January 12th, 2015 by Elma Jane

Mobile Point of Sale (POS) systems have rocked the retail world and the trending topic when it comes to POS is all about the mobile kind. When one searches the term POS, nearly every article that comes up is all about mobile, and many seem to believe it will change the retail industry.

Is traditional POS on its way out? Not so fast.

While mobile POS is indeed a hot topic, it is likely to be an enhancement, rather than a replacement, to traditional POS

There is definitely a need and a place, for both.

Everyone was certain that dot.coms would eradicate brick-and-mortar stores; they are still alive and well, and traditional brick-and-mortar stores have, like traditional POS, embraced the Internet and allowed it to serve them in the capacity of extension.

Retailers everywhere have incorporated the Internet into their business model by creating multi-channel sales strategies, such as e-commerce, digital marketing, social media marketing, online product information, specifications, reviews and online customer service.

In addition to their online presence, these same retailers have started to bring the Internet in-house by integrating such services as customer centric promotions at point of sale, introducing loyalty programs and member registration, facilitating digital signage, offering e-receipts via email, and self check out centers; all at the traditional POS kiosk.

Why bother with mobile POS anyway?

While it is true that traditional POS systems won’t be going anywhere soon, and with good reason, mobile POS systems have allowed retailers to make great strides when it comes to efficiency and customer service, as well as customer satisfaction.

Since the advent of Mobile POS, companies have made big changes in the way they handle customer transactions in-store, thus affording faster checkout, waiting line reduction, consultative selling, and more.

The list of mobile POS benefits goes on and on:

Email Receipts: Better for the environment, more convenient for customers and faster to process. A digital purchase receipts sent via email tells the customer that you care about the earth and about them.

Expanded Reach: With mobile POS, your sales are no longer confined within the four walls of your brick and mortar store. Sidewalk sales, seasonal mall kiosks, and special sponsorship events are just a few examples of all the places you can take your retail sales to, with a POS in hand.

Inventory and Price Search: When customers can be assisted with finding an item color, size or availability on the spot, rather than having to wait in line to do so, it makes them happier. The same can be said for pricing. POS in the hands of store reps can go a long way toward customer satisfaction.

Inventory Return Stations: There is always a certain volume of returns, but that volume increases for retailers particularly after the holidays. The implementation of mobile POS allows for retailers to set up additional return stations in order to avoid long lines and customer frustrations.

Mobile POS goes Mobile: Your investment in your company POS system doesn’t need to be one size fits all, regardless of store traffic volume in one location or another. Retailers may opt to have a blow out sale in one location, thus require additional checkout power for that location for a specific period of time. With mobile POS, devises and licensing can be utilized throughout different store locations on an as needed basis.

Optional Seasonal Subscription: The great thing about mobile POS is that you needn’t pay for a POS system year round if you’re not using it year around. Seasonal spikes in retail sales warrant the additional cost of extra POS licensing and hardware, but the rest of the year your budget shouldn’t need to encompass more than what is needed. Mobile lets you better manage your overall POS investment.

Storewide Promotion Opportunities: Mobile POS has allowed retailers to drive sales in various sections of the store by holding demonstrations or promotions in different departments to tout products or services. Customers can be marketed, and sold to, on the spot.

The growing industry of mobile payments doesn’t stop at in-store mobile POS. Digital wallets like Google Wallet and Apple Passbook, mobile-to-mobile cell phone transfers, Near Field Communication (NFC) payments, mobile device credit card swipe and other emerging technologies are quickly changing our cash and credit card world.

What about traditional POS?

Mobile payment systems are indeed terrific. So, when should you consider going with traditional POS? The reality is, in addition to the aforementioned benefits of traditional checkout kiosk functions, there times when mobile POS simply will not suffice.

Mobile POS is great when a customer wants to choose and pay for one item while on the sales room floor, but what about when the customer has a multitude of items? Ringing up and bagging groceries, removing anti-theft mechanisms, neatly folding and bagging clothing items and managing the sales of numerous agents, stations or departments are just a few examples of situations that often require the traditional POS checkout station.

By combining traditional POS strategies with mobile POS flexibility, retailers can leverage the command of a complex, and multi-dimensional, marketing and retail sales management system.

