Category: Mobile Payments

April 8th, 2016 by Elma Jane

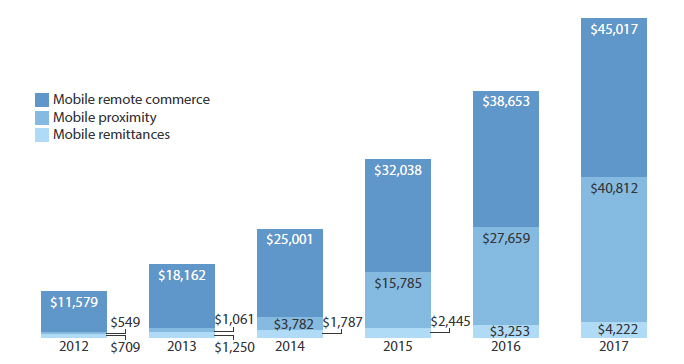

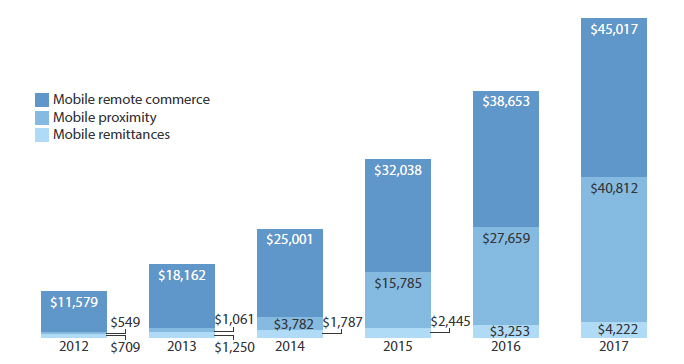

Mobile payments are soaring high. Many large retailers have embraced the innovation, but individual business owners have been slower to adopt.

Mobile payments can enhance customer engagement and loyalty. With mobile payment features, businesses can encourage more people to purchase using their mobile phone.

Customer experience will be the primary basis for competition.

The success of mobile payment providers and vendors are ultimately connected, as both need to work together. Small business merchants may not feel the urgent need to adopt mobile payments today, but they might lose in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Small business merchants may not feel the urgent need to adopt mobile payments today, but they might be left behind in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Competitive businesses need to get on board, they need to know the advantages and opportunities mobile payments can provide. To stay competitive and relevant, business merchants of all sectors and sizes need to explore the possibilities of mobile payments.

Posted in Best Practices for Merchants, Mobile Payments, Travel Agency Agents Tagged with: consumers, customer, merchants, mobile, Mobile Payments, payment providers, payments, provider's

March 3rd, 2016 by Elma Jane

Apple and Samsung, Plus HCE, Lending Momentum to Contactless

EMV migration in the U.S. is helping to establish NFC since nearly all EMV terminals come with built-in NFC capability. Consumers worldwide will make mobile payments with their handsets using near-field communication this year, nearly 70% will be Apple Pay and Samsung Pay users.

Some banks were offering mobile wallets based on HCE. Banks have responded to HCE because its cloud configuration stores and manages payments information, bypassing the secure element in the phone. This allows banks to introduce tap-and-pay mobile-payments services quickly because it eliminates the need to negotiate terms with mobile carriers and device manufacturers to gain access to the secure element. Cloud-based credentials can be tokenized to protect from hackers. Tokenization and HCE combination is extremely attractive to banks.

Apple, Samsung and a cloud-based technology host card emulation are playing a big role in spreading contactless payments.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: banks, consumers, contactless, contactless payments, EMV, HCE, host card emulation, mobile, Mobile Payments, mobile wallets, Near Field Communication, nfc, payments, terminals, tokenization

February 25th, 2016 by Elma Jane

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions

January 21st, 2016 by Elma Jane

Merchant accounts are as varied as the merchants themselves and the goods being sold.

What kind of account would you fall under:

High Risk Merchant Accounts – Finding a processor who is willing to take your account can be more challenging. High risk merchants range from travel agencies to multi-level marketing companies, credit restoration merchants, casinos, online pharmaceutical companies, adult/dating merchants and many other.

