Category: Small Business Improvement

October 18th, 2018 by Admin

As your business grows, your time seems to shrink. Here are some tips that can help you manage your time better.

Create a Plan

Creating a plan will always lead to a successful day. Organization will allow you to have a much more balanced day and better quality of life while running your business. Be sure to write down all the tasks you need to get done. Having them written down will give you a better idea of how much you have to do and what needs to get done.

Have a Calendar

Along with a list of all of your tasks, a calendar will help you figure out what else is happening throughout the day. Do you have meetings to go to, people to talk? A calendar will be your best friend for better time management. It will also help you block out time to get your to-do list done.

Prioritize

Now that you have your list and your list, it is time you prioritize and figure out what needs to get done first. A common mistake is to go down your to-do list as you wrote it and that is not efficient. Figure out your “Must’s”; “Should’s” and “can wait’s” so you can get the best out of your day. You will realize that many tasks are not as important for your productivity as you might think.

Delegate

Now that you see what you must do first, do you need to do it yourself? Perhaps some tasks do not require all of your attention. That is when delegating will be your greatest ally for time management. That run to the store for supplies can be done by your employee or family (if you run your business from home).

Learn to say no

Along with running and managing a business, there will be things that, while you would love to do, are not necessary for you to do. Learn to say no in a polite way and you will find yourself more organized and meeting deadlines faster. Sure, you might have a few disappointed people at first, but they will realize that you are working on being efficient for them and you and it will add value to your service.

Track your time spent

Do you feel you are spending way too much time on a task or job? Perhaps it is time you start tracking your time. This is an excellent tool for freelancers who find themselves working day and night. Tools like TopTracker can keep you accountable and give you perspective on how much time you are truly working. It will help you learn and adjust if necessary.

Eliminate Time Wasters

There are plenty of time wasters at the office! That e-mail didn’t need to be checked so many times, and that note could have waited for later. No, you do not need to check Facebook before work. Setting boundaries will allow you to become much more productive and have more time to do tasks like this after you have completed your list.

Always plan to be early

When it comes to meetings, calls or events, always plan to arrive early, this will help you prepare for unseen events like traffic jams or car problems. Practicing this habit will help you be on time and have less stress.

Take Small Breaks

To get all of your tasks done, you must take breaks. Taking breaks will allow your mind to rest for a few minutes and can help you become a lot more productive. Be sure to use your calendar so you can schedule some break time every day.

Focus

Lastly, focus. Know that the tasks needed need to get done in a timely matter. Be sure you focus and avoid any distractions while getting it all done. Focusing will help you be done with all tasks sooner than you think.

We hope these steps can help you get more out of your day and you can be in control of your time better.

Posted in Small Business Improvement Tagged with: business, business goals, calendar, data, delegate, efficiency, entrepreneur, entrepreneurship, freelancer, leaderhip, manage, plan, planner, planning, professionalism, smartphone, technique, time management, tools, track time

September 18th, 2018 by Admin

Starting a business can be tough. It requires time, effort and passion like no other. It requires you to have tough skin and not allow the small things to bother you.

Although all of these qualities can be good, you still need to start and you need money, right? Not necessarily. Starting a business doesn’t always require you have a big amount of money or a business loan. There is some business that requires little to absolutely no money to start. And to be honest, with a little of resourcefulness, you can make your business big while spending less.

Here are 3 simple businesses to start with no money:

- Start an online business: With the age of social media and the internet, starting a business online it can be as simple as 123. You can sell T-shirts on places like Zazzle or Cafepress (to name a few) and get your own designs going. If you have a passion for graphic design or just have really cool sayings and ideas, this is a sure way to get started and only requires you to open up an account, upload designs, and spread the word.

- Sell your things: Making money doesn’t have to be complicated. You might have things laying around that you no longer need or you know you will never use. You can simply turn to places like Facebook Marketplace, eBay or any online marketplace platform to sell up your used or gently used goods. Want to make it a bigger business? Check out garage sales, pick up free stuff (also being offered online) and get going. No money required.

- Sell up your skills: Blogging, writing, or just really good computer skills? Become a professional writer or Virtual Assistant and get paid to use up those skills! You can promote yourself online in places like Fiverr, UpWork, Craigslist and even Facebook Groups (Just be sure to follow the group’s guidelines on this!) Some of this are 100% free to promote and get work while others charge you a minimal fee after you get your first gig.

