October 28th, 2024 by Admin

In the age where technology is practically king, and your business needs to run. We have decided to share with you, apps that can help your business today.

1. OfficeSuite : Free Office + PDF Editor. OfficeSuite lets you view, edit and create in Word, Excel, and PowerPoint documents, and perform advanced PDF operations. Many find the app easy to use while on the go; however, do keep in mind that many found a need to purchase the paid version to get the best out of it. As of this post, the app rated 4.3 stars out of 5 in GooglePlay.

1. OfficeSuite : Free Office + PDF Editor. OfficeSuite lets you view, edit and create in Word, Excel, and PowerPoint documents, and perform advanced PDF operations. Many find the app easy to use while on the go; however, do keep in mind that many found a need to purchase the paid version to get the best out of it. As of this post, the app rated 4.3 stars out of 5 in GooglePlay.

2. Slack: This app brings your team together and maintains communication a breeze. This app helps you check off your to-do list and move your projects forward by bringing your team, conversations, tools, and information you need together. The app is great for big and small business and as of right now it rated 4.4 stars out of 5.

2. Slack: This app brings your team together and maintains communication a breeze. This app helps you check off your to-do list and move your projects forward by bringing your team, conversations, tools, and information you need together. The app is great for big and small business and as of right now it rated 4.4 stars out of 5.

3. Google Drive: This app can help you manage your projects, documents, and photos with ease. Better yet, you can start working on a document from your computer and continue on the go if needed. Google Drive is a safe place for all your files and puts them within reach from any smartphone, tablet, or computer. Currently, is rated 4.4 stars out of 5.

3. Google Drive: This app can help you manage your projects, documents, and photos with ease. Better yet, you can start working on a document from your computer and continue on the go if needed. Google Drive is a safe place for all your files and puts them within reach from any smartphone, tablet, or computer. Currently, is rated 4.4 stars out of 5.

4. Evernote: This is another note app but with more features! This app can help you jot down a few notes, create to-do lists, scan your hand-written notes, add images, web links and even audio. And best yet, this app can be accessed from your computer or on the phone making it extremely versatile. Rated 4.5 out of 5.

4. Evernote: This is another note app but with more features! This app can help you jot down a few notes, create to-do lists, scan your hand-written notes, add images, web links and even audio. And best yet, this app can be accessed from your computer or on the phone making it extremely versatile. Rated 4.5 out of 5.

5. DocuSign: Save time, money and the environment with this app. Docusign allows you to send contracts to your clients while on the go. This app also complies with the e-sign act, the documents are encrypted and is ISO 27001 SSAE16 compliant. Rated 4.5 out of 5.

5. DocuSign: Save time, money and the environment with this app. Docusign allows you to send contracts to your clients while on the go. This app also complies with the e-sign act, the documents are encrypted and is ISO 27001 SSAE16 compliant. Rated 4.5 out of 5.

6. aCalendar: We love Google calendars but this app takes it to a new level of organization. It syncs your phone and Google calendar, has agenda and widget view, 48 colors per calendar, moon phases, mini month or graphical week overview in a day and week view. Currently rated 4.4 out of 5.

6. aCalendar: We love Google calendars but this app takes it to a new level of organization. It syncs your phone and Google calendar, has agenda and widget view, 48 colors per calendar, moon phases, mini month or graphical week overview in a day and week view. Currently rated 4.4 out of 5.

7. Google Ads: With a business, you got to market. Google is usually a good way to get started a managing your Google Ads from your phone is even easier. You can view your campaign’s performance when you are not near your computer and it’s free. Rated 4.3 out of 5.

7. Google Ads: With a business, you got to market. Google is usually a good way to get started a managing your Google Ads from your phone is even easier. You can view your campaign’s performance when you are not near your computer and it’s free. Rated 4.3 out of 5.

8. Google Analytics: Google tools can be your friend and Google Analytics can help you learn how your website is performing. While on the go, this is a good app to have. It helps you see how your ad campaign is doing and what you can do to improve, for free. Rated 4.5 out of 5.