Posted in Best Practices for Merchants, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: brick and mortar, credit card swipe, credit-card, customer service, digital marketing, Digital wallets, e-commerce, mobile device, Mobile Payments, mobile point of sale, mobile pos, multi-channel, Near Field Communication (NFC), POS, retail industry, social media

September 29th, 2014 by Elma Jane

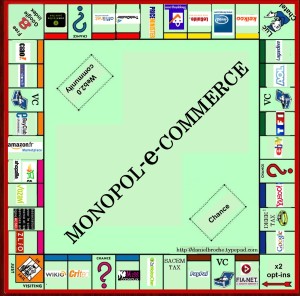

If your retail business products sells only in-store, then you’re falling behind. Consumers in the digital age expect options when they shop, and if you’re not offering those choices, your customers may pass you by for a more tech-savvy competitor. Consumers go into stores, evaluate products and buy online, or research online and go into the store for purchase. The two worlds have merged, if you’re not covering both spectrums, you’re missing out.

Recent research by UPS showing 40 percent of today’s shoppers use a combination of online and in-store interactions to complete their purchases. The days of physical stores being separated from online shopping are over. They’re no longer channels that are happening on their own. The UPS survey found that a large chunk of online shoppers cross channels during their shopping path. Be present on both channels and take advantage of that.

It’s not always possible or economic for an online-only retailer to open up a physical storefront, but existing brick-and-mortar stores or wholesalers can easily introduce an e-commerce component to their sales to expand their customer reach. Online sales help reach consumers that may not otherwise be able to purchase your products. Even if your company’s main focus is creating a personalized in-store experience, there are still ways to capture the online shopper market. In addition to giving consumers a way to research your products before coming in-store to purchase your offerings, you can offer people a way to conveniently buy items they already know they want.

For all the advantages a multi-channel sales strategy can give a retailer, there are still some challenges to this approach. Managing inventory versus cash flow and ensuring even demand on both channels have been company’s two greatest challenges in balancing in-store and online sales. Creating demand is how companies set themselves apart from competition. The secret sauce. The challenge is making sure that retail operations have a turnover ratio that works for the shipping schedules from the main warehouse. This isn’t a problem for e-commerce businesses, because product can be packaged and shipped as fast as it gets produced. But an omnichannel company has to take retail and e-commerce into account when stocking a warehouse.

There are a few different strategies retailers can use to help keep their sales operations well-balanced. Offering different items online versus in-store, to avoid inventory competition (i.e., selling seasonal or discontinued items online and current items in-store). Requiring a minimum order for online purchases or grouping products together rather than selling them individually to make e-commerce more worth your while.

The best way to balance a multi-channel sales strategy is to take a unified view of consumers online and offline by connecting their on- and offline behaviors via technology. Some of the retailers questions have is how to connect a person offline with what they buy online, how to recognize who they are in the store and know what they look at on your website, because people are switching back and forth. Link behaviors online with a unique ID through email or a mobile app, since 66% of customers use smartphones in-store.

Even if your business can’t actually sell and ship products via e-commerce,it’s still important to be in tune and up-to-date with the way customers want to interact with you on the Web. People are on the go, researching on phones and tablets. If you’re not savvy to what’s happening out there and don’t have the best-in-class SEO, you’ll miss out. You still need to engage in the digital world, even if it’s not always obvious.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: brick and mortar, business products, consumers, customers, digital world, e-commerce, email, mobile app, multi-channel sales, online and in-store, online shoppers, online shopping, phones, products, retail business, SEO, shoppers, Smartphones, tablets, web

September 11th, 2014 by Elma Jane

Online retailers are finding the bricks-and-clicks strategy to be an effective way to serve and engage shoppers. Perhaps that is why an increasing number of ecommerce merchants are setting up shop offline. It’s important to note, however, that a bricks-and-clicks business isn’t just about having a physical store and an ecommerce site. For this model to be effective, each channel must complement and add value to the other.

Guidelines to execute a bricks-and-clicks strategy:

Allow Access to Online Account Information in Physical Store

Bridge the gap between bricks and clicks by giving your customers and physical-store staff access to online account information. Doing so can enhance shopping experiences and drive sales.

Integrate Online and Offline Inventory, Fulfillment

Offer click-and-collect services that allow shoppers to buy merchandise online and pick it up at a local retail branch or service station. Many consumers would rather forgo the shipping costs and wait time and instead pick up their items at a time and place that’s convenient for them. Also, use your brick-and-mortar inventory when an item is out of stock online.

