Category: Travel Agency Agents

March 9th, 2016 by Elma Jane

Lisa an independent Travel agent started her business in October 2006. She has been using her bank as their credit card processor and use to do a manual type-in process. When she learned about NTC while trying to shop online because she thinks it’s time for her to upgrade her system, Lisa found that NTC is not only a payment expert when it comes to travel, but a technology expert as well that met her business’s needs.

Lisa is using NTC e-Pay an electronic invoicing that has streamlined their credit card processing. The process not only has it saved money with competitive rates but most importantly it saves time. The level of assistance provided went above and beyond what she expected.

NTC e-Pay is for all types of merchants in a Card-Not-Present Transaction.

Consumer Acess – consumer will have access to their transaction details on their device. For travel merchants, the consumer can have access to their itinerary while on the go!

Customizable Pricing – when custom pricing becomes an issue, shopping carts, POS systems and booking engines tend to get really complicated.

Fast – saves time and unnecessary cost. Moves money efficiently and effectively. Simply email payment request that can be paid in 2 simple steps.

- The customer receives an email with a link to the payment page. Customer reviews invoice details and agrees to terms. The customer enters payment information.

- Process, transaction is completed company is paid. You get paid in minutes, not months.

Protects you from Chargeback – the customer is required to agree to your Refund Policy, Privacy Policy, Timing and Delivery Policy.

Secured – credit card information is processed securely. The customer is entering their credit card information without faxing or emailing credit card numbers.

The no shopping cart e-Commerce solution! – avoids the complexities of a shopping cart or integration into an accounting or POS.

Thinking of upgrading your system give us a call at 888-996-2273 and know more of our NTC e-Pay platform.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargeback, consumer, credit card, Electronic invoicing, merchants, online, payment, POS, processor, shopping carts, transaction, travel, travel agent

March 7th, 2016 by Elma Jane

It is my pleasure to write this testimonial for National Transaction Company!

My travel agency has been associated with this organization since 2005 and I continue to believe they are the best solution for my home based operation’s credit card merchant transactions. The process is simple, efficient and it provides me a profitable way to accept client credit cards and manage my agency’s cash flow.

Their support team is the best!

Judy K

JMK TRAVEL INC.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: credit card, merchant, transactions, travel, travel agency

February 29th, 2016 by Elma Jane

True Stories of our Customers in Action

Travel Agency ~ An Independent Travel Firm had been using their bank as credit card processor. When they learned that Virtuoso and NTC were going to team up they jumped on the opportunity. Not only NTC has lowered their fees but NTC has streamlined their credit card processing. The manual type-in process before has been all automated batch process now which saves time. This is a great new partnership for Virtuoso and its members.

Wholesale Hardware Industry ~ Have been turned down his business loan by a traditional bank last year due to his bankruptcy few years ago. He has no option but to borrow using a Cash Advance, making daily payment with a very high-interest rate. NTC was able to get an approval for a Real Business Loan, with monthly payment with an annual rate.

Term loan amount: $85K – Line of credit: $75K

Another Travel Agency ~ NTC has great customer service, the support team will patiently guide you through the PCI compliance. The payments specialist will check whether they could reduce your rates (which they did successfully!). They will even follow up regularly with status updates. NTC is exemplary!

NTC has a lot to offer, from our e-Pay Service and other New Programs for ISO’s, and Options for your merchants. NTC, The Payments and Technology Expert! Visit us at www.nationaltransaction.com or call us at 888-996-2273.

