October 20th, 2015 by Elma Jane

We’ve covered a lot about EMV, but what about improving security for online and Card-Not-Present transactions? That’s where 3-D Secure comes in.

3-D Secure allows a card holder to authenticate himself while making an online payment.

In a traditional credit card transaction, a payment request is presented to the issuing bank for authorization. The Issuing bank authorizes the transaction based solely on the funds available to the card holder.

With card present, the magnetic strip on the card can be read and a signature collected. This process has now been largely superseded by Chip and PIN which gives the card holder the opportunity to identify himself via a secret PIN code.

An E-commerce transaction is conducted online, without the possibility to access the card physically. Un-authorized usage and fraud are therefore more likely.

3-D Secure allows transactions to be conducted in safety online, greatly reducing the risk of fraud and chargebacks.

How 3-D Secure Works?

When a payment request arrives at the merchant or payment gateway, the Merchant Plug In (MPI) component is activated. The MPI talks to Visa or MasterCard to check if the card is enrolled for 3-D Secure. If the card is not enrolled, this means that either the bank that issued the card is not yet supporting 3-D Secure or it means that the card holder has not yet been registered for the service. If the card is enrolled, the MPI will redirect the card holder to the 3-D Secure authentication web page for the issuing bank; the card holder will then identify himself. The MPI will evaluate the reply from the bank and, if successful, allow the transaction to proceed for authorization. The transaction could still fail for lack of funds or other reasons but is more likely to be approved because of the authentication.

3-D Secure allows 3 domains to work together.

Domain 1: The card holder has the peace of mind that his card is not used without his authorization.

Domain 2: Merchants are protected from fraud and can provide the product and service without delay or extra costs.

Domain 3: Banks see that the transaction has been authenticated and are more likely to approve the transaction, to the convenience of the card holder.

Implementation of 3-D Secure:

Visa is called Verified by Visa.

MasterCard is called Secure Code.

Amex is called SafeKey.

JCB is called J/Secure.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Internet Payment Gateway Tagged with: 3-D Secure, amex, card holder, card present, card-not-present, chargebacks, Chip and PIN, credit card, ecommerce, EMV, fraud, jcb, magnetic strip, MasterCard, merchant, online payment, payment gateway, pin code, visa

October 15th, 2015 by Elma Jane

There are numbers of guidelines issued for accepting card payments, and merchants are expected to understand them all. To avoid issues down the road know a few basic rules in order to keep your business going without being penalized.

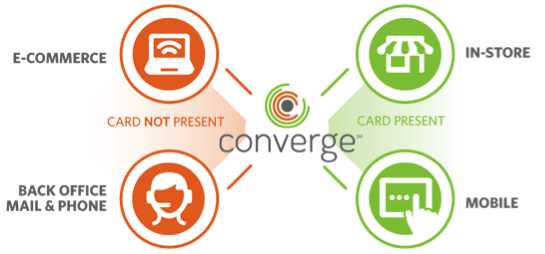

There’s a lot of ways to process a credit card: In-store, online, and by phone. There’s also different ways to pay and different brands of cards.

In-store and Card-not-present policies.

In-Store Policies:

- Always verify that the person presenting the card is the cardholder

- Ask for a 2nd ID for comparison

- Cards are non-transferable, cardholder MUST be present for purchase

- Compare the signature on the back of the card with that of the person who presents the card

- Inspect the card to confirm that it’s not visibly altered or mutilated

- Validate the card’s expiration date

Online/Phone Payment Policies: Card-not-present transactions

- Card account number

- Card billing address

- CID (3 digits on back of card OR 4 on the front)

- Card expiration date

- Card member’s home or billing telephone number

- Card member name (as it appears on the Card)

Rules for Visa, MasterCard and Amex that merchants need to know:

- Never store cardholder data on any systems to help minimize the risk of fraud and protect your business from potential chargebacks.

Complying with Federal Laws, State Laws and PCI

- A merchant should be familiar with and abide by Federal Laws regarding accepting credit cards. The Fair Credit Reporting Act is the federal law that establishes the foundation of consumer credit rights. This law regulates the collection and use of consumer credit information by merchants.

