September 18th, 2017 by Elma Jane

Smart Security for Smart Businesses:

Safe-T for SMB streamlines the PCI process while providing the layered security needed to protect card data

EMV – Fraud protection at the point of sale

EMV chip technology keeps the consumer’s card in their hand. It also helps protect the business from card-present fraud related chargebacks.

Encryption – Protection of payment card data in-transit

Safe-T scrambles cardholder data using advanced encryption technology, so data is protected at the point of entry, and throughout the authorization process.

Tokenization – Token ID protection of stored payment card data

Safe-T returns a token ID or an alias, consisting of a random sequence of numbers to the point-of-sale so the actual card number is never stored. Token IDs can be used for follow up transactions (i.e. recurring payments, voids, etc.).

Reduced PCI – Protection from complex PCI compliance

Maintaining PCI Compliance can be intimidating – second only, perhaps, to completing your taxes. Safe-T eases this process for customers by reducing the number of PCI Self-Assessment questions by more than 60% from 80 questions to 31.

Financial Reimbursement – Financial protection from a card data breach

Recovering from a card data breach can be costly for a small business. Safe-T offers Card Data Breach Reimbursement to financially protect your customer’s business in the event of a card data breach – regardless of the type of card data breach.

For Electronic Payment Set up with this feature call now! 888-996-2273

Posted in Best Practices for Merchants Tagged with: card data, card present, chargebacks, chip, data, data breach, EMV, encryption, fraud, payment, PCI, point of sale, Security, tokenization

April 27th, 2017 by Elma Jane

Adding Tokenization Service

Important notes when adding tokenization:

– Tokens replace credit or gift card numbers.

– The terminal must be enabled to accept tokenization.

– Tokens are unique for each merchant, for example:

The same card will produce a different token for each merchant.

– Merchants with multiple terminals sharing tokenization domains will receive the same token for a unique card and the token can be used across their stores if they wish to do so.

– Merchants may supply the token in place of card information in any subsequent transaction.

– Tokenization is supported for both credit cards and gift cards.

Tokenization protects card data when it’s in use and at rest. It converts or replaces cardholder data with a unique token ID to be used for subsequent transactions. This eliminates the possibility of having card data stolen because it no longer exists within your environment.

Tokens can be used in card not present environments such as e-commerce or mail order/telephone order (MOTO), or in conjunction with encryption in card present environments.

Tokens can reside on your POS/PMS or within your e-commerce infrastructure “at rest” and can be used to make adjustments, add new charges, make reservations, perform recurring transactions, or perform other transactions “in use”.

For Electronic Payment Set up with Tokenization call now 888-996-2273

or click here NationalTransaction.Com

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit, e-commerce, electronic payment, encryption, gift Card, merchant, moto, POS, terminals, tokenization, tokens, transaction