Posted in Best Practices for Merchants, Credit card Processing, Payment Card Industry PCI Security, Travel Agency Agents Tagged with: bank, Business Loan, card, cash advance, credit card, customers, loan, merchants, payment, PCI Compliance, processor, travel, travel agency

February 25th, 2016 by Elma Jane

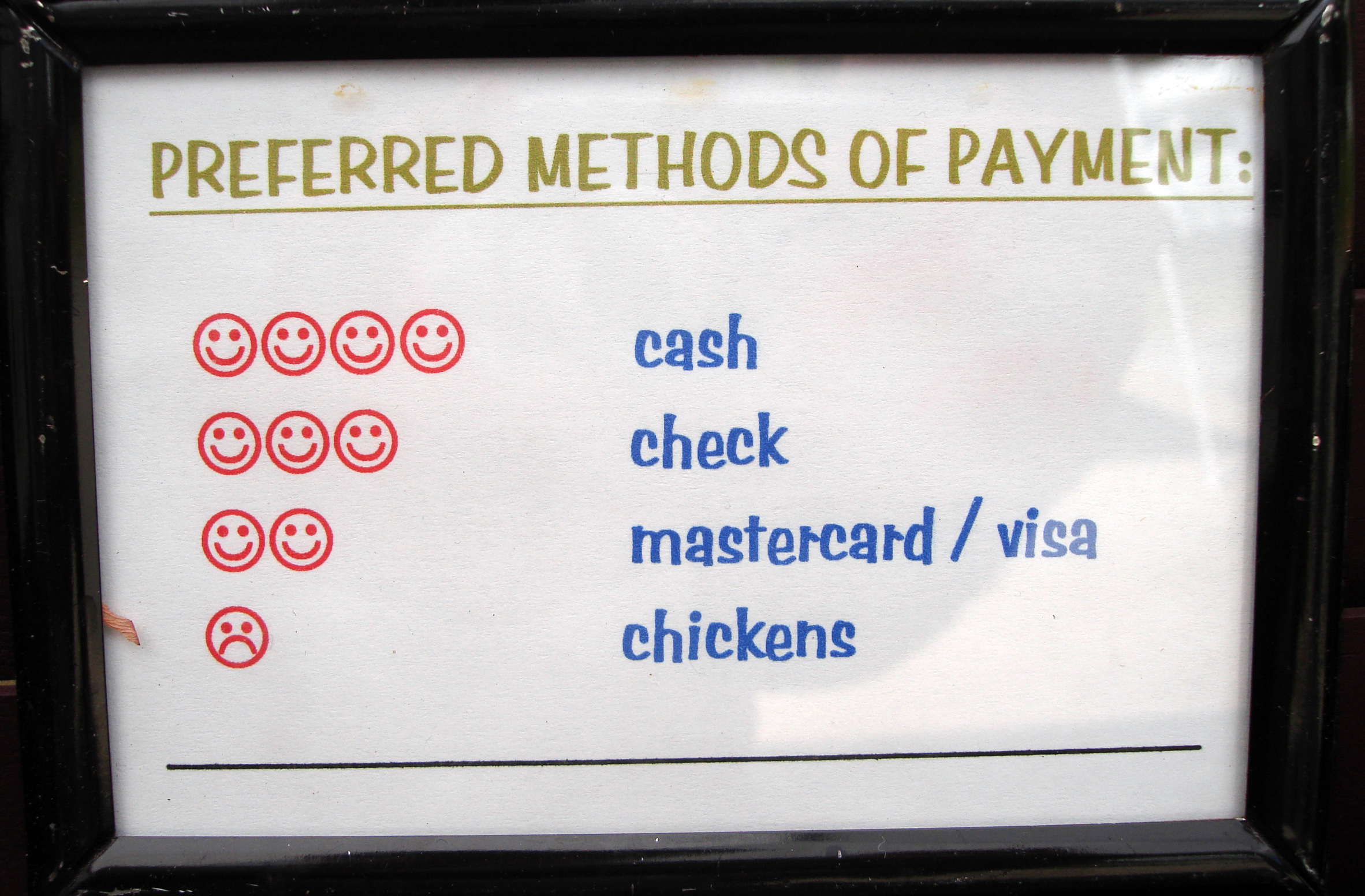

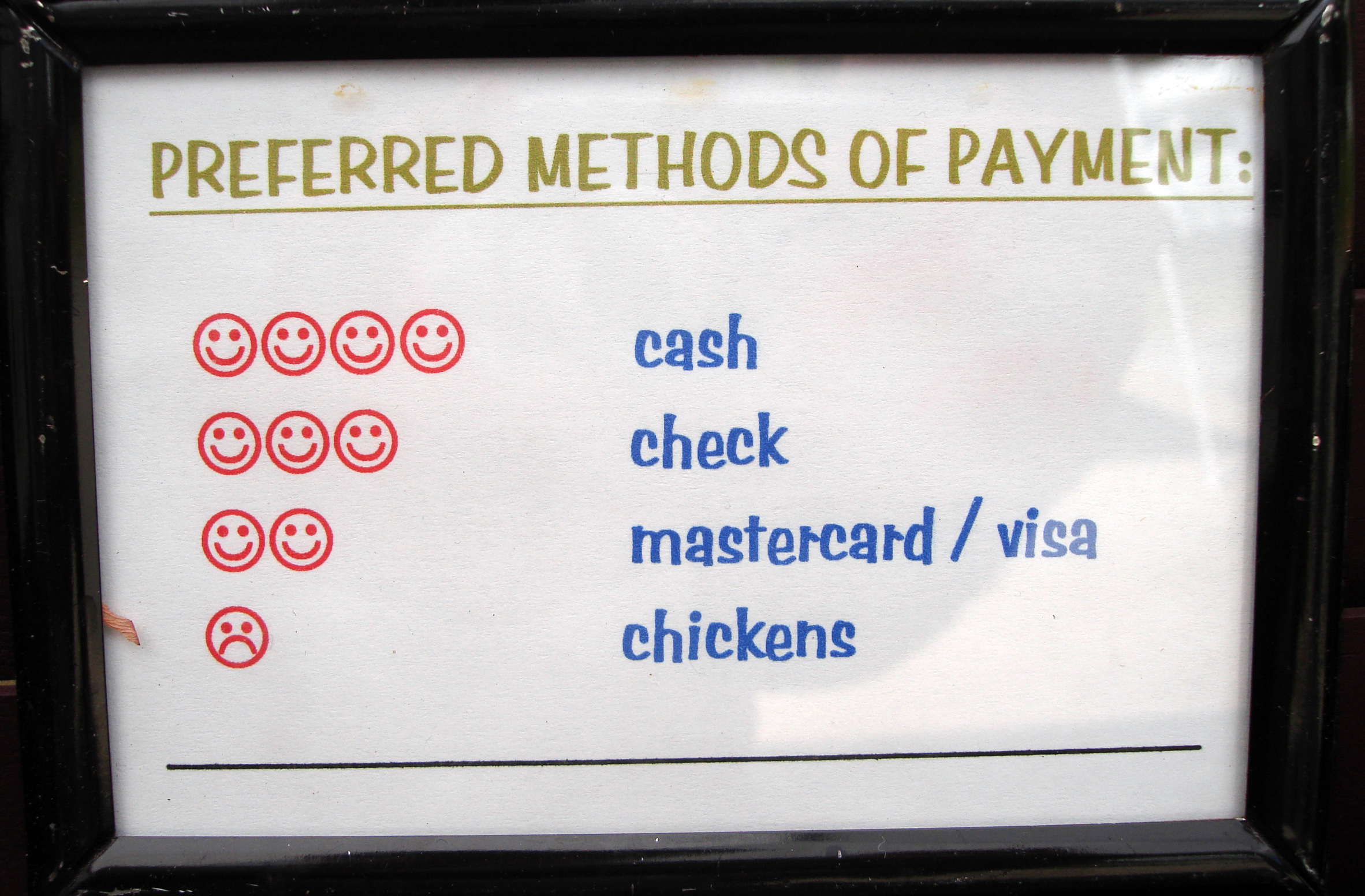

Merchants are constantly trying to find ways to improve their customer experience, like customer service and loyalty programs, but the one that is often overlooked is offering a variety of payment options.

Offering a variety of payment options can lead to your customer experience success. With more and more customers using alternative forms of payment and staying away from the traditional way which is cash and credit card.

Types of Payment Options:

E-Commerce – Online shopping is growing, your business should be adopting this trend. Merchants who do not currently offer an online store should consider taking their sales online. This will gain more exposure and will also enhance the overall customer experience.

