Category: Mobile Point of Sale

September 29th, 2015 by Elma Jane

There are three contenders competing for dominance in mobile payments.

NFC – or near-field communication, is a contactless data transfer system similar to RFID. When two NFC-enabled devices come into range, you can transfer data from one to the other (such as bringing a phone in range of a credit card terminal).

NFC is found in a lot of phones, especially the flagship devices from Samsung, LG, and Sony. Apple finally jumped into the NFC game in 2014, and Google relaunched its mobile payments service as Android Pay in 2015. Samsung also launched its own app, aptly named Samsung Pay, in 2015.

NFC is a safe method for payments. Sensitive data is stored in a secure element, either built into the SIM card of a phone or placed in a separate chip. In most cases, retailers never actually see your card or bank account data.

QR Codes – or quick-response codes, have the sort of ubiquity that NFC lacks. They work a bit like your standard bar codes, except that instead of relying on one-dimensional analog scanning, they are digital. That means that with a QR code reader app, your smartphone’s camera can be temporarily converted into a scanner. QR codes can embed way more information than your standard bar codes, which gives them the power to do things like open mobile sites, direct you to YouTube Videos, and even enable you to complete mobile payments.

iBeacon – is an Apple-developed technology that uses Bluetooth Low-Energy (BLE, or sometimes also called Bluetooth Smart). Unlike the other two types of technology, it’s really still in the developmental stages. While it can be used for mobile payments, at the moment the biggest application for iBeacon is actually as proximity alert or geo-fence that can go where GPS doesn’t.

It works like this: iBeacon units are set up throughout a building (such as a department store). When someone with an iBeacon-enabled device comes into range of those beacons, they transmit information. Some of the ways this technology could be used would be to transmit mobile coupons or other special offers, to guide customers throughout the store by department, or even to help them find specific items on a shopping list.

NFC devices need to be within 8 inches (though 2 inches is really most effective). iBeacons, on the other hand, have a range of 50 meters, or about 165 feet.

For payments, iBeacons would work nearly the same as NFC: the phone would wirelessly transmit payment information to the terminal or beacon via Bluetooth.

It’s also worth noting that while iBeacons are Apple technology, they are not exclusive to iOS devices. The phone just needs to have Bluetooth Smart and the appropriate app.

Samsung announced its own version of the iBeacon, called Proximity, at its 2014 developer conference in November. it works the same way as iBeacons, but rather than going through an app, Proximity works directly with the phone’s hardware.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: Android Pay, Apple, bank, card, credit card terminal, google, iBeacon, LG, Mobile Payments, Near Field Communication, nfc, payments, qr codes, Samsung, Samsung Pay, Sony

September 25th, 2015 by Elma Jane

National Transaction Terminals with NFC (near field communication) Capability to accept Apple Pay, Android Pay and other NFC payment transactions at your business. You will need to adopt point-of-sale devices with NFC/Contactless readers.

National Transaction offer a range of options to suite your specific needs.

Give us a call now! 1-888-996-2273 or go to www.nationaltransaction.com

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Android Pay, Apple Pay, contactless readers, Near Field Communication, nfc, payment, point of sale

September 24th, 2015 by Elma Jane

If you accept credit cards and don’t know what EMV is here is what you need to know.

EMV stands for Europay, MasterCard and Visa. A credit card that had a chip embedded in it is an EMV. EMV Cards have been standard in Europe for more than 10 years because they’re more secure than magnetic stripe cards. Magnetic stripe cards doesn’t change, it has static data, which makes them easy to clone. The chip embedded card makes it more difficult and costly to counterfeit because the data that is transmitted changes each time the card is read. This means less fraud.

Questions to ask to help you decide about terminal upgrade.

- Calculate your risk – Consider the cost of replacing your point-of-sale (POS) terminal vs. potential risk. Whether you replace it now or at a later time, eventually all businesses will have to replace their POS terminals.

- Educate your staff – Educated employees translate to better-educated customers. Merchants can help customers better understand this change and what it means for them.

