Category: Electronic Payments

February 3rd, 2014 by Elma Jane

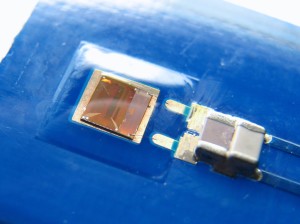

The migration to cards that use chips instead of magnetic strips, known as EMV technology, is well underway in the U.S. No government regulation is needed to make it happen. But the EMV migration and the Target breach are different things. It’s true that EMV chip cards can prevent criminals from producing counterfeit cards using stolen account numbers. But EMV doesn’t stop criminals using stolen cards online. So innovators are deploying new technologies to deter other forms of fraud.

Headline-grabbing events inevitably lead to calls for new laws. But in the case of our nation’s electronic payments systems, new government mandates would stifle marketplace innovations that hold great promise for providing consumer benefits and reducing criminal activities.

Financial institutions compete for customers by providing consumer protections even beyond requirements of current law. Many retailers also offer customers speedy transactions, such as “sign and go” and “swipe and go” for small transactions, while the payments industry ensures consumers still have zero liability. These protections and flexibility are why U.S. consumers are going cashless and carry more than one billion debit and credit cards. More than 70% of retail purchases are made with electronic payments, and our member companies process more than $4 trillion in electronic payments each year.

Fraud accounts for fewer than six cents of every $100 spent on payments systems – a fraction of a tenth of a percent. U.S. companies have made significant financial and technological investments, building sophisticated fraud tools that insulate consumers from liability. To build on this, Congress should foster greater international law enforcement cooperation to fight cybercrime, particularly in countries that harbor crime rings, and replace 46 divergent state breach notification laws with a uniform national standard.

The private sector is best positioned to address the constantly shifting tactics of criminals, and it is doing so without government mandates. Do Americans really want the government in charge of the security and monitoring of our payments?

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Visa MasterCard American Express Tagged with: counterfeit cards, cybercrime, data breach, debit and credit cards, electronic payment systems, electronic payments, emv chip cards, emv technology, fraud, liability, magnetic strips, migration, online, security and monitoring of our payments, small transactions

January 30th, 2014 by Elma Jane

As many as 40 million Target customers hacked over the holidays when thieves got into their credit and debit card. If you shopped at Target between November 27 and December 15 while thieves were hacking data, you’re unlikely to lose a dime. Federal law and industry practices protect virtually all customers from any liability for fraudulent charges. So many breaches occur in the first place. Credit and debit card fraud has nearly quadrupled in the past decade, hitting $11.3 billion in losses worldwide last year. That hurts profits and raises the cost of goods. The U.S. accounts for more than its share of fraud, and hardly a month goes by when there isn’t a breach from some large U.S. retailer, in part because the U.S. lags other countries in card security.

After the Target breach, the stolen account information flooded underground markets that operate on the Internet, selling batches of data that allow thieves to counterfeit cards and shop till they drop. The best thing that could happen is if this latest megabreach forced the industry and Congress to fix some of the system’s most troubling vulnerabilities.

Cyberthieves are growing more sophisticated, and nothing can prevent every data breach. But when a company as big as Target can be hacked for 19 days to the tune of 40 million records, consumers deserve more modern and tougher protections.

Some ideas for curbing cybercrime:

Put stronger protections on debit cards. Credit cards carry the gold standard in protection against having to pay for fraudulent charges. Federal law limits losses to $50, and most issuers take that down to zero. After a data breach, debit cards are similarly protected. But if your debit card is lost or stolen, by law you could lose up to $500, and reimbursement may depend on how quickly you report the loss. There’s no sound reason for the gap. It should be eliminated.

Set federal standards to protect data. The industry, led by Visa and MasterCard, has always provided its own security standards to keep data safe. Obviously, they’re not working. Federal standards could help, especially if backed by sanctions for flouting them. The Federal Trade Commission has some authority, but the law is nearly 100 years old, and some companies have challenged the agency in court. Since the Target breach, several senators are calling for more federal authority.

