Category: Internet Payment Gateway

January 2nd, 2014 by Elma Jane

Online consumers generate an avalanche of data.Companies such as Amazon and Target have used Big Data for years. It’s the secret behind their highly personalized product recommendations and email promotions.

The good news is that smaller companies can use the power of Big Data in their businesses, too. But just because you can gather tons of data, doesn’t mean you should. For most small-to-midsize businesses, trying to harness Big Data can sometimes do more harm than good. It can slow down your website and cost time and money.

To make effective data-driven decisions in your business, control the types of information you collect. Focus only on the metrics that truly affect conversion rates and ignore the ones that don’t have much of an impact.

Tracking raw ad impressions regardless of whether they yield clicks or conversions is an example of monitoring low-impact data. The same thing goes for blindly monitoring Facebook Likes or Klout scores. Stop wasting resources on metrics like these. Devote your efforts on the data points that count.

Here are the most important ones for e-commerce merchants.

Number of Site Visitors and Where They’re Coming From

Online marketing is rarely cheap and quick. You have to determine the best strategies to spend resources on. There are several free and easy-to-use tools that can provide this information.

Google Analytics is an excellent tool that gives you insights on your traffic and traffic sources. To go deeper, such as which specific newsletter or which Facebook update sent visitors to your site, you can create Custom Campaigns and add special URL tags for each campaign. This lets you drill down on the specific source for your referral traffic.

Also, set up your online campaigns to make it easy to monitor. For example, having a different landing page for each guest post will allow you to quickly see which ones are sending traffic. Or, for social media, you can publish updates using a simple tool like Buffer so you monitor clicks each from each post.

Sales and Beyond

Tracking your sales is key. Aside from looking at your basic sales numbers, compute your average order value and compare it with your marketing and advertising budget. Viewing how much you’re spending on each customer versus how much they’re spending on you will help create the right budget for customer acquisition and retention.

Beyond gross sales, monitor item returns to obtain the net sales volume. Determine also the reasons behind refunds and exchanges to improve your merchandise.

Also, track sales from promotional offers, to know what promos or discounts to provide in the future. If, for example, you used a loss leader to attract customers into your store, closely monitor overall sales based on that offer to see if it generated profits.

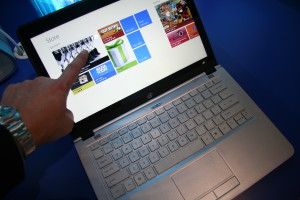

Knowing this sales data will enable you to send out tailored promotions to users. And if you can combine those insights with other data such as the time they usually buy from you or what device they use you’ll be able to optimize your campaigns for maximum conversions.

What Visitors Are Doing on your Site

Tracking the pages that users viewed, the actions they took, and their exit points can give you tremendous insights about your site and your visitors. Analyzing these things will tell you which aspects of your site need improvement.

For example, say you discovered that while shoppers are clicking the “add to cart” button, most leave before they provide their credit card details. This could mean that there’s something wrong with your checkout page. Perhaps it’s confusing or you need a stronger guarantee. Regardless, you won’t be able to identify the problem if you don’t track what’s going on.

How you track user behavior will depend on what you want to measure. If you want to track your exit traffic, for example, to add outbound link-tracker code to your website. For WordPress sites, this can easily be done using the Ultimate Google Analytics plugin.

On the other hand, if you want to track how users react to specific site elements such as buttons, text size, forms, and other key elements use heat maps that give you a visual representation of user behavior. Crazy Egg offers a solution for this. It enables you to see how people are behaving on each page.

Posted in e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway Tagged with: acquisition, Amazon, analytics, big data, campaigns, conversion, credit-card, data, data-driven, e-commerce, email, exchanges, Facebook, google, insights, online, personalized, refunds, resources, sales, target, wordpress

December 19th, 2013 by Elma Jane

10 Great Ecommerce & Mcommerce Ideas

Address Commonly-asked Questions

Instead of hiding commonly asked questions on an FAQ page somewhere on your site, display these answers in plain sight. Include your service agreement on every page, and provide frequent updates on orders in the mail, because one of the quickest ways to lose shoppers and sales is to make it difficult for them to do business with you.

Connect with Pinterest Influencers

Connect with the Pinterest influencers…accounts or boards with large followings…that relate to your product category. Ask for a pin here and there for a product you believe they would like. You’ll get large amounts of traffic, sales, and repins from their large followings. This method is repeatable and much quicker and cheaper than building a large following yourself.

