Category: Travel Agency Agents

May 4th, 2016 by Elma Jane

Some processors specialize in leasing terminals, but equipment lease locks up merchants and ends up costing you more, whereas you could get that same machine in a matter of months and get more than one.

If you lease a terminal you may also be required to purchase equipment insurance, another added cost. And, have the equipment return at the end of your lease. If a merchant owns an existing equipment, it can be reprogrammed at NO CHARGE and the merchant can continue to use it.

For account set-up, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: merchants, processors, terminals

May 2nd, 2016 by Elma Jane

The American Society of Travel Advisors has launched an online course for those interested in learning the ropes of becoming a travel agent.

The course is about the travel industry in general and giving tips on how to launch a career as a travel adviser.

The tutorial is designed for those who are entrepreneurial skills, have great social interaction and always wanted to play a key role in this exciting yet complex industry.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: travel, travel agents, travel industry

April 25th, 2016 by Elma Jane

There are a lot more details of what makes up a credit card rate, this information is a good start to know more about a merchant account. All merchant accounts are subject to the same costs with respect to interchange fees and assessments.

Most rates are made up of three parts:

Assessments – are paid directly to card network associations (Visa, MasterCard, Amex, etc.)

Interchange – are paid to the issuing bank that issued the card, and is typically made up of a flat rate.

Card present transactions (the card is physically present or swiped) are typically lower than card-not-present transactions (the card is keyed-In like e-commerce and mail-order transactions).

Card-not-present transactions have higher interchange rates because they are riskier.

Processor fees – the fees involved with providing the service, risk assessments, the type and size of the transaction. This includes the margin between the total rate and the two previous parts, along with other fees, like chargeback or statement fees.

Posted in Best Practices for Merchants, Credit card Processing, Travel Agency Agents Tagged with: bank, card, card network, chargeback, credit card, merchant account, rate, transaction

April 15th, 2016 by Elma Jane

Dynamic Currency Conversion

- Five supported currencies

- Retail, Restaurant, MOTO, E-commerce

- Price listed in merchant’s currency

- Customer is aware of currency conversion

- Customer may opt-out at the point of sale

- Conversion occurs at the point of sale

- Merchants may choose settlement method & time

- Supported by terminals, viaWarp and Virtual Merchant

- Merchant rebate up to 100bp

Multi-Currency Conversion

- 100+ supported currencies

- E-commerce only

- Price listed in customer’s currency

- Customer is not aware of currency conversion

- Customer may not opt-out at the point of sale

- Conversion occurs between the point of sale and settlement

- All transactions auto settle at 6pm (eastern) daily

- Supported by Internet Secure or direct certification

- No merchant rebate

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Merchant Account Services News Articles, Travel Agency Agents Tagged with: currency, Currency Conversion, customer, e-commerce, merchants, moto, point of sale, terminals, virtual merchant

April 12th, 2016 by Elma Jane

Bank Identification Number or (BIN) is the link between the customer and their credit, debit, prepaid or gift card.This help merchants identify the card, its owner, and the issuing bank. The first six digits are used to identify the issuing bank. These six digits are the Bank Identification Number (BIN).

What is a BIN LookUp and how can it help merchant?

The BIN and additional data about the card and the bank can be stored in a database since every card is associated with a bank. BIN lookup allows any merchant or institution doing card based transaction to check more about the transaction other than ensuring that the correct pin has been provided.

BIN LookUp gives the merchant added security and a number of benefits.

- Protection against fraud and reversals of payments. Bank institution allow merchants a limited number of reversals and fraud before stopping their card privileges, and each card chargeback costs you money.

- Permits a closer monitoring of the sales process. Who, what and where? Using these details you can service your customers better.

- You can also gain from using the BIN system if you issue your customers’ gift card or pre-loaded cards.

How Can BIN LookUp or Cardholder Bank LookUp Help Merchants?

Utilize the Cardholder Bank Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information. Merchant Connect BIN lookup data is accurate, it is an added protection to your business, assets, and your financial transactions.

