November 20th, 2015 by Elma Jane

LG is planning to launch its mobile payment service by December in a bid to compete in the global mobile payment market that is already dominated by tech majors such Apple Pay, Samsung Pay and Android Pay. The service solution dubbed as LG Pay. Some observers have said it will likely follow Samsung to the US, as well since it has trademarked the product name both at its homeland, South Korea and United States. The company broke the news in its Facebook page.

Posted in Best Practices for Merchants, Mobile Payments Tagged with: Android Pay, Apple Pay, global mobile payment, mobile payment, Samsung Pay

November 19th, 2015 by Elma Jane

The Ingenico iCMP PIN pad is now available with Converge in the US! This EMV-enabled device is flexible to use with a USB connection and Converge or with a Bluetooth connection and Converge Mobile (launching soon!).

Key features of the Ingenico iCMP include:

Chip, Contactless and Mag Stripe

Accept EMV chip cards, including Chip & Pin and Chip & Signature as well as mag stripe cards and contactless payments – mobile wallets like Apple Pay and contactless cards. The EMV-capabilities of the PIN pad help protect our customers from counterfeit card fraud.

Debit and Credit PIN Based Transactions

Accept debit and credit cards using PIN capabilities on the device. This is important to help further protect our customers from lost, stolen and NRI (not received/issued) fraud.

Encryption

Encrypted to keep card data separate and away from the mobile app/device and safe as it travels through the payment network.

Bluetooth or USB

Connect with a USB connection when using a computer and Converge www.convergepay.com or Bluetooth when using with the upcoming Converge Mobile app.

Pocket size

Takes up little space on a countertop, and it’s easy to carry when on the go.

Give us a call now at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: Apple Pay, card data, Chip & PIN, Chip & Signature, chip cards, contactless cards, contactless payments, Converge, Converge Mobile, credit cards, Debit and Credit, EMV, encryption, ingenico, mag stripe, mobile wallets, payment network, transactions

November 17th, 2015 by Elma Jane

Get your Business Ready for Apple Pay and Let your Customers know you Accept Apple Pay!

Business owners can order Apple Pay Decals for their Stores. Each Packs includes Two Glass Decals and Two Register Decals in different sizes, and a tool for affixing the ads to the appropriate surfaces. Those who need more than five will need to call Apple to place an order.

Apple made the Apple Pay Logo available for download and provided a PDF explaining its guidelines. Apple specifies that the Apple Pay Logo should be placed ahead of similar marks for other payment services like MasterCard and Visa. The guidelines document of the payment mark are available from the Apple Site.

It’s easy!

Click here to download Apple Pay mark to use within email, on your terminal screen, and on your website.

Order Apple Pay decals for your store to put on your storefront window and register.

National Transaction Terminals with EMV/NFC (near field communication) Capability to accept Apple Pay, Android Pay and other NFC payment transactions at your business. Give us a call now at 888-996-2273.

Posted in Best Practices for Merchants Tagged with: Android Pay, Apple Pay, EMV, MasterCard, Near Field Communication, nfc, payment services, payment transactions, terminals, visa

November 13th, 2015 by Elma Jane

It’s important for merchants to understand the basic of how a credit card terminal works. It is the channel through which the process flows and the merchants can choose the right one for their processing needs, whether they use a point-of-sale (POS) countertop model, a cardreader that attaches to a smartphone or mobile device, a sleek handheld version for wireless processing or a virtual terminal for e-commerce transactions.

A credit card terminal’s function is to retrieve the account data stored on the payment card’s EMV microchip or a magnetic stripe and pass it along to the payment processing company (also known as merchant account provider).

For card-not-present (CNP) – mail order, telephone order and online transactions – the merchant enters the information manually using a keypad on the terminal, or the e-commerce shopper enters it on the website’s payment page. The back half of the process remains the same.

The actual data transmission goes from the terminal through a phoneline or Internet connection to a Payment Processing Company, which routes it to the bank that issued the credit card for authorization.

In card-present transactions where the card and cardholder are physically present, the card is connected to the reader housed in the POS terminal. The data is captured and transmitted electronically to the merchant account provider, who handles the authorization process with the issuing bank and credit card networks.

