Category: Point of Sale

August 30th, 2024 by Admin

According to a poll by OnePoll on behalf of I Love Velvet titled “Consumer Mobile Point-of-Sale (MPOS) Attitudes Report” over half of retail customers think cash registers are outdated. The poll found that 51% of Americans think the cash register could soon be gone altogether as retailers opt for mobile point of sale systems. Consumers seem to favor MPOS systems allowing the shoppers to check out from anywhere in the store and that they return more often to stores with modern electronic payment technologies. Thirty five percent cited they would shop more often at stores with mobile point of sale payment systems. An additional 17% said they would share their shopping experience via social networking sites and 35% report they likely would tell a friend or recommend stores with these technologies. Forty six percent say that stores that have mobile payment systems seem to be more tech savvy and even more (56%) praise the store for making the experience more convenient and secure. Retailers are struggling to modernize their payment platforms to cut down long lines at registers, and place staff on the floor for better customer access. “It’s a great opportunity for retail store owners to dip into the mobile point of sale arena” said Richard Delos Santos of National Transaction Corporation.

Mobile point-of-sale equipment and software manufacturers are stepping up to the security plate as they seek to pass PCI DSS and other security related issues. As new mobile kiosks and point of sale hardware and software evolve so do the security challenges used to thwart credit card fraud and identity theft. The challenge for point of sale system providers is to create an increasingly secure and convenient way for customers to make electronic payments in-store or on their mobile devices. iPads, iPhones and Android tablets are often used by curious shoppers to compare and contrast features, prices and availability, why not let digital wallets be used to close the transaction? The use and connectivity of these new devices mean more complex security measures are needed to thwart attackers, crackers, and hackers.

In the coming years everything from NFC, to fingerprint readers in smartphones and tablets and even QR codes will change the landscape of mobile payment transaction processing and things are beginning to heat up. An estimated $17 Trillion of mobile transactions are predicted by 2020 and security and adoption will reign king on the streets. It might be time to look into the security and features that a mobile point-of-sale system can add over any existing point of sale systems and cash registers. Mobility is a great tool for a sales force, but security and convenience for the customer is a necessity that will only grow in the future.

If You need help setting up a merchant account, Call 888-996-2273 Today!

Posted in Credit Card Reader Terminal, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: Android, ipad, Iphone, mobile, MPOS, payments, point of sale, Processing, smartphone, tablet, transaction

February 9th, 2022 by Admin

John Stewart

January 17, 2022

https://www.digitaltransactions.net/trends-like-open-banking-and-bnpl-will-sustain-e-commerces-hot-streak-a-report-says/

Open banking, single-click checkout wallets, and the hot buy now, pay later trend will all help drive e-commerce volume worldwide in the coming five years, predicts Juniper Research in a report released Monday. This momentum is likely to push online sales long after the short-term impetus from the pandemic subsides, Juniper says.

E-commerce volume totaled $4.9 trillion globally in 2021, a figure the United Kingdom-based research firm forecasts will reach $7.5 trillion in 2026, when China will control a 37% share. Wider availability of multiple e-commerce channels, including mobile devices, will propel the overall growth worldwide, Juniper says. But along with the boom in e-commerce will come a corresponding growth in fraud via identity theft, account takeovers, and fraudulent chargebacks, the report warns. China, for example, will account for more than 40% of fraud losses worldwide in 2025, at more than $12 billion, Juniper forecasts.

Open banking is a trend by which fintechs can verify balances in consumers’ accounts and transfer funds to pay for online purchases. As standards bodies work to promulgate standards for this business, e-commerce payment providers “should … partner with specialists in … specific emerging payment areas to keep pace with changing merchant expectations around acceptance types,” the research firm says in its release, referring to digital wallets and crypto as well as open banking.

Open banking has taken on a higher profile in the global payments market with efforts by both of the global card networks to acquire firms that specialize in this area. Visa Inc. has acquired Tink AB, while Mastercard Inc. bought Aiia and Finicity Corp.

