April 22nd, 2014 by Elma Jane

Mobile Business App.

Customers should be able to easily find you wherever they are, from any device. Mobile presence is more or less essential for business success in today’s world, whether you just have a mobile-optimized website, or a full-scale dedicated mobile application for your business.

With smartphones and tablets, people have a computer in their pockets when they’re out and about are where people are engaging with content, so business want a mobile strategy.

The problem many businesses have with mobile strategy development is determining what is most effective, both in terms of reach and cost. Creating a mobile app isn’t the right path for every company, but if it’s something you’re considering, check the following questions before you invest.

Android, HTML5 or iOS?

No matter what platform you choose, it’s important not to take on too much too soon, regardless of your technical skill level. There are a lot of different solutions for app development. Keep it simple and work on it. Once you’ve made the decision to develop an app and figured out your end-goal for it, determine what platform you want to use. When businesses choose to create an app for only Android or iOS, they end up missing half the market, but building an app on both major platforms requires two different sets of technical skills. While an app creator can make it much easier to develop an app on multiple platforms, including Windows Phone and Blackberry, maintaining a multiplatform presence will end up costing you more. HTML5 Web-based apps may not be as visible as those in major platform app stores, but they are compatible on mobile browsers of any operating system, as well as desktop browsers.

Make an own app, or become part of an existing?

If you want to create your own native app, make sure you have a plan to continually update and work on it. Don’t underestimate the ongoing maintenance. Constantly engage with the app, and as you’re planning it in the first place, think about what you want to add over time.

Many businesses begin the app development process without considering the amount of time and money they will need to invest in the process. Becoming part of an existing app for example, a directory-type app that lists businesses in your industry can be an easier, less expensive way to claim your segment of the mobile market. The app creator can do the heavy technical work while also providing you with the opportunity to connect with its larger network of users.

What do you want to gain from your business app?

Is it to bring people into your store or to get them to visit your website? Many businesses waste a lot of resources because they think people will just come to their app. It’s trendy to say that you have a mobile app, but if your goal is just to have that mobile presence, you’ll create something that no one will ever see. Small businesses should set a clear goal to focus on before beginning app development. Having a mobile presence is more or less essential for business success in today’s world. Whether you just have a mobile-optimized website, or a full-scale dedicated mobile application for your business, your customers should be able to easily find you wherever they are, from any device.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Financial Services, Mobile Payments, Mobile Point of Sale, Smartphone Tagged with: Android, android or ios, app, app development, blackberry, business, device, html5, iOS, mobile, mobile application, mobile browsers, mobile presence, mobile strategy, mobile-optimized website, multiplatform, pockets, Smartphones, tablets, web-based apps, windows phone

February 20th, 2014 by Elma Jane

Android-iPhone-Credit-Card-Reader

Several options exist for mobile credit card processing.

Credit card processing on iPhone/ipad/Android/BlackBerry or Tablets – Using NTC’s portable credit card readers, merchants can now swipe credit cards on iPad or Android tablet devices. NTC’s Virtual Merchant solution allows users to download a secure application to interfere your smartphone with our merchant account services seamlessly. The application and credit card processing data on the carriers network or a WiFi connection to the internet.

NTC’s MagTek Bullet Swipe Credit Card Reader for Android Phones and Tablets.

Using any Android 2.2. or higher device you can process credit card transactions securely to the smartphone via Bluetooth and utilize wireless devices internet connection (WiFi or Carrier) to send the credit card processing data encrypted for processing approval.

Security anywhere. With the BulleT Secure Credit Card Reader Authenticator (SCRA), security comes with the flexibility and portability of a Bluetooth wireless interface. Small enough to fit into the palm of your hand, the BulleT enables secure wireless communications with a PC or mobile phone using the popular Bluetooth interface. Not only does the BulleT encrypt card data from the moment the card is swiped, but it also enables card authentication to immediately detect counterfeit or altered cards.

Ideal for merchant services accounts and financial institutions’’ mobile credit card processing, NTC’s BulleT offers MagnaSafe credit card processing security features with the convenience of a Bluetooth interface. This powerful combination assures credit card data protection, transaction security and convenience needed to secure mobile credit card processing with strong encryption and 2-factor authentication. The BulleT is specifically designed to leverage the existing magnetic stripe credit card reader as a secure token empowering cardholders with the freedom and confidence of knowing that their credit card transactions are secure and protected anytime, anywhere. Android Credit Card Swipe Reader for Android Phones and Tablets on your wireless mobile merchant account.

NTC’s MagTek iDynamo Credit Card processing swipe reader for iPhone and Ipad.