- Check state laws on the use of consumer credit information and accepting credit cards. Not all states have additional laws that regulate credit card practices, but some (such as California) prohibit merchants from requesting/requiring a customer to provide any personal information (like their address or telephone number) on any form involved with their credit card transaction. So, it is advised that merchants inquire about further information in their particular state.

- The Payment Card Industry Data Security Standard (PCI DSS) is a set of requirements designed to ensure that all companies processing, storing, or transmitting credit card information uphold a secure environment. These rules essentially apply to any merchant that has a Merchant ID (MID). If you are a merchant that accepts credit card payments, you are required to comply with the PCI Data Security Standard, large or small businesses.

EMV Liability Shift Set By Visa and MasterCard as of October 1st

U.S. banks and credit card companies are now using the EMV (Europay, MasterCard, and Visa) technology. The EMV liability shift for fraud carried out in physical stores with counterfeit cards belongs to the merchant if it has not yet upgraded its POS system to accept EMV-enabled chip cards. While issuers absorb losses under card-network rules, that burden will shift to acquirers in cases where the fraud occurs at merchants unprepared for EMV.

It’s good to know every aspect of your business. The above guidelines are part of a business that every merchants should be familiar with. The main reason for these rules is to protect your business and keep your customer’s payment card data safe and secure.

To start accepting more credit cards give us a call now at 888-996-2273. We have the latest terminals that’s EMV/NFC capable.

Posted in Best Practices for Merchants, Credit Card Security, EMV EuroPay MasterCard Visa, Payment Card Industry PCI Security Tagged with: amex, card network, card payments, card-not-present, chargebacks, chip cards, credit card, credit card companies, Data Security Standard, EMV, EuroPay, MasterCard, merchants, MID, Payment Card Industry, PCI-DSS, POS system, U.S. banks, visa

October 9th, 2015 by Elma Jane

Credit card fraud is much more difficult to prevent in a card-not-present transaction. In a face-to-face setting the merchant can inspect the card to ensure that it is valid and can verify that the cardholder is an authorized user on the account. None of these actions can be performed when the payment is submitted online or accepted by phone. As we moved in adopting EMV Technology, majority of fraud is going to migrate away from counterfeit and stolen cards towards the card-not-present transaction as happened in other countries.

A combination of best practices and fraud prevention tools can provide card-not-present merchants with strong fraud prevention capabilities.

Steps to avoid fraud and protect your business for a card-not-present transaction:

- Email Verification: Send a message to the email address provided by the customer requesting that the customer verify the email address is correct, you can ensure that the email is associated with the other information provided.

- Maintain PCI compliance:All merchants accepting card payments are now required to be compliant with the requirements of the PCI DSS (Payment Card Industry Data Standard) which sets the rules for data security management, policies, procedures, network architecture, software design and other protective measures.

- Security Code Verification. Requesting the three digit security code on the back of a credit card. Visa (CVV2), MasterCard (CVC 2) and Discover (CID) cards, and the 4-digit numbers located on the front of American Express (CID) cards. Card Security Codes help verify that the customer is in a physical possession of a valid card during a card-not-present transaction.

- Use an Address Verification Service (AVS): Enables you to compare the billing address provided by your customer with the billing address on the card issuer’s file before processing a transaction. AVS is good protection against card information obtained through means like phishing and malware because fraudster might not know the billing address.

- Use 3D Secure Service: MasterCard and Verified by Visa enable cardholders to authenticate themselves to their card issuers through the use of personal passwords they create when they register their cards with the programs. The liability of any fraudulent charges through the 3D service is picked up by the issuer, not the merchant.

- Verify the phone number and transaction information.Prior to shipping your products, call the phone number provided by the customer and verify the transaction information. Criminals may be unable to verify such information, because in their haste to max out the credit line before the fraud is discovered, they often order at random and do not keep records.

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Payment Card Industry PCI Security, Travel Agency Agents Tagged with: American Express, card-not-present, card-security, cardholder, cnp, credit card, Discover, EMV, MasterCard, merchant, Payment Card Industry, payments, PCI, visa

October 1st, 2015 by Elma Jane

The day the payments industry has pointed to for several years arrives today, a turning point in the U.S.‘s migration to EMV chip-and-PIN cards.