Physical goods will continue to dominate e-commerce spending, the report says, accounting for 82% of payment value by 2026. To tap into the trend, Juniper advises, payments providers should support buy now, pay later plans, which allow consumers to split purchases into four equal installments paid over a six-week period at no interest. BNPL is becoming more controversial, however, as the Consumer Financial Protection Bureau has launched an investigation of the option and as reports emerge that consumers with multiple accounts are more likely to miss a payment.

While still a big trend, e-commerce sales in the U.S. market cooled significantly last year as the pandemic effect lost some of its force. Third-quarter sales in 2021 reached $214.6 billion, up 6.6% year-over-year, according to the Census Bureau, which tracks retail sales. That follows an 8.9% rise in the second quarter and three straight quarters with increases of 32% or more. Fourth-quarter 2021 results are not yet available.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Financial Services, Mail Order Telephone Order, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Point of Sale, Small Business Improvement, Smartphone, Uncategorized, Visa MasterCard American Express Tagged with: banking and e-commerce, e-commerce, e-commerce businesses, e-commerce merchants, e-commerce processor, e-commerce transactions, ecommerce, ecommerce merchant, ecommerce merchants, ecommerce sites, mobile commerce payment, mobile payment, Mobile Payments, mobile processing transactions, mobile transactions, mobile wallet, mobile wallet transactions, mobile wallets, mobile-commerce payments, online transactions, point-of-sale transactions, transaction processing, transactions, wallet

January 12th, 2017 by Elma Jane

Accepting non-cash payments from your customers are valuable. If you don’t, you will miss out on sales; because of the growing numbers of customers who only carry plastic or wish to pay online. Today, you have many payment solution options.

Credit Card Terminals – you might remember the beginning of the credit card era and i’ts evolution with today’s countertop terminals. From the traditional swipe of their credit, debit or even gift card to make a purchase to today’s modern terminals. Like accepting EMV chip cards (to be in compliance with a PCI mandate) and NFC payments like Apple Pay.

Beyond the basics; these systems are generally supported by reporting sites that can help you monitor sales, and assist you with maintaining customer loyalty programs.

E-Commerce Solutions – online sales are growing every year. If you are considering an expansion of your business online; you need a complete hosted payment solution for transactions in all payment environments. Including in-store, back office mail/telephone order (MO/TO), mobile and e-commerce, that make your customers’ experience as intuitive and efficient as possible.

Point of Sale Systems – smart registers have evolved into high-tech point-of-sale (POS) systems due to technology advances. Not only taking customer payments; but it can transform your business with an advanced marketing programs, inventory management and sales and profitability tracking and reporting. Over the past years these advanced systems have become cost-effective and easy to use.

Wireless Terminals – in today’s hardware you have the option of accepting payments wirelessly, through a full-service terminal that is smaller than a countertop model, or through a mobile card reader plugin for a smartphone or tablet.

The advantage of a full-service wireless terminal is that it allows for receipt printing on the spot through the device and most modern full-service wireless terminals are EMV compliant and accept both EMV (chip card) and NFC payment types.

Call now 888-996-2273 and speak to our payment consultant to know which solution is best for you.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mail Order Telephone Order, Near Field Communication, Payment Card Industry PCI Security, Point of Sale Tagged with: card reader, chip cards, credit card, debit, e-commerce, EMV, gift Card, mobile, moto, nfc, online, payment solution, payments, PCI, point of sale, smartphone, terminals, transactions

September 16th, 2016 by Elma Jane

National Transaction offer valuable features and benefits, if you want to improve your business’s productivity, you should look for the following features below, that you need from your Electronic Payments provider.

Advanced Security Options – 6 out of 10 small businesses close within six months of a card data breach, it is important that Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. NTC offer Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. The Top-tier security is important on your business’s data especially customer information, consider adding additional authentication procedures.