Don’t Forget Comparison Shopping Engines

You’ve got a great ecommerce website. But is it hard to get traffic? Comparison shopping engines (CSEs)…like Google Shopping, Shopzilla, NexTag, Pronto, and Bing…deliver millions of shoppers to product pages every day. You list your items on the CSEs where purchase-ready shoppers will see them and click through to your site to complete the transaction. CSEs typically have a pay-per-click pricing model, and many merchants find it’s worth the cost.

Emphasize Product Photography

Whether you use high-quality renderings or actual product photography, make sure you take the time to present your products in the best possible manner. With the proliferation of product and photo sharing sites like Pinterest, The Fancy, Instagram, and OpenSky, having a beautiful product shot is imperative. Lifestyle shots of your product in use could also significantly increase conversion rates.

Make Research Easy for Prospective Buyers

Research (for buying decisions) is a massive resource cost to businesses around the world. It is also a primary reason for lost deals. Were you to provide comprehensive information that was easy to find and on which a buying decision can be made, then your close rate would substantially improve. Add to this, an easy purchasing process and, rather than scouring the web, a buyer would see your site as a preferred source.

Mimic the Brick-and-mortar Experience

Regardless of what channel they may be using to shop, online consumers are demanding the quality of the brick-and-mortar experience. They want to zoom in on a product, rotate it, change its colors…in short, they want to interact with the item as though they were physically in the same room with it. Retailers with rich interactive media that can offer this in omnichannel have a significant competitive advantage during the holiday season and can convert at rates of 30 percent higher than those that don’t.

Offer Support via Social Media

Nielson research discovered that in 2012 one-third of social media users prefer to contact a company via social media than by phone. On your support pages, provide links to your social media profiles. Set up notifications in the social media accounts so you know when someone contacts you. This way you provide timely customer support to those who want it…in the way they want it.

Stay Ahead of the Curve

“It doesn’t take a lot of time for cutting-edge to become old hat. Keep researching to be aware of the latest tools and technology. If you stay still, you will find that your competitors will quickly surpass you.

Take the ‘E’ out of ‘Ecommerce’

Retailers need to realize that the lines of commerce have been, as John Donahoe, CEO of eBay, said, obliterated. It’s no longer a world of online and offline commerce. It’s just commerce. Retailers are competing on a global scale with everyone, everywhere. You need to give shoppers a compelling reason to buy from you. Find a way to differentiate and make sure you can grab shoppers attention and keep them coming back.

Think Like a Shopper

Keep your site’s design simple and clean, make calls-to-action clear, and focus on the product. Go through the flows of your site: search, browse, and buy a product, or have a friend do it and watch him without helping. Pay attention to areas where anything is confusing, doesn’t work the way it should, or takes too many steps. Then make adjustments.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments Tagged with: brick and mortar, buying, channel, consumers, conversion, convert, customer support, e-commerce, ecommerce, interactive, m-commerce, mcommerce, media, omnichannel, online, orders, photo, product, profile, purchasing, retailers, sales, shopping, site, social media, transaction

December 19th, 2013 by Elma Jane

NTC’s BIG DATA

Improving Collection and Analytics tools to Create Value from Relevant Data.

Big data is a popular term used to describe the exponential growth and availability of data, both structured and unstructured. And big data may be as important to business…and society… as the Internet has become. Why? More data may lead to more accurate analyses. More accurate analyses may lead to more confident decision making, and better decisions can mean greater operational efficiencies, cost reductions and reduced risk.

With NTC Virtual Merchant product, it captures email addresses at the Point-of-Sale (POS) into a database to assist merchants and consumer stay connected, and for future Marketing.

In understanding Big Data For Merchants, NTC’s President Mark Fravel, provided a general overview of how online merchants can use Big Data. Large amounts of seemingly random data from many sources…can be used to create competitive advantages.

Necessity of Analytical Tools

Collecting Big Data is the easy part. Storing, organizing, and analyzing it is much more complex. One seam of data that several experts identify as a particularly rich, emerging source of information can be as diverse as CRM software, AdWords, and your own website. Mobile communications, including text messages and social media posts such as Facebook and Twitter. Making sense of it can be overwhelming without analytical tools. These tools facilitate the examination of large amounts of different types of data to reveal hidden patterns and correlations that are not otherwise easily discernible.

A good example is NTC, they could analyze data on visitor browsing patterns, login counts, phone calls, and responses to promotions…they can monitor to eliminate what isn’t working and focus on what does. Some of the off-the-shelf analytic solutions are so finely tuned, they can tell a vendor whether it needs to offer a 25 percent discount or if a 15 percent discount will suffice for a particular customer.