Rules set by Visa and MasterCard as of today, the liability for fraud carried out in physical stores with counterfeit cards belongs to the merchant if it has not yet upgraded its POS system to accept EMV-enabled chip cards. Banks will be issuing EMV Chip Cards.

An enormous change, as everyone learns to deal with the new technology that requires consumers to insert their cards and leave them in the store machines throughout a payment transaction, rather than swipe.

In a recent survey, less than a third of merchants overall have invested in EMV-compliant technology, and one study said 80 percent of small and midsize merchants have not upgraded their systems as of today’s liability shift.

Issuers are claiming to be more prepared than merchants, but according to the Smart Card Alliance, around 200 million chip cards have been issued to U.S. cardholders. That, however, is less than 17 percent of the approximately 1.2 billion payment cards in circulation.

What is clear is that today does not represent the end of the journey. The lack of preparedness at the physical point of sale, however, may be beneficial for card-not-present merchants.

Over the past few months, the mainstream media has awoken to the fact that implementing EMV does not mean fraud will disappear. Fraudsters quickly adapted to the difficulty of counterfeiting cards by attacking Card-Not-Present channels, where a chip has no effect.

In other markets, fraud migrated quite rapidly to card-not-present channels. It is necessary on e-commerce merchants to protect themselves with an array of tools, like device authentication, one-time passwords, randomized PIN pad and biometrics. Fraud mitigation tools like data analytics, address and CVV verification, 3D secure and tokenization. These services should be available from their merchant acquirer processor or gateway.

There should be a gradual reduction in card fraud over the next 12-18 months in spite of the delays in this country’s EMV migration. It’s going to take time for the technology to be adopted.

U.S. Merchants’ overall relative lack of preparedness for EMV may give e-commerce and mobile merchants time they didn’t think they would have to explore the options.

Sophisticated authentication technologies such as biometrics will help increase the security of card transactions. Device-based verification could be easily incorporated in an EMV transaction.

Banks have expressed interest more in using the phone as a biometrics. It’s all going to depend on what is the most convenient way to access your funds. The nice thing about biometrics is it’s meant to enable more convenience and stronger security.

Posted in Best Practices for Merchants, e-commerce & m-commerce, EMV EuroPay MasterCard Visa, Mobile Payments, Mobile Point of Sale, Point of Sale Tagged with: banks, biometrics, card fraud, card-not-present, chip cards, chip-and-PIN cards, e-commerce, EMV, gateway, merchant acquirer, merchants, mobile merchants, payments industry, point of sale, POS system, processor, tokenization, Visa and MasterCard

September 8th, 2015 by Elma Jane

A card not present transaction (CNP, MO/TO, Mail Order / Telephone Order, MOTOEC) is a payment card transaction made where the cardholder does not or cannot physically present the card for a merchant’s visual examination at the time that an order is given and payment effected, such as for mail-order transactions by mail or fax, or over the telephone or Internet.

The Card Associations created this term to help identify these Transactions, because CNP situations tend to be where the majority of fraudulent activity occurs; it is difficult for a merchant to verify that the actual cardholder is indeed authorizing a purchase.

The card security code system has been set up to reduce the incidence of credit card fraud arising from CNP.

Types of Security codes:

CVC1 or CVV1, encoded on track 2 of the magnetic stripe of the card and used for card present transactions. The purpose of the code is to verify that a payment card is actually in the hand of the merchant. This code is automatically retrieved when the magnetic stripe of a card is swiped on a point-of-sale (card present) device and is verified by the issuer. A limitation is that if the entire card has been duplicated and the magnetic stripe copied, then the code is still valid.

The most cited, is CVV2 or CVC2. This code is often sought by merchants for Card Not Present Transactions occurring by mail, fax, telephone or Internet. In some countries in Western Europe, card issuers require a merchant to obtain the code when the cardholder is not present in person.

Contactless cards and chip cards may supply their own electronically-generated codes, such as iCVV or Dynamic CVV.

Code Location

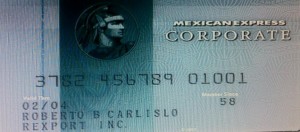

The card security code is typically the last three or four digits printed, not embossed like the card number, on the signature strip on the back of the card.