Use Online Data for Offline Selling, and Vice Versa

Data pertaining to online sales and traffic won’t just help you optimize your ecommerce site. It can also apply to offline decisions. For instance, if you see an increase in sales for a particular product on your website, you should consider promoting it offline, as well, to your brick-and-mortar shoppers.

Also pay attention to social media data such as Facebook likes and Pinterest pins. What’s trending on social sites can help with merchandising and marketing. Consider something similar in your brick-and-mortar business. Take note of the most liked, viewed, and pinned items online and then leverage that information when making decisions regarding product displays, inventory and more.

You can also use offline information to enhance your ecommerce site. Utilize in-store analytics tools, such as people counters and sensors, to better understand how your offline customers behave and then compare that with online behavioral data to spot patterns and opportunities.

Qualitative information, such as shoppers’ common questions and concerns, can also be used to improve your online shop. For instance, if your physical store associates keep getting the same questions about a particular product, there’s a good chance that online shoppers have similar queries. So you may want to include the answer in that item’s product description page.

Use Smartphone Beacons in Physical Stores

Beacons are Bluetooth-enabled devices that let brick-and-mortar merchants send customized offers and recommendations to their shoppers via their smartphones based on where the shoppers are in the store. For example, if a shopper is in the footwear department, the retailer can use its store beacons to send the shopper a coupon for shoes. Bricks-and-clicks businesses can also use the technology to send tailored offers to shoppers based on their online behavior.

Posted in Best Practices for Merchants Tagged with: account, Beacons, bluetooth, brick and mortar, business, consumers, coupon, customers, data, devices, ecommerce, Facebook, inventory, marketing, merchandising, Merchant's, Online Account Information, Online Data, pinterest, product, sales, shoppers, site, smartphone, social sites, store, website

September 10th, 2014 by Elma Jane

Merchant go into business to make a sale. They go to great length to advertise their business and then they make a sale and don’t track it… They don’t track the very customer they went into business to attract…That seems crazy…But now more companies are embracing the practice of collecting email addresses at the point of sale (POS) and they’re doing so with increasing regularity. An example, when customers are at the cash register, many brick-and-mortar stores now offer to email them receipts

Confidently collect email addresses at POS:

Your email service provider should be able to implement a text-to-join acquisition program for you that executes quickly and can be built specifically to mitigate the risks around POS data collection.

Instead of relying on sales associates to accurately input email addresses, your customers can use SMS to text their email addresses to your short code.

Customers receive an immediate SMS reply message letting them know to check their email for their receipt.

A mobile-optimized receipt is immediately emailed to the address.

This can be followed by an email inviting customers to join your company’s email program. Offering a purchase discount can increase opt-ins. New joiners can be sent an age verification email, if relevant.

Your welcome email, including discount coupon, is sent and the relationship starts off on the right foot.

Increasing your confidence about POS email address collection, a text-to-join program can increase your acquisition rates. It can engage those customers who prefer to provide their information privately via their mobile devices. It can help protect companies against potential blacklisting because of typos and confirmed opt-ins. It can even reduce overhead costs by saving sales associates valuable time. Understanding these important email address collection issues and adopting the prescribed best practices are critical to ensuring customers have a safe, positive and valuable experience with your company at the point of sale and beyond.

Virtual Merchant can collect data too, and as a provider we can help merchant use that data. We are committed to providing appropriate protection for the information that is collected from customers who visit the website and use the Virtual Merchant payment system. Policy Privacy is updated from time to time.The website is provided to our customers as a business service and use of the site is limited to customers only.

If the merchant never makes a sale before 10 why do they open at 9 ?? This is only one small example on how collecting data first and then analyzing that data can shape businesses and find money you may be throwing away ….

