September 5th, 2014 by Elma Jane

A cup of coffee, a pack of chewing gum., a newspaper at the airport. For even the smallest, most casual purchase, credit cards and debit cards are replacing cash as the preferred form of payment. One in three usually uses a credit card or a debit card for in-person purchases of less than $5. Eleven percent prefer credit cards, 22% debit cards and 65% cash, but the generational divide is striking. A slight majority (51 percent) of consumers 18-29 prefer plastic to cash, the only age group to do so. A preference for cash becomes stronger in each advancing age bracket, until at age 65-plus, 82 percent prefer cash.

Survey conducted by landline and cellphone found that: Credit cards and debit cards are used more frequently for small purchases by those employed full time (42%) or part time (34%) than for the unemployed (23%). People with children are more likely to use the cards for small purchases (41%) than those without children (30%), perhaps because parents have less time to wait around for change. Income doesn’t seem to be much of a differentiator, except for those near the bottom of the scale. A combined 38% of those making $75,000 or more preferred plastic for small purchases, compared with 43 percent of those making $50,000 to $74,900, 32% of those earning $30,000 to $49,900 and only 23% percent of those making less than $30,000.

Politically, we’ve finally found something on which we all can agree. Thirty percent of Democrats and a nearly identical 28% of Republicans favor credit cards or debit cards rather than cash for small purchases. Interestingly, those describing themselves as politically independent also were more independent from cash, 40% of them prefer plastic for such transactions.

The casual use of plastic is moving steadily through age brackets and already has a firm grip not only on millennials, but also increasingly on Gen Xers. Crunched another way, the data show that if you’re 49 or younger, you’re almost as likely to pay for a $5 purchase with plastic as you are to pay with cash. Fifty two percent prefer cash, 46% prefer debit or credit cards. Now, if you’re 50 or older, you’re still somewhat unlikely to pay for a $5 purchase with plastic. Seventy seven percent still prefer cash, with 21% reaching for debit cards or credit cards. Those who graduated from or attended college are significantly more comfortable than others with using plastic for small purchases.

A combined 39% of those with college degrees prefer debit cards (21%) or credit cards (18%) over cash (59%). Only 16% of those who have not attended college usually use debit cards for purchases of less than $5, along with only 6 percent who prefer credit cards for that purpose.

The trend is clear. Regardless of some differences in magnitude based on demographic factors, plastic is replacing cash as the currency of choice even for small purchases. Plastic use will increase for small purchases, both for debit and credit cards.

Why the shift to cards There are many reasons:

Technological advancements at the point of sale have made it just as fast to pay by plastic as by cash. Rewards have become a common feature of credit cards, with two out of three credit cards offering rewards, encouraging rewards chasing. Debit cards, with their balances available instantly and online have largely replaced paper checks and tedious manual records.

Financial institutions have spent decades persuading consumers to use and merchants to accept cards universally. Small purchases represent particularly appropriate uses of a debit card, assuming you don’t get carried away and overdraw the card-linked bank account. Why keep going to the bank and then carry cash if you don’t have to? Moving away from cash and moving toward using cards for even small purchases is more convenient.

Debit cards are everywhere already, but because their use can’t be reported to the credit bureaus and thus, they don’t build credit, they should only be used as a matter of convenience. People who frequently use credit cards for small, casual purchases also could overdo it, but probably not to a great degree. It would take a lot of lattes to send someone into credit counseling or bankruptcy court. In truth, we like the idea of using credit cards frequently for small, manageable expenses. This gives users the benefit of an active credit history, but leaves them with monthly bills that are small enough to pay off in full, so they don’t have to pay any interest. It’s getting to the point where, if I’m out and about, I’m using plastic the whole time. It’s just so much easier.