A POS retail terminal with a phone or Internet connection works best in a traditional retail setting that deals exclusively in card present transactions. For a business with a mobile sales, a mobile credit card processing option like Virtual Merchant Converge Mobile relies on a downloadable app to transform a smartphone or tablet into a credit card terminal equipped with a USB cardreader.

Wireless Terminals are compact, allowing you to accept credit cards in the field without relying on a phone connection. If you process debit cards, you’ll need a PIN pad in addition to your terminal so cardholders can enter their personal identification number to complete the sale.

Selecting the right terminal for your credit card processing needs depends largely on the type of business you run and the sorts of transactions you process. Terminals are highly specialized and provide different services. At National Transaction we offer a broad range of terminals with NFC (near field communication) Capability to accept Apple Pay, Android Pay and other NFC/Contactless payment transactions at your business. An informed business decision benefits your bottom line. Start accepting credit cards today with National Transaction.

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Point of Sale, Point of Sale Tagged with: Android Pay, Apple Pay, card-not-present, card-present transactions, cardholder, cardreader, cnp, contactless payment, Converge Mobile, credit card, credit card networks, credit card terminal, debit cards, e-commerce, EMV, magnetic stripe, mail order, merchant account provider, merchants, microchip, mobile credit card processing, mobile device, Near Field Communication, nfc, online transactions, payment processing company, PIN pad, point of sale, POS, POS terminal, smartphone, telephone order, virtual merchant, virtual terminal, wireless processing

November 6th, 2015 by Elma Jane

Money 20/20 was billed as the largest convention in payments history held in Las Las Vegas, during the last week of October 2015.

The show delivered well-organized, incisive content such as Europay, MasterCard and Visa (EMV) migration, mobile payments, security and omnichannel commerce.

20/20 Highlights

- Alternative lending and credit.

- Bill Payments, Financial Services: Newly released market research provides insights into the future of household bill payments, millennials, and financial services.

- Connected Commerce and the Mobile Enterprise: The Internet of Things is changing the way that consumers interact with their environments. Analysts predict up to 30 billion interactive devices will be connected to the Internet by 2020, noting that many of these devices will be payment-enabled.

- Marketing and Customer Experience: Most marketers agree that the era of demographic profiles and pull marketing is over. Retailers, card brands and information technology professionals looked at the customer experience in the digital world. They explored new marketing practices, trends in e-commerce and mobile commerce, and big data findings in other industries that may be useful to financial service companies.

- Mobile Banking: Banks are undergoing an incremental transformation as they learn to compete with nonbank lenders, balance cash management with digital currencies, and shift from local branches to online and mobile forms of banking.

- Mobile Payments: Payments analysts reviewed Apple Pay a year after its launch and a range of other mobile wallet offerings, and they speculated on how third-party wallets will impact bank apps.

- Payment Card Evolution: Payment card issuers, processors and network service providers analyzed the changing look, feel and role of payment cards in the greater ecosystem. Discussions ranged from card linking to the coolness factor of gift cards to how e-cards are expanding market opportunities.

- POS, Processing and Open Platforms: Executive roundtables with leading acquirers explored front-end and back-end technology and omnichannel commerce for small and midsize businesses.

- Regulatory Landscape: Increased federal and state oversight has had a significant impact on the financial services sector.

- Security: Security analysts made in-depth presentations on tokenization, end-to-end encryption, and secure methods of authentication designed to protect consumers, merchants and industry stakeholders from cybercriminals. Many agreed that EMV implementation in the United States will drive fraudsters to the card-not-present space. They discussed how EMV adoption has changed fraud patterns in other regions and offered examples of best practices geared toward identifying and preventing electronic payment fraud.

More than 10,000 attendees and 3,000 exhibitors from 75 countries attended Money20/20. Financial services professionals from mobile, retail, marketing services, data and technology met at what show organizers described as the intersection of mobile, retail, marketing services, data and technology.

The years to come will be a turning point in the payments sector, and with the recent shift to EMV, the entire conference confirmed that all the players are more interested than ever in finding innovative solutions for combating online fraud.

