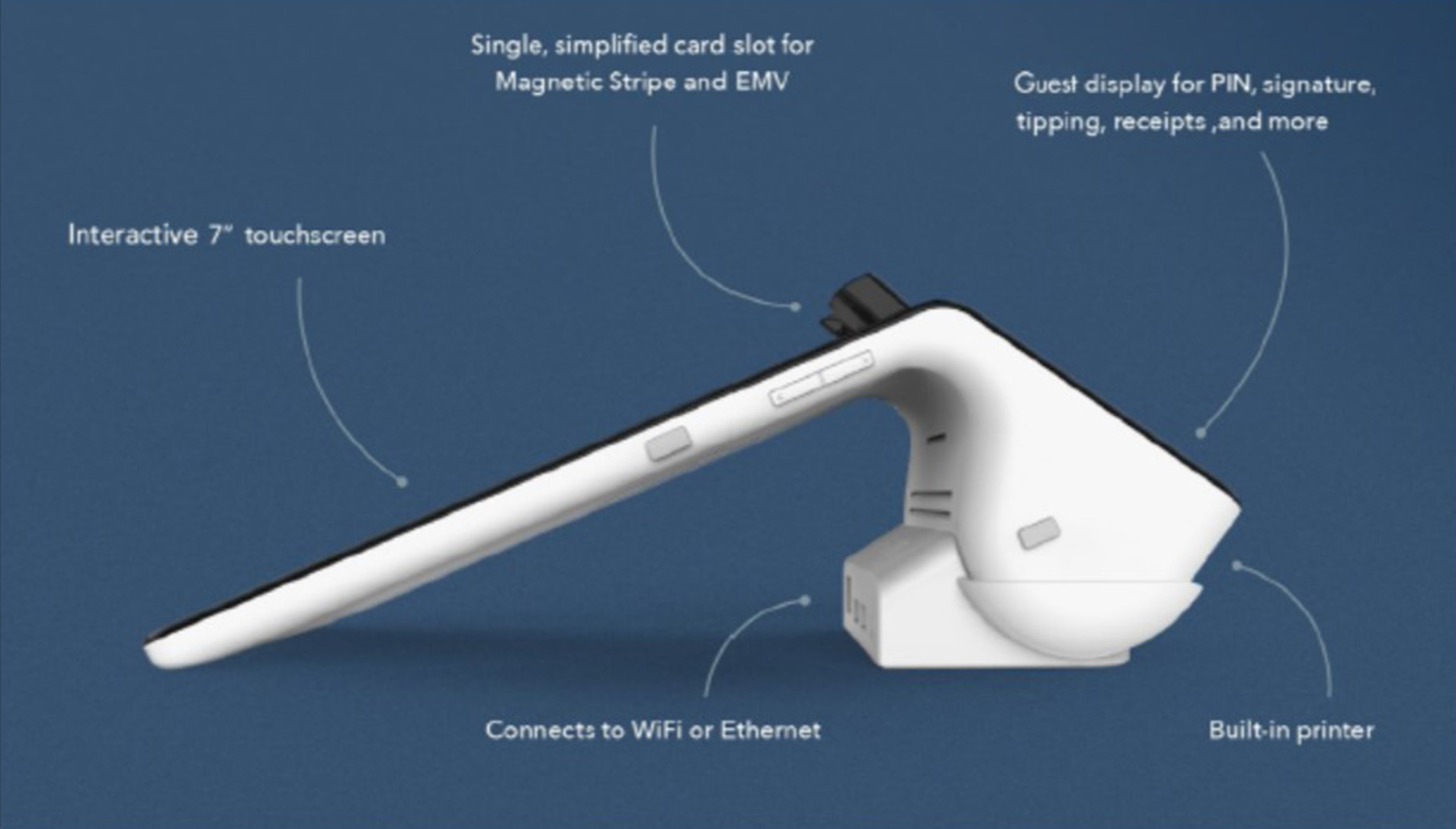

Smart Device for Lodging Transactions

Function meets form with this latest payment terminal.

Accepts All Payments – Magstripe, Chip (EMV) Cards, Mobile Payments like Apple Pay (NFC) and Manual Keyed.