Mobile Wallets – Consumers are becoming more comfortable doing transactions on their smartphone, by accommodating mobile wallets, your business can attract more customers and more sales for your business. Upgrading your point-of-sale (POS) to be a Near field communication (NFC)-enabled will allow you to accept any mobile wallet payment.

Offering a variety of payment options will help your business stay up to date. More payment options mean more customers. If you would like to expand your current payment processing options for your business, visit www.nationaltransaction.com or talk to our Payments Expert today at 888-996-2273 Extension 1.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: consumers, credit card, customer, e-commerce, Loyalty Programs, merchants, mobile, mobile wallets, Near Field Communication, nfc, online, payment, payment processing, Payments Expert, point of sale, POS, smartphone, transactions

February 24th, 2016 by Elma Jane

Helping customers protect and safeguard their payment data is one of National Transaction’s top priorities.

Our Payments Expert for travel agencies welcomes your questions, and always glad to give you assistance. We are good at what we do and we value your time.

We offer very valuable services and information to help you with your travel business needs, which saves you time, money & provide insights into your payment logistics.

National Transaction’s Electronic Payments Expert doesn’t sell anything, instead helps you choose wisely and discuss your options.

If you haven’t consulted a Payments Expert for your travel business take the time to seek one out and ask for their professional input.

visit www.nationaltransaction.com today, or call 888-996-2273 Extension 1. The Payments expert for travel agencies!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: customers, data, payment, travel, travel agencies, travel business

February 19th, 2016 by Elma Jane

This company is the best. If anyone, especially Travel Agents need to obtain a Credit Card Processing Company, this is the one to go with, ask for Megan. She is the Best!!!! Thank you for all your help….

Travel Agents,Travel,Credit Card Processing,Credit Card,Card

Posted in Best Practices for Merchants, Credit card Processing, Electronic Payments, Merchant Account Services News Articles, Travel Agency Agents Tagged with: card, credit card, credit card processing, travel, travel agents

February 16th, 2016 by Elma Jane

NTC ePay is an easy and effective way to process transactions for any Merchants.

National Transaction creates a custom link for your business, which you will use to send your customers an Electronic Invoice. Once your customer received the invoice, they will click on the link and pay the amount on the invoice.

The customer is required to agree to your Refund Policy, Privacy Policy, Timing and Delivery Policy before they can pay the invoice, this will protect you in a case of a Chargeback.

With this system in place, Credit Card information is processed securely. The customer is entering their credit card information without faxing or emailing credit card numbers.

Electronic Invoicing saves time and unnecessary costs. Documents don’t need to be scanned or email, all transactions are processed through the electronic invoice making it easy to keep track of.

Most of our Merchants using NTC ePay are in the Travel Industry, some are into boat Repair Business and Church Ministries. If you want to process securely, save time and unnecessary costs like our existing merchants, check out NTC ePay, The No Shopping Cart e-Commerce Solution!

Posted in Best Practices for Merchants, e-commerce & m-commerce, Travel Agency Agents Tagged with: credit card, customers, e-commerce, Electronic Invoice, merchants, transactions, travel, travel industry

February 3rd, 2016 by Elma Jane

A group of Travel Organizations is urging Congress to create a national commission to study airline competition, after a decade of consolidation and a year of record profits.

A similar commission gauged the Industry’s Health in 1993. But groups including the Travel Technology Association, Airports Council International-North America, the U.S. Travel Association and the American Society of Travel Agents (ASTA) contend that much has changed in the last quarter-century and the industry deserves a new look.

The recent series of mergers has left relatively few major airlines in control of the industry. Along with Southwest, the remaining three legacy carriers have about 80 percent of the market share for flights within the U.S. Ultra-budget airlines like Spirit, Frontier and Allegiant have provided some competitive fares on select routes, but their presence is not big enough to really affect the whole marketplace.