For your payments technology needs, give us a call at 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, cardholder, chargeback, credit, customer, database, debit, financial, fraud, gift Card, merchants, payments, prepaid, Security, transaction

April 8th, 2016 by Elma Jane

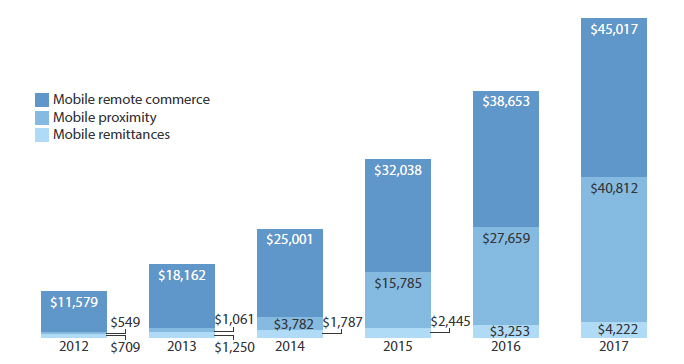

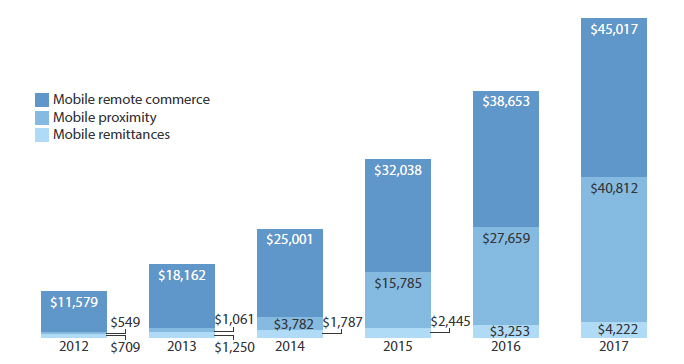

Mobile payments are soaring high. Many large retailers have embraced the innovation, but individual business owners have been slower to adopt.

Mobile payments can enhance customer engagement and loyalty. With mobile payment features, businesses can encourage more people to purchase using their mobile phone.

Customer experience will be the primary basis for competition.

The success of mobile payment providers and vendors are ultimately connected, as both need to work together. Small business merchants may not feel the urgent need to adopt mobile payments today, but they might lose in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Small business merchants may not feel the urgent need to adopt mobile payments today, but they might be left behind in the near future as consumers nowadays use their mobile devices to pay for goods and services.

Competitive businesses need to get on board, they need to know the advantages and opportunities mobile payments can provide. To stay competitive and relevant, business merchants of all sectors and sizes need to explore the possibilities of mobile payments.

Posted in Best Practices for Merchants, Mobile Payments, Travel Agency Agents Tagged with: consumers, customer, merchants, mobile, Mobile Payments, payment providers, payments, provider's

March 24th, 2016 by Elma Jane

Dear Virtuoso:

I wanted to praise one of our Virtuoso partners, National Transactions.

We have found National Transactions to be a wonderful partner. We have gotten excellent rates and support for our National Transaction merchant account– but more than that, their employees have helped us improve our processes, and I can already see our productivity rising. We have begun a new, online payment portal. This is an excellent tool we highly recommend!

National Transaction’s Steve Garlenski assisted and John Barbieri custom-designed a fabulous landing page – with all of our terms and conditions, cancellation penalties and places to check to authorize — and automatic receipt sent to both us and the client.

We really appreciate all they have done to help us with this important tool. It is so much better, faster and easier for us than obtaining signed paper credit card authorizations.

Thank you, Steve & John and National Transactions!

————–

Eleanor Hardy

President

The Society of International Railway Travelers®

Proud members of Virtuoso®

#1 Sellers of Virtuoso® Adventure & Specialty Travel, 2012

Winner, 15 Magellan Awards for Excellence

Celebrating the World’s Top 25 Trains since 1983

We thrive on referrals. Please tell your friends.

