Category: Mobile Payments

December 3rd, 2015 by Elma Jane

Industry professionals agree that mobile payments technology has surpassed e-commerce as the trend in the daily spending behavior of modern retail customers.

E-commerce’s impact on consumer spending has actually decreased, but it seems that the ability to pay with mobile devices has finally swayed consumers away from their computers.

The payments outlook has changed rapidly with the increasing availability of mobile technologies to the average retail consumer within the last year. Products like Apple Pay, Android Pay and Samsung Pay have totally altered the landscape of payment options.

Small Businesses will have to adapt in order to keep up with the rapid pace of technological developments. The evolution of payments technologies not only alters how consumers spend their money, but how that money is processed during a transaction.

There are still some concerns over cyber risks and data security, which led 58 percent of surveyed professionals to agree that point-of-sale debit and credit card transactions were still the safest form of payment, while mobile payments garnered 20 percent of support. But hypothetical worries over security aren’t real enough to slow mobile payments’ momentum moving forward.

Mobile payments transaction value is expected to hit $8.71 billion by the end of 2015. That figure will triple to $27.05 billion in comparison to 2016, according to new research; as a bigger base of consumers begin to use their phones for point-of-sale transactions and a wider range of merchants begin to accept mobile payments. By 2019, essentially all mobile payment transactions will be done on smartphones.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Point of Sale Tagged with: credit card, credit card transactions, debit, e-commerce, merchants, Mobile Payments, payments technologies, point of sale

November 20th, 2015 by Elma Jane

LG is planning to launch its mobile payment service by December in a bid to compete in the global mobile payment market that is already dominated by tech majors such Apple Pay, Samsung Pay and Android Pay. The service solution dubbed as LG Pay. Some observers have said it will likely follow Samsung to the US, as well since it has trademarked the product name both at its homeland, South Korea and United States. The company broke the news in its Facebook page.

Posted in Best Practices for Merchants, Mobile Payments Tagged with: Android Pay, Apple Pay, global mobile payment, mobile payment, Samsung Pay

November 17th, 2015 by Elma Jane

Within the payment processing industry, Merchant accounts are categorized according to how they process their transactions.

There are two primary merchant account categories:

Swiped (Card Present) and Keyed (Card-Not-Present).

Swiped or Card-Present Transactions: Are those in which both the card and the cardholder are present at the time the payment is processed, they physically swipe their customers credit card through a terminal or point-of-sale system.

The sub-categories within this group include:

Retail Merchants – Normally conduct their business in an actual storefront or office space. They primarily use counter-top terminals or Point-of-Sale systems. Restaurant Merchants – Requires a special set-up that allows for tips to be added to the final sale amount by settling the transaction with an adjusted price that will include the tip amount.

Wireless / Mobile Merchants – They use wireless terminals or mobile phones to run these transactions in Real-Time. Have the ability to accept credit cards transactions wherever they are located out on the road.

Hotel / Lodging Merchant – Will authorize a customer’s credit card for a certain sale amount.

Card-Present Transactions also include grocery stores, department stores, movie theaters, etc. Card acceptance settings where cardholders use unattended point-of-sale (POS) terminals, such as gas stations, are also defined as card-present transactions.

Keyed-In or Card-Not-Present Transactions: Whenever the transaction is completed and the cardholder (or his or her credit card) is not physically present to hand to the seller.

The sub-categories within this group include:

Mail Order / Telephone Order (MOTO) – The customers card information is gathered via over the phone, fax, email or internet and then manually key-entered into a terminal or payment gateway software. Once the transaction is approved and completed, the product is then shipped to the customer for delivery.

eCommerce / Internet – Conduct ALL of their business over the internet through a web site. So all credit card transactions are processed online via a payment gateway in real-time. The payment gateway is integrated into the web sites shopping cart. The cardholders card is charged instantly.

Travel Merchants is one example of Keyed or Card-Not-Present Transactions.