Association rule learning is another analytics method that is a good fit with Big Data. This could be, for example, a shopping cart analysis, in which a merchant can determine which products are frequently bought together and use this information for marketing purposes.

Uses of Big Data Analytics:

Big Data can be most useful in analyzing a customer’s shopping and purchasing experience, which can help a merchant in the following four ways.

Become more efficient by alerting you to merchandising efforts that are ineffective, and products that are not selling.

Encourage more purchases by presenting existing customers with complementary items to what they’ve purchased previously.

Enhance inventory management by eliminating slow-moving items and increasing the supply of fast-moving merchandise.

Example: A top marketing executive at a sizable U.S. retailer recently found herself perplexed by the sales reports she was getting. A major competitor was steadily gaining market share across a range of profitable segments. Despite a counterpunch that combined online promotions with merchandising improvements, her company kept losing ground….The competitor had made massive investments in its ability to collect, integrate, and analyze data from each store and every sales unit and had used this ability to run myriad real-world experiments. At the same time, it had linked this information to suppliers’ databases, making it possible to adjust prices in real time, to reorder hot-selling items automatically, and to shift items from store to store easily. By constantly testing, bundling, synthesizing, and making information instantly available across the organization…the rival company had become a different, far nimbler type of business.

Increase conversion rates by better identification of successful sales transactions.

Is Big Data Analysis Affordable?

NTC Data Storage is also a good alternative for small ecommerce merchants because it is relatively inexpensive and is scalable it can expand as data requirements grow.

Relying on data-driven decision-making is crucial in industries in which profit margins are slim. Amazon, which earns increasingly thin profit margins, is one of the most effective users of data analytics. As more Big Data solutions for small online businesses come to market and more online merchants incorporate Big Data into their business tool set, employing Big Data will become a necessity for all Merchants.

Using data wisely has the potential to boost margins and increase conversions for online merchants, and investors are banking on it.

This is Big Data for NTC we know WHO, WHAT,WHEN, AND WHERE a purchase took place.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Point of Sale, Visa MasterCard American Express Tagged with: analyses, analytic, big data, communications, competitive, consumer, cost, database, decision, ecommerce, email, internet, marketing, Merchant's, mobile, monitor, ntc, online, orgainizing, patterns, point of sale, POS, profit margins, promotions, risk, scalable, solutions, storing, text messages, virtual merchant, website

December 12th, 2013 by Elma Jane

Virtual Merchant Processing Gateway

Virtual Merchant

A virtual merchant is a website that sells goods and services to the public via online transactions with debit and credit card processing. The end result is a fully online experience where consumers can virtually visit a store to browse goods, purchase them fully online and receive them in the mail several days later, all from the comfort of your personal computer.

Virtual Merchant Element

Virtual merchants are made up of multiple features that basically make a website into an online store. Online stores provide e-commerce capabilities in the form of processing payments for orders and then shipping the goods or services either digitally or physically. Some brick and mortar companies may create a Web presence that only describes the store or displays the goods it sells, but they may not sell anything online.

Virtual merchants are a different breed from simple informational websites, utilizing a merchant account to create a secure online storefront. Merchant accounts create a contract between the store and online credit card processing companies. As part of this merchant account agreement, the virtual merchant pays the processor vendor a percentage of each transaction made via the online store. In some cases, this fee comes out to a monthly rate with a set per-transaction fee.

Virtual Merchant Services

Many virtual merchant services exist that cater to both online and offline business presences, though many that specialize in online retail offer more features and functionalities. These service providers offer virtual terminals to create a fully-functional payment gateway for processing purchases and creating a fluid shopping experience. Companies like National Transaction Corporation stand out as among the most popular of options due to their low merchant account fees and comprehensive virtual merchant services.

Benefits of Virtual Merchant

Virtual merchants expand the functionality of a website beyond a simple informational resource into a usable storefront. As is the case with most any type of online service, a virtual merchant service will help reduce overall work and costs associated with creating an online storefront, freeing you up to run your business as it was meant to be.

Using virtual merchant services for your website can benefit business in the following ways:

1. Easily integrates with your existing website for brand continuity

2. Facilitates more positive sales experiences

3. Improves customer service levels

4. Reduces administration and maintenance times for online retail websites

5. Removes geographic barrier from consumers, allowing for national and international sales

Secure information

Making each transaction as secure as possible becomes a main selling point of any company trying to build credibility through a Web presence. Virtual merchant services become an ideal solution as they offer all the necessary security measures to protect and keep private each buyer’s payment information.

