Category: Travel Agency Agents

January 27th, 2016 by Elma Jane

MasterPass To Make Booking Travel Experience Even Easier For JetBlue

MasterCard today added JetBlue as its latest merchant to accept digital payments with MasterPass. MasterPass will be available later this year on the airline’s website and mobile app, giving customers the opportunity to speed up their booking travel experience, according to a press release.

With MasterPass, shoppers can pay for the things they want at thousands of merchants with the security they demand, anywhere online or in app, using any device. The wallet securely stores shoppers’ preferred payment and shipping information which is readily accessible when they click on the “Buy with MasterPass” button and sign into their account.

U.S. consumers can sign up for a MasterPass account by visiting the MasterPass website or through a participating bank. Launched in 2013, MasterPass by MasterCard is free, easy to set up, and available anywhere you see the Buy with MasterPass button. It is currently available in 29 countries and is accepted at 250,000 merchants globally.

Accepting MasterPass by MasterCard on JetBlue’s online and in-app properties expands the relationship between the two companies. JetBlue announced in October 2015 that MasterCard would be its network partner for its co-brand portfolio.

Posted in Travel Agency Agents Tagged with: bank, customers, digital payments, merchant, mobile, mobile app, online, payments, Security, travel

January 21st, 2016 by Elma Jane

Merchant accounts are as varied as the merchants themselves and the goods being sold.

What kind of account would you fall under:

High Risk Merchant Accounts – Finding a processor who is willing to take your account can be more challenging. High risk merchants range from travel agencies to multi-level marketing companies, credit restoration merchants, casinos, online pharmaceutical companies, adult/dating merchants and many other.

Internet based merchant account (Ecommerce/Website order processing) – E-Commerce is a booming market, with so many people buying and selling goods online due to the wide reach and easy access to the internet.

Mobile or Wireless merchant account – This merchant is specifically designed for small businesses, solo professionals, and mobile services (including lawyers, landscapers, contractors, consultants, repair tradesmen, etc), who are constantly on the move and require a payment to processed on the spot.

MOTO (Mail or Telephone order) – This enables phone based or direct mail orders processing for customers who can buy your product or service from the comfort of their home. Since there is no card present there is no need for traditional equipment.

Multiple Merchant Accounts – Some businesses can have merchant accounts of a couple or all different types. Merchants who fall into this category are called multi-channel merchants as they sell their goods through a number of different channels. Most commonly this is related to retail stores who also have an online presence to sell their goods. This is very common in today’s competitive market where constant contact with customers is critical to success.

Traditional Account with Equipment – Most commonly used for retail businesses (grocery, departmental stores etc) where the transactions are processed in a face to face interaction also known as Point of Sale (PoS).

Interested to setup an account give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Point of Sale, Travel Agency Agents Tagged with: account, card, card present, credit, customers, e-commerce, high risk merchant, internet, merchant accounts, merchants, mobile, mobile services, moto, multi-channel merchants, payment, point of sale, POS, processor, transactions, travel, travel agencies

January 21st, 2016 by Elma Jane

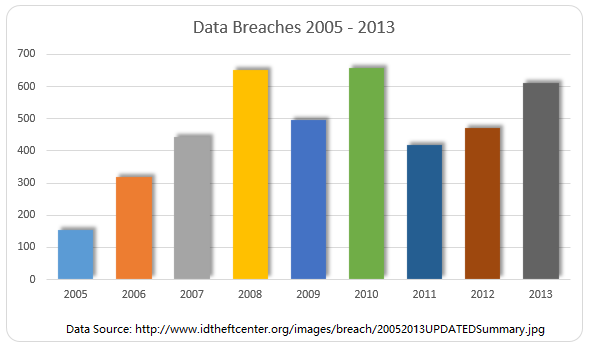

HYATT DATA BREACH HITS 250 HOTELS WORLDWIDE

Hyatt hotel company noted that the breach that occurred over the course of almost four months hit 250 different hotels over the span of about 50 countries.

The breach covered payment card data from the cards used at various Hyatt hotels in that range of dates, reports note, and most of the breaches seem to have hit at hotel restaurants. Those who also hit the spas at Hyatt, along with front desks, gold shops, and even parking structures may also have been impacted by the breach.

The company couldn’t confirm how long the network was vulnerable nor if any payment card data had actually been stolen.