American Express Cards have a four-digit code printed on the front side of the card above the number.

Diners Club, Discover, JCB, MasterCard, and Visa Credit and Debit Cards have a three-digit card security code. The code is the final group of numbers printed on the back signature panel of the card.

For Merchant Account Setup give us a call at 888-996-2273 or visit our website www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: card transaction, card-not-present, cardholder, chip cards, cnp, contactless cards, credit card, debit cards, magnetic stripe, merchant, moto, security code

August 24th, 2015 by Elma Jane

How can you protect your business if its card-not-present or keyed-in transactions?

Get to know your customer – Before processing large card-not-present transactions, make sure you know your customer. Be sure to check their ID and make sure the information on it matches the payment information they give you.

Have delivery confirmation – If shipping your product, make sure to request tracking information and a delivery receipt. If you are sending a large order, you will want to request a signature confirmation at delivery.

Match the billing and shipping zip codes – When shipping your product, you want to check to see if the billing zip code given for the payment matches the shipping address zip code. If the zip codes don’t match, ask your customer why. If their answer doesn’t make sense to you, or sound plausible – don’t accept the payment.

Obtain a signature – This is especially important for large transactions. Make your customer sign an invoice, a contract that states your refund policies and gives you authorization to take the payment or a credit card authorization form. Once signed, keep this document on file.

Request card information – Make sure customers can give you the name on the credit card, the card number, the expiration date, the CVV2 security code and the correct billing address if you are keying in a payment without a card.

A tip from National Transaction Corporation 888-996-2273 www.nationaltransaction.com

Posted in Best Practices for Merchants Tagged with: card-not-present, credit card, keyed-in transactions, payment

January 21st, 2015 by Elma Jane

With a crucial deadline, the payments industry is starting to look at just what kind of fraud liability and how much fraud merchant acquirers will have to assume if their merchants aren’t ready to accept Europay-MasterCard-Visa (EMV) chip cards by October.

While issuers currently absorb losses under card-network rules, that burden will shift to acquirers this fall in cases where the fraud occurs at merchants unprepared for EMV.

As a result, acquirers will have to reckon with a whole new category of risk exposure.

In card-not-present transactions, acquirers have faced this, but in the overwhelming majority of cases they’ll be confronting it for the first time.

Surprisingly, for all the talk in the industry about the imminent arrival of EMV, it appears few acquiring executives have fully accounted for what the shift really means for them.

Some 24% of U.S. point-of-sale terminals are “EMV-capable,” while 9% of debit/prepaid cards issued, and 2% of credit cards have EMV chips so far. But while terminals may be technically capable, it isn’t known just how many of these merchants have the software and trained personnel to accept EMV.

Foreign issuers, especially, may be licking their chops at the prospect of offloading their consumer-fraud risk onto U.S. acquirers. For years and years, these non-U.S. issuers have invested in EMV, but the U.S. is still using the mag stripe. So non-U.S. issuers appear to be very aware of the liability shift.

To be sure, acquirers’ increased risk exposure may be relatively short-lived. Under the network rules, liability rests with the issuer in cases where both the merchant and the issuer are EMV-compliant. That could be nearly universally the case within a few years. By 2018, nearly all cards and terminals will be compliant.

But that still leaves open the question of how many of these terminals will really be running chip card transactions.

The issue isn’t so much about terminals as about software. Many mid-size merchants are using so-called integrated solutions that run payments as part of a larger business-management system. That means acquirers must work with a number of other parties to reconfigure software, and that presents a challenge when it comes to getting masses of merchants EMV-compliant.

The bigger problem is the integrated point-of-sale market.

While the liability shift may impact acquirers, not all them are convinced their exposure will rise all that much. Some argue the risk of loss from lost/stolen/counterfeit cards at the point of sale is low and not likely to rise, especially for small-ticket merchants.

Fraudsters, are much more inclined to practice their trade online, where the risk of being caught is lower, compared to face-to-face transactions.