Credit card processing on an iPhone has never been easier. Simply attach NTC’s iDynamo card reader to your iPhone or iPad device, install our Virtual Merchant software from the App Store and you’re ready to go. Take advantage of lower credit card processing rates by processing swiped transactions instead of keying the credit card in later and get paid faster. From the company that leads with Security from the Inside MagTek has done it again with the iDynamo, a secure card reader authenticator (SCRA) designed to work with the iPhone and iPad. The iDynamo offers MagnasafeTM security and delivers open standards encryptions with simple, yet proven DUKPT key management, immediate tokenization of card data and MagnePrint card authentication to maximize data protection and prevent the use of counterfeit cards. Mobile merchants can now leverage the power of their iPhone/iPod Touch products without the worries of handling or storing sensitive card data at any time. Ideal for wireless mobile merchant accounts and mobile credit card processing, the iDynamo offers MagneSafe security features combined with the power of iPhone and iPod Touch products. This powerful combination assures convenience and cost savings, while maximizing credit card data protection and credit card transaction security from the moment the card is swiped all the way to authorization. No other credit card reader beats the protection offered by a MagnaSafe product.

Other credit card devices claim to encrypt data in the reader. NTC’s iDynamo encrypts the data inside the read head, closest to the magnetic stripe and offers additional credit card security layers with immediate tokenization of card data and MagnePrint card authentication. This layered approach to security far exceeds the protection of encryption by itself, decreases the scope of PCI compliance, and reduces fraud.

NTC’s iDynamo is rugged and affordable, so it not only withstands real world use, it performs to the high standards set by MagTek as the leader in magnetic credit card swipe reading products for nearly 40 years.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Services Account, Mobile Payments, Mobile Point of Sale, Payment Card Industry PCI Security, Smartphone Tagged with: Android, android phones and tablets, authenticator, blackberry, bluetooth, card authentication, credit card processing data, devices, encrypt card data, encrypted, internet, ipad, Iphone, magnetic stripe, magtek bullet, merchant account, merchant services accounts, Merchant's, mobile credit card processing, portable credit card readers, process credit card transactions, processing approval, secure, secure application, secure token, smartphone, swipe credit card reader, swipe credit cards, tablets, transaction security, virtual merchant, wifi, wireless devices internet connection

October 18th, 2013 by Elma Jane

Cash registers were the only game in town not too long ago, but these days companies have many more choices. Replacing antiquated cash registers with modern POS (point of sale devices carries a number of important benefits, including:

1. Can cut down on user errors. Hitting a wrong key is always a risk when ringing a sale, but point of sale devices have built in checks to ensure that the information is entered accurately.

2. Customers receive more informative itemized receipts with a point of sale devices. Many cash registers can only print the date and the amount of the sale, but since point of sale devices are tied into the inventory control system they can provide much more detailed information, including a description of the item, the list price and the sale price.

3. Easy to look up past transactions. If you need to know how much you sold last Tuesday a point of sale system can give you that information in a snap. It would take many hours of laborious work to find the same answer using a cash register.

4. Maintenance and repair costs are often much lower on a point of sale device than a cash register. The number of companies that repair cash registers is dwindling, and that means that repair costs can be rather high. There are many vendors who repair point of sale devices, and that can keep repair costs low.

5. Provide faster service than old fashioned cash registers. Every part of the process, from authorizing a credit card transaction to printing a customer receipt, is faster on a point of sale device.

6. Simplify the accounting process. Old fashioned cash registers force accountants to sort through hundreds of receipts, but with a point of sale system financial personnel can simply use the built in reports or create their own.

7. Unlike a cash register, a point of sale system often includes an overall inventory management system. Store owners can use a point of sale system to track their biggest sellers and reorder those products when stock gets low.

8. Workers now a days are often more comfortable with point of sale devices than old fashioned cash registers. Generation now entering the workforce never knew a time without computers, and as a result they are very comfortable working with computerized technology like point of sale devices.

9. You can use a point of sale system to create your own purchase orders, eliminating an extra step in the ordering process. You can even automate the ordering process to make sure you never run out of your hottest selling products.

10. You can see real time inventory with a point of sale device, something that even the best cash registers simply cannot do. In fact, many companies have found that implementing a point of sale system virtually eliminates the need for a costly hand count.

There are many reasons why your company should consider state of the art point of sale device and ditching the old fashioned cash register. These devices can lower the cost of doing business while increasing productivity, and that can be good for the bottom line.

Ready to make the switch from a cash register to a point of sale system? National Transaction can provide the software, hardware and support for any POS need. NTC integrate your payment processing into many accounting software titles such as Intuit Quickbooks or Peachtree Accounting. NTC can also provide integation for any restaurant cash register system and all industry specific solutions. NTC provide credit card readers for Android, Apple and Blackberry smartphones and tablet devices. National Transaction can make the World your Point Of Sale.

Posted in Credit card Processing, Mobile Point of Sale, Point of Sale, Visa MasterCard American Express Tagged with: accounting, amount, Android, Apple, authorizing, benefits, blackberry, cash register, computerized, control, costs, credit-card, date, devices, hardware, inventory, itemized, low, maintenance, point of sale, POS, price, print, process, readers, receipts, reorder, repair, sale, sale price, Smartphones, software, stock, system, transactions, vendors, virtually

October 3rd, 2013 by Admin

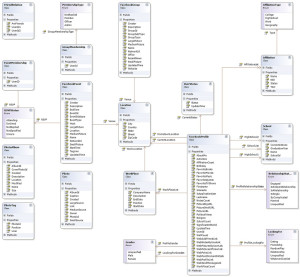

When managing a business nothing helps more than raw data. Storing that data in a database makes it infinitely more flexible and accessible. A database is an application that efficiently and effectively stores and retrieves data as well as ties that data to other data. Many large scale accounting applications like QuickBooks, PeachTree and many other titles store all their information in some form of a database.