Remember that being an entrepreneur is already making you be part of the different, the risk takers and the creative. So don’t play down your skills. You can start for free and grow from there. Even migrate to other passions of yours that can be turned to business.

Posted in Small Business Improvement Tagged with: blog, blogging, business, business tips, cafe press, craigslist, ebay, entrepreneur, Facebook, fiverr, freelancer, online business, social media, start a business, start-up, t-shirt, t-shirt printing, tips, upwork, virtual assistant, work from home, writing, zazzle

September 28th, 2016 by Elma Jane

Business Lines of Credit – is for businesses with an inconsistent cash flow. Either businesses that needs to borrow a small amount of capital, and businesses that use invoices.

Different types of lines of credit:

Cash Account, the most basic line of credit – which you can access when you’re in need of capital; whether you’re making a large purchase or covering a temporary gap in cash flow. You only have to pay the interest on the amount that you borrow; with this form of financing, the money is always available when it’s needed.

Inventory Line of Credit – specifically intended for purchasing inventory.

This kind of loans give the merchant, two advantages:

- First of all, you can purchase inventory wholesale.

- Second, purchasing inventory won’t take a large amount out of your cash flow because you’ll be paying in increments instead of one lump sum.

Invoice Financing – basically, this is a line of credit where invoices are the collateral.

Personal Loans Used for Business: Startups and young businesses, merchants who have excellent personal credit. Furthermore, personal loans are term loans that can be used for a number of purposes.

If your business is new to qualify for a business loan, consider using a personal loan.

Short Term Financing: Is for young businesses experiencing rapid growth.

Short term financing covers merchant cash advances and short term loans.

Term Loans: Is for Businesses that need cash to fund one-time expenses like equipment purchase/real estate or expanding a business. Term loans are basic, everyday loans. The merchant receives the capital in one lump sum and repayments are almost always monthly.

For more information about Loans/Financing call us at 888-996-2273

Posted in Best Practices for Merchants, Merchant Cash Advance, Small Business Improvement Tagged with: cash advances, credit, financing, loans, merchant

August 3rd, 2016 by Elma Jane

National Transaction offer valuable features and benefits. If you want to improve your business’s productivity, you should look for this features that you need from your merchant account provider.

Advanced Security Options – did you know that 6 out of 10 small businesses close within six months of a card data breach? Point-of-Sale devices should have appropriate security measures, particularly EMV, encryption and tokenization. With National Transaction we have Safe-T for Small and Medium Businesses and Safe-T for Large Businesses. Top-tier security is important on all your business’s data especially customer information, consider adding additional authentication procedures. Merchant account providers bundle various security features to make the process of becoming secure.

Fast Payment Processing – having up-to-date technology is the first step because some customers might become annoyed by slow service and leave. The sooner you have the money processed by your merchant account provider, the bigger and stronger your business can become. NTC is adept at administering payments quickly and efficiently. We can provide regular funding or next day funding.

Feature Flexibility – Look for a merchant provider that appropriately addresses your payment concerns. Obtaining the features you need from your merchant services provider is very important.

Mobile Payment Processing – NTC offer Virtual Merchant/Converge Mobile that gives you the ability to accept payments using your smartphone or tablet anywhere you go. The app works with most Apple and Android mobile devices. You can accept key-entered transactions or swipe cards using an encryption reader. You can now take chip card payments using Ingenico iCMP PIN Pad. Merchants who aren’t mobile payment capable do demonstrate unwillingness to progress with payment technology and might lose customers eventually.

Reliable Customer Support – NTC is available 24/7 answering the phone by humans and not automated systems. You got support with your hardware, answer questions and guide you to better understand the process. Customer support is perhaps the most important feature of any business partnership you make. You don’t want to choose the wrong provider.

Up-to-Date Tech – futuristic features, like mobile payment abilities, EMV/NFC, contactless payments are worth investing. Modern consumers are generally more familiar with up-to-date payment systems. Seeing a merchant service provider offer a swipe-only terminal should be a red flag, because the recent regulations require merchants to have EMV to provide better data security.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Financial Services, Merchant Account Services News Articles, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Small Business Improvement, Travel Agency Agents Tagged with: account, Breach, card data, chip card, customer, EMV, encryption, merchant, mobile, payment, point of sale, provider, Security, tokenization, transactions

June 3rd, 2016 by Elma Jane

To be responsive to the needs of our merchants and to meet that needs NTC offers next day funding. This is a value added service for customers and businesses that need to have their funds available quickly.