The end result becomes that the payment process is protected through secured-socket layering (SSL) encryption to prevent data interception during an order, and account information is stored in multi-tiered firewall protection.

Straightforward online ordering

The most important part of any online purchasing experience is the ease of the ordering process. Through the use of features like a shopping cart, purchasing all items in the cart and creating an account to remember purchasing information all contributes to customer retention. When a consumer chooses to buy their goods online, a typical order processing form will entail entering credit card and billing address information as well as a shipping address and shipping options.

Each of these functionalities is ultimately governed through virtual merchant software to ensure a seamless and painless experience. The software is often available in one of two formats, either hosted or in-house. As a hosted solution, the virtual merchant service maintains the payment portal and allows you to edit its look and essentially create your store on their servers and databases. As an in-house solution, you install the software onto your own website servers and integrate the merchant application into the existing website. Both offer inherent benefits from customization to reliable management, but it ultimately depends on a company’s overall needs.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Point of Sale Tagged with: credit card processing, debit and credit card processing, digitally, e-commerce, hosted, low merchant account fees, merchant account, online retail websites, online transactions, payment gateway, payment process, per-transaction, processing payments, processing purchases, processor, secure, store, storefront, transaction, virtual merchant, virtual terminals, virtually, website

December 3rd, 2013 by Elma Jane

De-clutter

A messy workplace is annoying, distracting, and can get out of hand. Keep clutter at bay by regularly tidying up.

Clutter can also exist inside the mind. Having piles of paper on your desk can keep you from finding a pen, having too many thoughts can curb your focus.

Fix this by de-cluttering your mind. Use a mind-mapping tool to organize all the ideas, tasks, or worries in your head.

Eat your Frog Early

When you arrive in the office every morning, do you dive right into your biggest task or do you get the minor stuff out of the way first? Author and personal development coach Brian Tracy says that the former is more effective in terms of productivity.

In his book Eat That Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less Time, Tracy cited a famous Mark Twain quote, “Eat a live frog first thing in the morning and nothing worse will happen to you the rest of the day.”

He used frog eating as a metaphor for task completion, in which the frog “is your biggest, most important task, the one you are most likely to procrastinate on if you don’t do something about it.” Finish that task as early as possible, and you can spend the rest of the day knowing that you’ve accomplished a big goal.

Resist the urge to complete smaller jobs first. Doing so will only feed your procrastination and won’t take you any further towards completing your big tasks.

When deciding on what to prioritize in your business, always put your highest-impact goals at the top of your to-do list. What step can you take today that will have the biggest effect on your company? Start with that, and either delegate or hold-off on the low-level tasks. This tough to do.

Follow the 80-20 Rule

The 80-20 rule, developed by Italian economist Vilfredo Pareto states that for many situations, about 80 percent of the effects or outcomes come from just 20 percent of the causes.

In business, the 80-20 rule comes into play when 80 percent of a company’s clients are generated from 20 percent of its sales staff, or when 80 percent of returns come from 20 percent of its customers.

Determine how the 80-20 principle applies to your business, then address that 20 percent so you can generate more results, or eliminate problems.

For instance, if you discover that 80 percent of your profits come from 20 percent of your customers, then nurture your relationships with those customers and reward them for their loyalty. Or perhaps you notice that 20 percent of your online marketing efforts are bringing in 80 percent of your site traffic. Stop spending resources on the low-performing strategies, and focus your efforts on the channels that work.

Have a Meeting Policy

If you must hold meetings in your company, keep them brief. Always have an agenda and a clear purpose for the meeting.

You may also want to consider having company-wide policies that tell people when and how to set-up meetings. Some companies for example, always hold meetings on the same day and time each week…e.g., Monday mornings, Thursday afternoons. This schedule enables people to plan their days and weeks more effectively.

Optimize your Relationships with Vendors

You optimize your site for speed and user-friendliness. Why not do the same for your suppliers and service providers?

Check with your vendors to ensure you’re working efficiently. Ask if there’s anything you can do to make their jobs easier, or recommend any improvements that they can implement. Don’t view your relationship as a service provider and client. Instead, treat your vendors as your partners.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Environmentally Green, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale Tagged with: agenda, business, ecommerce, loyalty, marketing, mind-mapping, online, optimize, organize, policies, prioritize, procrastinate, procrastinating, procrastination, spending, strategies, suppliers, task

October 25th, 2013 by Elma Jane

Some brands have managed to pull themselves together to mobilize their online sites…that’s design them to be visually friendly to mobile users.