Start processing credit card payments today whether Swiped or Keyed.

Give us a call now at 888-996-2273 so more details!

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Point of Sale, Smartphone, Travel Agency Agents Tagged with: Card Not Present transactions, card present, card-not-present, card-present transactions, cardholder, credit card, credit card payments, credit card transaction, ecommerce, keyed, Lodging Merchant, mail order, merchant accounts, merchants, mobile merchants, moto, payment gateway, payment processing, point of sale, POS terminals, Restaurant Merchants, Retail Merchants, shopping cart, swiped, telephone order, terminal, transactions, travel merchants

October 1st, 2015 by Elma Jane

The day the payments industry has pointed to for several years arrives today, a turning point in the U.S.‘s migration to EMV chip-and-PIN cards.

Rules set by Visa and MasterCard as of today, the liability for fraud carried out in physical stores with counterfeit cards belongs to the merchant if it has not yet upgraded its POS system to accept EMV-enabled chip cards. Banks will be issuing EMV Chip Cards.

An enormous change, as everyone learns to deal with the new technology that requires consumers to insert their cards and leave them in the store machines throughout a payment transaction, rather than swipe.

In a recent survey, less than a third of merchants overall have invested in EMV-compliant technology, and one study said 80 percent of small and midsize merchants have not upgraded their systems as of today’s liability shift.

Issuers are claiming to be more prepared than merchants, but according to the Smart Card Alliance, around 200 million chip cards have been issued to U.S. cardholders. That, however, is less than 17 percent of the approximately 1.2 billion payment cards in circulation.

What is clear is that today does not represent the end of the journey. The lack of preparedness at the physical point of sale, however, may be beneficial for card-not-present merchants.

Over the past few months, the mainstream media has awoken to the fact that implementing EMV does not mean fraud will disappear. Fraudsters quickly adapted to the difficulty of counterfeiting cards by attacking Card-Not-Present channels, where a chip has no effect.

In other markets, fraud migrated quite rapidly to card-not-present channels. It is necessary on e-commerce merchants to protect themselves with an array of tools, like device authentication, one-time passwords, randomized PIN pad and biometrics. Fraud mitigation tools like data analytics, address and CVV verification, 3D secure and tokenization. These services should be available from their merchant acquirer processor or gateway.

There should be a gradual reduction in card fraud over the next 12-18 months in spite of the delays in this country’s EMV migration. It’s going to take time for the technology to be adopted.

U.S. Merchants’ overall relative lack of preparedness for EMV may give e-commerce and mobile merchants time they didn’t think they would have to explore the options.

Sophisticated authentication technologies such as biometrics will help increase the security of card transactions. Device-based verification could be easily incorporated in an EMV transaction.

Banks have expressed interest more in using the phone as a biometrics. It’s all going to depend on what is the most convenient way to access your funds. The nice thing about biometrics is it’s meant to enable more convenience and stronger security.

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: banks, biometrics, card fraud, card-not-present, chip cards, chip-and-PIN cards, e-commerce, EMV, gateway, merchant acquirer, merchants, mobile merchants, payments industry, point of sale, POS system, processor, tokenization, Visa and MasterCard

September 29th, 2015 by Elma Jane

There are three contenders competing for dominance in mobile payments.

NFC – or near-field communication, is a contactless data transfer system similar to RFID. When two NFC-enabled devices come into range, you can transfer data from one to the other (such as bringing a phone in range of a credit card terminal).

NFC is found in a lot of phones, especially the flagship devices from Samsung, LG, and Sony. Apple finally jumped into the NFC game in 2014, and Google relaunched its mobile payments service as Android Pay in 2015. Samsung also launched its own app, aptly named Samsung Pay, in 2015.

NFC is a safe method for payments. Sensitive data is stored in a secure element, either built into the SIM card of a phone or placed in a separate chip. In most cases, retailers never actually see your card or bank account data.