Posted in Best Practices for Merchants Tagged with: Apple Pay, big data, bill payments, card-not-present, e-commerce, electronic payment, EMV, EuroPay, financial services, Gift Cards, MasterCard, merchants, Mobile Payments, mobile wallet, payments, POS, processors, Service providers, tokenization, visa

October 26th, 2015 by Elma Jane

End Of Life (EOL) terminals are terminals that are no longer produced by the manufacturer, but are still commonly in use today, some of these terminals may be considered obsolete.

If you’re a merchant having trouble with your Hypercom/Equinox 4200 series terminals and they have stopped working or you’re receiving an error message such as Security Error please call your service provider to discuss available options. This is an industry-wide outage that potentially affects all Hypercom/Equinox users.

Now’s a great time to upgrade If you haven’t already, you will need to adopt point-of-sale devices with NFC/contactless readers where you can accept Apple Pay, Android Pay and other contactless device in your business. National Transaction Terminals are EMV/NFC/Contactless readers capable! Give us a call now! at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: Android Pay, Apple Pay, contactless readers, EMV, Equinox, hypercom, merchant, nfc, point of sale, terminal

October 23rd, 2015 by Elma Jane

Loyalty programs continue to change and evolve, with the new and more powerful technology available today, rewarding customers is becoming easier and more targeted.

If you’re starting a new loyalty program or looking to maximize an existing one check this out.

Communication Is Key

Consumer-facing technology is playing a big role in today’s loyalty and rewards programs. Communication with customers is one of the most important marketing tools in loyalty, including digital coupons, direct communication and mobile payment via smartphones and apps.

Keep It Simple

The message to the customer should be simple, as loyalty and rewards programs may be complex and detailed on the backend. Employees should be able to easily communicate how the program works and it should be easy for consumers to understand.

Make It Mobile

Mobile apps, can connect with loyal customers on the go, and utilize messaging and notifications to communicate relevant promotions. The next wave of mobile will be mobile wallet integration, utilizing the big platforms like Google Pay and Apple Pay.

Personalize Offers

Loyalty and rewards programs are becoming more personal. With data and analytics can target promotions and offers based on customer behavior.

Top-Down Approach

When launching or building a loyalty or rewards program, companies need to get everyone on board, explain the goals of the program and what it will look like for customers. Everyone should understand the program and how it works.

For more information about Loyalty Rewards Program and Gift Card Processing you can give us a call now at 888-996-2273 or go to https://www.nationaltransaction.com/merchant-services/gift-card-loyalty-rewards-processing.html

Posted in Best Practices for Merchants, Gift & Loyalty Card Processing Tagged with: Apple Pay, data, Google Pay, Loyalty Rewards Programs, mobile payment, mobile wallet

October 6th, 2015 by Elma Jane

If you accept credit cards and don’t know what EMV is here is what you need to know.

EMV stands for Europay, MasterCard and Visa. A credit card that had a chip embedded in it is an EMV. EMV Cards have been standard in Europe for more than 10 years because they’re more secure than magnetic stripe cards. Magnetic stripe cards doesn’t change, it has static data, which makes them easy to clone. The chip embedded card makes it more difficult and costly to counterfeit because the data that is transmitted changes each time the card is read. This means less fraud.

Liability Shift rules set by Visa and MasterCard as of October 1st. The liability for fraud carried out in physical stores with counterfeit cards belongs to the merchant if it has not yet upgraded its POS system to accept EMV-enabled chip cards.

- Calculate your risk – Consider the cost of replacing your point-of-sale (POS) terminal vs. potential risk. Whether you replace it now or at a later time, eventually all businesses will have to replace their POS terminals.

- Educate your staff – Educated employees translate to better-educated customers. Merchants can help customers better understand this change and what it means for them.

- Upgrade your POS system – Consider using an EMV compliant credit-card reader on a wireless device for an ultra-secure mobile solution. This is also a chance to upgrade other options, such as near field communication NFC technology, which lets consumers use their mobile devices to make payments at the point of sale.

National Transaction Terminals with EMV and NFC (near field communication) Capability To accept Apple Pay, Android Pay and other NFC Transactions at your business. You will need to adopt point-of-sale devices with NFC/contactless readers.