With more than 15 years of experience, National Transaction offers a variety of electronic payment services and technology for businesses.

Our services include:

Currency Conversion, credit, and debit card processing, e-commerce and gateways, electronic checks, gift and loyalty card programs, mobile processing, cash advances and loans/funding program. We also have NTC e-Pay and MediPaid.

NTC e-Pay – is an Electronic Invoicing that made simple with NTC e-Pay! Free Setup, Nothing To Integrate, Secure, and Fast. Invoice customers Electronically with NTC e-Pay. Our e-Pay Platform can help Travel Merchants bring new customers and encourage repeat business.

Our Virtual Merchant Gateway – accept payments your way! Online, In-Store and On the Go. A payment platform that flexes with your business.

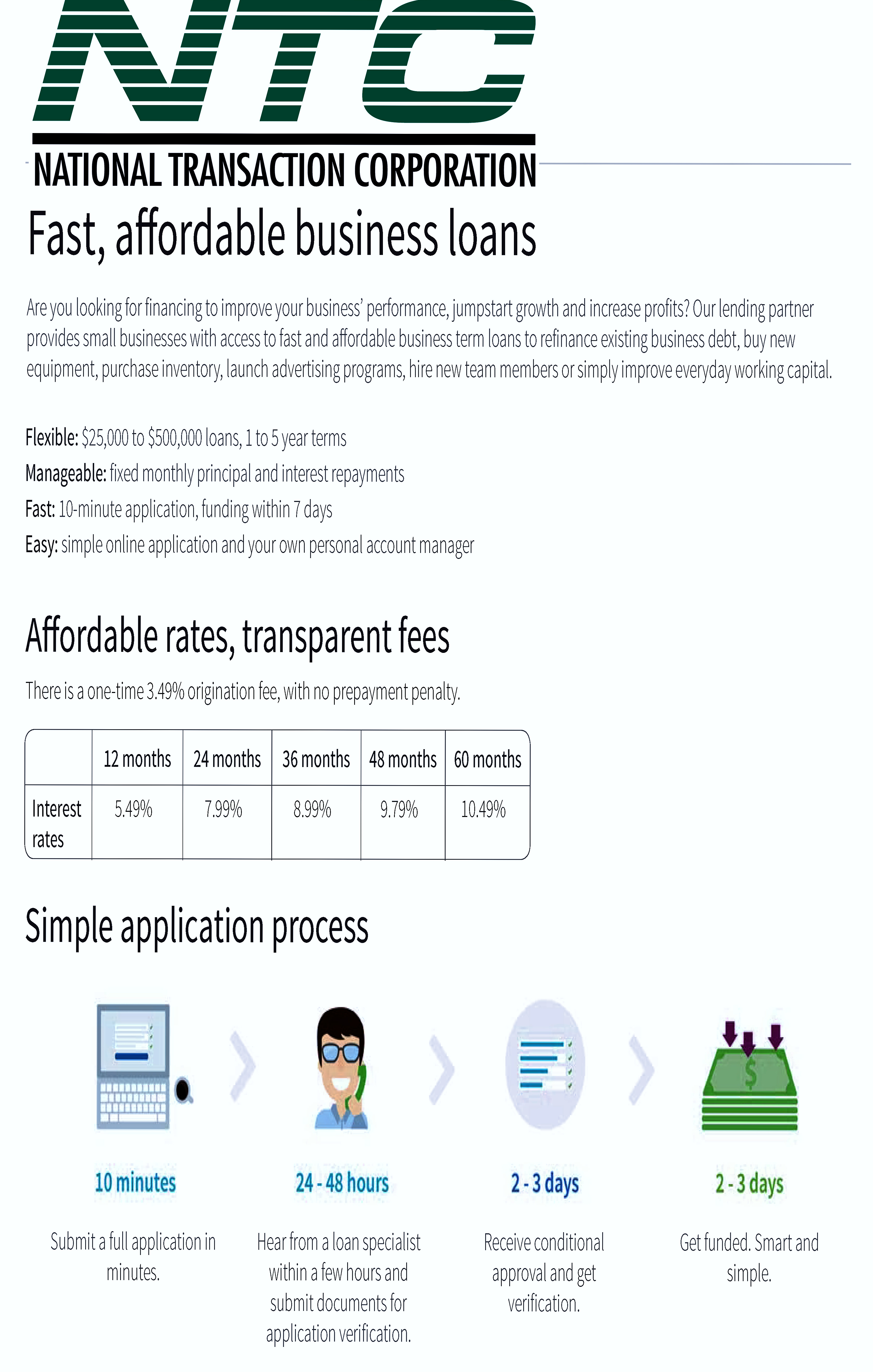

NTC Business Loans – Fast, Affordable, and Simple Application Process.

MediPaid – a medical health insurance claims payment. Delivering paperless, next-day deposits for Health Insurance Payments.

NTC provides services to thousands of customers. NTC maintains a one on one relationships with all its merchants providing them with 24/7 customer service and technical support!

To know more about our product and services give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, Gift & Loyalty Card Processing, Medical Healthcare, Merchant Account Services News Articles, Merchant Cash Advance, Merchant Services Account, Mobile Payments, Small Business Improvement, Travel Agency Agents Tagged with: cash advances, credit, Currency Conversion, customers, debit card, e-commerce, electronic checks, electronic payment, funding, funds, gateways, loans, Loyalty Card, merchants, Mobile Processing, service