Fast Payment Processing – first step is having up-to-date technology, because some customers might leave, the sooner you have the money processed by your provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – obtaining the features you need from your payment services provider is very important. Look for a provider that appropriately addresses your payment concerns.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. Furthermore, the app works with most Apple and Android mobile devices. Accept a key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad or the new RP457c card reader.

Reliable Customer Support – NTC is available 24/7, the phones are answered by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is the most important feature of any business partnership you make. At NTC we are very passionate about that.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a payment service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, Credit Card Security, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Breach, card data, card reader, chip card, contactless payments, data, EMV, encryption, merchants, mobile, mobile payment, nfc, payments, Payments provider, point of sale, provider, Security, service provider, smartphone, swipe, tablet, terminal, tokenization, transactions

August 11th, 2016 by Elma Jane

CURRENCY CONVERSION

Multi Currency Conversion (MCC):

In addition to 100+ supported currencies and all transactions autosettle at 6pm (eastern) daily.

Customer is unaware of the converted currency, also customer may not opt-out at the point of sale.

Conversion occurs between the point of sale and settlement.

E-commerce only and no merchant rebate.

Price listed in customer’s currency conversion also Supported by Internet Secure or direct certification.

Dynamic Currency Conversion (DCC): Customer is aware of the Conversion Currency, also customer may opt-out at the point of sale.

Conversion occurs at the point of sale and five supported currencies less than MCC.

Merchants may choose settlement method and time in addition to merchant rebate up to 100bp.

Price listed in merchant’s currency conversion.

For Retail, Restaurant, MOTO and E-commerce.

Supported by terminals, via Warp and Virtual Merchant.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Point of Sale Tagged with: currency, customer, DCC, Dynamic Currency Conversion, e-commerce, Internet Secure, MCC, merchant, moto, Multi Currency Conversion, point of sale, retail, terminals, transactions, virtual merchant

July 26th, 2016 by Elma Jane

Mobile payment space is growing yet, many small businesses and retailers are choosing to overlook the idea of mobile payment acceptance.

Here are stats that prove the importance of mobile payments:

About 45% of consumers use mobile payments out of convenience.

1 billion users will use in-store mobile payments by 2019.

An increase from $3.2 billion in 2014 to $487 billion by 2020 in US in-store mobile payments is predicted.

Millenials use contactless payments on a regular basis.

Over the next five years, mobile payments will reach about $3 trillion in volume.

There are 16 million Starbucks mobile app active users that make 8 million mobile payments per week.

Transactions globally are on mobile devices.

It is a great investment for a merchant to upgrade your point-of-sale (POS) to have near field communication (NFC) capabilities. If you’re not currently accepting mobile payments, you should start now, your customers who are already using mobile payments will thank you and your business will be ahead of the game as more businesses onboard mobile payment acceptance.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, Mobile Payments, Near Field Communication, Point of Sale Tagged with: contactless payments, customers, merchant, mobile payment, Near Field Communication, nfc, point of sale, POS, transactions

June 7th, 2016 by Elma Jane

Merchants need to stay competitive by offering the most modern forms of electronic payment processing technology to satisfy customers, because, in today’s world of smartphones and one-the-go payments, consumers have options in how they conduct their transactions. With proper education on the types of payment options, merchants can make the right decision for their business.

NTC is here to discuss that payment options.

EMV – or Europay, MasterCard, Visa is a fraud-reducing technology to protect card issuers, merchants, and consumers from counterfeit or stolen cards. The customer inserts or dips the chip card into the EMV terminal, rather than swiping the card at the point of sale. A one-time-use code is created for that transaction. This code makes it virtually impossible for anyone to duplicate, leaving customers safer from fraud.

NFC – stands for near field communication is a method of contactless data exchange between two electronic devices. NFC is used in mobile wallets such as Apple Pay, Android Pay, and Samsung Pay. More and more consumers leaning towards mobile wallets, merchants should be prepared to accept NFC payments by incorporating NFC-enabled equipment.

Virtual Merchant Mobile Payments – Mobile Payments are popular, you can take payments anywhere. Ideal for retail, restaurant and service businesses of any size. Accept payments your way online, in-store and on the go. Anytime and anywhere.