- Upgrade your POS system – Consider using an EMV compliant credit-card reader on a wireless device for an ultra-secure mobile solution. This is also a chance to upgrade other options, such as near field communication NFC technology, which lets consumers use their mobile devices to make payments at the point of sale.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: chip, credit card reader, credit cards, data, EMV, emv cards, EuroPay, magnetic stripe cards, MasterCard, merchants, Mobile Devices, Near Field Communication, nfc, payments, point of sale, POS terminal, visa

September 22nd, 2015 by Elma Jane

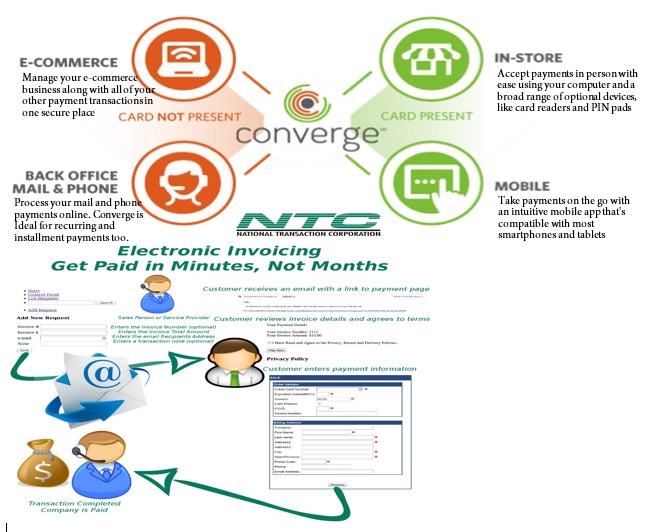

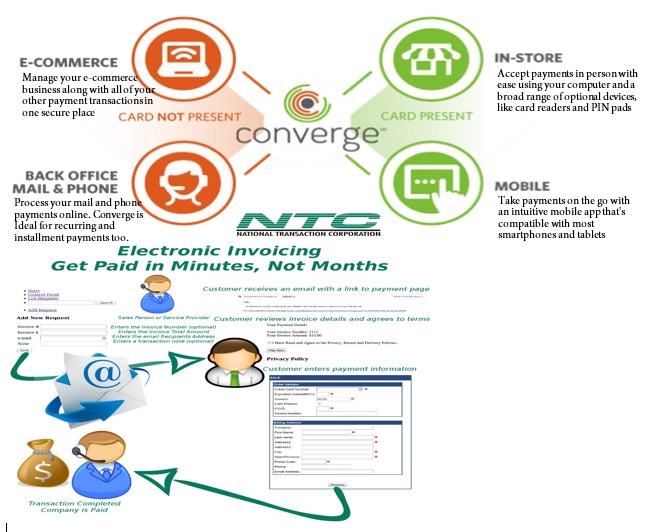

Virtual Merchant/Virtual Merchant Mobile now called Converge, is a popular product offering solutions for retail stores, Non Face to Face businesses along with E-commerce/Internet sites. Converege can be access anywhere with internet. Users can download the application on their smartphone or tablet. Converge also gives users the convenience of sending an invoice to customers electronically with NTC e-Pay!

For Retail store National Transaction offers the latest in EMV and NFC technologies. NTC customers can accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. NTC offers different solutions that cater to your business needs. For those already using a POS system, NTC integrates with most systems. NTC has you covered.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: Apple Pay, contactless payment, Converge, e-commerce, EMV, Google Wallet, nfc, POS system, smartphone, tablet, virtual merchant

September 11th, 2015 by Elma Jane

National Transaction Terminals with NFC (near field communication) Capability

To accept Apple Pay transactions at your business, you will need to adopt point-of-sale devices with NFC/contactless readers.

National Transaction offer a range of options to suite your specific needs:

Tablet solutions: Talech with iCMP device and NCR Silver.

Short-range wireless terminals for pay at the table: Bring the point-of-sale to your customers. Ideal for table-service restaurants, curbside pick-up, salons and more.

These terminals are all-in-one solutions with an integrated PIN Pad and printer. The short range terminals use secure, encrypted Bluetooth technology, allowing only the base and terminal to talk to each other, while also monitoring channels to prevent interference from other devices.

The Bluetooth terminals we offer are: VeriFone VX680B and Ingenico iWL220B. (Both Bluetooth Wireless)

Long-range wireless (cellular/mobile) terminals: Have a long-life battery and compact design, which allows you to process transactions anywhere your customers are ideal for deliveries, kiosks and more.

These terminals are all-in-one solutions with an integrated PIN Pad and printer. Phone lines and internet connections are not required to take advantage of our mobile payment solutions.

The GPRS wireless terminals we offer are: VeriFone VX680G and Ingenico iWL250G. (Both GPRS Wireless)

Countertop terminals:

Ingenico iCT250 – has a “magic box” cable management system that prevents cable tangle and clutter. The terminal boasts a color display for improved readability and ease of use.

Verifone VX520 – has a built-in secure software authentication process which prevents unauthorized software applications from being downloaded.

Ingenico iCT220 with iPP320 external PIN pad – has a “magic box” cable management system that prevents cable tangle and clutter, along with a black and white screen for crisp visual clarity. Combine with an iPP320 for a consumer- facing solution to support contactless payments. (Note: the iCT220 device only supports contactless transactions when connected to this external PIN pad).