February 22nd, 2016 by Elma Jane

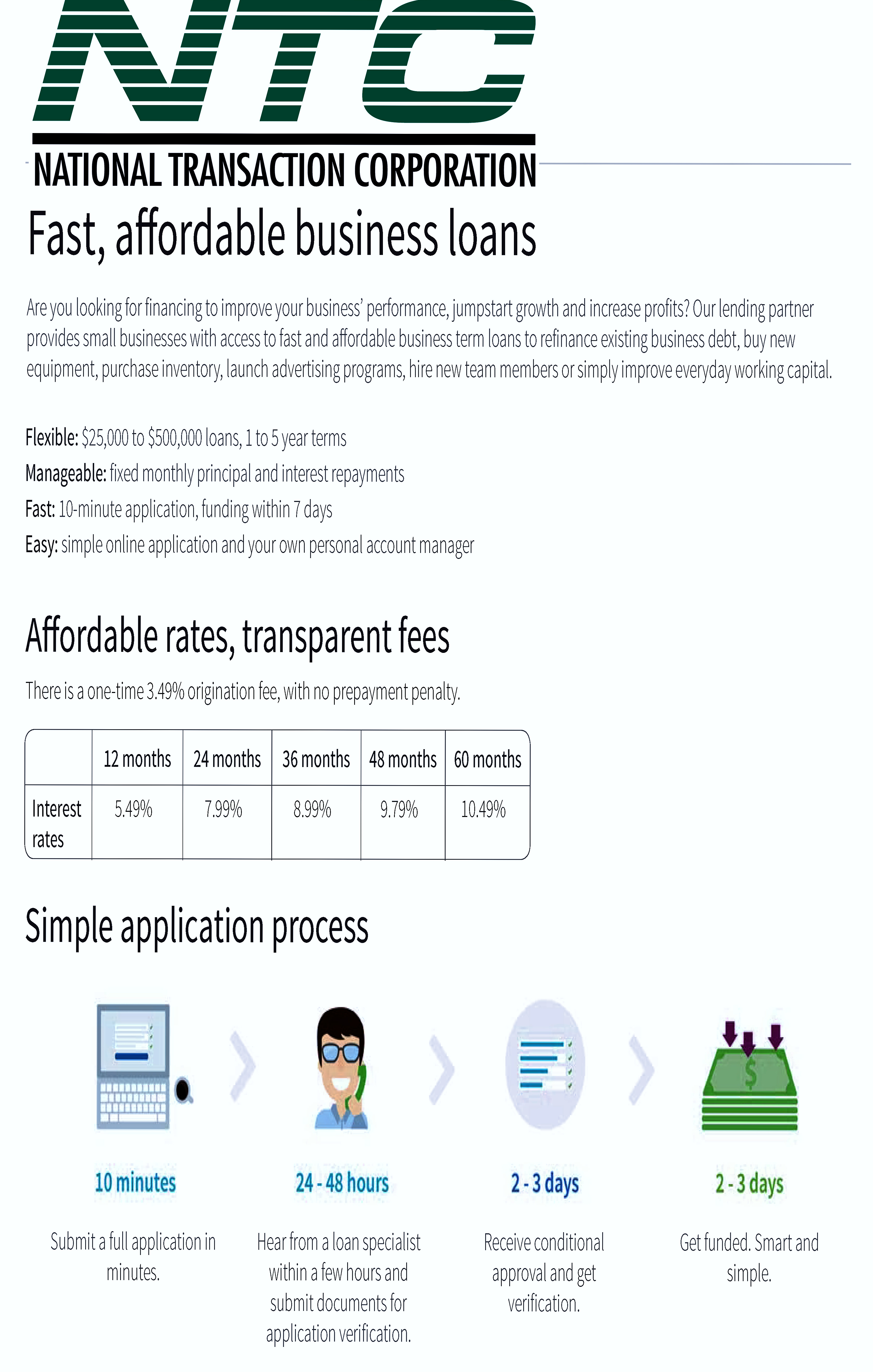

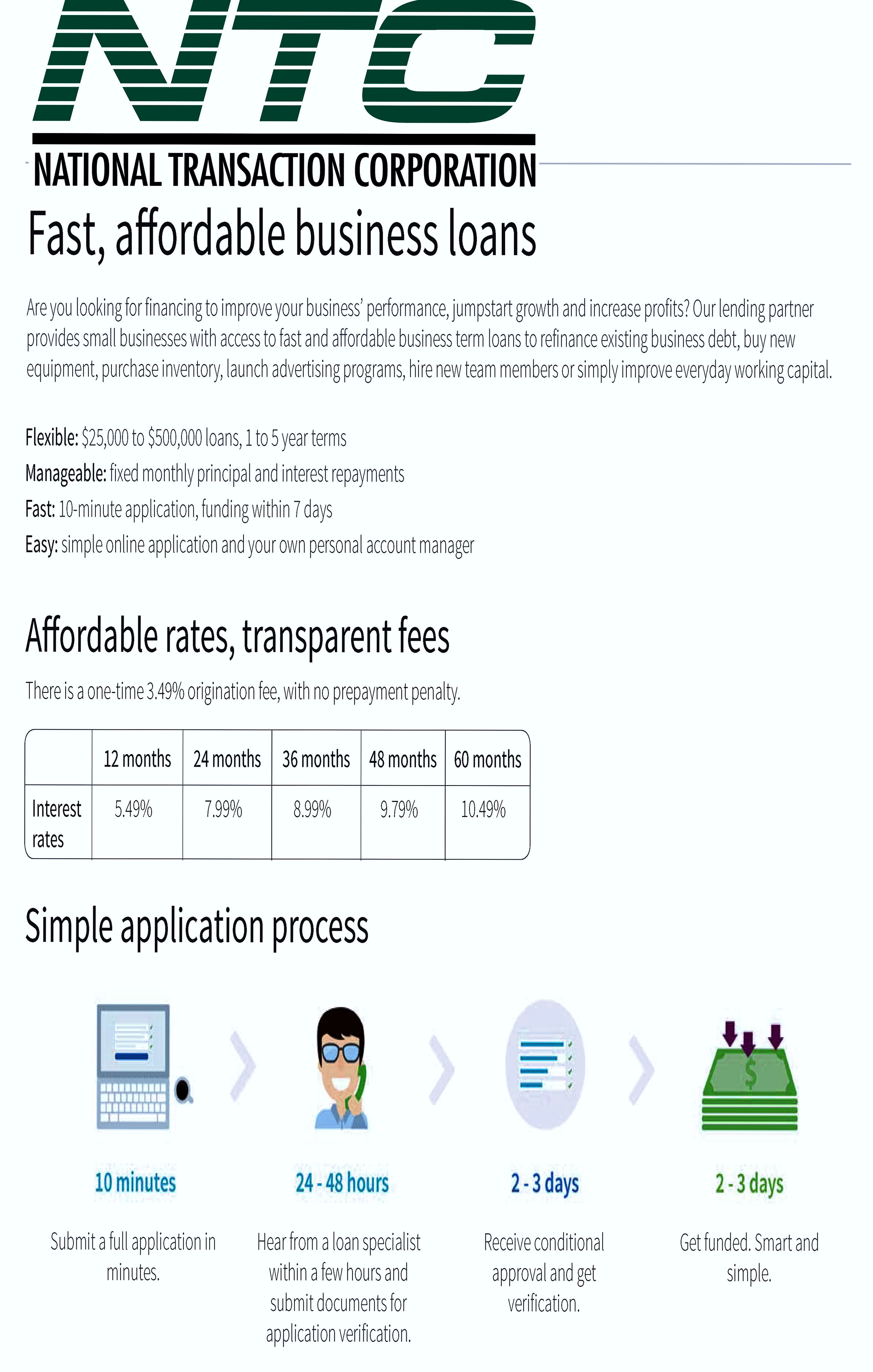

For Fast, Affordable Business Loans for all types of Merchants!

Are your looking for

financing? Our lending partner provides small businesses with access to fast and affordable business term

loans.

- Advance Funding of Merchant Processing

- Traditional Business Loans

- Fund Your Business Goal

- Open Business Opportunities

- Flexible Payment Schedules and Low Rates

For more information contact our Loan Specialist at 888-996-2273 Extension 1159

Posted in Best Practices for Merchants, Financial Services, Merchant Cash Advance, Small Business Improvement Tagged with: funding, loans, Merchant Processing, merchants, payment

September 12th, 2014 by Elma Jane

If you needed a loan, would you shop around first or go with the first lender you found? Small business owners are more likely to do the latter. For small business owners, personal interaction is key, and with many lenders focusing strictly on online marketing methods to reach new customers, these findings may come as a surprise.

While there is a plethora of alternative online lending options for small businesses, 44% of all loan applications are completed in person, even though business owners of all ages surveyed reported using an online process for researching and initiating a loan application, only younger business owners were very open to using it to complete the process.