April 10th, 2017 by Elma Jane

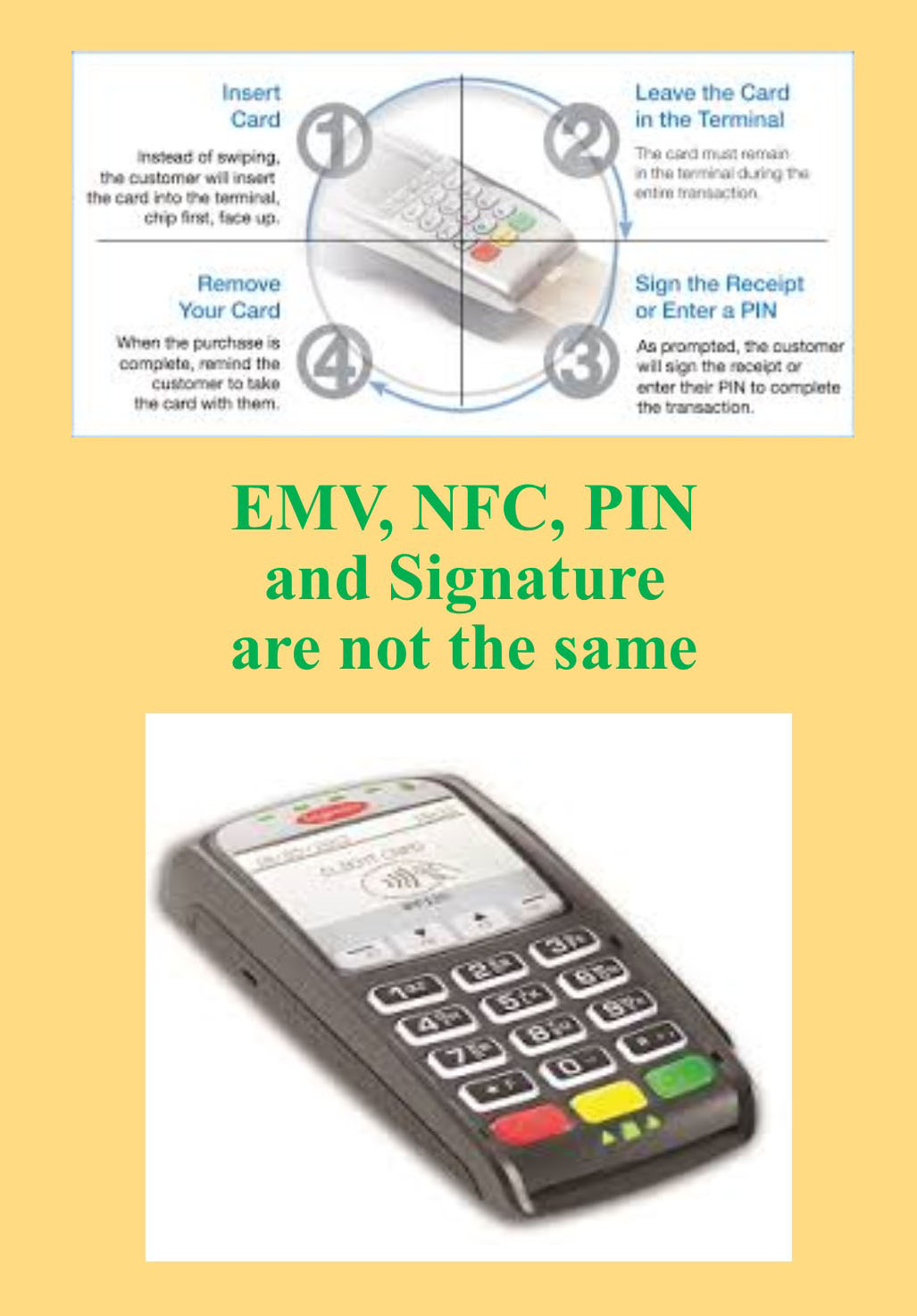

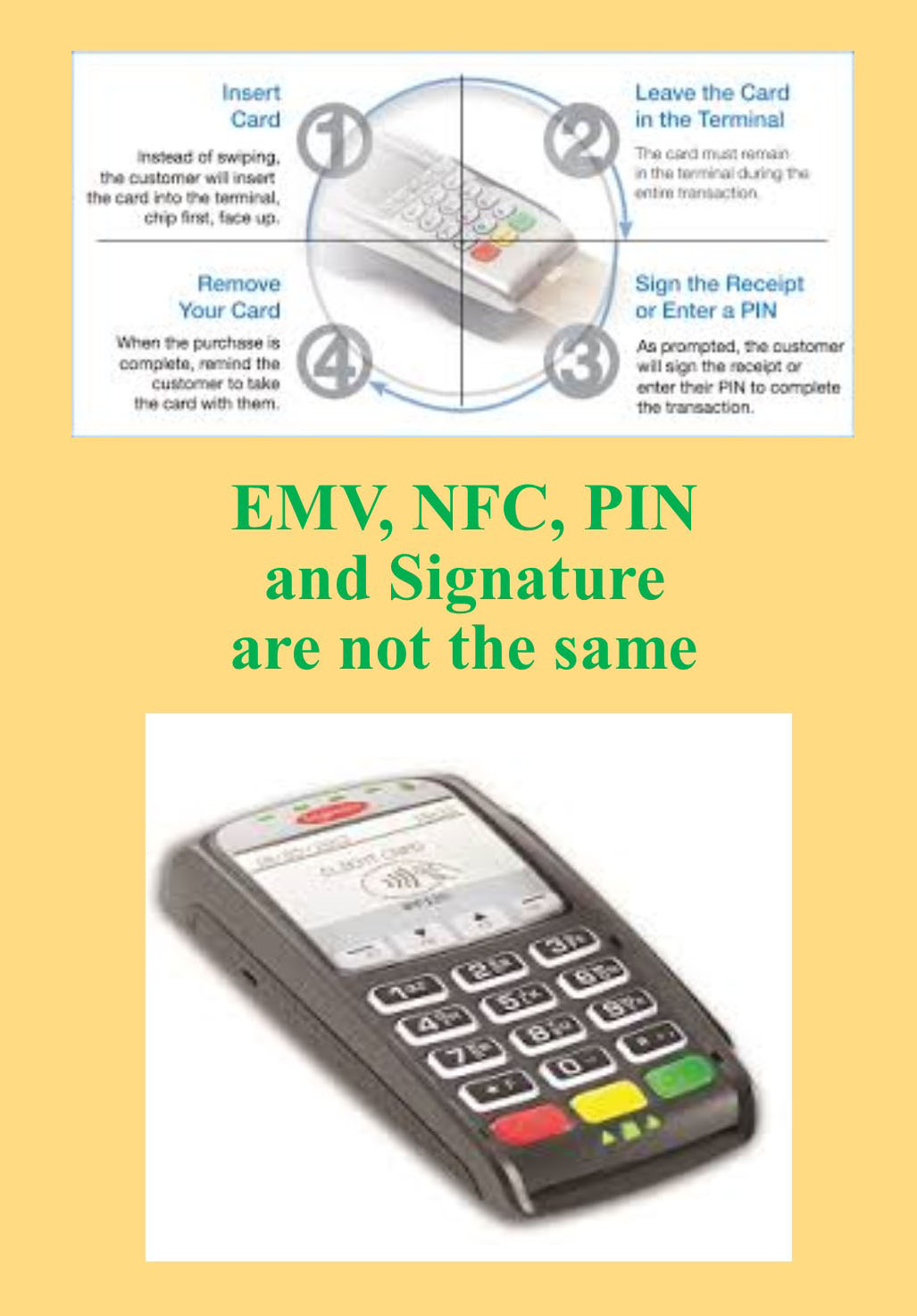

EMV, NFC, PIN and Signature are not the same

EMV (Europay, MasterCard and Visa) is a payment technology.

NFC (Near-Field Communication) is a technology that enables contactless EMV.

Apple Pay, Android Pay and Samsung Pay uses NFC technology to process payments in a tap at any contactless payment terminal.

NFC payments made with a mobile phone in-store by tapping the phone to an NFC-capable terminal are considered card-present transactions. NFC in-app purchases are considered card-not-present transactions.

Not all EMV terminals has NFC technology. NFC Technology/EMV terminals can be considerably more expensive than standard EMV.

There are EMV terminals that NFC capable but not enabled.

Payment cards that comply with the EMV standard are often called Chip and PIN or Chip and Signature cards, depending on the authentication methods employed by the card issuer.

PIN Debit are transactions routed through (EFT) electronic funds transfer. It immediately deducts the transaction amount from the customer’s checking account, which is linked to the debit card used for payment. EFT processing takes place when the customer chooses debit when prompted and then enters her PIN. PIN debit transactions are often referred to as online transactions because they require an electronic authorization.

PIN Based Transactions have no chargebacks rights as they are considered cash not credit.

Signature-based debit transactions are authorized, cleared and settled through the same Visa or MasterCard networks used for processing credit card transactions. Signature debit processing is initiated when the customer selects credit when prompted by the POS terminal. Signature debit transactions are referred to as offline transactions because a PIN debit network does not play a role in processing.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargebacks, EMV, nfc, payment, PIN, terminal, transactions

