June 23rd, 2024 by Elma Jane

Merchant Aggregators, Merchants of Records and Payment Service Provider what’s the difference?

Payment Service Provider – is a company, which provides payment gateway and related services (like antifraud tools) to merchants. PSP is a representative of one or several acquiring banks. The merchant signs an agreement with the acquiring bank and PSP. The acquiring bank provides a merchant account and secures settlements for merchant’s transactions directly to the merchant’s bank account. Payment Service Provider secures delivery of the merchant’s transactions to the acquiring bank and some related services like fraud scrubbing and recurring transactions. The merchant has an own merchant account with this model.

Merchant Aggregator – is a company, which uses one merchant account to process transactions from many merchants. Merchants don’t have any agreements with an acquiring bank, but with the merchant aggregator. You get quick setup and get shut down quickly. Most aggregators are hard to get hold of, they don’t have human customer support. The problem with this model is, it’s not intended as a long-term, scalable solution to accepting payments and they can freeze your account or hold your money if anything unusual happens.

Merchants of Record – are a merchant, who use services of payment service provider (PSP) or merchant aggregators to accept payments on their websites for goods or services they sell. Merchant of record role requires an array of administrative responsibilities, such as managing a merchant account with a payment processor, paying associated credit card rates & fees for the transactions and other responsibilities like complying with PCI DSS Standards.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank account, credit card, customer, merchant, payment gateway, payment processor, Payment Service Provider, PCI, transactions