Offers flexibility you want with the payment security you and your customer need:

- Accept credit and debit cards, including mag stripe, chip cards, and contactless payments/NFC, like Apple Pay and other mobile wallets.

- Calculate discounts, taxes, and tips automatically.

- Email customer receipts.

- Help protect cardholder data with an encrypted, chip card device.

- Record cash transactions.

- Use your own smartphone or tablet (works with most IOS and Android mobile devices).

Check out NTC’s electronic payment solutions that are EMV-capable, NFC-enabled and mobile wallet ready.

Posted in Best Practices for Merchants, Electronic Payments, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: chip card, consumers, contactless payments, customers, data, debit cards, electronic payment, EMV, fraud, merchants, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, point of sale, Security, Smartphones, terminal, transactions

May 18th, 2016 by Elma Jane

Terminals are ready, but the software isn’t – many merchants have EMV capable equipment, but has not been activated yet because it still needs to be certified.

The certification process includes security and compatibility tests.

For a small merchant, all you need to worry about is your equipment or software is EMV certified.

For software, developers, terminal manufacturers needs to get certification before they can deploy their products to merchants.

So many merchants who want to accept EMV, are now just waiting for their POS system to get necessary upgrades, which they can’t do until they’re certified.

Slower Checkout Time – common complaint by consumers. Dipping takes several seconds longer than swiping the card. There’s also a chance of forgetting your card because you have to leave your card inserted while waiting for the transaction to get approved.

The fastest Path to EMV – Depending on the nature of your business, the risk of landing yourself for credit card fraud is slim. The easiest way is to contact your merchant account provider and they will tell you what equipment and software you need and how much it will cost.

For our retail customers, we have the iCT250, the smart and compact desktop device designed for maximum efficiency. iCT250 offers a smart and effective payment experience on minimum counter space. Accept all electronic payment methods including EMV chip & PIN, magstripe and NFC/contactless.

For card-not-present, we have our payment gateway platform that accepts payments your way Online, In-Store and On the Go.

- E-commerce – manage your e-com business along with all of your other payment transactions in one, secure place.

- In-Store – accept payments in person with ease using your computer and a broad range of an optional device, like card readers and PIN pads.

- Back Office Mail & Phone – Process you mail and phone payments online. Converge is ideal for recurring and installment payments too.

- Mobile – Take payments on the go with an intuitive mobile app that’s compatible with most smartphones and tablets.

For more details give us a call at 888-996-2273 or check out our website for our products and services.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Internet Payment Gateway, Mail Order Telephone Order, Merchant Account Services News Articles, Mobile Payments, Near Field Communication, Point of Sale, Smartphone, Travel Agency Agents Tagged with: card, card readers, Chip & PIN, consumers, contactless, credit card, customers, e-commerce, electronic payment, EMV, fraud, in-store, magstripe, merchant account, merchants, mobile, nfc, online, payment, payment gateway, PIN pads, POS, provider, Security, terminals, transaction

