Category: Near Field Communication

July 23rd, 2015 by Elma Jane

The digital payments landscape is changing at a rapid pace. Consumers are finally adopting digital wallets, like Apple Pay and Android Pay.

The deadline for merchants to become EMV compliant, the global standard that covers the processing of credit and debit card payments using a card that contains a microprocessor chip, is quickly approaching.

Today’s consumers show an increasing desire to use new payment methods because they’re convenient. However, this presents a challenge to merchants, as many have not made the switch to the modern technology required to accept these methods since they’re generally hard-wired to resist technology changes.

Merchants must evolve with technology or they’ll find themselves unable to compete and in danger of losing customers.

Looking long term, the benefits of adopting new payment technology will outweigh the cost of transitioning. The fact is that new payment technology will reduce fraud risk due to counterfeit cards, provide greater insight into shoppers with sophisticated data and will ultimately lower costs for merchants over time.

The value merchants will get out of new payment methods:

Security

Investing in new payment technology will help reduce the risk of fraud. EMV, as an example. Beginning in October 2015, merchants and the financial institutions that have made investments in EMV will be protected from financial fraud liability for card-present fraud losses for both counterfeit, lost, stolen and non-receipt fraud.

EMV is already a standard in Europe, where fraud is on the decline. In turn, American credit card issuers are being pressured to replace easily hacked magnetic strips on cards with more secure “chip-and-PIN” technology. Europe has been using Chip, and Chip & Pin for years.

There’s nothing that can guarantee 100 percent security, but when EMV is coupled with other payment innovations, like tokenization that separate the customer’s identity from the payment, much of the cost and risk of identity theft is eliminated. If hackers get access to the token, all they get is information from one transaction. They don’t have access to credit card numbers or banking accounts, so the damage that can be done is minimal.

As card fraud rises, there’s a strong case to upgrade to a payment system that works with a smartphone or tablet and accepts both EMV chip cards and tokens.

Insight into Customer Behavior

In addition to added security, upgrading to new payment technology opens up a door to greater customer insights, improved consumer engagement and enables merchants to grow revenue by providing customers with receipts, rewards, points and coupons. By collecting marketing data at the point of sale a business can save on that data that they only dreamed of buying.

Investment Outweighs the Cost

New technology does have upfront costs, but merchants need to think about it as an investment that will grow top-line revenue. Beware of providers offering free hardware. Business can benefit by doing some research on the actual cost of the hardware.

By increasing security, merchants are further enabling mobile and emerging technologies, which will make shopping easier.

Customers will also be more confident in using their cards.

As an added bonus to merchants, most EMV-enabled POS equipment will include contactless technology, allowing merchants to accept contactless and mobile payments. This will result in a quicker check-out experience so merchants can handle more transactions.

Faster customer checkout.

The best system for is the one that makes the merchant as efficient and profitable as possible, as well as improves the customer checkout experience.

Retail climate is competitive, merchants have two choices:

Do nothing or embrace the fact that payments are changing. Transitions from old systems to new ones require work and risk, but merchants who use modern technology are investing in the future and will certainly outperform those who choose to do nothing.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: American credit card, card, card present, chip, Chip and PIN, contactless technology, credit, data, debit card, digital payments, Digital wallets, EMV, EMV compliant, EMV EuroPay MasterCard Visa, merchants, Mobile Payments, payment innovations, payment methods, payment technology, payments, point of sale, POS, provider's, smartphone, tablet, token, tokenization, transaction

July 10th, 2015 by Elma Jane

Every Merchant in the country needs to upgrade their terminal. Are you ready for the October 1, 2015 Liability Shift?

Beginning October 1, 2015, all businesses that accept in-person payments must be able to take cards embedded with chips to avoid liability for fraud. The chips are more secure than magnetic stripes.

National Transaction brings the latest EMV and NFC technologies to Merchants.

NTC Clients will be able to accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. Additionally, the Ingenico terminals are EMV Enabled, delivering the latest in fraud prevention technology.

The new EMV enabled terminals are designed to accept EMV chip cards and magnetic stripe cards.

EMV (an acronym for Europay, MasterCard® and Visa®) is a global technology standard for payment cards.

What are the benefits of having an EMV terminal?

These next generation terminals can reduce your risk of accepting counterfeit cards, as chip and PIN transactions verify both the card and the cardholder.