Posted in Best Practices for Merchants Tagged with: account, bank, bank account, bankruptcy, bills, cards, cash, cellphone, credit, credit counseling, credit history, data, debit cards, financial, financial institutions, Merchant's, payment, transactions

May 19th, 2014 by Elma Jane

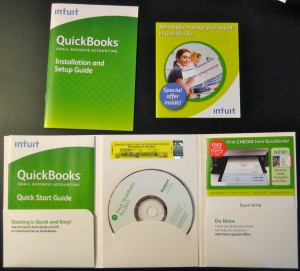

Keeping your business’s finances in order doesn’t have to take all day. Bookkeeping is a necessary for small business owners, but it’s a time-consuming chore.

If you use QuickBooks for payroll, inventory or keeping track of sales, there are several timesaving shortcuts you can utilize to make bookkeeping easier.

Time-saving tips for getting the most out of QuickBooks in the least amount of time. Help you spend more time building your business and less time using QuickBooks.

Download data whenever possible. Even after factoring in initial setup time, downloading banking and credit card activity directly into QuickBooks is a huge time saver. Doing this will minimize the chance of human error and enable you to record activity faster than if you did it manually.

Make the Find feature your friend. Using the Find feature is the most efficient way to locate a particular invoice in QuickBooks. Those who usually open the form and click Previous until the form appears on the screen know how tedious this process can be. The Find tool will search for almost any transaction-level data, depending on your filters.

Memorize transactions. QuickBooks has the capability to memorize recurring transactions (invoices, bills, checks, etc.) and set them for automatic posts daily, weekly, monthly, quarterly and annually, eliminating the need to enter the same transaction into the software every month.

Use accounts payable aging. Use this feature for a snapshot on who you owe money to and manage your cash flow more efficiently.

Use accounts-receivable aging. Use this feature for a snapshot of information on who owes you money, how much you are owed and how long the individual has owed you.

Use classes. Classes can be very helpful to track income and expenses by department, location, separate properties or other meaningful breakdowns of your business.

Use QuickBooks on the go with remote access. Remote-access methods include QuickBooks Online, desktop sharing and QuickBooks hosting on the cloud, which allows you to take the program on the go and make changes no matter where you are.

Posted in Best Practices for Merchants Tagged with: accounts, accounts payable, banking, banking and credit card, bills, Bookkeeping, card, cash flow, checks, cloud, credit, data, desktop, desktop sharing, finances, hosting, income and expenses, invoices, online, program, QuickBooks, Remote-access, software, transaction

November 19th, 2013 by Elma Jane

ISIS Electronic Wallet

Available Nationwide Isis Mobile Wallet

Latest version of the Isis Mobile Wallet has been announced. This is now available to consumers for download in the Google Play app store and at thousands of AT&T, T-Mobile and Verizon Wireless retail stores nationwide. Isis Mobile Wallet allows customers to pay at contactless payment terminals, and to save money through special offers and loyalty cards at participating merchants – all from their Isis Ready smartphone.

Today’s Isis Mobile Wallet nationwide launch is a milestone for consumers, merchants and banks. It’s the start of a smarter way to pay.

Together with Isis partners, a seamless mobile commerce experience have been built. Isis pleased to bring the magic and simplicity of the Isis Mobile Wallet to consumers across the U.S.

The redesigned Isis Mobile Wallet features a simplified user interface with a clean, white background and easy-to-navigate toolbars. Starting today, customers with one of the more than 40 Isis Ready smartphones available from AT&T, T-Mobile or Verizon Wireless can receive a free enhanced SIM card from their wireless carrier and download the Isis Mobile Wallet for free from Google Play. Integration with American Express Serve makes it convenient for Isis Mobile Wallet users to load funds to their American Express Serve Account from a U.S. debit or credit card, bank account, or through direct deposit, as well as pay bills online and send money to friends and family using an American Express Serve Account.

Posted in Digital Wallet Privacy, Electronic Payments, Mobile Payments, Near Field Communication, Smartphone, Visa MasterCard American Express Tagged with: American Express, AT&T, banks, bills, carrier, contactless, debit or credit, google, interface, ISIS, loyalty cards, Merchant's, mobile wallet, online, payment terminal, play app, smartphone, T-Mobile, Verizon, wireless