Posted in Best Practices for Merchants, Credit card Processing, Credit Card Reader Terminal, Credit Card Security, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: card network, card-not-present, chip cards, credit cards, debit/prepaid cards, EMV, EuroPay, fraud, integrated solutions, mag stripe, MasterCard, merchant acquirers, Merchant's, payments, payments industry, point of sale, terminals, transactions, visa

September 24th, 2014 by Elma Jane

The CVV Number (Card Verification Value) on your credit card or debit card is a 3 digit number on VISA, MasterCard and Discover branded credit and debit cards. On your American Express branded credit or debit card it is a 4 digit numeric code.

The codes have different names:

American Express – CID or unique card code.

Debit Card – CSC or card security code.

Discover – card identification number (CID)

Master Card – card validation code (CVC2)

Visa – card verification value (CVV2)

CVV numbers are NOT your card’s secret PIN (Personal Identification Number).

You should never enter your PIN number when asked to provide your CVV. (PIN numbers allow you to use your credit or debit card at an ATM or when making an in-person purchase with your debit card or a cash advance with any credit card.)

Types of security codes:

CVC1 or CVV1, is encoded on track-2 of the magnetic stripe of the card and used for card present transactions. The purpose of the code is to verify that a payment card is actually in the hand of the merchant. This code is automatically retrieved when the magnetic stripe of a card is swiped on a point-of-sale (card present) device and is verified by the issuer. A limitation is that if the entire card has been duplicated and the magnetic stripe copied, then the code is still valid.

The most cited, is CVV2 or CVC2. This code is often sought by merchants for card not present transactions occurring by mail or fax or over the telephone or Internet. In some countries in Western Europe, card issuers require a merchant to obtain the code when the cardholder is not present in person.

Contactless card and chip cards may supply their own codes generated electronically, such as iCVV or Dynamic CVV.

Code Location:

The card security code is typically the last three or four digits printed, not embossed like the card number, on the signature strip on the back of the card. On American Express cards, the card security code is the four digits printed (not embossed) on the front towards the right. The card security code is not encoded on the magnetic stripe but is printed flat.

American Express cards have a four-digit code printed on the front side of the card above the number.

MasterCard, Visa, Diners Club, Discover, and JCB credit and debit cards have a three-digit card security code. The code is the final group of numbers printed on the back signature panel of the card.

New North American MasterCard and Visa cards feature the code in a separate panel to the right of the signature strip. This has been done to prevent overwriting of the numbers by signing the card.

Benefits when it comes to security:

As a security measure, merchants who require the CVV2 for card not present payment card transactions are required by the card issuer not to store the CVV2 once the individual transaction is authorized and completed. This way, if a database of transactions is compromised, the CVV2 is not included, and the stolen card numbers are less useful. Virtual Terminals and payment gateways do not store the CVV2 code, therefore employees and customer service representatives with access to these web-based payment interfaces who otherwise have access to complete card numbers, expiration dates, and other information still lack the CVV2 code.

The Payment Card Industry Data Security Standard (PCI DSS) also prohibits the storage of CSC (and other sensitive authorization data) post transaction authorization. This applies globally to anyone who stores, processes or transmits card holder data. Since the CSC is not contained on the magnetic stripe of the card, it is not typically included in the transaction when the card is used face to face at a merchant. However, some merchants in North America require the code. For American Express cards, this has been an invariable practice (for card not present transactions) in European Union (EU) states like Ireland and the United Kingdom since the start of 2005. This provides a level of protection to the bank/cardholder, in that a fraudulent merchant or employee cannot simply capture the magnetic stripe details of a card and use them later for card not present purchases over the phone, mail order or Internet. To do this, a merchant or its employee would also have to note the CVV2 visually and record it, which is more likely to arouse the cardholder’s suspicion.