Get with the 21st century. The U.S. is far behind Europe, which almost a decade ago replaced the magnetic strip on cards with a digital chip that prevents thieves from counterfeiting cards with stolen data. That’s one reason the U.S. has become a mecca for hackers. The U.S. industry is migrating to these “EMV” cards, but it has moved slowly. The players fight among themselves over everything from who pays to the type of security. Requiring cardholders to use PIN numbers would provide the best security. Whatever the decision, the industry needs to get moving to meet a self-imposed 2015 deadline.

Posted in Best Practices for Merchants, Credit Card Security, Digital Wallet Privacy, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Payment Card Industry PCI Security, Visa MasterCard American Express

January 29th, 2014 by Elma Jane

More than 60 percent of online shoppers returned or exchanged at least one item. About 95 percent of customers will go back to an online merchant and make additional purchases after a positive return or exchange experience, making managing the process important for e-commerce success.

Exchanges and returns will shortly be a hot topic for online retailers as Christmas gift recipients contact sellers in the wake of an exceptional holiday selling season. These Christmas gift recipients will want to exchange and return unwanted gifts, items that are wrong size, or even items that may have been damaged in transit.

Returns and exchanges are important for building long term customer relationships, with some 95 percent of shoppers going back to online merchants that have offered a good exchange or return experience in the past, according to data from Endicia, an electronic postage solution provider. Conversely, about 85 percent of consumers will not return to an online shop after a poor return or exchange experience, again according to Endicia.

What follows are tips for offering a better exchange or return experience for online shoppers.

Create an Opportunity

Returns and exchanges are also an opportunity to make additional sales. As mentioned above, about 95 percent of shoppers will return to an online store and make an additional purchase after a positive return or exchange experience.

Similarly, about 45 percent of shoppers will actually recommend an ecommerce merchant, again according to Endicia, after a positive return experience, meaning that taking care of an existing customers could lead to new customers too.

Consider sending each shopper who returns or exchanges an item a follow-up email, asking for feedback about the experience. Identify ways to improve the return process, and business in general will improve too.

Know the Cost of Returning

A guitarist for a popular party and event band recently ordered a new guitar strap from a merchant on the Amazon marketplace. Unfortunately, there was an error in the shipment, and the merchant apparently sent a shorter strap than expected. When this guitarist contacted the seller about an exchange, he was told that a new strap would be shipped that day and that he could simply keep the smaller strap.

This solution was great for the customer, who did not have to repackage the strap or arrange for a carrier to pick it up. He was generally happy with the experience. This was probably also better for the merchant, who might have simply been able to order a new guitar strap from its distributor for about the same cost has having the strap returned.

To make this sort of business decision, it is important to understand the real cost of managing a customer return, including the cost of the shipping and the labor necessary for processing the return once it arrives back at the seller’s warehouse. If it cost as much or nearly as much to return the item as it would to simply purchase another one wholesale, consider letting the customer just keep it, saving everyone involved time and expense.

Provide Return Instructions or a Return Label in Every Order

Shoppers don’t want to wait for return labels. In fact, about 62 percent of online shoppers want a return label included in the initial shipment, according to Endicia. Including a return label is not difficult, and many online sellers may find that the ability to do so is either built directly into the retailer’s ecommerce platform or is available via an extension to the ecommerce platform.

A second option may be to offer shoppers a simple, self-service way to print a return label from your site. This self-service option does not require the customer to contact the shipper to get authorization or wait for an emailed label. According to the Endicia data, about 61 percent of shoppers will be happy with an easy way to print return or exchange labels.

State Return and Exchange Policies Clearly

Let customers know exactly what to expect from the return and exchange process. Post clear, simple-to-understand policies on a page of the site specifically designated for returns or shipping policies.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Electronic Payments, Gift & Loyalty Card Processing, Internet Payment Gateway, Visa MasterCard American Express Tagged with: Amazon, ecommerce, gift recipients, marketplace, online merchant, online retailers, online sellers, online shoppers, return or exchange, returns and exchanges, self-service

January 29th, 2014 by Elma Jane

Ecommerce and mobile-based e-commerce have grown significantly this year. Cyber Monday ecommerce sales, as an example, reached $1.735 billion originating from desktop and laptop devices, according to comScore. Even Black Friday, which is better known for brick-and-mortar retail sales, saw online spending reach $1.198 billion in the United States, again according to comScore. Mobile online spending may also have grown, as some reports indicate that mobile-based site traffic was up 55 percent around Thanksgiving.