QR Codes – or quick-response codes, have the sort of ubiquity that NFC lacks. They work a bit like your standard bar codes, except that instead of relying on one-dimensional analog scanning, they are digital. That means that with a QR code reader app, your smartphone’s camera can be temporarily converted into a scanner. QR codes can embed way more information than your standard bar codes, which gives them the power to do things like open mobile sites, direct you to YouTube Videos, and even enable you to complete mobile payments.

iBeacon – is an Apple-developed technology that uses Bluetooth Low-Energy (BLE, or sometimes also called Bluetooth Smart). Unlike the other two types of technology, it’s really still in the developmental stages. While it can be used for mobile payments, at the moment the biggest application for iBeacon is actually as proximity alert or geo-fence that can go where GPS doesn’t.

It works like this: iBeacon units are set up throughout a building (such as a department store). When someone with an iBeacon-enabled device comes into range of those beacons, they transmit information. Some of the ways this technology could be used would be to transmit mobile coupons or other special offers, to guide customers throughout the store by department, or even to help them find specific items on a shopping list.

NFC devices need to be within 8 inches (though 2 inches is really most effective). iBeacons, on the other hand, have a range of 50 meters, or about 165 feet.

For payments, iBeacons would work nearly the same as NFC: the phone would wirelessly transmit payment information to the terminal or beacon via Bluetooth.

It’s also worth noting that while iBeacons are Apple technology, they are not exclusive to iOS devices. The phone just needs to have Bluetooth Smart and the appropriate app.

Samsung announced its own version of the iBeacon, called Proximity, at its 2014 developer conference in November. it works the same way as iBeacons, but rather than going through an app, Proximity works directly with the phone’s hardware.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: Android Pay, Apple, bank, card, credit card terminal, google, iBeacon, LG, Mobile Payments, Near Field Communication, nfc, payments, qr codes, Samsung, Samsung Pay, Sony