Earlier this month the quick-service restaurant debuted a new item on its menu…the Smoke Brisket Sandwich…with a campaign that involved a number of social media components. Included among those were a game that awards points based on a customer’s tweets, the online challenges he or she wins and the photos uploaded to Instagram.

It starts with a purchase of the sandwich at an Arby’s outlet. When the customers receives her receipt she takes a picture of it and uploads it to mobile site PunchTab created for the campaign.

What sets this campaign apart from many others is that it is coordinated at the point of sale.

For this campaign, PunchTab created mobile Web onto which Arby’s customers upload a receipt. When users make a purchase, they can take a picture of their receipt and submit it via the mobile website. From there, points are dispersed, the players advance…and hopefully, return to Arby’s for more purchases, err, points.

Helping Business

There’s definitely been a trend in the POS and payments industry to add value offerings by helping businesses better understand their customers. This trend is built on the wealth of transactional data being collected by POS and payments companies, and the goal is to present simplified consumer behavior analyses that can be used by merchants to generate more revenue.

Looking ahead, more and more retailers will understand the value that capturing this customer data can unlock for this business, and will put the software in place to tap into a customer’s purchase history and thus their preferences.

Now the focus is on salespeople delivering a personalized experience to customers. The next stage, will focus on extending to individual customers the inside track on new products that will appeal to them and complement or replace things they have previously purchased.

Pimping Out The POS

Engaging with the customer at the point of sale is hardly a new idea. It certainly is an established practice in traditional brick and mortar operations…think credit card solicitations and offers for loyalty points and cards…as we all as e-commerce sites, where a customer is usually presented with several offers before the checkout is complete.

Now CRM is making its way into the mobile POS and customers are finding that there are a number of unique benefits to the model.

In the case of PunchTab, it ties the receipt-scanning functionality that doesn’t require an app…not to mention several other benefits to the system.

For example, Marketers get greater insight into purchasing behavior because a receipt is usually involved. Consumers are right there and thinking about the campaign…which they wouldn’t necessarily be when they got home to go online, and it is relatively easy system to set up.

Arby’s for example, has 40 POS systems and because it is a franchise, it requires coordinating with multiple owners. For them, mobile is the best and easiest way to engage with customers at the point of sale.

Real-Time Offers

Other companies…such as Groupon with its Breadcrumb mobile app…are adding even more advanced CRM capabilities, such as reporting at the mobile point of sale.

It is a growing trend for all mobile applications and most especially apps in the mobile POS to bring more CRM capabilities into their service platform.

Eventually, some of these CRM-infused mobile POS systems will be able to make offers in real time to customers based on their purchase at the moment and accumulated knowledge about the preferences of other customers that make similar purchases. Example it might be noted that in 20 percent of all purchases of a particular type of coffee the customer also purchase a biscotti, then the server can offer up the option as a reminder for purchase/order.

The example assumes the mobile POS system has access to customer data about purchase and preferences…which is somewhat rare now, but a trend gaining momentum.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: app, awards, brick and mortar, crm, customers, data, design, franchise, functionality, mobile, mobile pos, mobilize, online, payments, payments industry, point of sale, points, POS, purchase/order, purchases, receipt, receipt-scanning, restaurant, retailers, revenue, social media, transactional, uploaded, users, web, website

October 24th, 2013 by Elma Jane

Reflecting recent research that concludes mobile payment adoption remains low, Total System Services Inc. (TSYS) issued results from a survey that confirm consumers prefer banking applications other than payments for their mobile devices.

While reinforcing the dominance of debit and credit cards as payment mechanisms, the TSYS 2013 Consumer Payment Choice Study revealed that mobile devices are used as a tool for ancillary financial services, such as checking account balances and accessing discounts and rewards.

“For now, the hype largely remains hope for mobile from a payments standpoint,” the survey said. “On a relative basis, consumers would overwhelmingly prefer to have the ability to use their smartphone to monitor transaction activity or prevent fraud versus using their mobile phone as a form factor in a transaction.”

Columbus, Georgia-based processor TSYS found in its third annual survey that, out of 1,000 consumers surveyed online in the summer of 2013, 40 percent of respondents were interested in using mobile devices to instantly stop illegitimate transactions. Additionally, 37 percent indicated that the ability to view in real-time the transactions made with debit and credit cards was also an important feature.

Receiving instant offers and promotions from stores being visited (33 percent); temporarily blocking and unblocking purchases using certain bankcards (29 percent); and paying for purchases using reward/loyalty points (28 percent) rounded out the top payment-related uses for smartphones.