Eliminate your card present fraud liability exposure associated with the October 1st, 2015* liability shift imposed by the card brands.

Improve customer service for your international cardholder customer. EMV cards are already the standard in over 80 countries.

Be on the lookout for more information about how to be chip card ready before OCTOBER.

*Businesses with Automated Fuel Dispensers (also called “Pay at the Pump”) acceptance methods have until October 2017 to comply with the new standard.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Mobile Payments, Near Field Communication, Point of Sale Tagged with: cardholder, cards, chips, EMV, emv cards, EMV terminal, EuroPay, magnetic stripes, MasterCard, merchant, nfc, payment cards, payments, PIN transactions, terminal, visa

July 7th, 2015 by Elma Jane

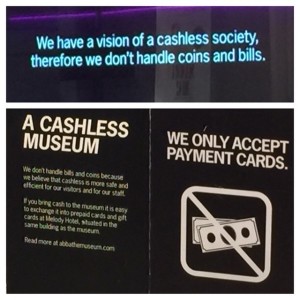

Cashless society is about to happen, hard to believe for some. We are all unable to decide on the edge of a new, cashless world where mobile payments reign supreme. If so, is this a bad thing? For some people yes, because for them change can be scary.

Every revolution needs a good crisis in order to grow its seed. The cashless revolution is the same. Current global financial conditions serves as the potential crisis, and truly the cashless revolution is upon us. Society is on the brink of great economic change, which will likely usher in a new era of worldwide, electronic currencies. The cashless society is coming.

Advances in mobile payment options as evidence of this impending cashless society, consider the practical benefits of mobile payments for the consumer. The most obvious is convenience. Many people prefer to swipe their smartphone atop a scanner to carrying around a stack of cash. Electronic payments are traceable, which is useful for tracking one’s spending and can add a sense of security. Also, carrying around large stacks of cash isn’t always feasible or safe.

Mobile payments also offer interested individuals a way to incorporate social media into their purchases; they can check-in to a site and tell all their friends about an exciting new product they bought, or announce their presence at a new coffee shop, all with that same initial swipe of an NFC-enabled phone. Add to this the many practical benefits of mobile payments as far as business owners are concerned, and it’s easy to see why so the technology is becoming so widespread.

And yet for all the benefits of mobile payments and point of sale technology, the two don’t necessarily exclude cash. Other company focuses on blending cash transactions with POS. This allows technologically savvy businesses to incorporate POS and mobile payment technology into their business, without excluding potential customers who prefer to use cash.

We aren’t necessarily evolving towards a cashless society, but towards a society with a plethora of payment options. POS technology is all about options. Want to pay with a swipe of your credit card? Swipe your credit card. Want to tap your NFC-enabled phone against a console. Tap and go. Want to pull a crisp twenty-dollar bill from your wallet and walk away from the counter with milk and eggs in your hand and a handful of coins jingling in your pocket? Go for it.

The question is: Will we ever become a truly cashless society? Maybe, maybe not, but as mobile payments become increasingly common, cash may very well fall into the retro category.

Posted in Best Practices for Merchants, Mobile Payments, Near Field Communication, Point of Sale Tagged with: credit card, electronic currencies, electronic payments, Mobile Payments, nfc, point of sale, POS, swipe

June 26th, 2015 by Elma Jane

As you can tell from the name, Android Pay playbook is remarkably similar to Apple Pay. Android Pay will use an on-board Near Field Communication (NFC) chip and tokenization services from the major networks to deliver a token from the phone to an NFC-enabled point of sale. Just like Apple Pay. Android Pay is supported by more than 700,000 merchant locations and Android Pay will provide APIs for app developers to take in-app payments from the on-board wallet. Both Apple Pay and Android Pay have fingerprint scanners on phones, you can enable payments with just a fingerprint scan.

While details are barely sufficient, rumor has it Google won’t charge banks a fee as Apple does on the transactions and that’s the difference. Additionally, technical differences in the operating systems underlying the payment system exist, but they won’t affect how every day users experience the system. Android Pay will suffer a slower upgrade path than Apple Pay, due to the lack of hardware support for the newer operating system (it can take Android twice as long to get users upgraded).