September 22nd, 2015 by Elma Jane

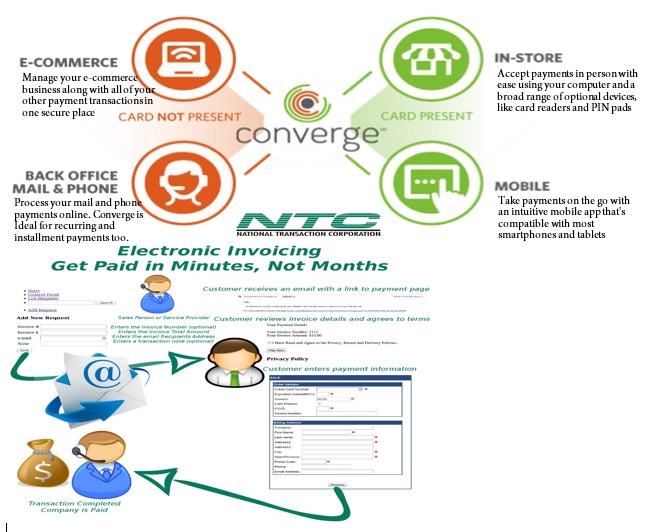

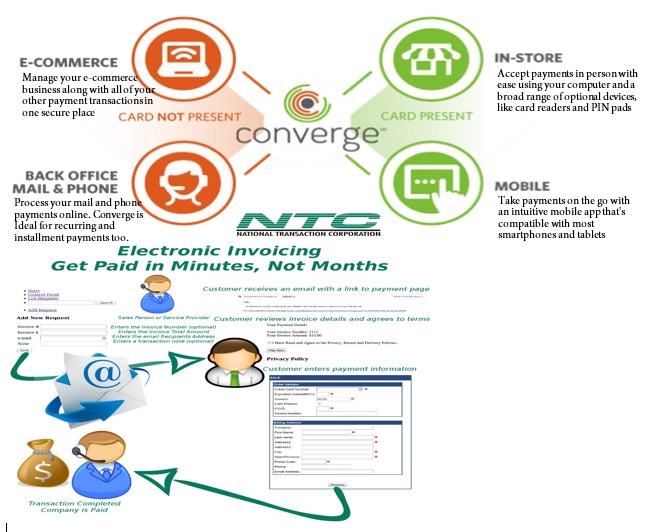

Virtual Merchant/Virtual Merchant Mobile now called Converge, is a popular product offering solutions for retail stores, Non Face to Face businesses along with E-commerce/Internet sites. Converege can be access anywhere with internet. Users can download the application on their smartphone or tablet. Converge also gives users the convenience of sending an invoice to customers electronically with NTC e-Pay!

For Retail store National Transaction offers the latest in EMV and NFC technologies. NTC customers can accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. NTC offers different solutions that cater to your business needs. For those already using a POS system, NTC integrates with most systems. NTC has you covered.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: Apple Pay, contactless payment, Converge, e-commerce, EMV, Google Wallet, nfc, POS system, smartphone, tablet, virtual merchant

July 30th, 2015 by Elma Jane

Converge Powers Potential

Over the next several weeks, we’ll focus on a series of topics to hopefully provide a better understanding of the payment capabilities

Converge can bring you customers. In this article, we’ll zoom in on the card-present product enhancements of Converge first, including bringing EMV and mobile wallet capabilities to in-person payments, and ultimately VirtualMerchant Mobile later this year.

New Peripherals Added to Converge – Ingenico iSC250 and Star Micronics TSP650II Printer

Ingenico iSC250 Signature-Capture PIN Pad – is a signature-capture PIN pad offering the ability to accept PIN-based transactions, like debit card and Electronic Benefit Transfer (EBT), as well as EMV chip card and mobile wallet payments.

The iSC250 will initially ship EMV-capable meaning it’s physically configured with a slot to accept an EMV chip card, but it does not yet have the EMV application to process a chip card transaction.

A simple download process later in the year will allow customers to accept chip cards. The good news is customers can accept NFC contactless payments right away, including Apple Pay and Google Wallet.

Key features of the Ingenico iSC250 include:

- EMV-capable smart card reader to support EMV chip cards; EMV-enabled with a download later in the year

- NFC-enabled for contactless cards and Apple Pay and Google Wallet mobile wallets

- Magnetic stripe capture for all standard mag stripe cards

- Encryption technology to help secure cardholder data at point of entry and throughout the payment network

- Signature Area Display for signature capture with electronic stylus

- Bright color 4.3″ display and backlit key pad for ease of use

Star Micronics TSP650III:

In addition to the new iSC250PIN pad, a new USB printer were also added to the lineup of Converge supported peripherals, the Star Micronics TSP650II receipt printer. Now customers have two options for thermal receipt printing!

ConvergeConnect Makes Device Setup a Snap

A new peripheral and device management software called ConvergeConnect to make it easier for your customers to setup their devices quickly as well as add additional peripherals as their business needs grow. It will be the go-forward device management application, and we’ll be able to bring more and more EMV and NFC devices to market faster, giving our customers even more in-store payment processing options.

Legacy peripherals, like magnetic stripe card readers, check imagers and the Epson ReadyPrint T20 printer will continue to be managed using the Device Assistant.

Customers may have to use both ConvergeConnect and Device Assistant depending on their peripheral configuration.

A new Peripheral Device Installation and Setup Guide was developed to help customers install and manage their peripherals for both applications.

