Category: Medical Healthcare

October 7th, 2016 by Elma Jane

NEXT DAY FUNDING

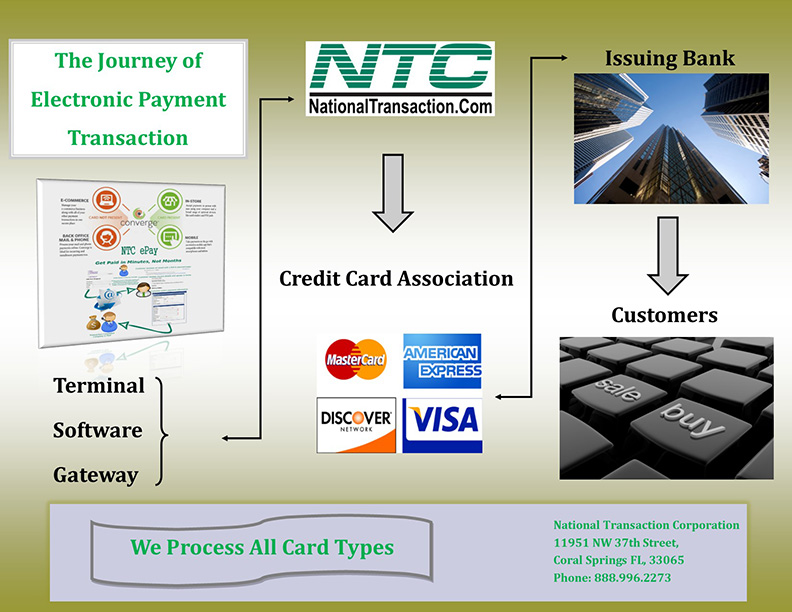

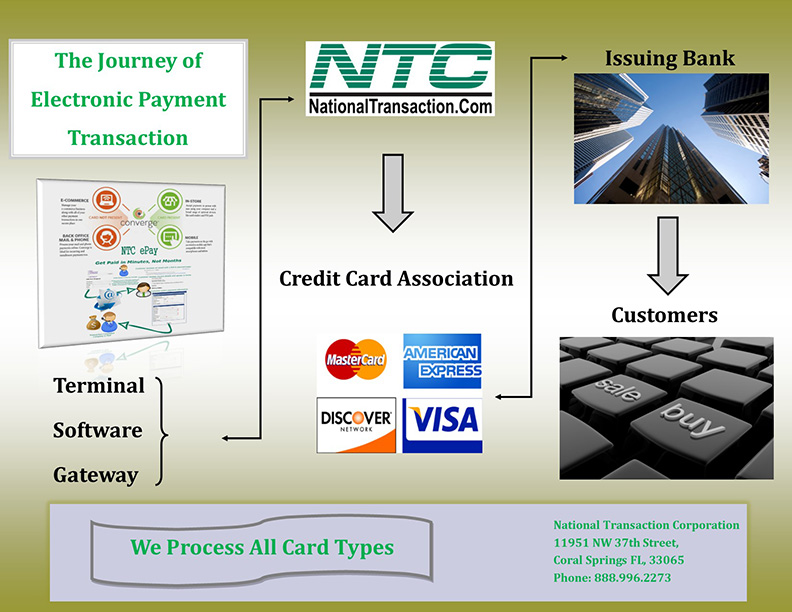

To be responsive to the needs of our merchants and to meet that needs, NTC offers next day funding in addition to the value added service for customers and businesses that need to have their funds available quickly.

National Transaction also offers a variety of electronic payment services and technology for businesses; with more than 15 years of experience.

Our services include:

- Currency Conversion

- Credit and debit card processing

- E-commerce and gateways

- Electronic checks

- Gift and loyalty card programs

- Mobile processing

- Cash advances and loans/funding program

- NTC e-Pay and MediPaid

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay!

Free Setup, nothing to Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. In addition, our e-Pay Platform can help Travel Merchants bring new customers while encouraging repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. Another payment platform that flexes with your business.

NTC Business Loans – Fast yet Affordable and most of all Simple Application Process.

MediPaid – another medical health insurance claims payment. Delivering paperless and next-day deposits for Health Insurance Payments.

Furthermore, NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants consequently providing 24/7 customer service and technical support!