Lack of domestic competition is not the only issue that traveler and travel agent advocates want the government to look at. U.S. carriers are also forming alliances with international airlines that go beyond basic code sharing agreements. For example, American Airlines and LATAM have inked a deal and are waiting for regulatory approval that would allow them to set prices and schedules on routes between the North and South Americas and easily use each other’s networks to offer connecting flights to their customers.

Other subject that the groups would like to study include:

Agreements with 100 other countries to allow unhindered international travel, under a policy called Open Skies.

Topics above are worth exploring to better understand the competitive landscape of Air Travel in the U.S.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: Air Travel, ASTA, international travel, travel, travel agents, Travel Association, Travel Organizations, Travel Technology, traveler

February 2nd, 2016 by Elma Jane

Businesses continue to struggle with the prohibited storage of unencrypted customer payment data. The Payment Card Industry Data Security Standard (PCI DSS), merchants are instructed that, Protection methods are critical components of cardholder data protection in PCI DSS Requirement.

PCI DSS applies to every company that stores, processes or transmits cardholder information. Regardless of the size or type of business you operate, the number of credit card transactions you process annually or the method you use to do so, you must be PCI compliant.

Data breach is not a limited, one-time occurrence. This is why PCI compliance is required across all systems used by merchants.

Encryption and Tokenization is a strong combination to protect cardholder at all points in the transaction lifecycle; in use, in transit and at rest.

National Transaction’s security solutions provide layers of protection, when used in combination with EMV and PCI-DSS compliance.

Encryption is ideally suited for any businesses that processes card transactions in a face to face or card present environment. From the moment a payment card is swiped or inserted at a terminal featuring a hardware-based, tamper resistant security module, encryption protects the card data from fraudsters as it travels across various systems and networks until it is decrypted at secure data center.

Tokenization can be used in card not present environments (travel merchants) such as e-commerce or mail order/telephone order (MOTO), or in conjunction with encryption in card present environments. Tokens can reside on your POS/PMS or within your e-commerce infrastructure at rest and can be used to make adjustments, add new charges, make reservations, perform recurring transactions, or perform other transactions in use. Tokenization protects card data when it’s in use and at rest. It converts or replaces cardholder data with a unique token ID to be used for subsequent transactions.

The sooner businesses implement encryption and tokenization the sooner stored unencrypted data will become a thing of the past.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, card data, card present, cardholder, compliance, credit card, customer, data, data breach, data security, e-commerce, EMV, encryption, Mail Order/Telephone Order, merchants, moto, payment, Payment Card Industry, PCI-DSS, POS, secure data, Security, terminal, tokenization, tokens, travel, travel merchants

February 1st, 2016 by Elma Jane

What is Zika Virus?

The Virus has been around for a long time, and for the most part was a benign mosquito-borne disease. Zika is transmitted through infected Aedes mosquitoes and can be passed from a pregnant mother to her baby during pregnancy or around the time of birth. It has spread from equatorial Africa into South and Central America as well as the Caribbean.

Recently in the last month, the virus was linked to microcephaly in infants. From October 2015 to January 2016, there were almost 4,000 cases of babies born with microcephaly in Brazil. Before then, there were just 150 cases per year.

The Centers for Disease Control and Prevention (CDC) has issued a travel alert that recommends pregnant women postpone travel to areas where the virus has been reported.

Affected areas

While Zika typically was found in equatorial Africa, the disease has spread and now threatens the bread and butter of most travel professionals in the United States. The affected areas include most of South America, in particular Brazil who is hosting the 2016 Summer Games, and the Caribbean, including several popular tourist destinations.

Airlines took note of this potential threat

Airlines offered refunds to travelers with concerns of the Zika Virus.

The key for travel agencies right now is to keep abreast of the virus and monitor it’s spread via the Centers for Disease Control and Prevention (CDC).

Contact your preferred suppliers who service destinations that are impacted and become familiar with their cancellation policies.

Be prepared to offer your clients some alternative destinations. One of the best options might be a cruise versus the destination. A cruise might be the answer for your clients as a ship can change itineraries on a moment’s notice.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: travel, travel agencies