Converge Mobile with EMV on the Horizon

Work continues on the new VirtualMerchant Mobile app to be branded as Converge Mobile, and releasing the Ingenico iCMP in the third quarter. The Ingenico iCMP accepts EMV and NFC transactions, including contactless cards and mobile wallets, like Apple Pay. Stay tuned as more information becomes available.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication Tagged with: card-present product, cardholder, chip card, contactless payments, data, debit card, EBT, Electronic Benefit Transfer, EMV, mag stripe cards, mobile wallet, nfc, NFC transactions, payment network, payments, PIN pad, PIN-based transactions, smart card reader, VirtualMerchant Mobile

July 23rd, 2015 by Elma Jane

The digital payments landscape is changing at a rapid pace. Consumers are finally adopting digital wallets, like Apple Pay and Android Pay.

The deadline for merchants to become EMV compliant, the global standard that covers the processing of credit and debit card payments using a card that contains a microprocessor chip, is quickly approaching.

Today’s consumers show an increasing desire to use new payment methods because they’re convenient. However, this presents a challenge to merchants, as many have not made the switch to the modern technology required to accept these methods since they’re generally hard-wired to resist technology changes.

Merchants must evolve with technology or they’ll find themselves unable to compete and in danger of losing customers.

Looking long term, the benefits of adopting new payment technology will outweigh the cost of transitioning. The fact is that new payment technology will reduce fraud risk due to counterfeit cards, provide greater insight into shoppers with sophisticated data and will ultimately lower costs for merchants over time.

The value merchants will get out of new payment methods:

Security

Investing in new payment technology will help reduce the risk of fraud. EMV, as an example. Beginning in October 2015, merchants and the financial institutions that have made investments in EMV will be protected from financial fraud liability for card-present fraud losses for both counterfeit, lost, stolen and non-receipt fraud.

EMV is already a standard in Europe, where fraud is on the decline. In turn, American credit card issuers are being pressured to replace easily hacked magnetic strips on cards with more secure “chip-and-PIN” technology. Europe has been using Chip, and Chip & Pin for years.

There’s nothing that can guarantee 100 percent security, but when EMV is coupled with other payment innovations, like tokenization that separate the customer’s identity from the payment, much of the cost and risk of identity theft is eliminated. If hackers get access to the token, all they get is information from one transaction. They don’t have access to credit card numbers or banking accounts, so the damage that can be done is minimal.

As card fraud rises, there’s a strong case to upgrade to a payment system that works with a smartphone or tablet and accepts both EMV chip cards and tokens.

Insight into Customer Behavior

In addition to added security, upgrading to new payment technology opens up a door to greater customer insights, improved consumer engagement and enables merchants to grow revenue by providing customers with receipts, rewards, points and coupons. By collecting marketing data at the point of sale a business can save on that data that they only dreamed of buying.

Investment Outweighs the Cost

New technology does have upfront costs, but merchants need to think about it as an investment that will grow top-line revenue. Beware of providers offering free hardware. Business can benefit by doing some research on the actual cost of the hardware.

By increasing security, merchants are further enabling mobile and emerging technologies, which will make shopping easier.

Customers will also be more confident in using their cards.

As an added bonus to merchants, most EMV-enabled POS equipment will include contactless technology, allowing merchants to accept contactless and mobile payments. This will result in a quicker check-out experience so merchants can handle more transactions.

Faster customer checkout.

The best system for is the one that makes the merchant as efficient and profitable as possible, as well as improves the customer checkout experience.

Retail climate is competitive, merchants have two choices:

Do nothing or embrace the fact that payments are changing. Transitions from old systems to new ones require work and risk, but merchants who use modern technology are investing in the future and will certainly outperform those who choose to do nothing.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: American credit card, card, card present, chip, Chip and PIN, contactless technology, credit, data, debit card, digital payments, Digital wallets, EMV, EMV compliant, EMV EuroPay MasterCard Visa, merchants, Mobile Payments, payment innovations, payment methods, payment technology, payments, point of sale, POS, provider's, smartphone, tablet, token, tokenization, transaction

July 10th, 2015 by Elma Jane

Every Merchant in the country needs to upgrade their terminal. Are you ready for the October 1, 2015 Liability Shift?