8. Google Analytics: Google tools can be your friend and Google Analytics can help you learn how your website is performing. While on the go, this is a good app to have. It helps you see how your ad campaign is doing and what you can do to improve, for free. Rated 4.5 out of 5.

9. ZOOM Cloud Meetings: Growing your business can mean lots of meetings in your future. When you are not able to meet in person, ZOOM Cloud can help. This app brings video conferencing, online meetings and group messaging into one easy-to-use application. People can connect through the app or via computer. Rated 4.4 out of 5.

9. ZOOM Cloud Meetings: Growing your business can mean lots of meetings in your future. When you are not able to meet in person, ZOOM Cloud can help. This app brings video conferencing, online meetings and group messaging into one easy-to-use application. People can connect through the app or via computer. Rated 4.4 out of 5.

10. Mailchimp: Chances are, if you have a business you are doing e-mail marketing. Up your game with Mailchimp and manage your e-mail marketing efforts on the go. Rated 4.1 out of 5.

10. Mailchimp: Chances are, if you have a business you are doing e-mail marketing. Up your game with Mailchimp and manage your e-mail marketing efforts on the go. Rated 4.1 out of 5.

App images via Google Play

Posted in Uncategorized Tagged with: Android, Android app, apps, b2b business, boost productivity, business, calendar, evernote, google, Google Apps, google drive, google play, mailchimp, productivity, slack, zoom

August 30th, 2024 by Admin

According to a poll by OnePoll on behalf of I Love Velvet titled “Consumer Mobile Point-of-Sale (MPOS) Attitudes Report” over half of retail customers think cash registers are outdated. The poll found that 51% of Americans think the cash register could soon be gone altogether as retailers opt for mobile point of sale systems. Consumers seem to favor MPOS systems allowing the shoppers to check out from anywhere in the store and that they return more often to stores with modern electronic payment technologies. Thirty five percent cited they would shop more often at stores with mobile point of sale payment systems. An additional 17% said they would share their shopping experience via social networking sites and 35% report they likely would tell a friend or recommend stores with these technologies. Forty six percent say that stores that have mobile payment systems seem to be more tech savvy and even more (56%) praise the store for making the experience more convenient and secure. Retailers are struggling to modernize their payment platforms to cut down long lines at registers, and place staff on the floor for better customer access. “It’s a great opportunity for retail store owners to dip into the mobile point of sale arena” said Richard Delos Santos of National Transaction Corporation.

Mobile point-of-sale equipment and software manufacturers are stepping up to the security plate as they seek to pass PCI DSS and other security related issues. As new mobile kiosks and point of sale hardware and software evolve so do the security challenges used to thwart credit card fraud and identity theft. The challenge for point of sale system providers is to create an increasingly secure and convenient way for customers to make electronic payments in-store or on their mobile devices. iPads, iPhones and Android tablets are often used by curious shoppers to compare and contrast features, prices and availability, why not let digital wallets be used to close the transaction? The use and connectivity of these new devices mean more complex security measures are needed to thwart attackers, crackers, and hackers.

In the coming years everything from NFC, to fingerprint readers in smartphones and tablets and even QR codes will change the landscape of mobile payment transaction processing and things are beginning to heat up. An estimated $17 Trillion of mobile transactions are predicted by 2020 and security and adoption will reign king on the streets. It might be time to look into the security and features that a mobile point-of-sale system can add over any existing point of sale systems and cash registers. Mobility is a great tool for a sales force, but security and convenience for the customer is a necessity that will only grow in the future.

If You need help setting up a merchant account, Call 888-996-2273 Today!

Posted in Credit Card Reader Terminal, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale Tagged with: Android, ipad, Iphone, mobile, MPOS, payments, point of sale, Processing, smartphone, tablet, transaction

October 13th, 2015 by Elma Jane

What can near field communication do for individual and how can it make lives easier. Many uses of NFC technology offer benefits in a number of everyday tasks ranging from paying for groceries to receiving adequate health care treatments.