Supplying the CSC code in a transaction is intended to verify that the customer has the card in their possession. Knowledge of the code proves that the customer has seen the card, or has seen a record made by somebody who saw the card.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Point of Sale, Visa MasterCard American Express Tagged with: (Card Verification Value), (CVC2), American Express, atm, authorization data, bank/cardholder, card holder data, card identification number, card issuers, Card Not Present transactions, card number, card numbers, card security code, card validation code, card-not-present, card-present transactions, cardholder, cards, cash advance, chip cards, CID, code, Contactless card, credit, credit-card, CSC, customer, customer service, CVC1, CVV Number, CVV1, CVV2, Data Security Standard, debit, debit card, debit cards, device, Diners Club, Discover, fax, gateways, iCVV or Dynamic CVV, individual transaction, internet, issuer, JCB credit, magnetic stripe, mail, MasterCard, merchant, payment card, Payment Card Industry, payment card transactions, payment gateways, PCI-DSS, Personal Identification Number, PIN, point of sale, post transaction authorization, security codes, telephone, terminals, unique card code, virtual terminals, visa, web-based payment

September 16th, 2014 by Elma Jane

Card-not-present merchants are battling increasingly frequent friendly fraud. That type of fraud..The I don’t recognize or I didn’t do it dispute. This occurs when a cardholder makes a purchase, receives the goods or services and initiates a chargeback on the order claiming he or she did not authorize the transaction.

This problem can potentially cripple merchants because of the legitimate nature of the transactions, making it difficult to prove the cardholder is being dishonest. The issuer typically sides with the cardholder, leaving merchants with the cost of goods or services rendered as well as chargeback fees and the time and resources wasted on fighting the chargeback.

Visa recently changed the rules and expanded the scope of what is considered compelling evidence for disputing and representing chargeback for this reason code. The changes included allowing additional types of evidence, added chargeback reason codes and a requirement that issuers attempt to contact the cardholder when a merchant provides compelling evidence.

The changes give acquirers and merchants additional opportunities to resolve disputes. They also mean that cardholders have a better chance to resolve a dispute with the information provided by the merchant. Finally, they provide issuers with clarity on when a dispute should go to pre-arbitration as opposed to arbitration.

Visa has also made other changes to ease the burden on merchants, including allowing merchants to provide compelling evidence to support the position that the charge was not fraudulent, and requiring issuers to a pre-arbitration notice before proceeding to arbitration, which reduces the risk to the merchant when representing fraud reason codes.

The new “Compelling Evidence” rule change does not remedy chargebacks but brings important changes for both issuers and merchants. Merchants can provide information in an attempt to prove the cardholder received goods or services, or participated in or benefited from the transaction. Issuers must initiate pre-arbitration before filing for arbitration. That gives merchants an opportunity to accept liability before incurring arbitration costs, and Visa will be using information from compelling evidence disputes to revise policies and improve the chargeback process

Visa made those changes to reduce the required documentation and streamline the dispute resolution process. While the changes benefit merchants, acquirers and issuers, merchants in particular will benefit with the retrieval request elimination, a simplified dispute resolution process, and reduced time, resources and costs related to the back-office and fraud management. The flexibility in the new rules and the elimination of chargebacks from cards that were electronically read and followed correct acceptance procedures will simplify the process and reduce costs.

Sometimes, an efficient process for total chargeback management requires expertise or in-depth intelligence that may not be available in-house. The rules surrounding chargeback dispute resolution are numerous and ever-changing, and many merchants simply do not have the staffing to keep up in a cost-effective and efficient way. Chargebacks are a way of life for CNP merchants; however, by working with a respected third-party vendor, they can maximize their options without breaking the bank.

Reason Code 83 (Fraud Card-Not-Present) occurs when an issuer receives a complaint from the cardholder related to a CNP transaction. The cardholder claims he or she did not authorize the transaction or that the order was charged to a fictitious account number without approval.

The newest changes to Reason Code 83, a chargeback management protocol, offer merchants a streamlined approach to fighting chargebacks and will ultimately reduce back-office handling and fraud management costs. Independent sales organizations and sales agents who understand chargeback reason codes and their effect on chargeback rates can teach merchants how to prevent chargebacks before they become an issue and successfully represent those that they can’t prevent.

Posted in Best Practices for Merchants, EMV EuroPay MasterCard Visa, Visa MasterCard American Express Tagged with: account, account number, acquirers, agents, Back Office, card, card holder, card-not-present, Card-not-present merchants, cardholder, cards, chargeback, chargeback fees, chargeback rates, cnp, CNP merchants, CNP transaction, fees, fraud, fraud management, Independent sales, independent sales organizations, issuer, management protocol, Merchant's, organizations, protocol, purchase, Rates, resolution, resolution process, resources, risk, sales agents, services, transaction, visa