User-friendly websites do help aid in conversion, but they don’t influence lender choice. Small business owners are more likely to use the first lender they meet, proof that even in an age of technology and advancements in online lending, human interaction is still one of the most important parts of the loan process, this may be due to the challenges small businesses face during the loan process as restrictions have increased on traditional loans.

First thing business owner do is ask rate…When it is more important to get the terms you want. If a lender term wants a higher rate, but let you pay it off on a longer term you may find more is less!

Despite great interest in strictly online alternative lending, many business owners still desire personal interactions with financial providers that will take the time to discuss business challenges and solutions. National Transaction standout over competitors because of its human/personal interactions.

Posted in Small Business Improvement Tagged with: business, competitors, customers, financial providers, lending options, loan, loan applications, marketing methods, National Transaction, provider's, rate, solutions, traditional loans, websites

September 3rd, 2014 by Elma Jane

Sales reps stand at the front lines of operations and keeping them motivated is key to any business’s success. To effectively motivate sales teams, business owners and sales managers need to create a fun, goal-oriented culture that both encourages friendly competition and recognizes how reps want to be rewarded.

If you think financial incentives are the way to go, you couldn’t be more wrong. Small business and startups don’t have a ton of money throw around in the first place. Second, when it comes to motivating sales teams, money simply isn’t everything.

Running sales contests in the past, using various software and tools. There was a single goal and the reps who achieved that goal were rewarded, usually with money. As a result, only a certain number of sales reps actually participated in these incentive programs. Those who knew they couldn’t reach that one goal didn’t bother to join, which meant the same reps would always get the cash. This was hardly the work of a cohesive, driven team with shared goals.

Rather than engage sales reps by establishing goals and metrics across the sales teams, such a financially driven contest missed its mark. Business should think outside the box.

So start creating amusing ways to motivate your sales teams.

Don’t forget to celebrate the good times – When the wins come, celebrate them. It can be as simple as a shout-out on the sales floor, an email message to the whole company to recognize the efforts.

Play Games – Organize daily contests and games based on different key performance indicators (KPI). A break that involves a quick game creates a sense of excitement for the entire team. It gives everyone something to chant for.

Public recognition –When sales reps have an exceptional week publicly recognizing their accomplishments in front of their peers is that extra little morale boost to keep pushing. Make sure the entire office is aware of the accomplishments of reps. It keeps their motivation high.

