November 29th, 2016 by Elma Jane

GET THE LOWEST CREDIT CARD TRANSACTION RATES & FEES BY DOING THE FOLLOWING:

1. Use newer POS systems to reduce credit card fees.

2. Find out what percentage of your gross sales go toward credit card rates.

3. Perform a statement review at least annually.

Any time a customer uses a credit card to purchase services and goods the merchant pays various rates and fees processing those transactions. Most of these fees go to the bank issuing the credit card as they take on the bulk of the risk in credit card transactions.

Visa, American Express and Discover own the network on which these credit card transactions are processed on and they receive part of the fee and percentage rate as well as establish these rates and fees. Finally the bank that provides merchant account services gets part of these rates and fees.

To a small business 2, 3, or even 4% might not sound like much but when these fees are on the gross total of sales they can be significantly higher than originally thought.

For this reason it’s a great idea to assess your merchant account statement to see if rates are in line and that your most frequently used cards and transaction types are getting the best rate possible. By going over your statement, you can see exactly what you pay per transaction and get details about your most common transaction types and credit card used to get the process going.

If you are unfamiliar with what these rates and fees mean on your statement companies like National Transaction can perform the review for you. Free of charge.

Ultimately the best thing to have is a merchant account service provider that will take the time to go over your business with an eye lowering your rates and fees. The savings can be significant. As a business grows it changes and there should be an ongoing strategy at maintaining the best processing rates and fees possible. Today with so many different credit card types, like rewards cards, airline miles programs and more it can pay off to check once or twice a year.

For FREE Rate Review give us 888-996-2273

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, credit card, customer, merchant, merchant account, POS, rewards cards, service provider, transaction

November 22nd, 2016 by Elma Jane

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

Be with NTC and enjoy the full benefits of our Electronic Payment Services with high levels of service and security.

In addition, you can enjoy from e-commerce payment gateways to retail and restaurant solutions, business-to-business processing capabilities to electronic invoicing (NTC ePay).

NTC is offering a cost-effective credit card payment processing services that are very fast, secure and easy to integrate.

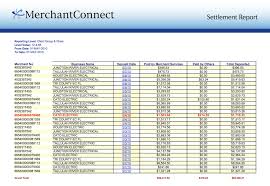

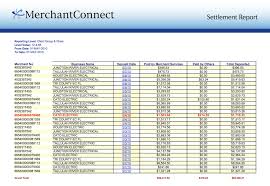

Get your Secure MerchantConnect Reporting Tool:

Get your Secure MerchantConnect Reporting Tool:

- Review and reconcile all of your transactions settle or batch settle and also much more.

- Create and save your custom reports that also can be imported or exported easily.

- Use our solution to turn any computer, laptop, smartphone or tablet into a processing center.

- Run & enjoy this on one or more devices to process credit card transactions with your merchant account.

- Peripherals allow swiping transactions and printing out receipts.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Our Merchant Cash Advance feature will help you very much to enjoy cash advance service. If your business accepts credit cards, getting cash for your business can be fast, simple and very easy.

Receive up to $150,000 per location in less than 10 business days—sometimes in as few as 72 hours.

National Transaction Merchant Cash Advance eliminates many hassles and delays common with bank loans.

Our Merchant Cash Advance builds on the strength of your business’ future credit and debit card sales, so a damaged personal credit history is not an immediate disqualifier.

Posted in Best Practices for Merchants Tagged with: bank, cash advance, credit card, debit card, e-commerce, Electronic invoicing, electronic payment, gateways, loans, merchant account, payment, payment services, Security, smartphone, transactions

October 14th, 2016 by Elma Jane

Merchant Account is a LOAN!

Merchant accounts are not depository accounts like checking and savings accounts; they are considered a line of credit. Therefore, when a customer pays with a credit card; a bank is extending credit to that customer and also making the payment on his/her behalf. As for processors or payment providers; they pay merchants before the banks collect from customers and are therefore extending credit to the merchant, that’s why Merchant account is considered as a LOAN.