Many ecommerce merchants are enjoying a robust holiday selling season even as some brick-and-mortar stores are seeing relatively flat Christmas sales. To ensure continued growth and success, Internet retailers may want to challenge their businesses to improve in several areas in 2014.

Retailers, however, should not rest on their current success, but rather should challenge their businesses to improve in several areas, including free shipping offers, mobile optimization, personalization, data driven decision making, and cross channel sales.

Offer Free, Two-Day Shipping

The first challenge for online sellers in 2014 may be to find ways to offer free, two-day shipping to all or most shoppers. While it is likely there will still be minimum purchase and maximum weight requirements and restrictions, online shoppers are going to expect faster free shipping options thanks, in part, to the growth in services like Amazon Prime and ShopRunner.

Consider order fulfillment services, distributed warehouses, drop shipping, or even partnerships with other retailers to help meet this challenge.

Offer Personalization and Customization

Personalization and customization could be a significant competitive advantage in 2014.

Challenge your business to finally begin offering personalization and customization both onsite and in marketing. The easiest place to start may be with email marketing. Work to segment email marketing campaigns so that they address customers by name and with relevant products and offers that are based on an individual’s or group of shoppers’ stated preferences or on-site behavior.

Taking on this challenge means that the retailer’s marketing department will need to collect meaningful information about what interests shoppers and organize separate, custom campaigns around those interests.

Put Mobile Design and Marketing First

In November, IBM reported that mobile devices accounted for 31 percent of U.S. ecommerce-related web traffic around the Thanksgiving holiday this year, and that 17 percent of ecommerce transactions came from smartphones or tablets. On average, tablet users spent more than $126.00 per order, and smartphone users spent about $106 per order.

This data shows that mobile e commerce is not simply a novelty, but rather a must have for 2014.

If an e-commerce business is not optimized for mobile sales, 2014 is the year to take on that challenge, including offering a responsive design and mobile friendly payment options.

Sell Seamlessly Across Channels, Devices

Try to think of every way that a shopper might interact with an online store, and then make all of those touch points work together in 2014.

Retailers online or in physical stores need to offer shoppers a seamless, cross channel shopping experience that makes buying things easier for the customer. To continue to enjoy success in 2014, consider offering shoppers the ability to share orders across devices, applications, and even marketplaces.

In practice, this might mean that items added to a cart in an online store show up in the cart for the retailer’s iPhone app too. Or that a customer’s order history displayed on a retailer’s site shows orders placed on-site and via a marketplace like Amazon or eBay.

Use Big Data for Big Information

In 2014, find sources of good, usable Big Data, and put the resulting big information to use.

As an example consider, Weather Trends International, a Big Data company that uses historical weather information and advanced data processing to accurately predict weather 11 months in advance. This sort of Big Data information could show a snowboard and ski retailer what sort of winter major ski resorts are likely to have next year, and could inform purchasing and inventory choices.

Similarly, knowing that a particular region is going to have a warmer than normal July and August might impact how, where, and when a clothing retailer promotes shorts or bikinis on Facebook or AdWords.

Big Data is a popular trend in business and in marketing. The concept can mean different things to different businesses. For ecommerce, retailers should seek to use Big Data to gather big information, if you will, that may be used to make better buying and selling decisions.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: adwords, Amazon, big data, big information, brick and mortar, cross channel, cyber, drop shipping, e-commerce, ecommerce, Facebook, internet retailers, laptop devices, Mobile Devices, mobile friendly payment options, mobile optimization, mobile-based site, on-site, online, online shoppers, online store, onsite, personalization, retailers marketing, retailers online, shopping experience, smartphone, Smartphones, tablet, tablets

January 23rd, 2014 by Elma Jane

Commonwealth Bank of Australia (CBA) will now offer the embedded payments service to customers that use the Samsung Galaxy S4 and have CBA’s mobile banking app. MasterCard indicated that this development allows these customers to make payments at more than 1.6 million PayPass-enabled merchant locations around the globe.