Reward rejections – Best thing for motivating sales was rewarding them for the no’s. Might sound crazy, but the more no’s you get, the closer you are to getting a yes. The prize of getting a yes is way larger than the reward rejections, so you still wanted to get yes.

Posted in Small Business Improvement Tagged with: business, operations, sales, tools

August 18th, 2014 by Elma Jane

As a small business, you may have ignored Facebook, but it turns out that by not having a presence on Facebook, you could be missing out on a huge business opportunity. The social networking site has a huge influence on what products and services people buy. More specifically, Facebook significantly influences millennial shoppers’ opinions of small businesses, including their decisions to purchase items not just online, but in-store as well. Nearly 60 percent of consumers ages 18 to 29 engage with Facebook ads at least once per week before buying an item in-store from a small business. Additionally, 62 percent believe Facebook is the most useful social media outlet for researching small businesses before visiting a store in person. That’s considerably higher than the 11 percent who feel the same about Twitter and the 12 percent who believe Pinterest is the best site for researching small businesses. Overall, 59 percent of millennial consumers visit the Facebook pages of small businesses at least once a week. To succeed both online and offline small businesses must first understand consumers’ online-to-offline shopping behaviors and invest at least a portion of their digital marketing dollars into the right technology and tools to create precisely targeted, relevant and personalized experiences.

The true value of Facebook, doesn’t lie in simply driving likes and adding new fans. It lies in using personalized content to convert digital hunters into loyal, repeat in-store buyers. The study discovered that by increasing the deals they offer on Facebook, businesses have the potential to make an immediate impact on their bottom line. Nearly 85 percent of the shoppers surveyed said local deals and offers on Facebook are important in their decision to purchase an item in-store. Forty percent of those surveyed said they think Facebook offers that can be redeemed in local stores are most likely to influence their decision to visit the website of a small business. With so many consumers constantly turning to Facebook when making purchasing decisions, business owners especially those in the restaurant, spa/beauty and education industries need to come to terms with the fact that Facebook is a highly important marketing tool that needs to be actively attended to and not just something they check in on every now and then.

Posted in Best Practices for Merchants, Small Business Improvement Tagged with: consumers, digital marketing, Facebook, marketing, marketing tool, millennial consumers, networking, pinterest, products, purchasing, services, shoppers, social media, social networking, twitter, website

June 6th, 2014 by Elma Jane

In business, Your website is often the first place consumers will go to find you. Your site is your chance to make a good first impression on potential leads and bring back existing customers, it’s important to make sure your website keeps its visitors interested and engaged.

Most brands are aware of the need to create an engaging Web presence, but smaller ones typically don’t think they have the time or resources to create a website at all. A trend among smaller business is to create just a Facebook page with no website. This is a great place to start, but to gain “customer trust”, having a website is important. It shows you’re an established company. A company’s website can be its “number 1” driver of business with the right tools and strategies. Building a great website doesn’t have to be expensive or time-consuming.

Optimize your Web presence for maximum customer engagement

Make your website experience match your customer-service experience.Consumers have come to expect the same type of experience with a brand online as they would in-store, enabling features on your website that allow visitors to complete as many interactions as possible for a seamless customer-service experience. These features can include detailed descriptions of each of your products and services, easy-to-access contact and purchase information, and a way for customers to reach you quickly, such as a live-chat function or links to your social media pages.

Personalize your website in ways that make sense for your business.Enhance customers’ experience on your website by customizing it to their needs. Use personalization tactics that make sense for you. Big Data analytics and voluntary surveys can help you send customized offers based on consumers’ past shopping habits and preferred contact methods which can help with sales conversions.

Use social media as a communication tool.The role of social media for businesses has evolved considerably. A way to share and promote content on your website, social media can and should be used as an extension of your customer service. Your website should be the focal point for your brand’s information. If you can get beyond that, social media should be a way to reach out to clients in a cost-effective way. By using Facebook, Twitter and other sites as a line of communication between your brand and your customers, you can drive them to your website in unique ways, such as by sharing a blog post that will help answer a customer’s question.

Posted in Small Business Improvement Tagged with: big data, Big Data analytics, blog, communication tool, consumers, customer service, customers, Data analytics, Facebook, leads, live-chat, products and services, resources, sales conversions, social media, tool, tools, twitter, website