At the bottom of the scale was to pay for purchases with mobile wallets (25 percent) and to use credit or debit card-funded prepaid accounts for the same purpose (22 percent). “Industry observers regard mobile payments as an assumed eventuality,” TSYS stated. “Our survey results indicate that consumers are presently more interested in increased non-payment functionality on their mobile device.”

But the processor remains optimistic about the promise of mobile payments. “We believe that as the infrastructure matures and the ability to use mobile payments becomes more widespread, this trend will change,” TSYS said.

Prepaid undermarketed?

In addressing the role of prepaid cards in the payment mix, TSYS expressed surprise that prepaid cards are apparently not being marketed aggressively by financial institutions. The processor noted that major banks jumped into the prepaid card industry in 2012 to offer general-purpose reloadable (GPR) prepaid cards as checking account alternatives.

But TSYS found that just over 10 percent of survey respondents indicated they had received GPR card offers from their banks. TSYS attributed that low percentage to the fact that the survey respondents were by default credit and debit card users, while GPR cards are primarily targeted to individuals without access to credit or debit cards.

Regardless, survey respondents aged 35 and younger accounted for 64 percent of those who had received such offers. “It could be that the younger demographic on average represents a less profitable checking relationship for banks, or that banks perceive them to be more receptive to the offering,” TSYS said.

Steady goes debit and credit

Consumer payment preferences in 2013 remain relatively unchanged from previous years, according to TSYS. Debit still trumps credit as the preferred payment instrument overall, with both methods being favored by every eight of 10 survey respondents. Debit is still the clear winner when it comes to supermarket shopping and gas purchasing, while credit is preferred when dining out and shopping in department stores. But when it comes to fast food cravings, cash is still king.

On the opposite end of the spectrum, and also consistent with TSYS’ 2012 report, only 11 percent of respondents said being able to set up text message alerts for account balances and transactions was most valuable, and a mere 6 percent valued the ability to register payment cards in mobile wallets.

However, credit tops debit for online purchases, TSYS said. Further of note is that PayPal Inc.’s digital wallet service rivals debit online, with both payment methods favored by roughly one-fifth of respondents. But for small-dollar purchases, like coffee and donuts, cash remains the preferred payment vehicle, despite innovative mobile schemes offered by companies like Starbucks and Dunkin’ Donuts.

Posted in Credit card Processing, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Gift & Loyalty Card Processing, Internet Payment Gateway, Mail Order Telephone Order, Merchant Services Account, Mobile Payments, Smartphone Tagged with: account, adoption, applications, banking, checking, consumers, credit cards, debit, devices, discounts, financial services, form factor, general-purpose, gpr, infrastructure, low percentage, mechanisms, mobile, mobile wallets, non-payment, offers, online, payment, payment related, phone, prepaid, processor, profitable, promotions, real-time, reloadable, reward/loyalty, rewards, smartphone, transaction, tsys

October 24th, 2013 by Elma Jane

You will be happy to learn that these days there is less hassle when setting up credit card payments online. In the past, companies were required to open a merchant account through a bank in order to be able to accept credit cards. Today, several services enable you to accept credit cards online without opening your own merchant account.

With more than 50 million users worldwide, Paypal is probably the most widely used such service. The company’s Payflow service is a turn-key solution with several added advantages such as recurring billing and fraud protection.

If you still want to take actual credit card payments online, a merchant account service is your best option. To open an Internet merchant account, you must fill in a merchant application and provide support documents. First, you must supply proof that you established a checking account for your Internet business.

If you have sole proprietorship or a micro business, you can open either a personal checking account or business checking account. If you opt for a personal checking account, the account must be in the name of the sole proprietor. If your internet business is a corporation, you must set up a corporate checking account.

This account will be used to deposit sales generated through your internet merchant account, but also to withdraw fees such as online payment gateway fees.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Visa MasterCard American Express Tagged with: accept, application, checking account, companies, credit-card, deposit, fraud protection, internet business, merchant account, merchant account service, micro business, online, payment gateway fees, payments, PayPal, recurring billing, sales, support, turn-key, worldwide

October 22nd, 2013 by Elma Jane

The best place to start understanding your customer is to put yourself into every step of a buying cycle and analyze what influences various purchase decisions.

Who is your customer?

Basic demographics and usually includes the following:

Age range Education level Gender Income level Location Marital status Profession

Many of these basic demographics can be inferred from your interactions with customers. In many cases, you can simply ask them.