Posted in Best Practices for Merchants, Mobile Point of Sale, Point of Sale Tagged with: brick and mortar, business, cash, cash register, customers, data, discount, discount coupon, email, merchant, mobile, Mobile Devices, payment, payment system, point of sale, policy, POS, provider, purchase, Rates, receipts, sale, service, sms, store's, virtual merchant, website

June 10th, 2014 by Elma Jane

Local businesses with brick-and-mortar stores have not been early adopters of ecommerce. But, with the proliferation of mobile devices and with changes in how consumers research and buy products, most local businesses now have websites, many of them mobile optimized. Smart brick-and-mortar retailers invest in local search engine optimization to ensure that their stores are found when a local shopper searches on products that they sell. More aggressive retailers also invest in pay-per-click advertising on Google to ensure that their store names, phone numbers, and addresses are visible to a local shopper that is researching on a smartphone. Google is by far the primary search engine used by mobile shoppers. Google favors mobile friendly online stores and rewards mobile sites with high search rankings. The next logical step for local retailers is investing in on online store.

There are several reasons:

1. Having an online store will help local retailers optimize Google rankings for specific products and brands.

2. Being able to show that an item is in stock may eliminate competitive shopping.

3. Eventually local retailers could sell products to consumers outside the retailers’ immediate area, and thus expand their business.

Many local businesses are hesitant to open an online store. Here is why:

1. Local businesses are typically unfamiliar with running an ecommerce business.

2. Have little ability to ship or fulfill online orders.

3. Cannot accommodate sales tax collection outside their local area.

4. Avoid the investment required.

To be sure, adding an online store is not for every local business. But, if a local retailer offers a unique set of products, she may want to evaluate the concept.

Posted in Best Practices for Merchants, e-commerce & m-commerce Tagged with: brands, brick and mortar, brick-and-mortar stores, consumers, ecommerce, google, Mobile Devices, mobile optimized, mobile sites, online orders, online stores, pay-per-click, products, sales tax, search engine, search engine optimization, smartphone, websites

March 3rd, 2014 by Elma Jane

A solution for mobile commerce will be needed eventually, whether you’re an ecommerce merchant or you run a brick-and-mortar shop.

There are mobile payment platforms for digital wallets, smartphone apps with card-reader attachments, and services that provide alternative billing options. Here is a list of mobile payment solutions.

Boku enables your customers to charge their purchases directly to their mobile bill using just their mobile number. No credit card information, bank accounts or registration required. The Boku payment option can be added to a website, mobile site, or app. Price: Contact Boku for pricing.

Intuit GoPayment is a mobile credit card processing app from Intuit. It accepts all credit cards and can record cash or check payments. Intuit GoPayment transactions sync with QuickBooks and Intuit point-of-sale products. Intuit GoPayment works with iOS and Android devices and provides a free reader. Price: $12.95 per month and 1.75 percent per swipe, or 2.75 percent per swipe and 3.75 per keyed transaction.

iPayment MobilePay is a mobile payment solution from Flagship Merchant Services and ROAMpay. The service accepts all major cards and can record cash transactions. To help build your customer database, the app completes customer address fields for published landlines. The app can handle taxes, tips, and can record transactions offline. You can use the service month-to-month. The app and the reader are free. Price: $7.95 per month; Each transaction costs $0.19 plus a swipe fee maximum of 1.58 percent, or a key fee between 1.36 and 2.56 percent.

ISIS mobile commerce platform enables brick-and-mortar stores to collect payments (via an NFC terminal) from the mobile devices of their customers. Provide your customers with a simplified checkout process through the contactless transmission of payments, offers, and loyalty integrated in one simple tap. Price: Isis does not charge for payment transactions in the Isis Mobile Wallet. Payment transaction fees will not be increased by working with Isis.

LevelUp is mobile payment system that uses QR codes on smartphones to process transactions. Use LevelUp with a scanner through your POS system, or use a standalone scanner with a mobile device. You can also enter the transaction through the LevelUp Merchant App, using your smartphone’s camera to read the customer’s QR Code and entering the amount to complete the transaction. LevelUp also provides tools to utilize customer data. Price: LevelUp charges a 2 percent per transaction fee. Scanner is $50; tablet is $200.

MCX is a mobile application in development by a group of large retail merchants. Details on the solution are vague, but MCX is intended to offer a customizable platform that will be available through virtually any smartphone. MCX’s owner-members include a list of merchants in the big-box, convenience, drug, fuel, grocery, quick- and full-service dining, specialty-retail, and travel categories. Price: To be determined.

mPowa is a mobile payment app to process credit and debit card transactions, and record cash and check sales. mPowa will soon launch its PowaPIN chip and PIN reader for the EMV (“Europay, MasterCard, and Visa”) card standard. (Developed in Europe, EMV utilizes a chip embedded in a credit card, rather than a magnetic strip.) The EMV standard is likely to gain footing to combat credit card fraud. mPowa is a good solution for merchants with a global presence. Price: 2.95 percent per transactions, or .25 percent or $0.40 per transaction when used as a current processor’s point-of-sale system.