July 19th, 2016 by Elma Jane

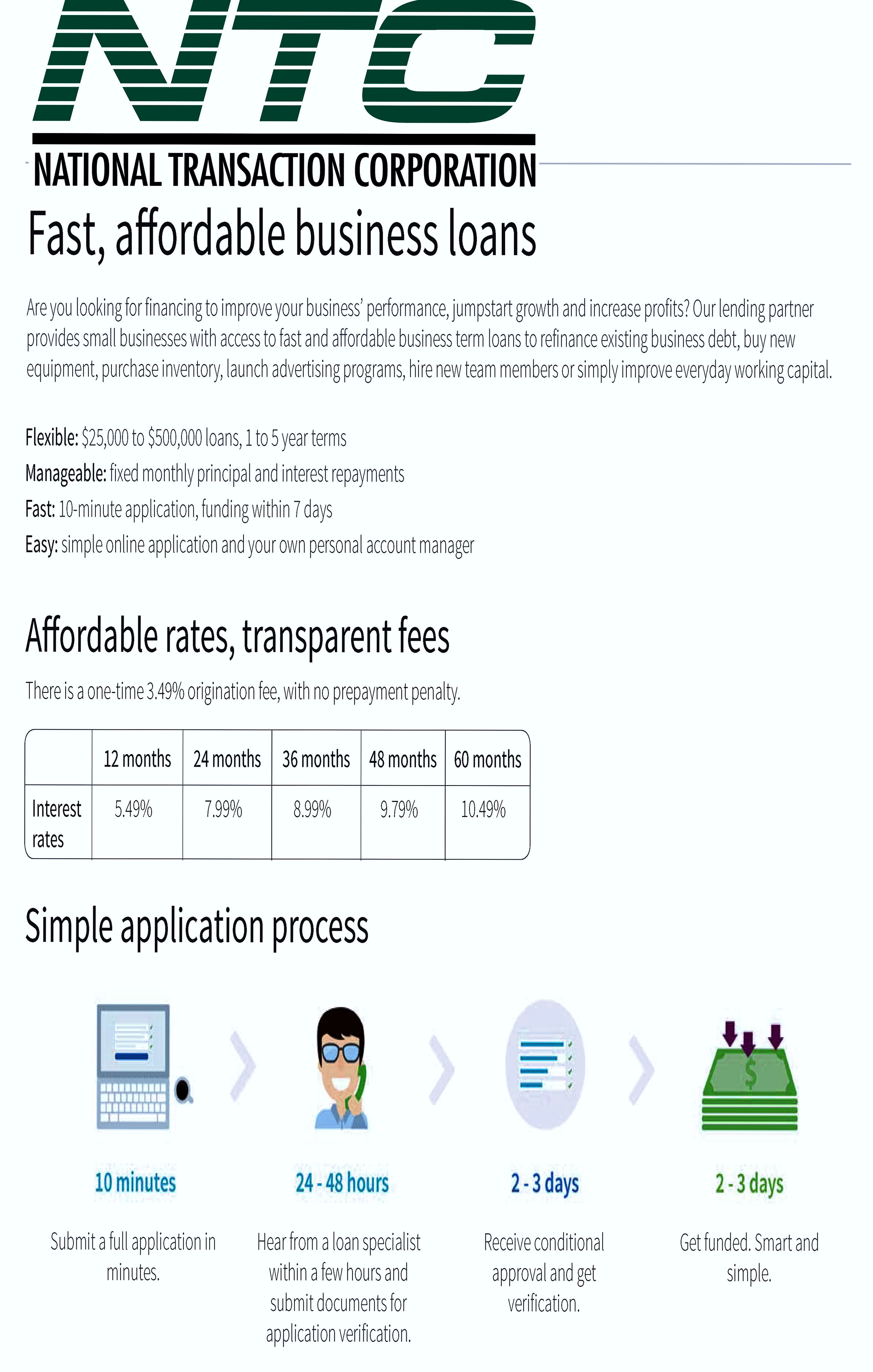

Here are some of the Common Business Loan Fees:

Application Fee – is a fee charged to cover the costs of processing and assessing your loan application.

Bank Wire Fee – When borrowing a loan, lenders commonly wire the money to your bank account via ACH, because the banks need to talk to each other and ensure the money is going to the right place and that no fraud is going on.

Check Processing Fee – ACH transfers are commonly used to collect periodic repayments from the debtor’s bank account. Some lenders offer the option of paying by check, but you’ll have to pay a fee for the extra cost involved.

Closing Cost – not to be confused with closing fees, encapsulate all the fees charged for processing a loan, including origination/closing fees, processing fees, referral fees, and/or packaging fees.

Draw Fee – similar to an origination fee, but is applicable instead for lines of credit.

Guarantee Fee – is charged on all SBA loans above $150K. Guarantee fee is charged to protect against credit-related losses in the mortgage portfolio.

Late Payment Fee – Missing a payment deadline can result in a late fee. A late payment may have an affect on your personal or business credit score.

Origination Fee – an up-front fee charged for processing a new loan application. Prepayment

Penalty – Is a borrower, a bank or mortgage lender agreement that regulates what the borrower is allowed to pay off and when.

Servicing and Maintenance Cost – fees charged to cover the costs associated with collecting payments, maintaining records, following up on delinquencies and any other costs associated with maintaining a term loan or line of credit.

Business loans are available in different types, from merchant cash advances to lines of credit. The most effective way to get the best deal on a business loan is to be educated and know that Fees are Negotiable.

Posted in Best Practices for Merchants, Financial Services Tagged with: ach, bank account, check, credit, fee, fraud, loan, payment

May 5th, 2016 by Elma Jane

Businesses or merchants accepting payments online needs an up-to-date and active security software that includes:

- FIREWALL PROTECTION – a software program that helps to screen out malware and hackers that try to reach you through the internet.

- ANTI-VIRUS PROGRAMS – Not all anti-virus program offers protection against all kinds of malware. Viruses are one type of malware. Spyware is another type of malware that can steal credit card information or your bank account.

Update:

- Keeping your operating systems, security software programs, and browser current can help secure your data information.

- Evaluate browser’s privacy settings, limit or disable cookies. Other cookies can be used maliciously and collect data information.

- Back up your data regularly. If your computer or device got compromised, you still have access to important files.

Need to set up an account give us a call at 888-996-2273

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank account, credit card, data, merchants, online, payments, Security

October 27th, 2015 by Elma Jane

If there’s an unauthorized charge made on your credit card account, no money is taken from you. There’s no immediate financial hit while you straighten things out. But if someone gets hold of your debit card information, your bank account will be drained depending on the nature of the transaction.

Differences between a credit card and a debit card:

Debit cards fall under a different federal law than credit cards. Regulation E, the Electronic Fund Transfer Act, says after two days, you could be liable for up to $50. After 2 days liability jumps to 500.00. Beyond 60 days, you could be liable for all unauthorized transactions. Otherwise, federal rules are on the bank’s side. Beyond 60 days, there’s likelihood you’ll never see your money again.

Federal law protects you from unauthorized charges made with your credit card number rather than with the actual card. In the event the credit card is in a thief’s hands, you’ll be liable, but only for a maximum of $50, provided you report the problem to the credit card company. However, in many cases a zero liability policy may kick in.