Tables are like spreadsheets. Rows and columns group together data in an organized manner. Databases can have many tables with many columns or just a few. Relational databases like SQL database engines link tables together using what are known as primary and foreign keys. So in the example of an invoice the Customer table has a Primary key uniquely identifying a specific customer from the rest of all of the customers. The Invoice table stores a foreign key in its table so the match between customer id’s links the two tables. The invoices themselves also have a primary key so that there can be many invoices for the same customer. These concepts are actually born of a mathematics branch known as Algebra.

Data at its most basic level is a specific bit of information. Like the number 19 or a specific date and/or time. A database holds these bits of data and an application built to interact with a database is used to generate information from the data. A clearer example is the invoice. An invoice has quantities, part numbers, serial numbers, account numbers, dates and even totals which are not stored in the database but are calculated each time the invoice is accessed. Invoices bring many bits of data to a single entity most commonly referred to as a report. Looking at a common invoice explains a transaction with the details stored in many tables all tying back to a single transaction.

Database servers run a service that can be connected over connections on a local area network or over the internet to allow applications on different computers access to data simultaneously. Many websites like Facebook, NASA and even Google make extended use of databases to supply services to millions of users concurrently. Whether it’s over the internet or across a physical office space, a database can be the heart of a businesses information technology.

SQL databases conform to an industry standardized set of functionality so that complex queries can be performed without knowing the underlying technical architecture.

Open Source

Open Source is usually associated with applications that are free to download, distribute and modify. Many times open source applications are developed by a community of developers over the internet that take feature suggestions from the user community and build them into the application. Open source applications tend to follow one of several ‘licenses’ like the GPL or General Public License to make sure the program is unmolested or incorporated into a proprietary software trying to take credit for the programming code.

There are many examples of open source titles here.

http://directory.fsf.org/wiki/All

https://en.wikipedia.org/wiki/List_of_free_and_open-source_software_packages

Open Source Databases

One aspect of open source known as LAMP has become wildly popular as the internet has matured. Lamp stands for Linux, the operating system, Apache, the web server component, MySQL, a wildly popular free and open database engine and the P stands for Perl, Python or PHP the three most popular languages of backend programming. Combining these components provides a very fertile ground for developing Web Applications that can be served across an office or the world. Many sites like Google and WordPress take full advantage of these technology to create feature rich applications that run in a web browser but work like a traditional desktop application like Microsoft Word. Being open source allows anyone to build on top of or out of the offering. This means you can customize the programming of any of these applications to best fit your particular style or way of doing business. This is a huge time saver for any small business.

Some common examples of open source applications that utilize Lamp architecture are listed below:

SugarCRM – A contact and lead management system to manage a sales force.

WordPress – The most popular blogging application on the internet.

OpenCart – An extremely flexible shopping cart software.

GNUCash – A full fledged accounting program.

Mobile Devices

Today we have smartphones and tablets that have web browsers built in and available for each platform. Using new techniques known as adaptive or responsive web layouts, information on a page automatically transform a web page to smaller displays. So any page can be designed once and displayed on a desktop browser, a tablet browser or a mobile phone browser. This allows web designers to best optimize the content for smaller displays while leaving the pages viewed on a desktop for a larger view. Using responsive design techniques your business data can even extend to mobile devices like iPhones and Android or Blackberry phones and tablets. The potential is huge for your business.

Posted in Best Practices for Merchants, Point of Sale Tagged with: Android, bits, blackberry, data, database, e-commerce, information technology, Iphone, MySQL, open source, relational, shopping cart, smartphone, SQL, tablet

August 6th, 2013 by Admin

In Canada, the game to corner mobile payment systems and the Digital Wallet is being played seriously. PayPal and Square are present but the 800 pound gorilla may have just entered the ring. Canadian banks are presenting merchant accounts capable of handling tap to pay transactions competing directly with Square and PayPal. Royal Bank of Canada has launched a mobile payment solution to provide contactless payment using Near Field Communication (NFC) enabled smartphones and tablets. Shoppers can simply wave their smartphone over a cash register or payment terminal and be on their way. No more swiping a credit card into a terminal or punching keys into a terminal and no more fumbling with cash or coins to settle a payment. Read more of this article »

Posted in Credit card Processing Tagged with: bank, bankers, blackberry, Canada, Canadian, Canadian travel agency agents, digital, electronic, financial services, ipad, Iphone, mobile, nfc, payments, PayPal, Rogers Communications, Royal Bank, smartphone, Square, tablet, travel