Check this out if the benefits are worth it:

Contactless Payments – well-known use of NFC technology is for contactless payment. Customers can use their smartphone over a card reader to make a purchase without swiping or counting out cash. This saves time and also reduces the chances of losing a credit card that comes with carrying multiple cards around.

Health Care – With NFC technology, hospitals can better track patient information and doctors’ notes in real-time. This helps prevent the wrong medications from going to the wrong patient and creates a streamlined system focused on the best in patient care.

Information Sharing – NFC tags most common way NFC is currently used on Android and Windows phones. Using your Phone or Tablet, you can tap a strategically-placed NFC tag, which prompts your phone to take action on something, like automatically prompts your phone to enable Wi-Fi, disable sounds and decrease brightness. Exchange information between two Android phones.

Pairing with Devices – Smart household appliances are adopting NFC. LG’s smart washing machines let you pair your phone with the machine so that you can remotely monitor the washing cycle.

Social Networking Social networking is booming, and NFC tags are looking to get in on the action. NFC allows users to interact with each other and update their location and other info without any unnecessary log-ins or tapping through menu screens.

Transportation – Swiping a smartphone not only allows the passenger access to the subway but also keeps track of the number of trips he has left. Passengers can come and go much faster and easily pay for extra trips.

Posted in Best Practices for Merchants, Near Field Communication, Smartphone Tagged with: Android, card reader, contactless payment, credit card, health care, Near Field Communication, nfc technology, smartphone

April 20th, 2015 by Elma Jane

With each year comes a new set of security risks businesses need to be aware of. The threats that have seen the most growth over the last year include point-of sale (POS) malware, malware traffic within secure and encrypted HTTPS websites and attacks on computer systems designed to control remote equipment.

Everyone knows the threats are real and the consequences are dire, so we can no longer blame lack of awareness for the attacks that succeed. Hacks and attacks continue to occur, not because companies aren’t taking security measures, but because they aren’t taking the right ones.

The large number of highly publicized POS breaches last year has heighted the need to make sure that businesses that use these devices are properly protecting them.

Malware targeting point-of-sale systems is evolving drastically, and new trends like memory scraping and the use of encryption to avoid detection from firewalls are on the rise. To guard against the rising tide of breaches, retailers should implement more stringent training and firewall policies, as well as reexamine their data policies with partners and suppliers.

For many years, businesses thought using a secure HTTPS Web connection protected them from a security breach. That no longer appears to be the case. While the increased number of businesses moving to a more secure Web protocol is a positive trend, hackers have identified ways to exploit HTTPS as a means to hide malicious code. Since the malware transmitted over HTTPS is encrypted, traditional firewalls fail to detect it.

Just as encryption can protect sensitive financial or personal information on the Web, it unfortunately can also be used by hackers to protect malware. One way organizations mitigate this risk is through SSL-based Web-browser restrictions, with exceptions for commonly used business applications to avoid slowing company productivity.

Several identified trends and predictions for the coming year, including the following:

Android will remain a main target for hackers. More sophisticated techniques will be developed to hinder Android malware researchers and users by making the malware hard to identify and research.

As wearable technology becomes more prevalent, expect to see malware start to target these devices.

Digital currencies, including Bitcoin, will continue to be targeted.

More organizations will enforce security policies that include two-factor authentication, which will likely increase the number of attacks on these technologies.

Posted in Best Practices for Merchants, Credit Card Security, Mobile Point of Sale, Payment Card Industry PCI Security, Point of Sale Tagged with: (POS) malware, Android, bitcoin, Digital currencies, point of sale, POS breaches, security breach, SSL-based Web-browser

September 19th, 2014 by Elma Jane

MasterCard is claiming a 98% success rate for pilot trials of a biometric verification system combining both voice and facial recognition.

It recently held a closed pilot to understand the consumer experience around voice and facial recognition.

A beta mobile app was tested in an e-commerce environment on over 14,000 transactions. The test group, used both Android and iOS operating systems. The results, yielding a successful verification rate of 98%, mixing a combination of voice and facial recognition. The process usually took less than 10 seconds.