There is no war between Apple and google. NFC won the war! We are seeing all of the armies gather together under its flag. As consumers, we love to see better products. When it comes to payments, we need standards and reliability.

With the alignment of the two operating system platforms on NFC, on user experiences like fingerprint unlocking and on both in-app and retail payments, consumers, retailers, and app developers can build an ecosystem we can all understand. Credit cards work great because they are ubiquitous. Everyone can use them everywhere, and every retailer has incentives to be a part of the system.

An NFC-based mobile payments experience will have this same effect. Over the next five years more and more retailers will add NFC-capable terminals. More phones will be fully capable of NFC payments with fingerprint sensors. More consumers will carry those phones.

So if it’s not a war, are there any losers? Companies focused on plastic cards, but not NFC. Transitory technologies like Samsung Pay’s MST (magnetic secure transmission) also have a strong transition period as they enable payments at non-NFC enabled terminals. MST (magnetic secure transmission) is a strong player because the user experience is very similar (hold a phone to a reader), even if the technical method is not the same.

Posted in Best Practices for Merchants, Near Field Communication Tagged with: banks, chip, credit cards, merchant, Mobile Payments, Near Field Communication, nfc, NFC payments, NFC-capable terminals, NFC-enabled, payment system, payments, point of sale, tokenization

June 18th, 2015 by Elma Jane

Every Merchant in the country needs to upgrade their terminal.

Are you ready for the October 1, 2015 Liability Shift?

Beginning October 1, 2015, all businesses that accept in-person payments must be able to take cards embedded with chips to avoid liability for fraud. The chips are more secure than magnetic stripes.

National Transaction brings the latest EMV and NFC technologies to Merchants.

NTC Clients will be able to accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. Additionally, the Ingenico terminals are EMV Enabled, delivering the latest in fraud prevention technology.

The new EMV enabled terminals are designed to accept EMV chip cards and magnetic stripe cards.

EMV (an acronym for Europay, MasterCard® and Visa®) is a global technology standard for payment cards.

By accepting chip cards EMV terminal, you help protect your business from card present fraud liability and prepare your business for the future of payment application technology. If your business accepts and processes a counterfeit card transaction on a non-EMV terminal, the liability for that fraudulent transaction is yours, not incurred by the card issuers.

How do you process an EMV chip card transaction?

- Insert Card. Instead of swiping, the customer will insert the card into the terminal, chip first, face up.

- Leave the Card in the Terminal. The card must remain in the terminal during the entire transaction.

- The Receipt or Enter a PIN. As prompted, the customer will sign the receipt or enter their PIN to complete the transaction.

- Remove Your Card. When the purchase is complete, remind the customer to take the card with them.

What are the benefits of having an EMV terminal?

These next generation terminals can reduce your risk of accepting counterfeit cards, as chip and PIN transactions verify both the card and the cardholder.

Eliminate your card present fraud liability exposure associated with the October 1st, 2015* liability shift imposed by the card brands.

Improve customer service for your international cardholder customer. EMV cards are already the standard in over 80 countries.

Be on the lookout for more information about how to be chip card ready before OCTOBER.

*Businesses with Automated Fuel Dispensers (also called “Pay at the Pump”) acceptance methods have until October 2017 to comply with the new standard.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication Tagged with: cardholder, cards, chips cards, contactless payment, EMV, emv chip cards, EMV terminal, EuroPay, magnetic stripe cards, MasterCard, merchant, nfc, payment cards, payments, visa

September 17th, 2014 by Elma Jane

Host Card Emulation (HCE) offers virtual payment card issuers the promise of removing dependencies on secure element issuers such as mobile network operators (MNOs). HCE allows issuers to run the payment application in the operating system (OS) environment of the smart phone, so the issuing bank does not depend on a secure element issuer. This means lower barriers to entry and potentially a boost to the NFC ecosystem in general. The issuer will have to deal with the absence of a hardware secure element, since the OS environment itself cannot offer equivalent security. The issuer must mitigate risk using software based techniques, to reduce the risk of an attack. Considering that the risk is based on probability of an attack times the impact of an attack, mitigation measures will generally be geared towards minimizing either one of those.

To reduce the probability of an attack, various software based methods are available. The most obvious one in this category is to move part of the hardware secure element’s functionality from the device to the cloud (thus creating a cloud based secure element). This effectively means that valuable assets are not stored in the easily accessible device, but in the cloud. Secondly, user and hardware verification methods can be implemented. The mobile application itself can be secured with software based technologies.