An All-In-One Smart terminal – simplified, single card slot for Magnetic Stripe and EMV. Customer display for PIN, signature, tipping, receipts and more. Interactive 7″ touchscreen. Connects to Wifi or Ethernet. With built-in printer.

Security – PCI certified, End-to-End Encryption. Data is protected by the latest technology.

Supports Lodging Transactions – Check-In/Check-Out, Quick Stay, Incremental Authorization/Update. Sale, refunds, and voids.

Reporting (HQ) – a simple dashboard where you can monitor your sales, refund transactions, get business insights and alerts, and view settlements and transaction in real time. Accessible on the internet or from the HQ App on your Smartphone.

Robust Payment processing – access your funds within 24-48 hours, 24/7 customer service, convenient reporting, PCI program & data breach coverage.

For Electronic Payments call now 888-996-2273 or go to www.nationaltransaction.com and click get started.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Electronic Payments, EMV EuroPay MasterCard Visa, Near Field Communication, Payment Card Industry PCI Security Tagged with: data, EMV, mobile, payment, PCI, Security, terminal, transactions

January 12th, 2017 by Elma Jane

Accepting non-cash payments from your customers are valuable. If you don’t, you will miss out on sales; because of the growing numbers of customers who only carry plastic or wish to pay online. Today, you have many payment solution options.

Credit Card Terminals – you might remember the beginning of the credit card era and i’ts evolution with today’s countertop terminals. From the traditional swipe of their credit, debit or even gift card to make a purchase to today’s modern terminals. Like accepting EMV chip cards (to be in compliance with a PCI mandate) and NFC payments like Apple Pay.

Beyond the basics; these systems are generally supported by reporting sites that can help you monitor sales, and assist you with maintaining customer loyalty programs.

E-Commerce Solutions – online sales are growing every year. If you are considering an expansion of your business online; you need a complete hosted payment solution for transactions in all payment environments. Including in-store, back office mail/telephone order (MO/TO), mobile and e-commerce, that make your customers’ experience as intuitive and efficient as possible.

Point of Sale Systems – smart registers have evolved into high-tech point-of-sale (POS) systems due to technology advances. Not only taking customer payments; but it can transform your business with an advanced marketing programs, inventory management and sales and profitability tracking and reporting. Over the past years these advanced systems have become cost-effective and easy to use.

Wireless Terminals – in today’s hardware you have the option of accepting payments wirelessly, through a full-service terminal that is smaller than a countertop model, or through a mobile card reader plugin for a smartphone or tablet.

The advantage of a full-service wireless terminal is that it allows for receipt printing on the spot through the device and most modern full-service wireless terminals are EMV compliant and accept both EMV (chip card) and NFC payment types.

Call now 888-996-2273 and speak to our payment consultant to know which solution is best for you.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Near Field Communication, Payment Card Industry PCI Security, Point of Sale Tagged with: card reader, chip cards, credit card, debit, e-commerce, EMV, gift Card, mobile, moto, nfc, online, payment solution, payments, PCI, point of sale, smartphone, terminals, transactions

November 15th, 2016 by Elma Jane

SMART TERMINAL

Another all-in-one mobile (IP countertop and Wi-Fi capable) terminal that gives customers the functionality they want and need.

Sleek modern device that delivers an incredible customer experience, and is a great option for retailers, coffee shops, and pop-up shops.

Includes two touch screens: a larger one for easy visibility of orders and other information, as well as a cardholder facing one that can be used for payments and tipping. It also offers a dashboard function, so your customers can monitor their transactions and other reports remotely. On top of that, it comes with the powerful security of Safe-T built in.

For your EMV/NFC terminal needs give us a call at 888-996-2273.

Posted in Best Practices for Merchants, Credit Card Reader Terminal Tagged with: cardholder, customers, EMV/NFC, mobile, payments, Security, terminal, transactions

October 7th, 2016 by Elma Jane

NEXT DAY FUNDING

To be responsive to the needs of our merchants and to meet that needs, NTC offers next day funding in addition to the value added service for customers and businesses that need to have their funds available quickly.