To know more about our product and services call us now! 888-996-2273

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Financial Services, Gift & Loyalty Card Processing, Internet Payment Gateway, Medical Healthcare, Mobile Payments Tagged with: credit, Currency Conversion, customers, debit card, e-commerce, E-Pay, electronic checks, electronic payment, funds, gateways, loans, Loyalty Card, merchants, payment services

June 3rd, 2016 by Elma Jane

To be responsive to the needs of our merchants and to meet that needs NTC offers next day funding. This is a value added service for customers and businesses that need to have their funds available quickly.

With more than 15 years of experience, National Transaction offers a variety of electronic payment services and technology for businesses.

Our services include:

Currency Conversion, credit, and debit card processing, e-commerce and gateways, electronic checks, gift and loyalty card programs, mobile processing, cash advances and loans/funding program. We also have NTC e-Pay and MediPaid.

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay! Free Setup, Nothing To Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. Our e-Pay Platform can help Travel Merchants bring new customers and encourage repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. A payment platform that flexes with your business.

NTC Business Loans – Fast, Affordable, and Simple Application Process.

MediPaid – a medical health insurance claims payment. Delivering paperless, next-day deposits for Health Insurance Payments.

NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants providing them with 24/7 customer service and technical support!

To know more about our product and services give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Medical Healthcare, Merchant Account Services News Articles, Merchant Cash Advance, Merchant Services Account, Mobile Payments, Small Business Improvement, Travel Agency Agents Tagged with: cash advances, credit, Currency Conversion, customers, debit card, e-commerce, electronic checks, electronic payment, funding, funds, gateways, loans, Loyalty Card, merchants, Mobile Processing, service

November 2nd, 2015 by Elma Jane

Delivering Paperless, Next-Day Deposits for Health Insurance Payments.

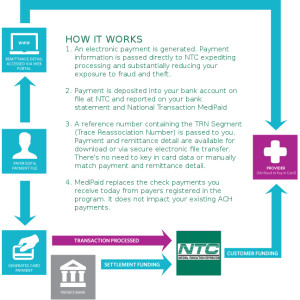

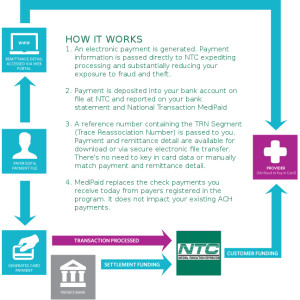

NTC’s MEDIPAID delivers next-day deposits for any Medical entity that must bill health insurance companies.

MEDIPAID will bring the speed, ease and convenience of credit card merchant accounts to the world of medical insurance payments. Upon MEDIPAID’s deployment, the medical office receives its payments considerably faster. The revenue is immediately available since it is paid directly into the businesses’ checking account with secure electronic payments.

MEDIPAID is designed to eliminate the healthcare provider’s paper check payments with electronic payments that include the remittance detail (ERA) and further allows providers to take advantage of distribution options to automate the claims payment posting processes.

Posted in Best Practices for Merchants, Medical Healthcare Tagged with: checking account, credit card, electronic payments, health insurance, healthcare provider's, medical insurance, MediPaid, merchant accounts, payments, provider's

February 10th, 2015 by Elma Jane

National Transaction Corporation and it’s medical software partners is introducing new “Payment Processing” solutions that can help your practice, securely and efficiently, capture payments and better serve patients. NTC offers a variety of solutions to accept patient payments/co-pays in the office, on the phone and online. With our solutions, you can make it more convenient for patients to pay via debit or credit card at the point of care to help drive more consistent cash flow. In addition we can help expedite receipt of claim payments using Medipaid, our new solution from NTC that replaces paper check payments you receive from insurance companies with fast, secure electronic deposits. Medipaid combines the convenience of electronic payments with standardized ERAs (electronic remittance advice) and automated posting options. It can help your practice accelerate cash flow and simplify reconciliation processes.

Here are some benefits when using this new and exciting program:

- Eligibility resolution

- Claims and tracking

- Rejections and denials

- Patient billing and payments

- Reporting and metrics

- Clinical tools

- 24/7 support

- Updated payer list information

- Payment Integrity/PCI compliant

- Tokenization & Encryption payment security (EMV microchip cards)

- Clinical exchange solutions

- HIPAA simplified

- E-payment (EFT & ERA)

- ICD-10 information on deadline set for October 1, 2015

- Regulation mandates from HIPAA and Affordable Care Act

If you are interested in learning more about our payment processing solution and Medipaid, we will be happy to e-mail additional information. Please feel free to contact us regarding any of your payment processing needs.