Perimeter Defense where data is protected with passwords and firewalls and the like is fine and well, but more needs to be put into protecting the data in the event someone clears security.

Encrypting Data is a great step to take, assuming someone manages to clear the perimeter, the encryption makes the data itself much more difficult to access and use. So while perimeter defense keeps unauthorized users away from data, encryption keeps those who reach the data from being able to readily read it.

Data Security is something none of us can take for granted, so doing what we can to protect that data being vigilant about statements, putting up proper security, encrypting data all of these contribute to better protected data and a safer time online.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card data, cards, data, online, payment, Security

January 14th, 2016 by Elma Jane

We would like to let our customers know of additional benefits that are coming, in addition of the protection that chip card technology provides.

On January 24, Verifone will release a software update for your card terminal that will include two important new features:

- PIN Debit: With this feature, when your customer pays with a Visa, MasterCard or Discover chip debit card, your terminal will allow you to process it as a debit transaction. The update will change the prompts you’re used to seeing based on how the card is configured.

- Tip Adjust: If your business accepts tips, you will now have the option to add the tip at the time of sale or adjust it later, just like with non-chip card transactions. To use the tip adjust feature, simply skip the tip prompt during the sale.

Once the download is available, your card terminal will automatically receive the new application during its monthly update. For best results, leave your terminal on overnight to ensure it receives the update.

We appreciate your business and we are committed to providing you with solutions to ensure your ongoing transition to chip card acceptance is smooth.

For more information on terminal upgrade, please visit www.chipcardsuccess.com.

Start accepting credit card payments at your business with the following features on your new POS terminal: NFC + EMV PIN & Signature capable. Give us a call now at 888-996-2273 or visit our website www.nationaltransaction.com Payments Expert for Travel Merchants and more!

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Near Field Communication, Point of Sale, Travel Agency Agents, Visa MasterCard American Express Tagged with: card, customers, EMV, MasterCard, merchants, nfc, payments, POS, transaction, travel, visa

January 12th, 2016 by Elma Jane

Can we securely store card data for recurring billing?

PCI DSS discourages businesses from storing credit card data, Merchants feel the practice is necessary in order to facilitate recurring payments.

The Payment Card Industry Data Security Standard (PCI DSS) is a proprietary information security standard for organizations that handle branded credit cards from the major card schemes including Visa, MasterCard, American Express, Discover, and JCB.

In order for the electronic storage of cardholder data to be PCI Compliant, appropriate encryption must be applied to the primary account number (PAN). In this situation, the numbers in the electronic file should be encrypted.

All PCI controls would apply to the environment in which the cardholder data is transmitted and stored. Tokenization can be implemented for recurring and/or delayed transactions. Travel Merchants and or Storage Facility could use this feature to help reduce the need for electronically stored cardholder data while still maintaining current business processes.

The best thing you can do for your business is to not store any cardholder data or personally identifiable information.

Tomorrow let’s tackle Encryption and Tokenization a strong combination to protect card data while reducing the cost of compliance!

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Security, Payment Card Industry PCI Security, Travel Agency Agents, Visa MasterCard American Express Tagged with: cardholder data, credit card, data, merchants, payments, Security, tokenization, transactions, travel

December 17th, 2015 by Elma Jane

Mobile Payments – It is bound to see more actions with tech giants Apple, Google and Samsung in mobile payment trends. We will also see new technologies like smartwatches, bracelets and rings that will give us the ability to provide payment options.

NFC – Near Field Communication, another familiar face among the payment trends. NFC, however, goes way beyond making payments using smartphones. These speed up POS payment processing quickly and easily without requiring a PIN or signature. While there are other POS payment methods, such as QR codes, NFC will come out on top. Merchants should ensure they have an overview of the current Point-of-Sale options and should, if needed, upgrade to the latest technology.

Security: Tokenization and biometric authentication will have a strong influence on the payment industry.

Tokenization – when applied to data security, is an extremely interesting method of securing credit card data. As the credit card numbers are substituted by tokens that has no value, then no harm can be done if tokens are stolen, which makes tokenization a secure process.

There are several new inventions when it comes to payment processing authentication such as password, PIN, and fingerprint methods. But they are weak so two-factor authentication is increasingly used to improve security.

Biometrics Authentication – like finger print scan, facial recognition, voice recognition, and pulse recognition are set to become increasingly significant. This will increase both security and convenience.