Beyond the basics, you will also benefit from more personal data, such as the following:

Interests Activities Political affiliation

That data is harder to access, but there are databases that will allow you to target individuals based on those criteria. Facebook’s ad platform provides an incredible amount of targeting data. You can infer your customer profiles by the types of results you get by running ads aimed at specific target markets. That will help identify the interests of your customers.

What? consider what consumers need to know about a product to make a purchase.

Are there ongoing costs? Does it need anything else to make it work? How big is it? How does it function? How long will it last? How much does it cost? Is there a warranty? What are its specs? What does it look like? What options are there? What sizes and colors are available?

To find those details, shoppers will seek different sources: articles, websites, blogs, and actually looking at products and trying them on. Make sure you understand the “what” questions for your products. Then, provide answers to those questions.

Why? The “why” questions are important. Do you know why your customers buy your products?

It could be for the following reasons.

Address an immediate need or desire. Loyal to a particular brand or store. Need flexibility to return products. Need product occasionally or on a regular schedule. Purchase because product is cool or trendy. Seek bargains. Seek high-quality products Seek little or no shipping or sales tax. Seek the lowest price possible. Shop around every time they buy.

Answers will surely vary. Consider also, what motivates your customers to purchase the products you sell and also why they purchase them from your company versus your competitor. This will help you better refine your value proposition of why shoppers choose your company.

How? This area is the most significant change in a consumer’s shopping cycle. As recently as 15 years ago, most product research was done in stores or catalogs or magazines. Today, product research is done in many ways. In the living room, in the boardroom, at the hospital, you name it. Most shoppers start their search at Amazon.com or on Google by searching on a product.

Many searches start with an opportunistic email promoting a product. From there, we may find the shopper looking at the item on that store’s website.

Consumers likely check product reviews, from other consumers. They may read professional reviews. Browse the Internet on SmartPhone.

The point is to understand your customer’s research process. It will vary widely. But in many cases it’s something like this.

An event triggers an interest in a product. Check other brands or alternative products. Conduct research by looking at a product’s pictures, reading descriptions. Evaluate the product’s real value, and eventually make a purchase decision. Narrow your selection and shop for price. Seek out reviews or ask friends.

Where? That leads us to the where customers are researching. They could be reading relevant blogs, going to brick and mortar stores, checking comparison shopping engines, and reading trade publication articles. They may be looking at Pinterest boards, Facebook posts, and checking with their network of friends on Twitter.

They will be using tablets (increasingly the shopper’s preference), smartphones, laptops, desktops, Xboxes, and store visits.

Can an ecommerce merchant be in all of these places with your message? Likely no. But you can identify where your customers are looking for information as they move through their cycle and try to make sure you are seen. You can also ensure that your messaging and content are mobile friendly.

To compete in the future, your store needs to provide input and information to support all those steps. If you lack reviews, your customers will seek them out elsewhere.

Most ecommerce merchants can describe their customers in a general way. They likely know basic demographics – age range, gender, income level. But, do they understand the “why, where, when, and how” their customers make their purchases? These basic tenants of marketing are more important than ever.

The buying process has never been more complex. Consumers have hundred of places online to purchase products that meet their needs. They may shop at home, at work, in the grocery store. They may be using an Android phone, an iPhone, or an Xbox.

Posted in e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Point of Sale, Point of Sale, Smartphone Tagged with: alternative, Android, brick and mortar, comparison, competitor, consumers, content, costs, customers, cycle, data, databases, desktops, ecommerce, Facebook's, flexibility, Iphone, laptops, leads, Merchant's, mobile, ongoing, online, phone, pinterest, platform, price, product, profiles, purchase, selection, shop, shoppers, smartphone, store's, tablets, target, trigger, value, websites, xbox

October 18th, 2013 by Elma Jane

All Alerts, All The Time

Will mobile payment apps hail the arrival of mobile interruptions that never let up? Consumers worry that adopting a mobile wallet app will open them up to a barrage of alerts, sounding the alarm every time the local supermarket has toilet paper for half-off. The services can even track your purchases, opening the floodgates for targeted ads. Frequent alerts could be a deal breaker.

Battery Woes

As smartphones gets bigger, badder and more powerful, battery technology is struggling to keep up. That’s a problem if you want to make a call — but it could be an emergency if your smartphone is your wallet, too. Users are already scrambling to find a charging outlet by lunchtime. Soon, failure to recharge might mean you lack the funds to buy lunch in the first place. Meanwhile, credit cards never need a battery boost, and paper money has worked faithfully since well before the invention of the light bulb.