Contact Elaine Zamora RN @ 954-346-3300 Ext. 1111 or Email: elaine@nationaltransaction.com

Posted in Medical Healthcare, nationaltransaction.com Tagged with: cash flow, claim payments, credit-card, debit, electronic deposits, electronic payments, electronic remittance advice, insurance companies, paper check, payment processing, payments, solutions

November 4th, 2014 by Elma Jane

“Healthcare’s Unique, Robust MEDIPAID Rolls Out”

Delivering paperless, next-day deposits for Medical Billers

National Transaction Corporation (NTC) in Coral Springs, Florida announced today that, by the first of December 2014, their paperless medical insurance electronic funds capturing suite: MEDIPAID will be fully functional nationwide. NTC’s MEDIPAID delivers next-day deposits for any Medical entity that must bill health insurance companies.

MEDIPAID will bring the speed, ease and convenience of credit card merchant accounts to the world of medical insurance billing. Upon MEDIPAID’s deployment, the medical office receives its payments considerably faster. The revenue is immediately available since it is paid directly into the businesses’ checking account with secure electronic payments.

NTC’s agents help merchants standardize their Electronic Remittance Advice (ERA) and distribution options to automate posting which further reduces paper and time burdens. At a rate far less than credit card processing or third party billing companies, MEDIPAID is designed to eliminate the healthcare provider’s paper check payments with electronic payments that include the remittance detail (ERA) and further allows providers to take advantage of distribution options to automate the claims payment posting processes.

For more information, Contact us anytime.

National Transaction Corporation

Posted in Best Practices for Merchants, Medical Healthcare Tagged with: billing, check payments, credit card processing, credit-card, electronic funds, electronic payments, Electronic Remittance, health insurance, Medical Billers, merchant accounts, Merchant's, paperless medical insurance, secure electronic payments

August 8th, 2014 by Elma Jane

The U.S. Defense Department is planning to issue a requests for bids on a multibillion dollar electronic health records or HER system by the end of September. The department issued its third draft of a Request for Proposals to industry early last month, conducted a briefing for vendors later in June and received responses to the draft earlier this month. The objective of the program is to modernize DoD’s EHR system and to make records accessible to the Department of Veterans Affairs, as well as to private medical providers. The goal of the planned system is to improve the quality of care from a clinical standpoint, while contributing to the seamless movement of medical records among key care providers. DoD has titled the project the (Defense Healthcare Management System Modernization Program) or DHMSM. DoD has shaped the contracting process to ensure that the project is well defined and properly managed from the start and it has sought feedback from the vendor community and other health IT experts. That accounts for the three draft RFPs, the meetings with vendors and consultations with Healthcare Organizations. This deliberative approach could help DoD avoid the pitfalls of the ill-managed Affordable Care Act launch.

Posted in Medical Healthcare Tagged with: Care Act, Department of Veterans Affairs, DHMSM, DoD, electronic health records, health experts, Healthcare Organizations, HER, industry, proposals

May 27th, 2014 by Elma Jane

The BACPAC Act, which establishes a site-neutral bundled payment model for Medicare post-acute care (PAC) introduced earlier this week. According to a press release from the Partnership for Quality Home Healthcare, the proposed payment structure would have PAC coordinators and their networks of post-acute care providers manage patient care through a 90-day, site-neutral bundled payment that would be initiated upon a patient’s discharge from the hospital.

CEO for The Partnership for Quality Home Healthcare, said in the company statement that the proposed legislation offers pro-patient solutions that are founded on years of research and analyses. Additionally, those solutions support a more effective and efficient delivery of quality post-acute care services.

As population ages, the need for well managed post-acute care will become a pressing necessity for the sustainability of our healthcare system. The BACPAC Act of 2014 represents positive Medicare reform that benefits patients, providers and taxpayer alike.

One of the major changes that the bill hopes to make is to reduce hospital readmissions. As the Partnership for Quality Home Healthcare explained, readmissions are a common cost-driver in PAC. However, the proposed legislation creates strong incentive for patients to be placed in the most clinically-appropriate, cost-effective setting. From there, it is more likely that patients would receive more efficient care through their treatment plan.