With the first wave of apps utilising Apple’s TouchID fingerprint recognition system coming to market – both US neo-bank Simple and PFM outfit Mint have shipped their first iOS upgrades to incorporate the technology. Biometric verification is beginning to gain currency among businesses and consumers as a useful tool in the fight against fraud.

The launch of Apple Pay will start to bring true scale to the next generation of payments authentication. The challenge is to take lessons from the different applications of biometrics already in place and elevate them into the next generation of authentication, not just for one platform, but for the mass market globally.

MasterCard already has first hand experience of a mass-market implementation of biometric card technology with the recent launch of the Nigerian eIDcard, which combines payment card functionality with a mix of fingerprint, facial and iris recognition.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: Android, Android and iOS operating systems, Apple Pay, Apple's TouchID, beta mobile app, biometric card, biometric card technology, biometric verification, biometric verification system, card, card technology, consumer, currency, e-commerce, facial recognition, fingerprint recognition, fingerprint recognition system, fraud, iOS, iOS operating systems, iris recognition, mass market, MasterCard, mobile app, payments authentication, platform, rate, transactions, verification rate, verification system, voice and facial recognition

July 22nd, 2014 by Elma Jane

An Android tablet is a great tool for work, but not every Android app was made for tablets. In fact, most Android apps were made for smaller smartphone displays. While those apps will run just fine on your tablet, they don’t do anything to take advantage of the extra screen space, and while smartphone apps are forced to hide options deep in menus, tablet apps have more room to put those controls front and center. Plus, phone apps just don’t look very good on a tablet. The interface is usually stretched and skewed to fill the larger screen. With that in mind, here are apps that will help you get to work on your Android tablet.

Android Device Manager (Free) – a good tool to help you find a lost or stolen Android device. Keeping it installed on your Android tablet will enable you to quickly locate your business phone if it’s ever misplaced. The app can force your phone to ring even if it’s in silent mode. Lock it to prevent thieves from accessing private or confidential business data and even locate your phone using its built-in GPS sensor. Using Android Device Manager on a tablet gives you plenty of space to view and pan around the map while you’re pinpointing the location of your phone. As a last resort, you can use the app to remotely wipe all the data from your smartphone.

Evernote (Free) – is a great app for taking notes, making to-do lists and saving photos and it’s even better on a tablet. The biggest difference between the smartphone and tablet version of Evernote is that the latter features a persistent sidebar that lets you quickly flip between notes, notebooks and tagged items. It has large buttons that let you create a new note, snap a photo or quickly dictate a voice memo. Those options are hidden in a slide-out menu in the smartphone app. You also get more space to view each individual note, which means you can see your entire memo or list at once with less scrolling and swiping.

Google Docs (Free) – Let’s face it: a word processor like Google Docs isn’t all that useful on your smartphone. Sure, it can come in handy when you need to make a few tweaks to an existing document, but you’ll need a bigger display to get much work done. The Google Docs app was really made for tablets, especially when you pair your slate with a Bluetooth keyboard to use it like a laptop computer. Not only do you get a better view of your entire document on the tablet, but you also get quick access to formatting options at the top of the interface, letting you change fonts, colors, text alignment and more. Those options are tucked away in several layers of menus in the smartphone app. Google’s Sheet spreadsheet editor and Slides presentation maker are also better suited for a large tablet display than a smartphone.

Google Drive (Free) – is a solid cloud storage platform for Android users, and a large tablet screen makes it easier to navigate your file library, thanks to a persistent sidebar that lets you jump to any folder with one tap. It also helps you search through shared and starred documents, or jump to a view of your recently uploaded files. But the best reason to use Google Drive on your tablet is that it lets you open those documents on the tablet version of Google Docs, which is much more functional on a large screen than on a smartphone.

Google Keep (Free) – is a minimalist productivity app that lets you quickly capture notes, voice memos and photos, then view all items in a colorful pinboard-style layout. It works fine on smartphones, but on tablets the app scales beautifully to fill the entire screen, letting you view more notes and photos at once. Otherwise, the app offers identical functionality on smartphones and tablets. In addition to pinning new notes to your board, you can create a to-do list and check items off with one tap. You can also set reminders for any item on your tablet and receive an alert on your smartphone when the time comes.