PayAnywhere is a solution to accept payments from your smartphone or tablet with a reader. It features an automatic tax calculation based on your current location, discounts and tips, inventories with product images and data, and more. Bilingual for English and Spanish users. PayAnywhere provides a free credit card reader and free app, available for iOS and Android. Price: 2.69 percent per swipe, 3.49 percent plus $0.19 per keyed transaction.

PayPal Here gives you a variety of options for accepting payments, including credit cards, PayPal, check, record cash payments, or invoice. With PayPal Here, you can itemize sales totals, calculate tax, offer discounts, accept tips, and manage payment email notifications. Available for iOS and Android. The app and reader are free. Price: 2.75 percent per swipe and 3.5 percent plus $0.15 per manually-entered transaction.

Square is a simple approach to mobile credit card processing. Square provides a free point of sale app and a free credit card reader for iPhones and iPads. Square offers a selection of tools to track sales, taxes, top-purchasing customers, and more. Square’s pricing is on the higher end, but with no monthly fee Square may be a good fit if you have infrequent mobile transactions. Price: 2.75 percent per swipe and 3.5 percent plus $0.15 per manually-entered transaction.

Posted in Credit card Processing, Credit Card Reader Terminal, Credit Card Security, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Check Services, Electronic Payments, EMV EuroPay MasterCard Visa, Financial Services, Internet Payment Gateway, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Small Business Improvement, Smartphone, Visa MasterCard American Express Tagged with: accepts all credit cards, alternative billing, Android, bank accounts, brick and mortar, check payments, contactless transmission, credit and debit transactions, credit card reader, credit-card, database, Digital wallets, ecommerce merchant, EMV, free app, iOS, itemize, keyed transaction, mobile commerce, mobile credit card processing, mobile payment platforms, mobile site, mobile transactions, nfc terminal, point of sale, process transactions, qr codes, record transactions offline, smartphone apps card-reader attachments, transactions

February 24th, 2014 by Elma Jane

When someone asks what business you are in, how do you typically respond?

For many online sellers, the answer is likely I sell (name of the product), I’m an ecommerce merchant or I’m an online retailer.

Make the focus of your business your customers and its value proposition, not the fact that you sell online. It’s time to simply answer the question of what business you are in with a response that is more or less, “I am a (distributor, retailer, reseller) of (name your products) for (name your market).”

Back then, most business owners who sold products online described themselves as “ecommerce businesses” or “online retailers,” to differentiate from brick-and-mortar or catalog retailers. Most operated their own pure-play online stores. Some sold products on eBay. Amazon’s marketplace was mostly comprised of larger retailers. There’s an evolution in how e-commerce owners describe themselves.

Today, you will still hear many online sellers describe themselves as “ecommerce businesses” or “online retailers.” But, in 2014, those terms don’t really apply. Whatever you sell, you are delivering a set of products to meet the needs of a specific market. “Ecommerce” or “online retailing” is simply a technology and a sales channel.

There is now no difference between “ecommerce” and “commerce.” It’s time to get rid of the “e” in ecommerce. Most businesses participate in ecommerce in some fashion. You engage your customers in many different channels — your own e-commerce site, brick-and-mortar, online marketplaces. Regardless, you and virtually every other B-to-C or B-to-B company are selling goods to customers across those channels.

Why Worry about Labels?

Today, commerce is multichannel and highly competitive. It’s done online, on the phone, face-to-face, and on desktop, mobile, and tablet devices. Make sure your business has an omnichannel strategy, so your shoppers can find you. Make sure the information about your company and products is consistent regardless of the channel. Focus on whom your prospective customers are, what they want to buy, and how much they are willing to pay.

Business owners should think strategically. Part of strategic thinking is focusing on the bigger picture, such as having the right products and ensuring that your buyers can find them.

Omnichannel Focus

Think about omnichannel commerce every day. Get your brand and products in front of your target customers regardless of where they are shopping. Below are some things to consider to facilitate an omnichannel strategy.

Chat and phone. If you don’t offer online chat or take phone orders, consider doing so.