There are many things that can go wrong. Best solution is to pay close attention to your statements, online or via a mobile app, frequently. Report if there’s a malicious transaction.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank account, credit card, credit card company, debit card, Electronic Fund Transfer, transaction

June 5th, 2015 by Elma Jane

Traditionally, travel-related merchants have a difficult time obtaining merchant accounts. National Transaction Corporation (NTC) is a full service merchant account provider with extensive experience in the travel arena and related markets, servicing thousands of travel-related merchant accounts by specializing in non-cash electronic transactions. Our services include processing credit card transactions, gift card transactions, and e-commerce transactions, among others. We offer a full line of products including credit card terminals, cellular devices, supplies, and accessories for each model sold. We offer aggressive rates and pricing for mail/telephone order, retail/restaurant, wireless, and online transactions while specializing in the travel and high volume sectors of merchant processing, and we are proud to be the preferred merchant provider for ASTA.

NTC is dedicated to providing the highest caliber of service and solutions in the merchant processing industry. We actually answer the phone when you need assistance! NTC has a team of dedicated employees providing personalized service to each account holder and are available directly through their toll free number, never hidden behind a menu system. Our excellent service truly separates us from everyone else in the industry. The principals of NTC have extensive experience in the processing arena for over 25 years, with experience in all facets of operation, including credit cards, credit initiation, credit investigation, loss prevention, deployment, and customer and terminal support. We employ internal sales associates as well as independent sales agents who offer many opportunities through their referral reward services and Independent Sales Organization (ISO) programs.

NTC’s online gateway allows for processing transactions, reviewing account history, and interacting with various shopping cart and accounting applications such as QuickBooks, Peachtree, and many other titles. Reservation software such as Trams are compatible and integrate well with all National Transaction merchant accounts. Whether you are a travel agency or an independent agent, we offer many solutions that cater to the travel industry and will increase your revenue with quicker deposits into your bank account.

Travel environments are unique in that your transactions are usually keyed; there is almost always a delayed delivery period, and large ticket transactions are not uncommon since one card holder may be paying for multiple tickets. They also tend to be seasonal, with peak season months generating an unusual spike in their “average” monthly volume, and charge-back’s pose a potential threat by travelers who are unable to complete their trip. Combine even a few of these factors together and you have cause for a reserve, or even account termination. National Transaction Corp specializes in understanding what makes your transactions unique, as a travel agent, and how they affect your merchant account.

The importance of customer service is something that is over looked when merchants compare the overall cost of monthly fees with their merchant account. That is, until the moment they need assistance with their account. Whether searching for missing deposits, having problems processing transactions, issuing refunds, processing voids, or questioning their billing statement, a merchant should always remember you get what you pay for. If you wonder why they can offer you no monthly fee, they are offering you no LIVE customer support. Customer support for them will come via means of email. You will wait hours for answers, and even days for a simple confirmation or general email, let alone a resolution.

National Transaction Corporation has over 17 years of dedication and experience in providing quality solutions in the credit card processing arena. From internet e-commerce applications to food stamp processing, from small start up businesses to fortune 500 companies, NTC has a complete product selection to customize a solution to grow with your business. We at NTC pride ourselves on being a full service, member service provider. It is our mission to provide the same dedication and service in maintaining your business as you experience in us earning your business. NTC will provide service after the sale. It is that service that sets us apart! For more information, contact NTC for world class service and solutions.

Contact National Transaction Corporation today at 888-996-2273 to see how we can help you with your travel merchant account, or visit us online at www.nationaltransaction.com for more information.

by Elizabeth Cody (Travel Research Online)

Posted in Best Practices for Merchants, Credit card Processing, e-commerce & m-commerce, Gift & Loyalty Card Processing, Merchant Account Services News Articles, Merchant Cash Advance, Travel Agency Agents Tagged with: ASTA, bank account, billing statement, credit card terminals, credit card transactions, credit cards, customer service, deposits, e-commerce, e-commerce transactions, electronic transactions, gift card transactions, Independent Sales Organization, ISO, merchant account provider, merchant accounts, merchants, service provider, travel, travel agency, travel agent, travel industry

September 5th, 2014 by Elma Jane

A cup of coffee, a pack of chewing gum., a newspaper at the airport. For even the smallest, most casual purchase, credit cards and debit cards are replacing cash as the preferred form of payment. One in three usually uses a credit card or a debit card for in-person purchases of less than $5. Eleven percent prefer credit cards, 22% debit cards and 65% cash, but the generational divide is striking. A slight majority (51 percent) of consumers 18-29 prefer plastic to cash, the only age group to do so. A preference for cash becomes stronger in each advancing age bracket, until at age 65-plus, 82 percent prefer cash.