The bill stemmed from the BACPAC analysis that was proposed by the Alliance for Home Health Quality and Innovation in January. The analysis, compiled and explained the benefits of bundled payment options for post-acute care, as well as how providers can control costs. If implemented correctly, bundling payments for chronic care management, rehabilitative and other forms of post-acute care could lead to more efficiency across care settings and encourage care coordination among providers. In the current fee-for-service system, care coordination is often overlooked, resulting in unnecessary tests, procedures and costs to the Medicare program that often do not improve patient care or outcomes. Medicare could see up to $100 billion in savings over 10 years by moving patients into different settings and reducing spending by certain degrees.

Posted in Medical Healthcare Tagged with: Alliance for Home Health Quality and Innovation, bundled payment, bundled payment options, care providers, chronic care management, costs, healthcare, Home Healthcare, Medicare, Medicare program, Medicare reform, networks, patient care, patient’s discharge, patients, payment, post-acute care, post-acute care services, procedures, provider's, Quality Home Healthcare, taxpayer, tests, treatment plan

January 9th, 2014 by Elma Jane

Notably after the Japanese tsunami…the Hungarian Red Cross has used mobile technology to raise funds for disaster relief, but for the first time has enlisted social media in the process. The organization is running a Facebook campaign that lets smartphone users make instant donations to aid victims of Typhoon Haiyan in the Philippines.

The donations will pass through the MasterCard Mobile app that was developed by the Hungarian m-payments firm Cellum. The solution relies on QR codes. The method is available only in Hungary.

Process works like this:

Download the MasterCard Mobile app to your smartphone and register your bank card, then follow the steps to secure your personal data.

To donate, scan the QR code shared on Facebook with the built-in scanner of MasterCard Mobile. Transaction data are displayed on the screen to ensure the donation goes to the chosen cause.

The QR code contains a minimum sum, which can be increased.

Then press the send button to review and confirm transaction data.

The app then initiates the transaction, which you need to authorize by entering your mPIN.

You will receive feedback on the successful transaction, which can later be viewed in the transactions menu.

The donations will pass through Cellum’s system and quickly go to the Hungarian Red Cross’ account, which is dedicated to typhoon relief efforts.

Donations are a matter of impulse and that people who decide to give want to act quickly, chances are they don’t carry around a pen to put down a 24-digit bank account number on a piece of paper. By the time they get home and visit their online bank where they could transfer the money, they have already been distracted by a hundred other stimuli, so they end up sending nothing. Cellum’s solution is simple; whenever the impulse hits people, they probably have their phone at hand said Cellum spokesman Balazs Inotay.

Posted in e-commerce & m-commerce, Internet Payment Gateway, Medical Healthcare, Smartphone Tagged with: account number, authorize, confirm transaction data, Facebook, m-payments, MasterCard, mobile app, mobile technology, personal data, phone, PIN, process, qr codes, Red Cross, scanner, secure, smartphone, social media, solution, successful transaction, transfer

November 12th, 2013 by Elma Jane

Since Medical Transcriptions is one of the product and services by National Transaction Corporation under National Transcription Corporation I just want to share this topic.

The abuse of the medical credit card system is growing by the day because many doctors are making these cards appear like an in-house payment program. Most patients are inclined to pay their doctor for their services directly, but they are more hesitant when a credit card is involved. Some medical professionals are masking the true source of their lending services and thus putting their clients at risk.

An example of this form of abuse can be seen by a company called CareCredit. Nearly 90% of New Yorkers in the CareCredit program opted for a program with no interest if the amount was paid in full. A quarter of them ended up paying 26.99% interest on their accounts instead. CareCredit has more than seven million cardholders nationwide, and it is currently the defendant in a variety of civil lawsuits.

If you are offered a chance to take to a credit card to cover your medical expenses, you should fully research the card before signing on the dotted line. Fully understand the terms of the card before agreeing to anything so you don’t end up in heavy debt.

Medical credit cards are designed to help people pay for procedures they may not be able to afford on their own. These cards give patients a chance to undergo the procedures their insurance may not pay for, as well as giving the doctor the opportunity to get their money right away.

While this may seem like a great setup, most patients are pressured into getting medical credit cards without knowing the excessive costs sometimes associated with them. They can fall into a debt trap very quickly.

Posted in Credit card Processing, Electronic Payments, Medical Healthcare Tagged with: amount, cards, clients, credit-card, debt, doctors, heavy debt, interest, lending, medical transcriptions, money, paid, patients, payment, procedures, professionals, risk, services, signing, system, terms