Should an attack occur, several approaches exist for mitigating the Impact of such an attack. On an application level, it is straightforward to impose transaction constraints (allowing low value and/or a limited number of transactions per timeframe, geographical limitations). But the most characteristic risk mitigation method associated with HCE is to devaluate the assets that are contained by the mobile app, that is to tokenize such assets. Tokenization is based on replacing valuable assets with something that has no value to an attacker, and for which the relation to the valuable asset is established only in the cloud. Since the token itself has no value to the attacker it may be stored in the mobile app. The principle of tokenization is leveraged in the cloud based payments specifications which are (or will soon be) issued by the different card schemes such as Visa and MasterCard.

HCE gives the issuer complete autonomy in defining and implementing the payment application and required risk mitigations (of course within the boundaries set by the schemes). However, the hardware based security approach allowed for a strict separation between the issuance of the mobile payment application on one hand and the transactions performed with that application on the other hand. For the technology and operations related to the issuance, a bank had the option of outsourcing it to a third party (a Trusted Service Manager). From the payment transaction processing perspective, there would be negligible impact and it would practically be business as usual for the bank.

This is quite different for HCE-based approaches. As a consequence of tokenization, the issuance and transaction domains become entangled. The platform involved in generating the tokens, which constitute payment credentials and are therefore related to the issuance domain, is also involved in the transaction authorization.

HCE is offering autonomy to the banks because it brings independence of secure element issuers. But this comes at a cost, namely the full insourcing of all related technologies and systems. Outsourcing becomes less of an option, largely due to the entanglement of the issuance and transaction validation processes, as a result of tokenization.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Near Field Communication, Visa MasterCard American Express Tagged with: (MNOs), (OS), assets, bank, card, card issuers, cloud, cloud based payments, cloud based secure element, cloud-based, hardware secure element, Host Card Emulation (HCE), issuing bank, MasterCard, mobile, mobile app, mobile application, mobile network operators, mobile payment, mobile payment application, nfc, operating system, payment application, payment transaction, payments, platform, risk, secure element, smart phone, software, software based technologies, token, tokenization, transaction, virtual payment, visa

May 6th, 2014 by Elma Jane

Mobile commerce platform provider ROAM, an Ingenico company has expanded its mPOS solutions to include chip-and-PIN acceptance with the RP750x mobile card reader. The reader allows mPOS players to get to market quickly with their own custom-branded solution, providing merchants with a powerful set of features that include device and fraud management, remote application configuration, and an mPOS application that can be localized for any language and currency in any country. Features include: Backlit display, EMV PIN pad, magnetic stripe reader, NFC reader and smart card reader. Configurable through the cloud, enabling direct shipment from factory to any country. Connects with smartphones, tablets and feature phones via Bluetooth or audio jack. Customizable for branding and form factor. Just Slightly larger than a credit card, a compact form factor. PCI PTS 3.1 with SRED, EMV Level 1 and 2, Visa-ready (Compliant with the latest industry standards).

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Financial Services, Mobile Payments, Mobile Point of Sale, Near Field Communication, Payment Card Industry PCI Security, Point of Sale, Smartphone, smartSD Cards, Visa MasterCard American Express Tagged with: bluetooth, Chip and PIN, cloud, compliant, credit-card, currency, EMV, fraud, magnetic stripe reader, Merchant's, mobile card reader, Mobile commerce platform, mPOS solutions, nfc, PIN pad, smart card reader, Smartphones, tablets, visa

April 15th, 2014 by Elma Jane

Amsterdam, Netherlands-based Cardis has been piloting its technology in Europe with Raiffeisen Bank in Austria and Sberbank in Russia. They are now focused on the U.S., as this is the fastest growing mobile payments market in the world, where there’s a huge opportunity. Integration of technology with a large U.S. processor and with a major U.S. retail brand, which will be launching a mobile site and mobile app using Cardis solution.

Cardis International is planning an April launch in the U.S. for its technology, which enables merchants to accept low-value contactless or mobile payments without incurring high processing charges. Cardis is able to bring down the processing cost of low-value payments, the company said, by aggregating multiple transactions into a single payment.