Survey conducted by landline and cellphone found that: Credit cards and debit cards are used more frequently for small purchases by those employed full time (42%) or part time (34%) than for the unemployed (23%). People with children are more likely to use the cards for small purchases (41%) than those without children (30%), perhaps because parents have less time to wait around for change. Income doesn’t seem to be much of a differentiator, except for those near the bottom of the scale. A combined 38% of those making $75,000 or more preferred plastic for small purchases, compared with 43 percent of those making $50,000 to $74,900, 32% of those earning $30,000 to $49,900 and only 23% percent of those making less than $30,000.

Politically, we’ve finally found something on which we all can agree. Thirty percent of Democrats and a nearly identical 28% of Republicans favor credit cards or debit cards rather than cash for small purchases. Interestingly, those describing themselves as politically independent also were more independent from cash, 40% of them prefer plastic for such transactions.

The casual use of plastic is moving steadily through age brackets and already has a firm grip not only on millennials, but also increasingly on Gen Xers. Crunched another way, the data show that if you’re 49 or younger, you’re almost as likely to pay for a $5 purchase with plastic as you are to pay with cash. Fifty two percent prefer cash, 46% prefer debit or credit cards. Now, if you’re 50 or older, you’re still somewhat unlikely to pay for a $5 purchase with plastic. Seventy seven percent still prefer cash, with 21% reaching for debit cards or credit cards. Those who graduated from or attended college are significantly more comfortable than others with using plastic for small purchases.

A combined 39% of those with college degrees prefer debit cards (21%) or credit cards (18%) over cash (59%). Only 16% of those who have not attended college usually use debit cards for purchases of less than $5, along with only 6 percent who prefer credit cards for that purpose.

The trend is clear. Regardless of some differences in magnitude based on demographic factors, plastic is replacing cash as the currency of choice even for small purchases. Plastic use will increase for small purchases, both for debit and credit cards.

Why the shift to cards There are many reasons:

Technological advancements at the point of sale have made it just as fast to pay by plastic as by cash. Rewards have become a common feature of credit cards, with two out of three credit cards offering rewards, encouraging rewards chasing. Debit cards, with their balances available instantly and online have largely replaced paper checks and tedious manual records.

Financial institutions have spent decades persuading consumers to use and merchants to accept cards universally. Small purchases represent particularly appropriate uses of a debit card, assuming you don’t get carried away and overdraw the card-linked bank account. Why keep going to the bank and then carry cash if you don’t have to? Moving away from cash and moving toward using cards for even small purchases is more convenient.

Debit cards are everywhere already, but because their use can’t be reported to the credit bureaus and thus, they don’t build credit, they should only be used as a matter of convenience. People who frequently use credit cards for small, casual purchases also could overdo it, but probably not to a great degree. It would take a lot of lattes to send someone into credit counseling or bankruptcy court. In truth, we like the idea of using credit cards frequently for small, manageable expenses. This gives users the benefit of an active credit history, but leaves them with monthly bills that are small enough to pay off in full, so they don’t have to pay any interest. It’s getting to the point where, if I’m out and about, I’m using plastic the whole time. It’s just so much easier.

Posted in Best Practices for Merchants Tagged with: account, bank, bank account, bankruptcy, bills, cards, cash, cellphone, credit, credit counseling, credit history, data, debit cards, financial, financial institutions, Merchant's, payment, transactions

August 7th, 2014 by Elma Jane

Using Transfer by Facebook, the user can transfer money after logging into their Rakuten Bank account from the Rakuten Bank app, selecting the person they wish to send money to from their list of Facebook friends in the app, and inputting the amount they wish to transfer.The fee-free transfer process can be completed on the app without any of the recipient’s account information and include a 50 character message to accompany the transaction. Money can also be transferred to non-Rakuten Bank account holders, for a fee of Y165. By accessing a URL on Facebook with the transfer notice, the recipient is able to specify a bank account for the money and complete the deposit.

Posted in Financial Services Tagged with: account holders, account information, app, bank account, Bank app, deposit, Facebook, free transfer process, transaction, transfer notice, URL

May 9th, 2014 by Elma Jane

Email is an indispensable part of running any business, it is so important. It’s often the best and least intrusive way to communicate with employees, colleagues and collaborators. Not all email platforms are equal, it’s important to choose one with the right email service and features your business need, also to avoid overpaying for features that you don’t need.

Factors to consider before settling on an email platform for your business.