Do I Have The Right Phone?

You’re ready to make a mobile payment — but is your smartphone? Only the most popular new Android and Windows smartphones have NFC support to enable tap-to-pay services, and Apple has decided to forgo NFC altogether with its iPhone handsets. Users of budget smartphones are likewise out of luck. And though smartphones may seem ubiquitous, only a little more than half of U.S. adults have one.

Is It Secure?

Mobile payments open up a whole new frontier for fraudsters — or so cautious consumers worry. In fact, tap-to-pay technology is as secure as swiping a plastic bank card, and cloud services like PayPal Here support two-factor authentication for extra reassurance. Still, consumers worry their personal information could be intercepted during a transaction, and not everyone is convinced that Google can provide the same level of protection as their bank. But hope remains. The survey found about half of the most security-conscious respondents were much more likely to be interested in mobile payment options if they could be promised 100 percent fraud protection.

Limits, Limits, Limits

Even with a glut of mobile payment options, most lack at least one critical feature. Google’s Wallet app lets you stow your payment information in your phone to buy items in brick-and-mortar shops, but its touch-to-pay functionality is limited to Android devices on Sprint and other smaller carriers. Last year, Apple introduced Passbook, a mobile wallet app that lets users store gift card credits, loyalty card information and more on their iPhones — but only a handful of participating businesses support the app. The mobile payment model isn’t just fragmented — it’s fundamentally limited by countless companies competing for an ever-smaller piece of the pie.

Mobile What?

A recent CMB Consumer Pulse survey showed about half of smartphone users have never even heard of mobile payments. And of the 50 percent who have, a meager 8 percent said they’re familiar with the technology. Banks, credit card companies and others hoping to cash in on consumer interest will have to invest in better messaging first.

What Are The Perks?

Credit cards come with alluring perks — signing bonuses, cash back and travel accommodations, to name a few. But mobile payment systems have serious benefits. They can utilize GPS technology to direct you to deals, keep tabs on your bank account to alert you when you’re near your spending limit, and store unlimited receipts straight to the cloud. Businesses profit from mobile wallets, too, which often charge lower fees than credit card companies and encourage return trips by storing digital copies of loyalty cards.

What’s In It For Me?

To convince consumers to abandon trusted payment options for something new, companies must strike an undeniable value proposition. In the late ‘90s, electronic retail giants like Amazon compelled consumers to enter their 16-digit credit card numbers into online portals, opening up a whole new world of convenience with online shopping. But today’s consumers aren’t convinced that mobile wallets are any more convenient than their physical counterparts. Credit and debit cards already offer a speedy, reliable way to pay on the go. And since they’re accepted virtually everywhere, customers can fork over a card without worry or confusion. Convincing people that new technology is worth their time and effort might ultimately be the toughest nut to crack for mobile payment purveyors.

Where’s The Support?

Even the most enthusiastic adopters are out of luck if their favorite shops lack the infrastructure to process mobile payments. Big-box retailers sprang up in the infancy of computer technology, so joining the mobile payment revolution could necessitate updates to check out hardware and software. Mobile payments could be a boon to businesses, but installing the upgrades could be expensive and disruptive — especially when consumer interest remains low.

Which to Pick?

Even curious consumers are confounded by the array of mobile payment options available. Google, Visa, MasterCard and even mobile carriers like Sprint and Verizon are among the heavy hitters on the mobile payment scene, each offering a discrete service with different apps — and different rules. Some rely on Near Field Communication (NFC) technology that lets users simply tap their smartphone against a special reader to pay, while others offer up scannable QR codes. Mobile payments may never take off until one company rises above the rest with a single killer service.

Forget about cash or credit. In 2013, consumers can simply swipe or scan their smartphones at the checkout to pay. A huge array of mobile payment services have sprung up in recent years, urging customers to abandon their plastic credit cards for the “mobile wallet” revolution, but so far, adoption of mobile payment technology has been dismal.

Posted in e-commerce & m-commerce, Electronic Payments, Gift & Loyalty Card Processing, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: alerts, Android, Apple, bank card, battery, cautious, consumers, crack, credit cards, deal, digital, fraud, gift card credits, google, GPS, information, Iphone, lower fees, loyalty cards, mobile, nfc, online, options, paper money, Passbook, payment, PayPal, personal, phone, plastic, portals, powerful, protection, purchases, secure, Smartphones, sprint, storing, support, Swiping, Tap to Pay, touch-to-pay, track, two-factor authentication, wallet, windows