April 6th, 2017 by Elma Jane

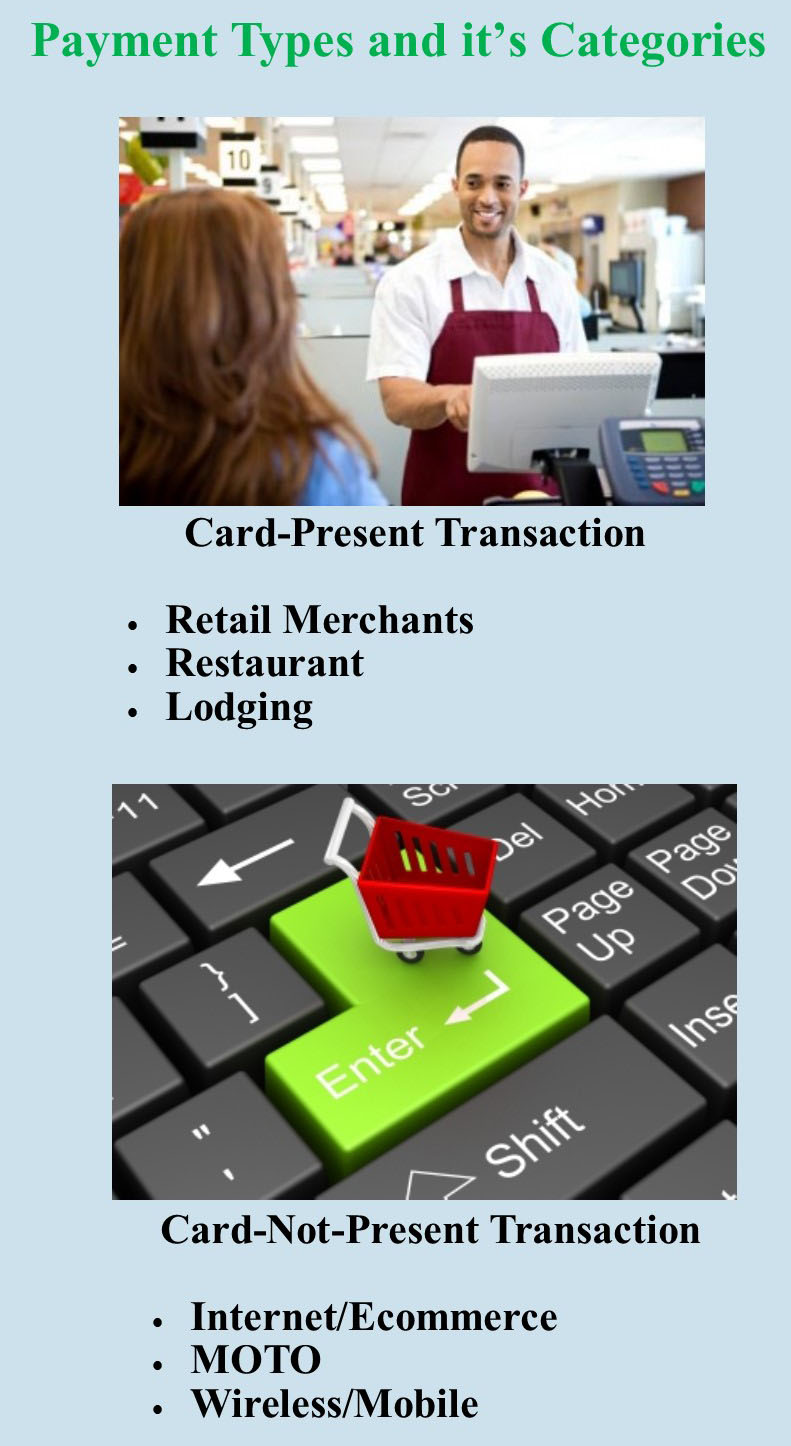

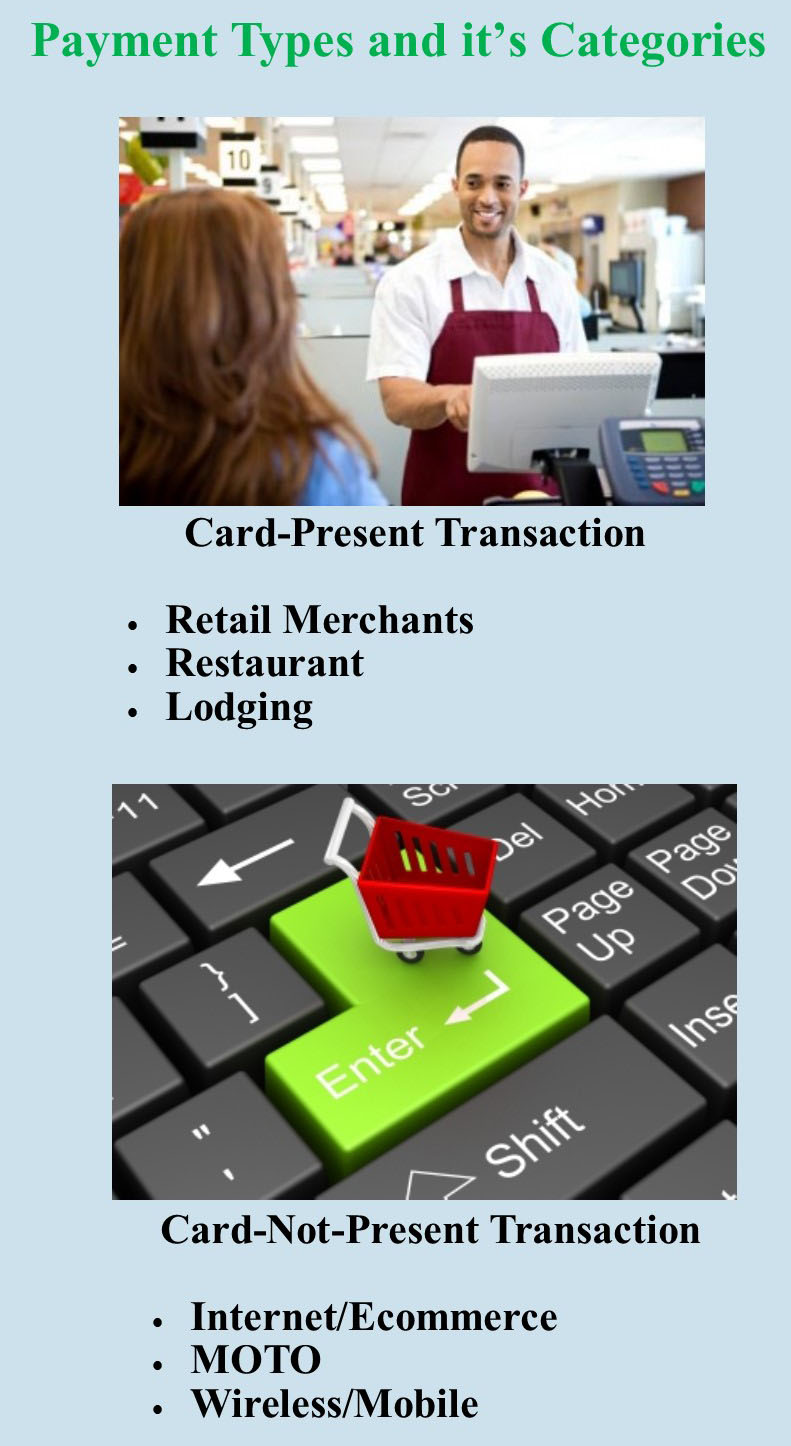

Payment types and it’s categories

The two main category types when it comes to credit card processing are swiped and keyed. Card present or card-not-present.

Swiped or card present transaction – merchants do a face-to-face transaction. A merchant can capture card information by dipping the chip or swiping the card in the terminal or POS. Merchants directly interact with a customer so the risk is low.

Card-Present Sub Categories:

Retail Merchants – conduct transactions face to face in a retail environment.

Face to Face (mobile) – this type of merchant is typically on the go, such as a vendor at a trade show. You can use a service like converge mobile that allows you to take the information in person.

Restaurant – the same as retail merchants, the difference is they may require the ability to add tips to their charges.

Lodging – processes their transactions like retail merchants except they may adjust the settlement amount depending on the customer’s length of stay.

Keyed or card-not-present are high risk, because merchants indirectly collect customers card information, and can process transactions in various ways.

Card-Not-Present Sub categories:

Internet/Ecommerce – conducts business through a web site by utilizing a shopping cart and an Internet payment gateway service. The payment gateway then collects the credit card information and processes it in real time.

Mail & Telephone Order (MOTO) – typically take the customer’s credit card information over the phone, by mail or through the Internet. They then manually process the transaction by keying it into either a credit card machine or through a virtual terminal such as Converge.

Talk to our payment consultant to know the best solution for your business.