Marketplaces. If you aren’t selling your products in marketplaces outside of your own online store, consider doing so.

Mobile. If you don’t have a mobile strategy, you need one.

Payment options. If you only take credit cards for payments on your website, add alternative payments like PayPal, Google Wallet, or Amazon Payments.

Social media. If you don’t have a social media presence, your market share is likely declining.

Customer Focus

Twenty-five years ago, if you asked a brick-and-mortar retailer or a catalog vendor what business she was in, she would likely respond as, say, “jewelry retailer,” “men’s clothing store,” “a department store,” or “hardware store.” She knew her target customer niche, how to reach them, and what products they wanted to buy. Those businesses that did the best job of (a) matching products to the consumer, (b) offering low prices, and (c) utilizing the right distribution likely won most of the business.

It’s time to get back to that focus. It’s more challenging than it used to be because the purchase cycles are far more complex than in 2002. There is no longer a straight path from identifying the need to research to purchase. Consumers typically identify a need and purchase intent, research products, research prices, research products further, conduct social media research, and then purchase a product and demand instant gratification and free shipping.

To be successful in 2014, commerce – not just ecommerce – requires the following.

Emphasize your value proposition. Regardless of how a shopper finds you, be sure he can quickly find out that you are a leading retailer of products in your market. Being clear on what your business is will also help establish trust with your shoppers.

Execute the 4 Ps of sales and marketing – “product,” “price,” “promotion,” and “place.”

First, make sure you know your target customers and what problems they are trying to solve or the need that you fulfill with your products. Know their demographics, their buying cycles, price tolerance, and where they research and shop.

Know your competitors.

Posted in Credit card Processing, Digital Wallet Privacy, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mail Order Telephone Order, Mobile Payments, Small Business Improvement, Smartphone Tagged with: alternative payments, Amazon, brick and mortar, catalog retailers, catalog vendor, commerce, credit cards for payments, e-commerce site, ebay, ecommerce, ecommerce merchant, mobile and tablet devices, omnichannel, omnichannel commerce, online retailer, online sellers, online stores, phone orders, sales channel, sell online

February 10th, 2014 by Elma Jane

Impact on 2013 Holiday Sales’s Big Data

Holiday season has ended and the analysis has begun to understand what worked and what did not for ecommerce merchants. Cyber Monday became the biggest online shopping day in history with a 20.6 percent increase in sales over 2012, according to the IBM 2013 Holiday Benchmark Report. Retailers are increasingly tapping into the avalanche of data from their own sites and from third-party sites to drive sales and better serve their customers. This article will address five key ways Big Data impacted the 2013 holiday shopping season.

Contextual Promotions

The use of Big Data has enabled contextual promotions – mostly real-time push notifications based on consumers’ social media activity, tracking their locations, or capturing their interactions on the web and mobile devices. This holiday season contextual promotions were heavily used. IBM’s Cyber Monday Report states, “On average, retailers sent 77 percent more push notifications during the five day holiday shopping period when compared to daily averages over the past two months.” Retailers invested in social media sites like Facebook, Pinterest, and Instagram (among others) during the November and December holiday season. This led to higher referral sales from these sources.

Several physical retailers, including Best Buy and Kohl’s, also deployed location-based promotions to push notifications while the consumer is in or near the store. Some retailers tracked consumers’ locations without their knowledge, raising privacy concerns. Other retailers required an opt in by consumers to receive these promotions.

Additionally, some retailers used mobile apps to send contextual promotions based on tracking shoppers’ activities on the app and their physical locations with using it. Macy’s and J.C. Penney, for example, partnered with Shopkick (a shopping app provider) during this holiday season to reward brick-and-mortar shoppers with discounts or song downloads for trying on clothes, scanning barcodes, or making purchases.

Gift Selection

Holidays are all about gift giving. Some retailers used their Big Data recommendation algorithms to make it simpler to select gifts. These retailers built predictive models that process data from multiple sources like social media, wish lists, gift registries, and past purchases to predict the right gift for an individual.

Improved Customer Service

The holiday season results in more traffic for ecommerce merchants, which naturally leads to an increase in the volume of customer service issues. To keep customers happy during this time and manage customer service costs, some retailers implemented Big Data solutions to monitor customer activity and proactively respond to negative social media posts or issues. After all, one negative tweet can significantly impact business during this time of the year.