The problem

Contactless card and NFC-based mobile payments are typically for low amounts, and yet still use a card processing infrastructure that was designed 40 years ago when the average credit card transaction was $100.

Traditional card processing systems require each transaction to be individually processed through the payment system, including authorization, clearing and settlement. The resulting variable costs of processing each transaction are independent of the transaction amount and too high for low-value payments, particularly in low-margin industries such as quick-service restaurants. QSR restaurants often have a 3 percent profit margin, yet, for low-value contactless payments, the processing cost could be as high as 6-7 percent of the transaction value.

Mobile and contactless cards offer consumers a convenient form factor. But they don’t solve the problem that low-value card payments are very expensive for merchants.

As an ever-increasing percentage of transactions have become cashless, card processing fees have become a significant cost. Costs that are based on the number of transactions, rather than their value. With average per person expenditures of $5 or under, feels each swipe fee much more than a business where customers spend $50 or more. But not accepting credit/debit cards for low-value transactions isn’t an option as many of customers don’t carry cash anymore.

Aggregation

Cardis’ solution is to act as an aggregator of low-value payments, sending a single batched transaction through to a processor instead of multiple low-value transactions. As there is no per transaction processing of individual low-value purchases, the cost-per-transaction is significantly reduced.

Cardis provides its technology as a software plug-in to payment service providers for contact-based and contactless card payments, mobile wallet transactions and NFC payments.

There are two models. For card payments, it will aggregate multiple purchases by an individual cardholder at a single merchant on a post-paid basis up to a specific amount, for example $20. To guarantee payment to the merchant, since the aggregated transaction is processed at a later date, it will pre-authorize an amount, for example $15, the first time the customer makes a purchase at that merchant.

Alternatively, merchants can opt for Cardis’ prepaid system. This involves the consumer setting up a prepaid account hosted by Cardis’ sponsoring bank that is topped up via ACH (automated clearing house) transfers. Using the Cardis prepaid account on a smartphone provides the digital equivalent to cash.

With its post-paid solution, merchants will save 30-50 percent per transaction compared to conventional card processing fees, while its prepaid solution saves merchants 80 percent per transaction. With the post-paid solution, it will only aggregate a customer’s purchases at a single specific merchant. But, as the prepaid solution aggregates the customer’s purchases across multiple merchants, this enables to offer a much lower processing fee to the merchant.

Cardis provides an audit trail enabling consumers to track individual transactions that are aggregated using its technology. Consumers don’t lose any of their card protection rights and guarantees by agreeing to let a merchant aggregate their payments through Cardis. They can always charge back any disputed transactions.

Cardis sees opportunities for digital content providers such as online music stores and games providers to use its aggregation technology. It can integrate solution with existing digital wallets.

Raiffeisen

In 2012, Austria’s Raiffeisen Bank launched a pilot of Cardis technology for NFC-based Visa V Pay debit card payments in partnership with Visa Europe. Raiffeisen’s MobileCard mobile payment product uses a secure element stored on an NFC-enabled MicroSD card inserted in a mobile phone. Although Cardis supports secure elements stored on SIM cards as well as on MicroSD cards and on the cloud, Raiffeisen opted for MicroSD cards, as this is an easier solution to implement.

Raiffeisen cardholders participating in the pilot use MobileCard on average three times a week, with an average transaction value of ($5.70). Merchants accepting MobileCard are seeing 40 percent to 70 percent lower merchant processing fees for an average transaction value of ($5.43) to ($13.60).

Spindle

In October 2013, Spindle, a U.S. mobile commerce company, signed an agreement with Multi-max, a manufacturer of vending machines for mid-size and small offices throughout North America, Europe and Asia. Spindle will integrate its MeNetwork mobile commerce technology into Multi-max’s line of K-Cup vending machines for rollout across the U.S.

The MeNetwork solution will incorporate all card-based payment acceptance services, as well as mobile marketing services. Spindle’s partner Cardis will provide low-value payment processing services for purchases at K-Cup vending machines.