Bonus Features

Once you’ve found an email service that covers all the basics, check for additional features that can boost your productivity. Some platforms such as Gmail and Outlook includes integrated video chat. That means you can use a single service for both exchanging messages and meeting remotely, making your day-to-day operations simpler and more efficient. Some email platforms also include instant messaging functionality. Instant messaging is better than email for real-time discussions, since you can exchange numerous short messages in rapid succession. Sending an instant message may be preferable to sending an email if the content of your message is not that important

Collaboration Tools

Good business email platform makes it easier for you to work together with your employees or colleagues. The best platforms include tools to help you collaborate. Services such as Gmail and Outlook include a built-in-calendar as part of your email inbox, in a few simple steps you can share your calendar with others so they can view and edit it on the fly. That can really help with planning and collaboration. Email threading is another feature that can help you work together with colleagues. Threaded emails make it easier to follow long exchanges because replies appear one after another in a single thread, instead of being spread throughout your inbox in the order they were received.

Free or Paid??

One thing you can’t get with a free Web mail service is the ability to use your brand’s name as part of your email address. Registering for a free Gmail account gives you an email address like [username]@gmail.com; but by subscribing to Google Apps for Business, you can secure an email address that reads [username]@[yourbusiness].com. In most cases, you’ll need to already own your own Web domain in order to use it as part of your email address, but registering a domain can cost as little as $10 per year. Services such as Microsoft Office 365, give you your own domain name without the need to pay additional hosting fees.

Security

Whether you pay for email or use a free service, you’ll want tight security for your business inbox especially if running your business involves the exchange of private client data and other sensitive data can be attached to your email account, such as bank account numbers and tax returns. Even more than with your personal email, it’s important to keep cyber criminals out of your business account. Before settling on an email service, check for common-sense security measures such as spam and phishing filters. Support for two-factor authentication is also important. The feature helps keep outsiders out of your inbox by requiring users to have two pieces of information to sign in. The first is your regular password and the second is a freshly generated code sent to either your mobile phone or a second email address. Other security features to check for include built-in antivirus measures to keep malware off your computer, which is especially important if you download a lot of attachments. Whether or not it’s important for you (and any employees) to have a branded email address is ultimately up to you. An email address that includes your own domain name can potentially boost the perceived credibility of your business. On the other hand, a generic email address might be fine for the smallest businesses, especially if you are a sole proprietor.

Storage Space

A branded email address isn’t the only advantage of a paid email service. Paid platforms offer plenty of other perks, such as expanded cloud storage for email and other files. Many free email services offer limited storagespace, forcing you to delete messages when your inbox gets full. If you run a small business that relies heavily on email and you prefer to archive messages rather than delete them, your inbox can fill up in a hurry. By subscribing to a paid service, you can gain access to a much bigger inbox. There are a few other related concerns to consider. The maximum size of an email attachment varies widely between different services, with some services capping attachments at 10GB and others letting you send huge files up to 300GB or more, as long as the file is already uploaded to the cloud.

Posted in Best Practices for Merchants Tagged with: antivirus, bank account, business account, chat, client data, cloud, code, computer, data, domain, email, email address, email inbox, email platforms, email service, Email threading, gmail, Gmail account, Gmail and Outlook, Google Apps, hosting, hosting fees, Instant messaging, Malware, messaging, Microsoft, Microsoft Office, mobile, mobile phone, password, personal email, phishing filters, phone, platforms, Security, security features, spam, spam and phishing, tax, tax returns, threading, video chat, Web domain, Web mail, Web mail service

April 18th, 2014 by Elma Jane

Capital One joins existing stakeholders equally owned by Bank of America, JPMorgan Chase, and Wells Fargo. Member-owner of the ClearXchange network.

Capital One has taken a stake in ClearXchange, the US bank-backed clearing house for person-to-person online payments transfer.

ClearXchange is the first network in the U.S. created by banks that lets customers send and receive (P2P) person-to-person payments easily and securely using an email address or mobile number.

With only the recipient’s mobile number or email address, the ClearXchange network enables customers to send funds directly from their bank account to the recipient’s bank account without the need to pass on more sensitive account information.

EVP of digital at Capital One, says partnering with clearXchange is another way of bringing safe and secure payments through convenient, digital channels to their customers.

With membership open to banks and credit unions of all sizes, ClearXchange has so far signed up only FirstBank as its sole non-owner participant, although it nonetheless claims to represent more than 50 percent of the consumer online banking market.

Posted in Credit card Processing, Electronic Payments, Merchant Services Account, Mobile Payments, Payment Card Industry PCI Security, Small Business Improvement, Smartphone, Visa MasterCard American Express Tagged with: account, bank account, Bank of America, Capital One, consumer online banking, digital channels, JP Morgan, market, mobile, online payments transfer, p2p, payments, person-to-person, secure payments, securely, U.S. Bank, US Bank, Wells Fargo