MasterCard is just one major issuer that views embedded chips in NFC-enabled phones as the key to unlocking mobile payments globally. But, its news yesterday of how it is going to leverage its Samsung partnership puts a bit of a different spin on digital wallets and mobile payments.

“Our focus is on helping consumers shop and pay in a way that best fits their needs, across all of their devices,” Mung Ki Woo, group executive of mobile and industry alliances at MasterCard, said in a December 11 statement.

The move is part of MasterCard’s continued relationship with Samsung. Earlier this year, MasterCard teamed with the handset maker to offer exclusive deals and special discounts to Samsung Galaxy S4 users in Bangladesh.

Posted in Electronic Payments, Financial Services, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone, Visa MasterCard American Express Tagged with: commonwealth, devices, Digital wallets, embedded payments, make payments, MasterCard, merchant, mobile banking app, Mobile Payments, nfc-enabled phones, paypass, Samsung, shop and pay

January 21st, 2014 by Elma Jane

A “cryptocurrency” is a peer-to-peer, decentralized, digital currency. Cryptocurrencies offer the potential for merchants to one day break the stranglehold of credit card processing fees. Cryptocurrencies are a disruptive technology that should be actively followed and considered. After all, online commerce is itself a disruptive technology.

Bitcoin

Bitcoin’s high cryptographic security allows it to process transactions in a very efficient and inexpensive way. You can make and receive payments using the Bitcoin network with little or no fees, and without a merchant account. Payments are made from a wallet application, either on your computer or smartphone, by entering the recipient’s address, the payment amount, and pressing send. To make it easier to enter a recipient’s address, many wallets can obtain the address by scanning a QR code or touching two phones together with NFC technology. Market Cap: $10.6 billion (12.1 million coins).

Bitcoin is the first implementation of a cryptocurrency, which was first described in 1998 by Wei Dai and specified by Satoshi Nakamoto in 2009, establishing a decentralized form of money that uses cryptography to control its creation and transactions. New Bitcoins are generated by a competitive and decentralized process called “mining,” the process of spending computing power to process transactions, secure the network, and keep everyone in the system synchronized together. The number of new Bitcoins created each year is automatically halved over time until Bitcoin issuance halts completely with a total of 21 million Bitcoins in existence.

Feathercoin – is based on Litecoin’s Scrypt-based hashing algorithm for GPU mining, rather than requiring Bitcoin’s expensive ASIC mining hardware. Feathercoin uses advanced checkpointing to provide additional security through a form of centralization without having to redistribute the Feathercoin software. At mining completion, 336 million coins will be produced. Market Cap: $11 million (26.2 million coins).

Litecoin – is based on the Bitcoin protocol, but differs from Bitcoin in that it can be efficiently mined with consumer-grade hardware. Litecoin provides faster transaction confirmations and uses a mining proof-of-work algorithm to target the regular computers with GPUs — graphics processing unite — most people already have. Litecoin provides a mining algorithm that can run at the same time on the same hardware used to mine Bitcoins. The Litecoin network is scheduled to produce 84 million currency units. Market Cap: $731 million (23.9 million coins).

Megacoin – raises the most red flags among this list of cryptocurrencies. Launched just six months ago, fifty percent of the total coins have been mined. Upon mining completion, only 42 million coins will exist. Its branding might lead an investor to believe it is associated with billionaire Kim Dotcom’s Mega.co.nz, but there is no connection. If you are interested in monitoring the fate of the more speculative cryptocurrencies, this is one to watch. Market Cap: $15.3 million (21.2 million coins).

Namecoin – is based on the Bitcoin source code. A cryptocurrency, Namecoin also acts as a DNS, a decentralize domain name system to buy, register, configure, and sell domains. The first project using Namecoin is the .bit domain. Market Cap: $44.4 million (7.4 million coins).

Peercoin – is a cryptocurrency project forked from Bitcoin that strives to achieve energy efficiency and increased security. Like other cryptocurrencies, initial coins are mined through the more commonly used proof-of-work hashing process. However, unlike other coins, as the hashing difficulty increases over time, users continue to be rewarded with coins generated by the additional proof-of-stake algorithm. Unlike most cryptocurrencies, Peercoin does not have a fixed money supply. Market Cap: $90.1 million (20.9 million coins).