Posted in Best Practices for Merchants, Financial Services, Travel Agency Agents Tagged with: bank, credit, credit card, customer, loan, merchant, merchant account, payment, payment providers, processors

October 13th, 2016 by Elma Jane

Code 10 merchants first line of defense!

How to use “Code 10”

- Call the voice authorization phone number provided by your Merchant Provider. This number can be found on the sticker on your terminal or call your Merchant Service provider and ask to be transferred to the Voice Authorization department.

- Choose the prompt for “Code 10”. Never call a phone number for the card issuing bank provided by a customer; or let the customer call the card issuing bank for you to obtain an authorization code. Do not accept an authorization code given to you by a customer. Authorization code obtained from your Authorization Center can be verified; but not the one from other sources.

- Provide the cardholder name, billing address and shipping address, if the order is a mail order, phone or Internet sale. The representative will attempt to verify the information you provide with the bank that issued the card to the customer.

- The representative will attempt to verify the cardholder information during your call; the data will be forwarded to an investigator for further research and will attempt to contact you within 24 – 72 hours with the current status or results of the investigation.

- Request another form of payment other than a credit card if an authorization request is declined. Do not split a declined transaction into smaller increments to obtain an authorization.

- Obtain an authorization code for the full amount of the sale. Always obtain the authorization code before shipping the merchandise.

Whether you are in a face-to-face environment, or via mail, phone or Internet that sell goods and services you can employ a “Code 10” authorization to verify additional information on a suspicious transaction.

You may be prompted by your processing terminal to call for voice authorization of the charges (CALL AUTH), or you may simply not feel right about the transaction. In either case, you can use “Code 10” to gain additional information before you release your merchandise.

Posted in Best Practices for Merchants, Credit Card Security Tagged with: bank, card, cardholder, customer, internet, merchant provider, merchants, service provider, terminal, transaction

October 6th, 2016 by Elma Jane

A personal guarantee is an agreement. The guarantors are responsible for repaying the loan with their personal assets; if a business is unable to finish repaying a loan.

This type of agreement is commonly required when you borrow capital from any bank; and also applies to many business credit cards. Traditionally, it is signed by anybody who at least owns 25% of the business.

Different Types of Agreements:

Some of them offer more protection for you and your business partners.

Unlimited Guarantee – is the only agreement available for a single-owner business, there’s a possibility that limitations are negotiable with your lender upon the agreement.

Limited Guarantee – the type of guarantee that are being used for businesses with multiple business partners are signing for a loan.

Two different types of limited guarantee:

Several Guarantee – means that you and your partner are responsible for a set percentage of the outstanding capital and legal fees. It is more desirable because each partner knows and agrees to how much they’ll be responsible for ahead of time.

Joint and Several Guarantee – This type of agreement could lead to problems between you and the other guarantors if something should go wrong because each guarantor is responsible for the full amount of the loan.

Read the fine print before signing a contract.

Posted in Best Practices for Merchants Tagged with: bank, credit cards, loan

September 29th, 2016 by Elma Jane

MerchantConnect is a great tool for merchants because it contains all the information that a merchant needs to manage their electronic payment activity. Furthermore, it’s fast, easy and secure!

- Merchant can either view or update account information and make changes.

- Find copies of statements.

- Furthermore find valuable products and services to help merchant with their business.

View recent deposits and other information about account activity including:

- Batch Details

- Chargeback

- Retrieval Status

- Deposit History

The merchant can also find news and information to help manage payments at your business. Learn how to:

- Best Qualify Transactions

- Reduce Risk

- Manage Chargebacks

- Find reference guides to help operate your payment terminal

The merchant can also utilize the BIN Lookup when you need to inquire about which bank issued a particular card. Simply enter the first six digits on the card and you will receive the information on the issuing bank, including contact information.