Web: http://www.irtsociety.com

Facebook | IRT Blog, Track 25

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, merchant account, online payment, travel

March 23rd, 2016 by Elma Jane

Mar 21, 2016 at 2:14 AM

Hi Gloria, Cathy & Bill,

I want to thank the National Transaction Corp team for Gloria’s excellent help last week regarding a repeatedly declined transaction – which the customer insisted should go through. With Gloria’s assistance and information, our customer finally acknowledged there were insufficient funds and gave us a new card to run instead. The joy of dealing with the public!

In the bigger picture, her help that day is typical of the wonderful service your whole team consistently provides. When I call periodically, it’s because there’s a problem… and it’s usually about money… and it’s usually “the other guy’s” fault!

Your team always goes to bat cheerfully and gets results for us. In this age of electronic switchboards and giant financial institutions, I’m amazed at the personal attention and speedy resolution your team always delivers.

We get cold calls from banks or card processors almost every week promising better rates or some “great deal” to handle our transactions. Before they can explain their offer, I tell them I’m already working with friends in the business and hang up as quickly as possible.

You’ve earned my business and loyalty and I can’t say enough good things about your service. Thank you for all you do!

Sincerely, George

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, customer, service

March 23rd, 2016 by Elma Jane

A data breach can occur from inside a business just as much as it can externally. The one common element between both is “Opportunity.” It doesn’t matter whether a business is a multi-national corporation or a small single-location.

Attacks from criminals can range in sophistication. While the sophistication of some attacks may be low, experts note that criminals continue to evolve their techniques and now they are becoming more sophisticated than ever.

While large corporations may have millions of customer records, they also maintain the resources to protect their sensitive information from the average criminal. It may take weeks, months, or even years for a criminal to penetrate the defenses of one large corporation. This is why attacks on small business are becoming so attractive to criminals.

It all goes back to the “Opportunity.” The average small business lacks the resources to properly protect their business from the variety of attacks at the disposal of criminals. Or worse, they may believe their business is of no interest to criminals. The fact is, they are less secure than larger businesses. These are all issues for the average small business owner, and more importantly, their customers.

So what can a small business do to protect themselves from the growing threat of a data compromise?

- Background checks on employees.

- Have someone monitor the network activity.

- Protect business with proper network security protocols.

- Protect your payment’s environment by using a layered approach that includes EMV, encryption and tokenization to help prevent sensitive payment card data from being stolen.

These are all fairly simple and inexpensive ways for businesses to help protect themselves and their customers from being a victim of a costly data compromise.

Posted in Best Practices for Merchants, Credit Card Security, Travel Agency Agents Tagged with: card, customer, data, data breach, EMV, encryption, payment, Security, tokenization

March 18th, 2016 by Elma Jane

Businesses that use mail order and telephone order (MOTO) payment may seem like a thing of the past. Thanks to the new payment technology solutions that help traditional forms of payment to expand the way they accept payment as well as prevent fraud.

Good reasons for MOTO businesses to broaden their payment solutions and offer their customers new ways to pay.

Convenience – consumers value convenience. The more convenient they can pay they will stay, and not take their business elsewhere.

Increase Customer – Additional payment options automatically leads to more customers. What is convenient for one consumer won’t necessarily be convenient for the other. Giving them options of how to submit payment is the best way to keep a customer and make them happy.

Fast – Keeping up with the times will reflect well on your business. Many people these days expect no less than the latest. If a business doesn’t offer the kinds of payment types that are currently widespread, a consumer will consider the service not suitable to their needs.

Payment options that are currently shaping businesses to operate besides digital payment systems, other non-traditional payment options being utilized by many small businesses are e-checks and gift cards. These options also provide consumers with convenience and make products/services feel more accessible.

Mail order and telephone order (MOTO) businesses do operate by accepting card-not-present transactions. Card-Not-Present (CNP) transactions are a major route for credit card fraud. Using a reliable payment processing system is something to think about. NTC can help MOTO businesses, by keeping traditional payments quick and secure.

Give us a call now at 888-996-2273 or visit us at www.nationaltransaction.com

Posted in Best Practices for Merchants, Travel Agency Agents