Internet based merchant account (Ecommerce/Website order processing) – E-Commerce is a booming market, with so many people buying and selling goods online due to the wide reach and easy access to the internet.

Mobile or Wireless merchant account – This merchant is specifically designed for small businesses, solo professionals, and mobile services (including lawyers, landscapers, contractors, consultants, repair tradesmen, etc), who are constantly on the move and require a payment to processed on the spot.

MOTO (Mail or Telephone order) – This enables phone based or direct mail orders processing for customers who can buy your product or service from the comfort of their home. Since there is no card present there is no need for traditional equipment.

Multiple Merchant Accounts – Some businesses can have merchant accounts of a couple or all different types. Merchants who fall into this category are called multi-channel merchants as they sell their goods through a number of different channels. Most commonly this is related to retail stores who also have an online presence to sell their goods. This is very common in today’s competitive market where constant contact with customers is critical to success.

Traditional Account with Equipment – Most commonly used for retail businesses (grocery, departmental stores etc) where the transactions are processed in a face to face interaction also known as Point of Sale (PoS).

Interested to setup an account give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Point of Sale, Travel Agency Agents Tagged with: account, card, card present, credit, customers, e-commerce, high risk merchant, internet, merchant accounts, merchants, mobile, mobile services, moto, multi-channel merchants, payment, point of sale, POS, processor, transactions, travel, travel agencies

January 18th, 2016 by Elma Jane

EMV + NFC = BIG PLUS FOR YOUR BUSINESS

The business is already making upgrades, so If you’re a merchant, business owner who’s still on the fence about upgrading your payment processing equipment to accept EMV cards why not take that upgrade a step further and add NFC while adding EMV systems?

Not only will the upgrade help prevent potential financial responsibility for fraudulent transactions, but you can also realize the added benefit of being able to process NFC transactions at the same time.

Customers want the ability to pay with a mobile device, and NFC will allow for such transactions to go on.

Having NFC tools in place will help provide a valuable note of future-proofing to systems in place, being ready for it will be to the business’ benefit.

EMV and NFC technology is just good business sense for three important reasons Added Security, Economic Sense and Staying Current.

For more information about terminal upgrade and features that suits best for your business give us a call at 888-996-2273.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale, Smartphone Tagged with: cards, customers, EMV, merchant, mobile, nfc, Security, transactions

December 16th, 2015 by Elma Jane

Google’s contactless payment solution, Android Pay, will now be available through the mobile checkouts of several Android apps in the U.S.

With this addition, it avoids having to pull out your card everytime you make a purchase, meaning card data never makes it to the merchants. A good news for anyone who is concerned about privacy.

Android Pay is compatible with all Near Field Communication (NFC) or Host Card Emulation (HCE) enabled devices using any OS released since KitKat.

With Coca-Cola signing up as the first merchant in the Google program, a new loyalty program was recently released for the mobile wallet, by tapping your phone on an NFC-enabled Coke vending machine, you’ll get a Coke and get points added into your Android Pay Account for future purchases.

http://www.pymnts.com/news/payment-methods/2015/android-pay-now-in-app-payment-option/

Posted in Best Practices for Merchants, Credit Card Security, Mobile Payments, Smartphone Tagged with: Android Pay, card, card data, contactless payment, HCE, host card emulation, loyalty program, merchants, mobile wallet, Near Field Communication, nfc, payment

December 11th, 2015 by Elma Jane

The use of in-store mobile payments increased in the US this year, from 5% in 2014 to 18% in 2015, research reveals, with approximately one in five consumers using their phone to make a payment at the point of sale.

The most popular uses of mobile payments in the US:

Public Parking (19%)

Gas Station Purchases (18%)

Coffee Shops and Fast Food Dining (17%)

Paying for Groceries (16%)

Public Transportation (16%)

Paying for a Taxi (16%)

Paying for restaurant bills (15%)

Checking out of a Hotel and Paying the Bill (13%)

Shopping for Clothing (12%)

Shopping in General on the High Street or in the Mall (10%)

Other (7%)

US consumers aged between 25 – 34 were seen as driving the largest portion of mobile payment activity at 36%, with those aged from 45-74 accounting for less than 10% of activity.