Whether you need a stand-alone POS terminal, want to take advantage of your existing tablet or PC, or require a wireless or mobile solution, National Transaction Corp., offers numerous user-friendly options. No matter how your customer wants to pay, NTC will help you enable quick and easy transactions from Traditional credit and debit cards, gift cards, smart cards (or EMV), mobile or digital wallets like Apple Pay and eCommerce or MOTO transactions.

Start growing your business quickly by accepting all kinds of credit card payments and debit cards. Choose a state-of-the-art solution so you can accept payment in store or on your mobile device. With transparent pricing, live customer support, no cancellation fees and a secure platform, you’ll be confident you made the right partner for your business with National Transaction Corp.

Learn how easy it can be to accept any contactless or Apple Pay transactions.

Click here for more information about Apple Pay.

For Merchant Account Setup give us a call at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: Apple Pay transactions, contactless readers, Countertop terminals, credit card, debit cards, Digital wallets, ecommerce, Gift Cards, mobile payment, moto, Near Field Communication, nfc, PIN pad, point of sale, POS terminal, smart cards, wireless terminals

July 7th, 2015 by Elma Jane

The global brand MasterCard is in the process of launching a pilot program with the help of Google, BlackBerry, Apple, Microsoft, and Samsung to boost security for online payments using facial recognition systems.

About 500 customers are trialing for the new features, participants will provide feedback based on their experience. The company will continue to refine the product until ready to launch. MasterCard confirmed that it is planning to eventually release the new biometric security system publicly.

The payments company is also in the process of securing agreements with two major banking institutions. If all goes as planned, the undisclosed financial establishments will likely participate in the launching of the new security option.

When consumers shop on the Internet, their banks need ways to verify their identities. So this particular product seamlessly integrates biometrics into the overall payments experience, a security expert at MasterCard said.

The system does not actually save a photo of the user during the verification process. Instead, it creates a map of the individual’s face. Afterwards, the map is turned into code, which is sent to MasterCard for confirmation. The facial recognition feature only kicks in when an individual makes an online purchase.

During checkout, users will be prompted to confirm their identity using fingerprint scanning or facial detection.

To prevent criminals from using a photo to dupe the verification process, a user is required to blink once while having his or her face scanned. Technical specifications and mobile requirements for the security feature are still unknown.

With the test of facial recognition, MasterCard seemingly hopes to move away from password-based protocols by providing additional security options for consumers.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: consumers, financial establishments, MasterCard, online payments, payments, payments company, products, Security

Biometrics Market To Reach $14.9 Billion by 2024

The Biometrics market currently sits at $2 billion, by 2024, it will reach $14.9 billion, with a cumulative total revenue of $67.8 billion. This is being driven by new advancements in Biometrics Hardware and Software that are not only transforming payments, but also serving as frictionless alternatives to security in a myriad of use cases.

For consumer facing security, Biometrics can be deployed at a low price-point for high-volume authentication. Think an iris scan or finger swipe for quickly unlocking a mobile device like an iPhone 6 or Samsung Galaxy S6.

The forecast goes over use cases that spans from Point-of-Sale transactions, to voter identification, making the case for Biometrics embedding itself into a vast number of aspects in everyday life.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Point of Sale, Smartphone Tagged with: biometrics, consumer, device, mobile, mobile device, payments, point of sale, Security, swipe, transactions

April 21st, 2015 by Elma Jane

An advanced strain of malware called “Punkey,” is capable of attacking Windows point of sale terminals, stealing cardholder data and upgrading itself while hiding in plain sight.

Researchers from Security vendor Trustwave discovered the new strain. The investigation found compromised payment card information and more than 75 infected, and active, Internet Protocol addresses for Windows POS terminals.

Punkey poses a unique threat to payment networks, particularly because it also can download updates for itself.

If the malware author has a new feature it wants to add or updates to get rid of bugs, it actually pushes the malware down from the command and control server, revealed by Trustwave’s SpiderLabs research center. Punkey operates like a typical Botnet.

The malware hides inside of the Explorer process, which exists on every Windows device and manages the opening of individual program windows. Punkey scans other processes on the terminal to find cardholder data, which it sends to the control server.

The malware performs key logging, capturing 200 keystrokes at a time. It sends the information back to its server to store passwords and other private information.

A year ago, security vendors warned retailers against using Windows XP at the point of sale, since Microsoft stopped supporting Windows XP security patches. However, even Punkey is not attacking Windows due to any vulnerability in the systems, so even merchants with newer versions of Windows are at risk.