Primecoin – is the first cryptocurrency with non-hashcash proof-of-work. Primecoin’s proof-of-work is based on searching for prime number chains, providing potential scientific value in addition to minting and security for the network. Similar to Bitcoin, Primecoin enables instant payments to anyone, anywhere in the world. It also uses peer-to-peer technology to operate with no central authority. Primecoin is also the name of the open source software that enables the use of this currency. Market Cap: $13.8 million (3.5 million coins).

ProtoShares – are used to mine Distribute Autonomous Corporation (DAC) backed cyrptocurrencies while they are still in development by Invictus Innovations. DACs are essentially automated businesses that perform services. And so ProtoShares are stakes in future cryptocurrency platforms. Cryptocurrencies under development are BitShares for asset trading and DomainShares for domain services. Protoshares will achieve a maximum supply of approximately 2 million coins in 2 years. BitShares money supply will be about 20 million coins. Market Cap: $23.1 million (1.1 million coins).

Quark – is a cryptocurrency that focuses on enhanced security, using nine separate rounds of encryption and six different algorithms. Quark is mined by CPU only, with 247 million mined in the first six month and then an additional 1 million units mined every year. Quark coin will continue to release coins in perpetuity at an inflation rate of .5% per year. Market Cap: $47.4 million (246.3 million coins).

Worldcoin – seeks to become the cryptocurrency of choice for merchants and consumers for their everyday transactions. Transactions are fully confirmed in about 60 seconds. Due to frequent block generation (30 seconds), the network supports more transactions without a need to modify the software in the future. At mining completion, 265 million coins will be produced. Market Cap: $20.6 million (35.2 million coins).

Posted in e-commerce & m-commerce, Electronic Payments, Financial Services, Internet Payment Gateway, Mobile Payments, Near Field Communication Tagged with: asic mining, bitcoin, credit card processing, cryptocurrencies, cryptocurrency, cryptographic security, decentralized, gpu mining, hashing algorithm, make and receive payments, merchant account, nfc technology, online commerce, payment amount, peer-to-peer, process transactions, QR code, wallet application

January 21st, 2014 by Elma Jane

Myths about seniors abound. Among them are that most seniors are poor, they don’t shop online, and they only buy necessities. Yet statistics show that this overlooked segment of our society has money to spend. Ecommerce vendors that can reach out to older Americans can be richly rewarded.

Conventional wisdom suggests that when seeking customers, ecommerce merchants should pursue teens and people in their twenties. These are the people who own the most electronic devices, are the most comfortable with technology, and do the most online buying. However, you may be overlooking a large and neglected segment of the U.S. population that is eager to spend money online — people over 50.

Advertisers ignore them, concentrating mainly on the 18 to 34 age group. Nielsen, the research firm, estimates that only about 5 percent of advertising dollars are directed at seniors. Merchants too tend to offer products that appeal only to younger shoppers. Marketing efforts are directed mainly at this group.

Why Target People Over 50?

Quite simply there are a lot of them and they have money. Nevertheless, brands focus on the under 50 age group. Yet the almost 78 million Baby Boomers in the U.S. — those born between 1946 and 1964 — are fairly affluent, well educated, comfortable with technology, and willing to try new products. They were raised in a spending-driven economy, unlike their parents who grew up during the Depression.

Indeed, according to Nielsen, Boomers’ online habits are similar to those of the 18 to 34 age cohort. Boomers represent 38.5 percent of all consumer packaged goods expenditures. Research firm Ipsos, in cooperation with Google, conducted interviews with 5,100 Boomers and seniors in April 2013 and found that while the most common reason to use the Internet was to find out about the news and weather, 57 percent shopped online in the prior month and 45 percent looked for coupons or daily deals.

As a society, we tend to stereotype seniors. The only advertising directed at them emphasizes physical infirmity. But older people do buy things other than pharmaceuticals, adult diapers, and scooters. Even those who are retired have disposable income. According to the U.S. Census Bureau and Bankrate, a financial services company, Americans over 50 account for 77 percent of all financial assets, and 54 percent of total consumer demand. They comprise 47 percent of all car sales and 80 percent of luxury travel purchases. They also buy toys, games and electronics for their grandchildren.