National Transaction also offers a variety of electronic payment services and technology for businesses; with more than 15 years of experience.

Our services include:

- Currency Conversion

- Credit and debit card processing

- E-commerce and gateways

- Electronic checks

- Gift and loyalty card programs

- Mobile processing

- Cash advances and loans/funding program

- NTC e-Pay and MediPaid

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay!

Free Setup, nothing to Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. In addition, our e-Pay Platform can help Travel Merchants bring new customers while encouraging repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. Another payment platform that flexes with your business.

NTC Business Loans – Fast yet Affordable and most of all Simple Application Process.

MediPaid – another medical health insurance claims payment. Delivering paperless and next-day deposits for Health Insurance Payments.

Furthermore, NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants consequently providing 24/7 customer service and technical support!

To know more about our product and services call us now! 888-996-2273

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Internet Payment Gateway, Medical Healthcare, Mobile Payments Tagged with: credit, Currency Conversion, customers, debit card, e-commerce, E-Pay, electronic checks, electronic payment, funds, gateways, loans, Loyalty Card, merchants, payment services

September 19th, 2016 by Elma Jane

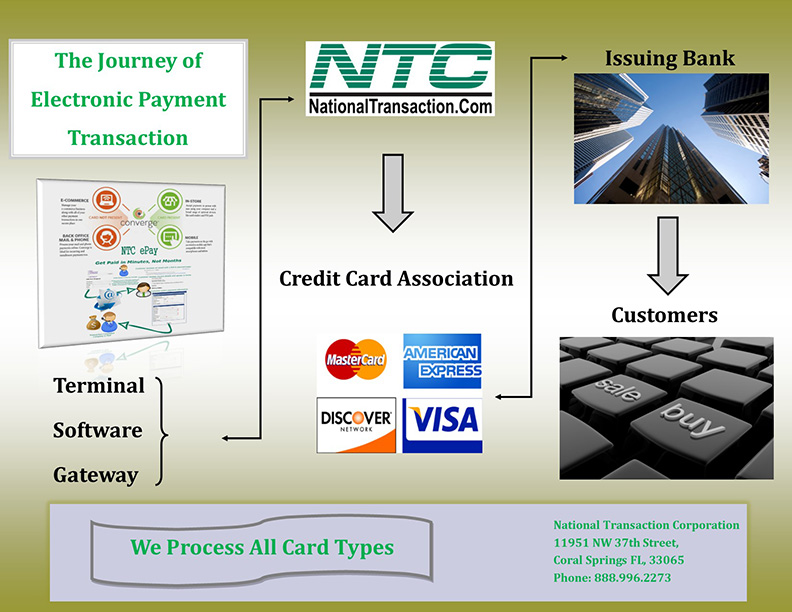

Terminal or credit card machines are used for processing debit and credit card transactions. Therefore, are often integrated into a Point of Sale System.

Electronic Authorizations – merchants had the choice of calling in for an authorization or imprinting their transactions, but many businesses opted voice authorization only on larger transactions because of the long waiting time for authorizing transaction over the phone.

Manual Imprinters – are considered a great backup processing method. Although time consuming and did not offer the speed or instant transfer capabilities, this imprinters are still widely used.

Point of Sale Terminals: POS emerged in 1979, which was a turning point in the credit card processing industry. As a result,

Visa introduced a bulky electronic data capturing terminal. The first of credit card machine or terminal as we know them today. It has greatly reduced the time required to process a credit card.

In the same year, MasterCharge became MasterCard and credit cards were replaced to include a magnetic information stripe which now has become EMV/chip and PIN.

The Future: There’s a lot of room for advancement when it comes to Credit card processing technology. Increasing processing speed, reliability and security are driving forces behind processing technology advancement.

Today’s credit card terminals are faster and more reliable with convenient new capabilities including contactless and Mobile NFC acceptance. The processing industry will definitely be adapting new technologies in the near future and has a lot to look forward to.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Near Field Communication, Visa MasterCard American Express Tagged with: chip, contactless, credit card, debit, EMV, mobile, nfc, PIN, point of sale, Security, terminal, transactions, visa