Hangouts (Free) – is an all-in-one messaging app that combines text messaging and videoconferencing functionality. The app imports your contacts from your Google account to let you create new conversations quickly and the ability to add and remove participants in the middle of a conversation helps it stand out from other messaging apps. You can start a video chat session at any time by tapping the video call button during a Hangouts session. That comes in handy when you need to meet with an employee, colleague or client, but can’t meet face-to-face. Hangouts works fine on a smartphone, but it’s better on a tablet. A persistent sidebar makes it easier to browse through your past conversations, and a larger touch-screen keyboard makes it easier to type out messages.

Informant 3 ($9.99) – is a powerful productivity app that combines a business calendar and task manager in a single location. The calendar automatically imports all your events and appointments from the stock Android calendar, so getting started with Informant 3 is easy. Once it’s set up, you can view your agenda at a glance. Change the view to get the optimal view of your day, week or month and add, move and delete items with a few taps. Meanwhile, the task manager lets you add items to a dynamic to-do list, set reminders and alerts, sort tasks by importance and more. Informant 3 works best on a tablet. Browsing your calendars and lists is easier and more comfortable on a larger display. The app also features a special tablet mode with a sidebar that lets you quickly jump between calendar dates.

Posted in Uncategorized Tagged with: Android, Android Device Manager, app, Bluetooth keyboard, computer, data, evernote, Google Docs, google drive, Google Keep, hangouts, Informant 3, laptop, notebooks, notes, phone apps, platform, smartphone, tablet

June 19th, 2014 by Elma Jane

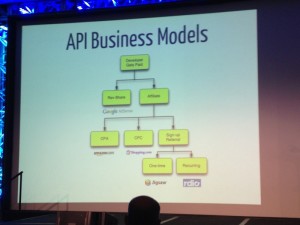

API Software Inc. has created an application ISOs can use to help merchants tabulate the best payment services deals. The Square Deal Pro app for the merchant services industry enables sales reps to compare their company’s rates to those of Square, PayPal, Stripe and other payments aggregators. Essentially, the application takes the mathematics burden off of the merchant and helps an ISO or agent compare bundled pricing with interchange-plus pricing.

Frank Haggar, a software developer, started asking merchants why they chose a certain provider and they just said the pricing was simpler. It might be more expensive, but it was easier for them to understand. That moved to develop Square Deal Pro. It’s a software that salespeople can have right on their phones and it makes a comparison and is easy to understand. Square Deal Pro, which operates on iPhones, Android devices and Windows phones, was established as a vendor-neutral tool that is also available for merchants to download if they were inclined to want to crunch numbers themselves. Service providers pay for the application and all of its sales features, but a free version for price comparisons only is available to merchants.

Merchants are experts in what they know how to do and they may not want something that includes math distracting them from that, but the sales rep can do it for them and use it along the lines of a calculator helping someone figure out mortgage rates. ISOs have various tools at their disposal and lock in key information in their brains to prepare for sales presentations, but most will likely find Square Deal Pro a valuable addition. Something that takes complicated pricing schemes and factors it all into an easy interface that puts out a clear comparison that is valuable, certainly out in the field.

API Software has to deliver something difficult or impossible to copy because that would set this permanently apart as opposed to being a lead to other similar products in the market. An ISO can change rates or make adjustments for a client if the numbers show that another provider is offering a less expensive option, but the numbers in the app don’t lie. The app will show how a bundled rate can work in your favor, such as if you are selling Girl Scouts cookies at $3 a box. Then use Square all day long, but an ISO can compare how his product works compared to others and the app can show, that at a certain time, it might be beneficial to switch over.

Square Deal Pro takes into account factors other than interchange rates, including merchant volume, average ticket price and whether transactions are keyed or swiped or both. All of those things determine where you fit in on the diagram of how your rate should be structured. There is a lot of analysis on minimal focal points. The application may also help defuse potential problems with merchants who sometimes feel their sales rep was not providing a fair assessment of pricing structure or comparisons.