International E-Commerce – It’s important that merchants offer shoppers their preferred local payment method. Merchants who are looking for e-commerce success will need to create an international strategy. Merchants should also consider checking with their payment service providers. Providers know their way around to alternative payment methods.

Cash on the Retreat – Cashless Society? Some countries in Europe are certainly cutting down on the usage of cash. In Sweden, it is now almost impossible to use cash to pay for bus tickets. Acceptable payment methods include customer cards, credit cards, and payments via smartphone apps. Traditional cash-based bakeries no longer exist and instead, now display signs requesting that customers use cashless payment methods for even the smallest amounts. The situation in Denmark is similar; the government is currently debating whether or not to release smaller retailers from the obligation of having to accept cash as a payment method. Cash is on the retreat, and alternative payment methods are advancing. However, cash is still on the list.

Real-Time Payments (Instant Payments) – The European Central Bank (ECB) will bring instant payments strongly in the near future. Instant or real-time payments are a trend which will be with us for a long time to come.

Regulatory Changes – The first Payment Services Directive (PSD) from 2007 is still currently implemented domestically. After a tough two-year negotiation period, the EU has now, finally, agreed on a second payment services directive (PSD2). The European Banking Authority (EBA) is set to develop more detailed guidelines and regulatory standards for various industries. Payment industries should begin preparing themselves now for implementation, doing this will allow them to be ready for the appropriate steps necessary in 2016/2017.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Near Field Communication, Point of Sale, Travel Agency Agents Tagged with: Apple, biometric, credit card, data security, e-commerce, google, merchants, Mobile Payments, Near Field Communication, nfc, payment industry, payment methods, payment options, payment processing, payment service providers, payment services, payment trends, payments, PIN, point of sale, POS, qr codes, real-time payments, Samsung, tokenization

December 10th, 2015 by Elma Jane

American Airlines is upgrading its international travel, with Premium Economy on its international flights, featuring larger seats and more legroom of about six inches more, improved entertainment systems and meal service. The seats will be located behind business class, separated from the main cabin section.

AA’s premium economy international flights will become available in late 2016. No available information about the pricing.

The new class of service will also come with priority check-in and boarding as well as a checked baggage allowance.

International travelers who loves to travel have more choices when they fly!

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: travel

December 8th, 2015 by Elma Jane

The President blamed (Visa Waiver Program) a special visa travel program for allowing one of the San Bernardino terrorists into the country.

The Visa Waiver Program eases entry into the United States for 20 million visitors from nations that meet certain conditions. Mainly tourists and overseas relatives of American citizens and residents, are able to enter the U.S. easily. Passport holders from 38 countries currently qualify for a 90-day visa-free stay in the US.

Visa waiver program is considered crucial to the multibillion dollar travel and tourism business. New York City’s Manhattan, Florida’s theme parks, the Grand Canyon, Hollywood and Las Vegas get a high amount of tourist traffic because of the Visa Waiver Program.

The House will vote on changes to the program today, a worrying news for Travel Industry.

The U.S. travel industry has seen these kinds of changes coming for some time now. The U.S. Travel Association has spent $2 million on lobbying this year alone. The group is not fighting against all changes to the visa program, but instead wants to make certain that any new facets do not go overboard and are not redundant.

Credits

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: tourism business, travel, Travel Association, travel industry, travel program

December 8th, 2015 by Elma Jane

In Travel Industry, it’s beneficial if travel agents could write and share some of the things that really work for them in running their business and the things that didn’t, whether you’re an online travel agents, homebased travel agents to tour operators. It’s not about being an expert, but the ideas that you can present and task that you face on a daily basis with Travel that may work for some or none will be a great tool to 70,000 agents. This is also a great way to market your Travel Agency. If you’re a travel agent who’s willing to discuss your successes and challenges in a monthly column check this out.

http://www.travelresearchonline.com/blog/index.php/2015/12/and-with-that-the-2015-travel-agent-diaries-are-a-wrap-but-what-about-2016/

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: homebased travel, online travel, tour operators, travel, travel agency, travel agents, travel industry

November 30th, 2015 by Elma Jane

ASTA American Society of Travel Agents presents The Looming Passport Crunch Tue, Dec 1, 2015 2:00 PM – 3:00 PM EST

Click Here for more info https://attendee.gotowebinar.com/register/8699341866862946817

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: travel, travel agents