Beginning October 1, 2015, all businesses that accept in-person payments must be able to take cards embedded with chips to avoid liability for fraud. The chips are more secure than magnetic stripes.

National Transaction brings the latest EMV and NFC technologies to Merchants.

NTC Clients will be able to accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. Additionally, the Ingenico terminals are EMV Enabled, delivering the latest in fraud prevention technology.

The new EMV enabled terminals are designed to accept EMV chip cards and magnetic stripe cards.

EMV (an acronym for Europay, MasterCard® and Visa®) is a global technology standard for payment cards.

What are the benefits of having an EMV terminal?

These next generation terminals can reduce your risk of accepting counterfeit cards, as chip and PIN transactions verify both the card and the cardholder.

Eliminate your card present fraud liability exposure associated with the October 1st, 2015* liability shift imposed by the card brands.

Improve customer service for your international cardholder customer. EMV cards are already the standard in over 80 countries.

Be on the lookout for more information about how to be chip card ready before OCTOBER.

*Businesses with Automated Fuel Dispensers (also called “Pay at the Pump”) acceptance methods have until October 2017 to comply with the new standard.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: cardholder, cards, chips, EMV, emv cards, EMV terminal, EuroPay, magnetic stripes, MasterCard, merchant, nfc, payment cards, payments, PIN transactions, terminal, visa

July 7th, 2015 by Elma Jane

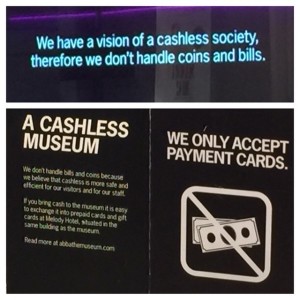

Cashless society is about to happen, hard to believe for some. We are all unable to decide on the edge of a new, cashless world where mobile payments reign supreme. If so, is this a bad thing? For some people yes, because for them change can be scary.

Every revolution needs a good crisis in order to grow its seed. The cashless revolution is the same. Current global financial conditions serves as the potential crisis, and truly the cashless revolution is upon us. Society is on the brink of great economic change, which will likely usher in a new era of worldwide, electronic currencies. The cashless society is coming.

Advances in mobile payment options as evidence of this impending cashless society, consider the practical benefits of mobile payments for the consumer. The most obvious is convenience. Many people prefer to swipe their smartphone atop a scanner to carrying around a stack of cash. Electronic payments are traceable, which is useful for tracking one’s spending and can add a sense of security. Also, carrying around large stacks of cash isn’t always feasible or safe.

Mobile payments also offer interested individuals a way to incorporate social media into their purchases; they can check-in to a site and tell all their friends about an exciting new product they bought, or announce their presence at a new coffee shop, all with that same initial swipe of an NFC-enabled phone. Add to this the many practical benefits of mobile payments as far as business owners are concerned, and it’s easy to see why so the technology is becoming so widespread.

And yet for all the benefits of mobile payments and point of sale technology, the two don’t necessarily exclude cash. Other company focuses on blending cash transactions with POS. This allows technologically savvy businesses to incorporate POS and mobile payment technology into their business, without excluding potential customers who prefer to use cash.

We aren’t necessarily evolving towards a cashless society, but towards a society with a plethora of payment options. POS technology is all about options. Want to pay with a swipe of your credit card? Swipe your credit card. Want to tap your NFC-enabled phone against a console. Tap and go. Want to pull a crisp twenty-dollar bill from your wallet and walk away from the counter with milk and eggs in your hand and a handful of coins jingling in your pocket? Go for it.

The question is: Will we ever become a truly cashless society? Maybe, maybe not, but as mobile payments become increasingly common, cash may very well fall into the retro category.

Posted in Best Practices for Merchants, Mobile Payments, Near Field Communication, Point of Sale Tagged with: credit card, electronic currencies, electronic payments, Mobile Payments, nfc, point of sale, POS, swipe