NationalTransaction.Com 888-996-2273

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, credit card, customer, ecommerce, merchants, payment, payment gateway, POS, swiped and keyed, terminal, virtual terminal

February 14th, 2017 by Elma Jane

Prevent Freeze, Holds, and Terminations

Common ways to prevent freezing; holds and termination to your account.

Minimize Chargebacks – chargeback should always be limited. An excessive number of chargeback whether won or lost is a red flag.

Minimize Fraud – if fraud is suspected, your account will be frozen pending an investigation.

One account per business type – if you have multiple businesses, you must have a separate account. If one account is being used for a different business altogether, that’s the quickest way for an account to be fully terminated.

Sell only the services or products you said you’d sell – selling other product or services could violate your Marketing Services Agreements.

Stay within your average monthly volume and ticket – an unusually high processing volume or average ticket is one of the fastest ways to get your funds held. To avoid this, notify your provider of an expected busy month. Call your provider for a large transaction before running it.

Use appropriate payment account types – card present (retail) and card-not-present accounts (internet). Card present means both customer and their credit card are present in the store. Card-not-present means card nor the person are not physically present at the time of the transaction. A large number of card present transactions on a card-not-present account or vice versa can result in a hold or termination of an account.

For Electronic Payments call now 888-996-2273 or got to www.nationaltransaction.com and click on get started

Posted in Best Practices for Merchants Tagged with: card present, card-not-present, chargeback, electronic payments, fraud, provider

January 19th, 2017 by Elma Jane

Card-Present vs Card-Not-Present – It’s important for a merchant to know what types of credit card payments their business will be taking.

If you rely on mailed, over-the-phone, or online payments a Card-Not-Present merchant account is what you need.

With this type of account, you don’t need the physical card. You are set up to accept credit cards where card information is being keyed into a credit card terminal or online.

A card-not-present merchant accounts base rate is higher than if you signed up for a Card-Present or swipe merchant account.

Why are card-not-present rates higher? There is less risk associated with a business swiping a credit card than keying it in. Why? When a card is swiped, a person is present; where the merchant can check ID and signature. When a person is not present, it’s open for consumer fraud.

However, when you’re setting up a Card-Not-Present merchant account, these factors are taken into consideration during the underwriting process, which leads to a lower base rate for keyed-in payments

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card present, card-not-present, credit card, merchant, online, payments, terminal

May 16th, 2016 by Elma Jane

Visa Europe has seen a significant increase in the number of contactless payments (card-present transaction) that it has processed this year, it nearly tripled to three billion.

Visa Europe attributed this increase to merchants integrating tap and pay into their checkout process.

This significant increase was largely due to London’s adoption of contactless technology. The contactless payments were also attributed to the launch of Apple Pay, urging consumers to adopt new payment methods.

Setting the stage for tomorrow’s technology, like wearable devices and mobile payment services making today’s achievement possible.

Posted in Best Practices for Merchants Tagged with: card present, consumers, contactless payments, merchants, mobile payment, ontactless technology, payment methods, services, transaction, visa

February 2nd, 2016 by Elma Jane

Businesses continue to struggle with the prohibited storage of unencrypted customer payment data. The Payment Card Industry Data Security Standard (PCI DSS), merchants are instructed that, Protection methods are critical components of cardholder data protection in PCI DSS Requirement.

PCI DSS applies to every company that stores, processes or transmits cardholder information. Regardless of the size or type of business you operate, the number of credit card transactions you process annually or the method you use to do so, you must be PCI compliant.

Data breach is not a limited, one-time occurrence. This is why PCI compliance is required across all systems used by merchants.

Encryption and Tokenization is a strong combination to protect cardholder at all points in the transaction lifecycle; in use, in transit and at rest.

National Transaction’s security solutions provide layers of protection, when used in combination with EMV and PCI-DSS compliance.

Encryption is ideally suited for any businesses that processes card transactions in a face to face or card present environment. From the moment a payment card is swiped or inserted at a terminal featuring a hardware-based, tamper resistant security module, encryption protects the card data from fraudsters as it travels across various systems and networks until it is decrypted at secure data center.