According to the 2010 Census, there are 51.6 million Americans aged 60 to 84 comprising 16.6 percent of the population and 41.9 million between 50 and 59 years of age. Statistics from the U.S. Bureau of Labor Statistics show that approximately 18.5 percent of Americans age 65 and over were working in 2012. This percentage will likely increase in future because of erosion in traditional pension plans, a decrease in the value of financial assets, and the uncertainty of 401K plans. Working people need clothing, cars, and electronics.

The results of the 2012 Pew Internet & American Life Project Survey showed that over half of those 65 and older are online and 70 percent use the Internet on a daily basis. However, persons over 75 do not use the Internet very much. But the age group right behind them is comfortable with the Internet and when they reach 75 they will likely continue to use the Internet for email, research, and shopping.

Thirty-four percent of those over 65 visit social networking sites, while 86 percent use email.

What do Older Shoppers Look For Online

U.K. research firm Shoppercentric advises that seniors look for quality and value over bargains when shopping. However, they do tend to use coupons and discounts.

In most cases, it’s not necessary to change your website or your product offerings to attract seniors. It is simply a matter of letting them know that you are interested in their business. Many online businesses find that partnering with organizations such as AARP and offering a discount is a good first step in attracting older customers.

Seniors have the inclination and time to perform extensive research before making a purchase decision. Be sure to provide detailed information about your products and services. Visuals are helpful too. Seniors like to do online research on hobbies, vacation destinations, auto, and appliance purchases. They also rely on the Internet for health information.

Seniors are receptive to email marketing. They are more likely to respond to that than other online forms of communication.

Is Millennial Purchasing Power Overestimated?

Merchants who target people in their teens and 20s may be overestimating the purchasing power of this segment of the population. A substantial number of them are living with their parents, are underemployed or unemployed and don’t have a great deal of discretionary income. In 2012, 36 percent of the country’s young adults ages 18 to 31— the Millennial generation — were living in their parents’ home, according to a Pew Research Center analysis of U.S. Census Bureau data. Of those still living with parents, only 29 percent were employed. Millennials may actually have considerably less purchasing power than Baby Boomers and seniors.

Posted in e-commerce & m-commerce, Electronic Payments, Financial Services, Internet Payment Gateway Tagged with: bargains, ecommerce, electronic devices, email, financial services, Merchant's, online businesses, online buying, shop online, shopped online, spend money online

January 6th, 2014 by Elma Jane

It can be difficult for travel agencies to choose a merchant services provider. The credit card processing industry generally categorizes travel agents as a high risk business type due to the fact that most travel agency transactions take place long before the actual product or service is delivered to the customer. This leaves travel merchants open to chargebacks and other payment disputes, which are costly procedures that deter many merchant services providers from offering travel merchant accounts.

National Transaction Corporation is one of the travel merchant account providers and credit card processors to provide high risk merchant services for travel agents. Most providers are geared toward e-commerce business types, although some offer options for traditional travel credit card processing. National Transaction Corporation (nationaltransaction.com) is a Coral Springs, FL-based, NTC’s member bank is US Bank Minneapolis, MN; that offers high risk travel agent merchant accounts. NTC’s credit card processing, no holds on funding, integration with Trams, Sabre, and ARC business solutions, and payment gateways for e-commerce travel merchants. National Transaction Corporation’s parent company Elavon, has a grade of “C” award. The Better Business Bureau (BBB) currently grants National Transaction Corporation an “A+” grade, citing only one complaint in the last three years.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Travel Agency Agents Tagged with: chargebacks, credit card processing, e-commerce, high risk, merchant services provider, no holds funding, payment disputes, payment gateways, provider's, transactions, travel agencies, travel agency, travel agents, travel merchant account, travel merchants

January 3rd, 2014 by Elma Jane

Results of a new survey on overall mobile use by consumers has several ramifications for payments using mobile devices. The report, from global management consultancy Deloitte, found the number of consumers who said their device is NFC-equipped more than doubled from 2012 to 2013. More importantly perhaps, for a technology many observers have pronounced dead and buried, of those whose devices are equipped with NFC technology, more than one-third said they have made a contactless payment using their phone in the past month.

The report also found that the number of app downloads decreased 13 percent this year in the U.S. and even more in other countries. Per-app spending also decreased during the year, but the report’s authors still believe the outlook for apps is positive.