Punkey just runs like any Windows binary would. Even if the system is upgraded or a new system is put in place, criminals are still getting malware on the POS in other ways.

Many retailers use remote desktop support software, which fraudsters take advantage of, they steal a password and install malware like a technician would install any software.

While Punkey represents a more sophisticated POS malware than Trustwave has seen previously, merchants can still protect themselves through attention to basic security best practices.

Merchants should update antivirus and firewall protections, monitor the remote access software, establish two-factor authentication and check network activity daily for anything out of the ordinary. Unfortunately, many organizations have neither the expertise nor the manpower to perform these tasks.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Mobile Point of Sale, Payment Card Industry PCI Security, Point of Sale Tagged with: card, cardholder, cardholder data, data, Malware, Merchant's, payment, payment networks, point of sale, POS terminals, retailers, terminals

April 20th, 2015 by Elma Jane

With each year comes a new set of security risks businesses need to be aware of. The threats that have seen the most growth over the last year include point-of sale (POS) malware, malware traffic within secure and encrypted HTTPS websites and attacks on computer systems designed to control remote equipment.

Everyone knows the threats are real and the consequences are dire, so we can no longer blame lack of awareness for the attacks that succeed. Hacks and attacks continue to occur, not because companies aren’t taking security measures, but because they aren’t taking the right ones.

The large number of highly publicized POS breaches last year has heighted the need to make sure that businesses that use these devices are properly protecting them.

Malware targeting point-of-sale systems is evolving drastically, and new trends like memory scraping and the use of encryption to avoid detection from firewalls are on the rise. To guard against the rising tide of breaches, retailers should implement more stringent training and firewall policies, as well as reexamine their data policies with partners and suppliers.

For many years, businesses thought using a secure HTTPS Web connection protected them from a security breach. That no longer appears to be the case. While the increased number of businesses moving to a more secure Web protocol is a positive trend, hackers have identified ways to exploit HTTPS as a means to hide malicious code. Since the malware transmitted over HTTPS is encrypted, traditional firewalls fail to detect it.

Just as encryption can protect sensitive financial or personal information on the Web, it unfortunately can also be used by hackers to protect malware. One way organizations mitigate this risk is through SSL-based Web-browser restrictions, with exceptions for commonly used business applications to avoid slowing company productivity.

Several identified trends and predictions for the coming year, including the following:

Android will remain a main target for hackers. More sophisticated techniques will be developed to hinder Android malware researchers and users by making the malware hard to identify and research.

As wearable technology becomes more prevalent, expect to see malware start to target these devices.

Digital currencies, including Bitcoin, will continue to be targeted.

More organizations will enforce security policies that include two-factor authentication, which will likely increase the number of attacks on these technologies.

Posted in Best Practices for Merchants, Credit Card Security, Mobile Point of Sale, Payment Card Industry PCI Security, Point of Sale Tagged with: (POS) malware, Android, bitcoin, Digital currencies, point of sale, POS breaches, security breach, SSL-based Web-browser

March 10th, 2015 by Elma Jane

If you can’t accept credit cards for your business, you are losing out on potential revenue. Most people don’t carry more than $20 in cash with them at a time, and people who use credit cards tend to spend more than their cash-carrying counterparts.

These days you can turn your smartphone or tablet into a credit card reader, but which service should you choose? What do you need to consider when deciding?

NTC is here to help you understand all the intricacies of taking credit card payments with your smartphone or credit card.

Credit card reader or Wedge are useful in a variety of industries and for businesses of all sizes. Arts and crafts business accepting credit card payments at conventions and other events. A pub that gives its servers credit card readers rather than having to pay for everything at the bar. POS systems with a mobile integration can swipe your card on the spot rather than taking credit cards over the phone when ordering delivery.

If you work in one of these fields it might be time to think about getting a wedge:

Arts and crafts vendors: Do you sell your wares at conventions, art shows, and other big events? You could be a book reseller, an artist, a jewelry maker, a clothing retailer, or even a makeup seller.

Food Service: Food trucks were among the earliest adopters of mobile card readers, but there is no shortage of restaurants that are using them now. There are companies both offer POS systems in addition to their mobile card readers, which is perfect for delivery services.

Service providers: If you don’t have a brick-and-mortar office or base of operation where customers visit you, or if you conduct your business in your customers’ homes (carpet cleaners, plumbers, lawn care, mobile dog groomers, exterminators, etc.), a credit card reader/wedge gives you flexibility as well as credibility, as well as added security.

Understanding the Costs of Accepting Credit Card Payments

In the traditional business model, to accept credit card payments you would have to set up a merchant account. A merchant account typically entails a detailed look at your credit history and business.