Posted in Credit card Processing, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Gift & Loyalty Card Processing, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Near Field Communication, Payment Card Industry PCI Security, Smartphone, smartSD Cards, Visa MasterCard American Express Tagged with: accept, ach, aggregated, aggregation, aggregator, authorization, automated clearing house, average transaction, batched, card payments, card processing infrastructure, card processing systems, card-based payment acceptance, cardholders, clearing, contactless, contactless payments, cost-per-transaction, credit card transaction, debit card payments, Digital wallets, high processing charges, low-value payments, merchant aggregate, Merchant's, microSD, mobile app, mobile commerce, mobile payment, Mobile Payments, mobile site, mobile wallet transactions, nfc-based, payment service providers, pre-authorize, prepaid, processed, Processing, processing cost, processing fees, processor, settlement, smartphone, transactions, transfers

April 11th, 2014 by Elma Jane

A new standard that uses Host Card Emulation (HCE) was introduced by VISA to enable financial institutions to securely host Visa accounts in the cloud. Visa’s move to support HCE includes tools and services as well as the standard. It is available now and will include support for QR codes and in-app payments in the future.

With this new service and platform that Visa is developing, it will enable clients and partners to issue Visa accounts digitally in the cloud, on secure elements in smartphones, or linked to a digital wallet. The solution will also enable the issuance of payment tokens that will replace the 16-digit payment account number and can be limited for use with a specific device, merchant or payment channel.

Layers of security will deploy by Visa to protect payment accounts in the cloud, including at the Visa network, application and hardware levels. Device fingerprinting technology, one-time use data, payment tokens and real-time transaction analysis will make up a multi-layered defense against unauthorized account access for their services.

Visa has intensified its Visa PayWave contactless payment application and is introducing a new implementation guidelines, program approval process standard and requirements for their standards.

Visa is also developing a tool, its software development kit (SDK) to support clients who wish to develop their own cloud-based payment applications or want to enhance their existing mobile banking applications with Visa PayWave functionality.

HCE is introduced to make it easier for developers to create NFC applications like mobile payments, loyalty programs, transit passes, and other custom services. Visa’s move to enable NFC payments with Android devices is welcome news and will guide the way for the payments industry.

Clients and partners around the globe are continuously looking for cost efficient, flexible and secure ways to enable mobile payments. The Android HCE feature provides with a platform to evolve the Visa PayWave standard, support the development of secure, cloud-based mobile applications, while at the same time offer greater choice.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Electronic Payments, Financial Services, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: accounts, android devices, approval, cloud, cloud-based mobile applications, contactless payment, device fingerprinting, Digital Wallet, digitally, financial institutions, HCE, host card emulation, in-app, mobile banking, nfc, payment account number, payment channel, payment tokens, payments, qr codes, real-time transaction, secure elements, securely, Smartphones, unauthorized, visa, visa network

March 17th, 2014 by Elma Jane

Young people and Londoners are leading the way in adopting cashless payments in the U.K., The U.K.-based market research firm also found that non-bank electronic payment methods such as PayPal are trusted more than contactless and mobile card payments.

According to research, 38 percent of British people are interested in being able to make mobile payments and an enthusiastic 8 percent claim they would apply for mobile payment services straight away. Eighteen percent of U.K. Internet users say they would prefer to be able to stop using cash altogether.

Support for a cashless society is strongest in London, with 30 percent prepared to stop using cash. And it is the nation’s youth who are leading the way in new payment forms. Twenty-two percent of those aged 25 to 34 have used Barclays’ Pingit peer-to-peer mobile payment system, compared to 5 percent of those aged 45-54. About 17 percent of 25- to 34-year-olds have used the virtual currency Bitcoin at least once.

However, consumers are more concerned about the security of mobile payments than card payments. Sixty-five percent of consumers showed some concern about mobile payment security and 61 percent showed some concern about contactless cards, compared with 34 percent who were concerned about using debit cards and the 33 percent who were concerned about credit cards.

Consumers were notably less concerned about using non-bank payment services such as PayPal, which protect users’ financial data from being seen by third parties. Only 27 percent of Internet users are concerned about using non-bank payment services such as PayPal.

Posted in Credit card Processing, Credit Card Security, Digital Wallet Privacy, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Smartphone Tagged with: card payments, cashless payments, cashless society, contactless, contactless cards, credit cards, debit cards, electronic payment methods, financial data, internet users, mobile card payments, mobile payment security, mobile payment services, non-bank, non-bank payment services, peer-to-peer mobile payment system, Security, Virtual Currency