Half of the survey’s 2,000 respondents in the US cited security concerns as the main reason for not using mobile devices for in-store payments, while consumers place the greatest trust in traditional financial institutions like banks (49%) for provision of payment services.

Mobile technology is now moving beyond simply being a mode of communication and advancing towards the era of the always-connected consumer, says US telecommunications sector leader at Deloitte.

http://www.nfcworld.com/2015/12/11/340588/store-mobile-payments-increase-four-fold-across-us/

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale Tagged with: banks, financial institutions, Mobile Payments, payment services, payments, point of sale

December 10th, 2015 by Elma Jane

WALMART LAUNCHES QR CODE MOBILE PAYMENTS SERVICE

Customers at US retail giant Walmart will soon be able to pay for purchases by scanning a QR code at the point of sale using Walmart Pay. Walmart Pay will be integrated into the Walmart app, the retailer’s own mobile payment service introduced in selected stores this month, with a nationwide launch expected in the first half of next year.

With this launch, Walmart becomes the only retailer to offer its own payment solution that works with any iOS or Android device, at any checkout lane, and with any major credit, debit, prepaid or Walmart gift card all through the Walmart mobile app.

Walmart Pay will allow for the integration of other mobile wallets in the future.

http://www.nfcworld.com/2015/12/10/340527/walmart-launches-qr-code-mobile-payments-service-in-the-us/

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: credit, debit, gift Card, mobile payment, mobile payment service, mobile wallets, payment service, payment solution, point of sale, prepaid

December 7th, 2015 by Elma Jane

Most payments will probably be made with apps in phones or smartwatches in less than a decade from now, using NFC, biometrics or other mechanisms that don’t involve swiping or using plastic cards.

If your mobile device has an integrated NFC chip, you can use a mobile wallet app like Apple Pay and Android Pay to pay for items that support NFC transactions at a retail store. Simply wave your device near an NFC compatible terminal to pay, no card swiping required.

Both Apple Pay and Android Pay have fingerprint scanners on phones, you can enable payments with just a fingerprint scan.

In some countries, it’s easy for consumers to get credit cards with imbedded NFC chips. This means that you may be able to wave your card at the terminal instead of swiping, no phone required. In America, though, because NFC hasn’t caught on until recently, analysts expect that NFC via smartphone and smartwatch services such as Apple Pay and Android Pay will dominate contactless transactions in the next few years.

Just as credit cards replaced cash, credit cards will be replaced by digital payments which will continue to rely on the credit infrastructure but will obscure the plastic card itself.

As consumers, we love to see better products. When it comes to payments, we need Standards and Reliability.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: biometrics, cards, contactless transactions, credit cards, digital payments, mobile wallet, nfc, NFC chip, payments, smartphone, terminal

December 4th, 2015 by Elma Jane

The payments world continues to reinvent itself almost daily, predictions have now become reality. Demand for mobile payments are growing, with the increasing mobile internet penetration that enables the users to process Mobile Point-of-Sale (MPOS) and close the sales process quickly. Moreover, the rising adoption of tablets and smartphones across the globe allows the retailers and merchants to integrate MPOS into their payment systems.

Mobile presents a tremendous opportunity for merchants today. The usage of cloud-based solutions is expected to fuel the MPOS market. These solutions enable merchants to access customer information and product data across multiple platforms. Large amount of data would require highly compatible Mobile Point-of-Sale (MPOS) that will capture information such as payment preferences, and buying behavior to fuel the market. MPOS would also enable merchants to store a large amount of data that can be accessed from anywhere across the globe by authorized personnel. The value that this channel can provide is very powerful creating new business opportunities.

Interested in Electronic Payments give us a call now at 888-996-2273

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale Tagged with: merchants, mobile, mobile internet, mobile point of sale, MPOS, payments, point of sale