As for the application’s name, Haggar doesn’t want any confusion over whether this might be a new Square product.

Posted in Best Practices for Merchants Tagged with: account, aggregators, Android, assessment, bundled pricing, developer, devices, interchange, interchange rates, interchange-plus pricing, iPhones, ISOs, market, merchant services, merchant volume, Merchant's, mortgage rates, payment, PayPal, phones, pricing, Pro app, products, provider, Rates, sales, Service providers, software, Square, Square Deal Pro app, Stripe, transactions, Windows phones

May 15th, 2014 by Elma Jane

Looking to buy a new business phone? Wait!!! A slew of hot new smartphones are set to launch in the coming months, 2014 has already seen its share of major releases. This spring, HTC unveiled the new HTC One M8, which packs a slick all-metal body and Samsung debuted the featured-packed Galaxy S5. Nokia also released the Lumia Icon, its new flagship Windows Phone. But some of the year’s biggest releases are still to come, including a new version of Apple’s iPhone and a follow-up to Samsung’s stylus-equipped Galaxy Note 3. Meanwhile, a new Android phone from startup OnePlus could make a splash.

Galaxy Note 4

Samsung is expected to launch a follow-up to the Galaxy Note 3 this fall, one of the best business phones ever made, thanks in part to the included S Pen stylus, which slides out from a slot on the phone’s chassis and turns the device into a note-taking machine. The phablet also boasts a stunning 5.7-inch display that’s big enough for real productivity tasks. Samsung hasn’t officially confirmed any details about the Note 3’s successor, but there are a few safe bets. For starters, fans can expect the line’s trademark stylus to return for the Galaxy Note 4. Its display meanwhile, should rival the Samsung’s newer Galaxy S5 in terms of brightness and picture quality. Finally, considering Samsung packed a fingerprint reader into the S5’s home button, it’s likely the company will do the same for the Note 4. A fingerprint reader can make your business phone more secure, since only you can unlock the device with a quick swipe of your finger.

iPhone 6

Apple’s iPhone 5s is a great phone, but its compact 4-inch display could be too small for some people. Reports indicate that Apple might deliver a much bigger device in the iPhone 6, which is expected to debut this fall in 4.7-inch and 5.5-inch variants. That’s a big deal for business users who depend on their smartphone to stay productive but prefer a larger display. Both models are also rumored to include a blazing-fast A8 processor, an upgrade over the speedy 64-bit A7 chip found in the iPhone 5s. The iPhone 6 is also expected to include the same fingerprint reader that debuted with the iPhone 5s. The reader is embedded in the phone’s home button, and lets you unlock the device simply by placing your finger on the button. And of course, the iPhone is the only smartphone that gives you access to Apple’s App Store, which features the biggest and arguably the best, library of business and productivity apps on any platform.

LG G3

LG is preparing to unveil a successor to its flagship phone, the LG G2 this spring. The so-called LG G3 could be one of the year’s most noteworthy business phones if it retains the G2’s superlong battery life. The phone ran for up to 11 hours in tests that involved continuous Web browsing, making it one of the longest-lasting smartphones ever made. In addition to longevity, the G2 boasts a snappy quad-core processor, a roomy 5.2-inch display and a handy multitasking feature called QSlide, which lets you run a second app in a floating window over your main app. That’s a plus for business users who need to juggle tasks such as responding to email while conducting research in a Web browser. LG hasn’t yet announced which features will get an upgrade for the LG G3, but fans won’t have to wait long to find out. The company is expected to show the device off at a special press event on May 27, though it’s not yet known when the phone will hit store shelves.

Lumia 635

Windows Phone fans saw the release of a new flagship device in the Nokia Lumia Icon this spring. Now, Nokia is following that up with the Lumia 635. A new midrange Windows Phone with a lower price point, that could make it worth a look for budget-minded business users, especially since the device runs on Windows Phone 8.1, a new version of Microsoft’s mobile operating system. One of the phone’s standout features is Cortana, a voice-activated personal digital assistant that can notify you of upcoming appointments, flight information, weather alerts and more. Also, new in Windows Phone 8.1 is the Action Center, which is similar to the notification hub found on both the Android and iOS operating systems. Just swipe down from the top of your phone’s display to view all of your alerts at a glance, and like every Windows Phone device. The Lumia 635 is fully integrated with the desktop version of Microsoft Office.