Tokenization can be used in card not present environments (travel merchants) such as e-commerce or mail order/telephone order (MOTO), or in conjunction with encryption in card present environments. Tokens can reside on your POS/PMS or within your e-commerce infrastructure at rest and can be used to make adjustments, add new charges, make reservations, perform recurring transactions, or perform other transactions in use. Tokenization protects card data when it’s in use and at rest. It converts or replaces cardholder data with a unique token ID to be used for subsequent transactions.

The sooner businesses implement encryption and tokenization the sooner stored unencrypted data will become a thing of the past.

Posted in Best Practices for Merchants, Travel Agency Agents Tagged with: card, card data, card present, cardholder, compliance, credit card, customer, data, data breach, data security, e-commerce, EMV, encryption, Mail Order/Telephone Order, merchants, moto, payment, Payment Card Industry, PCI-DSS, POS, secure data, Security, terminal, tokenization, tokens, travel, travel merchants

January 21st, 2016 by Elma Jane

Merchant accounts are as varied as the merchants themselves and the goods being sold.

What kind of account would you fall under:

High Risk Merchant Accounts – Finding a processor who is willing to take your account can be more challenging. High risk merchants range from travel agencies to multi-level marketing companies, credit restoration merchants, casinos, online pharmaceutical companies, adult/dating merchants and many other.

Internet based merchant account (Ecommerce/Website order processing) – E-Commerce is a booming market, with so many people buying and selling goods online due to the wide reach and easy access to the internet.

Mobile or Wireless merchant account – This merchant is specifically designed for small businesses, solo professionals, and mobile services (including lawyers, landscapers, contractors, consultants, repair tradesmen, etc), who are constantly on the move and require a payment to processed on the spot.

MOTO (Mail or Telephone order) – This enables phone based or direct mail orders processing for customers who can buy your product or service from the comfort of their home. Since there is no card present there is no need for traditional equipment.

Multiple Merchant Accounts – Some businesses can have merchant accounts of a couple or all different types. Merchants who fall into this category are called multi-channel merchants as they sell their goods through a number of different channels. Most commonly this is related to retail stores who also have an online presence to sell their goods. This is very common in today’s competitive market where constant contact with customers is critical to success.

Traditional Account with Equipment – Most commonly used for retail businesses (grocery, departmental stores etc) where the transactions are processed in a face to face interaction also known as Point of Sale (PoS).

Interested to setup an account give us a call at 888-9962273

Posted in Best Practices for Merchants, e-commerce & m-commerce, Mail Order Telephone Order, Mobile Payments, Mobile Point of Sale, Point of Sale, Travel Agency Agents Tagged with: account, card, card present, credit, customers, e-commerce, high risk merchant, internet, merchant accounts, merchants, mobile, mobile services, moto, multi-channel merchants, payment, point of sale, POS, processor, transactions, travel, travel agencies

December 18th, 2015 by Elma Jane

A leading provider of mobile point of sale and mobile payment technology, published today the EMV Migration Tracker.

Many merchants have deployed EMV capable terminals while cardholders have received cards with EMV chips, but not much data has been published about the real world use of EMV chip card technology in the U.S. Most published statistics rely on surveys or forecasts rather than real transactional data.

The EMV Migration Tracker shows new data and insights since the October 1 liability shift, including:

- Over 50% of all cards in use now have EMV chips on them. From October to November, the percent grew 5% as banks and card issuers accelerated their rollout of new chip cards.

- Over 83% of American Express cards have EMV chips, while Discover lags at 40%

- Over 63% of the cards used in Hawaii have EMV chips, but Mississippi sees just 11% penetration of chip cards.

While EMV chip card technology has been implemented in Europe years ago, the rollout of EMV in the U.S is just beginning. The rollout came earlier this year with the October 1 liability shift in card present transaction, meaning that merchants who have not upgraded their POS system can become liable for counterfeit card fraud losses that occur at their stores. This is an early step in an ongoing process that the Payments Security Task Force predicts will lead to 98 percent of U.S. credit and debit cards containing EMV chips by the end of 2017.

http://www.finextra.com/news/announcement.aspx?pressreleaseid=62506

Posted in Best Practices for Merchants Tagged with: American Express, banks, card issuers, card present, card technology, cardholders, chip cards, credit, data, debit, Discover, EMV, EMV chips, merchants, mobile payment, mobile point of sale, payment technology, point of sale, POS, provider