February 25th, 2016 by Elma Jane

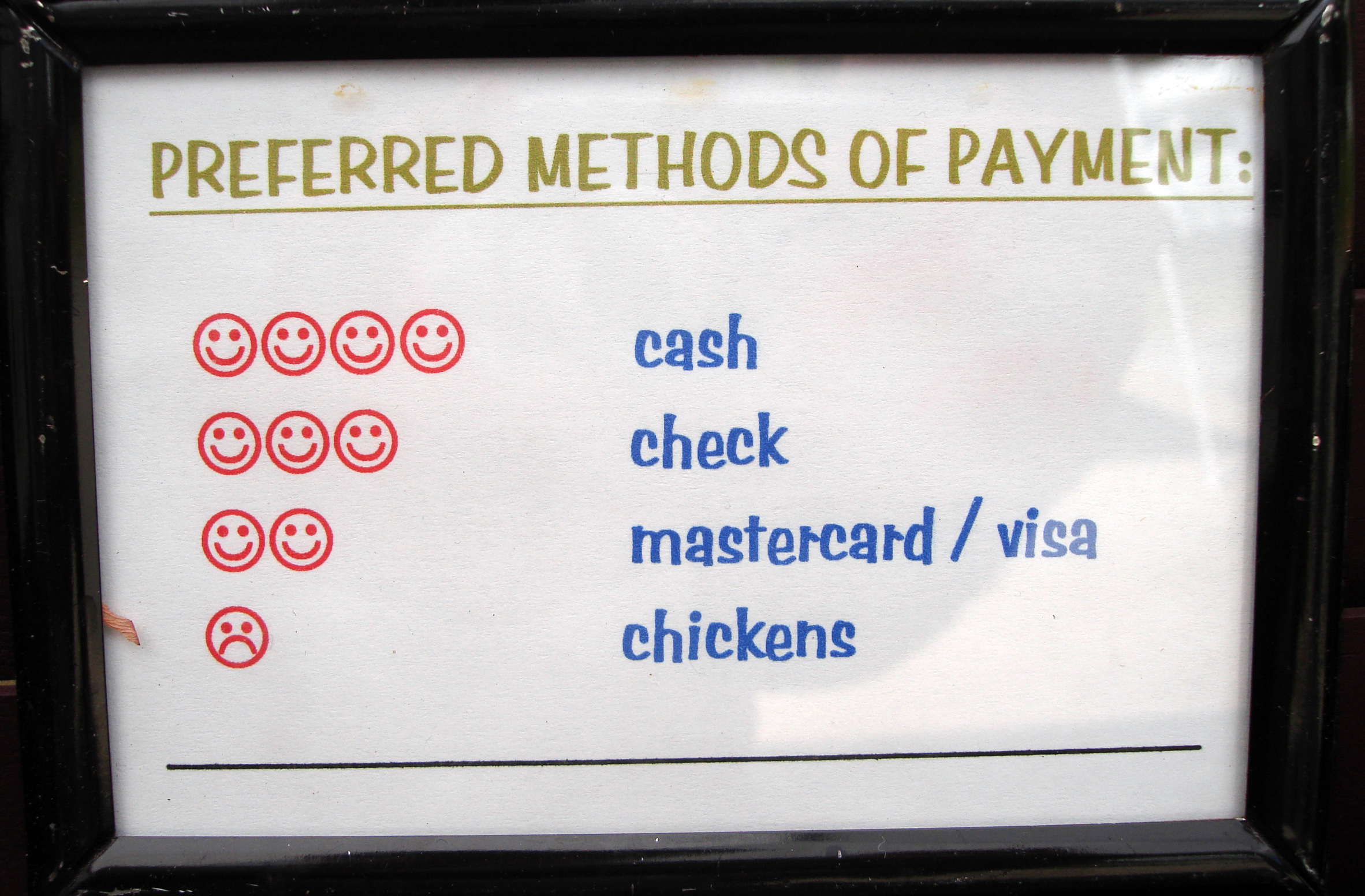

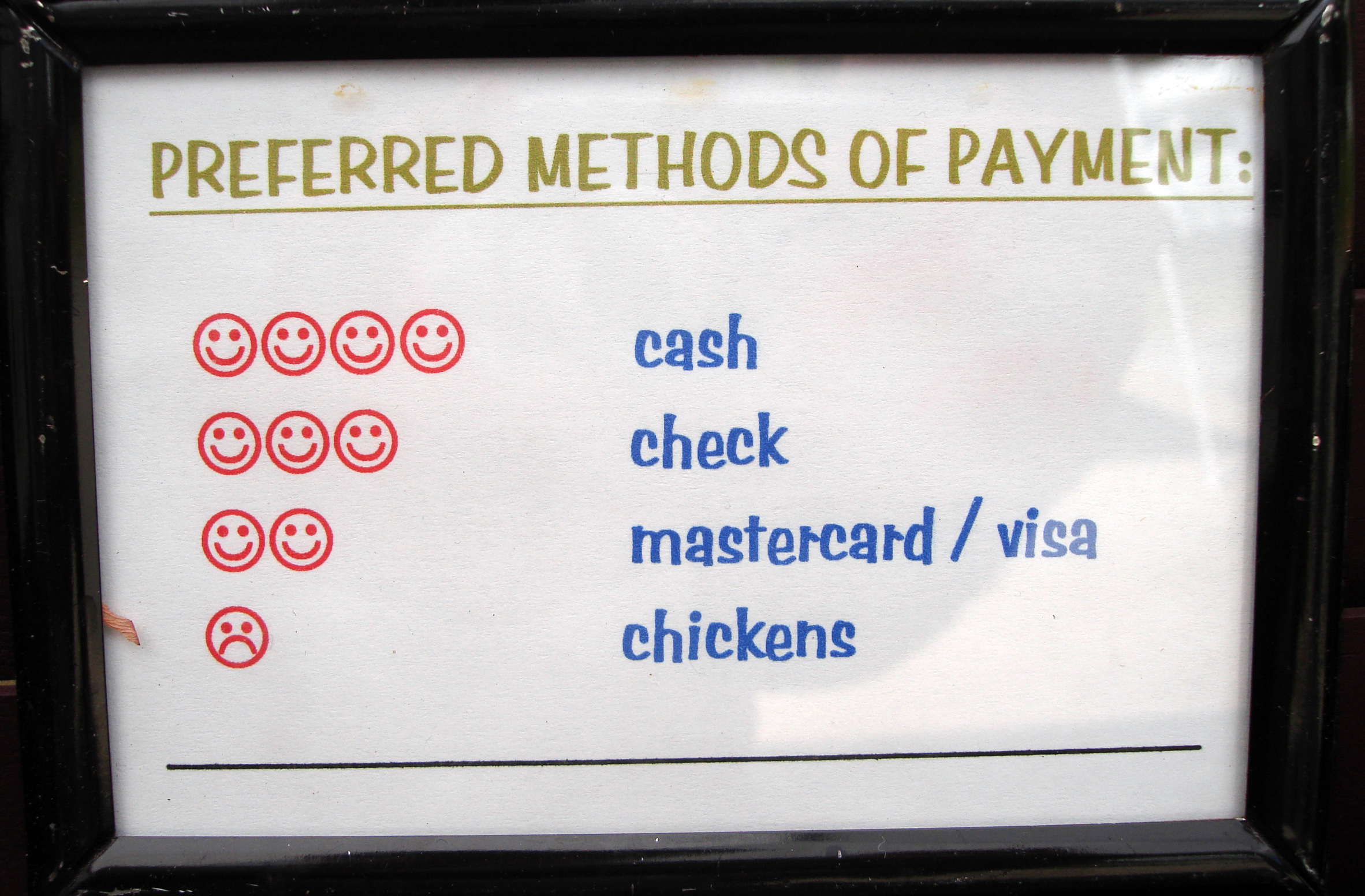

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions

February 24th, 2016 by Elma Jane

Merchants can bring in new customers and encourage repeat business by using their point-of-sale terminal as a marketing tool. A point-of-sale terminal allows you to process payment and accept debit and credit cards, and generate more business by using the right tools.

Customize Receipts – a customized receipt becomes an advertisement. The customer knows where that receipt is from should they want to contact you.

Gift Cards Program – Gift card recipient are likely to spend over the face value of the card. Customers will appreciate simplified gift shopping.

Loyalty Program – Loyalty program makes customers think of your business first and encourages them to come back often to earn a reward.

Referral Rewards – Print an offer to reward referrals, so they can send people to you.

A merchant account is not just an expense by finding the right tool you can generate more income for your business!

visit www.nationaltransaction.com today, or call 888-996-2273 Extension 1

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Point of Sale Tagged with: credit cards, customers, debit, gift Card, loyalty program, merchant account, merchants, payment, point of sale, terminal