OnePlus One

The OnePlusOne set to launch this June, is a powerful new business phone with a unique set of features. The 5.5-inch Android device packs a huge display, a top-tier processor and a high-capacity battery. The phone also adds features you won’t find in many flagship phones, such as always-on voice commands. So instead of fiddling with menus and touch-screen controls, you can set an alarm, place an appointment in your calendar or access turn-by-turn directions by uttering a few words – even when the display is off. The OnePlus One also offers a few notable security features you won’t find in most other smartphones. For instance, the phone’s Privacy Guard setting lets you block individual apps from accessing personal information stored on your device. The OnePlus One also ships with built-in encryption for SMS text messages to ensure your private business communications remain private.

Posted in Smartphone Tagged with: Android, Android and iOS operating systems, Android device, Android phone, App Store, Apple's iPhone, Apple's iPhone 5s, chip, Cortana, desktop, device, digital, email, encryption, fingerprint reader, flagship phones, Galaxy Note 3, Galaxy Note 4, Galaxy S5, high-capacity, HTC, HTC One M8, hub, integrated, iOS, iPhone 6, LG G2, LG G3, Lumia 635, Microsoft, Microsoft Office, Microsoft's mobile operating system, mobile, Nokia, Nokia Lumia Icon, OnePlusOne, operating systems, phablet, phones, platform, Privacy Guard, processor, QSlide, S Pen stylus, Samsung, Security, slot, Smartphones, sms, stylus, swipe, top-tier processor, touch-screen controls, voice commands, web, Web browsing, windows, windows phone, Windows Phone 8.1

April 22nd, 2014 by Elma Jane

Mobile Business App.

Customers should be able to easily find you wherever they are, from any device. Mobile presence is more or less essential for business success in today’s world, whether you just have a mobile-optimized website, or a full-scale dedicated mobile application for your business.

With smartphones and tablets, people have a computer in their pockets when they’re out and about are where people are engaging with content, so business want a mobile strategy.

The problem many businesses have with mobile strategy development is determining what is most effective, both in terms of reach and cost. Creating a mobile app isn’t the right path for every company, but if it’s something you’re considering, check the following questions before you invest.

Android, HTML5 or iOS?

No matter what platform you choose, it’s important not to take on too much too soon, regardless of your technical skill level. There are a lot of different solutions for app development. Keep it simple and work on it. Once you’ve made the decision to develop an app and figured out your end-goal for it, determine what platform you want to use. When businesses choose to create an app for only Android or iOS, they end up missing half the market, but building an app on both major platforms requires two different sets of technical skills. While an app creator can make it much easier to develop an app on multiple platforms, including Windows Phone and Blackberry, maintaining a multiplatform presence will end up costing you more. HTML5 Web-based apps may not be as visible as those in major platform app stores, but they are compatible on mobile browsers of any operating system, as well as desktop browsers.

Make an own app, or become part of an existing?

If you want to create your own native app, make sure you have a plan to continually update and work on it. Don’t underestimate the ongoing maintenance. Constantly engage with the app, and as you’re planning it in the first place, think about what you want to add over time.

Many businesses begin the app development process without considering the amount of time and money they will need to invest in the process. Becoming part of an existing app for example, a directory-type app that lists businesses in your industry can be an easier, less expensive way to claim your segment of the mobile market. The app creator can do the heavy technical work while also providing you with the opportunity to connect with its larger network of users.

What do you want to gain from your business app?