If you need a to set-up an account and want to use this tool give us a call at 888-996-2273

Posted in Best Practices for Merchants, Electronic Check Services, Electronic Payments Tagged with: bank, card, chargeback, electronic payment, merchants, payments, risk, terminal, transactions

August 23rd, 2016 by Elma Jane

Bank claims that they no longer support QuickBooks Direct Connect as of May 2016. As a result of product changes. It would be nice if QuickBooks would take time and prominently post that fact.

For those interested in QuickBooks plugin NTC has a special offer for the next 30 days!

In conclusion, QuickBooks geared mainly toward small and medium-sized businesses and also offer on business premises accounting applications as well as cloud based version that accept business payments, manage and pay bills, and payroll functions.

For more information about your payment needs give us a call at 888-996-2273 or go to www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: bank, payments

May 27th, 2016 by Elma Jane

Refunds – transfers funds from your merchant account to the customer’s account.

Refunds are always associated with a transaction that has settled.

A settled transaction – is funds that have already transferred from the customer to the merchant. You can only refund a transaction with a Settling or Settled status.

The refunded transaction goes through the typical settlement process. As the refund settles, the funds are sent back to the customer’s bank account. It is normal for your customer to experience a delay because the customer’s bank may take a couple of days to deposit these funds.

Voids – will cancel the transfer of funds from the customer to the merchant and can be issued if the transaction is either Submitted for Settlement or Authorized. The original authorization should disappear from the customer’s statement within 24 to 48 hours.

Posted in Best Practices for Merchants Tagged with: account, bank, customer, funds, merchant, merchant account, refunds, transaction

May 9th, 2016 by Elma Jane

Preventing double refunds depend on the timing of the chargeback. It is a bit challenging, the key lies in attention to detail.

A chargeback may already exist for the transaction when a customer say they just spoke to their bank. Merchants must pay attention to this big clue.

There are different time limits for resolving disputes before they become actual chargebacks, depending on the issuing bank.

- If customers indicate they did contact their bank, merchants need to call the issuing bank to determine if a case number has been assigned to the transaction dispute.

- If there is a case number that has been assigned, the merchant can disregard the refund request.

If a case number has not been assigned, merchants need to inform the bank that a refund has been initiated and a chargeback is not necessary.

Preventing Double Refunds Before Chargebacks are Filed

Provide prompt refunds to customers when they are warranted.

- Estimate when the funds will be available.

- Let customers know that a refund has been issued.

- Take care to ensure the credit isn’t process as a debit.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargeback, credit, customer, debit, merchants, refunds, transaction

May 9th, 2016 by Elma Jane

Double refunds are when a customer is provided with two refunds for the same transaction. Chargebacks can be involved in a double refund.

Double Refunds Happen When:

Chargebacks are filed after a refund is issued. The consumer contacts the merchant and requests a refund, but the funds aren’t returned immediately. The consumer thinks the request for the refund was ignored and files a chargeback. Then both the chargeback and the refund are being processed.

Chargebacks are filed before a refund is issued. The consumer calls the bank and initiates a chargeback. Then, the consumer calls the merchant and expresses dissatisfaction. To try to avoid a chargeback, the merchant provides a refund. However, the merchant has no idea of the fact that a chargeback has already been filed because the consumer calls the bank first

Even thou a merchant provided a refund with a customer that doesn’t guarantee that a chargeback won’t be initiated. Same thing with chargeback that has been filed doesn’t guarantee that customer won’t contact the merchant and demand a refund as well.

Just because a merchant provided a customer with a refund that doesn’t guarantee that a chargeback won’t be initiated. Same thing with chargeback that has been filed doesn’t guarantee that customer won’t contact the merchant and demand a refund as well.

It is possible for the customer to receive a double refund for the one purchase transaction.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: bank, chargebacks, consumer, customer, merchant, refunds, transaction