Credit card companies assess a small fee to merchants for processing payments. With merchant accounts and card readers, the cost is built in and deducted automatically, so you don’t have to worry about paying it yourself. With a merchant account, you typically get lower rates because of the decreased risk.

It’s not just the standard fees that you need to worry about when you want to accept credit card payments. There are costs hidden everywhere, so let’s address some of these issues:

Internet Availability Typically, smartphone and tablet card readers need some sort of Internet connectivity, via a cellular signal or Wi-Fi. Most smartphones these days are capable of becoming Wi-Fi hotspots, so you can create your own Wi-Fi. However, this option relies on your phone’s data plan. The more transactions you make, the more data you use.

Compatibility You also need to make sure that your devices are compatible with the card reader. Check the list of compatible devices before you commit to one service over another.

Also note that you’re going to usually have to enable location services on your phone.

Card Compatibility, Manual Entry Fees, Location There are card readers that seems to work best with a specific device. You’re typically going to pay more for manually entering credit card numbers because of the greater risk – the card doesn’t have to physically be present to complete the transaction.

Likewise, you’re usually going to pay more for accepting international cards, and you’re not always going to be able to accept payments outside the U.S.

Taxes and Tips Several mobile credit card readers will let you add sales tax to the base purchase without requiring you to calculate it, which is handy if you’re not fond of math or just want the transaction to go more quickly.

As an alternative, you can build the sales tax into the listed prices, which some of your customers might appreciate.

Finally, depending on your industry, you may want to check that the credit card reader you use allows your customers to add a tip.

Time to Get Your Money The final cost to consider for credit card readers is more of a convenience fee than anything — it’s the time before you can access your money.

If you’re in a high-risk industry or have a high volume of business, you are probably better off obtaining a merchant account and using one of their mobile solutions.

You’re also going to want to worry about refunds and chargebacks. If, for whatever reason, a consumer complains to his or her credit card company and there’s a chargeback.

Features to look For in Your Credit Card Reader Features-wise, you can at least expect the basics to remain consistent across smartphone credit card readers: you can swipe cards, manually key them in, and issue receipts. It’s the little things that will ultimately set one service provider apart from the rest. Some of the things you may want to look out for include:

Record-Keeping for Cash and Checks Sure, you can manage your cash intake the old fashioned way and let your bank deal with checks. But some credit card readers, (which doesn’t actually require you to swipe cards, but more on that later) will let you create digital receipts for cash and check transactions as well.

POS Integration Depending on your needs, you might want to look for a service that has easy POS integration.

E-Commerce Integration Likewise, look for easy integration with an online store, if you have one. Easy integration is ideal for centralizing your accounts.

Accounting Integration & More Do you use an accounting service? If so, you might prefer the ability to transfer your data directly from your card swiping service to your accounting software.

Invoicing If you do custom orders, offer services, or provide goods to a business, you’re all too familiar with invoices. With some services, you can generate invoices through them and send them to clients via email. The biggest advantage to this is simply that you get your money quicker because there’s no need to cut a check and send it through snail mail.

Voids and Refunds It’s unfortunate, but you do need to make accommodations to process refunds and void transactions. Sometimes your finger slips on a key and you don’t notice until afterward, and sometimes the customer just changes their mind. Make sure that you understand how to use these features in whichever service you choose.

Card Reader Design Needless to say there is more than a bit of awkwardness trying to balance a phone with a 5.1-inch screen in your hand while also stabilizing the card reader while swiping the card. Especially when you’re working with limited table space. It’s worth looking at the card reader and the device it’s attached to and making sure that the design works for you.

Permissions for Multiple Users Do you have several employees? The ability to give permissions to multiple users comes in handy here. With it, you can enable employees (or your friends) to accept payments without giving them full access to your account. This is great if you happen to have multiple booths at events, or if you send multiple employees out on location and each one needs to be able to accept payments.

Accepting credit card payments doesn’t have to be a terrifying prospect, even if you’re running just a small-time business. You can get a mobile credit card reader for free in many cases, and while you won’t pay the lower fees associated with traditional merchant accounts, the costs are still readily manageable. What you need to consider are the hidden costs — not necessarily in the service providers, but the ones that come from using a data connection, or requiring Wi-Fi. How soon you get your money should also be a top priority.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Mobile Payments, Mobile Point of Sale, Smartphone, smartSD Cards Tagged with: (POS) systems, card reader, chargebacks, credit card reader, credit cards, e-commerce, high risk, merchant account, Merchant's, mobile card readers, mobile integration, POS, processing payments, Service providers, wedge