Is it to bring people into your store or to get them to visit your website? Many businesses waste a lot of resources because they think people will just come to their app. It’s trendy to say that you have a mobile app, but if your goal is just to have that mobile presence, you’ll create something that no one will ever see. Small businesses should set a clear goal to focus on before beginning app development. Having a mobile presence is more or less essential for business success in today’s world. Whether you just have a mobile-optimized website, or a full-scale dedicated mobile application for your business, your customers should be able to easily find you wherever they are, from any device.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Financial Services, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: Android, android or ios, app, app development, blackberry, business, device, html5, iOS, mobile, mobile application, mobile browsers, mobile presence, mobile strategy, mobile-optimized website, multiplatform, pockets, Smartphones, tablets, web-based apps, windows phone

March 17th, 2014 by Elma Jane

With so much to do each day, it’s easy for a small business owner to get bogged down in details. That’s where your smartphone comes in. With the right apps, your mobile device can automate the tasks that used to be daily chores. Whether you need help keeping track of all your business documents, or organizing your calendar and contacts list, it’s time to let your smartphone do some of the heavy lifting.

Back up your business files. Your work machine contains everything you need for a productive day, including every file and document you are working on. But you can’t always be at the office. With your smartphone and the right apps, however, you can back up and access your business files from anywhere. Dropbox, Box, Google Drive, SkyDrive and iCloud are all solid mobile apps that automate the process of syncing your business files to the cloud so you can access them from any Web-connected device, including your smartphone or tablet. Better yet, any edits you make will be synced across all your devices, so you can stay productive and organized.

Manage new contacts. Swapping business cards is a great networking strategy, but cards are easy to lose, and manually inputting all that contact information into your address book is a chore. So let your smartphone enter all that data into your address books. CamCard (available for iOS and Android) is an all-in-one business card management solution. Just point your iPhone camera at a card and snap a photo. The app’s text-recognition software will pull out the key details and update your address book automatically. It can even search for new contacts on LinkedIn to add a photo and additional personal details for each new contact.

Silence your smartphone. A buzzing or ringing smartphone can be distracting – not to mention embarrassing – during a business meeting. Silencing your phone is simple, but chances are you’ll occasionally forget. That’s why there are handy apps that monitor your smartphone calendar for meetings and appointments, then silence your phone for the duration of that event. You can even whitelist specific numbers so you won’t miss an emergency call. When the meeting is over, your smartphone’s ringer and vibration settings will be returned to their normal state. That way, you can stay focused and free from distraction when it matters most. Android users can try Silencify. For iPhone users, AutoSilent is a good option.

Sync your calendars. Both Android and iOS have built-in calendars to help you plan your week and schedule meetings. But juggling both a mobile calendar and a desktop office calendar is a pain, so why not use your smartphone to synchronize the two? If you use Microsoft Outlook as your business calendar, for example, Google Calendar offers an easy way to link them. And iPhone users can synchronize their mobile calendar with Outlook by plugging their smartphone into their computer and accessing the Calendars tab in the iTunes options menu. Automating the process of syncing your calendars means you’ll never mix up appointments. And if you share your business calendar with your employees, it ensures that everyone is always on the same page.

Sync your social media accounts. A strong presence on Facebook and Twitter can help you engage your customers and grow your business. Mobile apps can help you keep your business profiles fresh when you’re on the go, but reposting those updates on each platform individually can be a chore especially from a tiny smartphone screen. Fortunately, there’s an easy way to automate the process of synchronizing social media posts between your business profiles. Simply visit this page to link your Facebook and Twitter accounts. After that, go ahead and use the Facebook mobile app to post updates, news or promotions to your business’s Facebook page, each post will be automatically funneled to your Twitter followers as well.

Posted in Best Practices for Merchants, Mobile Payments, Small Business Improvement, Smartphone Tagged with: all-in-one, Android, apps, automate, automate the process, automating, box, business documents, business profiles, camcard, devices, dropbox, Facebook, google drive, icloud, iOS, Iphone, linkedin, Mobile Apps, mobile device, networking, organizing, productive, skydrive, small business, smartphone, synchronize, synchronizing social media, syncing, tablet, twitter, web-connected

1.

1.  2.

2.  3.

3.  4.

4.  5.

5.  6.

6.  7.

7.  8.

8.  9.

9.  10.

10.