The good news is, we see a lot of potential remaining in the apps market space over the long term. We believe that the overall declines indicated in this year’s survey may be due to increasing sophistication among consumers. It is likely that they have already obtained the core apps they prefer for work and play, with those choices persisting over time as they upgrade and change their devices said Craig Wigginton, vice chairman and U.S. telecommunications sector leader for Deloitte.

Posted in Credit card Processing, Electronic Payments, Environmentally Green, Mobile Payments, Near Field Communication, Smartphone Tagged with: apps, contactless, devices, equipped, mobile, nfc, outlook, payments, Per-app, phone, report, technology, upgrade

January 2nd, 2014 by Elma Jane

Online consumers generate an avalanche of data.Companies such as Amazon and Target have used Big Data for years. It’s the secret behind their highly personalized product recommendations and email promotions.

The good news is that smaller companies can use the power of Big Data in their businesses, too. But just because you can gather tons of data, doesn’t mean you should. For most small-to-midsize businesses, trying to harness Big Data can sometimes do more harm than good. It can slow down your website and cost time and money.

To make effective data-driven decisions in your business, control the types of information you collect. Focus only on the metrics that truly affect conversion rates and ignore the ones that don’t have much of an impact.

Tracking raw ad impressions regardless of whether they yield clicks or conversions is an example of monitoring low-impact data. The same thing goes for blindly monitoring Facebook Likes or Klout scores. Stop wasting resources on metrics like these. Devote your efforts on the data points that count.

Here are the most important ones for e-commerce merchants.

Number of Site Visitors and Where They’re Coming From

Online marketing is rarely cheap and quick. You have to determine the best strategies to spend resources on. There are several free and easy-to-use tools that can provide this information.

Google Analytics is an excellent tool that gives you insights on your traffic and traffic sources. To go deeper, such as which specific newsletter or which Facebook update sent visitors to your site, you can create Custom Campaigns and add special URL tags for each campaign. This lets you drill down on the specific source for your referral traffic.

Also, set up your online campaigns to make it easy to monitor. For example, having a different landing page for each guest post will allow you to quickly see which ones are sending traffic. Or, for social media, you can publish updates using a simple tool like Buffer so you monitor clicks each from each post.

Sales and Beyond

Tracking your sales is key. Aside from looking at your basic sales numbers, compute your average order value and compare it with your marketing and advertising budget. Viewing how much you’re spending on each customer versus how much they’re spending on you will help create the right budget for customer acquisition and retention.

Beyond gross sales, monitor item returns to obtain the net sales volume. Determine also the reasons behind refunds and exchanges to improve your merchandise.

Also, track sales from promotional offers, to know what promos or discounts to provide in the future. If, for example, you used a loss leader to attract customers into your store, closely monitor overall sales based on that offer to see if it generated profits.

Knowing this sales data will enable you to send out tailored promotions to users. And if you can combine those insights with other data such as the time they usually buy from you or what device they use you’ll be able to optimize your campaigns for maximum conversions.

What Visitors Are Doing on your Site

Tracking the pages that users viewed, the actions they took, and their exit points can give you tremendous insights about your site and your visitors. Analyzing these things will tell you which aspects of your site need improvement.

For example, say you discovered that while shoppers are clicking the “add to cart” button, most leave before they provide their credit card details. This could mean that there’s something wrong with your checkout page. Perhaps it’s confusing or you need a stronger guarantee. Regardless, you won’t be able to identify the problem if you don’t track what’s going on.

How you track user behavior will depend on what you want to measure. If you want to track your exit traffic, for example, to add outbound link-tracker code to your website. For WordPress sites, this can easily be done using the Ultimate Google Analytics plugin.

On the other hand, if you want to track how users react to specific site elements such as buttons, text size, forms, and other key elements use heat maps that give you a visual representation of user behavior. Crazy Egg offers a solution for this. It enables you to see how people are behaving on each page.

Posted in e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway Tagged with: acquisition, Amazon, analytics, big data, campaigns, conversion, credit-card, data, data-driven, e-commerce, email, exchanges, Facebook, google, insights, online, personalized, refunds, resources, sales, target, wordpress