National Transaction offer a range of options to suite your specific needs.

If you’re using Virtual Merchant Mobile now called Converge please contact our office at 888-996-2273 to know your options.

Posted in Best Practices for Merchants, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa Tagged with: Android Pay, Apple Pay, chip cards, contactless readers, Converge, credit cards, EMV, EuroPay, magnetic stripe, MasterCard, merchants, Near Field Communication, nfc, payments, POS, terminal, Virtual Merchant Mobile, visa

September 25th, 2015 by Elma Jane

National Transaction Terminals with NFC (near field communication) Capability to accept Apple Pay, Android Pay and other NFC payment transactions at your business. You will need to adopt point-of-sale devices with NFC/Contactless readers.

National Transaction offer a range of options to suite your specific needs.

Give us a call now! 1-888-996-2273 or go to www.nationaltransaction.com

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: Android Pay, Apple Pay, contactless readers, Near Field Communication, nfc, payment, point of sale

September 22nd, 2015 by Elma Jane

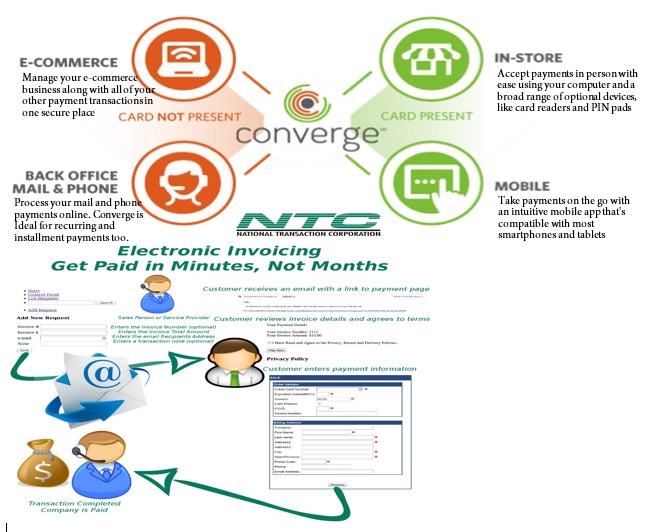

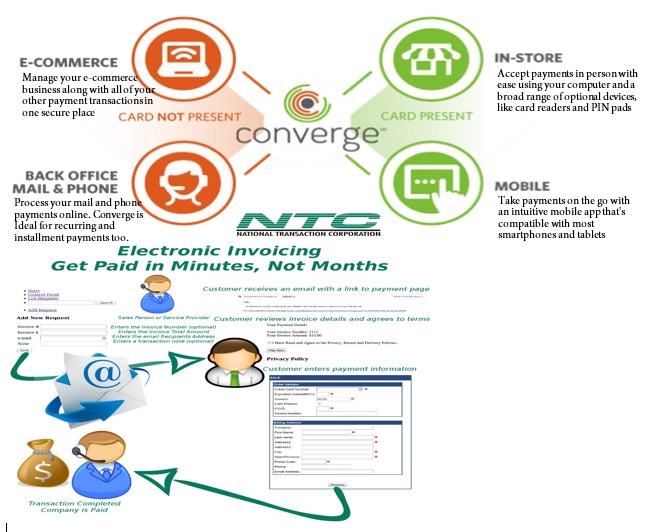

Virtual Merchant/Virtual Merchant Mobile now called Converge, is a popular product offering solutions for retail stores, Non Face to Face businesses along with E-commerce/Internet sites. Converege can be access anywhere with internet. Users can download the application on their smartphone or tablet. Converge also gives users the convenience of sending an invoice to customers electronically with NTC e-Pay!

For Retail store National Transaction offers the latest in EMV and NFC technologies. NTC customers can accept contactless payment with the same NFC technology used by Apple Pay, Google Wallet and SoftCard. NTC offers different solutions that cater to your business needs. For those already using a POS system, NTC integrates with most systems. NTC has you covered.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Electronic Payments, Mobile Payments, Mobile Point of Sale Tagged with: Apple Pay, contactless payment, Converge, e-commerce, EMV, Google Wallet, nfc, POS system, smartphone, tablet, virtual merchant