Real-time data feeds inform retailers in advance if customers will experience issues like a slow site, out of stock products, or delayed delivery. Retailers can either proactively correct the issue or notify the customers afterwards. Fab.com, for example, automatically credits a customer the difference if a price of an item drops immediately after purchase. T-Mobile USA has integrated Big Data across multiple IT systems to combine customer transaction and interactions data to better predict customer defections. By monitoring social media interactions with transaction data and billing systems, T-Mobile USA has reportedly reduced customer defections in half in a single quarter. Dell uses Big Data solutions to analyze real-time feeds from weather reports, delivery trucks, and orders to proactively resolve delivery problems before customers are aware of them.

Integrated Analytics

Most large retailers serve customers across multiple channels and devices. This makes it critical for those retailers to have a single view of all customer and product activity using data from all sources. Some retailers are already using such solutions and several more deployed such solutions before the holiday season. This one capability is crucial to track other Big Data uses, such as contextual promotions, gift selection, personalized customer experience, and improved customer service.

Personalized Customer Experience

Retailers have used Big Data to personalize their site content for several years. This was a competitive differentiator during this holiday season, however, as indicated by pre-holiday survey by Baynote, a personalized customer experience solution provider. The survey noted that eighty-one percent of retailers planned to upgrade ecommerce platforms to focus on customer experience, and to increase engagement, revenue, and ultimately lifetime value from improved relationships with shoppers. Retailers can categorize each shopper into a segment of one with its own customized landing pages, product catalog, campaigns, and even content. The result is an enhanced customer experience and an improved conversion rate.

Amazon.com continued to maintain its dominance in this space by using its extremely rich data set to personalize the shopping experience for its millions of shoppers. Another benefit from personalizing the customer experience is increased impulse buys, which become more important during the holidays as shoppers are in the right frame of mind to spend money.

Posted in e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Merchant Account Services News Articles, Small Business Improvement Tagged with: analysis, analyze real-time feeds, barcode, benchmark, big data, brick and mortar, credits a customer the difference, customer service issues, customer transaction and interactions data, ecommerce merchants, large retailers, location based promotions, making purchases, online shopping, physical retailers, real-time data feeds, retailers, rich data set, shopping season, social media activity, transaction data and billing systems

January 29th, 2014 by Elma Jane

Ecommerce and mobile-based e-commerce have grown significantly this year. Cyber Monday ecommerce sales, as an example, reached $1.735 billion originating from desktop and laptop devices, according to comScore. Even Black Friday, which is better known for brick-and-mortar retail sales, saw online spending reach $1.198 billion in the United States, again according to comScore. Mobile online spending may also have grown, as some reports indicate that mobile-based site traffic was up 55 percent around Thanksgiving.

Many ecommerce merchants are enjoying a robust holiday selling season even as some brick-and-mortar stores are seeing relatively flat Christmas sales. To ensure continued growth and success, Internet retailers may want to challenge their businesses to improve in several areas in 2014.

Retailers, however, should not rest on their current success, but rather should challenge their businesses to improve in several areas, including free shipping offers, mobile optimization, personalization, data driven decision making, and cross channel sales.

Offer Free, Two-Day Shipping

The first challenge for online sellers in 2014 may be to find ways to offer free, two-day shipping to all or most shoppers. While it is likely there will still be minimum purchase and maximum weight requirements and restrictions, online shoppers are going to expect faster free shipping options thanks, in part, to the growth in services like Amazon Prime and ShopRunner.

Consider order fulfillment services, distributed warehouses, drop shipping, or even partnerships with other retailers to help meet this challenge.

Offer Personalization and Customization

Personalization and customization could be a significant competitive advantage in 2014.

Challenge your business to finally begin offering personalization and customization both onsite and in marketing. The easiest place to start may be with email marketing. Work to segment email marketing campaigns so that they address customers by name and with relevant products and offers that are based on an individual’s or group of shoppers’ stated preferences or on-site behavior.

Taking on this challenge means that the retailer’s marketing department will need to collect meaningful information about what interests shoppers and organize separate, custom campaigns around those interests.

Put Mobile Design and Marketing First

In November, IBM reported that mobile devices accounted for 31 percent of U.S. ecommerce-related web traffic around the Thanksgiving holiday this year, and that 17 percent of ecommerce transactions came from smartphones or tablets. On average, tablet users spent more than $126.00 per order, and smartphone users spent about $106 per order.

This data shows that mobile e commerce is not simply a novelty, but rather a must have for 2014.

If an e-commerce business is not optimized for mobile sales, 2014 is the year to take on that challenge, including offering a responsive design and mobile friendly payment options.

Sell Seamlessly Across Channels, Devices

Try to think of every way that a shopper might interact with an online store, and then make all of those touch points work together in 2014.

Retailers online or in physical stores need to offer shoppers a seamless, cross channel shopping experience that makes buying things easier for the customer. To continue to enjoy success in 2014, consider offering shoppers the ability to share orders across devices, applications, and even marketplaces.

In practice, this might mean that items added to a cart in an online store show up in the cart for the retailer’s iPhone app too. Or that a customer’s order history displayed on a retailer’s site shows orders placed on-site and via a marketplace like Amazon or eBay.

Use Big Data for Big Information

In 2014, find sources of good, usable Big Data, and put the resulting big information to use.

As an example consider, Weather Trends International, a Big Data company that uses historical weather information and advanced data processing to accurately predict weather 11 months in advance. This sort of Big Data information could show a snowboard and ski retailer what sort of winter major ski resorts are likely to have next year, and could inform purchasing and inventory choices.

Similarly, knowing that a particular region is going to have a warmer than normal July and August might impact how, where, and when a clothing retailer promotes shorts or bikinis on Facebook or AdWords.

Big Data is a popular trend in business and in marketing. The concept can mean different things to different businesses. For ecommerce, retailers should seek to use Big Data to gather big information, if you will, that may be used to make better buying and selling decisions.

Posted in Credit card Processing, e-commerce & m-commerce, Electronic Payments, Internet Payment Gateway, Mobile Payments, Mobile Point of Sale, Smartphone, Visa MasterCard American Express Tagged with: adwords, Amazon, big data, big information, brick and mortar, cross channel, cyber, drop shipping, e-commerce, ecommerce, Facebook, internet retailers, laptop devices, Mobile Devices, mobile friendly payment options, mobile optimization, mobile-based site, on-site, online, online shoppers, online store, onsite, personalization, retailers marketing, retailers online, shopping experience, smartphone, Smartphones, tablet, tablets

December 30th, 2013 by Elma Jane

Google

With New Debit Card, Google Admits Digital Isn’t Everything

The maker of all things digital is introducing a debit card for accessing Google Wallet accounts. Google is getting physical.

A debit card alone is not a platform, or at least not a new one. In this case, it’s the payments version of comfort food: an everyday, easy-to-use technology to drive greater adoption of the less familiar Wallet platform.

This isn’t a new concept for a digital wallet. PayPal itself has a debit card. The significance for Google is more in its apparent acknowledgment that its business needs to play in the physical world. Earlier this week, the company ramped up its Google Shopping Express service with a partnership with Costco, further expanding its presence in the buying and selling of physical goods. Its self-driving cars are another way the company is reaching beyond digital, though never losing sight of the digital-derived lesson that the real business opportunity is in platforms, not just products.

The MasterCard-branded card is swipe-able at stores, and it can be used to withdraw cash at ATMs, Google said. The company pitched its new plastic in a blog post today as a way to pay for things offline without waiting for the money in your Google Wallet to transfer to a bank account.

This should sound familiar to users of PayPal or any other digital wallet, where the lag time between receiving money and being able to spend it makes such services marginal in the brick-and-mortar world, where most consumer dollars get spent.

That it took Google this long to make such a card available shows just how hard it is for the company to re-imagine itself as expanding beyond digital. For years, Google has supported NFC tap-to-pay technology that lets users of the few phones with such chips use their handsets to pay by Wallet at the few merchants with point-of-sale systems that support NFC. With the release of a debit card, Google seems to be acknowledging that battle is lost for now. In a world Google is trying to remake in its digital-first image, plastic still prevails.

Posted in Digital Wallet Privacy, Mobile Payments, Mobile Point of Sale, Near Field Communication, Point of Sale, Smartphone Tagged with: brick and mortar, costco, debit card, digital, handsets, MasterCard, nfc, payments, PayPal, phones, plastic, platform, point of sale, Tap to Pay, wallet